Top 5 bank trackers in Switzerland

- Top 5 Bank Trackers in Switzerland

- 1. Banktrack

- 2. Neon

- 3. Revolut

- 4. Yapeal

- 5. Inyova

- Why Switzerland's Banking System is Both a Blessing and a Curse

- The Blessing:

- The Curse:

- Security First: How Safe Are Bank Trackers?

- Encryption Standards

- Regulatory Compliance

- User Controls

- 1. Set Up Customized Alerts

- 2. Regularly Review Your Dashboard

- 3. Explore Advanced Features

- 6 Benefits in a Bank Tracker

- 1. All Accounts, One Dashboard

- 2. Real-Time Currency Conversion

- 3. Personalized Financial Insights

- 4. Budgeting Made Effortless

These are the best bank trackers in Switzerland:

- Banktrack

- Neon

- Revolut

- Yapeal

- Inyova

Switzerland: a land of majestic Alps, luxurious watches, and yes, one of the most sophisticated banking systems in the world.

But let's face it: navigating Swiss finances can sometimes feel like deciphering an ancient code. Multiple currencies, stringent regulations, hidden fees, it's enough to make anyone's head spin.

But what if managing your money could be as exhilarating as a downhill ski run in Zermatt?

Enter the world of bank trackers, the financial superheroes ready to transform your monetary woes into wealth-building wins.

Top 5 Bank Trackers in Switzerland

1. Banktrack

Managing your money can often feel like juggling too many things at once, multiple accounts, fluctuating expenses, and the constant need to stay on top of your cash flow.

Whether you're trying to stick to a budget or a small business aiming to optimize operations, the right tool can make all the difference.

Try Banktrack, an all-in-one cash management software designed to take the complexity out of financial tracking and forecasting.

