Automated invoice management for businesses: tools and benefits

- Benefits of automated invoice management

- Software to automate invoice management

- 1. Banktrack

- 2. QuickBooks Online

- 3. Zoho invoice

- 4. FreshBooks

- 5. Xero

- Best invoice automated software

- 1. Automatic bank reconciliation

- 2. Payment tracking

- 3. Automated payment reminders

- 4. Cash flow management

- 5. Financial analysis and reports

- Frequently asked

- 1. Can an automated invoicing system integrate with other accounting programs?

- 2. What type of companies can benefit from invoice automation?

- 3. How much does it cost to implement an automated invoice management system?

- 4. Does automated invoice management software send reminders for payments and collections?

Your company is growing, and with that, the volume of invoices you need to manage.

Processing hundreds or thousands of invoices involves a high consumption of time, risk of errors, and unnecessary administrative costs.

Additionally, relying on traditional methods such as manual data entry and handling paper documents slows down financial processes.

For companies dealing with large volumes of billing, automation has become more of a necessity than an option.

Implementing an automated invoice processing system based on artificial intelligence and machine learning helps reduce processing times, minimize errors, and improve financial control.

In this article, we will teach you the tools you need to say goodbye to the manual management of your company’s invoices, regardless of its size.

Benefits of automated invoice management

- Optimizes personnel costs: the team can focus on strategic tasks instead of wasting time on manual invoice management.

- Prevents duplicate invoices and payments: an automated system identifies repeated records before they become a financial issue.

- Enhances visibility and control: it provides real-time access to the status of each invoice, making decision-making easier.

- Facilitates audits and regulatory compliance: all information is organized and accessible, simplifying reviews and reducing legal risks.

- Reduces operational expenses: unnecessary costs such as printing, physical storage, and mailing of paper documents are eliminated.

- Speeds up approval and processing: invoices are automatically validated and sent to the appropriate personnel, reducing waiting times.

- Minimizes errors: by reducing manual data entry, mistakes in amounts, dates, and suppliers are significantly decreased.

- Improves cash flow management: with up-to-date information on pending and upcoming payments, the company can better plan its liquidity.

- Strengthens supplier relationships: a transparent and efficient system prevents payment delays and builds greater trust.

- Secures early payment discounts and avoids penalties: automating due dates ensures compliance with optimal deadlines and prevents fines.

Software to automate invoice management

1. Banktrack

Banktrack is a software specialized in automating invoice management, with a particular focus on streamlining financial processes through the use of advanced technologies.

This software is designed to help businesses manage large volumes of billing efficiently, reducing manual work, minimizing errors, and improving accuracy in accounting.

Below are some of its key features:

1. Invoice reading and digitization with OCR technology

Banktrack uses Optical Character Recognition (OCR) technology to read physical invoices and automatically digitize them.

This process allows businesses to avoid manually entering data from each invoice, saving a considerable amount of time and reducing the risk of human errors.

OCR is capable of identifying and extracting relevant information such as supplier names, dates, amounts, and invoice numbers from scanned documents or photos.

2. Invoice export

Once invoices are digitized, Banktrack allows them to be exported into documents for users to store digitally.

The exported files can be saved in various formats, such as PDF or Excel, making it easier to access, review, and file them later.

This not only improves organization but also aids in auditing and compliance with tax regulations.

3. Payment and collection calendar

BankTrack includes a payment and collection calendar tool, which allows businesses to have full control over their obligations and cash flow.

Through this calendar, users can view the due dates of invoices to be paid and collected, enabling them to plan ahead and avoid delays in payments or collections.

4. Alerts and reminders

The system has automatic alerts to keep users informed about upcoming invoice due dates or any other relevant events.

These alerts can be customized, meaning you can set up the software to notify you of any situation requiring attention, such as overdue payments, upcoming invoices to send, or even if any specific action is needed on an invoice.

5. Improved financial control

Banktrack not only automates the operational tasks related to invoices but also provides tools to enhance the company’s financial control.

The digitization and integration of data allow users to generate more accurate financial reports, which helps in making strategic decisions regarding cash flow and the company’s financial health.

