Top 7 Best Treasury Cash Flow Forecasting Software

- Top 7 Treasury Cash Flow Forecasting Software

- 1. Banktrack

- 2. Kyribia

- 3. Coupa

- 4. Payhawk

- 5. QuickBooks

- 6. Fuell

- 7. PlanGuru

- 6 Key Features of a Treasury Cash Flow Forecasting Software

- 1. Advanced Data Analytics

- 2. Customizable Forecasting Models

- 3. Integration Capabilities

- 4. Real-time Monitoring and Reporting

- 5. Scenario Planning and Sensitivity Analysis

- 6. Collaboration and Accessibility

- What is Cash Flow Forecasting

- Why is it Important?

- Conclusion

- Frequently Asked Questions - FAQs

- How does cash flow forecasting software benefit businesses?

- Can cash flow forecasting software integrate with existing financial systems?

- Is scenario planning supported by cash flow forecasting software?

- How does real-time monitoring enhance cash flow management?

- Is cloud-based deployment necessary for cash flow forecasting software?

- What factors should businesses consider when choosing cash flow forecasting software?

Are you looking for the best treasury cash flow forecasting software out there?

- Banktrack

- Kyribia

- Coupa

- Payhawk

- QuickBooks

- Fuell

- PlanGuru

Businesses are constantly seeking ways to optimize their cash flow management.

One of the most effective tools is the best treasury cash flow forecasting software. This software not only streamlines the cash flow forecasting process but also provides invaluable insights to drive strategic decision-making.

Let's delve into the features and benefits of this financial solution.

Top 7 Treasury Cash Flow Forecasting Software

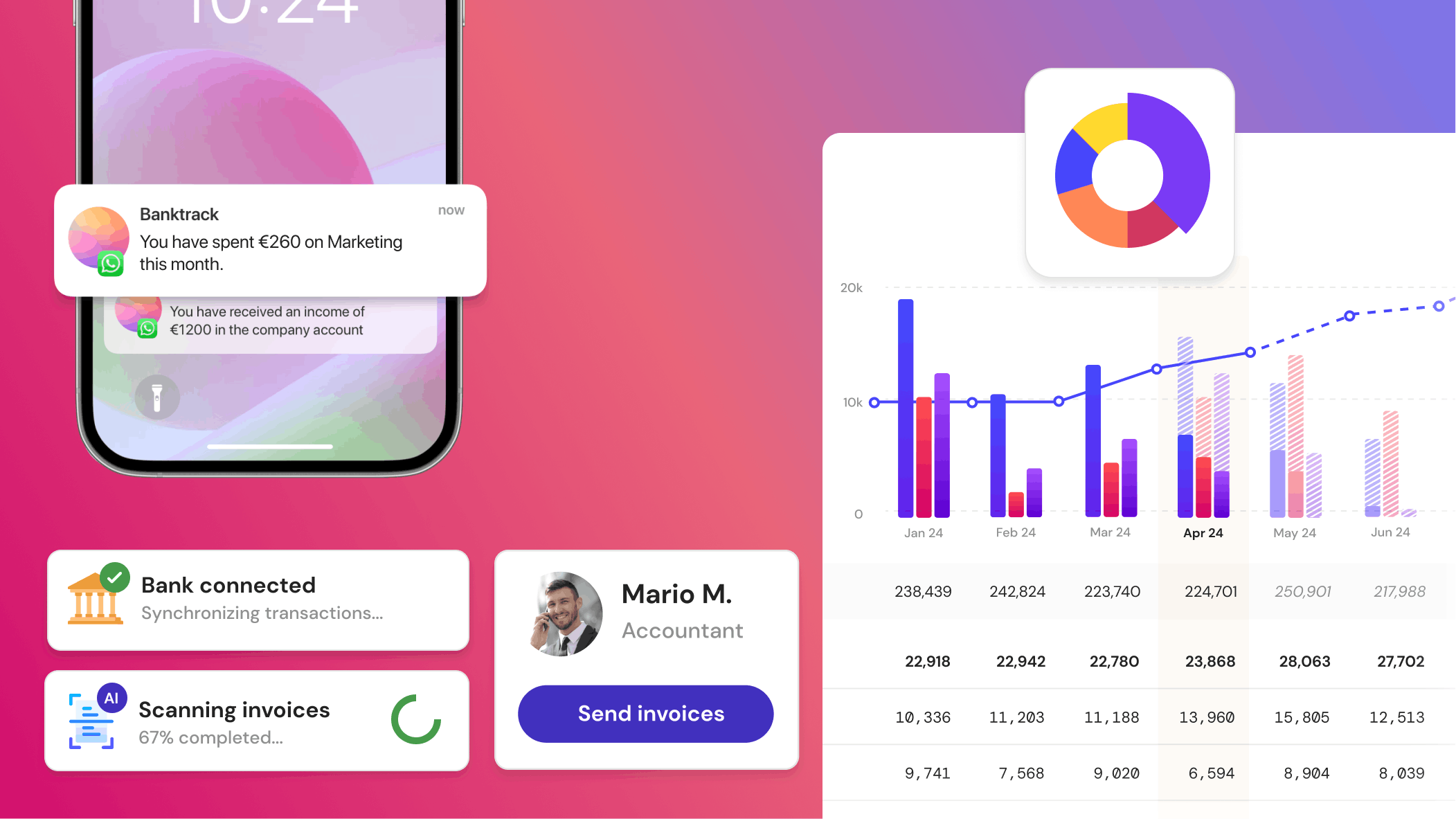

1. Banktrack

Banktrack is the best treasury cash flow forecasting software.

