Top 7 Best Treasury Management Software

- What is a treasury management software?

- Top 7 best treasury management software

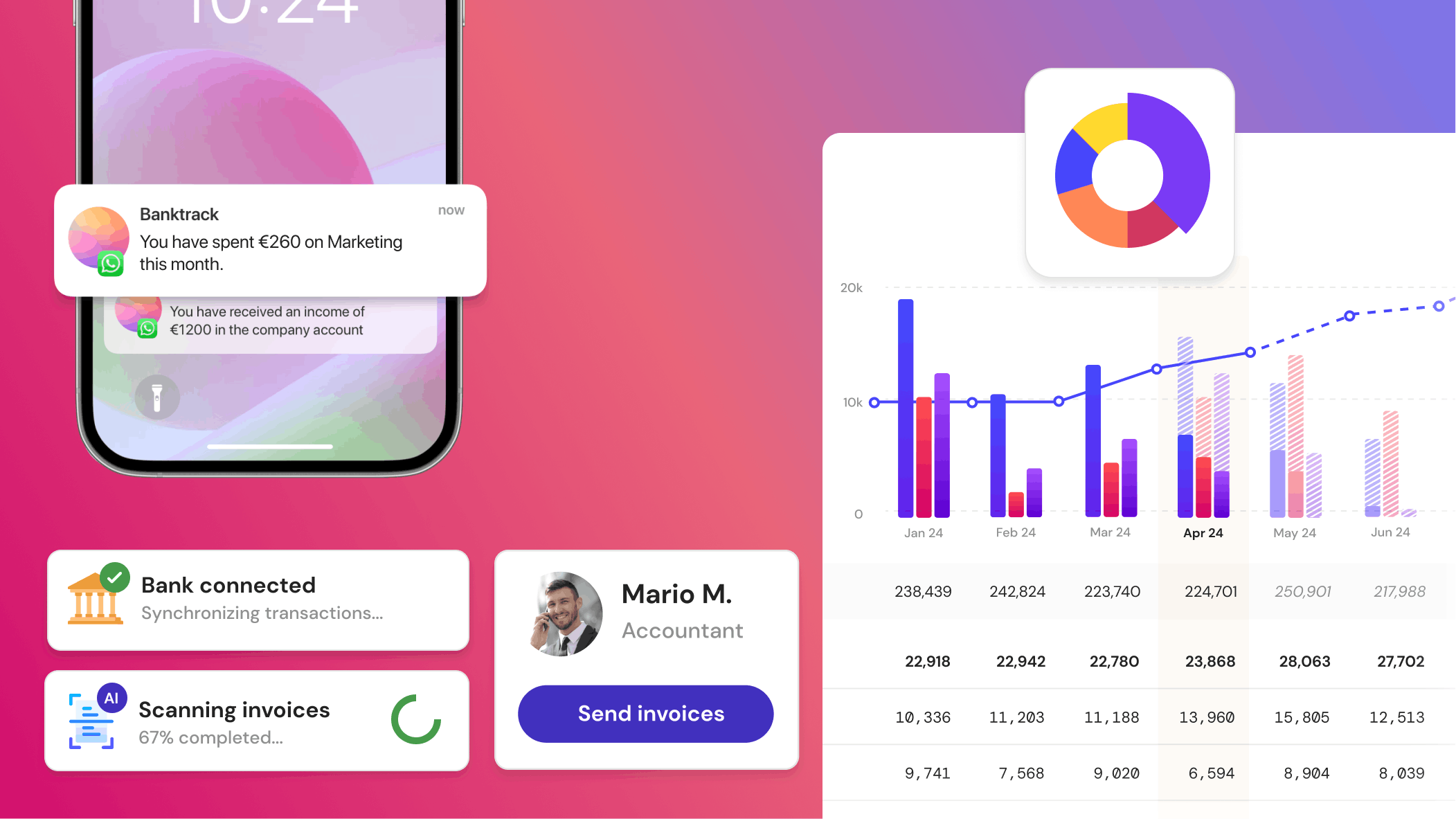

- 1. Banktrack

- 2. Kyribia

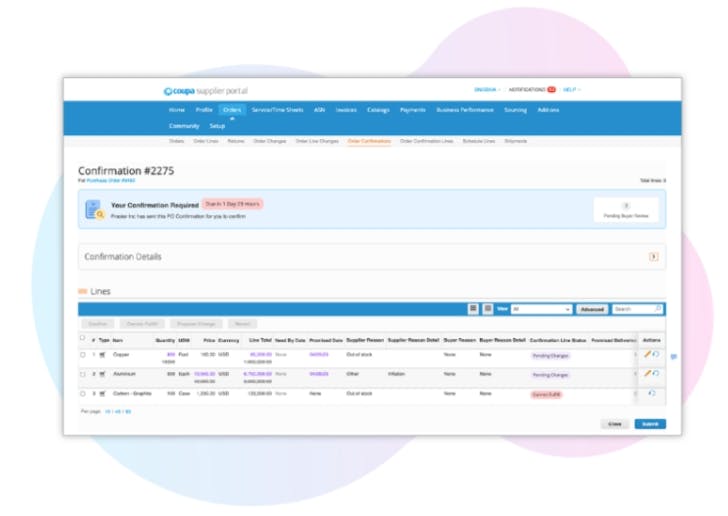

- 3. Coupa

- 4. Payhawk

- 5. Fuell

- 6. PlanGuru

- 7. QuickBooks

- 7 key features of a top treasury management software

- 1. Expense tracking and categorization

- 2. Customizable budgeting and adaptability

- 3. Automated transactions and syncing

- 4. Goal setting and progress tracking

- 5. Strong security measures

- 6. User-friendly interface and accessibility

- 7. Personalized insights and recommendations

- How do I choose the right treasury management software?

- Conclusion

- Frequently asked questions - FAQs

- 1. What is treasury management software?

- 2. How does treasury management software benefit businesses?

- 3. What are the key features of treasury management software?

- 4. How should businesses choose the right treasury management software?

- 5. Can treasury management software integrate with existing accounting systems?

- 6. Is treasury management software suitable for small businesses?

