Everything About the Activity-Based-Budgeting Method

- What is Activity-Based Budgeting?

- How Does ABB Work?

- 5 Benefits of Using Activity-Based-Budgeting

- 1. More Accurate Cost Tracking

- 2. Better Cost Control

- 3. Improved Resource Allocation

- 4. Informed Decision-Making

- 5. Greater Transparency

- How to Implement Activity-Based Budgeting in 6 Steps

- 1. Set Clear Goals

- 2. List Your Activities

- 3. Identify Cost Drivers

- 4. Allocate Costs

- 5. Develop Your Budget

- 6. Monitor and Adjust

- 4 Common Challenges and How to Overcome Them

- 1. Overcomplicating the Process

- 2. Incorrect Cost Drivers

- 3. Inadequate Monitoring

- 4. Lack of Support

- Why Banktrack is the Best Solution for Corporations in 2024

- 1. Quick Access to Important Financial Data

- 2. Detailed Tracking and Customization

- 3. Personalized Reports and Alerts

- 4. Solid Bank Integration Features

- 5. Flexible Pricing Plans

- Why Choose Banktrack for Financial Management

Here is everything you need to know about the Activity-Based-Budgeting method.

Managing a budget can be challenging, but using the right methods can make it much easier.

One such method is Activity-Based Budgeting (ABB). ABB helps organizations understand their costs better and allocate resources more effectively.

This guide will explain what ABB is, why it’s useful, and how you can implement it in a straightforward way.

What is Activity-Based Budgeting?

Activity-Based Budgeting (ABB) is a method for managing your budget by focusing on the activities that cause costs in your organization.

Instead of just looking at overall spending or using last year’s budget as a guide, ABB breaks down costs by each activity or process.

This way, you can see exactly how much each activity costs and make more informed decisions about your budget.

How Does ABB Work?

- Identify Activities: List out all the activities your organization does. This could be anything from manufacturing products to handling customer service.

- Find Cost Drivers: Determine what drives the costs for each activity. For example, the number of items produced might drive the cost of manufacturing.

- Allocate Costs: Assign costs to each activity based on how much they use resources. This helps in understanding the true cost of each activity.

- Create a Budget: Use the cost information from ABB to build a more accurate budget. This budget reflects the actual costs of activities.

- Monitor and Adjust: Regularly compare your actual spending to your budget. Make adjustments as needed to stay on track.

5 Benefits of Using Activity-Based-Budgeting

So why use Activity-Based Budgeting? Activity-Based Budgeting offers several benefits that can help your organization manage finances more effectively:

1. More Accurate Cost Tracking

ABB provides a clearer picture of where your money is going. By focusing on specific activities, you can see exactly how much each activity costs.

This helps in creating a budget that reflects reality, rather than relying on broad estimates.

2. Better Cost Control

When you know the costs associated with each activity, you can spot areas where you might be overspending.

An expense tracking app allows you to make changes to reduce unnecessary expenses and manage your budget more effectively.

3. Improved Resource Allocation

ABB helps ensure that resources are used where they are most needed.

By understanding the true cost of activities, you can allocate resources more efficiently, making sure they contribute to the most valuable activities.

4. Informed Decision-Making

With detailed cost information, you can make better decisions about pricing, investments, and other financial matters.

Knowing the cost of each activity helps you make more informed choices that can improve your overall financial performance.

5. Greater Transparency

ABB makes it easier to see how costs are incurred. This transparency can improve accountability and help you understand where every dollar is spent.

How to Implement Activity-Based Budgeting in 6 Steps

Implementing ABB might seem like a lot of work, but it can be broken down into manageable steps. Here’s a simple guide to help you get started:

1. Set Clear Goals

Before you begin, decide what you want to achieve with ABB.

Are you looking to control costs better or make more informed decisions? Having clear goals will help guide your implementation process.

2. List Your Activities

Identify and list all the key activities in your organization.

This could involve talking to different departments to understand what they do and how they spend resources.

3. Identify Cost Drivers

Determine what factors cause costs for each activity.