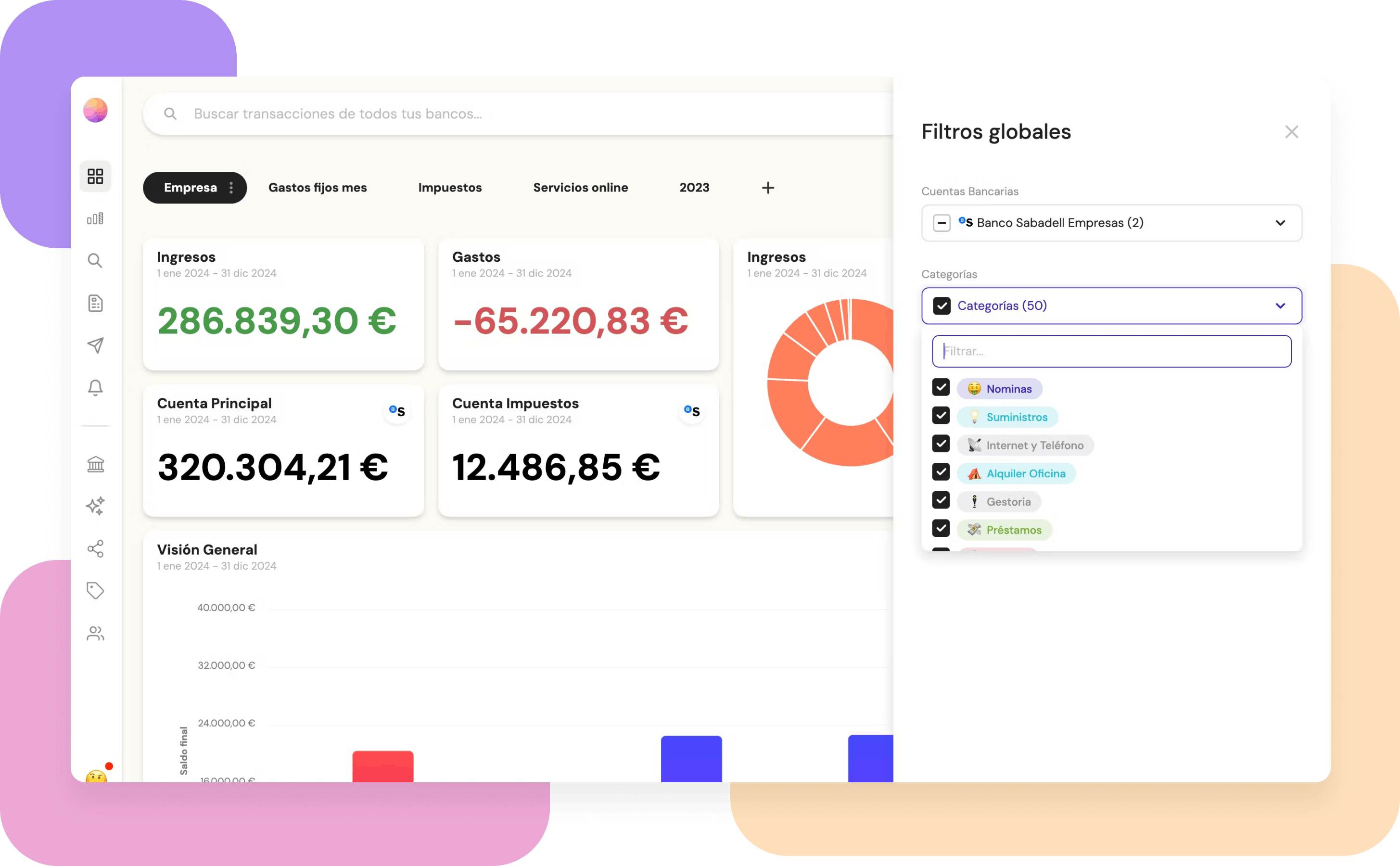

Its main features and benefits:

- All-in-One Cash Management: Combines professional-grade features with accessibility, making it ideal for small-to-medium-sized businesses (SMBs).

- Customizable Dashboards: Design a workspace tailored to your financial needs, allowing you to track income, spending, and savings goals with real-time visuals.

- Seamless Bank Integration: Connect with over 120 financial institutions, including traditional and neobanks, through secure and compliant Open Banking technology.

