Top 7 bank trackers in Austria to manage your finances

- Top 7 Bank Trackers in Austria

- 1. Banktrack

- 2. Revolut

- 3. Moneydance

- 4. Mint

- 5. PocketSmith

- 6. Fintonic

- 7. Emma

- 4 Steps To Setting Up and Using a Bank Tracker in Austria

- Step 1: Choose the Right Tracker

- Step 2: Sync Your Bank Accounts

- Step 3: Set Financial Goals

- Step 4: Monitor and Adjust Your Budget

- The Impact of Bank Trackers on Financial Health

- Better Spending Habits

- Enhanced Savings Management

- Greater Control Over Investments

- Common Challenges and Solutions

- Syncing Issues with Austrian Banks

- Data Privacy Concerns

- App Limitations and Fees

- Why You Need a Bank Tracker in Austria

- Austria’s Banking System and Regulations

- Financial Habits in Austria

- 5. Key Features to Look for in a Bank Tracker

- 1. Security and Data Protection

- 2. Multi-Account Management

- 3. Budgeting and Savings Tools

- 4. Real-Time Notifications

- 5. Currency Support

- Why Banktrack is the Right App for You

Top 8 Bank Trackers in Austria

- Banktrack

- Revolut

- Moneydance

- Mint

- PocketSmith

- Fintonic

- Emma

- Wally

In today’s fast-paced world, managing your finances well is more important than ever, especially in a country like Austria, with its solid banking system and focus on transparency.

Whether you’re a resident, expat, or frequent traveler, a bank tracker can make money management easier,helping you budget, save, and track your expenses and investments.

So, how do you choose the right bank tracker for your needs? Here you will find everything you need to know about selecting and using expense report software in Austria.

