10 best cash management software for small businesses

- 10 Best Cash Flow Management Software Tools

- 1. Banktrack

- 2. PlanGuru - Financial Management Software for Small Business

- 3. Float as a Cash Management System

- 4. Scoro

- 5. CashAnalytics

- 6. Pulse

- 7. QuickBooks

- 8. Google Docs

- 9. Cube

- 10. Vena Solutions

- Why is Cash Flow Management Important?

- 4 Benefits of Using Cash Flow Management Tools

- How Can Banktrack Help Your Business

- Frequently Asked Questions

- 1. Why is cash flow management important?

- 2. What are the benefits of using cash flow management tools?

- 3. How can Banktrack benefit my business?

- 4. What are some limitations of using cash flow management tools?

- 5. Are there affordable options for cash flow management software?

- 6. How can cash flow management tools help with decision-making?

This is the top 10 Best Cash Management Software for Small Businesses:

- Banktrack - Your Cash Management Software

- PlanGuru

- Float

- Scoro

- CashAnalytics

- Pulse

- Quickbooks

- Google Docs

- Cube

- Vena Solutions

Effective cash flow management is essential to ensure financial stability and sustainable growth in a business.

Companies now have at their disposal a wide range of financial management tools designed to optimize this process.

But to enjoy the advantages, you need to implement a solution that's as sharp as your business acumen and as reliable as your morning coffee.

Take charge of your finances like a boss and watch your business thrive.

10 Best Cash Flow Management Software Tools

1. Banktrack

Backtrack is the best cash management software for small and medium enterprises.

