Best 5 Apps for Tracking Expenses and Receipts

These are the best apps for tracking expenses and receipts.

- Banktrack

- Expensify

- QuickBooks

- Shoeboxed

- Wave

Keeping track of your finances can be a boring and complex task, especially when you have to manage both expenses and receipts.

With the right app, however, you can streamline this process, making it easier to stay on top of your money without breaking a sweat.

But with so many apps out there, how do you know which one is the best? In this guide, we’ll dive into the top apps for tracking expenses and receipts, helping you choose the one that best suits your needs.

And at the top of our list? Banktrack, a great option that integrates perfectly with your financial life.

Top Apps for Tracking Expenses and Receipts

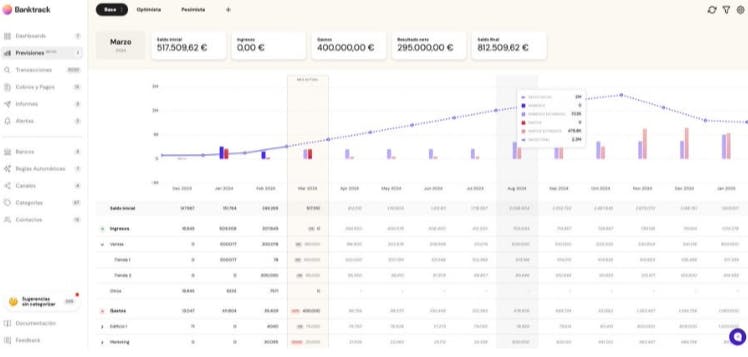

1. Banktrack

Banktrack stands out as the best expense tracking app that also deals with all your receipts. Why? Because it has strong features, seamless bank integration, and strong focus on security.

Whether you're managing personal finances or running a business, Banktrack offers everything you need in one powerful platform. So let’s explain it in more detail:

Key Features

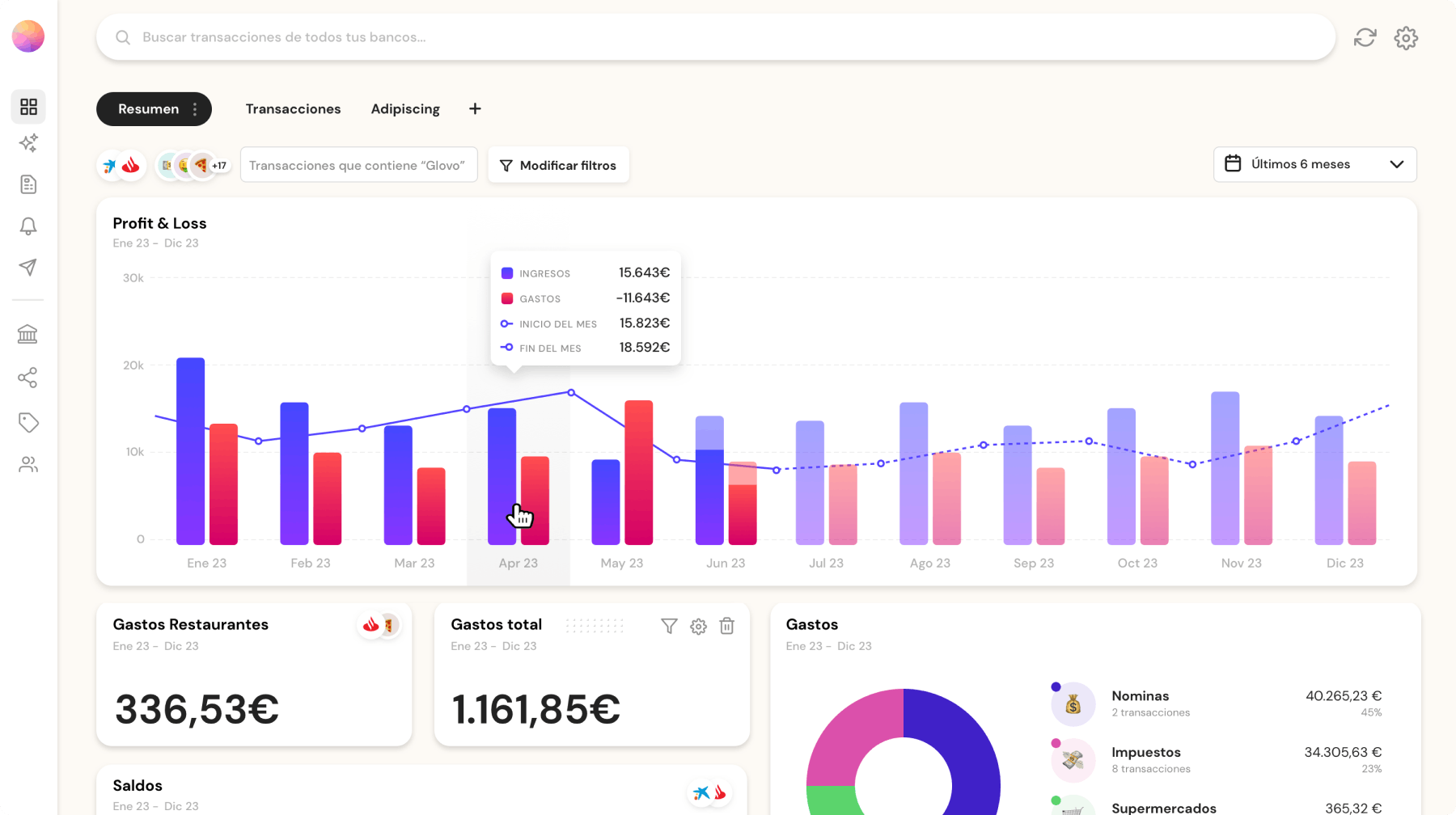

- Customizable Dashboards: Banktrack allows you to create dashboards tailored to your specific needs, giving you a clear, real-time view of your financial status.

- Whether you want an overview of your spending, a detailed breakdown of expenses, or a comparison of income and expenses over time, Banktrack’s fully customizable dashboards make it all possible.

