Best 6 Expense Tracker Software with Bank Sync features

- 6 Best Expense Trackers with Bank Sync: Our Top Picks

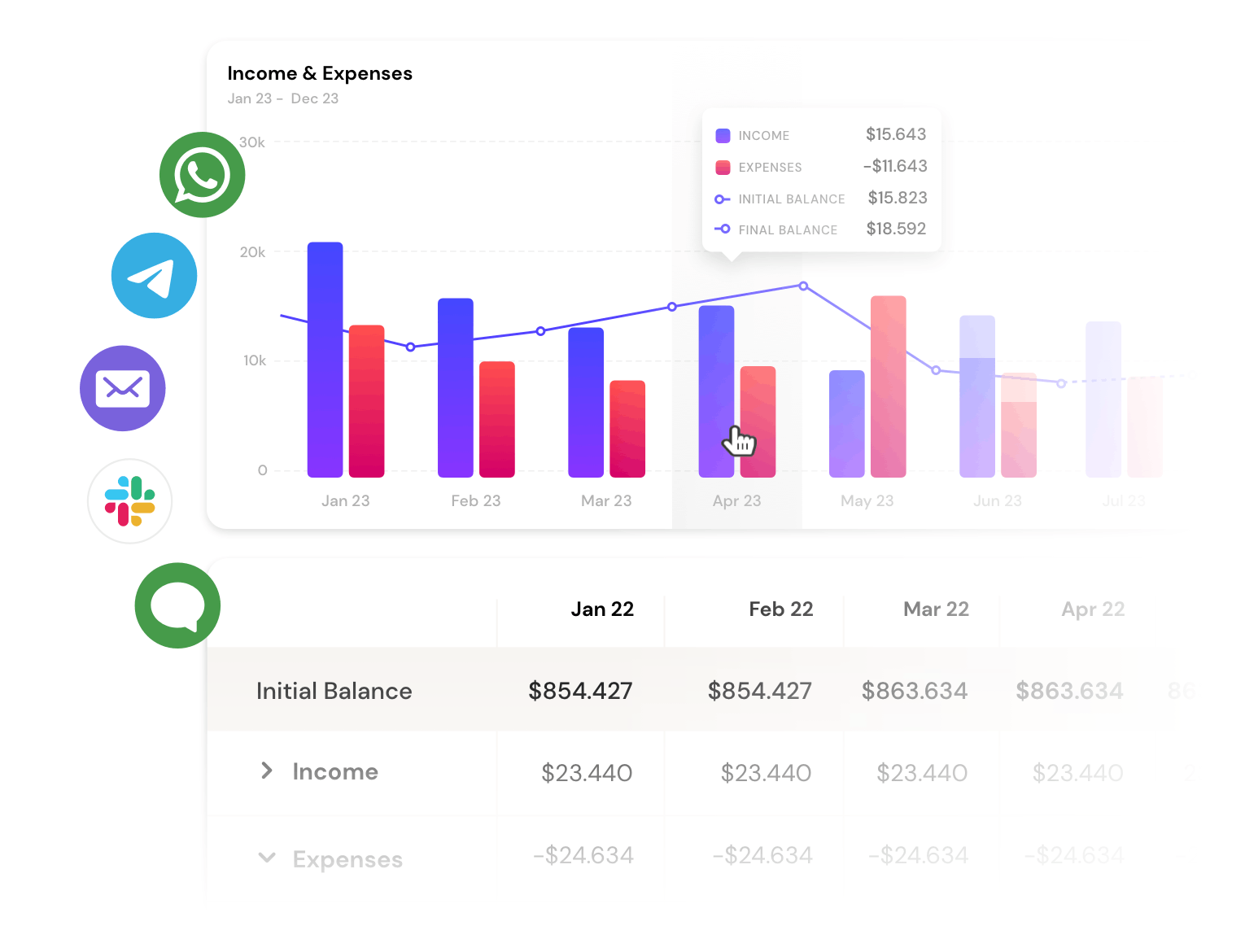

- 1. Banktrack

- 2. Mint

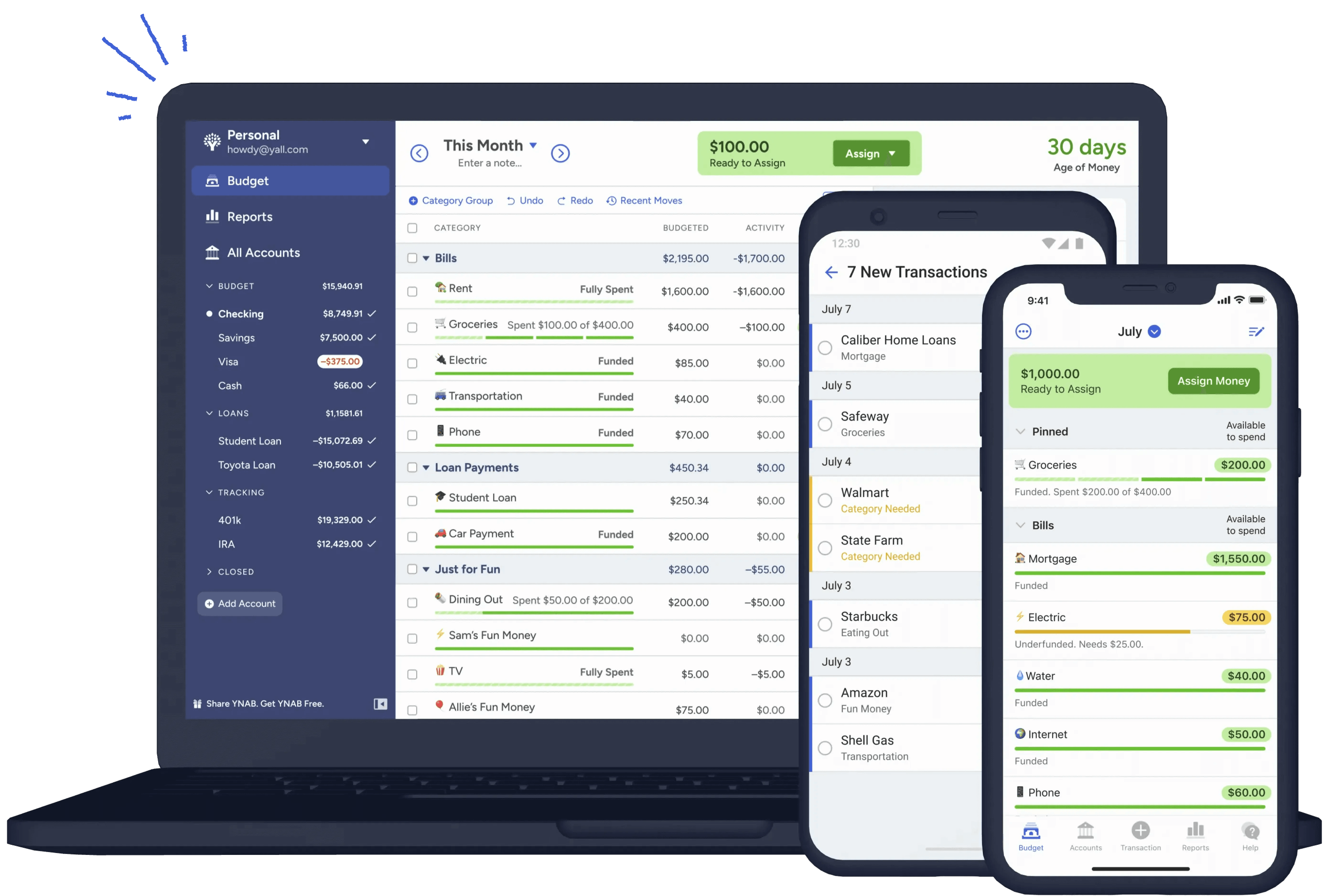