What is the best treasury management software?

- Banktrack

- Kyribia

- Coupa

- Payhawk

- Fuell

- PlanGuru

- QuickBooks

Efficient treasury management is extremely important for businesses to thrive.

As companies deal with complex financial transactions, the need for a treasury management software becomes very much needed. Right?

So don’t worry, this article delves into the world of treasury management software, highlighting its importance, key features, and how it streamlines financial operations for businesses.

What is a treasury management software?

Managing corporate finances involves many tasks, including cash flow management, risk assessment, and financial planning.

This is why a treasury management software serves as a great comprehensive solution to streamline these processes.

From automating routine tasks to providing real-time insights, such software empowers finance professionals to make informed decisions efficiently.

Top 7 best treasury management software

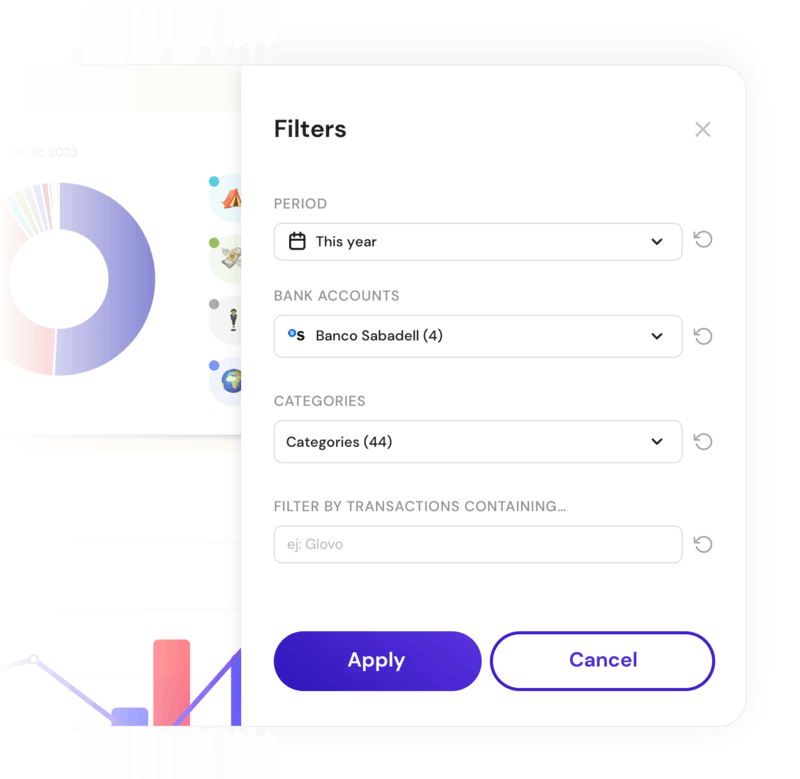

1. Banktrack

Banktrack is the best treasury management software for all types of enterprises.