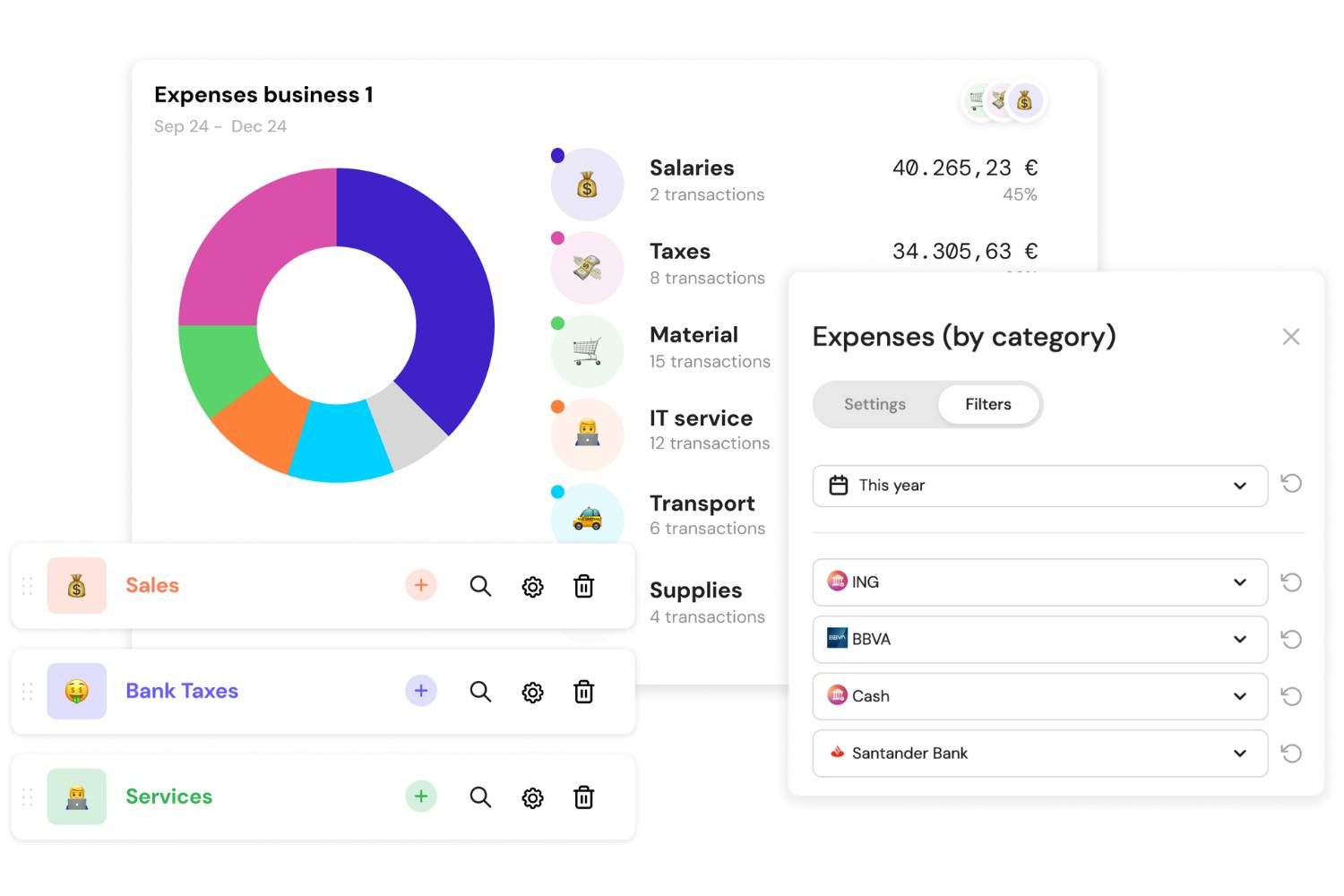

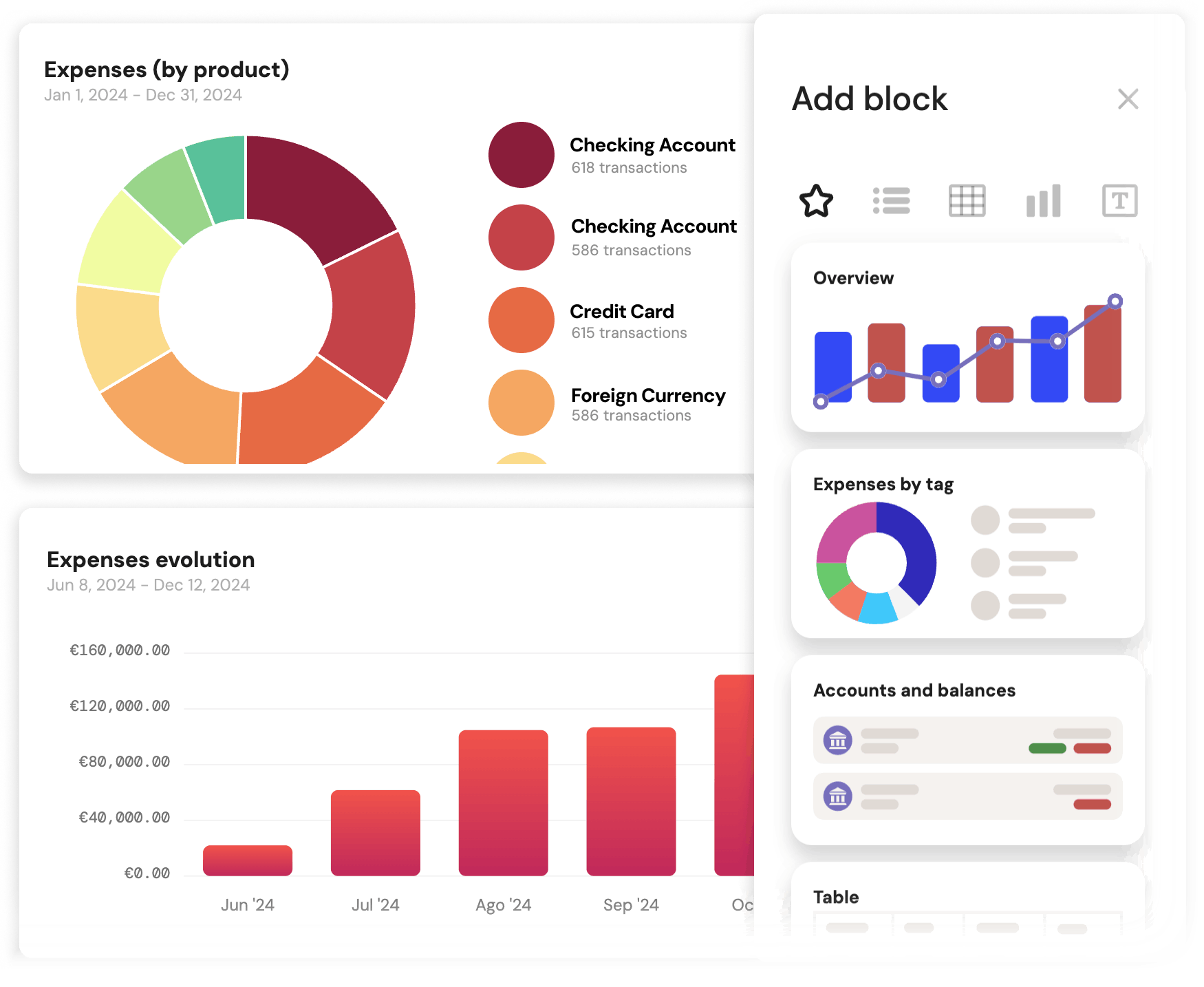

Banktrack’s main strength lies in its ability to create personalized dashboards that integrate and link all bank accounts, enterprises and products.

This flexibility allows users to rapidly access the information they need in the moment and in the most efficient way possible.

You can also customize them to your specific needs at a given time.

Automatic transaction categorization

With Banktrack, you can easily organize your transactions using hierarchical categories (taxonomies) and custom labels.

Taxonomies allow you to classify transactions at different levels (e.g., Income > Sales > Online), while labels help you identify transactions based on projects, clients, or events.

This enables you to group and analyze specific data, such as cash flow or costs by project, making decision-making and managing multiple initiatives easier.

You will have predefined categories to start with, so you don’t have to start from scratch. Additionally, our technology will make this process easier with categorization suggestions.

Finally, you can create automatic rules to instantly and effortlessly categorize transactions.

These rules work by identifying patterns in the transactions, such as keywords in descriptions, recurring amounts, or specific accounts, and automatically assigning the appropriate category or label.

This not only saves time but also ensures accurate and consistent classification across all your financial operations.

