Top 5 Xero alternatives in 2025

If you feel that Xero no longer meets your business’s financial management needs, we present 5 treasury and accounting software alternatives that are considered some of the best on the market.

Many businesses that initially found Xero to be the perfect solution have, over time, discovered it might not be exactly what they were looking for.

Whether you’re seeking more flexibility, better pricing, or a platform that better suits your industry, the good news is that there are several alternatives to Xero that offer the perfect balance of features, ease of use, and value.

In this article, we explore the best alternatives to Xero, helping you find the ideal tool to manage your business’s finances as it grows.

5 best Xero alternatives in 2025

- Banktrack

- Quickbooks

- Zoho books

- Freshbooks

- Net suite

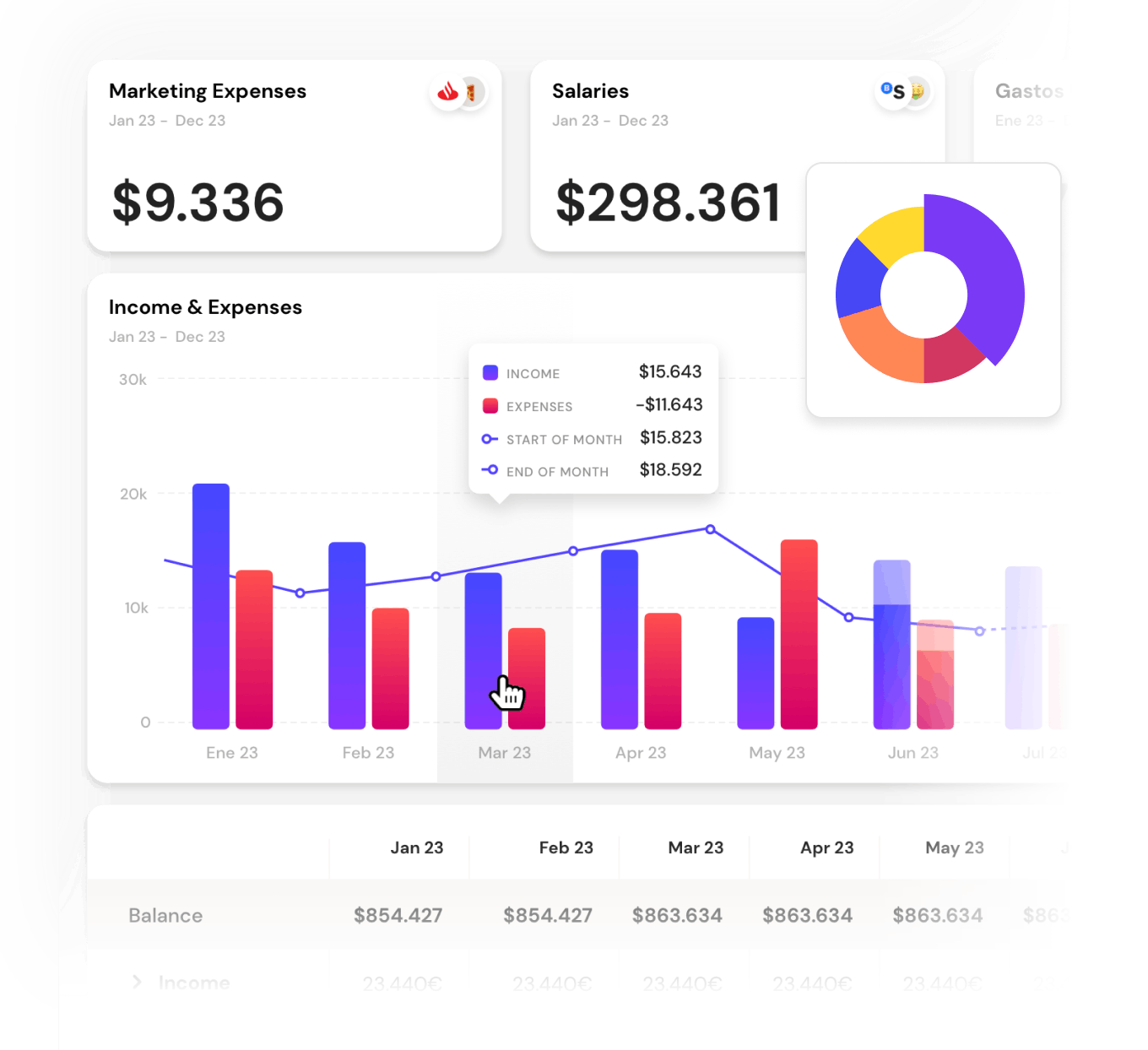

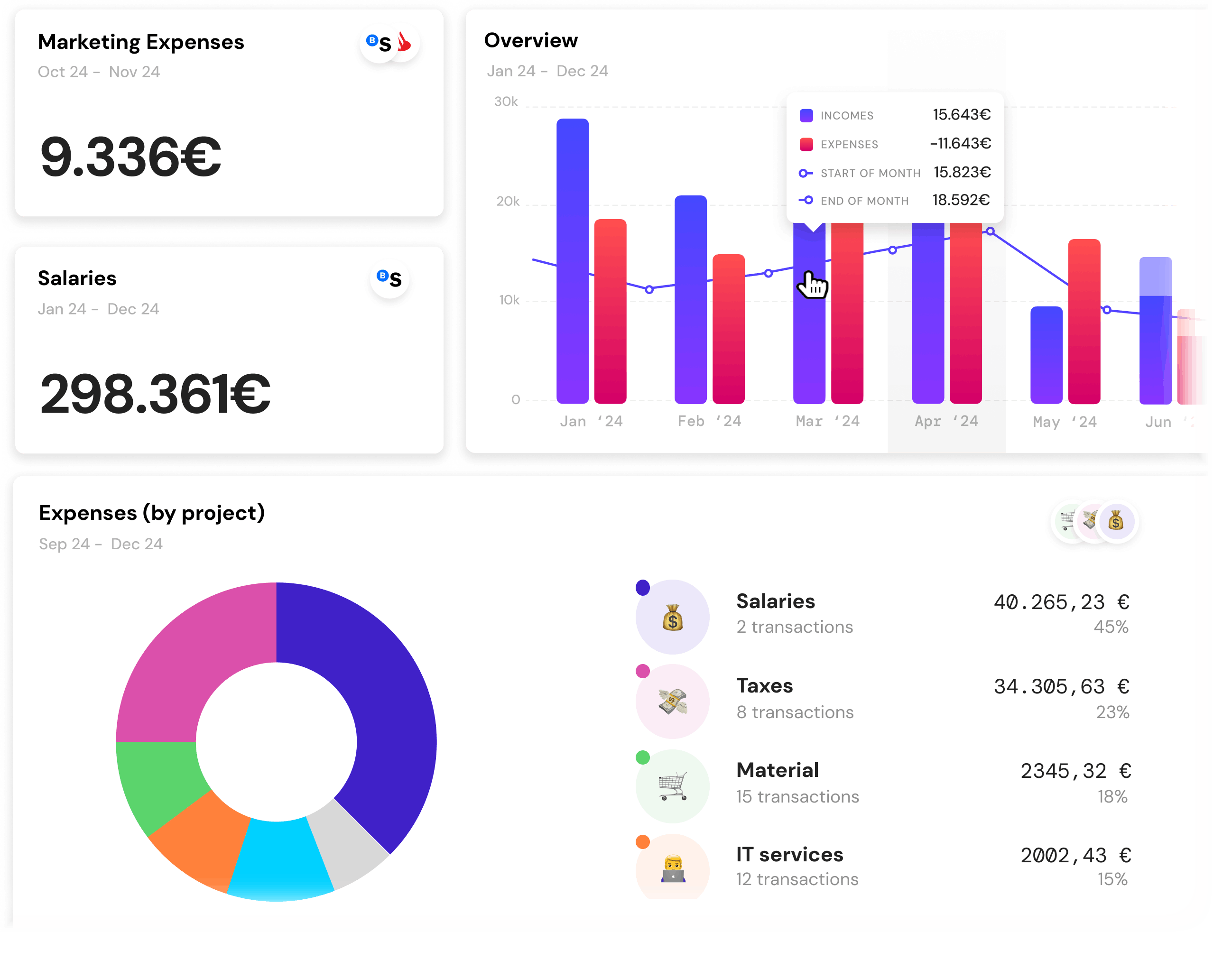

1. Banktrack

Banktrack is a tool specialized in treasury management, with a focus on cash flow control, liquidity, and financial risk management, making it an interesting alternative to Xero for businesses that need greater control over their treasury and financial optimization.