2. QuickBooks Online

QuickBooks is one of the most popular accounting platforms for small and medium-sized businesses.

Known for its ease of use and ability to adapt to the needs of growing businesses, QuickBooks offers an all-in-one solution for financial management, helping entrepreneurs keep their finances organized and optimized.

It’s perfect for both those with accounting experience and those looking to simplify the process.

Features:

- Invoice creation: automatically create and customize invoices with recurring billing options.

- Payment tracking: track payments, overdue invoices, and send payment reminders.

- Integrations: seamlessly integrates with banks, payment gateways, and other accounting tools.

- Reporting & analytics: generates detailed reports on sales, profits, and expenses.

- Multi-currency support: supports invoices in different currencies for global clients.

3. Zoho invoice

Zoho Invoice is a tool designed to streamline invoice and payment management, especially for freelancers and small businesses.

Its focus is on simplifying the administrative tasks related to finances, allowing users to dedicate more time to what really matters—growing their business.

With an intuitive interface and powerful automation features, Zoho Invoice makes accounting easier and faster.

Features:

- Customizable templates: offers a variety of templates to create branded invoices.

- Recurring invoices: automatically send recurring invoices to clients at scheduled intervals.

- Time tracking: track time spent on projects, which can be added directly to invoices.

- Automated payment reminders: sends automated reminders for overdue invoices.

- Online payments: allows clients to pay directly from the invoice using integrated payment gateways.

- Multi-currency & multi-language support: works globally with the ability to set different currencies and languages.

4. FreshBooks

FreshBooks is an online accounting platform built with entrepreneurs, freelancers, and small businesses in mind.

Its goal is to make accounting as simple and accessible as possible, removing the complexity from financial processes.

With a clear focus on ease of use, FreshBooks helps users keep track of their finances without needing to be accounting experts.

Features:

- Automated invoicing: create and send invoices automatically on a set schedule.

- Expense tracking: automatically track and categorize business expenses.

- Online payments: allows clients to pay online using credit cards or other methods.

- Invoice customization: customizable invoice templates and the ability to add your logo.

- Recurring billing: set up automatic billing for ongoing clients or subscriptions.

- Mobile app: invoice management on the go via the mobile app.

5. Xero

Xero is a cloud-based accounting platform designed to help small and medium-sized businesses manage their finances efficiently and in real-time.

With a focus on simplicity and collaboration, Xero enables business owners and accountants to work together smoothly without the need for complicated manual processes.

It’s an ideal choice for those seeking a modern accounting solution that’s accessible from anywhere.

Features:

- Customizable invoices: create professional-looking invoices that can be tailored with logos and branding.

- Automated reminders: send automated payment reminders to clients.

- Inventory management: track inventory and update invoices accordingly.

- Bank feeds: automatically import bank transactions and reconcile with invoices.

- Multi-currency support: manage invoices in different currencies for international clients.

- Reports: generate real-time financial reports like profit and loss statements.