Top 7 Bank Trackers in Austria

1. Banktrack

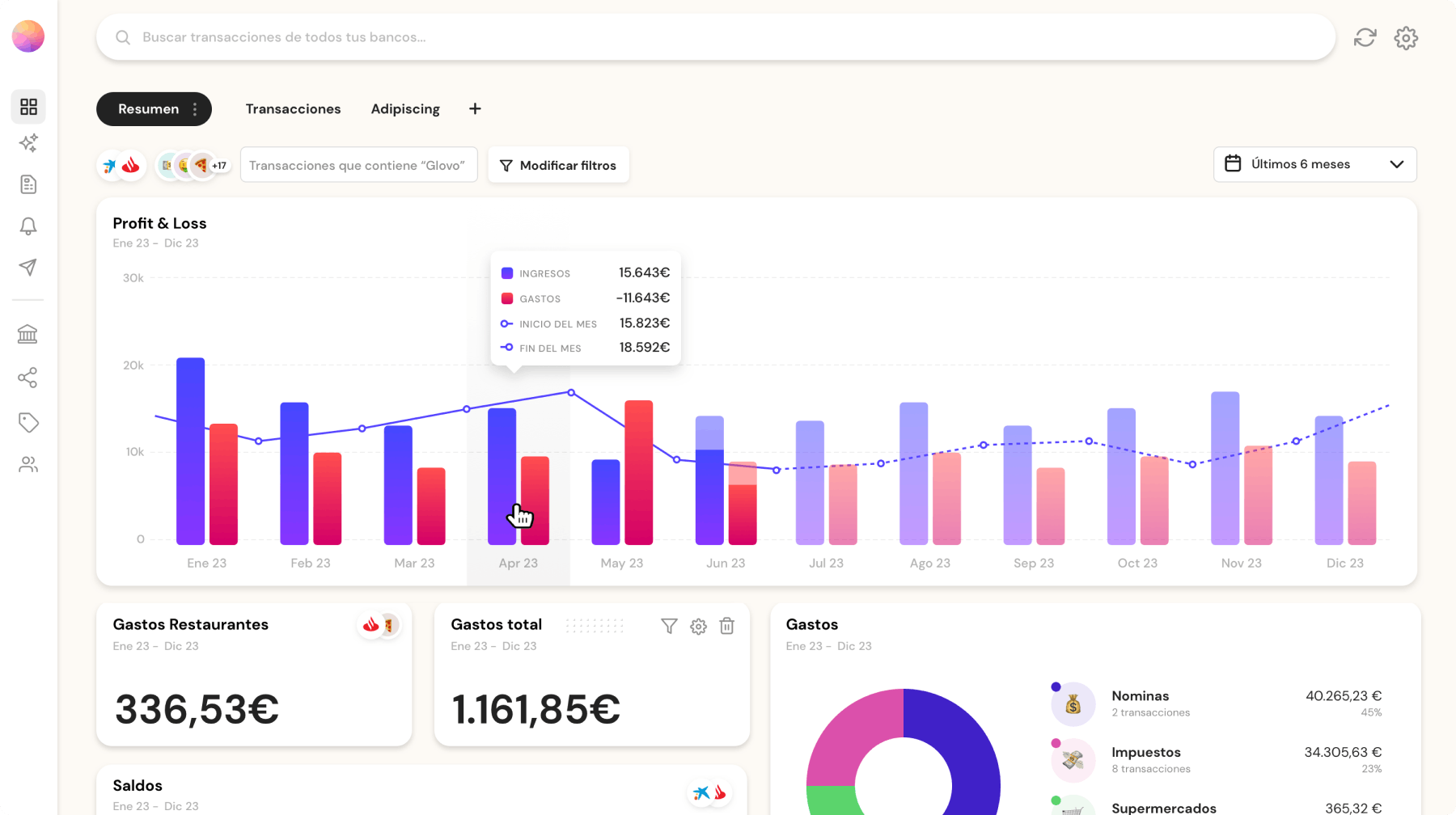

Banktrack is a highly rated expense tracking app in Austria, offering a range of powerful features that make managing your finances easy and efficient.

Its real-time tracking, customizable dashboards, and seamless integration with multiple banks make it a top choice for both individuals and businesses.

Key Features:

- Customizable Dashboards: Banktrack lets you personalize your financial dashboard to focus on what matters most to you, whether it’s tracking expenses, monitoring savings, or setting financial goals.

You can adapt your view to see the most relevant information at a glance.