Users can effectively access real-time financial information thanks to its customizable dashboards and flexible categorization options, which also allow for accurate tracking of income and expenses.

Businesses can easily make informed decisions and stay in constant control of their finances with the help of personalized reports and alerts.

Key features:

- Ultra-customizable dashboards: allows users to create fully tailored dashboards for clear and efficient financial data visualization according to their specific needs.

- Integration with multiple bank accounts and products: simplifies the connection and centralized management of all your bank accounts and financial products, making fund control easier.

- Customizable spending metrics: provides the ability to define and adjust spending indicators based on the priorities and needs of each business.

- Automated alerts and reports: generates automatic notifications and detailed reports to keep users informed of any important financial changes or events.

- Invoice reconciliation: eases the process of reconciling invoices with bank records, ensuring transaction accuracy and preventing errors.

- Cash flow forecasting: enables precise projections and financial planning to optimize future cash flow management.

Affordable pricing starting at €39 per month.

2. Kyribia

Kyriba is a treasury management tool that supports corporate strategy decision-making for big businesses.

Although the platform is a fantastic option for big businesses, it is not supported for smaller companies.

Key Features:

- Money management: allows efficient management of cash flows and optimization of available funds.

- Currency exchanges: facilitates the management and conversion of different currencies, enhancing international operations.

- Liquidity planning: helps forecast short- and long-term cash needs to ensure financial solvency.

- Bank connections: eases integration with various banking institutions, enabling centralized account management.

3. Coupa

Enterprise cash and spend management is mainly what Coupa offers.

Although the platform is another popular treasury solution for large businesses, it lacks some features that are necessary to support expanding companies.

Key features:

- Management of cash and liquidity: helps businesses monitor and optimize their cash flow, ensuring they have the right amount of liquidity at the right time to meet financial obligations.

- Management of investments and debt: allows companies to manage their investment portfolios and debt obligations, ensuring they make informed decisions to balance risk and return.

- Projecting: provides forecasting tools to predict future cash flows, enabling businesses to plan ahead and make proactive financial decisions.

- Multilateral netting: streamlines the settlement of intercompany transactions by netting payments and receipts across multiple parties, reducing transaction costs and simplifying financial management.

- In-House Banking: enables businesses to manage their internal bank accounts and financial operations, centralizing cash management and reducing reliance on external financial institutions.

4. Payhawk

Payhawk is a worldwide application for managing expenses that integrates sophisticated tracking software with corporate cards.

Its key features are:

- Reimbursement of pre-paid expenses: paying back employees for expenses they’ve already covered for the company.

- Exchanges of currencies without commission: exchanging currencies without extra fees.

- Creation of virtual and physical credit cards with customizable spending caps: issuing credit cards with set spending limits to control costs.

- Multi-entity management: centralized management of expenses and cash flow across multiple business units.

5. Fuell

Fuell combines sophisticated treasury management tool with corporate cards. This makes it a good option for businesses or individuals looking to manage their treasury.

Its functionalities are:

- Create an infinite number of real and virtual credit cards: issue as many physical and virtual credit cards as needed for the business.

- Compatibility across different ERPs: works seamlessly with various ERP systems for smooth integration.

- OCR technology, approved by the tax agency, for automatic receipt reading: uses OCR to automatically scan and process receipts, compliant with tax regulations.

- Create personalized expense reports and automate VAT recovery: customize expense reports and automate the process of recovering VAT.

