Top 9 bank trackers in France in 2024

- Top 9 Bank Tracker in France 2024

- 1. Banktrack

- 2. Linxo

- 3. Revolut

- 4. Emma

- 5. Fintonic

- 6. Spendee

- 7. Toshl Finance

- 8. N26

- 9. PocketSmith

- 4 Steps For Setting Up and Using a Bank Tracker in France

- Step 1: Choose Your Ideal Tracker

- Step 2: Sync Your Bank Accounts

- Step 3: Set Your Budgets and Goals

- Step 4: Use Real-Time Alerts to Your Advantage

- 3 Tips for Making the Most of Your Bank Tracker

- 1. Schedule Regular Check-Ins

- 2. Use Visual Insights to Your Advantage

- 3. Set and Celebrate Small Wins

- Why Use a Bank Tracker in France?

- Key Features to Look for in a Bank Tracker

- Get the Best Bank Tracker in France

Top 9 Bank Tracker France

- Banktrack

- Linxo

- Revolut

- Emma

- Fintonic

- Spendee

- Toshl Finance

- N26

- PocketSmith

Living in France has many advantages: good food, rich culture and a solid banking system. But let's face it: keeping accounts isn't exactly the most exciting thing. Whether you live here, just moved here or visit often, managing your money doesn't have to be a nightmare.

A great bank tracker can help you see exactly where your money is going each month, making it easier to budget, save and even invest. Curious about how a bank tracker can make things simpler for you?

Top 9 Bank Tracker in France 2024

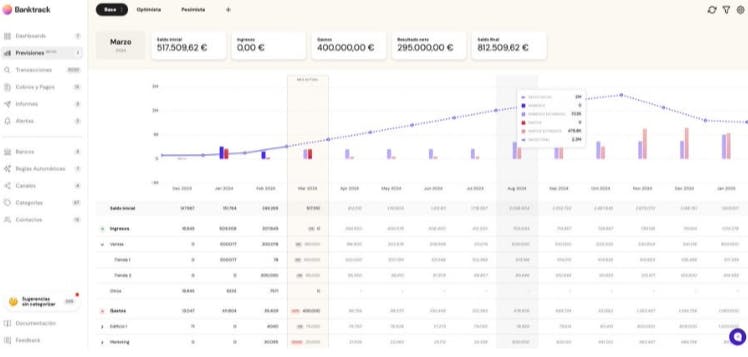

1. Banktrack

If managing receipts and invoices feels overwhelming, Banktrack is here to simplify expense tracking.

It offers powerful, flexible tools for both personal and business finances, making modern expense management easy and secure.

Key Features

- Customizable Dashboards: Get a real-time view of your finances. Customize dashboards to monitor spending, analyze expenses, and track income over time.

- Seamless Bank Integration: Banktrack syncs with over 120 banks, from traditional to neobanks, using Open Banking for secure, centralized access.

- Expense Categorization: Categorize and track spending precisely with custom categories, giving you clearer insights into your financial habits.

We have the 5 best apps for tracking expenses and receipts

- Strong Security Measures: Your data is safe with authorized providers, read-only access, and encryption, ensuring top-level security.

- Cash Flow Forecasting: Banktrack’s forecasting tools analyze past trends to help you plan ahead and prepare for future financial needs.

Check out the top 7 best cash flow management software in 2024

- Automated Bank Reconciliation: Forget manual reconciliation, Banktrack automatically matches your bank statements to your records, saving time and reducing errors.

Pros and Cons:

Pros:

- Comprehensive features for both personal and business needs

- Integrates with a wide range of banks

- Strong security measures

Cons:

- Some advanced features require a subscription

- Might be more than you need for simple tracking

2. Linxo

Linxo, is for its real-time notifications and multi-account tracking. It’s designed for French banking and offers insights into spending patterns with daily and monthly breakdowns.

Linxo also has a premium version with added features like personalized budget alerts, making it a solid choice for anyone serious about tracking their finances.

3. Revolut

Revolut is for anyone with a lifestyle that crosses borders. With Revolut, you can manage multiple currencies, set budgets, and even track international spending in real time.

It also has savings vaults and spending analytics, which help you set aside funds for goals, all while offering top-notch data security.

4. Emma

Emma is a user-friendly app with subscription management, so you can track recurring charges like Netflix or Spotify. With Emma, you can categorize spending, set budgets, and even get reminders for upcoming bills.

It’s for anyone wanting an app that’s as intuitive as it is informative, making it easy to stay on top of monthly expenses.