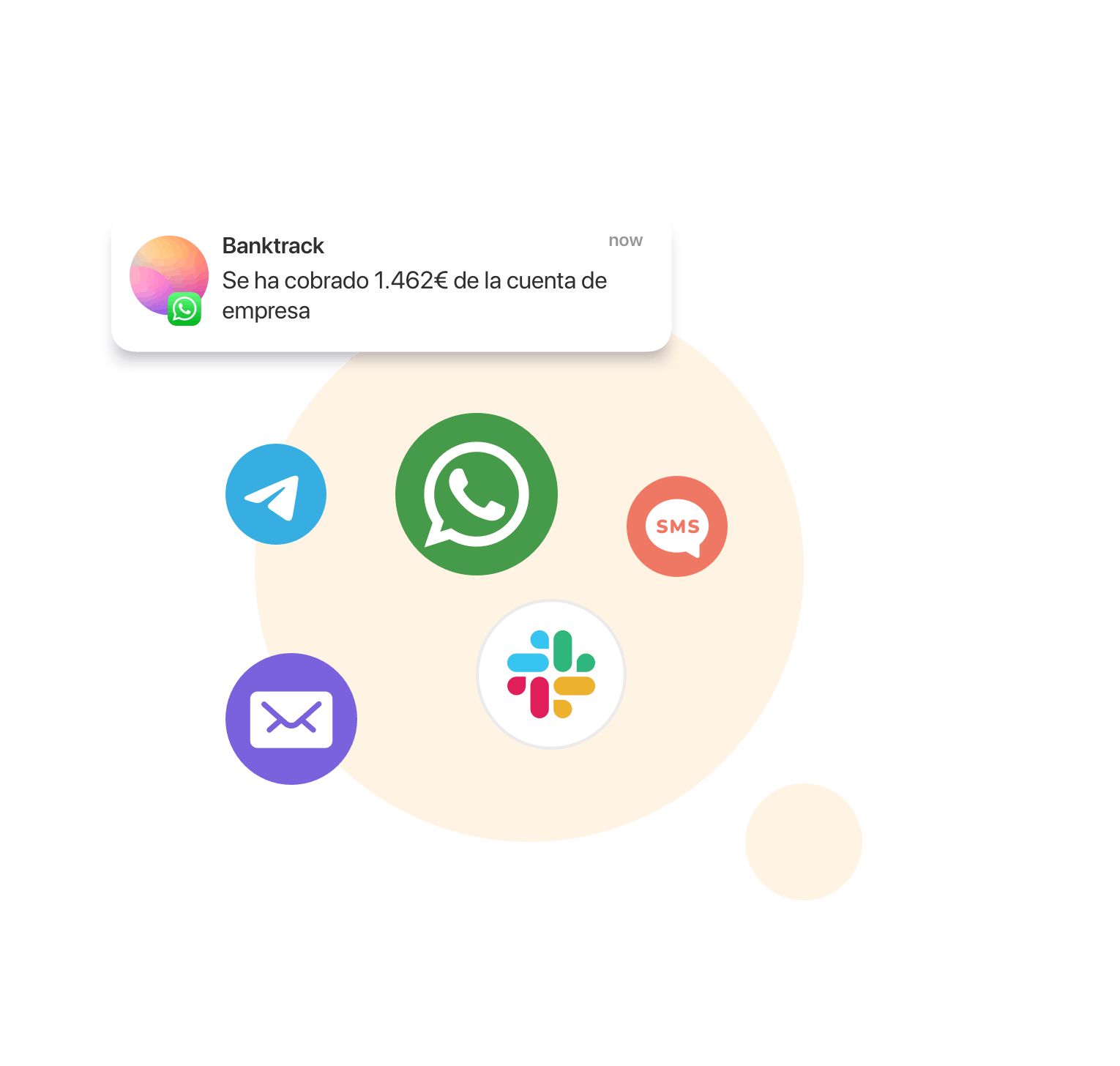

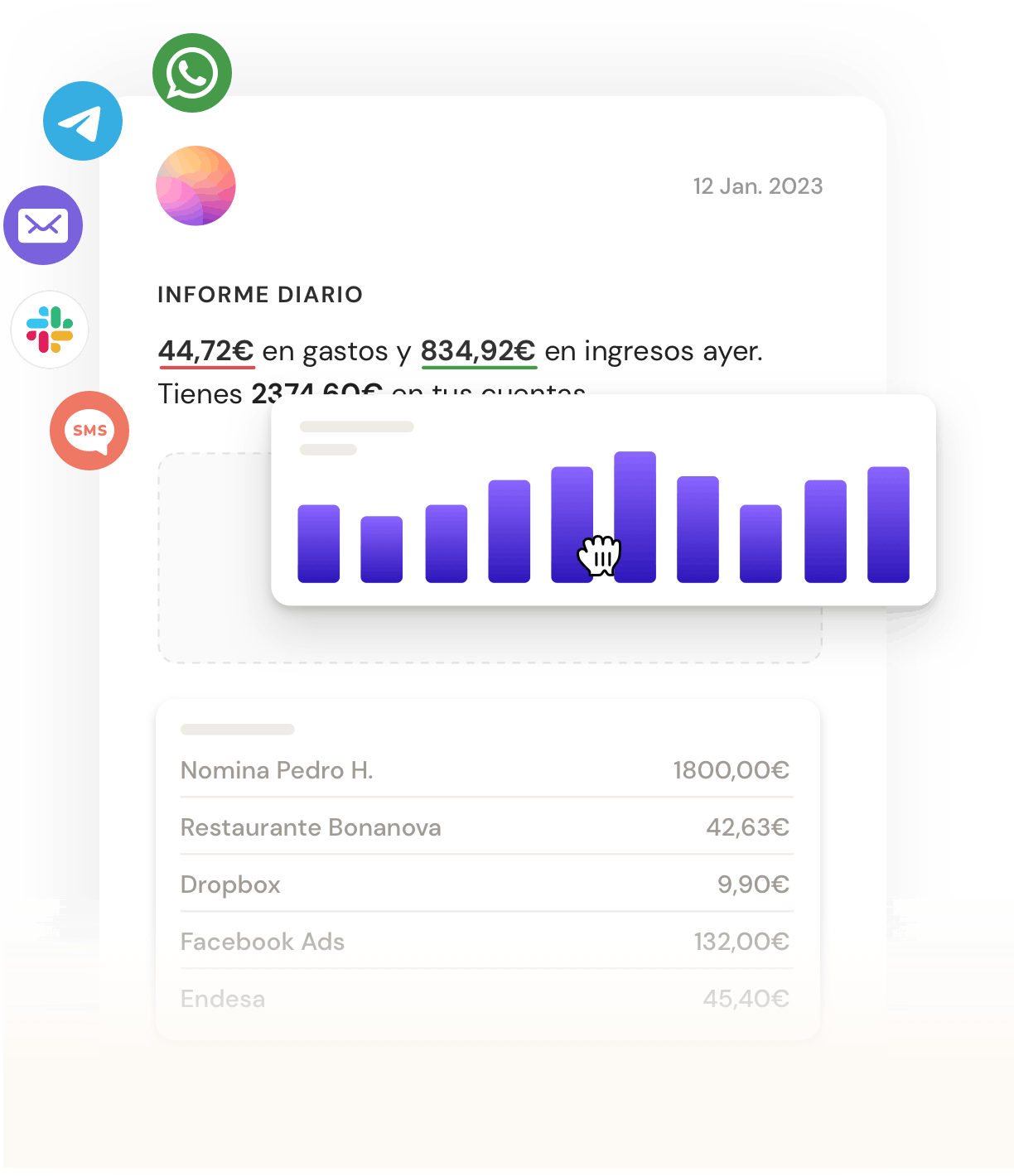

- Real-Time Notifications: Stay informed with alerts for low balances, duplicate charges, and upcoming bills across your preferred channels like WhatsApp, Slack, Telegram, or email.

- Custom Spending Limits: Set specific budgets for categories like dining, groceries, or entertainment, with instant alerts when you’re close to overspending.

- Drag-and-Drop Reporting: Build detailed financial reports effortlessly using