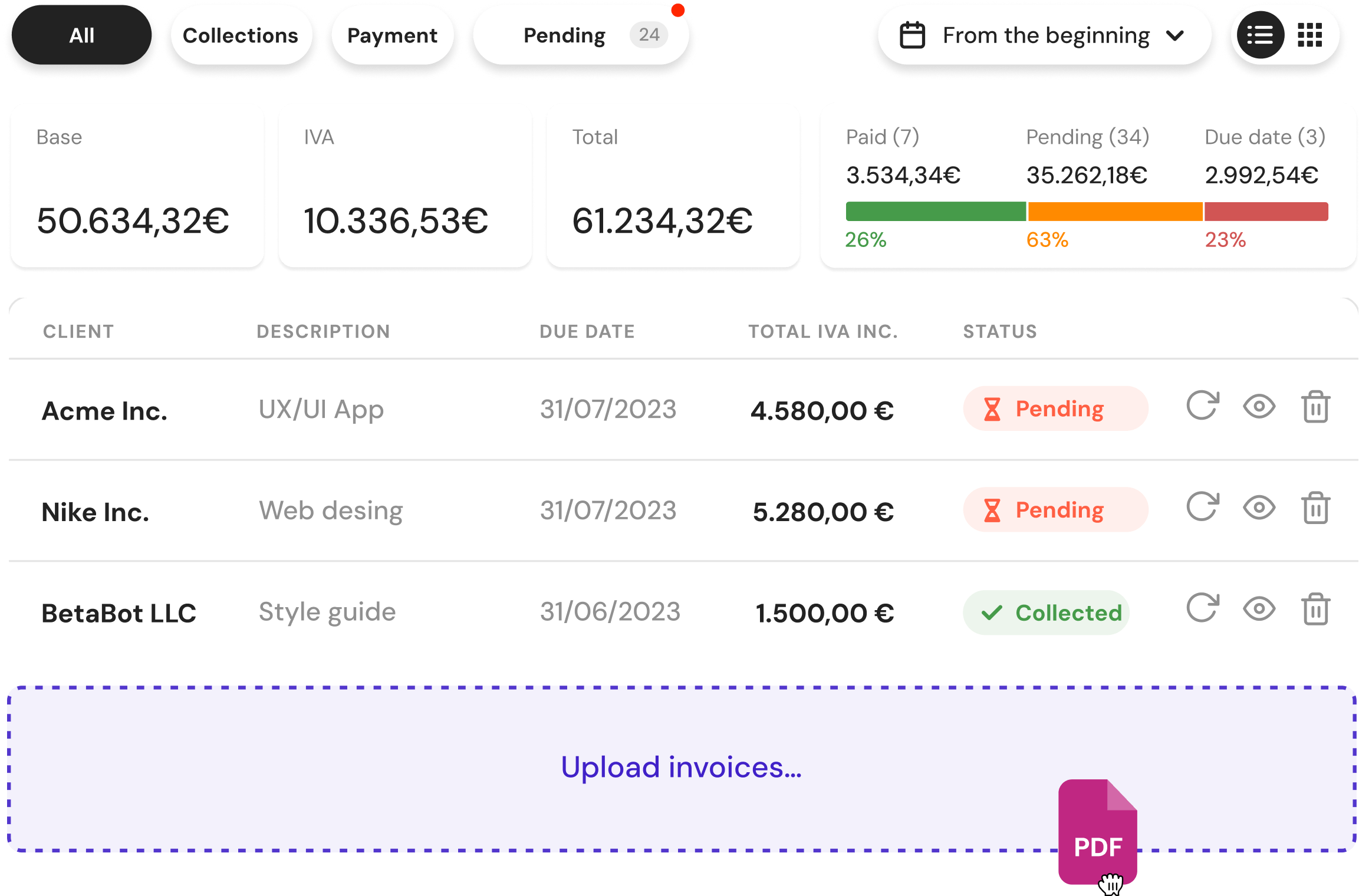

Automatic invoice reconciliation

With Banktrack, you can easily reconcile your invoices in an instant.

Your employees can send their purchase receipts via WhatsApp or email for reconciliation, which will then be linked to the transactions, helping you better understand where your money is being spent.

You can export all your reconciled transactions with smart filters, so you can send them to your accountant.

Receivables and payments calendar

The receivables and payments calendar is a tool that clearly and organized shows you all the important dates when you need to receive money (receivables) or make payments.

For example:

- Receivables: Invoices that your clients owe you.

- Payments: Invoices, services, or debts you need to pay.

This calendar helps you:

- Know how much money will come in or out each day.

- Avoid delays or forgotten payments.

- Better plan your cash flow to avoid running out of money at key moments.

Forecast creation

The treasury forecasting feature allows you to create clear tables and graphs with estimated expenses and income, synced in real-time with the linked bank accounts.

You can customize scenarios to simulate different financial situations and automatically visualize projections in monthly or annual formats.

Additionally, the system automatically calculates monthly increases, making cash flow planning and analysis easier.