Best invoice automated software

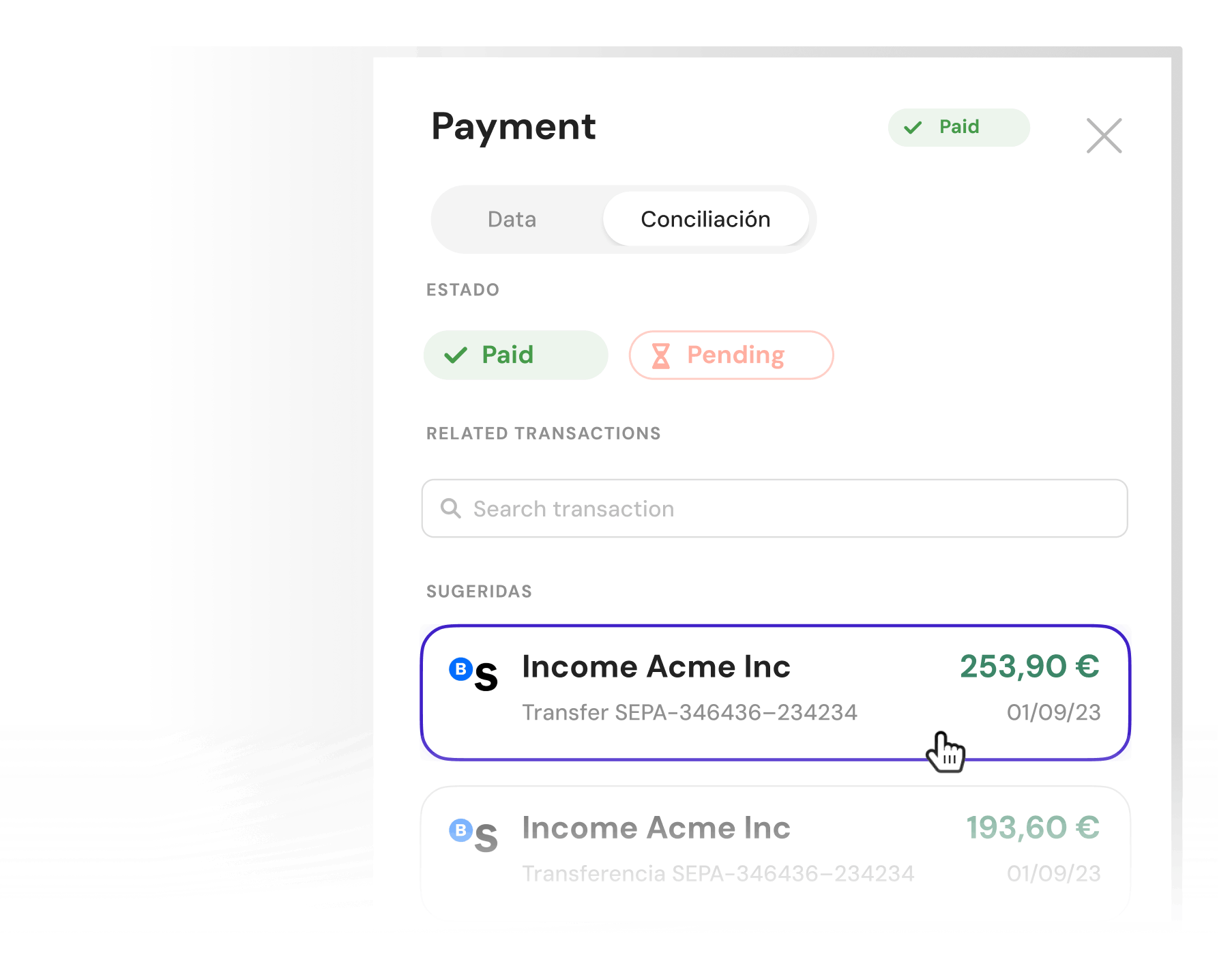

1. Automatic bank reconciliation

Banktrack centralize all your bank accounts, allowing you to automatically import all transactions.

This facilitates the reconciliation of payments with issued invoices without the need to manually enter transaction data.

2. Payment tracking

Although it doesn't create invoices, Banktrack makes it easier to track received and pending payments.

You can monitor the status of your invoices and ensure that payments match correctly with bank records.

3. Automated payment reminders

You can set up automatic reminders for overdue or pending payments, helping reduce delays in client payments without manual intervention.