Thanks to its adaptable dashboards and flexible categorization options, users can efficiently access real-time financial information and maintain precise records of their income and expenses.

Personalized reports and alerts enable businesses to stay in constant financial control and make well-informed decisions.

Key Features:

- Personalized dashboards

- Integration with multiple bank accounts and products

- Customizable spending metrics

- Automated alerts and reports

2. Kyribia

Kyriba is a treasury cash flow forecasting software that supports corporate strategy decision-making.

Although the platform is a good option for big businesses, it is not recommended for smaller companies.

Key Features:

- Money administration

- Money exchanges

- Planning for liquidity

- Banking connections

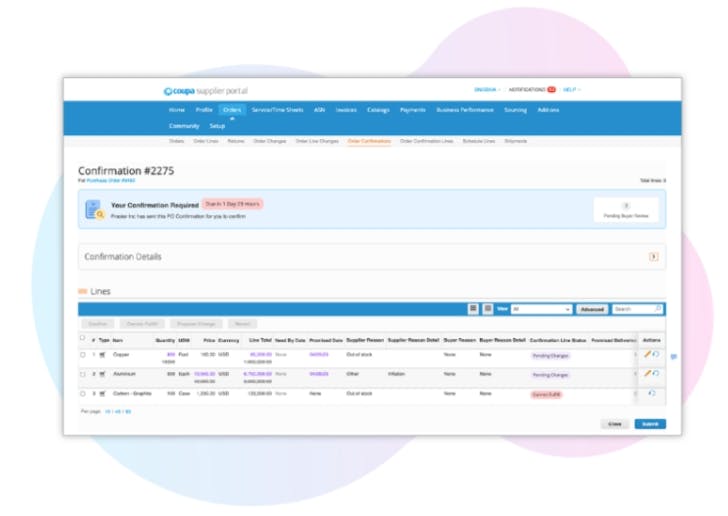

3. Coupa

Coupa provides enterprise treasury, cash and spend management.

While the platform is a well-liked treasury solution for large enterprises, it lacks certain features that are essential for growing businesses.

Key features:

- Controlling money and resources

- Debt and investment management

- In-House Banking

- Multilateral Netting

4. Payhawk

Payhawk is a worldwide application for managing treasury and expenses that integrates sophisticated tracking software with corporate cards.

Its key features are:

- Its main characteristic: the reimbursement of pre-paid expenses.

- Exchanges of currencies without commission.

- Creation of virtual and physical credit cards with customizable spending caps.

- Multi-entity management, which enables businesses to centrally manage the flow of expenses.

5. QuickBooks

Another popular treasury cash flow forecasting software is QuickBooks, which is known for being easy to use and providing basic cash flow management capabilities.

QuickBooks is a good option for businesses that currently use the platform for bookkeeping, even though it might not have all the advanced features of specialized cash management software.

Important characteristics:

- Traditional cash flow management capabilities

- Capabilities for billing and invoicing

- Analysis and reporting of financial data

- Smooth compatibility with accounting software

6. Fuell

Fuell uses both sophisticated expense management software with corporate cards. This makes it a good option for businesses or individuals looking to manage their treasury cashflow.

Its functionalities are:

- The ability to create an infinite number of real and virtual credit cards.

- Compatibility across different ERPs.

- OCR technology, approved by the Tax Agency, for automatic receipt reading.

- The ability to create personalized expense reports and automate VAT recovery.

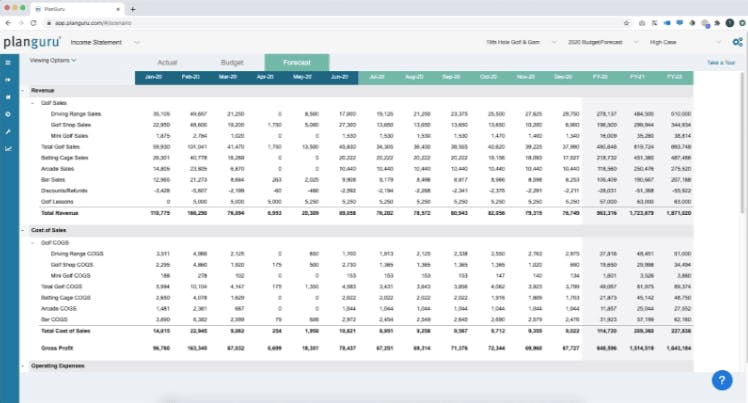

7. PlanGuru

Using PlanGuru's tools for treasury management, businesses can analyze financial information and make educated decisions about their future.

