Top 10 Best Business Cash Management Tools

- 1. Banktrack - Your Cash Management Software

- 2. Scoro

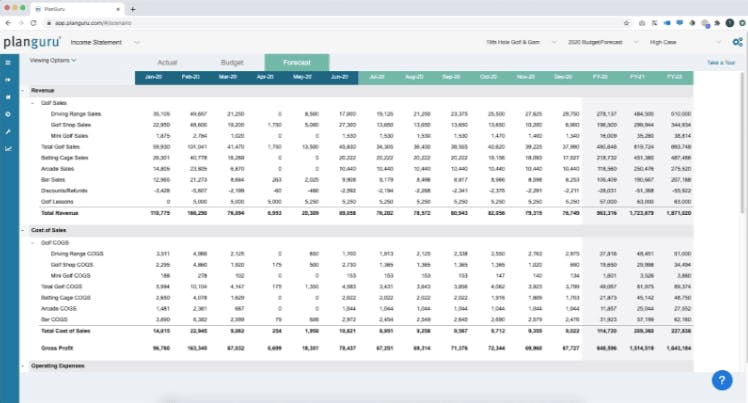

- 3. PlanGuru

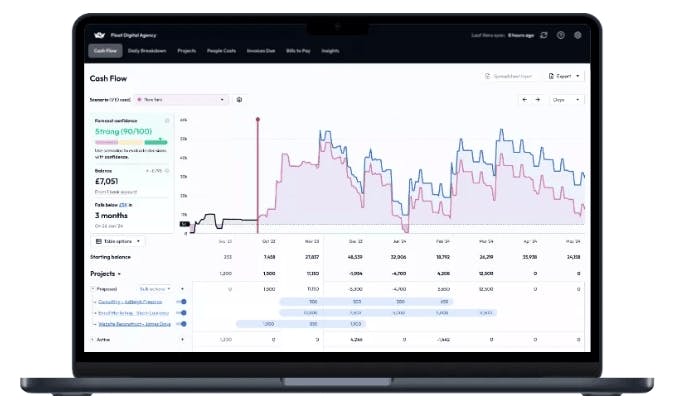

- 4. Float

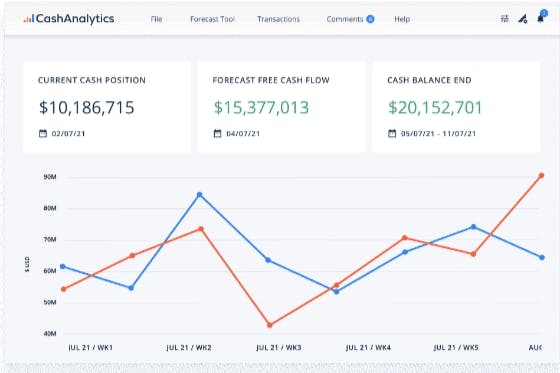

- 5. CashAnalytics

- 6. Pulse

- 7. Google Docs

- 8. QuickBooks

- 9. Vena Solutions

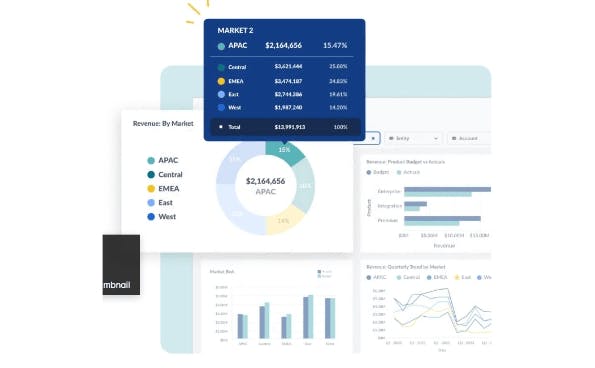

- 10. Cube

- 3 Benefits of Using Cash Flow Management Tools

- Conclusion

- Frequently Asked Questions

- Why is Cash Flow Management Important?

- What Are the Benefits of Using Cash Flow Management Tools?

- How Can Banktrack Benefit My Business?

- What Are Some Limitations of Using Cash Flow Management Tools?

- Are There Affordable Options for Cash Flow Management Software?