- 3. YNAB (You Need a Budget)

- 4. PocketGuard

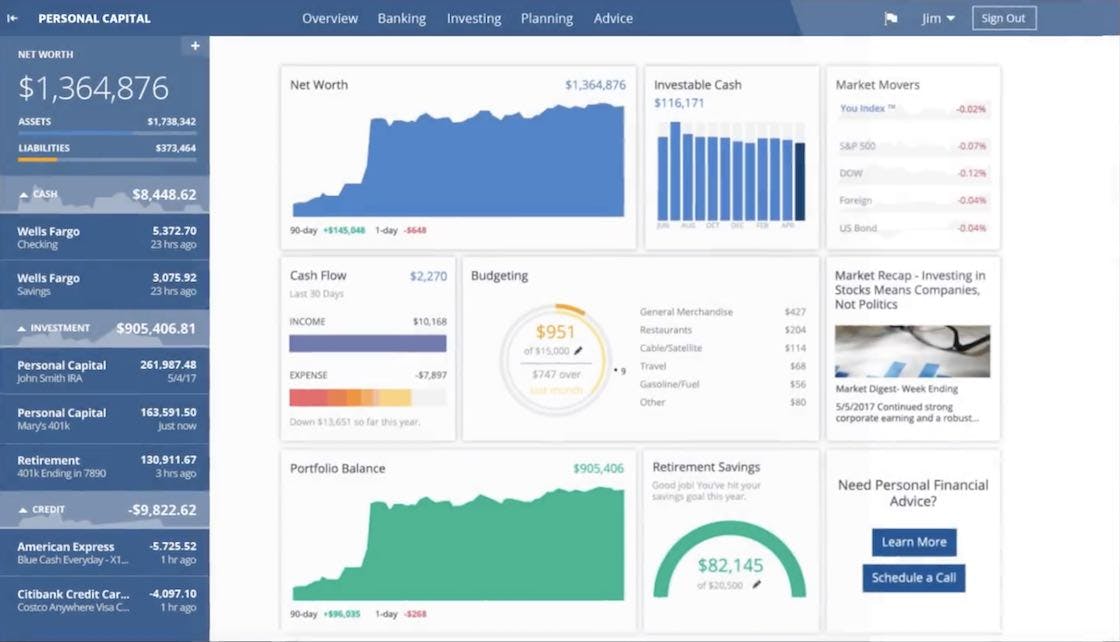

- 5. Personal Capital

- 6. Simplifi by Quicken

- What is an Expense Tracker with Bank Sync?

