Best 5 alternatives to Embat

These are the 5 best alternatives to Embat:

- Banktrack

- Agicap

- Float

- Planguru

- Fathom

Managing your finances or your business’s cash flow doesn’t have to be complicated.

Tools like Embat are great for forecasting and keeping your money in check, but they’re not the only option out there.

Maybe Embat feels too restrictive, or perhaps you’re looking for something more tailored to your needs.

Whatever the reason, there are some fantastic alternatives to explore; tools that can make handling money less stressful and more effective.

Let’s break down a few top choices and why they might be the perfect fit for your financial journey.

Top 5 Alternatives to Embat

1. Banktrack

Banktrack isn’t just another treasury cash flow forecasting software, it’s like your financial assistant. Whether you’re managing many accounts or running a small business, this tool puts you in the driver’s seat.

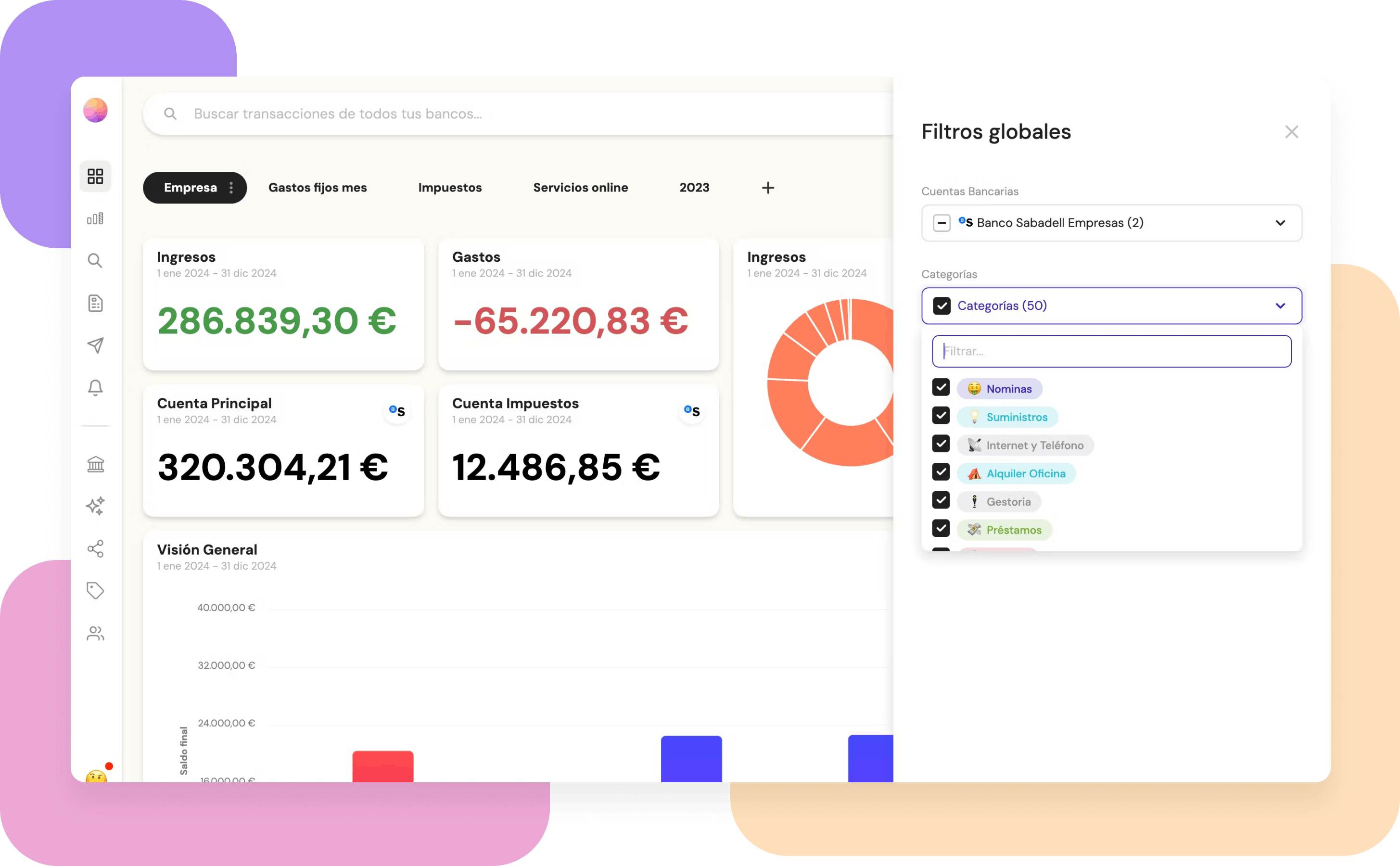

Why it’s great: Banktrack lets you create your own dashboard, so you’re always focusing on what matters most. Want to track spending categories or see your savings grow in real-time? It’s all possible here.

What makes it special:

- Customizable Dashboards: Tailor your financial view to track spending, income streams, and savings goals in real-time.

- Seamless Integration: Connect with over 120 banks worldwide, consolidating all accounts: checking, savings, credit cards, and investments, into one secure platform.

- Spending Controls: Set category-specific spending limits, receive instant alerts for overspending and adjust limits as your budget evolves.

- Real-Time Notifications: Gives you instant alerts (no more surprises!): Alerts for low balances, duplicate charges, and upcoming bills. Delivered via WhatsApp, Slack, Telegram, SMS, or email.

- Drag-and-Drop Reporting: Create professional financial reports with ease, featuring visual graphs and shareable formats. Reporting tools are drag-and-drop easy: great for small businesses that need professional reports without the headache.

- Advanced Security: End-to-end encryption to protect sensitive data. Multi-factor authentication for secure access. And GDPR compliance to ensure regulatory adherence.

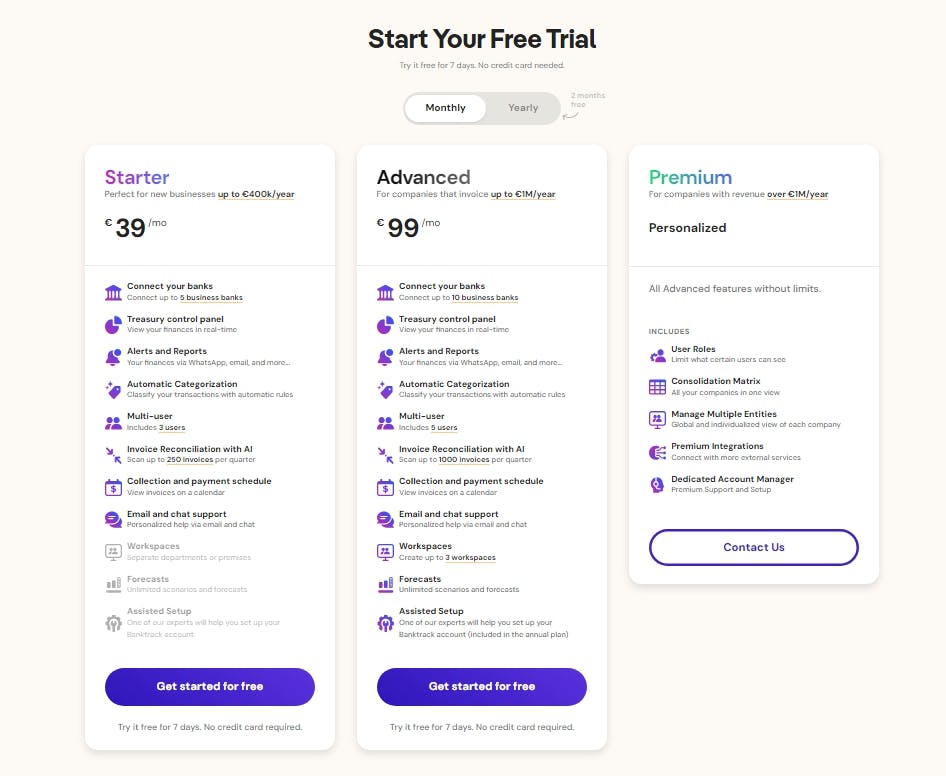

Affordable Pricing: High-value features at an affordable price, making it accessible for freelancers, and small businesses too.