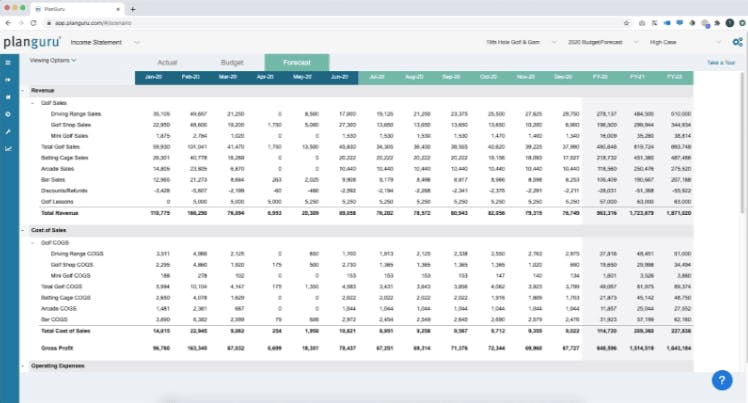

6. PlanGuru

Using PlanGuru's tools for treasury management, businesses can analyze financial information and make educated decisions about their future.

By integrating with QuickBooks and Excel, users can improve their financial processes and obtain insightful knowledge about their cash flow.

Key features:

- Forecasting and budgeting tools: provides tools to predict financial trends and create detailed budgets for better financial planning.

- Integration with QuickBooks and excel: easily integrates with QuickBooks and Excel for streamlined financial management and reporting.

- User education resources: offers training materials and resources to help users maximize the platform's features.

30-day money-back guarantee; and a 14-day free trial

7. QuickBooks

Another popular treasury management platform is QuickBooks, which has a reputation for being easy to use and providing basic treasury capabilities.

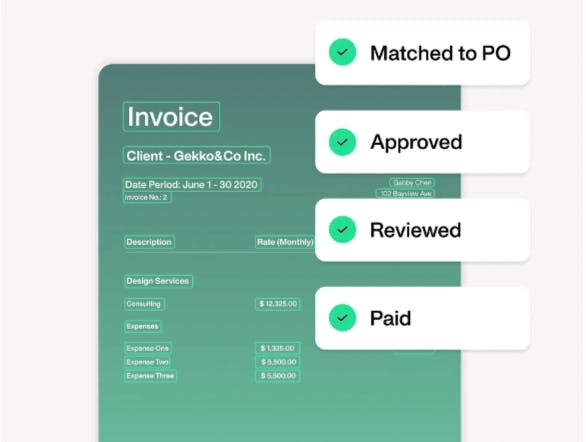

QuickBooks is still a good option for businesses that currently use the platform for bookkeeping, even though it might not have all the advanced features of specialized cash management software.

Important characteristics:

- Traditional cash flow management capabilities: offers basic tools to track and manage cash inflows and outflows for better financial control.

- Capabilities for billing and invoicing: allows businesses to create, send, and manage invoices and billing processes efficiently.

- Analysis and reporting of financial data: provides detailed financial reports and analysis to help businesses make informed decisions.

- Smooth compatibility with accounting software: integrates seamlessly with other accounting software for simplified financial management.

7 key features of a top treasury management software

1. Expense tracking and categorization

Simplifying expense categorization and tracking spending is almost a priority for users.

A treasury management software streamlines this process by allowing users to categorize expenses, establish spending limits, and generate tailored reports to analyze their spending habits.

With integrated views of multiple bank accounts and financial products, users gain a comprehensive overview of their financial situation fast and effortlessly.