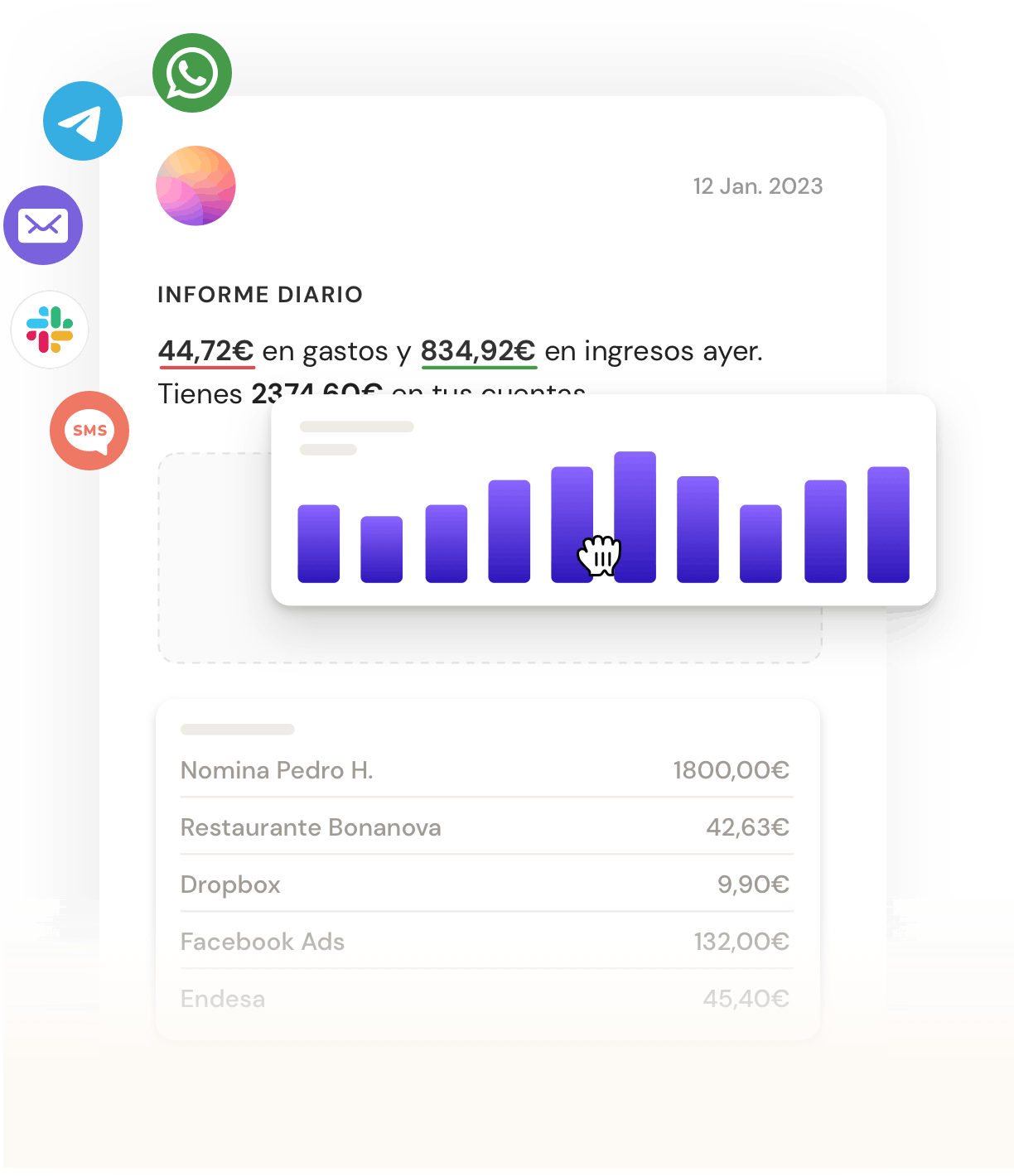

- Real-Time Alerts: You’ll receive notifications through your preferred platform (WhatsApp, SMS, email, or Slack) about important account activity, such as low balances, upcoming payments, or unusual transactions.

- Integration with Multiple Banks: Banktrack connects with over 120 banks, including major Irish banks, so you can easily sync your accounts and get a comprehensive view of your finances.

- Spending Limits and Budgeting: Set spending limits for different categories, like groceries, entertainment, and bills. Banktrack will alert you if you’re getting close to your limit, helping you stay within your budget.

- Automated Reports: Generate detailed financial reports that can be customized and sent via WhatsApp, email, or other platforms. This is especially useful for businesses or anyone who needs to keep track of expenses.

