Best 7 bank trackers in the Netherlands

- Top 7 Bank Trackers in the Netherlands

- 1. Banktrack

- Who Should Try Banktrack?

- 2. ABN AMRO Grip

- 3. Rabobank Personal Finance Management (PFM)

- 4. YNAB (You Need A Budget)

- 5. Money Lover

- 6. Revolut

- 7. ING Banking App

- Why Do Bank Trackers Matter?

- 4 Tips for Choosing the Best Bank Tracker

- 7 Benefits of Using Bank Trackers in the Netherlands

- 1. Streamlining Multi-Bank Accounts

- 2. Tracking Expenses Across Different Currencies

- 3. Offering Localized Insights

- 4. Making Financial Management Accessible for Expats

- 5. Enhanced Budgeting and Saving Tools

- 6. Proactive Financial Alerts

- 7. Catering to a Cashless Economy

- Why Banktrack Stands Out Against Competitors

These are the best bank trackers in the Netherlands:

- Banktrack

- ABN AMRO Grip

- Rabobank

- YNAB

- Money Lover

- Revolut

- ING Banking App

Managing money isn’t always fun, but it doesn’t have to be a headache either.

Whether you're trying to save for your next adventure, track your spending habits, or just avoid those end-of-month surprises, having the right bank tracker can make all the difference.

In the Netherlands, where juggling multiple banks and cross-border payments is common, these tools are more than just convenient, they’re game-changers.

From tracking your daily coffee splurge to planning long-term savings goals, a good bank tracker puts you in the driver’s seat of your financial life.

Ready to find out which bank trackers are worth your time? Let’s dive into the best options and how they can help you crush your money goals.

Top 7 Bank Trackers in the Netherlands

1. Banktrack

Banktrack is more than just a financial tool, it's an all-in-one cash management software designed to simplify cash flow management and financial forecasting for both individuals and small-to-medium-sized businesses (SMBs).

With an impressive suite of features, it bridges the gap between professional-grade tools and accessibility, ensuring users of all levels can take control of their finances effectively.

Here’s a deeper dive into what makes Banktrack a top-tier choice in the market:

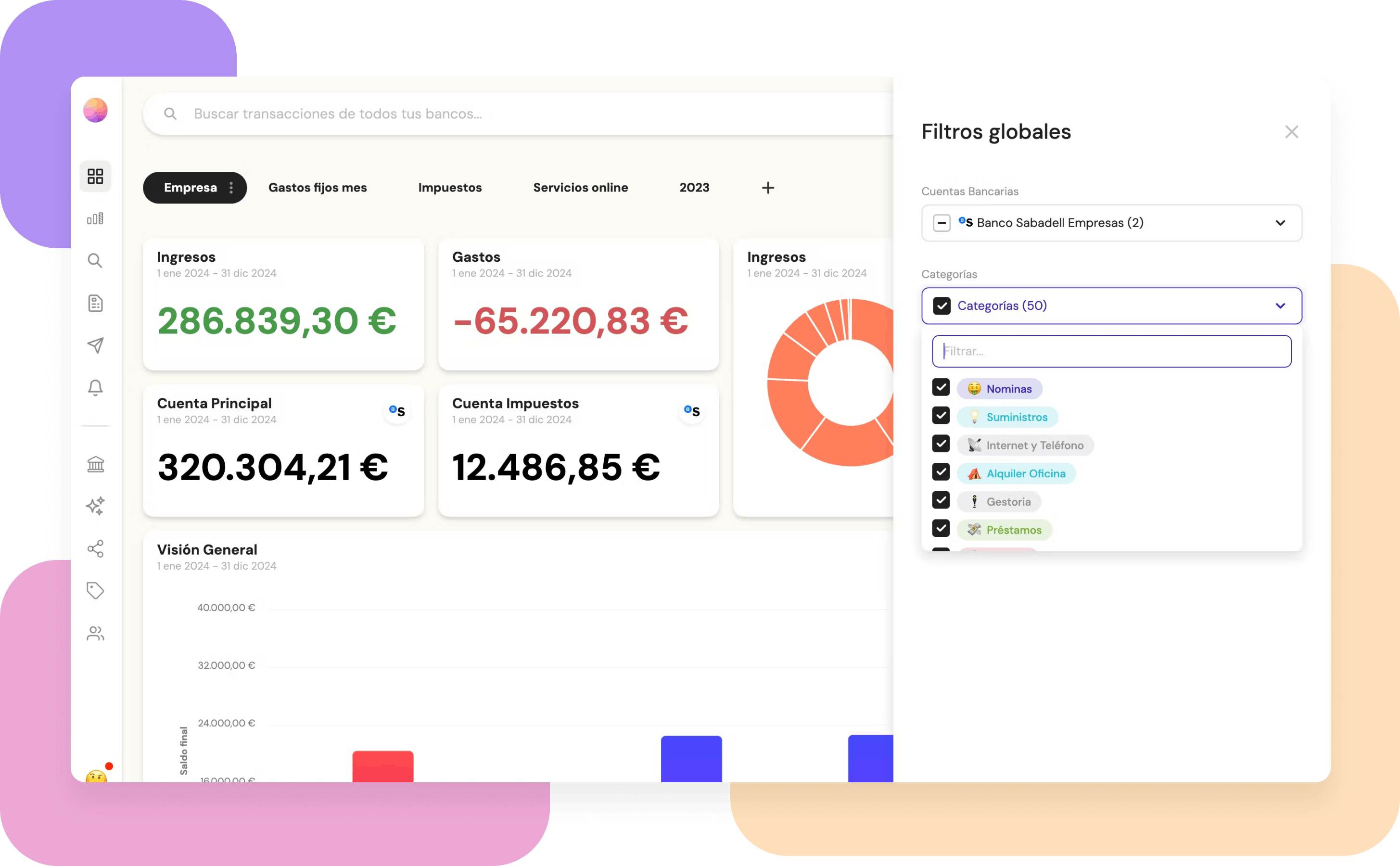

Customizable Dashboards

Banktrack’s highly flexible dashboards let you design a financial workspace that reflects your needs.

Want to track multiple income streams, monitor specific spending categories, or visualize progress toward savings goals? With Banktrack, you can:

- Create a personalized layout to focus on what matters most.

- Visualize your financial health in real time, helping you make informed decisions quickly.

- Drag and drop widgets to reorganize your dashboard as priorities change.

This level of customization makes it easy to stay organized and ensure no detail goes unnoticed.

Seamless Integration with Over 120 Banks

One of Banktrack's best features is its ability to connect perfectly with a wide range of financial institutions, including both traditional banks and digital neobanks.

Thanks to its advanced integrations:

- Link all your accounts: checking, savings, credit cards, and even investment portfolios, into a unified view.

- Save time by managing everything in one platform, eliminating the need to juggle multiple apps or websites.

- Leverage Open Banking technology, ensuring secure and compliant connections with your banks.

Whether you bank locally in the Netherlands or have international accounts, Banktrack brings everything together effortlessly.

Customizable Spending Limits and Overspending Alerts

Banktrack empowers users to take control of their spending by enabling custom spending limits. Here’s how it works:

- Set category-specific limits: Control how much you allocate for dining out, groceries, travel, or entertainment.

- Receive instant alerts: Get notified when you’re approaching or exceeding your set limits.

- Adjust limits on the go: Flexibility is key, and Banktrack allows you to modify limits as needed to accommodate changes in your budget.

This feature ensures you can curb impulsive spending and stick to your financial plans.

Real-Time Alerts and Notifications Across Channels

Staying informed is essential, and Banktrack excels with its real-time alert system.

- Low-balance warnings: Prevent overdrafts by receiving alerts before your account hits critical levels.

- Duplicate charge notifications: Quickly identify and address potential billing errors.

- Bill reminders: Stay ahead of upcoming payments to avoid late fees.

With alerts available via WhatsApp, Slack, Telegram, SMS, or email, Banktrack ensures you’re informed no matter where you are or what communication platform you prefer.