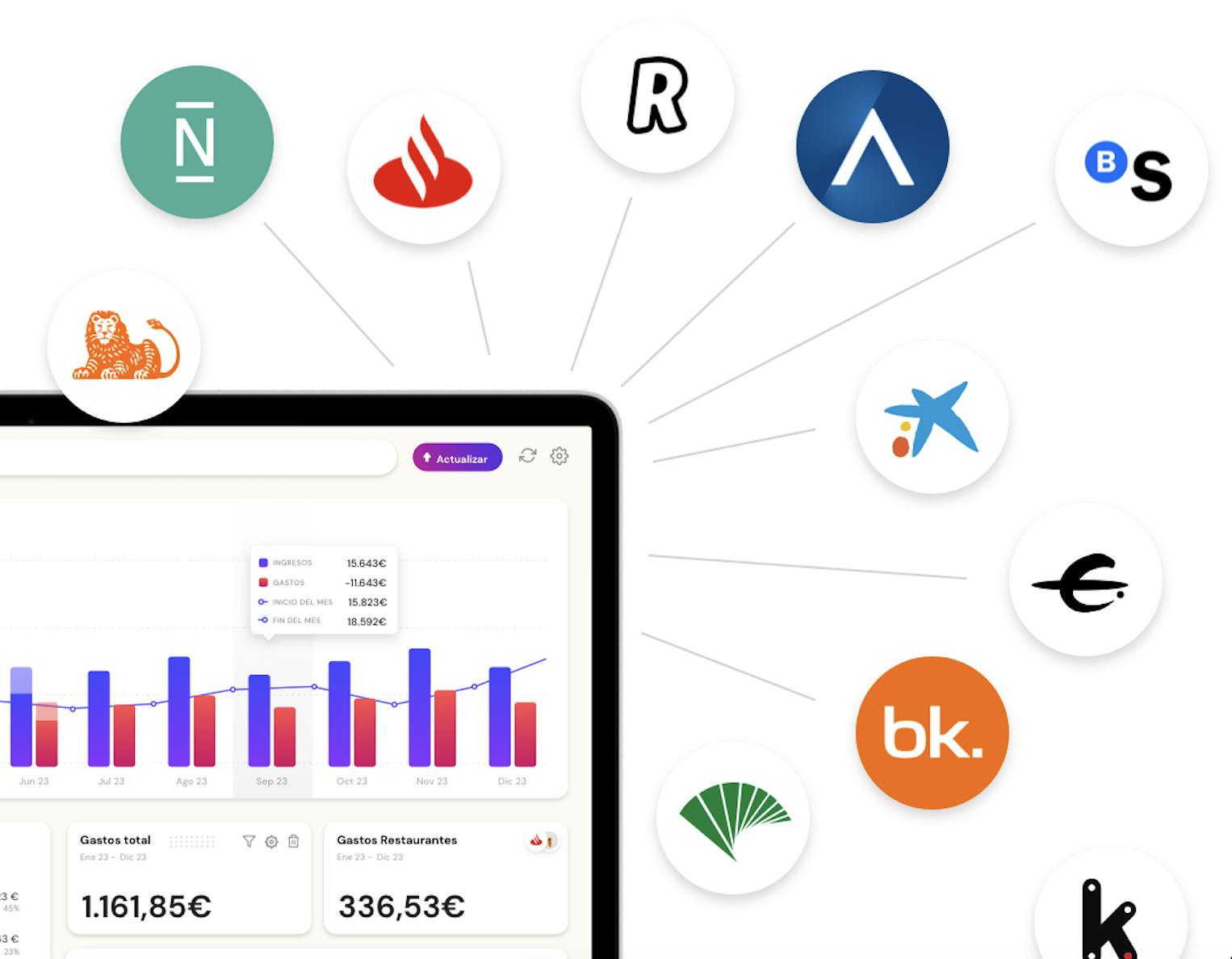

- Seamless Bank Integration: And if you are looking for an expense tracker software with bank sync features, you are in luck, because one of Banktrack’s best features is its ability to sync with over 120 banks, including both traditional banks and neobanks. Yes, all of this in the same platform.

- And what can this do for you? It means that you can view all your financial data in one place, making it easier to manage your money. Banktrack offers both Open Banking (PSD2) and Direct Access connections, ensuring your data is securely integrated from virtually any bank.

- Expense Categorization: Banktrack provides flexible categorization options, allowing you to categorize expenses and income precisely. This helps you understand where your money is going and where it’s coming from, making it easier to create detailed financial reports and make informed decisions.

- Strong Security Measures: Security is a top priority for Banktrack. The app uses authorized and audited data providers, offers read-only access to your bank accounts, and encrypts all transaction data.

- Cash Flow Forecasting: Banktrack’s cash flow forecasting features allow you to predict future cash flow trends by analyzing your historical financial data.

- You can create dynamic forecasts that adjust based on real-time data, helping you avoid the most common limitations of cash flow forecasting.

- Automated Bank Reconciliation: Reconciling bank statements with internal records is often a tedious process, but Banktrack automates this task, making it efficient and reliable.

- The app automatically matches your bank statements with your internal records, quickly identifying discrepancies.

- Pros:

- Comprehensive set of features for both personal and business use.

- Seamless integration with a wide range of banks.

- Strong security measures to protect your financial data.

- Best for all types of enterprises, startups and individuals or even for couples!

Cons:

- Advanced features require a subscription. But the good news is, it's quite affordable! Starting at 17 euros a month.