5. Fintonic

Originally developed in Spain, Fintonic is growing in popularity across Europe for its AI-powered financial insights. It offers detailed tracking, spending summaries, and alerts for unusual transactions.

Fintonic is great if you want a tracker that can notify you of fees and help you find savings on regular expenses like utilities and insurance.

6. Spendee

Spendee is all about visual budgeting, offering graphs and charts that help you understand spending habits at a glance. It’s great for visual learners and supports multi-currency tracking, ideal for anyone frequently traveling across Europe.

Spendee also has shared wallets, making it a top pick for managing group expenses or shared budgets.

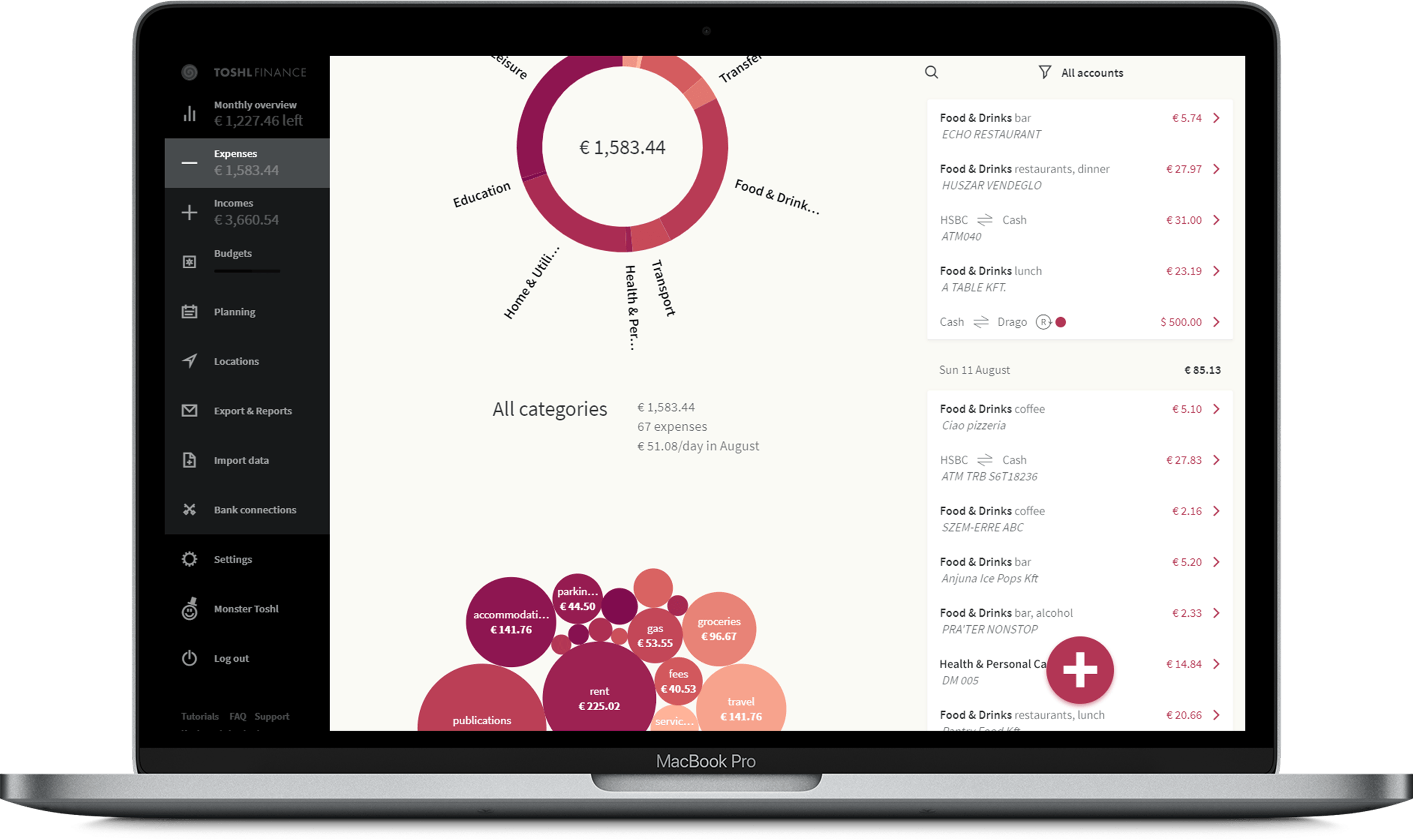

7. Toshl Finance

Toshl Finance is a tracker that supports bank integration across France and Europe. It’s ideal for those who want a more fun, engaging way to manage finances, complete with categorization and budget tracking features.