a simple interface that visualizes trends and helps you collaborate with others.

- Advanced Security Standards: Banktrack uses end-to-end encryption, multi-factor authentication, and GDPR compliance to protect your sensitive financial data.

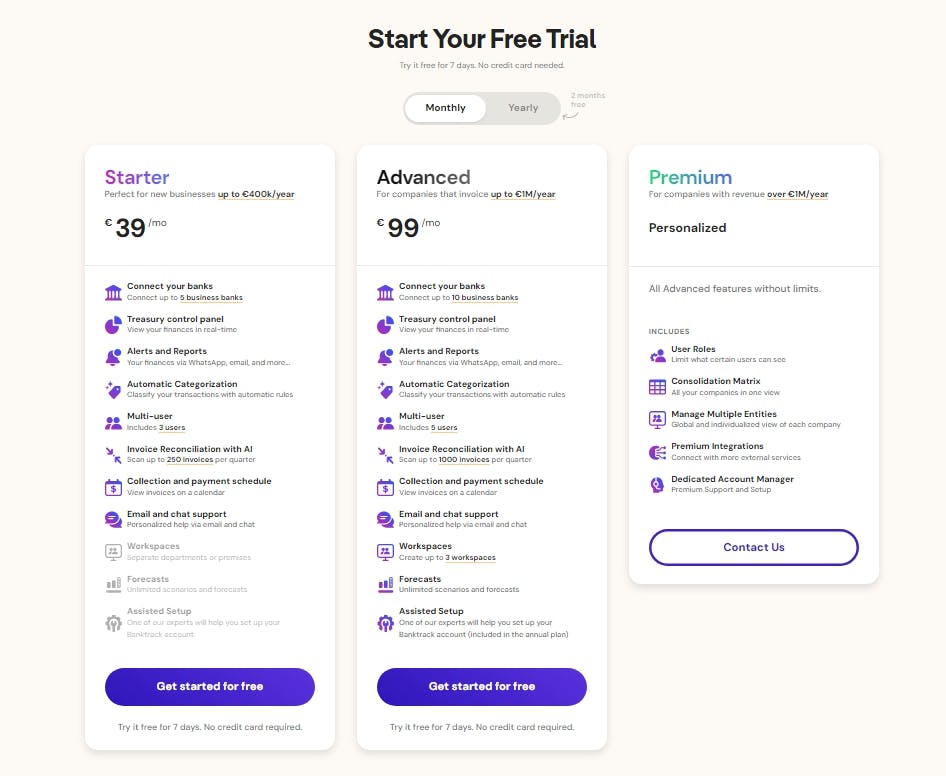

Affordable Pricing: Starting at just €16.58 per month, Banktrack offers high-value features at a fraction of the cost of enterprise solutions like Agicap, making it accessible for freelancers and small businesses alike.