Perfect for: Anyone who needs a flexible, all-in-one solution to simplify money management.

- Small business owners tracking cash flow and expenses.

- Freelancers juggling diverse income sources.

- Businesses setting financial goals and budgets.

2. Agicap

Agicap might be your ideal alternative if you are looking for a business cash management tool. It’s designed to take the guesswork out of cash flow management for small or medium business owners, and it has tools that help you plan ahead and keep your finances on track.

What makes it stand out: Agicap is all about making forecasting simple. Whether you’re testing different financial strategies or preparing for unexpected expenses, it’s built to handle your needs.

Features you’ll love:

- Real-time updates synced with your bank accounts.

- Scenario planning, so you can see what happens if sales drop or expenses rise.

- Easy collaboration tools to keep your team aligned.

Perfect for: Business owners who want a simple, reliable way to manage their cash flow.

Not really your fit? Check this other article on Agicap alternatives.

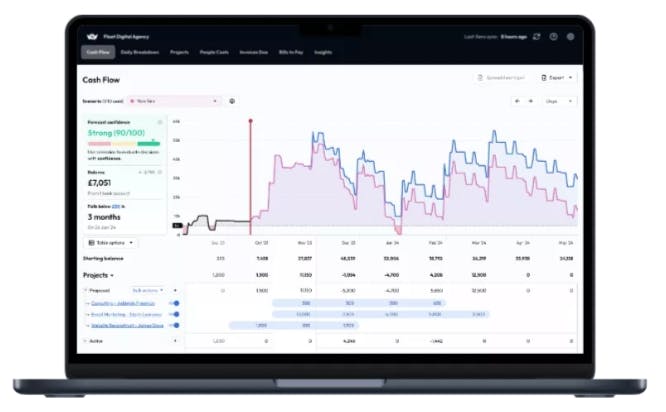

3. Float

Want a tool that makes forecasting feel less intimidating? Float is a lightweight option that’s big on clarity. It syncs directly with your accounting software to give you a clear picture of your cash flow.

Why it’s worth a try: Float focuses on making cash flow forecasting intuitive, even if you’re not a financial expert.

Features to check out:

- Automatically updates with your financial data, so you don’t have to.

- Lets you play out “what-if” scenarios to plan for the future.

- Clean, simple design, no spreadsheets required.

Perfect for: Startups and small businesses that need a forecasting tool without the learning curve.

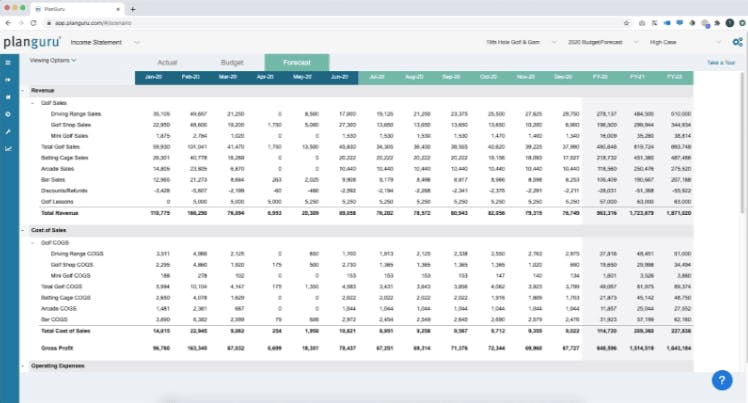

4. Planguru

If you’re all about long-term strategies, Planguru might be your next go-to. It’s built for businesses that want detailed forecasting and analysis to plan for growth.