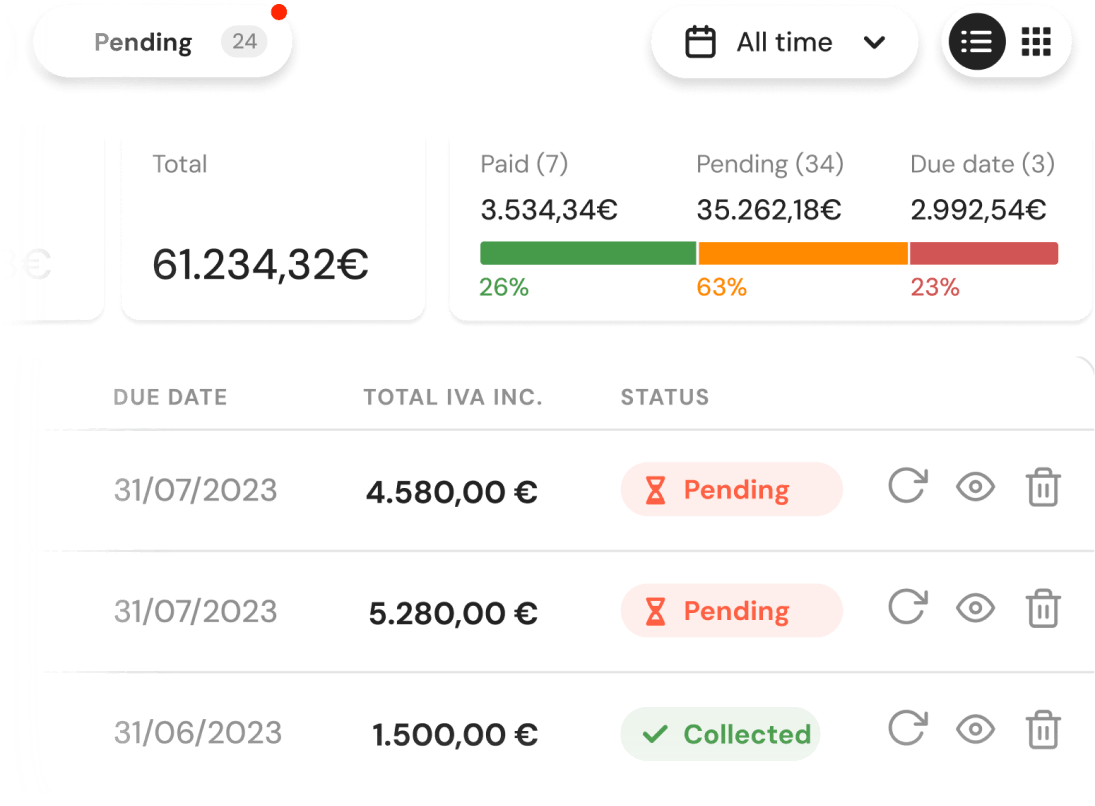

4. Cash flow management

The tool allows you to view cash flow in real-time, helping businesses maintain control over their financial situation and know which invoices are pending payment, facilitating decision-making.

5. Financial analysis and reports

Banktrack provides detailed reports on bank transactions and payments, which helps with financial management.

Although it doesn't create invoices, it provides a clear view of payments and the status of accounts receivable.

Frequently asked

1. Can an automated invoicing system integrate with other accounting programs?

Yes, most automated invoice management systems are compatible with accounting programs, banks, and enterprise resource planning (ERP) systems, allowing for seamless data integration and preventing data duplication.

2. What type of companies can benefit from invoice automation?

Invoice automation is useful for companies of all sizes, but it is especially beneficial for those handling high volumes of invoicing, such as large corporations, e-commerce businesses, or recurring service providers.

3. How much does it cost to implement an automated invoice management system?

Costs can vary depending on the features of the software and the size of the company. However, the initial investment is usually quickly compensated by reduced operational costs, minimized errors, and time savings.

4. Does automated invoice management software send reminders for payments and collections?

Yes, many automated management systems include alert and reminder tools that notify users about invoice due dates, overdue payments, or outstanding collections.

This helps maintain cash flow under control and prevents forgotten payments or collections.

Share this post

Related Posts

5 best bank reconciliation software in 2025

Discover the top 5 bank reconciliation software for 2025. Streamline your financial processes, automate reconciliations, and ensure accurate financial management with the best tools available. Find out how to choose the right software for your business.Never miss a payment with bill management

Take control of your payments with bill management solutions. Stay organized, set reminders, and ensure you never miss a due date again.Top 9 bank trackers in France in 2024

Explore the top bank trackers in France to simplify your finances. These apps help you monitor spending and set budgets.

Try it now with your data

- Your free account in 2 minutes

- No credit card needed