2. Neon

Neon is a bank tracker and digital bank built specifically for Swiss residents. It integrates with local banks and focuses on providing a straightforward financial experience.

With Neon, users can track their spending in CHF and set budgets for specific categories.

What makes Neon stand out is its fee transparency. It allows free cash withdrawals abroad (up to a limit) and provides detailed breakdowns of any transaction fees.

For those who value a clean, efficient platform tailored to Swiss banking needs, Neon is an excellent choice.

Main features:

- Swiss-Based: Tailored for the Swiss market.

- No Hidden Fees: Transparent pricing.

- User-Friendly Interface: Clean design that's easy to navigate.

- Free Withdrawals: Up to a certain limit, even abroad.

- Budgeting Tools: Set and track financial goals.

- Secure Login: State-of-the-art encryption.

3. Revolut

Revolut is a powerhouse for anyone dealing with multi-currency transactions. Its multi-currency wallets allow users to hold and exchange over 30 currencies, including CHF, Euros, and USD, making it ideal for travelers, expatriates, or anyone with international financial commitments.

Revolut’s best feature is its ability to provide live exchange rates, ensuring that users get the best possible value when converting money.

In addition, Revolut categorizes spending into clear, intuitive graphs and offers tools like “Vault Savings,” which automatically rounds up purchases to save the spare change.

Whether you’re managing daily expenses or planning a big trip, Revolut brings simplicity and efficiency to your financial life.

Main features:

- Multi-Currency Accounts: Hold and exchange 30+ currencies.

- Crypto-Friendly: Buy and sell cryptocurrencies within the app.

- Perks and Rewards: Cashbacks, discounts, and more.

- Instant Transfers: Send money globally at lightning speed.

- Spending Analytics: Visualize your spending patterns.

- Vault Savings: Round up transactions to save spare change.

4. Yapeal

Yapeal is a Swiss digital banking platform designed with user feedback at its core.

Unlike traditional banks, Yapeal doesn’t rely on branches or paper-based processes; it’s entirely digital. One of its key features is real-time notifications, ensuring users are instantly updated about their transactions.

For families, Yapeal is considered one of the best household expense manager apps as it offers shared accounts that simplify managing household finances. It also integrates AI-driven insights to help users optimize their spending habits.

By combining innovation with compliance under Swiss banking regulations, Yapeal delivers a forward-thinking financial management solution that feels personal and adaptable.

Main features:

- Community-Driven: Features developed based on user feedback.

- Fully Digital: No paperwork, no hassle.

- Regulated: Swiss banking license ensures compliance and security.

- Real-Time Notifications: Stay updated instantly.

- Family Accounts: Manage finances for the whole family.

- AI Insights: Smart algorithms to optimize your spending.

5. Inyova

Inyova is unique in combining financial tracking with ethical investing. Users can monitor their daily cash with this expense tracking app while aligning their investment portfolio with sustainable and socially responsible goals.

For instance, Yova offers insights into how your financial choices impact environmental and societal causes.

Whether it’s tracking spending or managing a sustainable investment portfolio, Yova offers a holistic approach to financial management that resonates with socially conscious users.

Main features:

- Sustainability Focused: Invests in ethical and environmentally conscious projects.

- Fully Digital: Paper-free platform for modern financial management.

- Regulated: Swiss banking license ensures compliance and security.

- Real-Time Updates: Instantly track your spending and investments.

- Ethical Investment Options: Choose sustainable portfolios aligned with your values.

- AI Insights: Smart algorithms analyze spending and optimize financial planning.

