The Best Expense Tracking App in 2024

- Top 7 Best Expense Tracking Apps

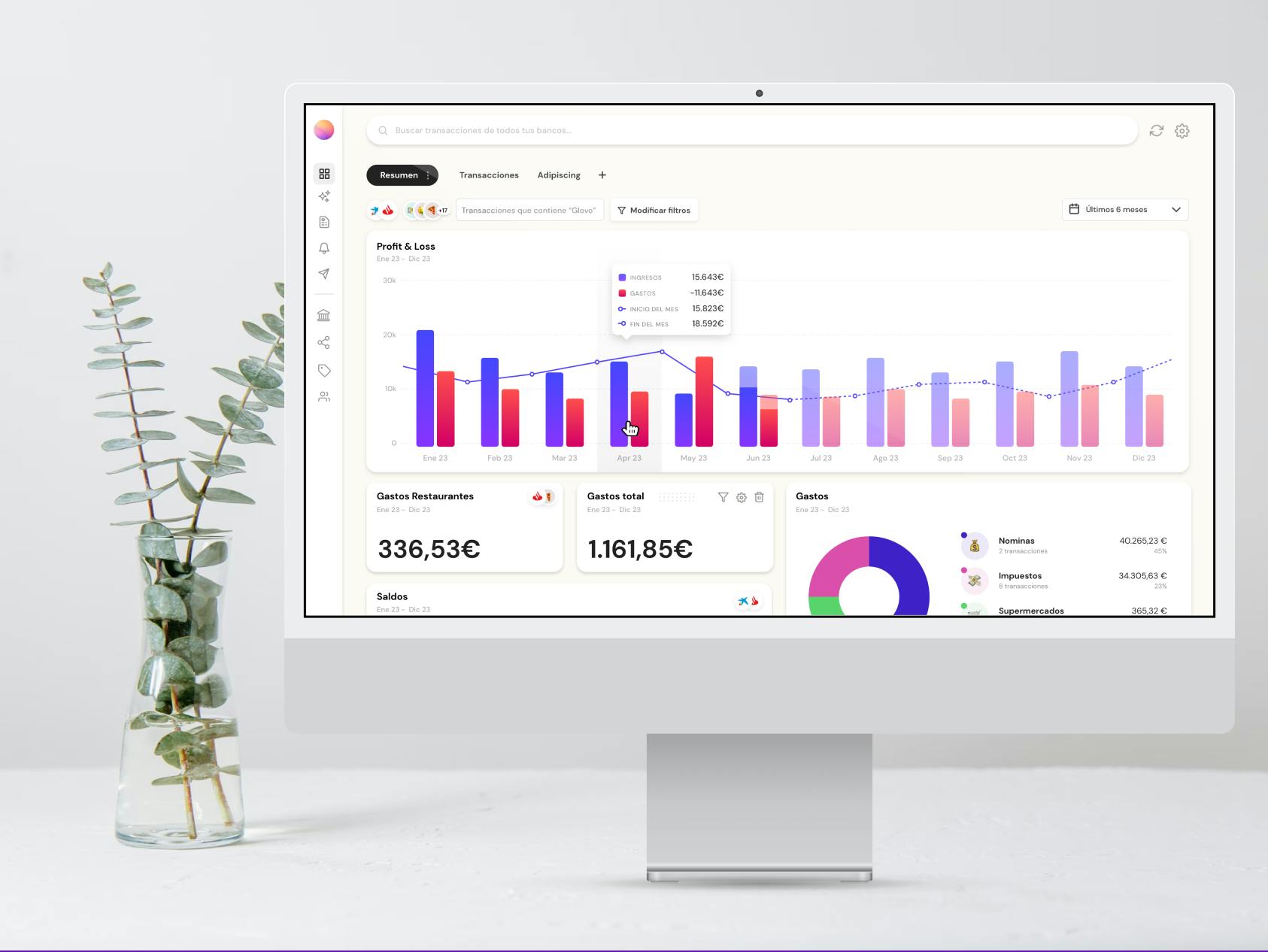

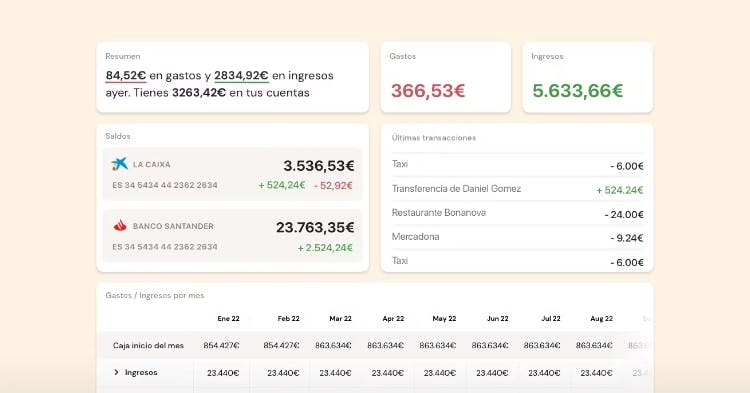

- 1. Banktrack

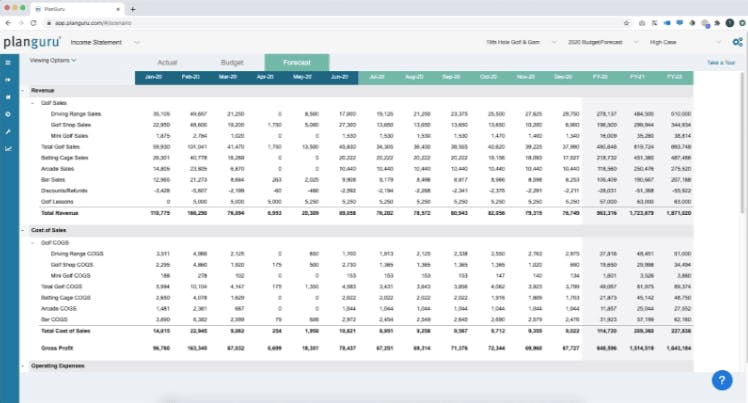

- 2. PlanGuru

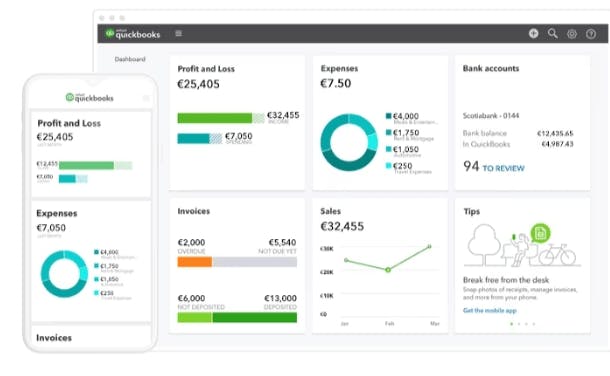

- 3. QuickBooks

- 4. Pulse

- 5. QuickBooks

- 6. Vena Solutions

- 7. Cube

- 7 Reasons Why Expense Tracking is Essential for Financial Well-being

- What Features does a Good Expense Tracking App Have?

- 1. User Interface and Accessibility

- 2. Expense Tracking and Categorization

- 3. Budget Customization and Flexibility

- 4. Automated Transactions and Syncing

- 5. Goal Setting and Tracking

- 6. Security Measures

- 7. Personalized Insights and Recommendations

- 8. Customer Support and Assistance

- Conclusion

- Frequently Asked Questions - FAQs

- How can I find the best personal finance tracking app?

- Is it safe to use an expense tracking app like Banktrack?

- Can I sync my bank accounts with an expense tracking app?

- How does Banktrack provide personalized insights and recommendations?

Are you looking for the best expense tracking app?