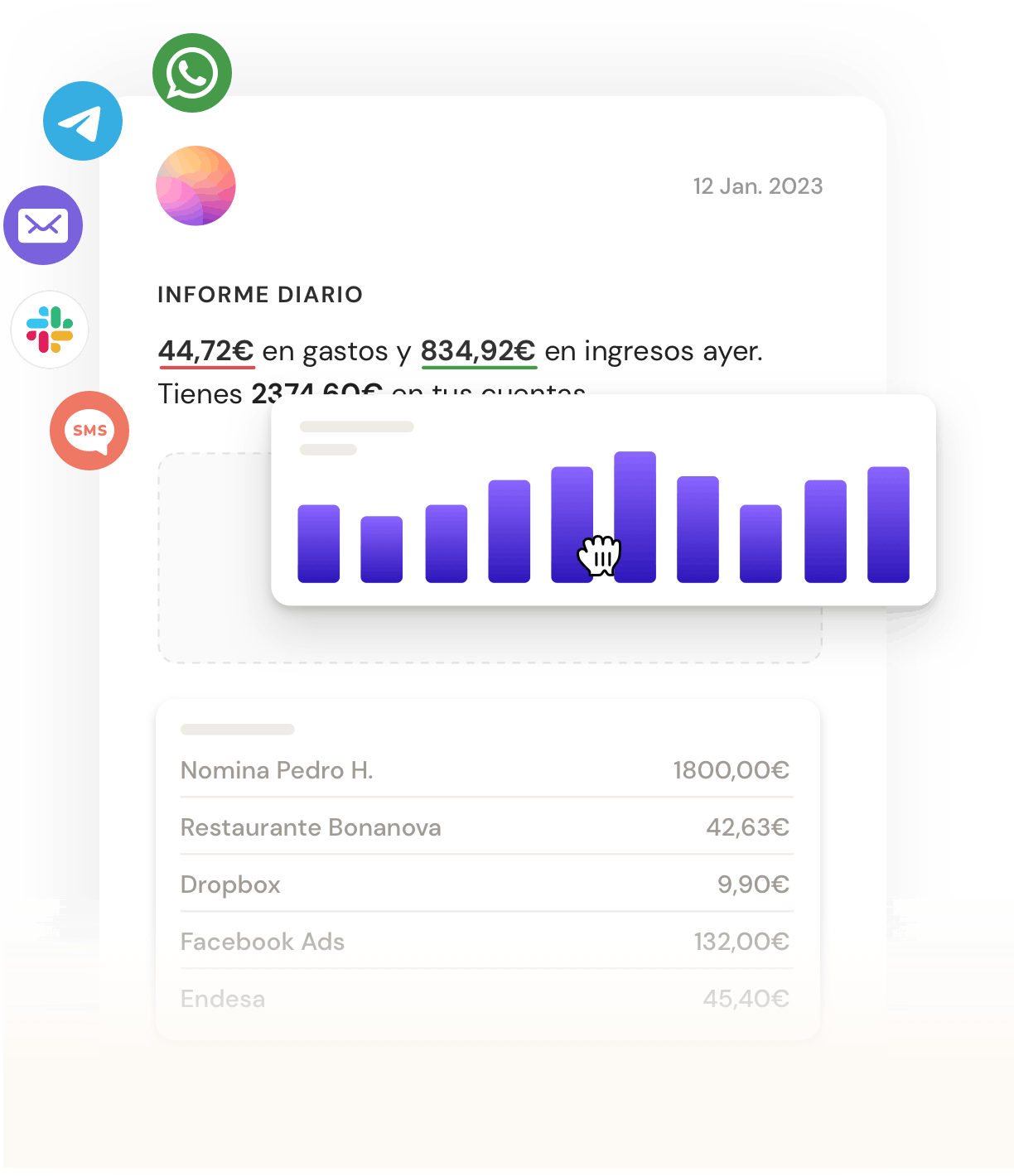

Drag-and-Drop Reporting: Effortless Insights

Creating professional, detailed financial reports is often a tedious task, but not with Banktrack. Its drag-and-drop interface makes reporting intuitive and highly efficient:

- Build custom reports: Analyze expenses, income trends, or savings goals with ease.