So, how could Banktrack serve as an alternative to Xero?

1. Focus on treasury and liquidity

Xero is a general accounting tool, meaning that while it offers financial reporting and bank reconciliation features, it is not fully optimized for managing short- and long-term liquidity.

Banktrack, on the other hand, is specifically designed for managing treasury functions, including cash flow planning, liquidity control, and cash movement forecasting.

This makes it more suitable for businesses that need precise control over their bank balances and cash flows in real time.

2. Financial risk management

While Xero offers basic financial reporting features, its ability to manage financial risks and conduct in-depth analysis of treasury fluctuations is limited.

Banktrack provides advanced tools for financial risk management, allowing businesses to identify and mitigate risks associated with currency fluctuations, interest rates, and other economic factors that can affect cash flow and liquidity.

3. Bank reconciliation

Both systems, Xero and Banktrack, allow for bank reconciliation, but Banktrack is specifically optimized to manage multiple bank accounts in real time and provide a detailed view of cash movements.

This is particularly useful for businesses managing multiple bank accounts, needing more frequent reconciliations, or requiring deeper integration with their banking infrastructure.

4. Specialized treasury reporting

Xero offers general financial reports like balance sheets and income statements, but these reports are not fully focused on treasury management.

Banktrack, in contrast, generates detailed treasury reports such as cash forecasts, liquidity analysis, and available funds flow, among others.

This allows treasurers and financial managers to make more strategic plans and informed decisions about managing their funds.

5. Financial planning and cash flow projection

Xero has cash flow tools that allow for basic forecasts, but its ability to project long-term cash flow and accurately manage working capital may not be as advanced.

Banktrack, as an alternative to Xero, offers more specialized capabilities for long-term projections, liquidity impact analysis, and real-time adjustments based on current and future cash flows.

6. Integration with financial tools

While Xero is well-suited for general accounting and integration with payment platforms and banks, Banktrack is more specialized in integrating and managing specific financial tools for treasury, such as payment management, real-time cash flow reconciliation, and optimizing banking processes.

Why choose Banktrack over Xero?

If your business focuses primarily on optimizing its treasury, managing liquidity with a high degree of precision, and requires a tool specialized in financial risk management and cash flow, then Banktrack might be a more suitable option than Xero.

Xero is geared more towards general accounting, whereas Banktrack has a deeper and more specific focus on treasury management.

Banktrack would be an excellent alternative to Xero for businesses that:

- Need detailed and specialized control over their cash flow.

- Manage multiple bank accounts and require fast and precise reconciliations.

- Want to make long-term treasury projections and optimize their liquidity.

- Are looking for a tool to manage financial risks related to treasury operations.