- Banktrack

- PlanGuru

- QuickBooks

- Pulse

- Quickbooks

- Vena Solutions

- Cube

From monthly bills to everyday expenses, keeping track of where your money goes can be a daunting task.

Fortunately, the rise of expense tracking apps has revolutionized the way individuals manage their finances, offering convenience, efficiency, and insight like never before.

We will delve into the key features to look for in an expense tracking app so you can make the decision for yourself.

Top 7 Best Expense Tracking Apps

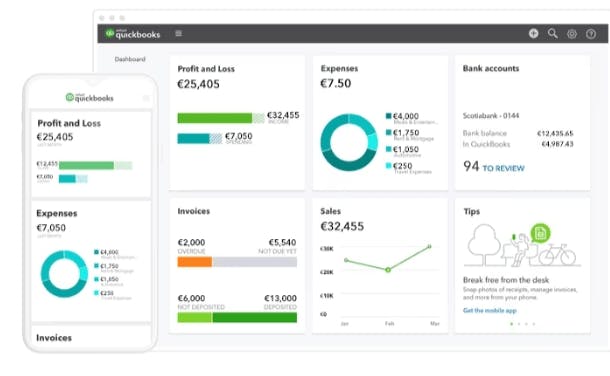

1. Banktrack

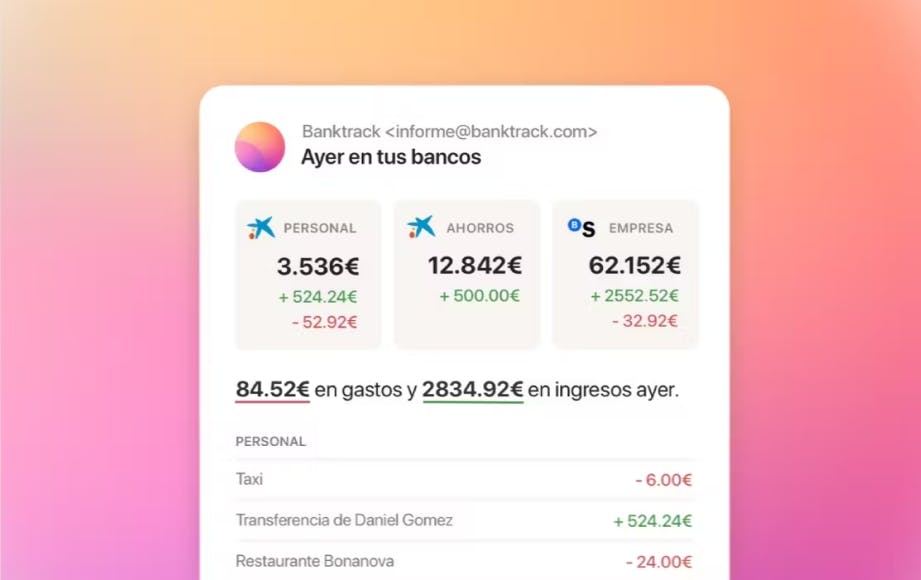

Banktrack stands out as the best expense tracking app for all types of enterprises.

Users can effectively access real-time financial information thanks to its customizable dashboards and flexible categorization options, which also allow for accurate tracking of income and expenses.

Businesses can easily make informed decisions and stay in constant control of their finances with the help of personalized reports and alerts.

Key Features:

- Personalized dashboards

- Integration with multiple bank accounts and products

- Customizable spending metrics

- Automated alerts and reports

- Affordable pricing starting at €16.58 per month

2. PlanGuru

PlanGuru offers budgeting and forecasting capabilities, giving businesses the power to analyze complex financial data and make informed decisions about their business's future.

With integration with QuickBooks and Excel, users can streamline their financial processes and gain good insights into their cash flow.

Key Features:

- Budgeting and forecasting tools

- Integration with QuickBooks and Excel

- Educational resources for users

- 14-day free trial and 30-day money-back guarantee

3. QuickBooks

Another popular accounting program is QuickBooks, which is known for being user-friendly and having basic cash flow management features.