- 5 Benefits of Using an Expense Tracker with Bank Sync

- 1. Accuracy and Efficiency

- 2. Real-Time Updates

- 3. Comprehensive Financial Overview

- 4. Improved Budgeting

- 5. Enhanced Security

- How Does Bank Sync Work?

- How to Choose the Right Expense Tracker with Bank Sync

- 1. Ease of Use

- 2. Features

- 3. Security

- 4. Compatibility

- 5. Cost

- 5 Tips for Maximizing the Benefits of an Expense Tracker with Bank Sync

- 1. Regularly Review Your Transactions

- 2. Set Financial Goals

- 3. Create and Stick to a Budget

- 4. Take Advantage of Reports and Insights

- 5. Stay Informed

- How can banktrack help you

The best expense tracker softwares with a bank sync feature:

- Banktrack

- Mint

- YNAB

- PocketGuard

- Personal Guard

- Simplifi by Quicken

Managing money isn’t exactly anyone’s idea of fun, but what if I told you it could be a lot less painful?

An expense tracker with a bank sync feature is a tool so handy, you’ll wonder how you ever lived without it. Really.

This guide will walk you through everything you need to know about these financial lifesavers, from what they are, to the best ones out there, and how to make them work for you.

6 Best Expense Trackers with Bank Sync: Our Top Picks

There are plenty of expense trackers out there, but not all are created equal. Here are some of the best:

1. Banktrack

When it comes to managing your finances, you need a tool that not only tracks your expenses but also integrates perfectly with your bank accounts, provides strong security, and offers advanced features to optimize your financial performance. Banktrack is that tool.

Here’s why Banktrack stands out as the best cash management tool:

1. Transaction Tracking

Banktrack excels in transaction tracking, providing real-time monitoring of all financial activities. Here’s how it makes transaction tracking a breeze:

