Top 7 best cash flow management software in 2025

- Top 7 best cash flow management software

- 1. Banktrack

- 2. Cube

- 3. Vena Solutions

- 4. Scoro

- 5. PlanGuru

- 6. Float

- 7. CashAnalytics

- What is a cash flow management software

- The impact of a good cash flow management software

- Enhanced cash visibility

- Optimized working capital

- Reduced financial risks

- Improved decision making

- Step-by-step explanation of cash flow calculation

- How a cash flow management software helps in cash flow management

- Choosing the right cash flow management software

- Frequently Asked Questions - FAQs

- How does cash flow management software differ from accounting software?

- Is cash flow management software suitable for small businesses?

- Can cash flow management software integrate with existing accounting systems?

- What security measures are in place to protect sensitive financial data?

- Can cash flow management software help in identifying opportunities for cost savings?

Wondering what the best cash flow management software is?

- Banktrack

- Cube

- Vena Solutions

- Scoro

- PlanGuru

- Float

- CashAnalytics

Let us save you the time and hassle. You are looking for Banktrack. With a cash flow management software by your side, you gain the clarity needed to understand how money moves within your business.

Cash flow quietly takes center stage in the business world, playing a very important role in keeping operations running smoothly. It's basically the lifeline that ensures the lights stay on and the gears keep turning.

For businesses and even law firms handling complex cases, understanding financial tools like cash flow management software or legal funding options is crucial to maintaining financial stability.

We will break down the concept and walk you through each calculation step, ensuring you are not lost in a sea of numbers.

