The Best 8 Bottomline Alternatives

- Top 8 Bottomline Alternatives

- 1. Banktrack is your Cash Management App

- 2. Scoro

- 3. Google Docs

- 4. QuickBooks

- 5. Vena Solutions

- 6. Cube

- 7. Float

- 8. PlanGuru

- Why is Cash Flow Management Important?

- 7 Benefits of Using Banktrack's Platform

- Conclusion

- Frequently Asked Questions - FAQs

- What are some alternatives to Bottomline?

- Why might someone choose Banktrack over Bottomline?

- Why is cash flow management important?

The best bottomline alternatives:

- Banktrack

- Scoro

- Google Docs

- QuickBooks

- Vena Solutions

- Cube

- Float

- PlanGuru

Bottomline is a leading provider of SaaS solutions. It offers a comprehensive platform designed to streamline payments, securities, and messaging processes, enabling financial institutions to achieve lower costs and wider reach.

But it is not the only solution out there is it?

As you can imagine, the market is full of alternatives for users to choose from and align with their preferences.

Let’s discover what these are.

Top 8 Bottomline Alternatives

1. Banktrack is your Cash Management App

Banktrack is the best cash management application for the year 2024.

Why is it thought to be the best option? Let us explain:

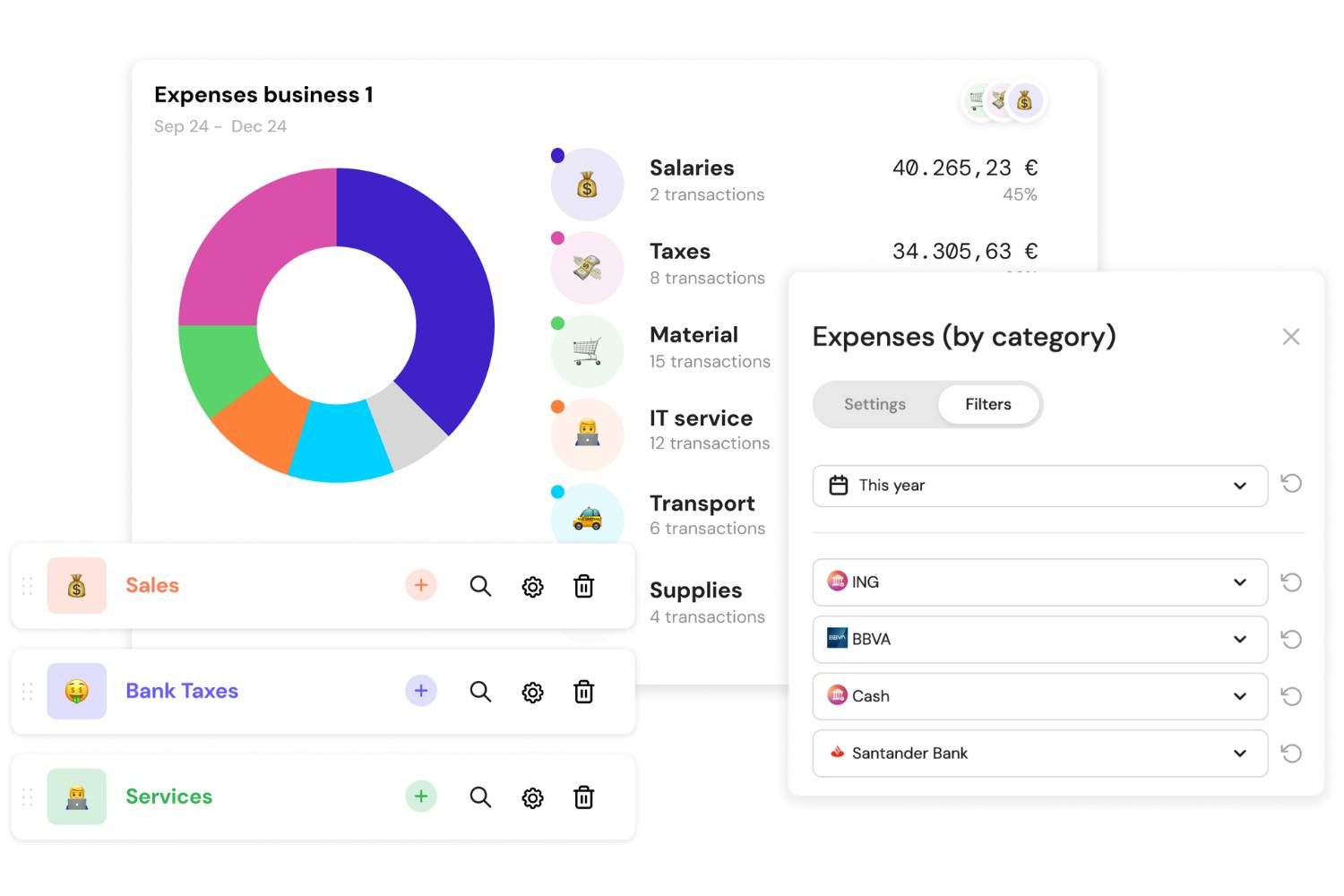

Custom Dashboards