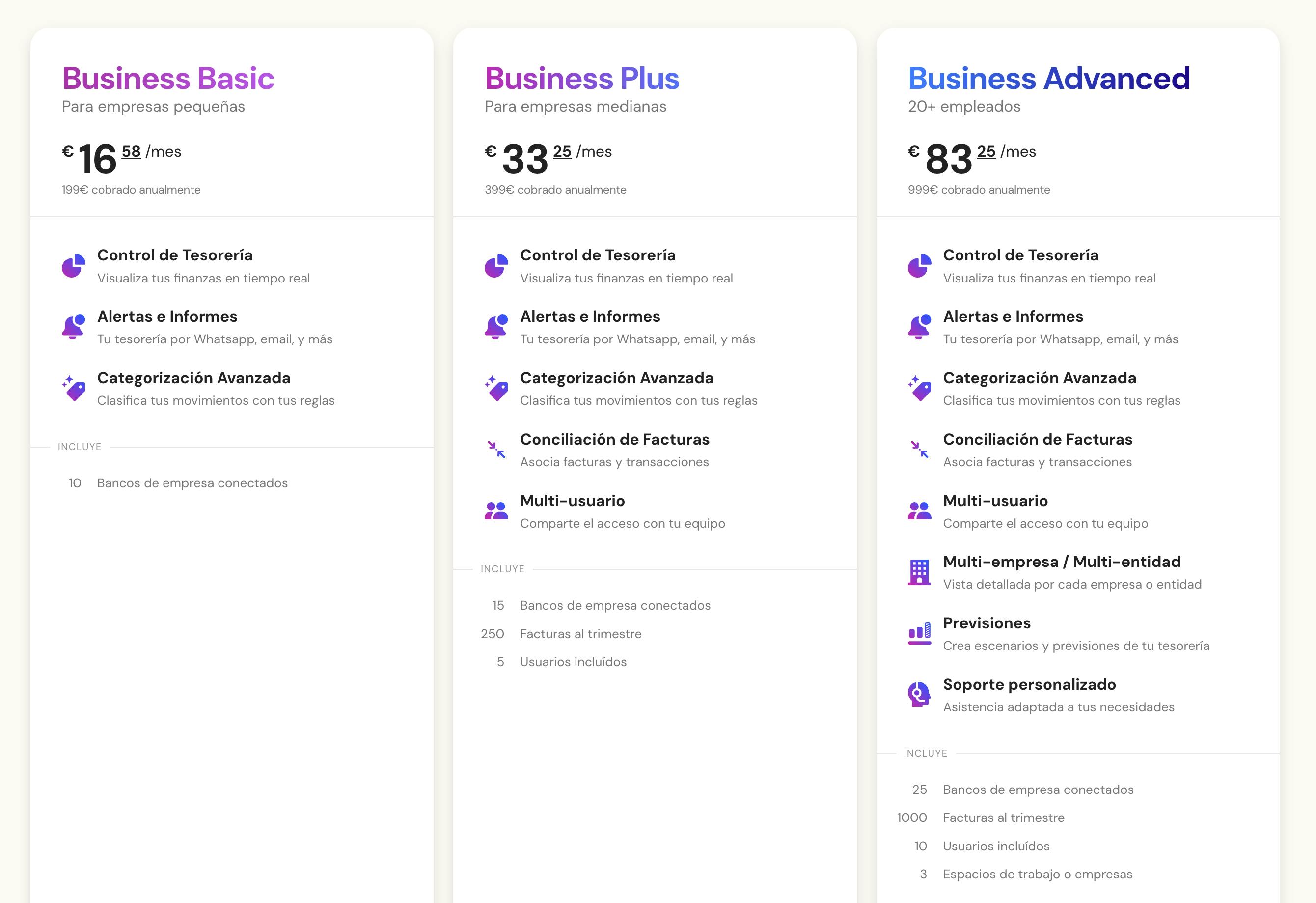

- Affordable Pricing: With pricing starting at €16.58 per month, Banktrack offers great value for individuals and businesses looking for a comprehensive financial management solution.

Why Banktrack is the Best Bank Tracker in Austria

Banktrack excels because of its advanced features, ease of use, and seamless bank integration.

Its real-time alerts, spending controls, and goal-setting tools make it the best option for anyone looking to stay in control of their finances.

Whether you're managing personal accounts or business expenses, Banktrack offers the flexibility and tools you need to succeed. Its affordable pricing and strong security features also make it a top choice in Austria.

2. Revolut

Revolut is widely known for its multi-currency accounts, allowing users to hold and transfer money in multiple currencies, including euros.

Revolut’s expense tracking, budgeting tools, and notifications make it a top choice for those who frequently travel or make international transactions.

Revolut also offers additional features like savings vaults and investment options, making it ideal for Austrians with cross-border financial needs.

3. Moneydance

Moneydance is a versatile financial tracker that offers advanced budgeting, investment tracking, and bill payment features.

Compatible with Austrian banks, it’s ideal for individuals with multiple accounts. Its simple interface and customizable reporting make it an attractive choice for Austrian residents looking for an all-in-one financial management solution.

4. Mint

While Mint isn’t exclusive to Austria, it’s popular among international users for its ease of use. Mint is a cash management software that offers budgeting, bill reminders, and categorization features.

It’s a straightforward option for beginners and those looking for a tool to get an overview of their finances without advanced features.