- How Can Cash Flow Management Tools Help with Decision-Making?

Wondering what the best business cash management tools are?

- Banktrack - Your Cash Management Software

- Scoro

- PlanGuru

- Float

- CashAnalytics

- Pulse

- Google docs

- Quickbooks

- Vena Solutions

- Cube

Having effective cash flow management is crucial for the financial stability and sustainable growth of any business, including yours.

With the range of financial management tools available today, choosing the right software is paramount to optimizing this process.

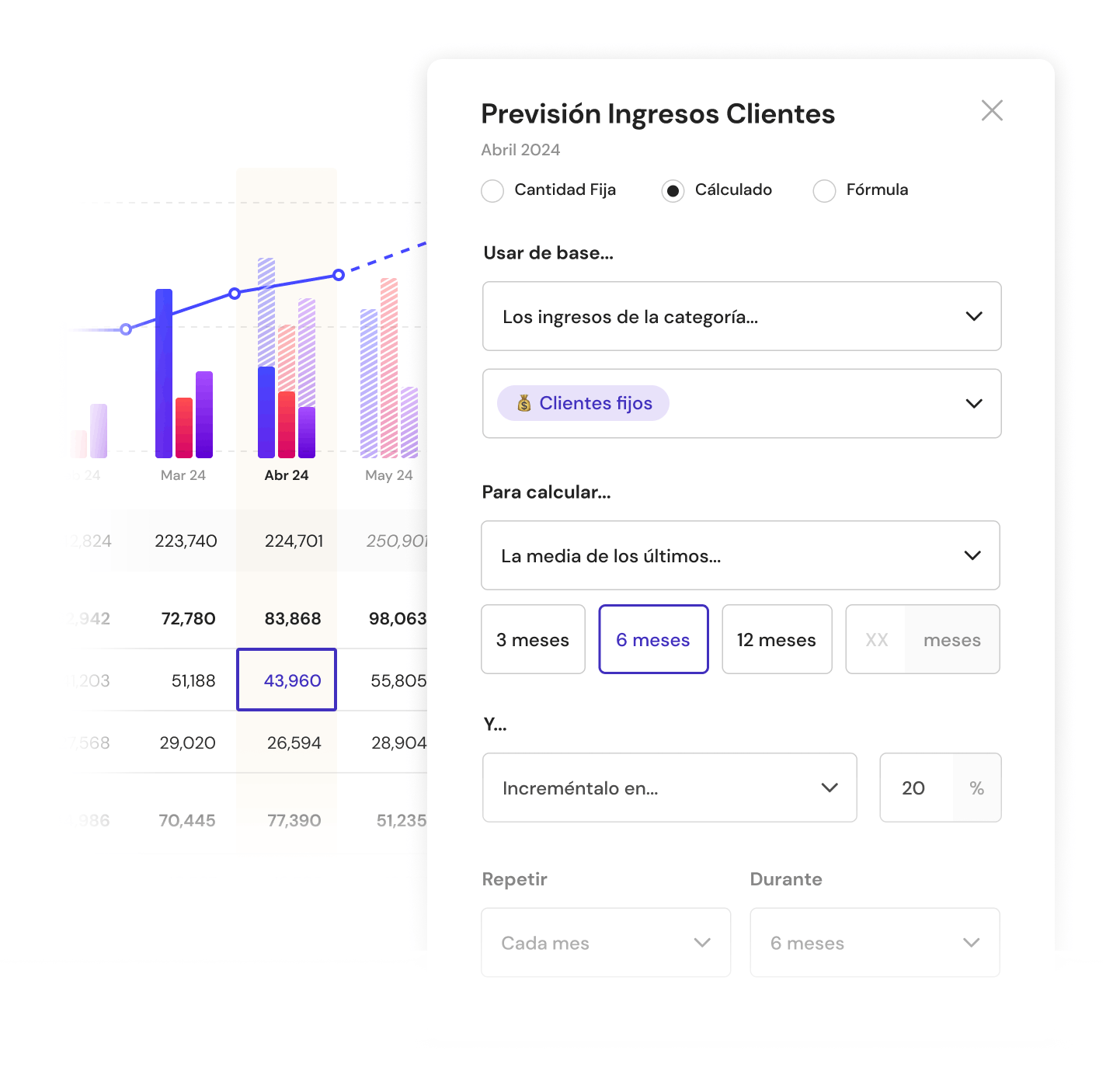

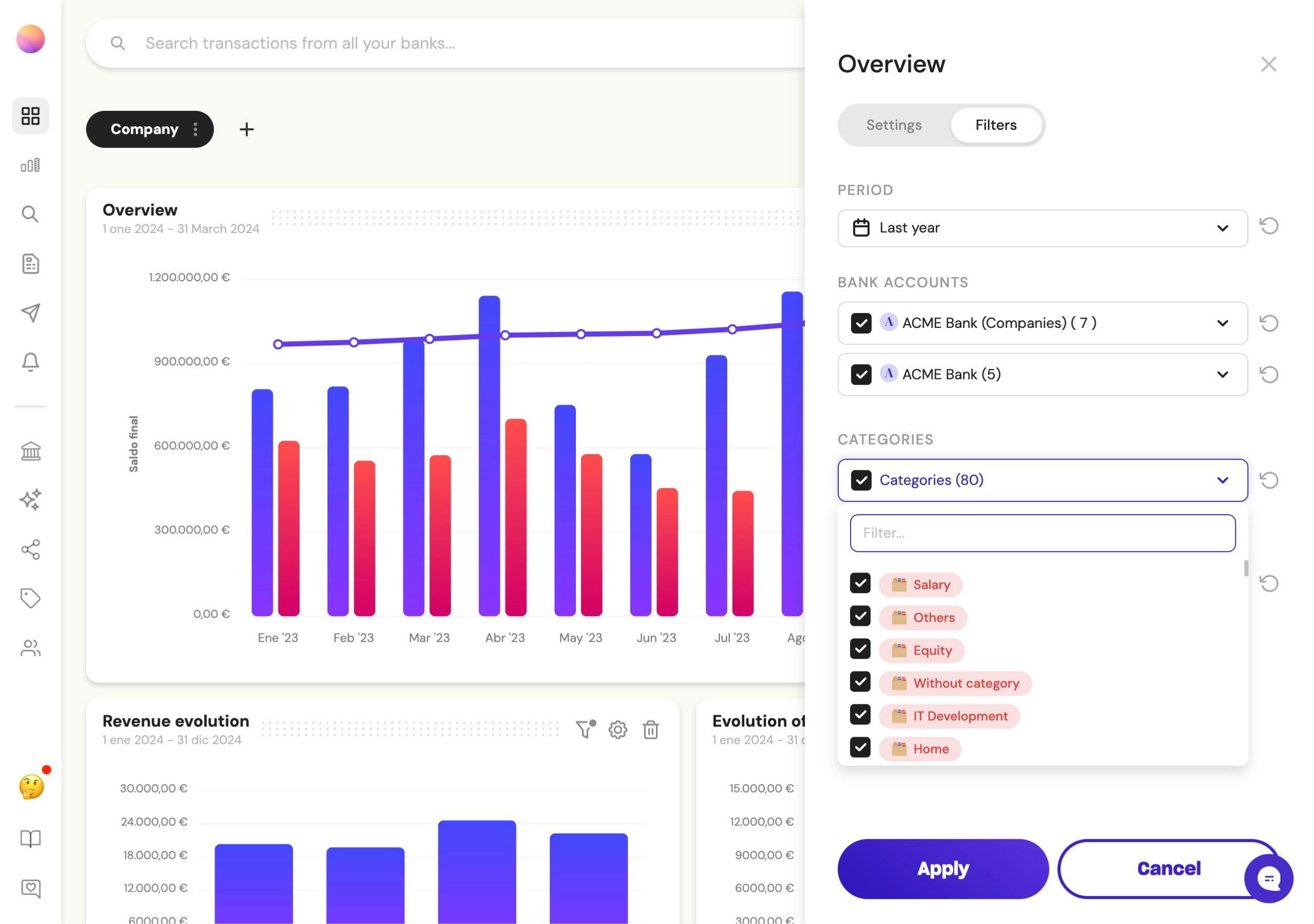

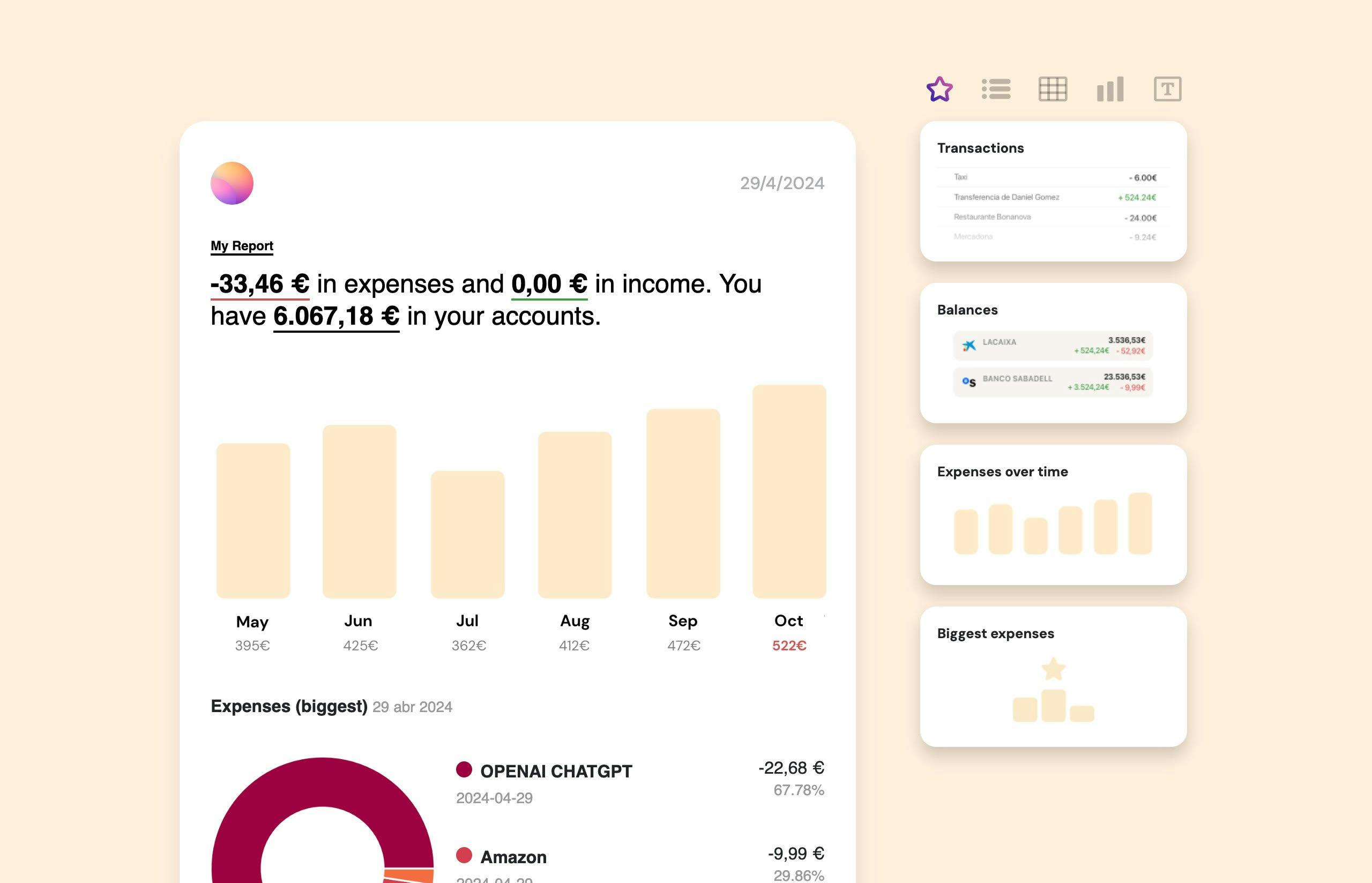

1. Banktrack - Your Cash Management Software

Banktrack stands out as the ideal cash management tool for all types of enterprises.

Its customizable dashboards enable users to access real-time financial information efficiently, while its flexible categorization options allow for precise tracking of expenses and income.