By integrating with QuickBooks and Excel, users can improve their financial processes and obtain insightful knowledge about their cash flow.

Key features:

- Forecasting and budgeting tools

- Integration with QuickBooks and Excel

- User education resources

- 30-day money-back guarantee; and a 14-day free trial

6 Key Features of a Treasury Cash Flow Forecasting Software

1. Advanced Data Analytics

Utilizing the power of advanced data analytics, this software analyzes historical financial data and market trends to generate accurate cash flow forecasts.

By using predictive modeling algorithms, it provides users with very actionable insights to optimize cash flow strategies.

2. Customizable Forecasting Models

The best treasury cash flow forecasting software offers customizable forecasting models tailored to the unique needs of each business.

Whether it's short-term or long-term forecasting, users can adjust parameters and scenarios to accurately predict cash flow dynamics.

3. Integration Capabilities

Seamless integration with existing financial systems, such as accounting software and enterprise resource planning (ERP) systems, ensures data consistency and enhances workflow efficiency.

This integration streamlines the data collection process and eliminates manual errors, saving time and resources.

4. Real-time Monitoring and Reporting

With real-time monitoring and reporting functionalities, users can track cash flow performance against forecasted projections.

A good treasury cash flow forecasting software simplifies this process by allowing users to categorize expenses, set spending limits, and generate customizable reports to gain insights into their spending patterns.

With integrated views of different bank accounts and financial products, users can gain a comprehensive understanding of their financial landscape with ease.

Comprehensive dashboards and customizable reports provide stakeholders with actionable insights to drive informed decision-making.

5. Scenario Planning and Sensitivity Analysis

The software enables scenario planning and sensitivity analysis to assess the potential impact of various economic factors and market uncertainties on cash flow forecasts.

This proactive approach empowers organizations to develop contingency plans and mitigate financial risks effectively.

6. Collaboration and Accessibility

Cloud-based deployment allows for secure collaboration and remote access to cash flow data and insights.

This accessibility ensures that key stakeholders can make informed decisions anytime, anywhere, enhancing organizational agility and responsiveness.

However, it is important that you choose a secure software so that your data is never compromised. A treasury cash flow forecasting software prioritizes the security of user information by using authorized and audited banking data providers approved by regulatory authorities.

With encrypted transaction data and stringent security measures in place, users can trust that their financial information is safe and secure.

What is Cash Flow Forecasting

Cash flow forecasting is the process of estimating future cash inflows and outflows to ensure that a company has enough liquidity to meet its financial obligations.

You can also greatly benefit from a cash management tool in addition to a software that has cash flow functionalities.

It involves analyzing past trends, current market conditions, and future projections to predict cash flow fluctuations accurately.

Effective cash flow forecasting is crucial for maintaining financial stability and facilitating growth opportunities.

Why is it Important?

Accurate cash flow forecasting is very important for businesses of all sizes and industries.

It enables companies to anticipate potential cash shortages or surpluses, allowing them to make informed decisions regarding investments, expenses, and financing options.

With the best treasury cash flow forecasting software, organizations can gain real-time visibility into their cash positions, mitigate financial risks, and optimize working capital management.

Conclusion

When selecting the best treasury cash flow forecasting software for your organization, consider factors such as scalability, ease of use, customer support, and integration capabilities.

You should also evaluate multiple vendors, request demos, and request feedback from other users to make an even more informed decision that aligns with your business objectives.

Get your operations in full swing by starting with Banktrack!

Frequently Asked Questions - FAQs

How does cash flow forecasting software benefit businesses?

Cash flow forecasting software provides businesses with accurate predictions of future cash flows, enabling them to make informed financial decisions and optimize working capital management.

Can cash flow forecasting software integrate with existing financial systems?

Yes, the best treasury cash flow forecasting software offers seamless integration with accounting software and ERP systems, ensuring data consistency and workflow efficiency.

Is scenario planning supported by cash flow forecasting software?

Yes, cash flow forecasting software allows for scenario planning and sensitivity analysis, enabling organizations to assess the potential impact of various economic factors and market uncertainties on cash flow forecasts.

How does real-time monitoring enhance cash flow management?

Real-time monitoring allows stakeholders to track cash flow performance against forecasted projections, providing actionable insights to drive informed decision-making and mitigate financial risks.

Is cloud-based deployment necessary for cash flow forecasting software?

Cloud-based deployment offers secure collaboration and remote access to cash flow data and insights, enhancing organizational agility and responsiveness, but it's not mandatory.

What factors should businesses consider when choosing cash flow forecasting software?

Businesses should consider factors such as scalability, ease of use, customer support, and integration capabilities when selecting cash flow forecasting software that aligns with their needs and objectives.

Share this post

Related Posts

Verifactu for Startups in Spain: Complete Guide 2025

Verifactu introduces a new era of electronic invoicing in Spain, requiring startups to send invoices directly to the Tax Agency.Top 7 Best Treasury Management Software

What is the best treasury management software? Managing corporate finances involves many tasks, including cash flow management, risk assessment, and financial planning.

Try it now with your data

- Your free account in 2 minutes

- No credit card needed