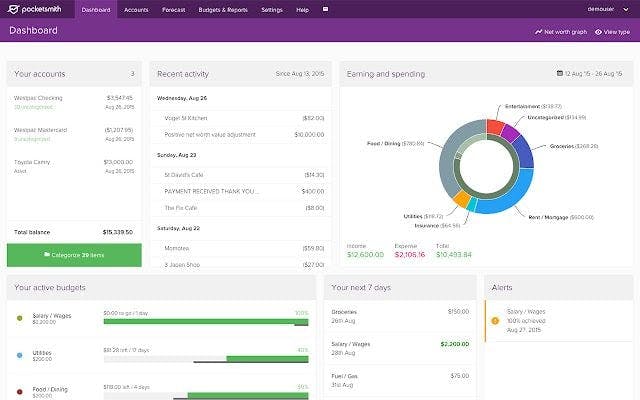

5. PocketSmith

PocketSmith is ideal for those who want a proactive approach to their finances. It features budgeting tools and advanced forecasting, helping you understand where your finances might be in the coming months or even years.

PocketSmith integrates with Austrian banks and supports multiple currency accounts, making it perfect for users with international accounts or investments.

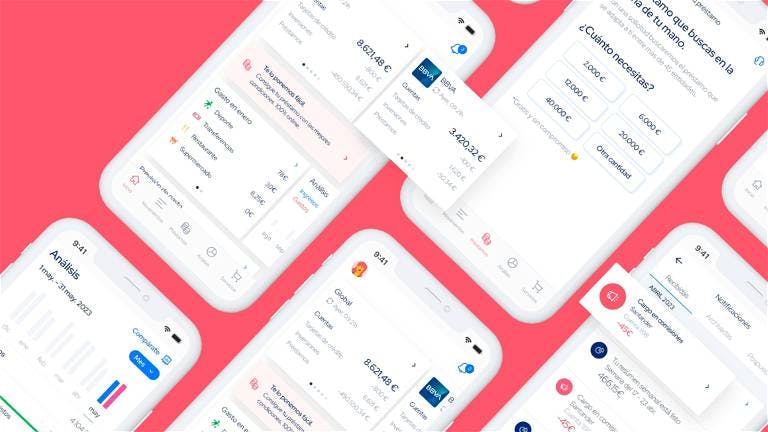

6. Fintonic

Although originally developed in Spain, Fintonic has gained popularity across Europe for its easy integration with EU banks, including those in Austria. It provides real-time tracking, spending summaries, and custom alerts.

Fintonic’s AI-driven insights help you save on unnecessary fees and identify areas where you could reduce spending.

7. Emma

Emma is designed as a “financial friend” that helps users with budgeting, expense tracking, and subscription management.

Emma connects with most European banks and offers a subscription tracking feature, ideal for users who want to manage recurring expenses. The app's visual interface and smart categorization make it simple to understand your spending habits.

4 Steps To Setting Up and Using a Bank Tracker in Austria

Step 1: Choose the Right Tracker

Start by identifying what you need most from a bank tracker. Are you looking for in-depth budget analysis, investment tracking software, or multi-currency management?

Choose a tracker based on your requirements, whether you’re more focused on budgeting, investment tracking, or multi-account management.

Check out the best expense tracking app in 2024!

Step 2: Sync Your Bank Accounts

Most bank trackers allow you to connect directly to your bank accounts. Make sure the tracker supports Austrian banks and provides a secure connection.

By linking your accounts, you’ll get automatic transaction updates, saving you time on manual entry.

Step 3: Set Financial Goals

Set specific finance goals, such as saving a certain amount each month or sticking to a weekly dining budget. Many trackers provide progress updates and reminders, keeping your goals front and center and making it easier to stay on track.

Step 4: Monitor and Adjust Your Budget

Regularly review your budget categories and make adjustments based on your spending trends. If you notice an increase in discretionary spending, you can cut back in other areas to stay within your monthly budget.

Most bank trackers allow you to adjust categories and receive alerts if you’re overspending.

The Impact of Bank Trackers on Financial Health

Better Spending Habits

Bank trackers encourage mindful spending. By categorizing expenses and setting limits, users are often more conscious of where their money goes.

This awareness can help reduce impulsive purchases and unnecessary expenses.

Enhanced Savings Management

A bank tracker with goal-setting features allows you to allocate a portion of your income toward specific savings goals.

Whether saving for a holiday, a house, or an emergency fund, you’ll be able to track your progress and adjust your goals as needed.