With personalized reports and alerts, businesses can maintain constant control over their finances and make informed decisions with ease.

Key Features:

- Personalized dashboards

- Integration with multiple bank accounts and products

- Customizable spending metrics

- Automated alerts and reports

- Affordable pricing starting at €16.58 per month

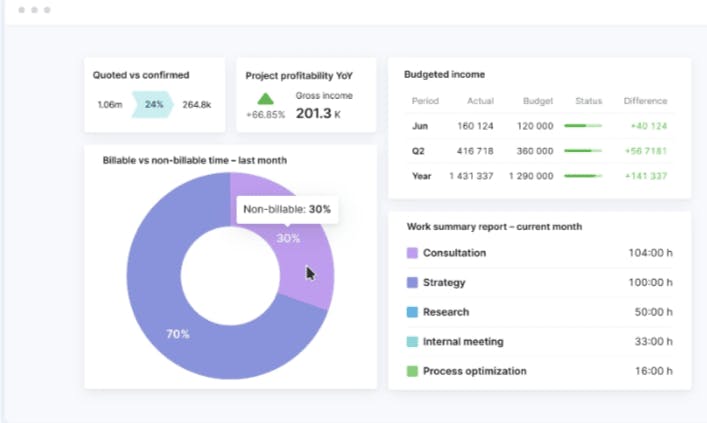

2. Scoro

Scoro offers quite a complete solution for businesses, combining cash flow management with project management, sales tracking, and invoicing.

While the basic version may lack advanced financial functionalities, upgrading to higher-tier plans provides access to a wealth of tools designed to streamline operations and drive growth.

Key Features:

- Comprehensive business management tools

- Project management and sales pipeline tracking

- Supplier management and invoicing

- Customizable reporting options

3. PlanGuru

PlanGuru offers budgeting and forecasting capabilities, empowering businesses to analyze complex financial data and make informed decisions about their business's future.

With integration with QuickBooks and Excel, users can streamline their financial processes and gain good insights into their cash flow.

Key Features:

- Budgeting and forecasting tools

- Integration with QuickBooks and Excel

- Educational resources for users

- 14-day free trial and 30-day money-back guarantee

4. Float

Float simplifies cash flow management with its user-friendly interface and budgeting tools.

Users can create budgets, simulate various scenarios, and receive expert reviews to optimize their financial planning.

While the pricing may be considered relatively high, Float's functionality and ease of use make it a worthwhile investment for many businesses.

Key Features:

- Simplified budgeting and forecasting

- Clean and intuitive interface

- Multi-user functionality

- Expert review options for premium plans

5. CashAnalytics

CashAnalytics specializes in cash flow forecasting and tracking for mid-market businesses, offering automated solutions to streamline financial processes.

While the pricing may be on the higher side, the software's advanced analytics and multi-currency support make it a valuable asset for larger enterprises.

Key Features:

- Multi-currency support

- Advanced analytics for cash flow forecasting

- Automated transaction tracking

- Tailored solutions for mid-market businesses

6. Pulse

Pulse provides efficient cash flow management solutions for business owners, with features tailored to organize cash flow by customer and project.

While some advanced functionalities may require higher-tier subscriptions, Pulse's simplicity and ease of use make it an attractive option for small businesses.

Key Features:

- Cash flow organization by customer and project

- Simple and intuitive interface

- Integration with accounting software

- Affordable pricing starting at $29 per month

7. Google Docs

Google Docs offers a range of downloadable templates for cash flow management, providing cost-effective solutions for businesses.

While these templates may lack advanced features found in dedicated software, they offer a simple and accessible option for managing cash flow independently.

Key Features:

- Variety of downloadable templates for cash flow management

- Low-cost or free options

- Immediate availability and ease of use

- Limited customer support and basic functionalities

8. QuickBooks

QuickBooks is also a widely used accounting software known for its basic cash flow management tools and ease of use.

While it may lack some advanced functionalities found in specialized cash management software, QuickBooks serves as a practical choice for businesses already using the platform for bookkeeping purposes.

Key Features:

- Basic cash flow management tools

- Invoicing and bill payment capabilities

- Financial reporting and analysis

- Seamless integration with accounting software

9. Vena Solutions

Vena Solutions offers cloud-based financial planning and cash management solutions, leveraging Excel for a familiar user experience.