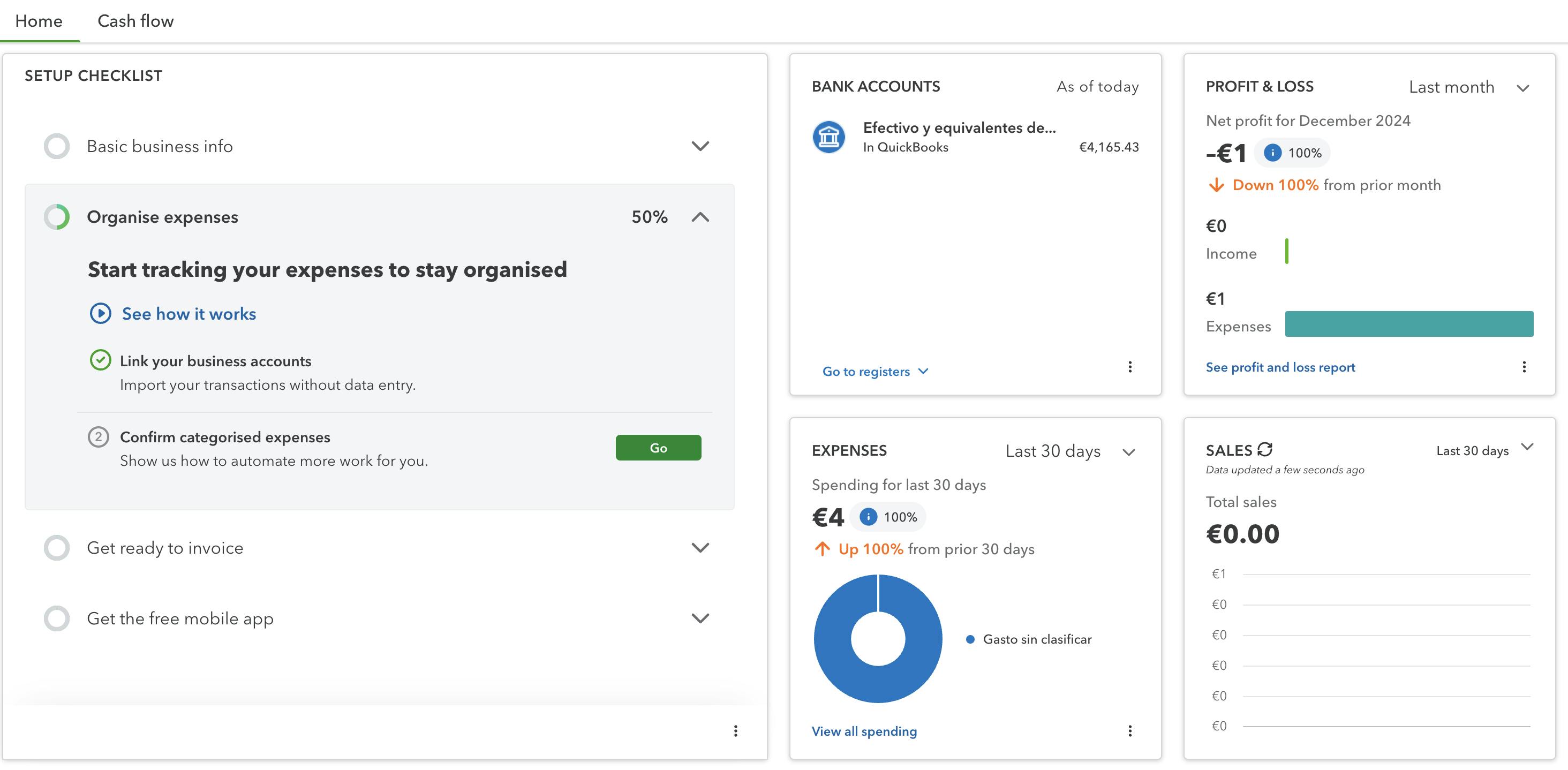

2. Quickbooks

QuickBooks is another highly popular tool in the world of accounting and financial management, designed to help small and medium-sized businesses manage their finances efficiently. Like Xero, it offers similar features, but there are key differences that make QuickBooks a viable alternative, especially for businesses with specific needs.

Here’s how QuickBooks works as an alternative to Xero:

1. Ease of use

Both platforms are intuitive and user-friendly, allowing users with limited accounting experience to manage finances without hassle.

QuickBooks may be more familiar to many businesses, especially in markets like the U.S., making it easier for those transitioning from other platforms.

2. Pricing and plans

QuickBooks offers more flexible and affordable pricing, with options for freelancers, small businesses, and medium-sized companies.

Xero, on the other hand, is better suited for larger businesses with more complex accounting needs, which can make it pricier for smaller companies.

3. Accounting features

Both platforms handle basic tasks like invoicing, bank reconciliation, and financial reporting, but QuickBooks offers more advanced features, especially in customizable reporting and inventory management. It also integrates well with payroll tools, making it ideal for companies that need to manage employees and payments.

4. Bank integration

Both platforms integrate with banks for automatic reconciliation, but QuickBooks may support fewer banks in some regions.

However, it still offers efficient transaction import and categorization, similar to Xero.

5. Inventory management

QuickBooks is stronger in inventory management, offering more robust tracking and valuation tools, which is ideal for businesses dealing with physical products.

Xero also supports inventory but with fewer features.