Why it works: Planguru goes beyond cash flow, it’s a complete treasury management software for serious strategists.

What’s impressive:

- Forecast up to 10 years into the future (hello, long-term planning).

- Consolidate budgets for multiple departments or locations.

- Analyze “what-if” scenarios to choose the best course of action.

Perfect for: Businesses and financial professionals looking for in-depth planning tools.

5. Fathom

Ever wish your financial data could tell a story? Fathom makes it happen with its visual-first approach. It’s perfect for businesses who want to see their financial health at a glance.

What’s cool about it: Fathom turns numbers into colorful charts and easy-to-read insights.

Why you’ll love it:

- Track performance with custom KPIs.

- Create stunning reports that make decision-making easy.

- Consolidate data from multiple businesses into one view.

Perfect for: Visual learners and anyone who loves data that’s easy to digest.

How to Pick the Right Expense Tracker for You

Feeling overwhelmed by the options? Don’t worry, it’s all about figuring out what you need most.

- If you need flexibility, Banktrack’s customizable dashboards might be your best bet.

- If you run a business, Agicap’s real-time tracking and Float’s forecasting tools make planning a breeze.

- If you’re a numbers geek, Planguru and Fathom deliver the deep insights you crave.

The key is to start with an expense tracking app that feels intuitive and grows with you.

No matter which option you choose, these alternatives make managing your money smarter, simpler, and stress-free.

The 3 Benefits of Trying Alternatives

Switching from a familiar tool like Embat to a new alternative might feel like a big leap, but the benefits can be worth it.

Here’s why exploring other options could be a game-changer for your finances or business:

- Tailored Features for Your Needs: Not all tools are created equal. Some, like Float, excel at simplicity, while others, like Banktrack, offer a wide array of features for those who need customization.

- Better Budget Alignment: While Embat might suit larger businesses, its pricing or complexity could be overkill for individuals or startups. Alternatives like Banktrack or Agicap often deliver just what you need without unnecessary extras.

- Enhanced Efficiency: A tool that aligns perfectly with your workflow saves time. Whether it’s real-time notifications or drag-and-drop reporting, the right features can make your life easier.

Take Control of Your Finances with Banktrack

Banktrack is a powerful tool designed for small-to-medium-sized businesses looking to improve their cash flow management and financial forecasting.

Its best features include customizable dashboards, which allow users to track spending, visualize savings, and adjust priorities in real time.

With integration to over 120 banks, it consolidates all accounts: checking, savings, credit cards, and investments, into one platform.

Spending controls, like category-specific limits and overspending alerts, help users stay on budget, while real-time notifications for low balances, duplicate charges, and bill reminders keep them informed.

The intuitive drag-and-drop reporting feature makes creating professional, shareable financial reports simple and quick.

Banktrack prioritizes security with end-to-end encryption and GDPR compliance, offering enterprise-grade protection at an accessible price of €16.58 per month.

Ideal for freelancers and small business owners, Banktrack makes managing money easy, efficient, and secure.

Share this post

Related Posts

Best 7 Cash Flow Forecasting Softwares for Startup Businesses

Explore the best cash-flow forecasting software for startups, with tools that simplify budgeting, projections, and financial planning to keep your business healthy and scalable.Advanced cash flow forecasting: techniques and tools

Master advanced cash flow forecasting with top techniques and tools like treasury software, AI analytics, BI platforms, and ERP systems to streamline financial planning and decision-making.Top 10 Alternatives to Agicap in 2024

Find smarter, budget-friendly alternatives to Agicap for smarter cash flow management this year.

Try it now with your data

- Your free account in 2 minutes

- No credit card needed