Top 10 Best Expense Report Softwares in 2024

- Top 10 Best Expense Report Software

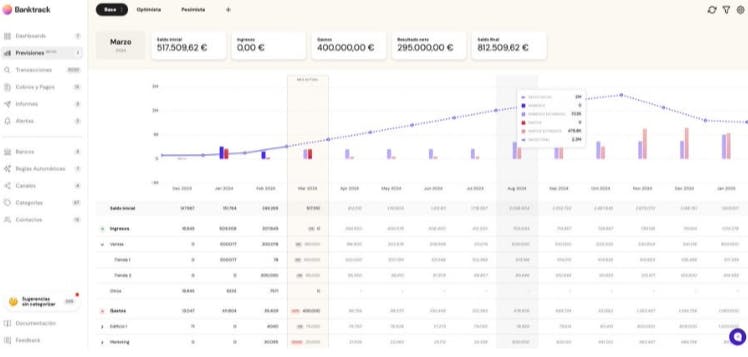

- 1. Banktrack - #1 Expense Report Software

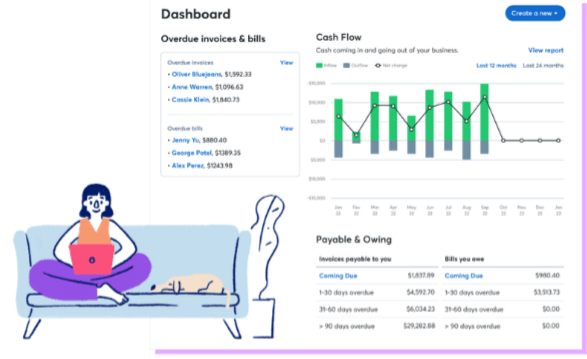

- 2. Expensify

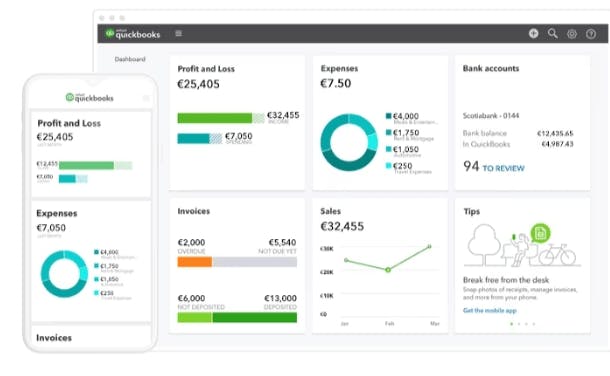

- 3. QuickBooks

- 4. Shoeboxed

- 5. Wave

- 6. ExpensePoint

- 7. Rydoo

- 8. Certify

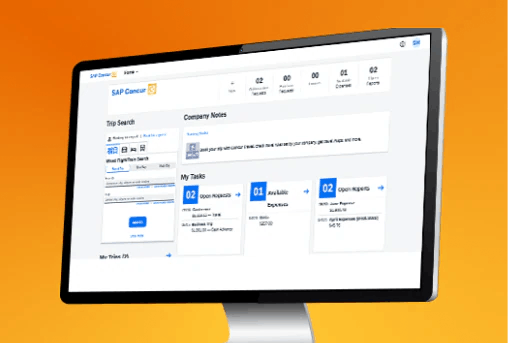

- 9. Abacus

- 10. Concur

- Why Use an Expense Report Software?

- 1. Streamlined Expense Tracking

- 2. Simplified Reimbursement Process

- 3. Efficient Financial Reporting

- 4. Reduced Paperwork

- Comparison of the Best Expense Report Softwares

- Why Choose Banktrack as your Expense Report Software

The best expense report softwares:

- Banktrack

- Expensify

- QuickBooks

- Shoeboxed

- Wave

- ExpensePoint

- Rydoo

- Certify

- Abacus

- Concur

Managing expenses can be a headache, especially if you’re juggling multiple receipts, invoices, and transactions.

Whether you're a small business owner, a freelancer, or just someone who needs to keep personal finances in check, having the right expense report software can make a world of difference.