First of all, this cash management solution stands out by its capacity to build personalized dashboards combining perspectives from various financial products, companies, and bank accounts.

With Banktrack, you can easily obtain the information you need to manage your spending.

Adapted Categories

A good cash management software allows you to adjust the categories to suit your needs because they are specifically designed to fit your expenses.

You can create and modify an infinite number of categories using sophisticated rules to arrange your revenue and expenses however you see fit.

You can monitor your finances and determine where your money is going thanks to this flexibility.

Custom Reports and Alerts

Moreover, Banktrack offers personalized reports and alerts.

Customized reports can be generated, and you can get alerts regarding your spending via email, Slack, Telegram, WhatsApp, and SMS.

You can even configure these alerts to tell you when there are duplicate charges, low balances, or other significant events.

This will help you stay on top of your finances and make wise decisions at all times.

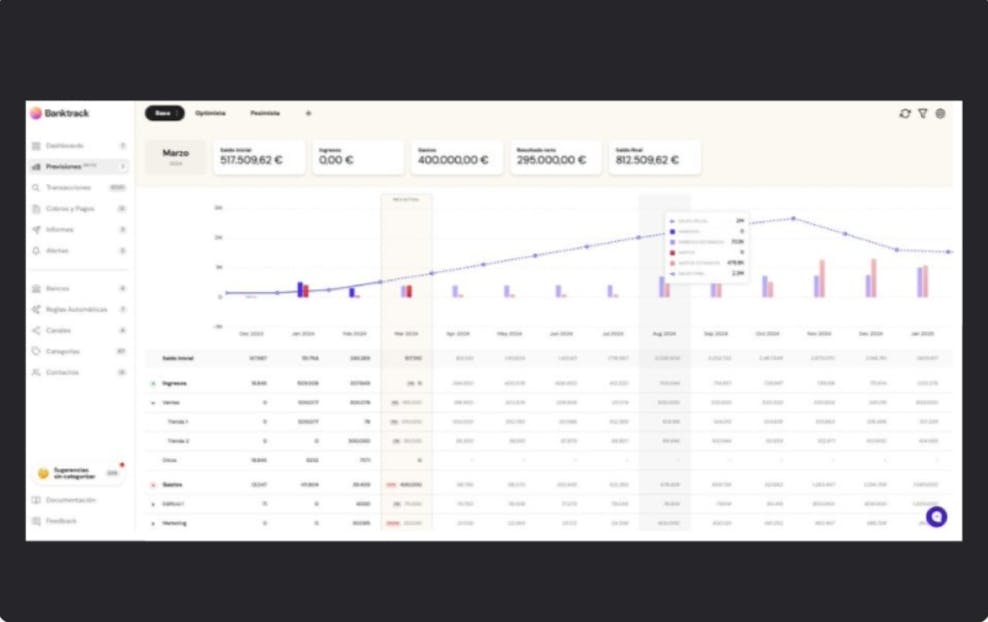

Forecasts

You can create estimates of cash flow and make sure they are met.

Formulas also allow you to add a lot more dynamic functionality to your calculations.