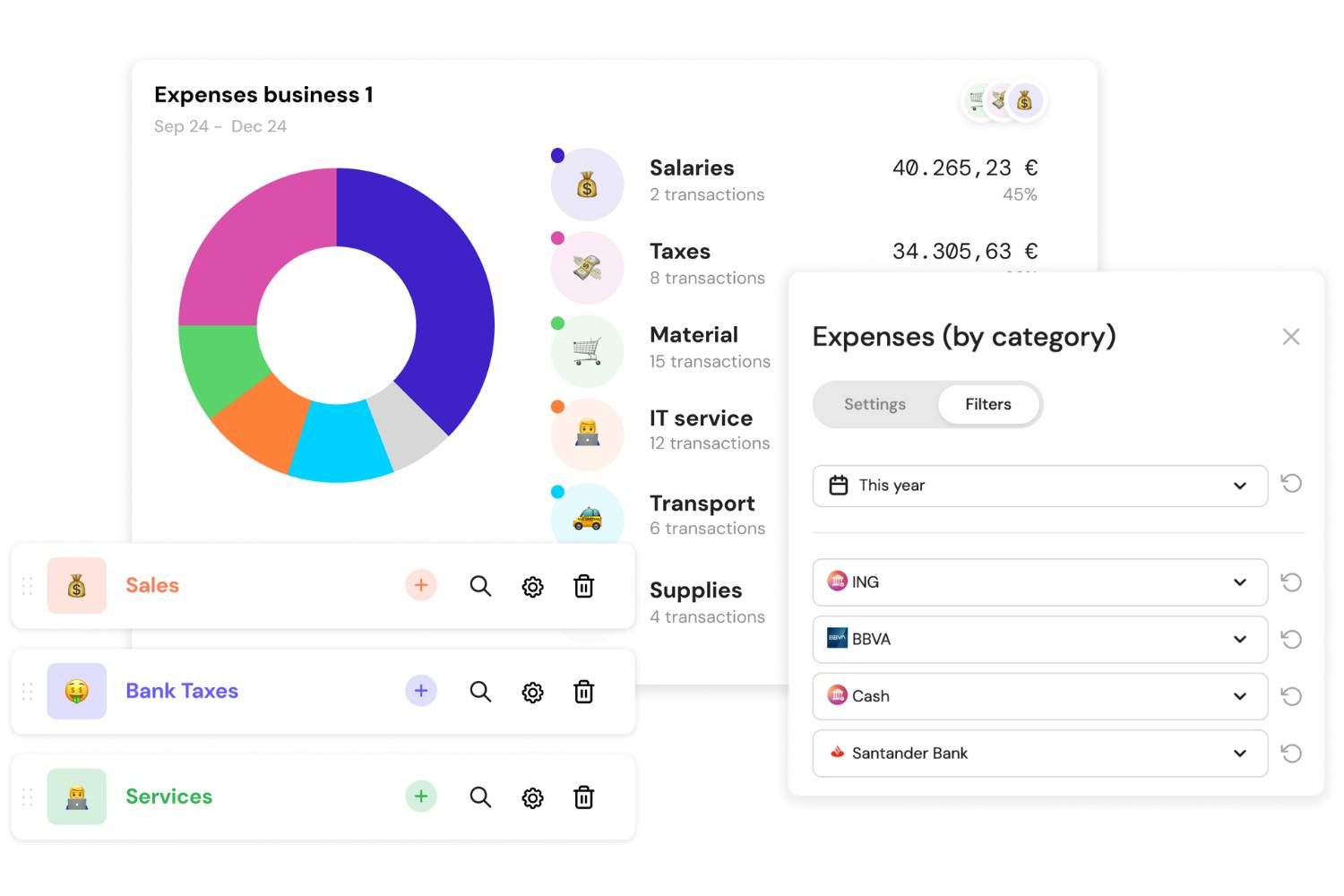

Customizable Dashboards

Banktrack’s dashboards can be tailored to meet your specific needs. They offer a clear, real-time view of your financial status, making it easier to manage your money efficiently.

Whether you want to see an overview of your spending, a detailed breakdown of your expenses, or a comparison of your income and expenses over time, Banktrack’s customizable dashboards have you covered.