While some users may find the learning curve steep for certain tools, Vena's comprehensive features and flexible reporting options make it a valuable asset for businesses of all sizes.

Key Features:

- Cloud-based financial planning and cash management

- Excel-based interface for familiar user experience

- Knowledgeable support staff and online training materials

- Flexible reporting options and mobile support

10. Cube

Cube streamlines cash flow management with automated data consolidation and customizable reporting options.

While some users may encounter a learning curve with certain features, Cube's ability to analyze data and generate customized reports makes it a valuable tool for businesses seeking efficient financial management solutions.

Key Features:

- Automated data consolidation from spreadsheets

- Customizable dashboards and reports

- Scenario planning and analysis tools

- Integration with accounting software

3 Benefits of Using Cash Flow Management Tools

Effective cash flow management tools offer several benefits for businesses, including:

- Enhanced Financial Visibility: Cash flow management tools provide businesses with a clear and real-time view of their financial standing. By consolidating financial data from various sources and presenting it in an easily digestible format, these tools offer insights into cash inflows and outflows, outstanding invoices, and upcoming expenses.

- This enhanced visibility enables businesses to identify potential cash shortages or surpluses in advance, allowing for proactive decision-making to maintain financial stability.

- Process Automation and Efficiency: Cash flow management tools streamline repetitive financial tasks and automate processes, reducing the time and effort required for manual data entry and reconciliation.

- By integrating with accounting systems and bank accounts, these tools can automatically categorize transactions, generate invoices, and reconcile accounts, freeing up valuable time for finance teams to focus on strategic initiatives. This automation not only increases efficiency but also minimizes the risk of human error, ensuring accuracy in financial reporting and compliance with regulatory requirements.

- Informed Decision-Making for Long-Term Success: With access to accurate and up-to-date financial information, businesses can make informed decisions that align with their long-term goals and objectives.

- Cash flow management tools provide valuable insights into cash flow trends, profitability, and liquidity, empowering decision-makers to assess the financial health of the business and identify areas for improvement. Whether it's evaluating investment opportunities, optimizing pricing strategies, or managing working capital, these tools enable businesses to make data-driven decisions that drive sustainable growth and profitability.

Conclusion

In conclusion, choosing the right cash management software is essential for businesses of all sizes to ensure financial stability and sustainable growth.

Investing in Banktrack's customizable dashboards and many of their other detailed features can empower businesses to optimize their cash flow and thrive in today's competitive marketplace.

Frequently Asked Questions

Why is Cash Flow Management Important?

Effective cash flow management ensures liquidity, timely payments, and financial stability for businesses.

What Are the Benefits of Using Cash Flow Management Tools?

Cash flow management tools offer improved financial visibility, process automation, and informed decision-making for businesses.

How Can Banktrack Benefit My Business?

Banktrack provides personalized dashboards, customizable categories, and automated alerts for efficient cash flow management, leading to improved financial control and decision-making.

What Are Some Limitations of Using Cash Flow Management Tools?

Some tools may have a learning curve, performance issues with large datasets, or limited functionalities for larger businesses.

Are There Affordable Options for Cash Flow Management Software?

Yes, several options offer cost-effective solutions, such as Google Docs templates or basic plans from software providers like Float or Pulse.

How Can Cash Flow Management Tools Help with Decision-Making?

By providing up-to-date and accurate financial data, cash flow management tools enable businesses to make informed decisions about investments, expenses, and financial strategies.

Share this post

Related Posts

Best 8 Cashflow Monitoring Apps in 2025

Discover the best 8 cashflow monitoring apps in 2025 that help businesses track income, expenses, and liquidity in real timeThe 6 Best SaaS Financial Projections for Founders in 2025

Discover six top SaaS financial-projection platforms tailored for founders, enabling accurate subscription modelling, scenario planning, and metric tracking to drive scalable growth in 2025.7 Best Financial Projection Apps in 2025

Discover the top financial-projection apps that simplify scenario modelling, integrate with your accounting data, and help your business forecast revenue, expenses and growth with confidence.

Try it now with your data

- Your free account in 2 minutes

- No credit card needed