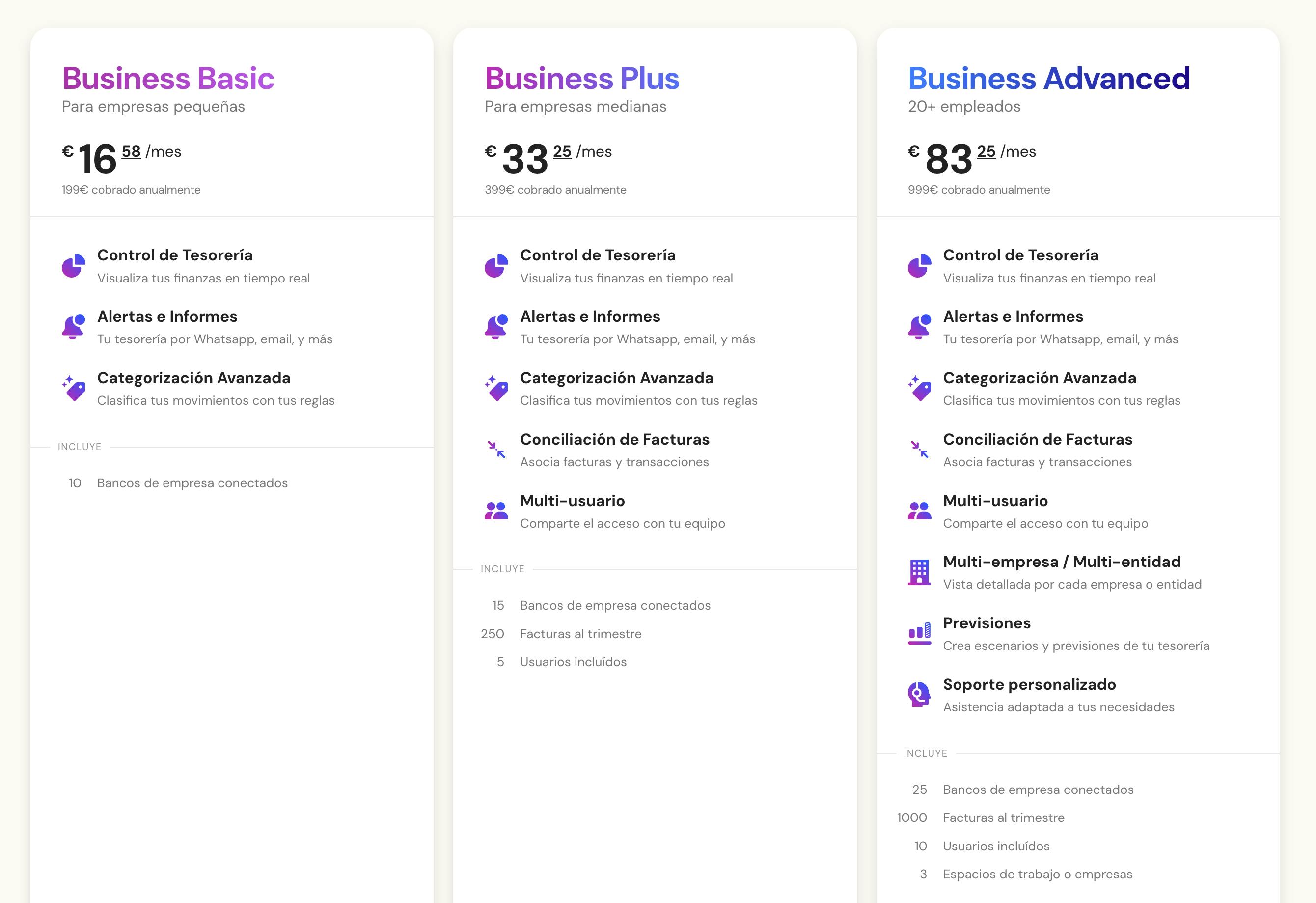

Affordable Prices

Banktrack offers a variety of plans with different functionalities at affordable prices.

For example, the "Business Basic" plan allows the connection of up to 10 bank accounts for just €16.58 per month.