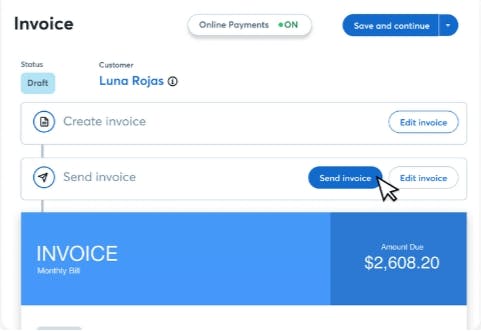

2. Expensify

Expensify is another strong contender, especially for those who need an app that handles both personal and business finances.

With features like SmartScan, automatic expense reports, and integration with accounting software, Expensify simplifies the process of tracking expenses and managing receipts.

Key Features

- SmartScan Technology: Expensify’s SmartScan allows you to snap a photo of your receipt, automatically capturing and categorizing the expense. This feature saves time and reduces the hassle of manual data entry.

- Automatic Expense Reports: it can generate detailed expense reports that are easy to share or export, making it ideal for both personal finance tracking and business expense management.

- Mileage and Time Tracking: In addition to expenses, it can track mileage and billable hours, making it a comprehensive tool for freelancers and business owners.

- Integration with Accounting Software: Expensify syncs with popular accounting software like QuickBooks, Xero, and NetSuite, making sure your financial data is always up to date.

Pros and Cons

Pros:

- User-friendly interface with powerful features.

- Automates a lot of the manual work involved in tracking expenses.

- Ideal for both personal and business use.

Cons:

- Some advanced features require a paid subscription.

- May be more robust than necessary for simple personal expense tracking.

- It is a good cash management software for freelancers, and anyone looking for a comprehensive expense tracking tool that can handle more than just receipts.

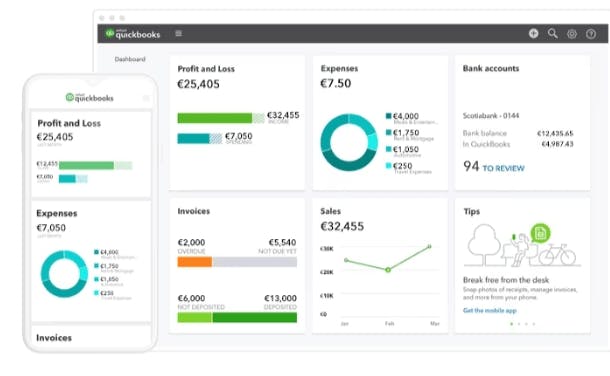

3. QuickBooks

QuickBooks is a well-known name in the accounting world, and it’s no surprise that it excels in tracking expenses and managing receipts as well. According to Forbes, it is one of the best receipt scanner apps in 2025.

Whether you’re a small business owner or a freelancer, QuickBooks offers a suite of features that can help you stay on top of your finances.

Key Features

- Receipt Capture: QuickBooks allows you to capture photos of your receipts and automatically match them with transactions. This feature ensures that every expense is accounted for, making it easier to keep accurate records.

- Expense Categorization: The app automatically categorizes your expenses and syncs with your bank accounts, helping you track your spending and stay within budget.

- Invoicing and Payments: QuickBooks goes beyond expense tracking by offering invoicing and payment processing, making it a comprehensive tool for managing your business finances.

- Tax Preparation Integration: QuickBooks organizes your receipts and expenses in a way that makes tax time less stressful, ensuring you’re always prepared for the IRS.

Pros and Cons

Pros:

- Combines expense tracking with powerful accounting features.

- Ideal for small business owners who need more than just receipt tracking.

- Integrates with a wide range of financial tools and services.

Cons:

- Can be pricey, especially for those who need access to all of its features.

- Might be overkill for those looking to track personal expenses.

- It is a good cash management software for startups looking for top-notch expense tracking features.

4. Shoeboxed

If you’re drowning in paper receipts and need a way to organize them digitally, Shoeboxed is probably the app for you.

Designed specifically for receipt management, it is one of the top 10 business expense tracker apps according to Forbes.

And the reason is very simple, Shoeboxed turns your piles of paper into organized digital records, making it easy to keep track of all your expenses.