In this guide, we’ll explore the top 10 expense report software options.

Top 10 Best Expense Report Software

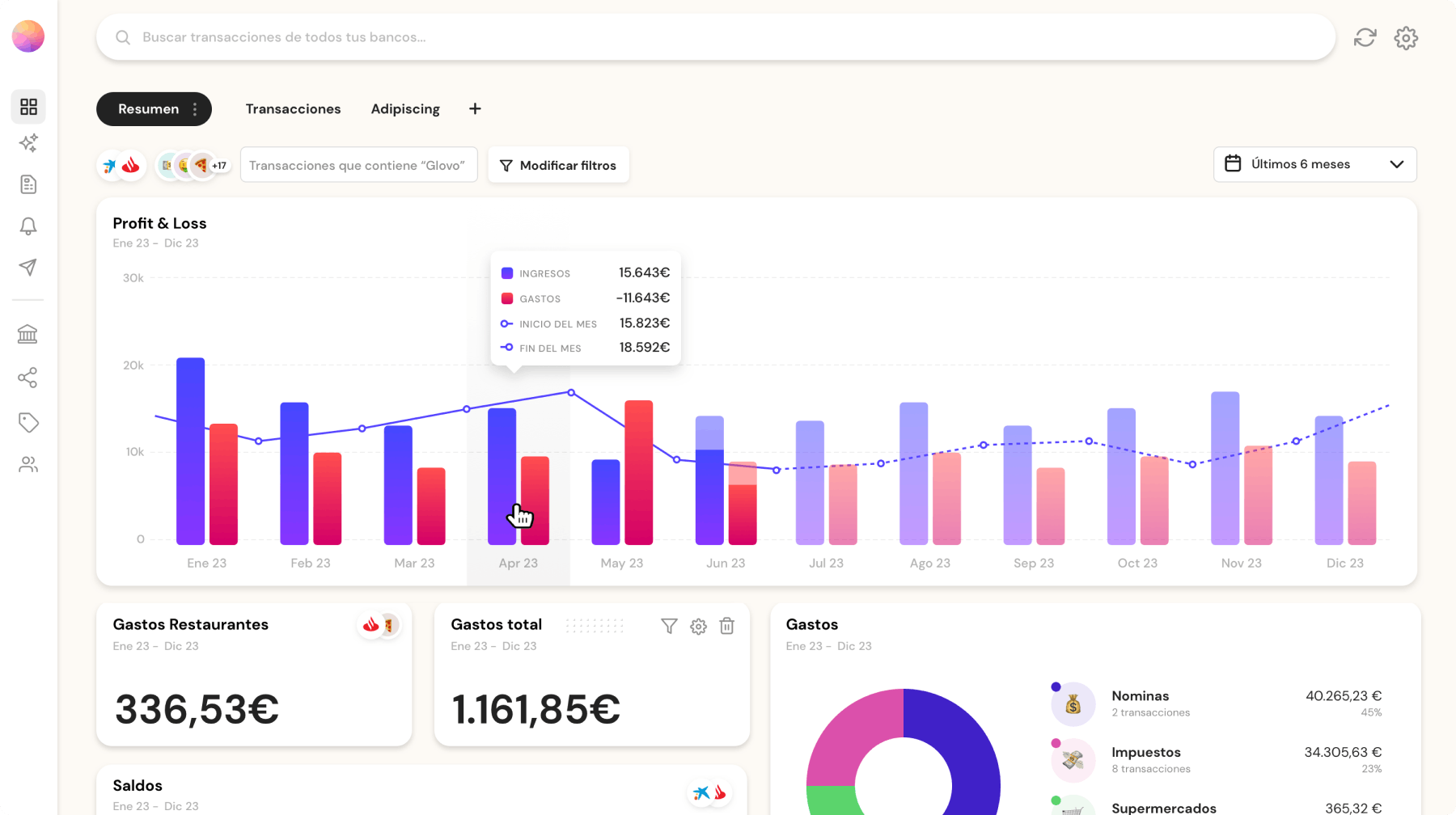

1. Banktrack - #1 Expense Report Software

If receipts and invoices are your downfall, you are in luck. We can help you answer the question: “How can I keep track of expenses?”