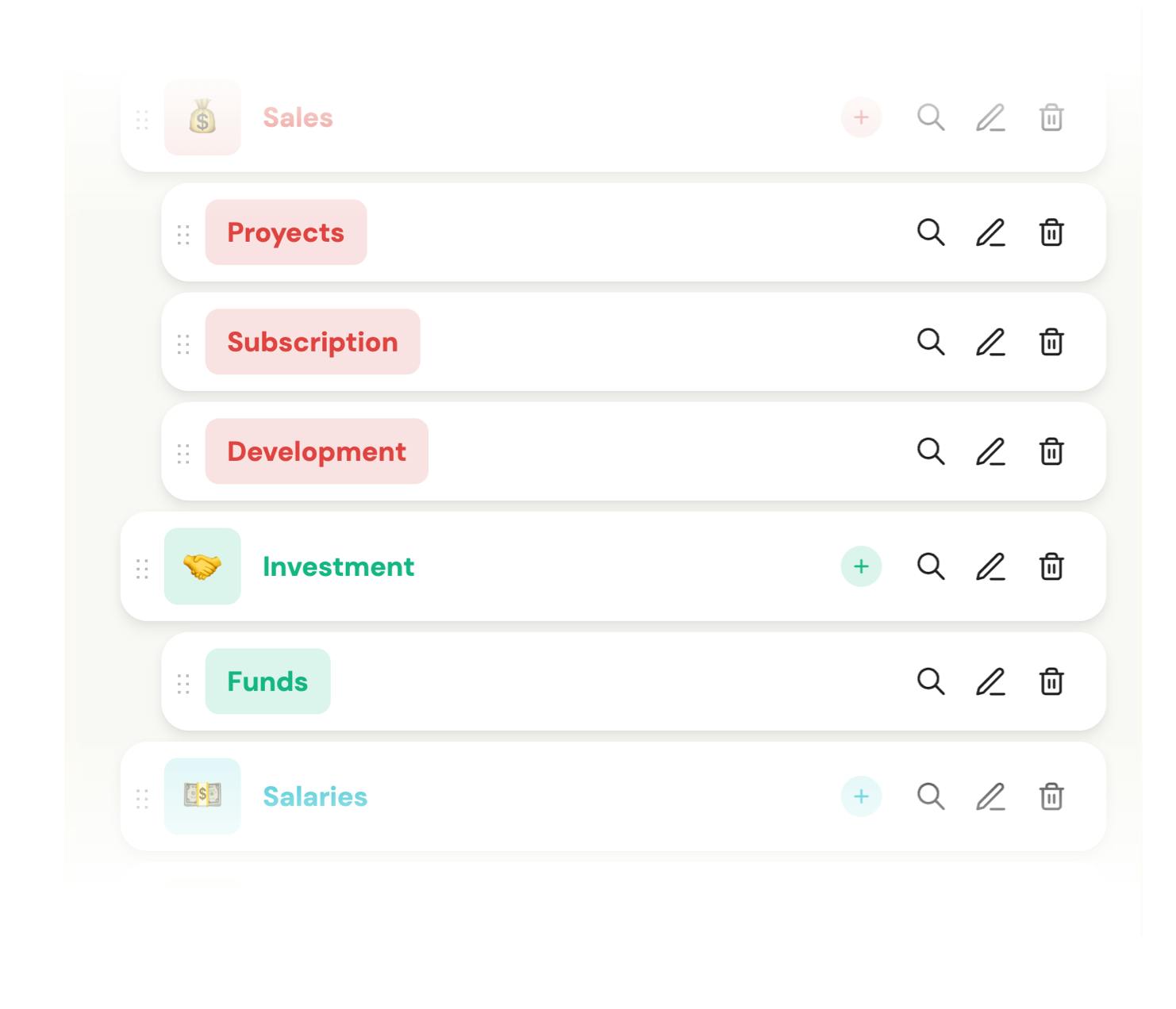

Flexible Categorization

The platform allows you to categorize expenses and income precisely, ensuring that you always have a clear understanding of where your money is going and where it’s coming from.

This flexibility in categorization helps in creating detailed financial reports, which are crucial for making informed decisions.

You can create custom categories that align with your specific needs, making it easier to track and analyze your financial data.

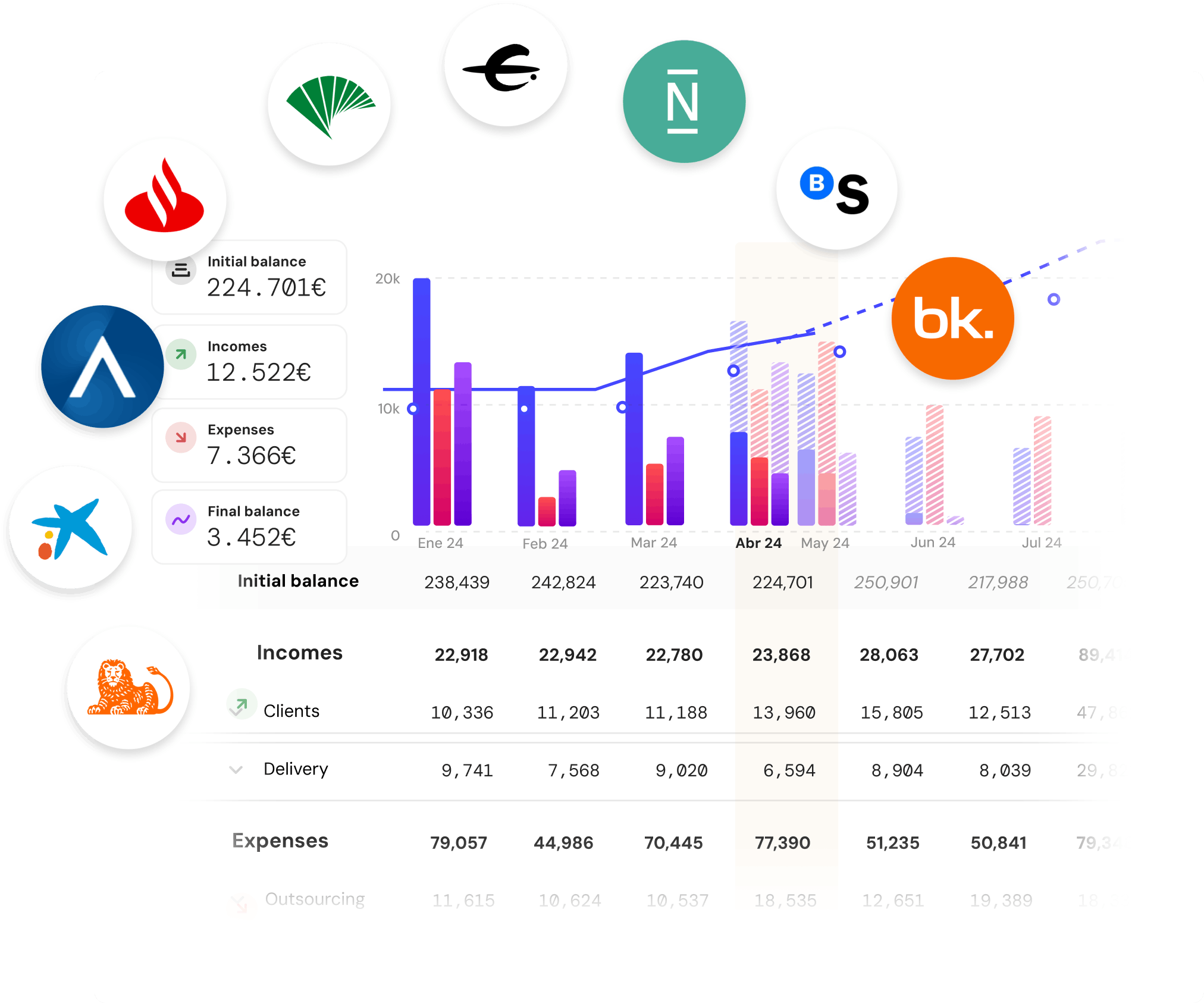

2. Seamless Bank Integration

One of the best features of Banktrack is its ability to sync with a vast array of banks.