Although QuickBooks might not have all the sophisticated features of specialized cash management software, it is still a good option for companies that already use the platform for bookkeeping.

Key Features:

- Basic cash flow management tools

- Invoicing and bill payment capabilities

- Financial reporting and analysis

- Seamless integration with accounting software

4. Pulse

Pulse provides efficient tracking features solutions for business owners, with functionalities to organize cash flow by customer and project.

Pulse is a good choice for small businesses due to its simplicity and ease of use, even though some advanced features might require more expensive subscriptions.

Key Features:

- Cash flow organization by customer and project

- Simple and intuitive interface

- Integration with accounting software

- Affordable pricing starting at $29 per month

5. QuickBooks

QuickBooks is also a widely used expense tracking app known for its basic cash flow management tools and ease of use.

While it may lack some advanced functionalities found in specialized cash management software, QuickBooks serves as a practical choice for businesses already using the platform for bookkeeping purposes.

Key Features:

- Basic cash flow management tools

- Invoicing and bill payment capabilities

- Financial reporting and analysis

- Seamless integration with accounting software

6. Vena Solutions

Vena Solutions offers expense tracking, financial planning and cash management solutions, leveraging Excel for a familiar user experience.

While some users may find the learning curve steep for certain tools, Vena's comprehensive features and flexible reporting options make it a valuable asset for businesses of all sizes.

Key Features:

- Cloud-based financial planning and cash management

- Excel-based interface for familiar user experience

- Knowledgeable support staff and online training materials

- Flexible reporting options and mobile support

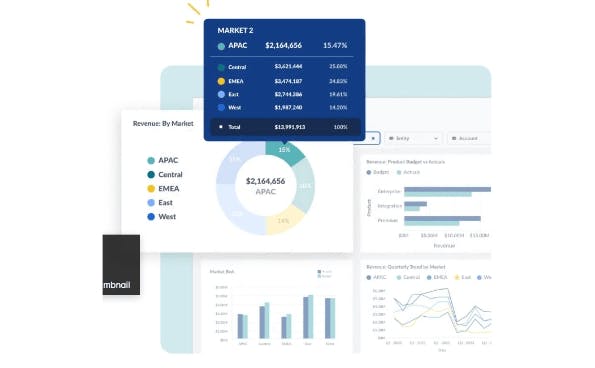

7. Cube

Cube streamlines expenses and cash flow management with automated data consolidation and customizable reporting options.

Cube's ability to analyze data and generate customized reports makes it a valuable tool for businesses looking for effective financial management solutions, even though some users may find certain features to be challenging to use at first.

Key Features:

- Automated data consolidation from spreadsheets

- Customizable dashboards and reports

- Scenario planning and analysis tools

- Integration with accounting software

7 Reasons Why Expense Tracking is Essential for Financial Well-being

Yes, it sounds great. But is it truly important? What tangible benefits does it have?

Here are several reasons why expense tracking is important:

- Financial Awareness: Believe it or not, just being aware of your finances can make a great difference. Tracking expenses provides individuals with a clear understanding of where their money is being spent. It helps identify areas of overspending and know where there are opportunities for savings!

- Budgeting: Expense tracking serves as the foundation for creating and sticking to a budget. By knowing how much is spent in different categories, individuals can allocate their resources more effectively and prioritize spending based on their financial goals.

- Identifying Spending Patterns: Analyzing expense data over time reveals recurring patterns and habits. This insight enables individuals to make informed decisions about their spending behavior and identify areas where adjustments may be needed.

- Debt Management: Tracking expenses allows individuals to monitor debt repayment progress and identify opportunities to accelerate debt reduction. By allocating more funds towards debt repayment, individuals can reduce interest costs and achieve financial freedom sooner.

- Financial Goal Setting: Expense tracking provides clarity on current financial circumstances, allowing individuals to set realistic and achievable financial goals. Whether saving for a vacation, a home, or retirement, understanding expenses is essential for developing a strategic plan to reach these goals.