Banktrack is a top choice for keeping track of your expenses due to its many and complex features, seamless integration, and strong security measures.

It's designed to handle both personal and business finances, making it a flexible tool for anyone looking to modernize their expense management.

Key Features

- Customizable Dashboards: Banktrack’s dashboards provide a real-time view of your financial status. You can customize these dashboards to see an overview of your spending, a detailed breakdown of expenses, and comparisons of income and expenses over time.

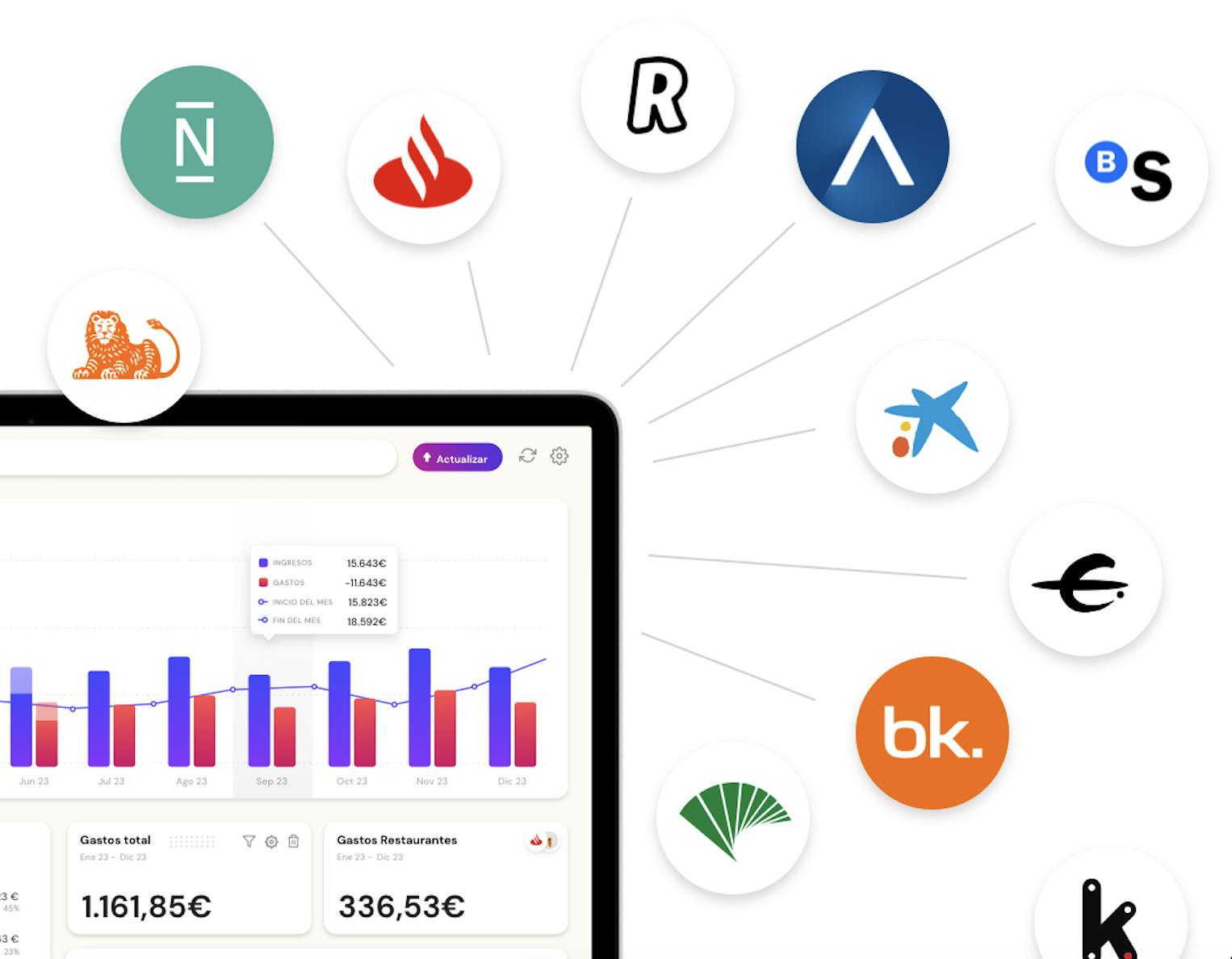

- Seamless Bank Integration: Banktrack syncs with over 120 banks, including both traditional and neobanks. This integration allows you to manage all your accounts from a single platform. It uses Open Banking (PSD2) and Direct Access methods to ensure secure and efficient data integration.