6. Financial reporting

QuickBooks provides a broader range of customizable reports and analytical tools, offering deeper insights into business performance, such as profit margins and cash flow projections, which can be more detailed than Xero’s reports.

7. Customer support

QuickBooks offers more extensive support, including phone, live chat, and tutorial access, as well as a large network of certified accountants for personalized assistance. Xero provides support mainly through its online help center and community forums.

8. Scalability

While Xero is better suited for larger, more complex businesses, QuickBooks is designed for small and medium-sized businesses but can scale with the QuickBooks Online Advanced plan for larger companies.

9. Community and educational resources

Both platforms offer educational resources, but QuickBooks provides a wider range of video tutorials and official certifications, making it ideal for businesses looking for in-depth training.

3. Zoho Books

Zoho Books is another popular accounting software designed to help small and medium-sized businesses manage their finances. Like Xero, it offers a wide range of financial tools, but with several unique advantages that make it a strong alternative for businesses looking for specific features.

Here’s how Zoho Books compares to Xero:

1. Ease of use

Both platforms are intuitive, but Zoho Books has a slightly simpler interface, making it a good choice for users with limited accounting experience. It’s easy to set up and navigate, which can be a plus for smaller businesses or startups.

2. Pricing and plans

Zoho Books is often seen as a more affordable option compared to Xero, offering competitive pricing with flexible plans for small businesses. It's a great choice for those seeking a cost-effective solution with essential accounting features.

3. Accounting features

Both platforms support basic accounting functions like invoicing, expense tracking, and financial reporting.

Zoho Books stands out for its automated workflows and customizable invoicing, as well as integration with other Zoho products, making it a great choice for businesses already using the Zoho ecosystem.

4. Bank integration

Zoho Books offers automatic bank feeds and reconciliation, similar to Xero, allowing businesses to easily import and categorize transactions. However, it may not support as many banks or regions as Xero does.

5. Inventory management

Zoho Books offers basic inventory management features, including stock tracking and reporting.

While Xero also has inventory tools, Zoho Books is more suitable for businesses with simpler inventory needs and can be more affordable for smaller operations.

6. Financial reporting

Zoho Books provides comprehensive financial reports, such as balance sheets, profit and loss, and cash flow statements.

It’s slightly less customizable than Xero, but offers solid reporting for small businesses with standard reporting needs.

7. Customer support

Zoho Books offers robust customer support through email, phone, and live chat, as well as a detailed knowledge base.

Xero has similar support options but is often preferred by businesses with more complex accounting requirements.

8. Scalability

Zoho Books is well-suited for small to medium businesses but may not scale as easily as Xero for larger enterprises. However, for businesses not yet at a large scale, Zoho Books provides everything needed at a more accessible price point.

9. Integration with other tools

A key advantage of Zoho Books is its integration with the Zoho suite (CRM, Projects, etc.), making it an excellent choice for businesses already using other Zoho tools.

Xero offers extensive third-party integrations, but Zoho Booksprovides a more cohesive experience for those within the Zoho ecosystem.

Freshbooks

FreshBooks is another popular accounting software primarily designed for small businesses, freelancers, and service-based companies.

While Xero is aimed at businesses of all sizes, FreshBooks offers a more streamlined and user-friendly option for businesses with simpler accounting needs.

Here’s how FreshBooks works as an alternative to Xero:

1. Ease of use

FreshBooks is known for its simplicity and user-friendly interface. It's easy to set up and navigate, making it an ideal choice for small business owners or freelancers with little accounting experience.

Xero, while also user-friendly, offers more advanced features that may require a steeper learning curve.

2. Pricing and plans

FreshBooks offers affordable plans aimed at small businesses and freelancers, with clear pricing based on the number of billable clients.

In comparison, Xero can be more expensive, especially for smaller businesses that don’t need the full range of features offered by Xero.

3. Accounting features

Both platforms handle core accounting tasks like invoicing, expense tracking, and reporting. However, FreshBooks is especially known for its time tracking, project management, and client invoicing features, which are great for service-based businesses.

Xero offers a broader range of accounting features, but FreshBooks shines in client-focused functionalities.

4. Bank integration

FreshBooks integrates with major banks to automatically import transactions, much like Xero. However, Xero offers more extensive bank connections, especially for businesses in multiple countries, making it more suitable for international businesses.