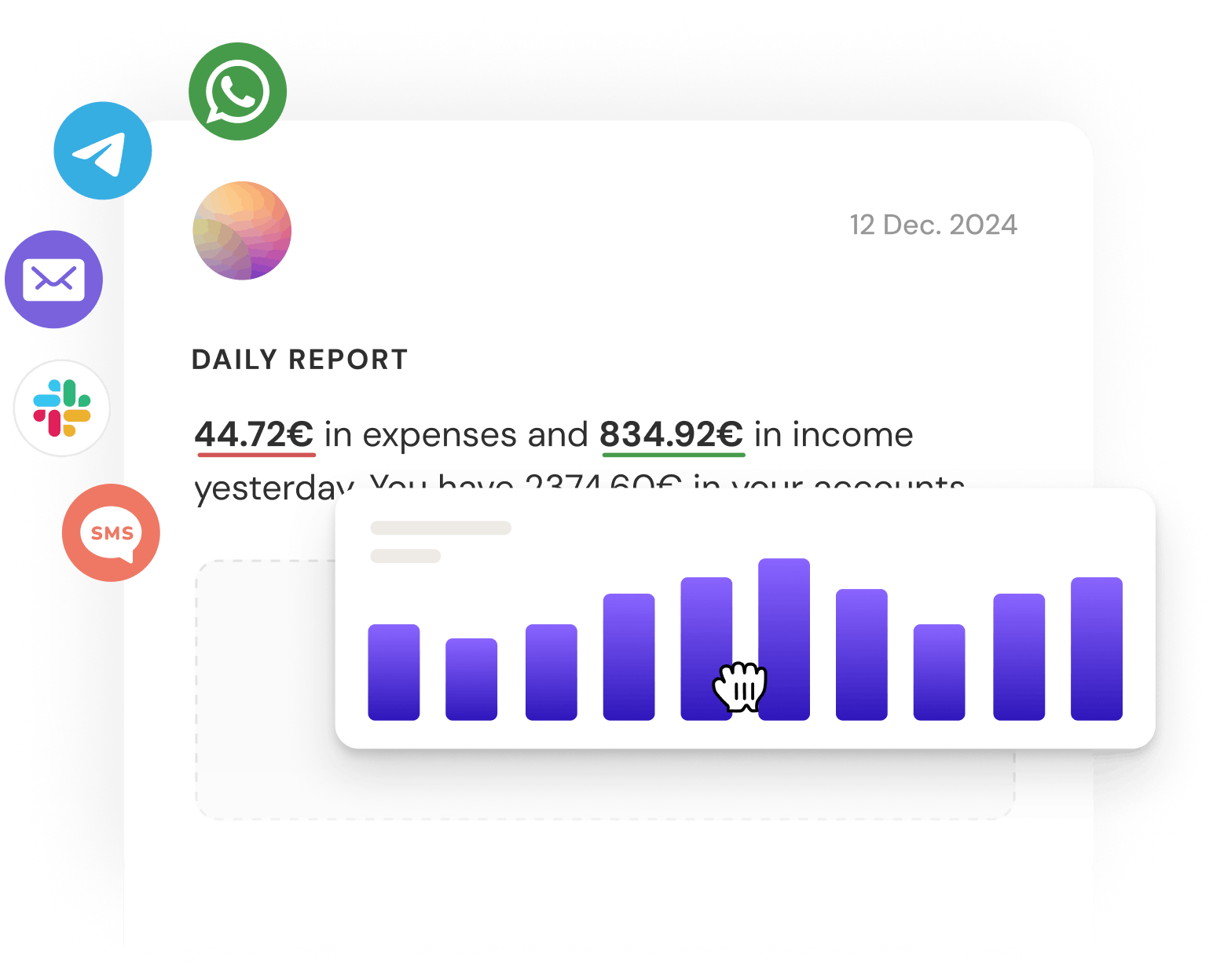

Alerts and reports

You can create alerts to receive notifications via email or WhatsApp when there is an issue with your account, such as a duplicate payment, or something similar. Likewise, you can create custom reports within the software to easily and intuitively see the data you need to monitor your business’s cash flow.

In addition, Banktrack has different categories to adapt to your spending metrics:

Their ability to adapt to your categorization needs is truly remarkable. With advanced rules, you can create and customize unlimited categories to organize your expenses and income accurately. This flexibility allows you to keep a detailed track of your finances and understand where your money is being spent.

What's more, Banktrack also offers personalized reports and alerts. You have the option to create custom reports and receive alerts about your expenses through different channels such as WhatsApp, SMS, email, Slack, or Telegram.

You can set up alerts for duplicate charges, low balances, or any other important aspect for you. This feature helps you maintain constant control over your finances and make informed decisions at all times.

Altogether, these features make Banktrack an excellent cash management software for small businesses as well as bigger enterprises.