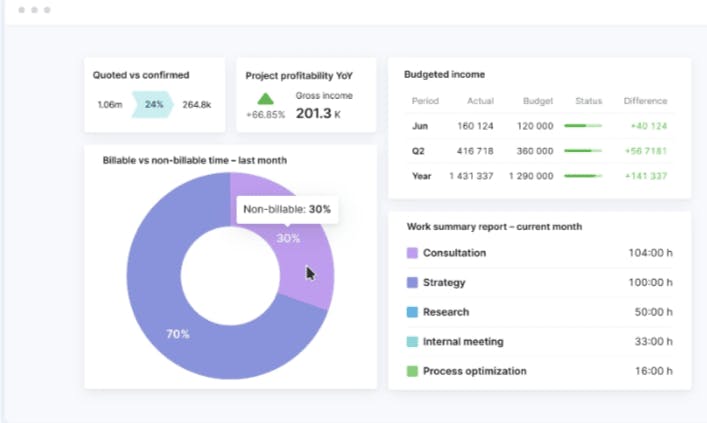

2. Scoro

Scoro offers businesses a comprehensive solution by integrating project management, sales tracking, invoicing, and cash flow management.

While the entry-level plan may not offer as many sophisticated financial features as the premium versions, upgrading grants you access to a wealth of resources that can assist you in expanding and optimizing your company.

Key Features:

- Customizable reporting options

- Comprehensive business management tools

- Project management and sales pipeline tracking

- Supplier management and invoicing

3. Google Docs

Google Docs provides a range of downloadable cash flow management templates, providing reasonably priced options for businesses.

While these templates may not have all the advanced features found in specialized software, they still offer a simple and approachable way to manage your cash levels on your own.

Important characteristics:

- Numerous cash flow management templates that can be downloaded

- Free or inexpensive options

- Quick accessibility and simplicity of use

- Minimal customer service and fundamental features

4. QuickBooks

QuickBooks is another cash management program that is well-known for its user-friendliness and basic cash management features.

QuickBooks is still a good option for businesses that currently use the platform for bookkeeping, even though it might not have all the advanced features of specialized cash management software.

Important characteristics:

- Rudimentary cash flow management instruments

- Capabilities for billing and invoicing

- Analysis and reporting of financial data

- Smooth compatibility with accounting software

5. Vena Solutions

Vena Solutions offers cloud-based cash management and financial planning services with an intuitive Excel user interface.

Though some users may find some tools to have a steep learning curve, Vena's wide feature set and flexible reporting options make it a great resource for businesses of all kinds.

Important characteristics:

- Cloud-based cash management and financial planning

- Excel-based interface for a comfortable and familiar use

- Support representatives with expertise and online training resources

- Adaptable reporting choices and mobile assistance

6. Cube

Cube simplifies cash management control by using automated data consolidation and fully configurable reporting features.

Although certain users may initially find certain features difficult to use, Cube's capacity to analyze data and produce customized reports makes it an invaluable resource for companies searching for efficient financial management solutions.

Important characteristics:

- Consolidating data automatically from spreadsheets

- Personalized reports and dashboards

- Tools for scenario planning and analysis

- Integration with accounting software

7. Float

Float is a cash management app that simplifies budgeting and forecasting.

Budgets can be created by users and modified to play a variety of scenarios, such as rising material costs or hiring more staff.

Among its features are:

- Well-designed Interface: Float boasts a clean and intuitive interface, facilitating the quick and easy creation of forecasts for different scenarios.

- Multi-User Functionality: The Essential plan allows up to three users, while the Enterprise plan accommodates up to 100 users, offering flexibility for businesses of different sizes.

- Premium Plans Include Expert Review: With Premium or Enterprise licenses, Float offers quarterly or monthly reviews of forecasts by in-house experts, providing valuable insights for improved cash-flow management.

However, users report it is relatively expensive. The Essential plan starts at $59 per month, while the Enterprise license costs $199 per month, which may be considered costly for some businesses.