Manually syncing financial data can be a nightmare, but Banktrack’s bank aggregator simplifies this process significantly.

Extensive Bank Coverage

Banktrack syncs with over 120 banks, including both traditional banks and neobanks. This extensive coverage ensures that no matter where your business banks, you can integrate all your accounts into one platform.

This means you can see all your financial data in one place, making it easier to manage your finances.

Dual Connection Methods:

Depending on your bank, Banktrack offers two types of connections:

- Open Banking (PSD2): This method, compliant with the latest European regulations, provides a secure and standardized way to access your banking data.

- Direct Access: For banks not covered under PSD2, Banktrack offers direct access connections, ensuring integration of financial data from virtually any bank.

These connection methods ensure efficient and secure integration of your financial data, so you don’t have to worry about the hassle of manually entering transactions.

3. Robust Security Measures

When it comes to financial management, security is paramount. Banktrack takes several measures to protect your personal and banking data:

Authorized Data Providers

Banktrack uses only authorized and audited data providers approved by the Bank of Spain, ensuring that your data is handled securely.

This means you can trust that your financial information is in safe hands.

Read-Only Access

Banktrack is an app to view all your bank accounts. This means that while it can view and import your financial data, it cannot conduct transactions, adding an extra layer of security.

You don’t have to worry about unauthorized transactions or any tampering with your accounts.

No Storage of Banking Passwords

The connection process is done through a unique access token, meaning your banking passwords are never stored in the system.

This approach enhances security by minimizing the risk of password theft.

Data Encryption

All transaction data is encrypted within Banktrack’s systems, ensuring the confidentiality and security of your financial information. Encryption protects your data from unauthorized access, ensuring that your financial information remains private and secure.