5. Inventory management

Unlike Xero, FreshBooks doesn’t offer advanced inventory management.

It’s better suited for service-based businesses and freelancers who don’t need to track physical inventory.

If inventory management is crucial for your business, Xerowould be a better fit.

6. Financial reporting

FreshBooks provides essential financial reports, including profit and loss statements and tax summaries.

While its reporting is sufficient for small businesses and freelancers, it is more limited compared to the customizable and comprehensive financial reports available in Xero.

7. Customer support

FreshBooks offers excellent customer support, including phone, email, and live chat. It is particularly noted for its responsive and friendly support team.

Xero also provides good support, but FreshBooks stands out for its more personalized and accessible service, especially for small businesses.

8. Scalability

FreshBooks is best suited for small businesses and freelancers who need basic accounting features.

As businesses grow and require more complex accounting tools, they may outgrow FreshBooks and need to switch to a more comprehensive platform like Xero.

9. Integration with other tools

FreshBooks integrates with a variety of third-party tools, such as payment processors, project management apps, and time tracking software.

However, its integration options are more limited than Xero, which offers broader third-party app integration, especially for larger businesses.

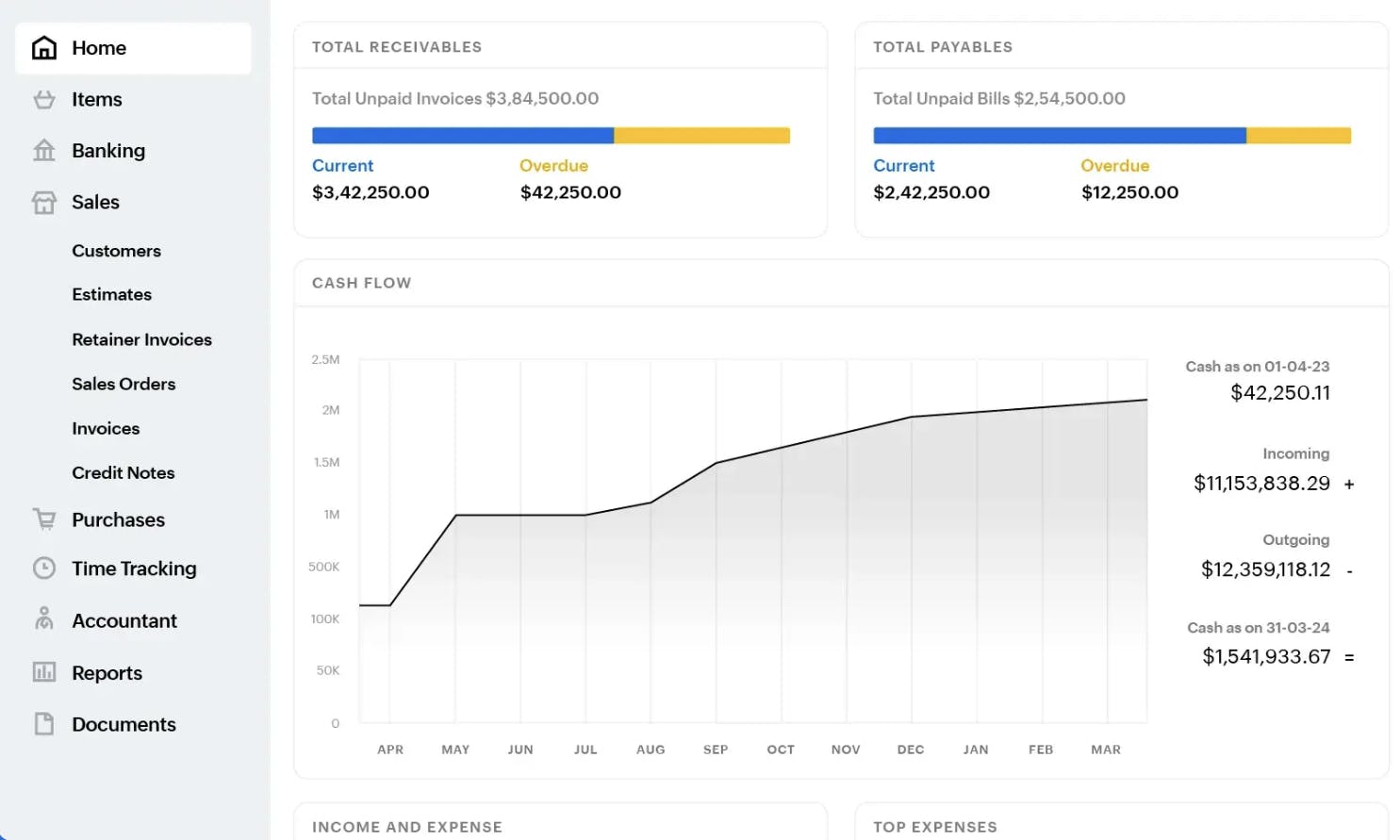

5. Net suite

NetSuite is an enterprise-level cloud-based ERP (Enterprise Resource Planning) solution that offers comprehensive financial management and business operations tools.

While Xero is geared towards small and medium-sized businesses, NetSuite is better suited for larger companies or businesses with more complex accounting and operational needs.

Here’s how NetSuite works as an alternative to Xero:

1. Target audience

NetSuite is designed for larger businesses and organizations that need a full-suite solution for managing not just accounting but also inventory, CRM, eCommerce, HR, and more.

In contrast, Xero is more focused on small to medium-sized businesses that primarily need accounting and finance tools.

2. Ease of use

While Xero is known for its user-friendly interface, NetSuite can be more complex due to its extensive feature set.

NetSuite requires more training and customization, making it better suited for businesses with dedicated financial teams or ERP consultants.

Xero, on the other hand, is ideal for businesses that need an easy-to-use and intuitive solution.

3. Pricing and plans

NetSuite is generally much more expensive than Xero. It offers customizable pricing based on the needs and scale of the business, but it typically caters to larger enterprises.

Xero is a more affordable option for smaller companies and startups, with tiered pricing based on features and company size.

4. Accounting features