Top 7 best cash flow management software

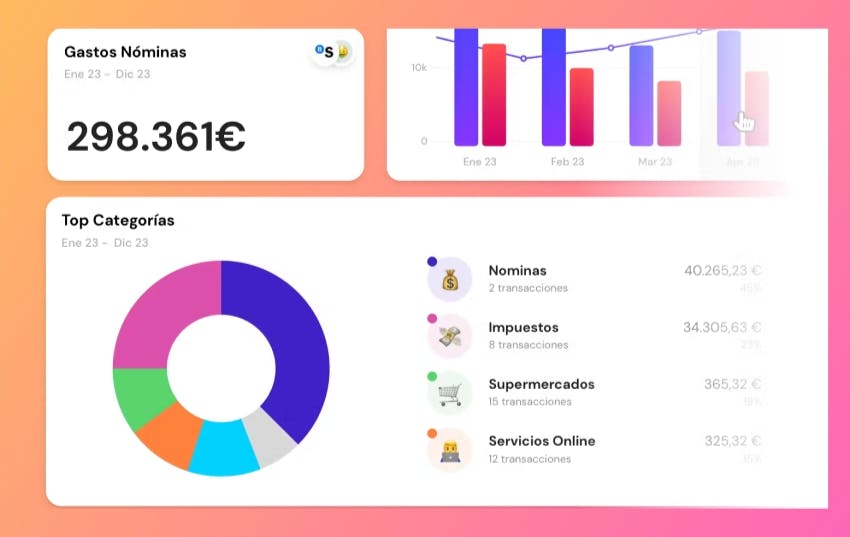

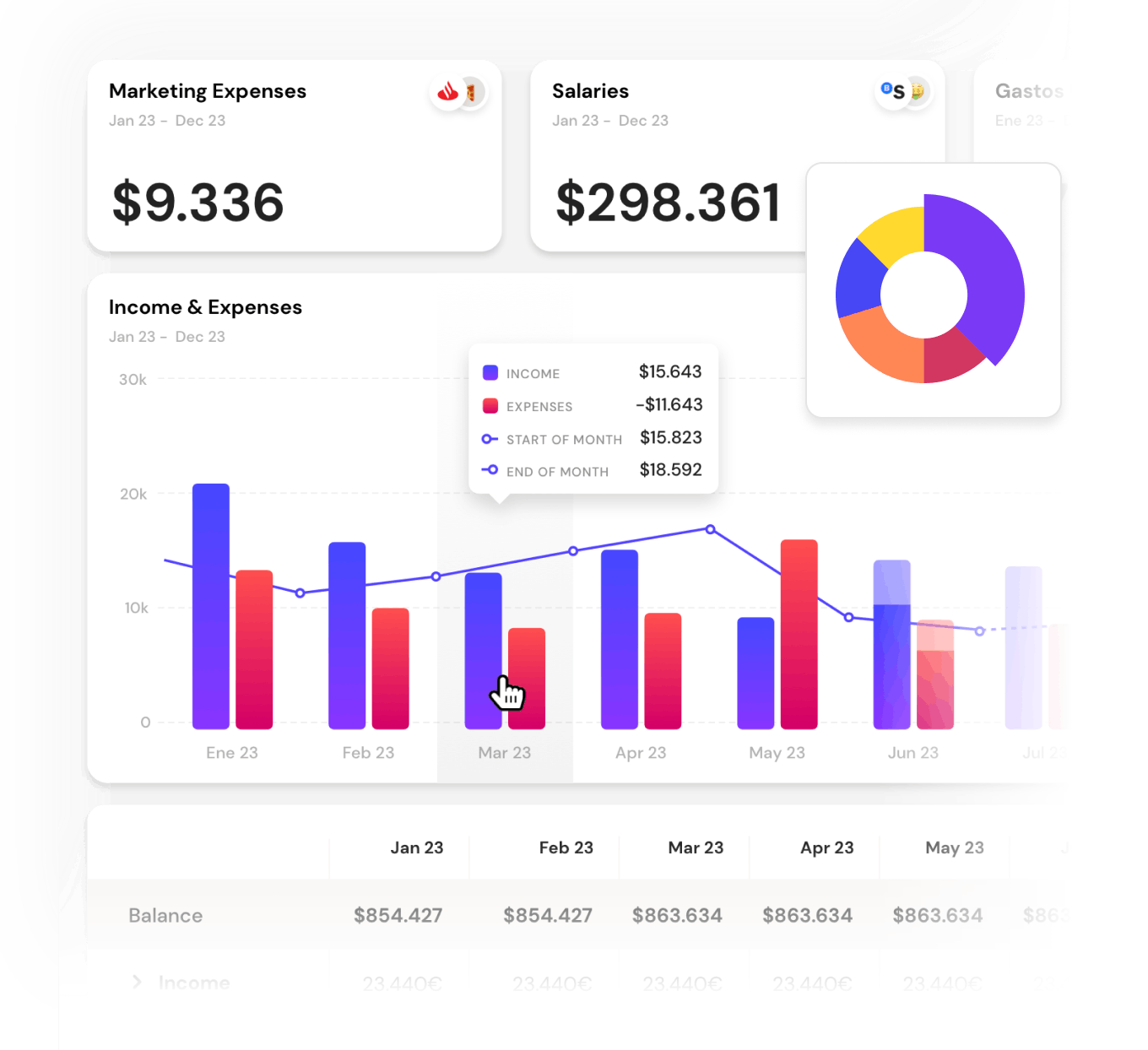

1. Banktrack

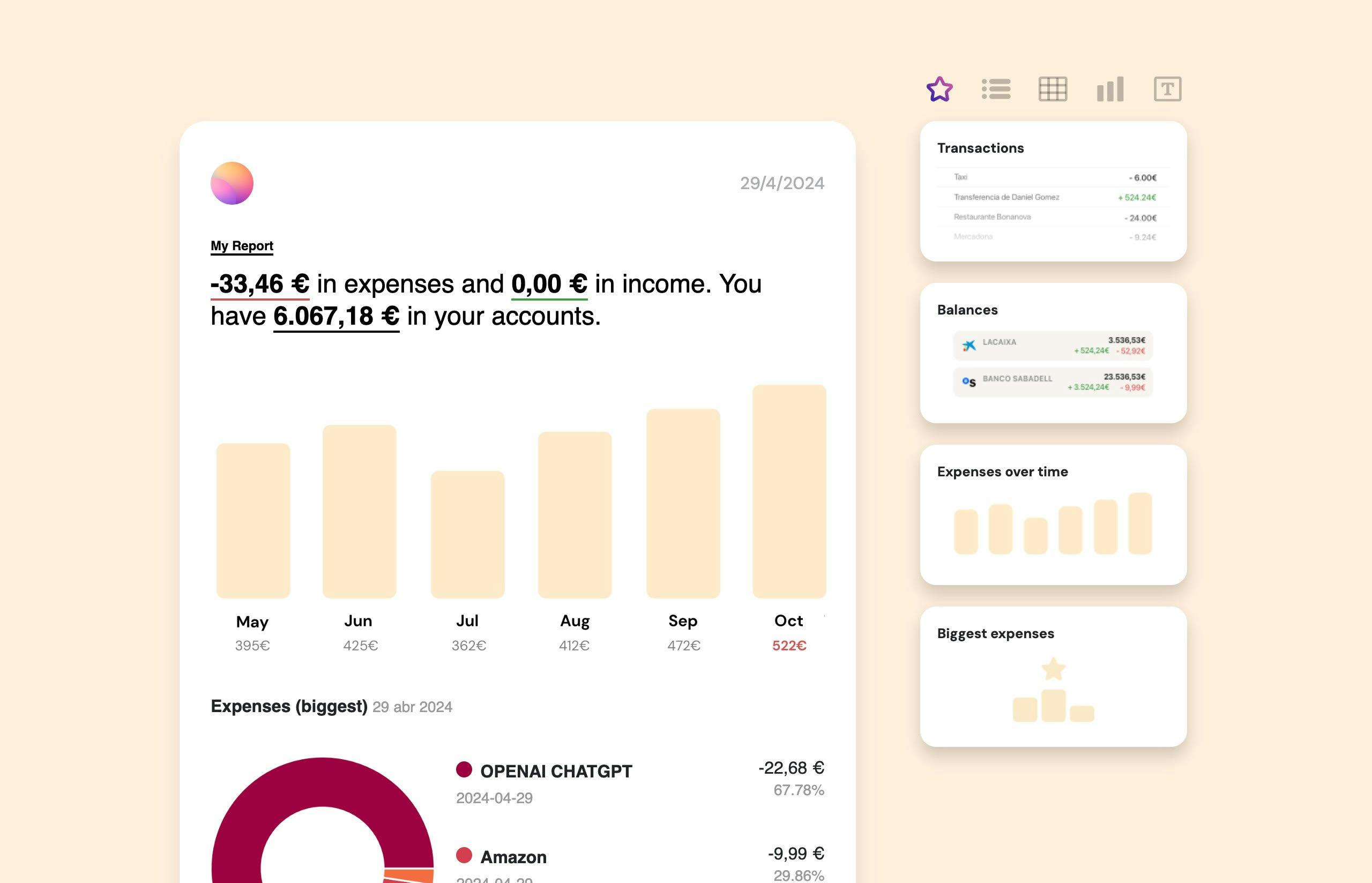

Banktrack stands out as the best cash management software for all types of enterprises.

Users can effectively access real-time financial information thanks to its customizable dashboards and flexible categorization options, which also allow for accurate tracking of income and expenses.

Businesses can easily make informed decisions and stay in constant control of their finances with the help of personalized reports and alerts.

Key Features:

- Personalized dashboards

- Integration with multiple bank accounts and products

- Customizable spending metrics

- Automated alerts and reports

- Affordable pricing starting at €16.58 per month

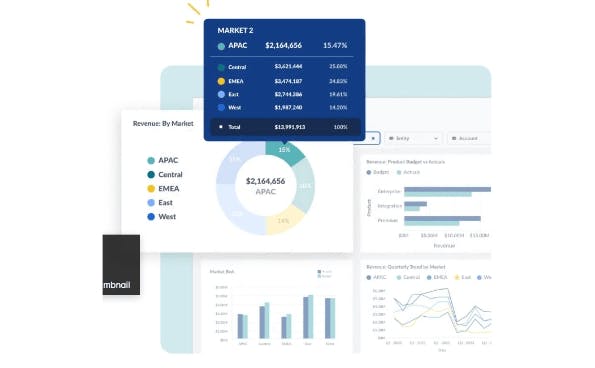

2. Cube

With Cube, users can access real-time financial information thanks to its customizable dashboards and flexible categorization options, which also allow for accurate tracking of income and expenses.

Businesses can also make informed decisions and stay in constant control of their finances with the help of Cube's personalized reports and alerts.

- Automated data consolidation

- Sharable planning templates

- Customizable dashboards and reports

- Scenario planning and analysis

- Bidirectional Excel and Google Sheets integration

- Approval workflow

- Drill-throughs and audit trails

- User-based controls

- Centralized formulas and KPIs

3. Vena Solutions

Vena's Cash Flow Management Software has several key features designed to streamline financial operations for businesses of all sizes.

Overall, Vena offers a comprehensive solution tailored to meet the diverse needs of modern financial teams.