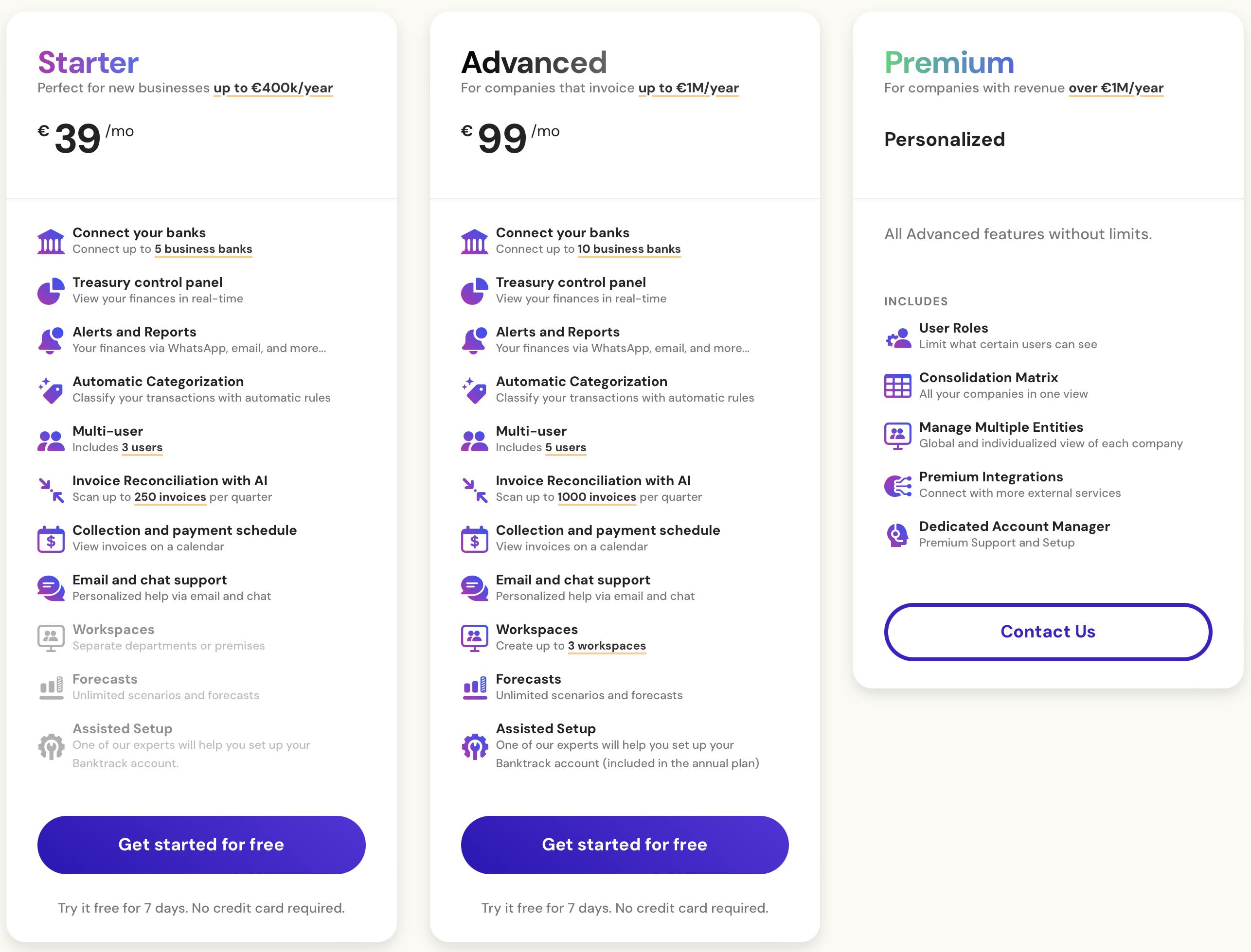

Prices: The best part is, you can use Backtrack for only 16,58€ per month!

We present to you all the plans with their full functionalities:

2. PlanGuru - Financial Management Software for Small Business

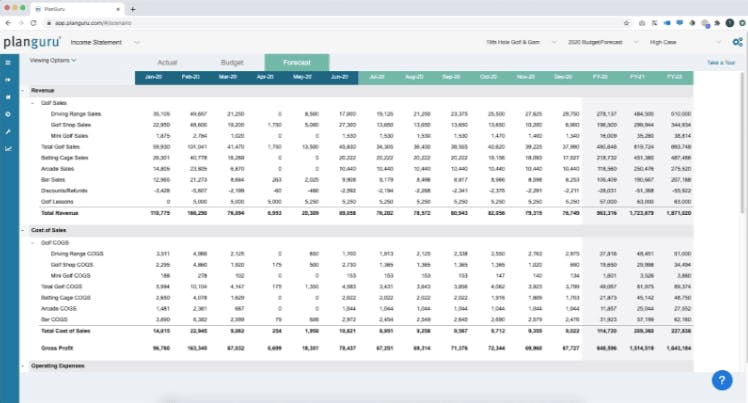

PlanGuru is a budgeting and forecasting software designed for business owners. Its analytical tools empower entrepreneurs to delve into intricate financial data, offering insights that aid in decision-making.

The software allows users to import up to five years of past transactions and create budgets and forecasts for up to 10 years into the future.

One of its key features is the ability to adjust assumptions, enabling users to predict how different scenarios may impact their business's financial position and adapt their cash-flow.

PlanGuru has some advantages:

- QuickBooks and Excel Integration: PlanGuru seamlessly integrates with QuickBooks and Excel, automatically importing transactions from these platforms into its system.

- Educational Resources: The platform provides various educational resources, including demos, video tutorials, and online courses covering cash-flow management fundamentals and software usage.

- Free Trial: PlanGuru offers a 14-day free trial for users to explore its features. Additionally, there's a 30-day money-back guarantee for those unsatisfied with the service.

However, PlanGuru is known to be quite expensive, the software subscription starts at $99 per month for a single user, with the Multi-Department plan, accommodating three users, priced at $299 per month.