This might involve reviewing past data and consulting with team members to figure out what drives costs.

4. Allocate Costs

Assign costs to each activity based on the identified cost drivers.

This might involve using software or tools to help track and manage these costs.

5. Develop Your Budget

Create a budget using the activity-based cost information.

Make sure it reflects your goals and provides a clear view of your financial situation.

6. Monitor and Adjust

Regularly review your performance against the budget.

If you find discrepancies or changes in activities, adjust your budget accordingly to stay on track.

4 Common Challenges and How to Overcome Them

Even with the best plans, there can be challenges when implementing ABB.

Here are some common issues and tips on how to address them:

1. Overcomplicating the Process

It’s easy to make things more complicated than they need to be. Keep your approach simple and focus on the most important activities and cost drivers.

2. Incorrect Cost Drivers

If you don’t identify cost drivers accurately, your cost information may not be reliable. Take the time to analyze and understand what drives costs for each activity.

3. Inadequate Monitoring

If you don’t regularly check your performance against the budget, you might miss important changes. Set up regular reviews to ensure you stay on track.

4. Lack of Support

If key people in your organization don’t support ABB, it can be challenging to implement it effectively. Communicate the benefits clearly and involve important stakeholders in the process.

Why Banktrack is the Best Solution for Corporations in 2024

In 2024, Banktrack stands out as the top choice for corporations looking to streamline their financial management.

Here's why Banktrack is the best solution for managing your finances this year:

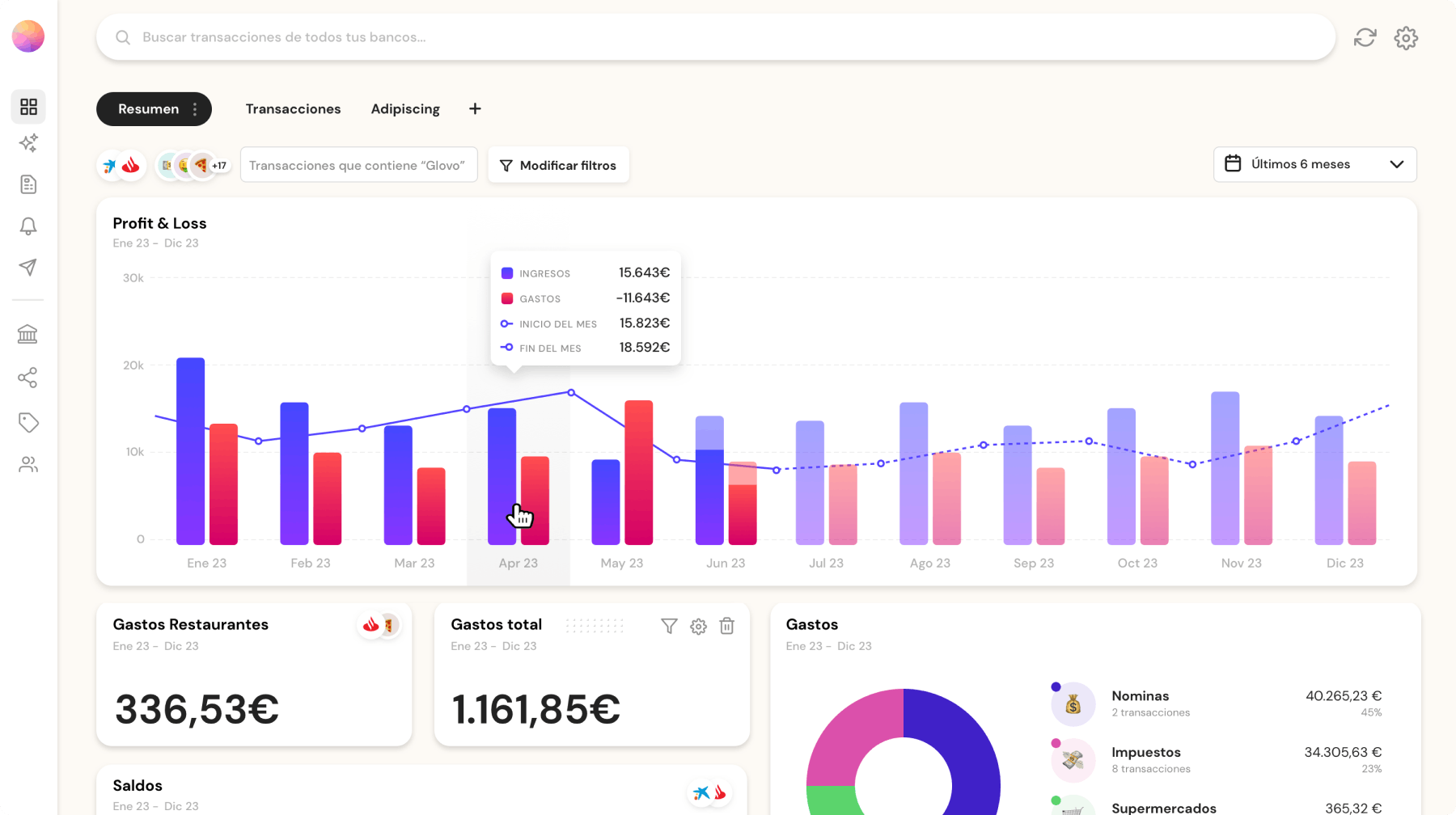

1. Quick Access to Important Financial Data

Banktrack offers users immediate access to essential financial information through its highly configurable dashboards.

These dashboards can combine views from various bank accounts, businesses, and financial products into one place.

This means you can easily see an overview of your financial status without jumping between different platforms.

2. Detailed Tracking and Customization

The app allows users to create and customize categories for revenues and expenses. This feature is very valuable for corporations that need to track and understand their financial activities in detail.

Whether you're managing multiple departments or complex financial transactions, Banktrack helps you keep everything organized and transparent.

3. Personalized Reports and Alerts

Banktrack keeps you informed with personalized reports and financial alerts. You can receive updates about your expenses and financial activities through your preferred channels, including WhatsApp, SMS, email, Slack, or Telegram.

This ensures you’re always up-to-date with your financial situation and can quickly respond to any issues.

4. Solid Bank Integration Features

One of Banktrack's standout features is its ability to link with over 120 banks. The app’s bank sync feature and aggregator supports both Open Banking (PSD2) and Direct Access connections.

This means you can securely and efficiently sync financial data from various sources, making it easier to manage and consolidate your financial information.