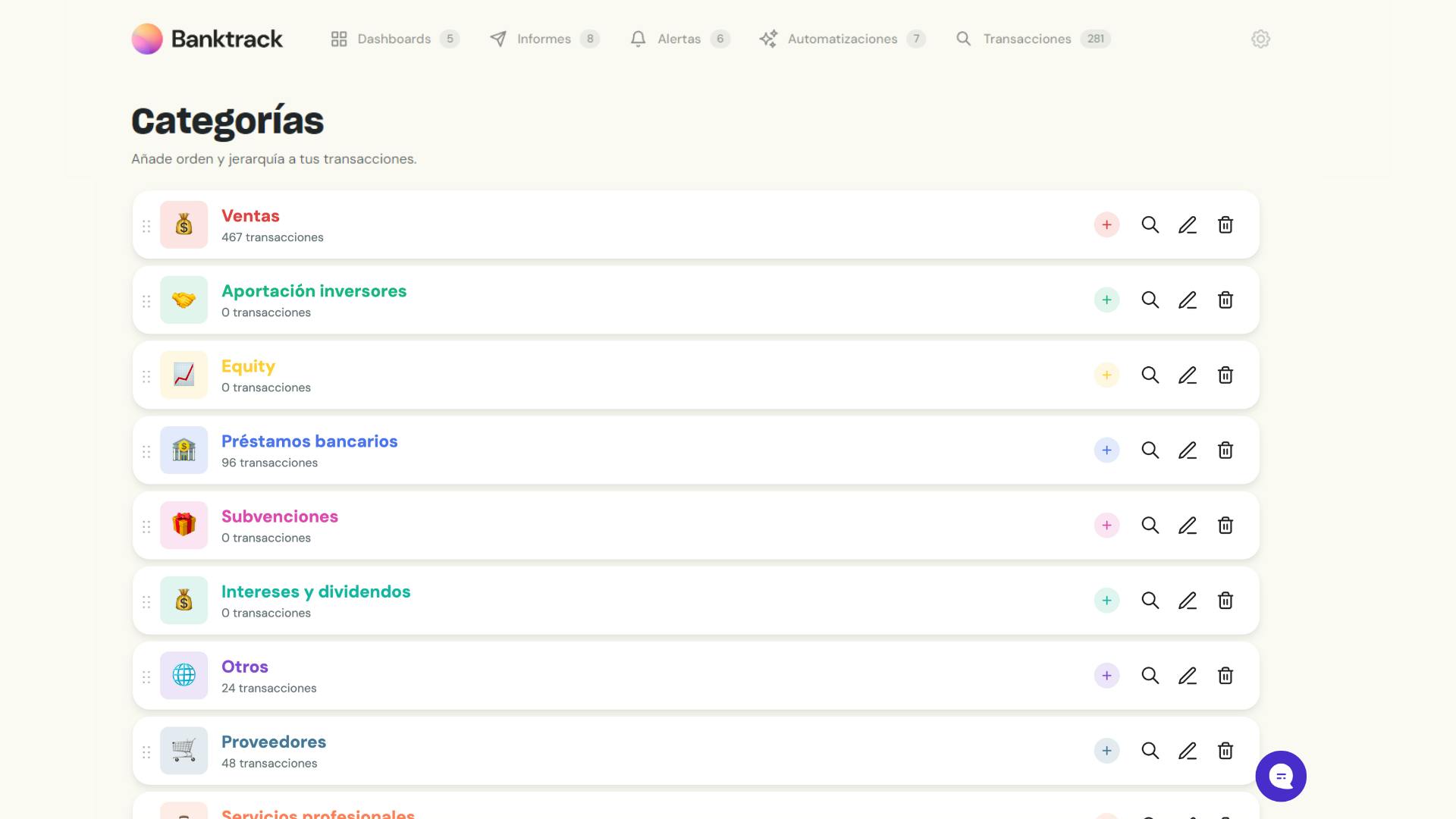

- Expense Categorization: You can categorize expenses and income with precision, which helps in creating detailed financial reports. Custom categories make it easy to track specific spending patterns and analyze your financial data.