- Excel Integration

- Knowledgeable Support

- Flexible Reporting

- Cloud-Based with Mobile Support

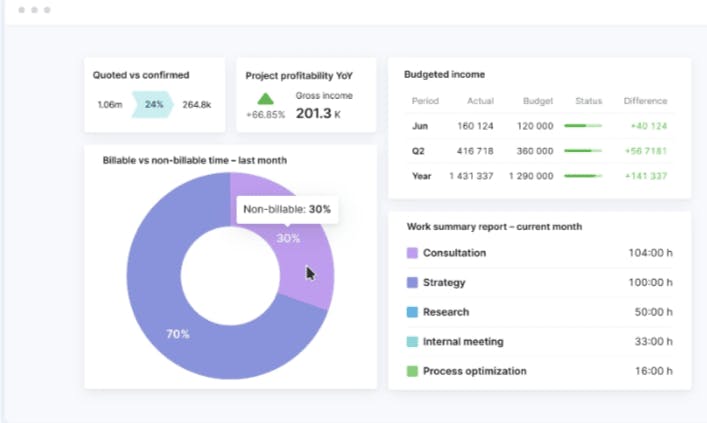

4. Scoro

Scoro combines cash flow management with project management, sales tracking, and invoicing.

Although the basic version might not have as many advanced financial features as the higher-tier plans, upgrading gives you access to many tools that can help you grow and streamline your business.

Important characteristics:

- All-inclusive tools for managing businesses

- Monitoring the sales pipeline and project management

- Managing suppliers and billing

- Options for customized reporting

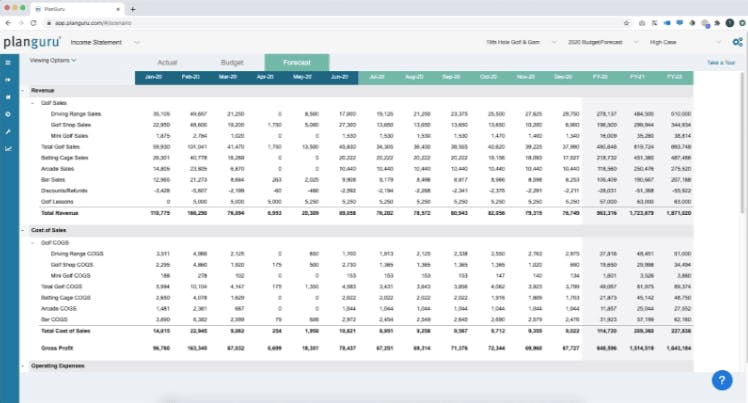

5. PlanGuru

PlanGuru offers budgeting and forecasting capabilities, giving businesses the ability to analyze complex financial data and make informed decisions about their business.

Users can gain valuable insights into their cash flow and optimize their financial processes by integrating with QuickBooks and Excel.

Important characteristics:

- Tools for forecasting and budgeting

- Integration with Excel and QuickBooks Educational materials for users

- 30-day money-back guarantee and a 14-day complimentary trial

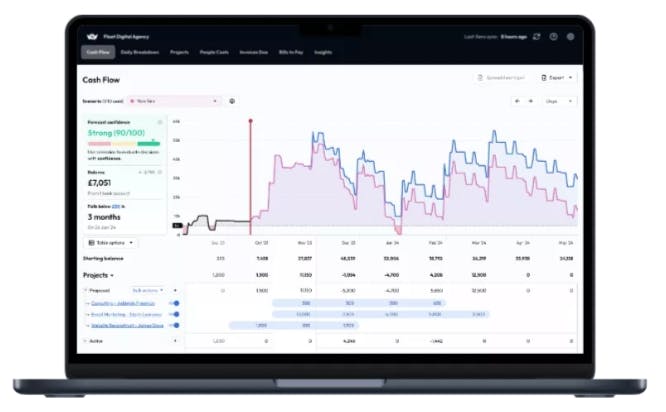

6. Float

Float simplifies cash flow management with its user-friendly interface and budgeting tools.

To maximize their financial planning, users can create budgets, run different scenarios, and get professional reviews.

For many businesses, Float is a worthwhile investment due to its functionality and ease of use, even though its pricing may be deemed relatively high.

Important characteristics:

- Forecasting and budgeting made simpler

- Clear and simple user interface

- Multiple user capabilities

- Options for expert review of premium plans

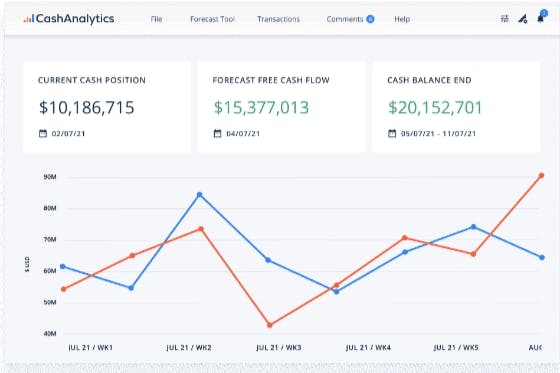

7. CashAnalytics

CashAnalytics specializes in cash flow forecasting and tracking for mid-market businesses, offering automated solutions to streamline financial processes.