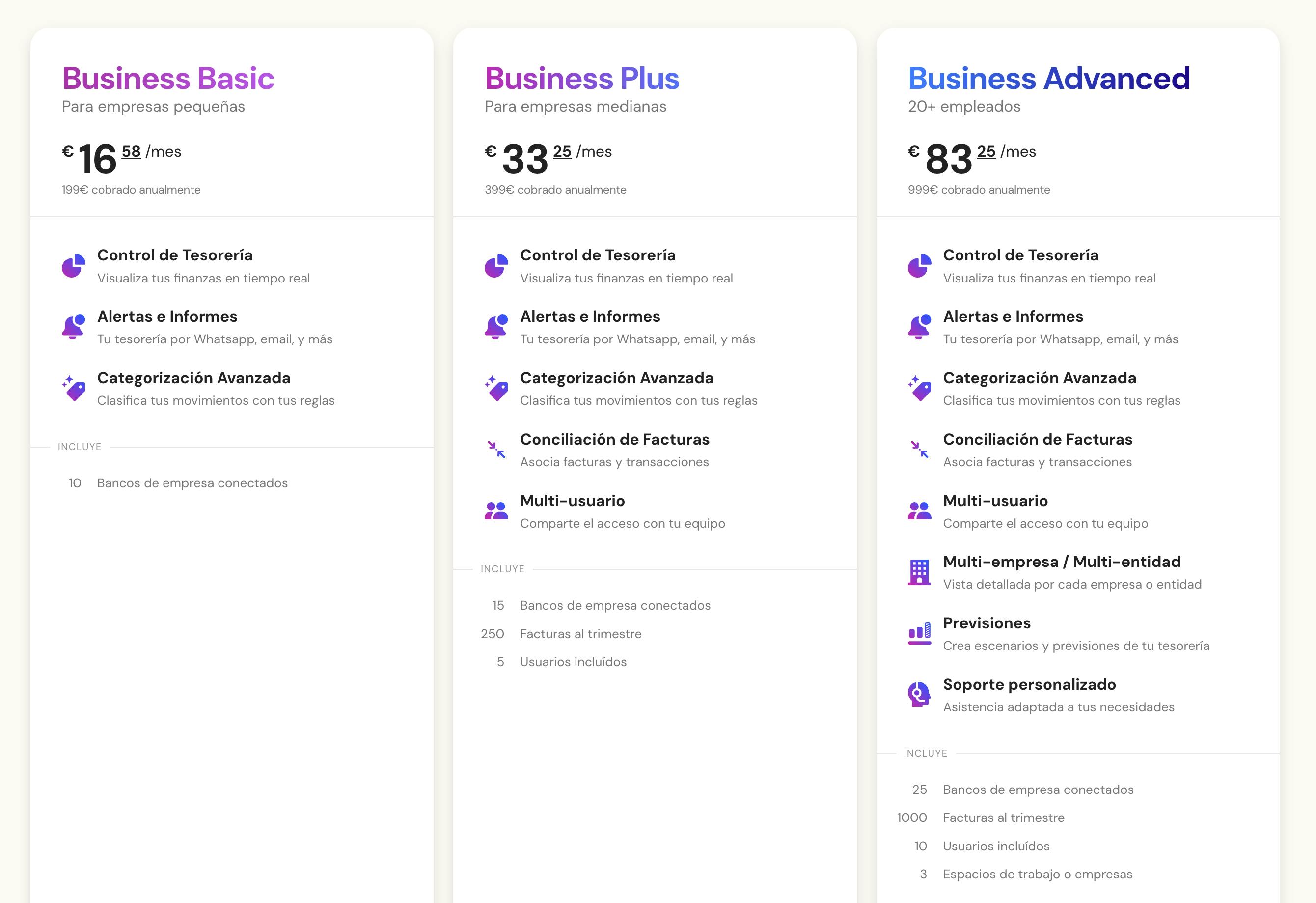

5. Flexible Pricing Plans

Banktrack offers a range of competitively priced plans to suit different needs and budgets.

Whether you’re an individual, a small business, or a large enterprise, you’ll find a plan that fits your requirements.

This flexibility ensures that you get the features you need without overspending.

Why Choose Banktrack for Financial Management

Activity-Based Budgeting (ABB) makes managing your money easier by focusing on what really drives your costs. It helps you create a more precise budget, control expenses better, and make smarter decisions.

Though setting it up takes some effort, the payoff is worth it with clearer financial insights and better budgeting.

If you want to get a better handle on your finances and improve your budget, give ABB a shot. It’s a simple way to track costs and allocate resources effectively, helping you reach your financial goals.

For corporations in 2024, Banktrack is a top choice for financial management. It offers quick data access, detailed tracking, customizable alerts, and seamless bank integration, all with flexible pricing to fit your needs.

Share this post

Related Posts

Best 7 Cash Flow Forecasting Softwares for Startup Businesses

Explore the best cash-flow forecasting software for startups, with tools that simplify budgeting, projections, and financial planning to keep your business healthy and scalable.Best 7 bank trackers in the Netherlands

This guide lists the top 7 tools to help you track expenses, monitor accounts, and improve your financial management. Find the perfect tracker to stay on top of your moneyBest 5 alternatives to Embat

Looking for alternatives to Embat? This guide highlights the top 5 project management and collaboration tools that offer great features to enhance team productivity

Try it now with your data

- Your free account in 2 minutes

- No credit card needed