- Collaborate effortlessly: Share reports with family, business partners, or advisors in just a few clicks.

- Visualize your data: Use graphs and charts to get a clear understanding of your financial patterns.

This feature is especially valuable for small businesses that require detailed cash flow or expense reporting without investing in complex enterprise tools.

Advanced Security Standards

Your financial data is sensitive, and Banktrack takes security seriously. It adheres to strict privacy and compliance protocols, including:

- End-to-end encryption: Protecting data during storage and transmission.

- Secure authentication protocols: Prevent unauthorized access with multi-factor authentication.

- Regulatory compliance: Fully aligned with GDPR and other global security standards.

This ensures your information is safe while you enjoy the platform’s extensive features.

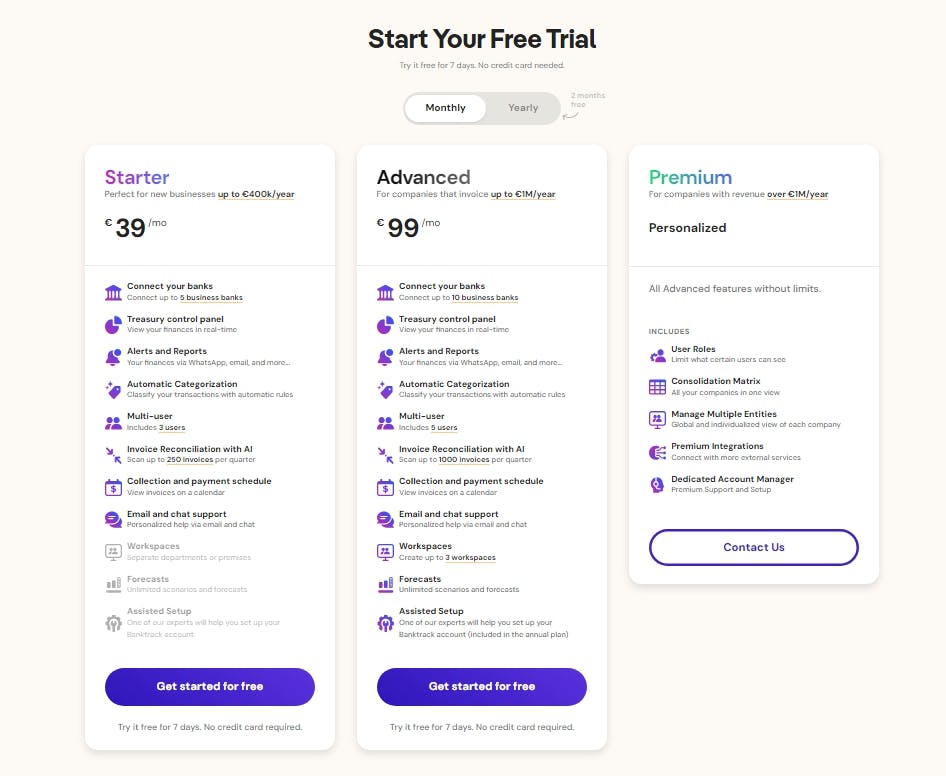

Affordable Pricing for Businesses

One of Banktrack’s biggest advantages is its affordability. It delivers high-value features at a price point that’s accessible for small businesses.

For companies, it’s a cost-effective alternative to larger enterprise solutions, which often cater to larger organizations with much higher fees.

Who Should Try Banktrack?

Banktrack is ideal for:

- Expats: managing accounts across multiple banks or currencies.

- Small business owners: looking for a simple, affordable tool to track expenses and cash flow.

- Individuals: aiming to set realistic financial goals and curb overspending.

- Freelancers and contractors: needing to track income from various sources in a reliable cash management software for freelancers.

2. ABN AMRO Grip

If you’re an ABN AMRO customer, Grip is a perfect choice. This app simplifies financial management with features such as:

- Automated categorization of transactions into predefined budgets.