Toshl even supports crypto assets, so if you’re into digital currencies, this is a great option.

8. N26

N26 is a digital bank, it has built-in tracking tools for budgeting and goal-setting, especially suited for users across Europe.

If you have an N26 account, you can take advantage of these features to categorize spending and get insights into financial health, all while using it as your main bank account.

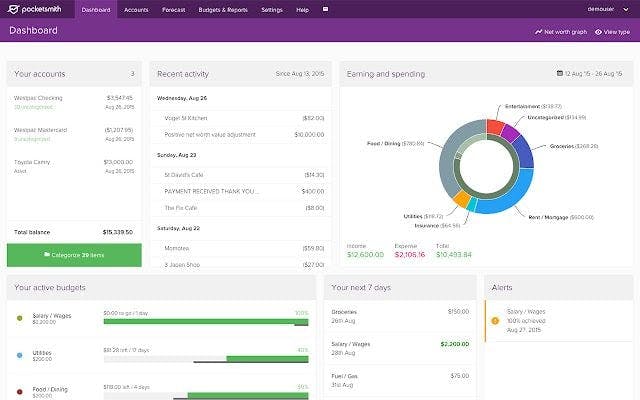

9. PocketSmith

PocketSmith is a choice for anyone who wants to plan finances far into the future. With forecasting features that let you see years ahead, PocketSmith is for long-term financial goals.

You can manage multi-currency accounts for your business, and it’s ideal for those who are serious about detailed budgeting.

4 Steps For Setting Up and Using a Bank Tracker in France

Step 1: Choose Your Ideal Tracker

Find out which features are most important for your lifestyle. Want to streamline budgeting? Manage multiple currencies?

Limiting your goals will help you choose the right application. Banktrack is what you're looking for. Check out the best expense tracking app in 2024.

Step 2: Sync Your Bank Accounts

Once you’ve chosen your tracker, sync your accounts for automatic tracking. Many apps work with major French banks, so it’s just a matter of allowing a secure connection.

Step 3: Set Your Budgets and Goals

Customize your spending categories, set savings goals, and create budgets for different areas (like dining, travel, or rent). Many trackers will send reminders to help you stick to your targets.