Key Features

- Receipt Scanning: Shoeboxed offers multiple ways to submit receipts, including through the mobile app, email, or even mail-in services. The app then extracts the data from your receipts and organizes it for you.

- Expense Reports: Shoeboxed generates detailed expense reports from your scanned receipts, making it easy to prepare for tax time or submit reimbursement claims.

- Business Card Management: In addition to receipts, Shoeboxed can also scan and organize business cards, helping you keep track of your contacts and their associated expenses.

- IRS-Accepted Receipt Archive: Shoeboxed stores all your receipts in a format that’s accepted by the IRS, ensuring that you’re always compliant with tax regulations.

Pros and Cons

Pros:

- Excellent for organizing and digitizing receipts.

- Multiple submission methods, including a mail-in service.

- IRS-compliant storage, perfect for tax preparation.

Cons:

- Limited additional financial management features beyond expense and receipt tracking.

- Requires a subscription for full access to features.

- It is best for individuals and small businesses looking for a simple and effective way to digitize and organize receipts.

5. Wave

Wave has a partly free, user-friendly app that combines accounting, invoicing, and receipt tracking, making it ideal for freelancers and small business owners who need a comprehensive financial tool without the cost.

Key Features

- Receipt Scanning: Wave’s mobile app allows you to scan receipts and sync them with your accounting records in real-time, ensuring that your finances are always up to date.

- Expense Management: Are you looking for free expense categorization features and an app to link all bank accounts? Then this is probably a good option, as it makes it easy to track your spending and stay within budget.

- Invoicing and Payments: Beyond expense tracking, Wave offers invoicing features with payment processing, making it a great all-in-one solution for freelancers and small business owners.

- Custom Reports: Wave allows you to generate financial reports tailored to your business needs, including profit and loss statements, tax summaries, and more.

Pros and Cons

Pros:

- Completely free with no hidden fees.

- Combines accounting, invoicing, and receipt tracking in one app.

- Easy-to-use interface that’s perfect for beginners.

Cons:

- Limited to basic accounting and expense management features.

- Customer support can be slow, especially for the free version.

- It is best for freelancers and small business owners looking for a free, all-in-one financial management solution.

Why Tracking Expenses and Receipts is Essential

Let’s now discuss why tracking your expenses and receipts is crucial so you can understand the meaning behind the features that all the prior apps have:

1. Stay Within Your Budget

Tracking expenses helps you monitor where your money goes, allowing you to make adjustments before overspending.

This is especially important if you’re trying to stick to a budget.

2. Simplify Tax Season

Having all your receipts organized can make tax season less stressful.

You’ll have everything you need for deductions and tax filings right at your fingertips.

3. Make Better Financial Decisions

When you know where every dollar is going, you’re in a better position to make informed financial decisions, whether you’re saving for a big purchase, paying off debt, or simply trying to stay within your means.

4. Enhance Business Efficiency

For business owners, tracking expenses and receipts is crucial for maintaining accurate records, managing cash flow, and complying with financial regulations.