- Strong Security Measures: Banktrack takes security seriously, using authorized data providers, offering read-only access to your accounts, and encrypting all transaction data. This ensures that your financial information is safe and secure.

- Cash Flow Forecasting: Banktrack’s forecasting tools analyze historical data to predict future cash flow trends. This helps in anticipating potential financial challenges and planning accordingly.

- Automated Bank Reconciliation: You don't know how to do a bank reconciliation? Don’t worry, because you actually don't have to learn. The software automatically reconciles your bank statements with internal records, reducing errors and saving time.

Pros and Cons

Pros:

- Comprehensive set of features for personal and business use.

- Seamless integration with a wide range of banks.

- Strong security measures to protect financial data.

Cons:

- Some advanced features may require a subscription.

- It might be more powerful than necessary for simple expense tracking.

- It is best for individuals and businesses looking for an all-in-one tool with robust features and strong security.

2. Expensify

Expensify is a popular choice for expense management due to its user-friendly interface and powerful features. It’s ideal for both personal use and business expense tracking.

Key Features

- SmartScan Technology: Expensify’s SmartScan lets you take photos of receipts, and the app automatically captures and categorizes the details. This reduces manual data entry and saves time.

- Automatic Expense Reports: The app generates detailed expense reports that are easy to share and export. This feature is especially useful for businesses that need to manage and analyze employee expenses. In fact, according to Forbes, automation is taking over the expense report and that is ok. So make use of technology to make your life easier!

- Mileage and Time Tracking: Expensify can also track mileage and billable hours, making it a good cash management software for freelancers and business owners.

- Integration with Accounting Software: Expensify integrates in real time with popular accounting softwares.

Pros and Cons

Pros:

- Easy-to-use interface with powerful automation features.

- Suitable for both personal and business use.

- Integrates with major accounting platforms.

Cons:

- Advanced features may require a subscription.

- May be more than needed for simple personal expense tracking.

- It is best for users who need a powerful tool with automation features and integration capabilities.

3. QuickBooks

QuickBooks is a well-known accounting software that also excels in expense tracking.

It’s an ideal small business expense tracking software for startups and freelancers who need financial management features.

Key Features

- Receipt Capture: QuickBooks allows you to snap photos of receipts and match them with intercompany transactions, making it easy to keep track of expenses.

- Expense Categorization: The app automatically categorizes expenses and integrates with your bank accounts, helping you stay organized and on budget.

- Invoicing and Payments: QuickBooks offers invoicing and payment processing features, making it a quite complete tool for managing business finances.

- Tax Preparation Integration: The software organizes your expenses in a way that simplifies tax preparation, ensuring you’re always ready for tax season.

Are you looking for a budgeting app rather than an expense tracking software? These are the best budgeting apps for tracking your money on the go according to The Guardian.

Pros and Cons

Pros:

- Combines expense tracking with powerful accounting features.

- Ideal for small business owners and freelancers.

- Integrates with a wide range of financial tools.

Cons:

- Can be expensive, especially for advanced features.

- Might be more complex than necessary for basic expense tracking.

- It is best for small business owners and freelancers who need an all-in-one accounting and expense tracking solution.

4. Shoeboxed

Shoeboxed is specifically designed for organizing and digitizing receipts. If you’re overwhelmed by paper receipts, this app can help you get organized.

Key Features

- Receipt Scanning: You can scan receipts using the mobile app, email them in, or even mail them to Shoeboxed. The app extracts and organizes the data for you.

- Expense Reports: Shoeboxed generates detailed expense reports that are perfect for tax preparation and reimbursement claims.