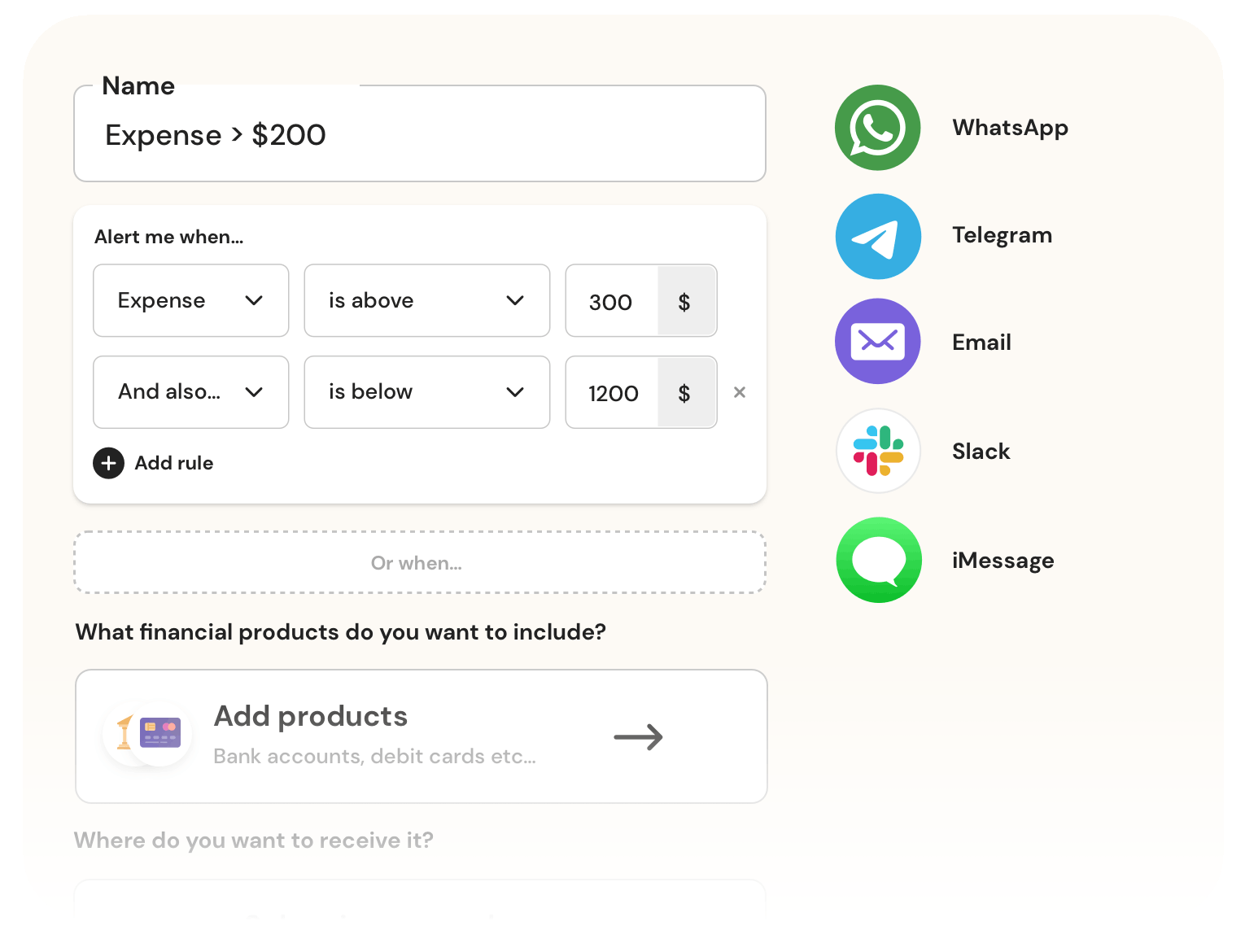

2. Customizable budgeting and adaptability

Budget customization and flexibility are indispensable features in an treasury management app, considering the diverse financial goals and preferences of users.

This is why Banktrack empowers users to set spending limits across different categories and receive personalized notifications through their preferred channels, be it WhatsApp, SMS, email, Slack, or Telegram.

Moreover, the ability to create, customize, and distribute financial reports via multiple platforms ensures users maintain full control over their financial management.

3. Automated transactions and syncing

Manual synchronization of financial data across various banks can be arduous and time-consuming.

Banktrack simplifies this process by offering automated transactions and syncing capabilities.

As the premier app for linking all bank accounts, it provides seamless integration with over 120 banks, leveraging both Open Banking (PSD2) and Direct Access connections for efficient and secure data integration.

This automated syncing guarantees users access to real-time transaction information without the hassle of manual entry.

4. Goal setting and progress tracking

Setting and monitoring financial goals are very important in maintaining motivation and making sure you stick to your budget.

Check out our article on personal finance tracking for more insights!

A treasury management software enables users to establish savings targets, debt repayment goals, and milestones, complete with progress tracking features to monitor their financial journey.

This functionality empowers users to take charge of their finances and work towards achieving their financial objectives efficiently.