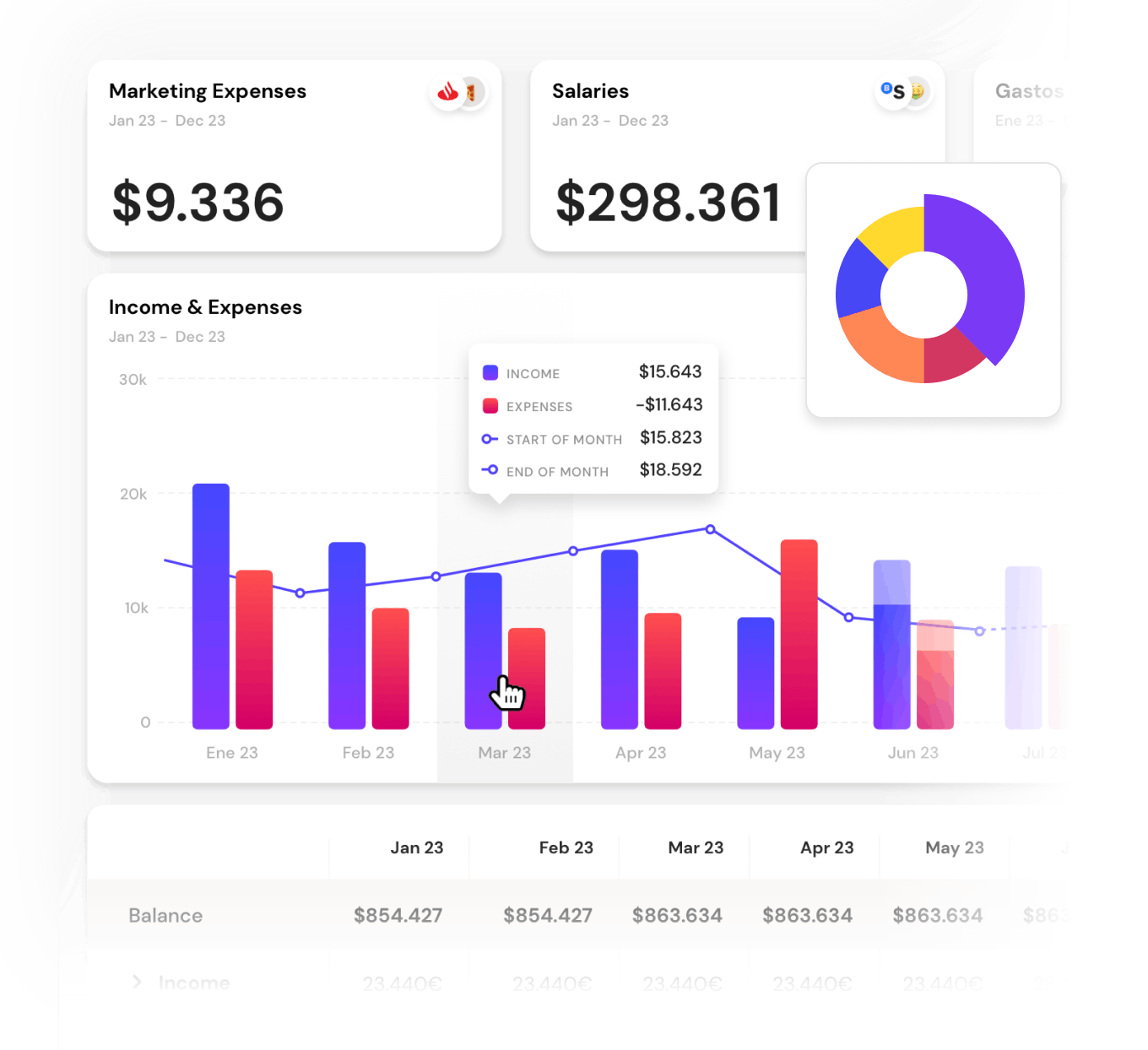

4. Cash Flow Forecasting

Understanding and predicting cash flow is vital for business stability and growth. Banktrack’s cash flow forecasting features are designed to give you an edge:

Historical Data Analysis

By analyzing your historical financial data, Banktrack can predict future cash flow trends. This insight helps you anticipate potential shortfalls and surpluses, allowing for better financial planning. Knowing what to expect financially enables you to make informed decisions and prepare for the future.

Dynamic Forecasting

You can create dynamic cash flow forecasts that adjust based on real-time data. This feature ensures that your financial projections are always accurate and up-to-date.

A software for real time cash flow forecasting helps you stay flexible and responsive to changes in your financial situation.

5. Bank Reconciliation

Reconciling bank statements with internal records is often a tedious and error-prone process. Banktrack automates this task, making it efficient and reliable:

Automated Reconciliation

The platform automatically matches your bank statements with your internal records, identifying discrepancies quickly and accurately. Automated reconciliation reduces the risk of errors and ensures that your financial records are always accurate.

2. Mint

Mint is a popular free personal finance app. So yes, it’s free, user-friendly, and packed with features.

Mint syncs with your bank accounts, tracks your expenses, categorizes them, and even alerts you if you’re overspending.

It also offers bill tracking and credit score monitoring. If you want a comprehensive, all-in-one solution, Mint is a solid choice.

If you’re curious about other apps that can replace Mint or offer different features, we’ve created a detailed guide to the best Mint alternatives.

It’s worth exploring if you want more control, different pricing options, or enhanced financial tools.

3. YNAB (You Need a Budget)

YNAB is designed to help users gain control over their finances through proactive budgeting.

The idea is to give every dollar a job, which helps you take control of your money. YNAB’s bank sync feature ensures your budget is always up-to-date, reflecting your actual spending.

It also offers educational resources to help you improve your financial literacy.

If you’re serious about budgeting, YNAB is worth the investment.

4. PocketGuard

PocketGuard does exactly what it says on the tin – it helps you guard your pocket.

This app simplifies budgeting by showing you how much disposable income you have after accounting for bills, goals, and necessities.

Its bank sync feature keeps your spending data current, so you always know how much you can safely spend.

5. Personal Capital

Personal Capital is ideal for those who want to manage both their day-to-day expenses and long-term investments. Its bank sync feature provides real-time updates on your financial accounts, giving you a clear picture of your net worth. Personal Capital also offers tools for retirement planning and investment management.

6. Simplifi by Quicken

Simplifi is all about, well, simplifying your financial life.

It offers a streamlined approach to budgeting and expense tracking.

Its bank sync feature ensures that your financial data is always current, helping you stay on top of your spending and savings goals.

Simplifi is perfect for those who want a no-fuss, easy-to-use financial management tool.

What is an Expense Tracker with Bank Sync?

An expense tracker with bank sync is like having a personal accountant who works 24/7, doesn’t complain, and doesn’t charge a fortune.

It's a digital tool that keeps an eye on your spending by automatically syncing transactions from your bank accounts.

This integration eliminates the need for manual entry of expenses, making the tracking process more accurate and efficient. Imagine not having to manually log every coffee, every impulse buy, and every grocery trip.

The primary components of such a system include:

- Expense Tracking Software: This software records and categorizes your expenses.

- Bank Sync Feature: This feature automatically imports transaction data from your linked bank accounts. Say goodbye to tedious manual entry.

Sounds like a dream, right? Well, it's real, and it's fantastic.

5 Benefits of Using an Expense Tracker with Bank Sync

1. Accuracy and Efficiency

Let’s be honest: keeping track of expenses manually is a recipe for disaster. Miss one receipt, and your budget is off. Enter data wrong, and good luck figuring out what went wrong.

An expense tracker with bank sync takes care of all that. It imports transactions automatically, categorizes them, and keeps everything up-to-date.

This means you get accurate records with minimal effort – a win-win.

2. Real-Time Updates

Waiting for your monthly bank statement to see where your money went? That’s so last century.

With real-time updates, you always know where you stand financially. This means you can make decisions based on current information, not on what happened last month.