Both platforms offer core accounting functions like invoicing, expense tracking, and financial reporting.

However, NetSuite provides a more comprehensive financial management suite, including multi-currency handling, advanced financial consolidation, and revenue recognition.

Xero focuses more on basic accounting and cash flow management, making NetSuite better for businesses that need advanced financial operations management.

5. Integration and scalability

NetSuite offers extensive integrations with other enterprise tools (CRM, HR, etc.) and is highly scalable, making it suitable for businesses that expect to expand or need to integrate with a larger suite of systems.

Xero is more limited in its integrations and is better suited for businesses that don’t require deep enterprise software integrations.

6. Financial reporting

Both platforms provide financial reporting, but NetSuite offers much more robust and customizable reporting options.

It allows businesses to create multi-dimensional financial reports that cover various business units, regions, and departments, while Xero focuses on standard reports like profit and loss statements and balance sheets.

7. Customer support

NetSuite offers dedicated support teams and implementation specialists, often through partners or consultants.

Due to its complexity, support is usually tailored for larger companies.

Xero provides support through its help center, email, and chat, which is more accessible for small and medium businesses needing general accounting help.

8. Implementation and customization

NetSuite requires a more extensive implementation process, with options for customization to fit the needs of larger enterprises.

It can take longer to set up and requires consulting services.

Xero, on the other hand, is easy to implement and doesn’t require the same level of customization, making it ideal for companies that need a quick and straightforward setup.

9. Suitability for growing businesses

NetSuite is ideal for businesses that have outgrown basic accounting software like Xero and need an all-in-one ERP solution to manage various aspects of their business.

Xero is better for small to medium-sized businesses with relatively simple accounting needs.

Share this post

Related Posts

The 8 Best Odoo Alternatives for Businesses in 2025

The 8 best Odoo alternatives for businesses in 2025 to streamline operations, CRM, and accounting with efficient software.Top 7 best cash flow management software in 2025

Wondering what the best cash flow management software is? With a cash flow management software by your side, you gain the clarity needed to understand how money moves within your business.Top 10 Small Business Expense Tracking Softwares

Managing your small business finances can be stressful and overwhelming at times. That is where these expense tracking software solutions come in.

Try it now with your data

- Your free account in 2 minutes

- No credit card needed