Why Switzerland's Banking System is Both a Blessing and a Curse

Switzerland's banking reputation is simply legendary.

The country houses over 250 banks, ranging from global giants like UBS and Credit Suisse to local cantonal banks. This abundance offers incredible opportunities but also layers of complexity.

The Blessing:

- Financial Stability: Swiss banks are among the most secure in the world.

- Diverse Services: From basic savings accounts to sophisticated investment portfolios.

- Privacy Laws: Strict confidentiality attracts global clientele.

The Curse:

- Complex Navigation: So many options can lead to decision paralysis.

- Hidden Fees: Currency conversions and international transactions can be costly.

- Regulatory Maze: Compliance with Swiss laws requires meticulous attention.

Security First: How Safe Are Bank Trackers?

Understandably, security is a top concern when it comes to your hard-earned money.

Most bank trackers use bank-grade encryption to secure user data.

Features like two-factor authentication add an extra layer of security, ensuring that even if someone gains access to your device, your accounts remain protected.

Moreover, compliance with Swiss data privacy laws and GDPR regulations ensures that financial information is handled with care. Trusted bank trackers operate under strict guidelines, giving users peace of mind as they manage their finances digitally.

Encryption Standards

Reputable bank trackers use bank-level encryption (256-bit SSL) to protect your data.

Regulatory Compliance

- FINMA Regulation: Many are regulated by the Swiss Financial Market Supervisory Authority.

- Data Privacy Laws: Compliance with Swiss and EU GDPR standards.

User Controls

- Two-Factor Authentication: Adds an extra layer of security.

- Customizable Permissions: You decide what the app can access.

How to Maximize Your Bank Tracker in 3 Steps

1. Set Up Customized Alerts

- Budget Overruns: Get notified before you overspend.

- Large Transactions: Immediate alerts for high-value transactions protect against fraud.

- Bill Reminders: Never miss a payment deadline.

2. Regularly Review Your Dashboard

Spend a few minutes each week to:

- Assess Spending Habits: Identify areas to cut back.

- Adjust Budgets: Life changes; so should your financial plans.

- Celebrate Milestones: Recognize when you hit savings goals.

3. Explore Advanced Features

- Investment Tracking: Monitor stocks, bonds, and ETFs.

- Loan Management: Keep tabs on interest rates and repayment schedules.

- Shared Accounts: Manage expenses with family or roommates.

6 Benefits in a Bank Tracker

1. All Accounts, One Dashboard

No more juggling multiple apps or logging into various websites. Bank trackers aggregate:

- Checking and Savings Accounts

- Credit Cards

- Investment Portfolios

- Loans and Mortgages

Imagine seeing your entire financial landscape at a glance!

2. Real-Time Currency Conversion

Switzerland's proximity to the Eurozone means frequent dealings in multiple currencies. Bank trackers provide:

- Live Exchange Rates

- Automatic Conversion

- Fee Transparency

This feature alone can save you hundreds in hidden fees.

3. Personalized Financial Insights

Ever wondered where all your money goes? Bank trackers analyze your spending habits and provide:

- Customized Reports

- Spending Categories

- Savings Recommendations

It's like having a financial advisor, minus the hefty fees.

4. Budgeting Made Effortless

No more nasty surprises at the end of the month, set financial goals and let the app keep you on track. Features include:

- Monthly Spending Limits

- Goal Tracking (e.g., saving for a vacation)

- Bill Reminders

If you are specially interested in bill management, you can try using a bill management app.

Share this post

Related Posts

The 6 Best Quipu Alternatives in Spain for 2025

The 6 best Quipu alternatives in Spain for 2025 to simplify invoicing, accounting, and financial management for businesses.Best 7 Cash Flow Management Tools in Finland for 2025

These are the best cash flow management tools in Finland: Banktrack Procountor Netvisor Visma eAccounting Fennoa Float QuickBooks Online In Finland’s competitive business environment, from Helsinki’s6 bank tracker apps in Germany in 2025

Looking for reliable bank tracker apps in Germany? Here are six options to help you monitor spending, manage budgets, and stay on top of your finances.

Try it now with your data

- Your free account in 2 minutes

- No credit card needed