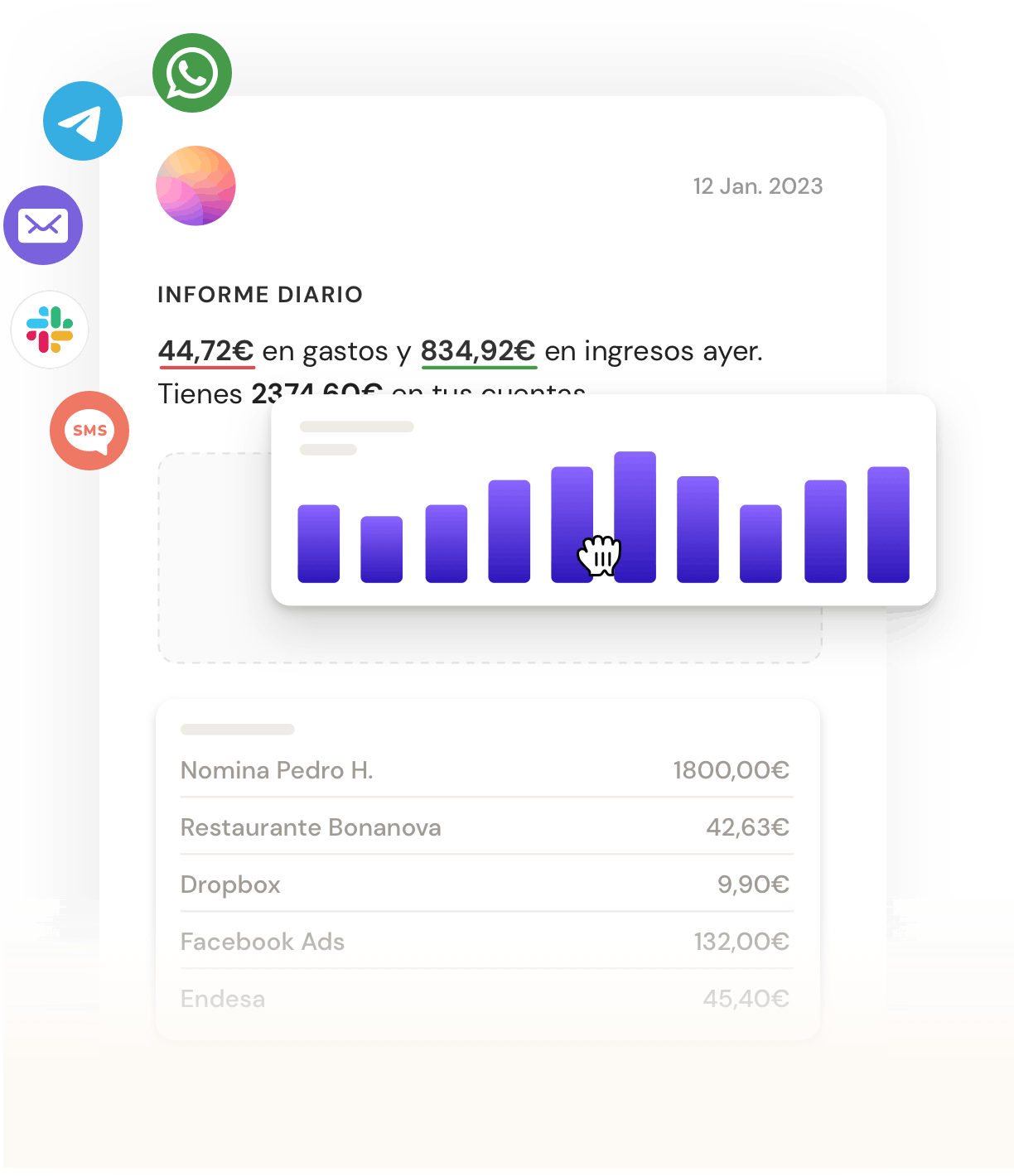

Step 4: Use Real-Time Alerts to Your Advantage

Real-time alerts help you avoid overdrafts, catch any unusual spending, and stay informed. Turn on notifications for transactions or specific spending categories to keep everything on track.

3 Tips for Making the Most of Your Bank Tracker

1. Schedule Regular Check-Ins

Make it a habit to review your finances every week or month. Look over your spending, make adjustments if needed, and evaluate whether you’re meeting your goals. Regular check-ins help you stay on top of everything and make changes as needed.

2. Use Visual Insights to Your Advantage

Many trackers offer graphs or charts, which are great for seeing spending trends. Use these visuals to understand where your money is going, and look for areas where you could save a little more.

3. Set and Celebrate Small Wins

Celebrate small wins, like meeting your budget or hitting a savings goal. It’s a great motivator and reminds you of your progress.

Why Use a Bank Tracker in France?

France has a strong banking system and some of the world’s strictest data privacy laws.

That means you can use a bank tracker in France with confidence, knowing that these tools are often secure and take your privacy seriously. Bank trackers offer several benefits that fit well with French financial habits:

- Automated Tracking: Keep track of every expense automatically.

- Expense Breakdown: See where you’re spending most, from groceries to travel.

- Goal Setting: Set and monitor savings targets, whether it’s for a vacation or an emergency fund.

- Investment Insights: Many trackers help you follow your investments, so you know exactly how they’re performing.

Key Features to Look for in a Bank Tracker

When choosing a bank tracker, look for features that matter most to you:

- Security & Data Privacy: Make sure the app complies with GDPR and uses encryption.

- Multi-Account Integration: Check if it syncs with all your French bank accounts and any credit cards or investment accounts.

- Multi-Currency Support: If you travel often or have international accounts, this is a big plus.

- Real-Time Alerts: Notifications for low balances, upcoming bills, or large transactions can be lifesavers.

- Budgeting & Goal-Setting: The best trackers allow you to customize budgets, track savings, and visualize financial goals.

Get the Best Bank Tracker in France

Managing your finances in France is easier than ever with a reliable bank tracker, helping you avoid unnecessary fees and stay on top of your spending. With options like Banktrack, Revolut, and Emma, there’s a tool to suit your needs, whether for personal or business accounts.

Banktrack provides customizable features, real-time notifications and affordable pricing, making it the best choice for both individuals and businesses in France. Start tracking your finances today and get one step closer to achieving your financial goals.

Share this post

Related Posts

The 7 Best Fintonic Alternatives in Spain for 2025

The 7 best Fintonic alternatives in Spain for 2025 to track expenses, manage budgets, and improve personal financial control.Top 7 bank trackers in Austria to manage your finances

Explore the top 7 bank tracker apps in Austria for 2024. Easily manage budgets, track expenses, and gain control over your finances with these essential tools.

Try it now with your data

- Your free account in 2 minutes

- No credit card needed