3. Comprehensive Financial Overview

Ever tried to get a clear picture of your finances by piecing together information from different apps, spreadsheets, and scraps of paper? Not fun.

An expense tracker with bank sync gives you a holistic view of your finances in one place.

You can see your income, expenses, and savings all at a glance, making it easier to plan and manage your money.

4. Improved Budgeting

If you’ve ever tried budgeting only to give up because it was too complicated, you’re not alone. These tools make budgeting a breeze.

They automatically track your spending, categorize it, and show you where you might be overspending. It’s like having a financial coach who gently nudges you in the right direction.

5. Enhanced Security

Worried about the security of your financial data? You should be. Luckily, modern expense trackers with bank sync use top-notch security measures.

Encryption, secure connections, two-factor authentication; they’ve got it all.

Your data is safer with them than it is with that shoebox full of receipts under your bed.

How Does Bank Sync Work?

The technology behind bank sync might sound like wizardry, but it’s actually quite straightforward. Here’s a step-by-step breakdown:

- Authorization: You grant the expense tracker permission to access your bank account data. This usually involves logging in through a secure portal provided by your bank.

- Data Retrieval: The tracker uses the bank’s API (Application Programming Interface) to take your transaction data. It’s like having your bank send a digital copy of your transactions directly to the app.

- Categorization: The software then automatically categorizes your transactions. Coffee from Starbucks? That goes under “Dining.” Monthly Netflix charge? “Entertainment.”

- Synchronization: The data is continuously updated, so your expense tracker app always has the latest information. No more waiting for end-of-month statements or trying to remember every single expense.

How to Choose the Right Expense Tracker with Bank Sync

With so many options, how do you choose the right one? Here are some factors to consider:

1. Ease of Use

You don’t need a degree in finance to use these tools, or at least, you shouldn’t.

Look for an app with a user-friendly interface that makes it easy to navigate and understand your financial data.

2. Features

What do you need the app to do? Some people just want basic expense tracking, while others need budgeting, investment management, and a bill management app.

Make sure the app you choose has the features that are important to you.

3. Security

This one’s a no-brainer. Make sure that the app uses strong security measures to protect your financial data.

Look for features like encryption, secure connections, and two-factor authentication.

4. Compatibility

Not all apps sync with all banks. Before you commit, check that the app is compatible with your bank and any other financial institutions you use.

5. Cost

While many expense trackers offer free versions, some require a subscription for advanced features. Determine your budget and choose an app that offers the best value for your needs.

5 Tips for Maximizing the Benefits of an Expense Tracker with Bank Sync

Got your expense tracker set up? Great! Here’s how to get the most out of it:

1. Regularly Review Your Transactions

Even though the tool syncs your transactions automatically, it’s a good idea to review them regularly.

This ensures accuracy and helps you catch any miscategorized expenses. Plus, it’s a good habit to stay familiar with your spending.

2. Set Financial Goals

Use the insights from your expense tracker to set realistic financial goals. Whether it’s saving for a vacation, paying off debt, or building an emergency fund, having clear goals will help you stay motivated.

3. Create and Stick to a Budget

Make use of the budgeting features of your expense tracker to create a budget that aligns with your financial goals.

Monitor your spending to ensure you stay within your budget. It’s not always fun, but it’s worth it.

4. Take Advantage of Reports and Insights

Most expense trackers offer detailed reports and insights into your spending habits. Use these reports to identify areas where you can cut back and improve your financial health.

5. Stay Informed

Keep up-to-date with any new features or updates to your expense tracker. Developers frequently release improvements that can enhance your experience and provide additional benefits. Don’t miss out on tools that can make managing your finances even easier.

How can banktrack help you

Banktrack is a safe tool for cash management that helps businesses of all sizes or even individuals to track their financial transactions, manage cash flow, and optimize financial performance.

With its strong transaction tracking, seamless bank integration, and advanced forecasting tools, Banktrack stands out as the best solution to streamline financial management processes.

Whether you’re a startup juggling multiple bank accounts or an established business seeking better cash flow control, Banktrack provides the tools you need to succeed.

Investing in an expense tracker with bank sync capabilities is a smart move for anyone looking to achieve greater financial stability and success.

Start exploring the available options today and take the first step towards a more organized and financially secure future.

Your wallet will thank you!

Share this post

Related Posts

10 best cash management software for small businesses

Wondering what your options are as a small business to manage your cash flows wisely? We have curated a list of the top 10 best cash management softwares for you.Best 7 bank trackers in the Netherlands

This guide lists the top 7 tools to help you track expenses, monitor accounts, and improve your financial management. Find the perfect tracker to stay on top of your moneyTop 5 Best bank trackers in Portugal

Explore 5 bank tracker apps available in Portugal to easily manage budgets, track expenses, and gain control over your finances in 2024.

Try it now with your data

- Your free account in 2 minutes

- No credit card needed