Why Banktrack is the Right App for You

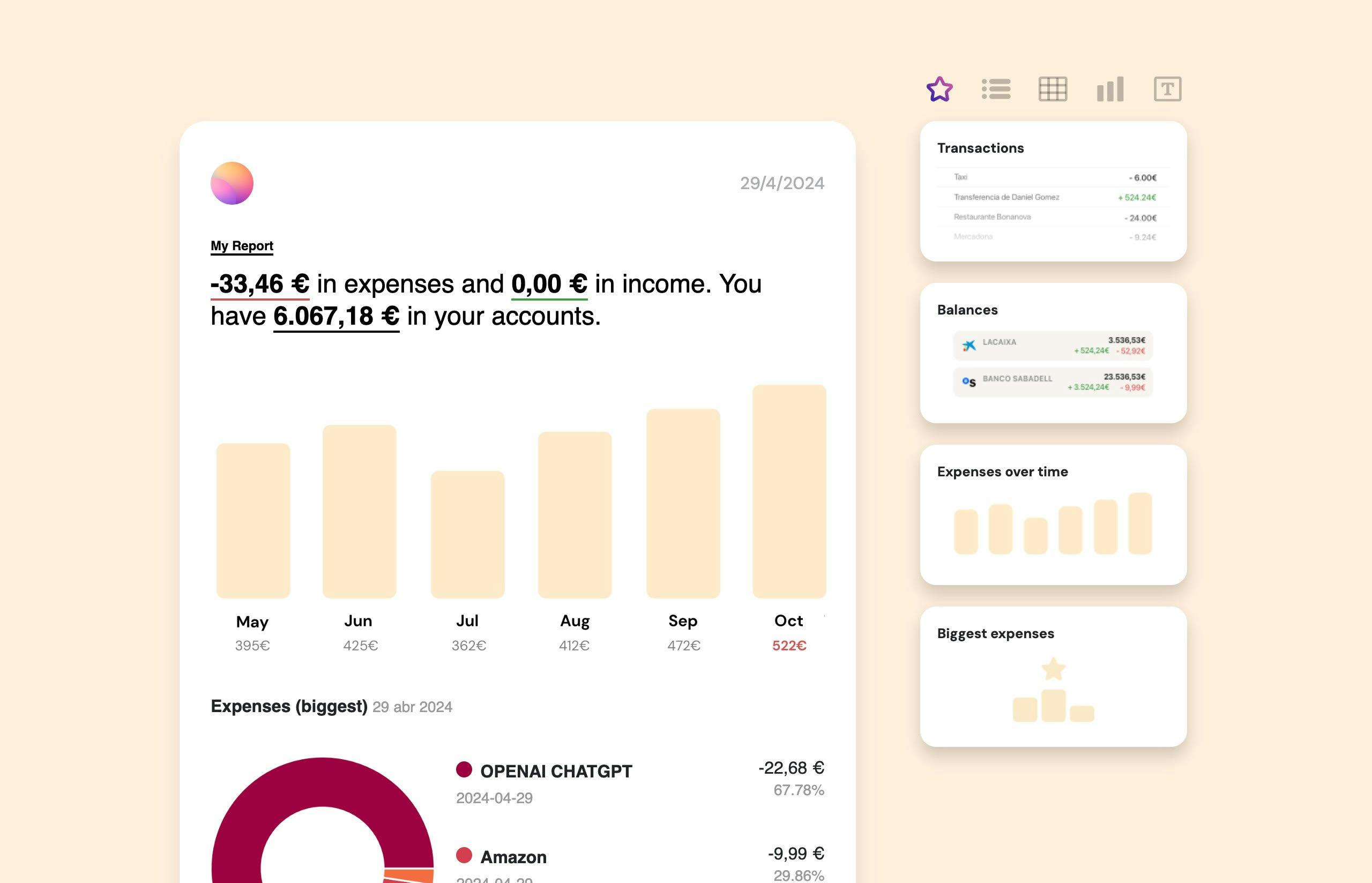

When it comes to managing your finances, finding the right app for tracking expenses and receipts can make all the difference.

Banktrack stands out as the top choice due to its comprehensive features, strong security, and perfect integration with a wide range of banks which will automate the process of having to manually introduce all data.

Whether you're managing personal finances or running a business, Banktrack offers everything you need in one powerful tool.

This makes the process simple in a way in which you are not only organizing your finances but it also allows you to have a clear and customizable picture of where your money is going and how you can always stay up-to-date.

Share this post

Related Posts

Best 6 Expense Tracker Software with Bank Sync features

Managing money isn’t exactly anyone’s idea of fun, but it is definitely important and it can even be simpler than you think. Let us show you how.Top 10 Best Expense Report Softwares in 2024

Effortlessly manage expenses with a software designed to track receipts, invoices, and transactions, ideal for small businesses and freelancers.

Try it now with your data

- Your free account in 2 minutes

- No credit card needed