5. Strong security measures

Security stands as the first concern when it comes to managing personal and banking data.

And Banktrack places utmost priority on user information security. How?

It employs authorized and audited banking data providers endorsed by regulatory authorities like the Bank of Spain.

With encrypted transaction data and rigorous security protocols in place, users can rest assured that their financial information remains safeguarded and confidential.

6. User-friendly interface and accessibility

The backbone of any expense tracking application lies in its user interface and accessibility.

A smooth, intuitive interface that seamlessly adapts across various devices is extremely important for effective financial management. You don't want to not be able to use the software wherever and whenever you want.

A treasury management software sets the standard with its sleek design and cross-platform compatibility, ensuring users can effortlessly access their financial data wherever they are.

7. Personalized insights and recommendations

Beyond mere expense tracking, a top-tier treasury management application should offer personalized insights and recommendations to facilitate informed financial decision-making.

Banktrack provides tailored analysis of spending patterns, suggesting areas for potential savings, and delivering actionable recommendations to improve financial well-being.

Nevertheless, users can also make use of the the app's reports and financial visuals to draw their own conclusions and insights. We actually highly encourage that!

How do I choose the right treasury management software?

Choosing the best treasury management software for your business requires careful consideration of various factors.

First, evaluate your company's specific needs, budget constraints, and scalability requirements before making a decision.

Additionally, consider factors such as user-friendliness, integration capabilities, and customer support.

When selecting treasury management software, it’s important to consider several key factors to ensure it meets your company’s needs.

Here are some essential aspects to keep in mind:

- Scalability: the software should be able to grow with your company, allowing you to add new features and handle increasing transaction volumes as your business expands.

- Integration with other ERPs: it should seamlessly integrate with your existing ERP systems (such as SAP, Oracle, QuickBooks, etc.) to ensure centralized and smooth financial management across platforms.

- Ease of use: the interface should be intuitive and user-friendly, allowing teams to adopt it quickly without extensive training.

- Security: the software must have strong security measures, such as data encryption and multi-factor authentication, to protect sensitive financial information.

- Quick support: it should offer responsive customer service, with fast response times for troubleshooting or queries.

- Good reviews: check the feedback from other users to ensure the software is reliable and meets performance and quality expectations. Positive reviews and recommendations are a good indicator of its effectiveness.

Conclusion

In conclusion, investing in the best treasury management software is completely worth it as it optimizes financial operations, enhances cash flow management, mitigates risks, and ensures regulatory compliance.

By using these advanced features and capabilities, businesses can streamline their treasury management processes and drive sustainable growth in today's competitive market.

Frequently asked questions - FAQs

1. What is treasury management software?

Treasury management software is a comprehensive solution designed to streamline financial operations, including cash management, risk assessment, and financial reporting, for businesses.

2. How does treasury management software benefit businesses?

Treasury management software automates routine financial tasks, provides real-time insights, enhances cash flow management, mitigates financial risks, and ensures compliance with regulatory requirements, thereby improving operational efficiency and decision-making.

3. What are the key features of treasury management software?

Key features of treasury management software include automated cash management, risk management solutions, integrated financial reporting, payment processing capabilities, and security and compliance features.

4. How should businesses choose the right treasury management software?

Businesses should consider factors such as their specific needs, budget constraints, scalability requirements, user-friendliness, integration capabilities, and customer support when selecting treasury management software.

5. Can treasury management software integrate with existing accounting systems?

Yes, leading treasury management software solutions offer seamless integration with existing accounting systems, allowing businesses to generate comprehensive financial reports and streamline financial processes.

6. Is treasury management software suitable for small businesses?

Yes, treasury management software solutions cater to businesses of all sizes, including small businesses offering scalable options to meet the unique needs of small and medium-sized enterprises (SMEs) as well as large corporations.

Share this post

Related Posts

Top 7 Best Treasury Cash Flow Forecasting Software

Curious to know what the top 7 best treasury cash flow forecasting softwares for accurate financial planning and management in 2024 are?The Worst 9 Limitations of Cash Flow Forecasting

Cash flow forecasting predicts how much cash will come in out over a certain period. Here are 12 limitations that you should have in mind.

Try it now with your data

- Your free account in 2 minutes

- No credit card needed