- Emergency Preparedness: Knowing where money is being spent enables individuals to build emergency funds to cover unexpected expenses or financial setbacks. By having a clear picture of their financial situation, individuals can better withstand unforeseen circumstances without resorting to debt or financial stress.

- Improving Financial Health: Ultimately, expense tracking empowers individuals to take control of their finances and make informed decisions that improve their overall financial health. By understanding their spending habits and making adjustments as needed, individuals can work towards achieving financial stability and long-term prosperity.

What Features does a Good Expense Tracking App Have?

1. User Interface and Accessibility

Of course, one of the most critical aspects of any expense tracking app is its user interface and accessibility.

A user-friendly interface that is intuitive to navigate and accessible across multiple devices is essential for seamless financial management.

An expense tracking app exemplifies this with its sleek design and compatibility with both desktop and mobile platforms, ensuring users can easily access their financial data anytime, anywhere.

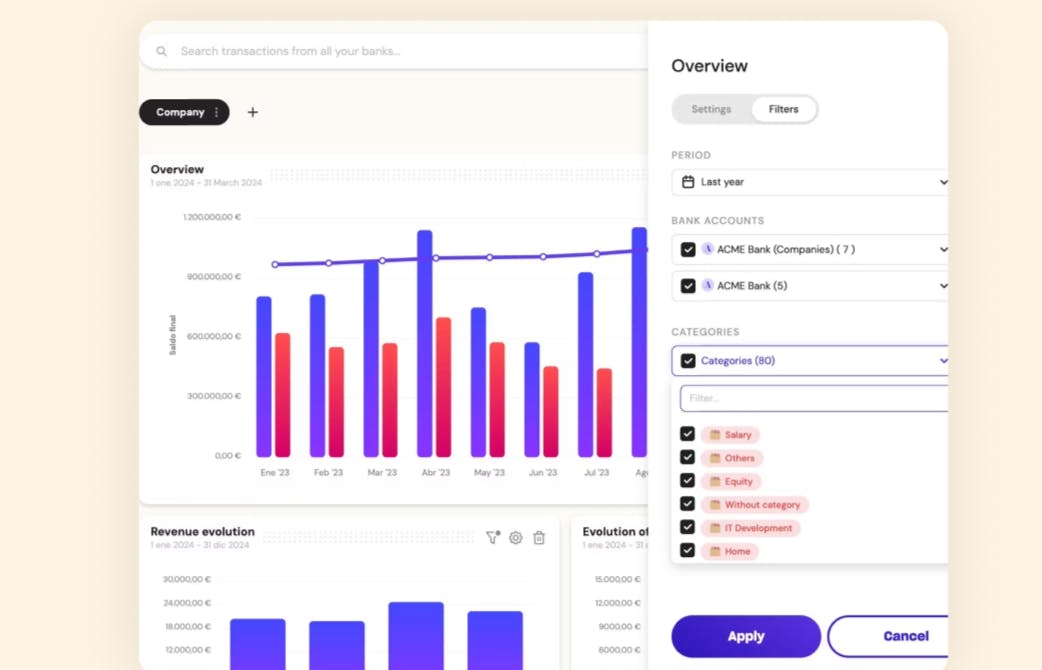

2. Expense Tracking and Categorization

Effortlessly categorizing expenses and tracking spending is another important feature to look for in expense tracking apps.

Banktrack simplifies this process by allowing users to categorize expenses, set spending limits, and generate customizable reports to gain insights into their spending patterns.

With integrated views of different bank accounts and financial products, users can gain a comprehensive understanding of their financial landscape with ease.

Amazing, right?

3. Budget Customization and Flexibility

Every individual has unique financial goals and preferences, right?

That is why budget customization and flexibility are essential features to look for in an expense tracking app.