Additional users incur an extra cost of $29 per month each, potentially making scalability costly. And there is also a limited number of three users.

In addition, PlanGuru's functionality may be insufficient for larger businesses, as it lacks comprehensive cash management support required by such entities. User reviews have highlighted difficulties in document sharing across accounts, particularly affecting larger teams.

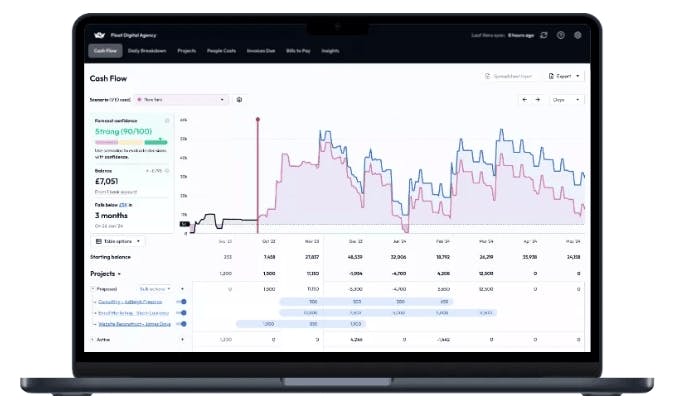

3. Float as a Cash Management System

Float is a cash-flow management software and app that simplifies budgeting and forecasting. Users can create budgets and adjust them to simulate various scenarios, such as increases in material costs or the hiring of new employees.

Its functionalities include:

- Well-designed Interface: Float boasts a clean and intuitive interface, facilitating the quick and easy creation of forecasts for different scenarios.

- Multi-User Functionality: The Essential plan allows up to three users, while the Enterprise plan accommodates up to 100 users, offering flexibility for businesses of different sizes.

- Premium Plans Include Expert Review: With Premium or Enterprise licenses, Float offers quarterly or monthly reviews of forecasts by in-house experts, providing valuable insights for improved cash-flow management.

However, users report it is relatively expensive. The Essential plan starts at $59 per month, while the Enterprise license costs $199 per month, which may be considered costly for some businesses.

In addition, Float's forecasts are limited to three years into the future, and some users have expressed a desire for more customization options beyond the pre-designed templates provided by Float.

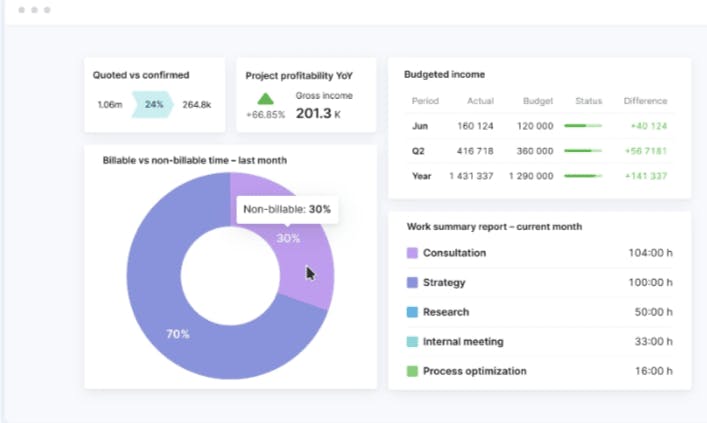

4. Scoro

Scoro is a good solution for businesses seeking a comprehensive tool that extends beyond mere cash-flow management.

Its software not only facilitates budgeting, forecasting, and cash-flow management but also encompasses a wide array of other business functionalities. With over 100 capabilities, including:

- Project management

- Sales pipeline tracking

- Supplier management

- Invoicing

- Employee time tracking

However, Scoro comes with some limitations noted by users. The basic version of Scoro only offers basic financial functionalities, such as invoicing and financial reporting summaries. Users must upgrade to more expensive plans to access budgeting and forecasting tools.

This adds up to the already high cost and onboarding fee, as access to the full capabilities of the Pro version costs $63 per user per month.

Additionally, Scoro charges an upfront onboarding fee, starting at $1,699, for businesses requiring human support during the implementation process.

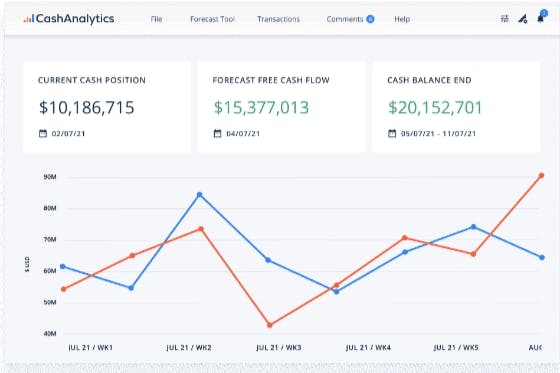

5. CashAnalytics

CashAnalytics stands out as a good cash-flow management tool tailored for larger businesses, particularly targeting companies in the mid-market segment.

Designed to streamline cash-flow forecasting and tracking processes, CashAnalytics offers automated solutions catered to the finance teams of these sizable enterprises.

CashAnalytics' key strengths are:

- Ability to operate across multiple currencies and seamlessly track transactions across various banks and ledgers.