- Business Card Management: The app also scans and organizes business cards, helping you keep track of your contacts and expenses.

- IRS-Accepted Receipt Archive: Shoeboxed stores your receipts in a format accepted by the IRS, ensuring compliance and easy tax preparation.

Pros and Cons

Pros:

- Excellent for digitizing and organizing receipts.

- Multiple submission methods, including mail-in services.

- IRS-compliant storage for tax purposes.

Cons:

- Limited features beyond receipt management.

- Requires a subscription for full access.

- It is best for individuals and small businesses needing a specialized tool for receipt management.

5. Wave

Wave offers a free expense tracking app that also focuses on invoicing, and accounting. It’s ideal for freelancers and small business owners who need a cost-effective tool.

Key Features

- Receipt Scanning: Wave’s app lets you scan and sync receipts with your accounting records, keeping your financial data up to date.

- Expense Management: The app categorizes expenses and integrates with your bank accounts, making it easy to track spending.

- Invoicing and Payments: Wave includes invoicing features with payment processing, making it a flexible tool for managing business finances.

- Custom Reports: You can generate financial reports tailored to your needs, including profit and loss statements and tax summaries.

Pros and Cons

Pros:

- Completely free with no hidden fees.

- Combines expense tracking, invoicing, and accounting in one app.

- User-friendly interface ideal for beginners.

Cons:

- Limited to basic accounting and expense management features.

- Customer support may be slower for the free version.

- It is best for freelancers and small business owners looking for a free, all-in-one financial management solution.

6. ExpensePoint

ExpensePoint offers a range of features that can be customized to fit your specific needs. It’s suitable for businesses of all sizes.

Key Features

- Expense Management: ExpensePoint allows you to track and manage expenses with customizable categories and approval workflows.

- Receipt Capture: You can capture and upload receipts using the mobile app, which automatically matches them with transactions.

- Integration with Accounting Software: ExpensePoint integrates with major accounting software, ensuring your financial data is synced across platforms.

- Detailed Reporting: The app provides detailed financial reports that can be customized to meet your business needs.

Pros and Cons

Pros:

- Highly customizable to fit different business needs.

- Integrates with major accounting platforms.

- Offers detailed reporting features.

Cons:

- May be more complex than necessary for small businesses.

- Some advanced features require a subscription.

- It is best for businesses that need a customizable expense management solution with detailed reporting.

7. Rydoo

Rydoo is a modern expense management tool designed for both individuals and businesses. It offers a range of features aimed at simplifying expense tracking.

Key Features

- Receipt Scanning: Rydoo allows you to scan receipts and automatically extracts and categorizes the data.

- Expense Approval Workflow: The app includes an expense approval workflow, making it easy for businesses to manage employee reimbursements.

- Integration with Financial Software: Rydoo integrates with popular financial software, ensuring seamless data transfer and accurate records.

- Customizable Reports: Rydoo offers customizable reporting options, allowing you to generate reports that suit your needs.

Pros and Cons

Pros:

- Modern interface with intuitive features.

- Expense approval workflow for businesses.

- Integrates with major financial software.

Cons:

- Advanced features may require a subscription.

- May have a learning curve for new users.

- Best for individuals and businesses looking for a modern, feature-rich expense tracking tool.

8. Certify

Certify offers a variety of features for managing expenses and receipts. It’s designed for businesses that need a strong expense management solution.

Key Features

- Receipt Capture and Management: Certify allows you to capture receipts using your mobile device and automatically categorize expenses.

- Expense Reporting: The app generates detailed expense reports that are easy to share and export.

- Integration with Accounting Systems: Certify integrates with major accounting systems, ensuring your financial data is synced across platforms.

- Compliance and Policy Management: The app includes features for managing expense policies and ensuring compliance.

Pros and Cons

Pros:

- Many features focused on expense management.

- Integration with major accounting systems.

- Includes compliance and policy management features.

Cons:

- Can be expensive for small businesses.

- Some users may find it complex to navigate.

- It is best for businesses needing a strong expense management tool with compliance features.

9. Abacus

Abacus offers real-time expense tracking and reporting, making it a great choice for businesses and individuals who need up-to-date financial information.