Banktrack enables users to set spending limits in various categories and receive personalized notifications and alerts through their preferred channels. You can choose between the following:

- SMS

- Slack

- Telegram

Additionally, the ability to create, customize, and send financial reports via multiple platforms ensures users have full control over their financial management.

4. Automated Transactions and Syncing

Manually syncing financial data with different banks can be time-consuming and tedious.

That's where automated transactions and syncing come into play.

Banktrack is the best app to link all bank accounts, because it bank aggregator allows users to sync with over 120 banks, offering both Open Banking (PSD2) and Direct Access connections for efficient and secure integration of financial data.

This seamless syncing process ensures users have access to real-time transaction information without the hassle of manual entry.

5. Goal Setting and Tracking

Setting and tracking financial goals is very important for staying motivated and on track with budgeting efforts.

With an expense tracking app, users can set savings goals, debt repayment targets, and milestones, with progress tracking features to monitor their financial journey.

This feature empowers users to take control of their finances and work towards achieving their financial objectives quite effectively.

6. Security Measures

Security is, of course, the number one priority when it comes to managing personal and banking data.

An expense tracking app prioritizes the security of user information by using authorized and audited banking data providers approved by regulatory authorities.

With encrypted transaction data and stringent security measures in place, users can trust that their financial information is safe and secure.

7. Personalized Insights and Recommendations

In addition to tracking expenses and setting goals, a top-notch expense tracking app should provide personalized insights and recommendations to help users make informed financial decisions.

Banktrack goes above and beyond by offering tailored analysis of spending habits, suggesting areas for potential savings, and providing actionable recommendations to improve financial health.

However, you can also take advantage of the reports and financial visuals to make your own conclusions!

8. Customer Support and Assistance

A good, prompt and reliable customer support is essential for addressing any issues or questions that users may encounter while using the app.

Look for solutions that have very well reviewed customer support and assistance to ensure you don't encounter issues along the way.

Conclusion

In conclusion, expense tracking apps like Banktrack offer comprehensive features designed to streamline financial management and provide valuable insights into spending habits.

By prioritizing user interface, expense tracking, budget customization, automated syncing, goal setting, security, personalized insights, and customer support, Banktrack exemplifies the pinnacle of expense tracking app excellence.

Whether you're a budgeting novice or a seasoned financial pro, investing in the right expense tracking app can really change the way you manage your finances, providing peace of mind and financial freedom for years to come.

Frequently Asked Questions - FAQs

How can I find the best personal finance tracking app?

We encourage you to look for the above mentioned features when choosing an app. While Banktrack stands out as a top choice for expense tracking, you can also research online reviews and comparisons of different apps to find one that best suits your needs and preferences.

Is it safe to use an expense tracking app like Banktrack?

Yes, Banktrack prioritizes user security by employing authorized and audited banking data providers approved by the Bank of Spain. Additionally, all transaction data is encrypted to ensure the confidentiality and security of users' financial information.

Can I sync my bank accounts with an expense tracking app?

Yes, many expense tracking apps, including Banktrack, offer the option to sync with various banks and financial institutions, allowing users to automatically import transaction data for a comprehensive view of their finances.

How does Banktrack provide personalized insights and recommendations?

Banktrack analyzes users' spending habits and financial goals to provide tailored insights and recommendations for improving financial health. These recommendations may include areas for potential savings, budget adjustments, and goal-setting strategies.

Share this post

Related Posts

Best 8 Cashflow Monitoring Apps in 2025

Discover the best 8 cashflow monitoring apps in 2025 that help businesses track income, expenses, and liquidity in real timeThe 6 Best SaaS Financial Projections for Founders in 2025

Discover six top SaaS financial-projection platforms tailored for founders, enabling accurate subscription modelling, scenario planning, and metric tracking to drive scalable growth in 2025.7 Best Financial Projection Apps in 2025

Discover the top financial-projection apps that simplify scenario modelling, integrate with your accounting data, and help your business forecast revenue, expenses and growth with confidence.

Try it now with your data

- Your free account in 2 minutes

- No credit card needed