- Leverages advanced analytics to analyze accounts payable and accounts receivable, providing valuable insights into cash-flow forecasting by examining past client and vendor behavior.

However, CashAnalytics has a very high cost, with the most basic plan starting at $500 per month and more advanced options commanding even higher fees.

Moreover, despite its advanced capabilities, some users have noted that the CashAnalytics software interface lacks the user-friendliness that you can, however, find in other options.

6. Pulse

Pulse is an online tool and mobile app designed exclusively for business owners seeking efficient cash-flow management solutions.

One standout feature of Pulse is its ability to organize cash-flow by customer and project, providing users with individualized insights into managing cash-flow for each account.

Some advantages to Pulse are:

- Excellent Functionality for Cash-flow Management: Pulse offers unique features, such as organizing cash-flow tracking by project, setting it apart from other competitors in the market.

- Simple and Easy to Understand: User reviews consistently praise Pulse for its simplicity and ease of use, making it accessible to business owners of all skill levels.

- Integration with Accounting Software: Pulse seamlessly integrates with accounting software like QuickBooks, allowing for automatic transaction uploads and synchronization.

Nevertheless, there are also limitations to Pulse:

- Key Functions Require More Expensive Plans: While Pulse's basic plan starts at $29 per month, access to advanced functionality, such as connecting to QuickBooks, requires a higher-tier subscription starting at $59 per month.

- Limited Tools Beyond Cash-flow Management: Pulse solely focuses on cash-flow management and lacks additional financial tools such as project management or tax planning, which may be limiting for some users with broader financial needs.

- Limited Support: Pulse offers limited customer support options, with no live customer service available. Users are directed to an online help center with an FAQ section for assistance.

7. QuickBooks

QuickBooks is one of the most widely used accounting program globally, known for its many financial management tools.

Among its offerings is a basic cash-flow management software, providing users with the capability to forecast cash-flow and budget up to 90 days into the future. Additionally, QuickBooks facilitates tasks such as:

- Managing invoices

- Paying bills

- Generating financial reports

While QuickBooks may not offer the same level of sophistication as specialized cash-flow management tools, it serves as a practical choice for users already utilizing the software for bookkeeping purposes.

8. Google Docs

If you choose to manage your business's cash-flow independently, Google Docs and Sheets offer downloadable templates that can serve as valuable tools.

These templates enable you to record transactions, track cash-flow, and in some cases, even provide forecasting capabilities for future financial planning.

A simple Google search or browsing through offerings from companies selling cash management software can lead you to a variety of these templates.

The pros to Google Docs are:

- Low-Cost and Often Free: Google Docs templates are a cost-effective option, particularly suitable for businesses on a tight budget. These templates provide cash-flow insights without requiring any financial investment.

- Wide Variety of Options: Numerous pre-built cash-flow templates are available for Google Docs, offering users the flexibility to experiment and choose the template that best suits their needs and preferences.

- Immediate Availability: With Google Docs, there's no need for lengthy onboarding processes or software setup. Users can simply download a template and begin filling it in for cash-flow management right away.

However, you should be aware that Google Docs does not have customer support, not all cash-flow management templates available on Google Docs are of equal quality and the cash-flow management capabilities are very basic and limited.

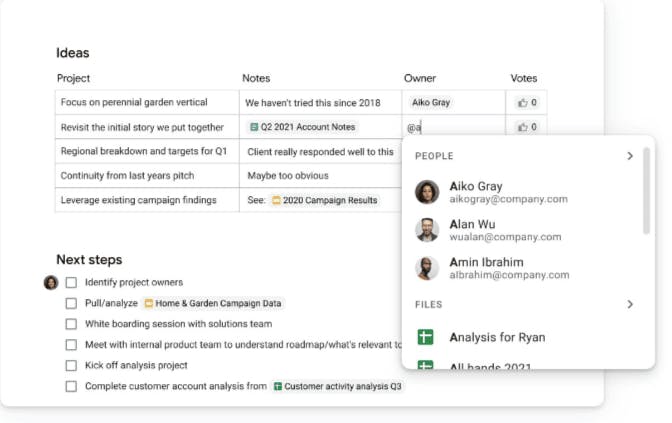

9. Cube

With Cube, businesses gain access to several cash management processes in a single, centralized platform. One of Cube's standout features is its ability to automatically transfer data from any spreadsheet into a multi-dimensional database.

Some key features are:

- Automated Data Consolidation: Cube streamlines the process of data consolidation by automating the transfer of data from spreadsheets into a multi-dimensional database, eliminating manual data entry and ensuring accuracy.

- Customizable Dashboards and Reports: Cube provides customizable dashboards and reports, allowing users to tailor their financial insights and presentations to their specific needs and preferences.

- Scenario Planning and Analysis: With Cube, businesses can conduct scenario planning and analysis, allowing them to assess the potential impact of various scenarios on their financial performance and make informed decisions.

However, despite its advanced features, Cube may lack some of the reporting features and visuals offered by other software solutions.