- Spending alerts to keep you informed of unusual activity.

- Integration with ABN AMRO accounts, ensuring a smooth user experience.

Grip’s ease of use makes it ideal for individuals seeking a hassle-free tool linked directly to their primary bank.

3. Rabobank Personal Finance Management (PFM)

Rabobank’s PFM tool combines innovation and practicality. It’s designed for those who want to go beyond traditional banking. Key features include:

- Detailed spending analysis with graphs and charts.

- Savings goals with real-time progress tracking.

- Multi-bank integration, allowing you to add external accounts.

This tracker is a game-changer for Rabobank users aiming to optimize their financial habits.

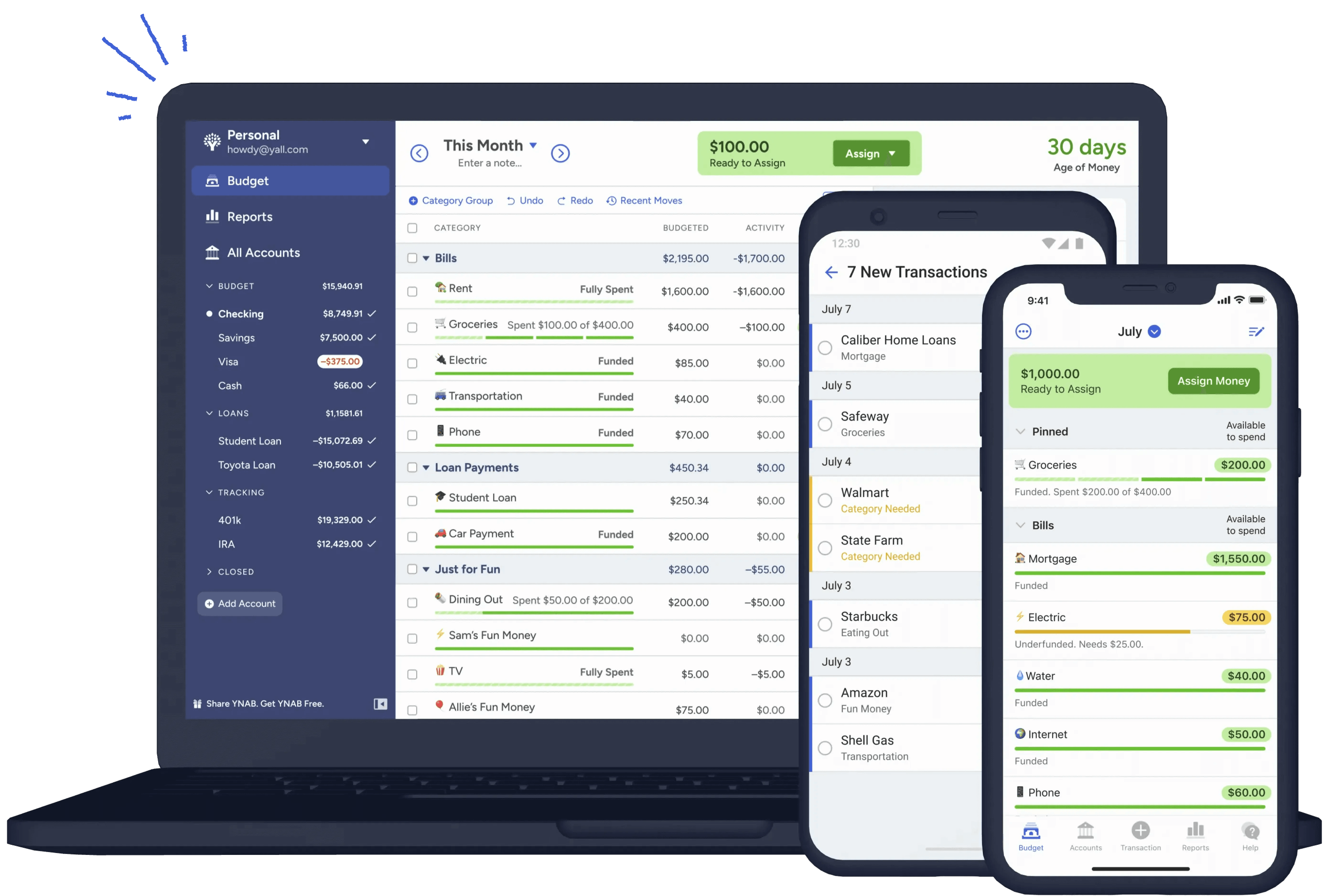

4. YNAB (You Need A Budget)

YNAB is a global favorite and is widely used in the Netherlands. It’s particularly known for:

- Zero-based budgeting: Allocate every euro to a purpose.

- Debt management tools: Track and reduce debt effectively.

- Cross-device syncing, ensuring your data is available anywhere.

While it requires a subscription, YNAB’s advanced tools make it worth the investment for those serious about financial discipline.

5. Money Lover

Money Lover is perfect for individuals managing multiple currencies or accounts across borders. Highlights include:

- Expense tracking with support for different currencies.

- Bill reminders to avoid late fees.

- Savings goal management with visual progress updates.

Its versatility makes it an excellent option for expats or frequent travelers.

6. Revolut

Revolut isn’t just a banking app; it also offers good budgeting and tracking tools. Features include:

- Automatic transaction categorization for budgeting insights.

- Built-in savings accounts for setting aside money effortlessly.

- Currency exchange tracking, ideal for international use.

As a popular app in the Netherlands, Revolut’s free and premium versions cater to a wide range of users.

7. ING Banking App

For ING customers, the built-in budgeting and financial insights within the ING app are top-notch. Features include:

- Spending breakdowns for specific time periods.

- Customizable alerts to stay on top of your finances.

- Easy integration with ING’s savings and investment accounts.

This tracker is an excellent option for ING account holders looking for a streamlined solution.

Why Do Bank Trackers Matter?

Managing money effectively is no longer just about checking your bank balance every now and then. Bank trackers provide valuable insights into your financial health, helping you:

- Track expenses: See where your money goes and make informed decisions about your spending.

- Simplify budgeting: Automate the categorization of transactions to create and stick to a budget.

- Manage multiple accounts: Keep all your financial data in one place, even if you have accounts with different banks.

- Plan for the future: Use insights from trackers to set savings goals and track investments.

- Stay alert: Receive notifications for upcoming bills, low balances, or unusual spending.

For residents of the Netherlands, where many juggle multiple accounts or even cross-border finances, these seven tools are invaluable.

4 Tips for Choosing the Best Bank Tracker

When deciding on a bank tracker, keep these tips in mind:

- Assess your needs: Are you looking for detailed budgeting, savings tools, or cross-border capabilities?

- Try free trials: Many trackers offer free trials so you can test features before committing.

- Read reviews: Check feedback from other users in the Netherlands for real-world insights.

- Prioritize security: Ensure the app has robust encryption and data protection.

7 Benefits of Using Bank Trackers in the Netherlands

The Netherlands, with its blend of diverse banking options, a high number of expats, and an increasingly cashless economy, offers both opportunities and challenges for managing personal finance tracking.

Bank trackers step in as indispensable tools to simplify financial management and address these complexities effectively. But what are exactly its benefits?

1. Streamlining Multi-Bank Accounts

Many people in the Netherlands manage multiple bank accounts, especially if they have a mix of personal and business finances or use different banks for savings and daily transactions.

Bank trackers allow you to:

- Centralize your accounts: View balances and transactions from multiple banks in one dashboard.

- Eliminate repetitive logins: No more toggling between apps to check balances or transfers.

- Spot trends across accounts: Identify where you’re spending the most or where you can save more effectively.

This feature is particularly useful for expats or freelancers who may use international banks alongside Dutch institutions.

2. Tracking Expenses Across Different Currencies

The Netherlands has a significant number of international residents, business travelers, and expats who deal with multiple currencies regularly. Bank trackers simplify this by:

- Automatically converting transactions: Track your spending in euros or any currency of your choice without manual calculations.