Key Features

- Real-Time Expense Reporting: Abacus provides real-time expense reporting, allowing you to track and manage expenses as they occur.

- Receipt Capture: The app includes receipt capture and automatic data extraction features, reducing manual data entry.

- Integration with Accounting Software: Abacus integrates with popular accounting software, ensuring seamless data transfer and accuracy.

- Expense Approval Workflow: The app includes an expense approval workflow, making it easy to manage and approve employee expenses.

Pros and Cons

Pros:

- Real-time expense tracking and reporting.

- Includes receipt capture and data extraction features.

- Integrates with major accounting software.

Cons:

- Some advanced features may require a subscription.

- May be more suited for businesses than individual users.

- It is best for businesses and individuals who need real-time expense tracking and reporting.

10. Concur

Concur is an enterprise-level expense management solution designed for larger organizations with complex expense tracking needs.

Key Features

- Expense Reporting and Management: Concur provides a suite of tools for expense reporting and management, including receipt capture and expense categorization.

- Integration with Financial Systems: The app integrates with major financial and accounting systems, ensuring seamless data transfer.

- Travel and Expense Management: Concur includes features for managing travel expenses, including booking and expense reporting.

- Compliance and Policy Management: The app includes tools for managing expense policies and ensuring compliance with company regulations.

Pros and Cons

Pros:

- Variety of tools for expense and travel management.

- Integrates with major financial systems.

- Includes compliance and policy management features.

Cons:

- Can be expensive for smaller organizations.

- May be more complex than necessary for smaller businesses.

- Best for large organizations with complex expense and travel management needs.

Why Use an Expense Report Software?

Before we get into the details, let’s understand why an expense report software is essential:

1. Streamlined Expense Tracking

Expense report software helps you track all your spending in one place, making it easier to see where your money is going.

This can help you stay on budget and manage your finances more effectively.

Are you wondering if you need a more complex tool to help you with budgeting? This is how you can determine if you need a business budgeting software.

2. Simplified Reimbursement Process

For businesses, an expense report software makes it easier to process reimbursements.

Employees can submit their expenses digitally, and managers can approve them with just a few clicks.

3. Efficient Financial Reporting

These tools often include reporting features that generate detailed financial reports.

This is crucial for analyzing spending patterns, preparing for tax season, and making informed financial decisions.

4. Reduced Paperwork

Gone are the days of drowning in a pile of receipts.

Expense report software digitizes your documents, making it easier to store, organize, and retrieve them whenever needed.

Comparison of the Best Expense Report Softwares

- Banktrack is the best expense report software because it has complex and customizable features, perfect bank integration, tailored reports and alerts and strong security measures.

- Expensify offers a user-friendly interface with powerful automation features, ideal for both personal and business use.

- QuickBooks provides a full-featured accounting solution with excellent expense tracking capabilities.

- Shoeboxed specializes in digitizing and organizing receipts, perfect for those overwhelmed by paper.

- Wave is a free option that combines expense tracking with invoicing and accounting features.

- ExpensePoint and Rydoo provide customizable and modern expense management solutions.

- Certify offers many features for businesses needing advanced expense management.

- Abacus provides real-time expense tracking, making it great for businesses and individuals.

- Concur is an enterprise-level solution designed for larger organizations with complex needs.

Evaluate each tool based on your specific requirements, whether it’s budget, features, or ease of use. With the right expense report software, managing your finances can be simpler and more efficient than ever before.

Why Choose Banktrack as your Expense Report Software

When it comes to managing expenses and receipts, the right software can make a huge difference in efficiency and accuracy.

Banktrack stands out as the top option due to its complex and useful features, perfect bank integration, and strong security measures.

Share this post

Related Posts

Best 5 Apps for Tracking Expenses and Receipts

Find the best apps to streamline expense and receipt tracking. Discover top picks, to simplify your financial management.Best 6 Expense Tracker Software with Bank Sync features

Managing money isn’t exactly anyone’s idea of fun, but it is definitely important and it can even be simpler than you think. Let us show you how.

Try it now with your data

- Your free account in 2 minutes

- No credit card needed