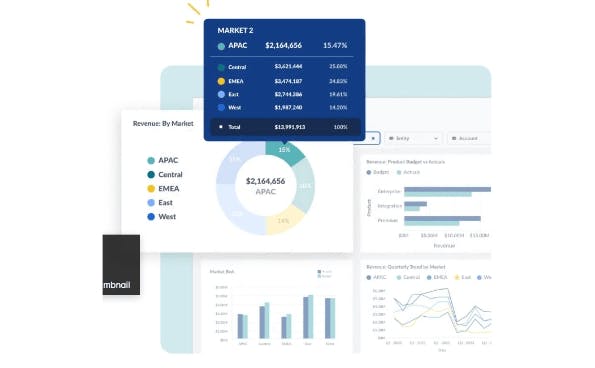

10. Vena Solutions

Vena Solutions is a great cloud-based cash management system designed to improve the management of financial data for businesses.

Offering a wide range of tools, Vena helps financial teams to automatize financial planning, cash flow management, and financial reporting processes.

Where does Vena stand out?

- Uses Excel on the Front End: Vena leverages Excel as its front-end interface, providing users with a familiar and intuitive environment for financial data management and analysis.

- Knowledgeable Support Staff and Online Training Materials: Vena offers access to a knowledgeable support staff and comprehensive online training materials, ensuring that users receive the assistance and resources needed to maximize the software's capabilities.

- Flexible Reporting Options: The software offers flexible reporting options, enabling users to easily analyze data and generate customized reports tailored to their specific requirements.

- Cloud-based with Mobile Support: Vena operates on a cloud-based platform, offering the flexibility of access from anywhere, anytime. Additionally, mobile support ensures seamless access to financial data on the go, enhancing convenience and efficiency for users.

What are its limitations?:

- Steep Learning Curve for Some Tools: While Vena provides powerful tools, some users may encounter a steep learning curve when navigating certain features or functionalities, requiring additional time and effort to fully grasp and utilize them effectively.

- Cloud Performance Issues with Large or Complex Reports: Users may experience performance issues with Vena's cloud-based platform when running large or complex reports, potentially impacting the efficiency and speed of data processing and analysis.

Why is Cash Flow Management Important?

Cash flow is the lifeblood of any business, as it represents the amount of cash coming in and going out of the company in a given period.

Poor cash flow management can lead to liquidity problems, difficulties in paying debts, and even bankruptcy. Thus, the importance of finding the right software to manage your finances accurately.

On the other hand, effective cash flow management can improve the financial health of the company, providing the ability to invest in growth, respond to financial emergencies, and seize strategic opportunities.

4 Benefits of Using Cash Flow Management Tools

What benefits can a cash flow management tool have in my businesses?

- Improved financial visibility: Cash flow management tools provide a clear view of the company's income and expenses, enabling better financial planning and budgeting.

- Process automation: With features such as automated invoicing and bank reconciliation, cash flow management tools help reduce administrative burden and improve operational efficiency.

- Informed decision-making: By providing updated and accurate financial data, cash flow management tools enable companies to make informed decisions about investments, expenses, and financial strategies.

How Can Banktrack Help Your Business

You know that effective cash flow management is extremely important for ensuring the financial stability and sustainable growth of a business.

Thus the reason for a cash management software.

As such, we have seen that these have amazing benefits to small businesses especially. From personalized dashboards to automated alerts, these tools offer valuable insights and functionalities to help businesses manage their finances more efficiently.

From the prior analysis, we can conclude that Banktrack's customizable categories and unique features make it a top option for many small businesses to manage their cash flows.

By using Banktrack, businesses can:

- Gain improved financial visibility

- Streamline processes

- Make informed decisions for long-term success

Frequently Asked Questions

1. Why is cash flow management important?

Cash flow is the lifeblood of any business, representing the amount of cash coming in and going out. Effective management ensures liquidity, timely payments, and financial stability.

2. What are the benefits of using cash flow management tools?

Cash flow management tools offer improved financial visibility, process automation, and informed decision-making, leading to better financial planning and budgeting.

3. How can Banktrack benefit my business?

Banktrack offers personalized dashboards, customizable categories, and automated alerts to help businesses manage their finances efficiently. It provides insights into spending patterns and ensures constant control over financial transactions.

4. What are some limitations of using cash flow management tools?

Some tools may have a steep learning curve, performance issues with large datasets, or limited functionalities for larger businesses. It's essential to evaluate each tool's capabilities and limitations before making a decision.

5. Are there affordable options for cash flow management software?

Yes, several options offer cost-effective solutions, such as Google Docs templates or basic plans from software providers like Float or Pulse. These options provide essential functionalities without breaking the bank.

6. How can cash flow management tools help with decision-making?

By providing up-to-date and accurate financial data, cash flow management tools enable businesses to make informed decisions about investments, expenses, and financial strategies, ultimately contributing to long-term success.

Share this post

Related Posts

The 6 Best SaaS Financial Projections for Founders in 2025

Discover six top SaaS financial-projection platforms tailored for founders, enabling accurate subscription modelling, scenario planning, and metric tracking to drive scalable growth in 2025.The 8 best alternatives to Spendee in 2025

Looking for a fresh way to manage your budget? Check out these top Spendee alternatives to help you track spending, set goals, control your finances.8 MoneyWiz alternatives for personal finance management

Looking for alternatives to MoneyWiz for managing personal finances? Explore 8 top apps that simplify budgeting and track expenses.

Try it now with your data

- Your free account in 2 minutes

- No credit card needed