Greater Control Over Investments

For individuals with investment portfolios, bank trackers provide valuable insights into investment performance.

By monitoring returns and adjusting your strategy based on real-time data, you gain more control over your portfolio and can make informed decisions.

Common Challenges and Solutions

Syncing Issues with Austrian Banks

Not all bank trackers are compatible with every Austrian bank. Before choosing a tracker, check if it supports your bank. If your bank isn’t supported, you may be able to import transactions manually, though this requires more work.

Data Privacy Concerns

Since bank trackers deal with sensitive financial data, privacy is essential. Choose a tracker that complies with Austria’s data protection laws and provides transparent privacy policies. Trackers with secure encryption methods are preferable for peace of mind.

App Limitations and Fees

Some bank trackers offer limited features for free, while others require subscriptions for advanced tools. Evaluate the cost-to-value ratio and determine if the premium features justify the price based on your specific needs.

Why You Need a Bank Tracker in Austria

Austria’s Banking System and Regulations

Austria is recognized for its secure and regulated banking system, designed to protect consumers and provide transparency.

With strict data protection laws like the GDPR (General Data Protection Regulation), Austria ensures that financial institutions and digital apps handling personal information prioritize data privacy.

This regulatory environment makes it easier to use bank tracking tools with confidence, knowing that your data is handled securely.

Financial Habits in Austria

Austria’s residents tend to have organized financial habits, valuing security and control over their assets. Bank trackers align well with these priorities by offering clear insights into spending, savings, and investments.

Additionally, bank trackers help expatriates and international travelers stay on top of financial obligations in multiple currencies and accounts, which is especially useful in a globally connected country like Austria.

5. Key Features to Look for in a Bank Tracker

1. Security and Data Protection

Austria’s strict data privacy regulations mean that any financial app used should have robust security protocols, like end-to-end encryption and two-factor authentication, to protect your data.

When choosing a bank tracker, look for those that comply with GDPR requirements and prioritize security to avoid potential data breaches.

2. Multi-Account Management

Many people have more than one bank account or credit card, which can complicate budgeting. A good bank tracker should be able to handle multiple accounts and provide a consolidated view of all financial activity.

For example, if you have a checking account for daily expenses, a savings account for long-term goals, and an investment account, the bank tracker should seamlessly integrate these to give you a holistic view of your finances.

3. Budgeting and Savings Tools

Effective bank trackers go beyond basic tracking by offering tools for budgeting and saving. Look for trackers that allow you to set monthly spending limits, track category-specific expenses, and set up alerts to prevent overspending.

Additionally, savings goals can help you automate a portion of your income toward your long-term objectives, like buying a home or building an emergency fund.

4. Real-Time Notifications

Some bank trackers offer real-time notifications for transactions, account balances, and unusual spending patterns. These alerts can help you monitor your financial activity more closely and prevent unexpected overdrafts or missed payments.

5. Currency Support

If you travel frequently or hold accounts in different currencies, a bank tracker that supports multi-currency functionality can be invaluable.

This feature allows you to track spending across borders without worrying about conversion rates and foreign transaction fees.

Why Banktrack is the Right App for You

A bank tracker in Austria offers significant benefits for anyone looking to improve their financial management. From streamlined budgeting to enhanced investment tracking, the right bank tracker can help you stay on top of your finances and achieve your financial goals.

Banktrack stands out as the top choice due to its comprehensive features, strong security, and perfect integration with a wide range of banks which will automate the process of having to manually introduce all data.

Share this post

Related Posts

The 7 Best Fintonic Alternatives in Spain for 2025

The 7 best Fintonic alternatives in Spain for 2025 to track expenses, manage budgets, and improve personal financial control.Top 8 alternatives to 1Money in 2025

These are the top 8 alternatives to 1Money for personal finance management. Find the best apps for budgeting, expense tracking, and financial planning.The 8 best alternatives to Spendee in 2025

Looking for a fresh way to manage your budget? Check out these top Spendee alternatives to help you track spending, set goals, control your finances.

Try it now with your data

- Your free account in 2 minutes

- No credit card needed