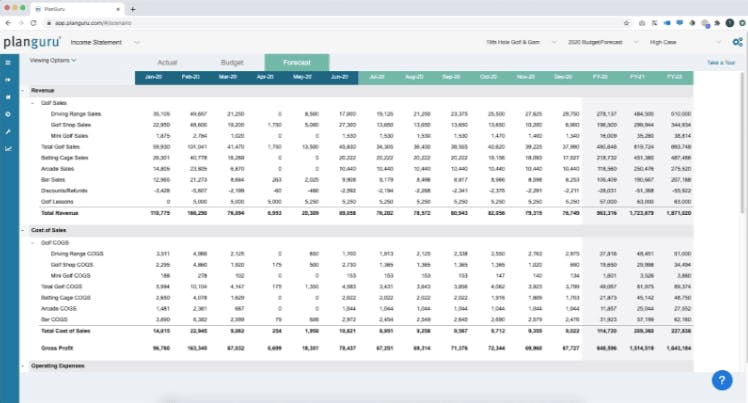

8. PlanGuru

With the help of PlanGuru's forecasting and budgeting tools, you can examine financial data and make well-informed decisions about cash management.

Users can gain valuable insights into their cash management and optimize their financial processes by using this platform.

Key Features:

- Budgeting and forecasting tools

- Integration with QuickBooks and Excel

- Educational resources for users

- 14-day free trial and 30-day money-back guarantee

Why is Cash Flow Management Important?

Cash flow is the lifeblood of any business, as it represents the amount of cash coming in and going out of the company in a given period.

Poor cash flow management can lead to liquidity problems, difficulties in paying debts, and even bankruptcy. Thus, the importance of finding the right software to manage your finances accurately.

On the other hand, effective cash flow management can improve the financial health of the company, providing the ability to invest in growth, respond to financial emergencies, and seize strategic opportunities.

7 Benefits of Using Banktrack's Platform

By taking advantage of the features that cash management solutions have to offer, individuals and companies can gain a range of benefits:

- Enhanced Financial Control: These platforms offer real-time insights and analytics, allowing users to monitor cash levels and manage their finances more effectively.

- Improved Efficiency: Automation of routine tasks such as payment processing and account reconciliation reduces manual effort, saving time and minimizing errors.

- Cost Savings: Streamlined operations and reduced manual interventions lead to significant cost reductions in financial management processes.

- Increased Security: Advanced security measures and fraud detection capabilities ensure the protection of sensitive financial data and transactions.

- Better Decision Making: Access to comprehensive financial data, categories and visual reports supports informed decision-making, enabling better strategic planning and resource allocation.

- Compliance and Risk Management: The platform helps in complying to regulatory requirements and managing financial risks through good compliance features and risk assessment tools.

- Scalability: A cash management software can grow with the business, accommodating increasing transaction volumes and expanding financial needs without compromising performance.

Conclusion

Bottomline is a leading provider of SaaS solutions, but it's not the only option available.

Banktrack stands out as a top alternative, offering personalized dashboards, adaptable categories, custom reports, and alerts.

With its user-friendly interface and affordable pricing plans, Banktrack provides an effective and flexible cash management solution.

Frequently Asked Questions - FAQs

What are some alternatives to Bottomline?

Some notable alternatives to Bottomline include Banktrack, Scoro, Google Docs, QuickBooks, Vena Solutions, Cube, Float, and PlanGuru. Each of these platforms offers different features suited to help with cash management and financial planning.

Why might someone choose Banktrack over Bottomline?

Banktrack is praised for its personalized dashboards, adaptable categories, and custom reports and alerts. It offers a high degree of customization and affordable pricing plans, making it an excellent choice for detailed cash management.

Why is cash flow management important?

Effective cash flow management is crucial for maintaining liquidity, paying debts, and avoiding bankruptcy. It enhances a company's financial health, enabling investments in growth, response to financial emergencies, and the seizing of strategic opportunities.

Share this post

Related Posts

10 best cash management software for small businesses

Wondering what your options are as a small business to manage your cash flows wisely? We have curated a list of the top 10 best cash management softwares for you.Top 5 Xero alternatives in 2025

If Xero no longer meets your business needs, explore other accounting solutions that offer better features, pricing, and flexibility for your company.Top 5 bank trackers in Switzerland

Managing your finances in Switzerland is easier with the right bank tracker. This guide highlights the top 5 tools designed to help you track expenses, monitor accounts, and optimize your budget.

Try it now with your data

- Your free account in 2 minutes

- No credit card needed