- Expense breakdown by currency: See how much you're spending abroad or in foreign currencies for a clear picture of your financial habits.

- Exchange rate insights: Stay updated on currency fluctuations to make informed financial decisions.

Whether you’re paying bills in euros or managing subscriptions in USD, bank trackers make handling different currencies a breeze.

3. Offering Localized Insights

The Dutch financial landscape comes with its own nuances, from payment systems like iDEAL to regional banking regulations. Bank trackers provide:

- Dutch-specific features: Many trackers are tailored to include integrations with local banks like ABN AMRO, Rabobank, and ING.

- iDEAL payment tracking: Easily monitor payments made through the popular Dutch online payment system.

- Tax-ready reports: Simplify tax season with automated categorization of deductible expenses, a feature highly appreciated by entrepreneurs and freelancers.

These localized insights ensure that you’re not just tracking your money but also staying compliant and efficient in your financial management.

4. Making Financial Management Accessible for Expats

With a large expat community in the Netherlands, financial management can become overwhelming. Bank trackers ease the burden by:

- Offering multilingual support: Many tools include Dutch, English, and other language options.

- Adapting to international needs: Features like cross-border transaction tracking and support for global banks make them ideal for expats.

- Helping with integration: Trackers make it simple to combine Dutch accounts with international financial systems.

This accessibility ensures that newcomers to the Netherlands can adapt to the local financial system without stress.

5. Enhanced Budgeting and Saving Tools

In a country where saving for future goals like travel, education, or even a new bike is common, bank trackers excel by:

- Setting personalized goals: Whether it's saving for a summer vacation or a new home, trackers allow you to set achievable financial targets.

- Visualizing your progress: Dynamic graphs and updates show how close you are to reaching your goals.

- Customizable spending categories: Get granular by tailoring categories for groceries, dining out, transportation, and more.

With these tools, you can build smarter spending habits and stay motivated to achieve your financial dreams.

6. Proactive Financial Alerts

Bank trackers go beyond passive tracking by keeping you informed in real-time. They provide:

- Low-balance warnings: Avoid overdraft fees by staying on top of your account balance.

- Bill reminders: Never miss a due date, whether it’s for rent, utilities, or subscriptions.

- Unusual activity alerts: Get notified if a transaction looks suspicious, adding an extra layer of security.

These alerts help you maintain control over your finances while avoiding common pitfalls.

7. Catering to a Cashless Economy

The Netherlands is known for its rapid transition to a cashless society, with most payments happening digitally. Bank trackers:

- Track card payments effortlessly: Monitor spending via debit and credit cards without manual inputs.

- Support for digital wallets: Sync your transactions from platforms like Apple Pay or Google Pay.

- Detailed analytics for contactless payments: Keep tabs on every tap and swipe for a complete financial overview.

In such an environment, bank trackers ensure that you don’t lose track of where your digital money is going.

Why Banktrack Stands Out Against Competitors

Bank trackers are indispensable tools for modern financial management.

Whether you’re focused on budgeting, saving, or simply gaining a better understanding of your spending habits, there’s a tracker for you.

Banktrack’s versatility and affordability make it a top bank tracker in the Netherlands.

With its intuitive design, real-time data integration, and robust reporting capabilities, Banktrack strikes the perfect balance between simplicity and performance.

Whether you’re looking to streamline your business finances or you are a small business owner seeking for a better cash flow management software, Banktrack delivers exceptional value.

Share this post

Related Posts

Best 8 SMS-Based Expense Tracker

An SMS-based expense tracker allows you to track spending effortlessly by logging your expenses via text messages.Best 11 alternatives to Monarch Money

These are the best 11 alternatives to Monarch Money for budgeting and finance tracking in 2024.Top 7 bank trackers in Austria to manage your finances

Explore the top 7 bank tracker apps in Austria for 2024. Easily manage budgets, track expenses, and gain control over your finances with these essential tools.

Try it now with your data

- Your free account in 2 minutes

- No credit card needed