Larger businesses will find the software invaluable due to its multi-currency support and advanced analytics, even though the pricing may be a little on the higher side.

Important characteristics:

- Support for multiple currencies

- Sophisticated analytics for predicting cash flow

- Tracking transactions automatically

- Customized options for mid-market companies

What is a cash flow management software

An effective cash flow management software serves as the cornerstone of financial stability for businesses of all sizes.

From tracking expenses to forecasting future cash flows, these tools offer a wide range of functionalities aimed at optimizing financial processes.

The impact of a good cash flow management software

Using the right cash flow management software might help you like an analytics contractor can have many benefits for businesses, ranging from improved efficiency to enhanced decision-making capabilities.

Let's explore some of the ways in which this software can positively impact your financial operations:

Enhanced cash visibility

Gain visibility into your cash flow with real-time dashboards and customizable reports.

Track transactions, monitor account balances, and identify trends effortlessly, giving you the power to make data-driven decisions with confidence.

Optimized working capital

By streamlining invoicing processes and optimizing payment cycles, cash flow management software helps businesses unlock trapped cash and improve working capital efficiency.

This ensures adequate liquidity to fund daily operations and strategic initiatives.

Reduced financial risks

Identify and mitigate financial risks effectively with advanced risk assessment tools and predictive analytics.

By proactively addressing potential cash flow challenges, businesses can be sure they are ready against liquidity crises and unexpected problems.

Improved decision making

Access to accurate and up-to-date financial data enables stakeholders to make informed decisions promptly.

Whether it's allocating resources, negotiating terms with suppliers, or identifying investment opportunities, a cash flow management software provides the insights you need to start those strategic growth initiatives.

Step-by-step explanation of cash flow calculation

To calculate cash flow, we first add up all the income. This includes sales, investment returns, and other revenues.

Then, all you need to do is subtract all expenses, such as production costs, salaries, and payments to suppliers.

The formula is simple: Cash Flow = Total Income - Total Expenses.

Voilà! That's how you get your company's cash flow. It's the snapshot of your liquidity.

Practical examples of cash flow calculation

- Let's consider a bakery that has $10,000 in income and $6,000 in expenses for a month. Its cash flow is $4,000.

- Or, think about an online store with $15,000 in income and $10,000 in expenses. The cash flow is $5,000.

These examples demonstrate how cash flow reflects the amount of cash available after covering expenses.

How a cash flow management software helps in cash flow management

A cash flow management software offers various features that streamline cash flow management for entrepreneurs, including:

- Real-Time Control: Sync your bank accounts and customize views of income and expenses.

- Data Export: Easily search for and export transactions to Excel.

- Automatic Categorization: Define criteria to automatically categorize expenses and income.

- Customizable Financial Reports: Create reports with an intuitive "drag and drop" editor.

- Instant Notifications: Receive personalized alerts about your financial situation via various channels such as Email, WhatsApp, or SMS.

- Information Sharing: Securely share financial data without the need to provide banking credentials.

These tools give entrepreneurs the power to have more rigorous and real-time control over their cash flow, facilitating informed financial decision-making.

Choosing the right cash flow management software

Choosing the best cash flow management software for your business is very important if you want to guarantee its financial stability and growth.

Here are some key factors to consider when making your decision:

- Scalability: ensure that the software can accommodate your business's growth and evolving needs. Look for solutions that offer escalable features and pricing plans to support your expansion.

- Ease of use: opt for a user-friendly interface that simplifies navigation and promotes adoption across your team. Intuitive design and seamless integration with existing systems can improve a lot your productivity and efficiency.

- Integration capabilities: imagine having to manually integrate all your data. Check whether the software integrates with your existing accounting systems, banking platforms, and other essential tools.

- This ensures smooth data syncronization and workflow automation, eliminating manual data entry and reducing errors.

- Customization options: look for a software that allows for customization of dashboards, reports, and alerts to align with your business's unique requirements. Flexible categorization options and personalized metrics enable tailored insights and actionable decision-making.

- Security measures: prioritize platforms that employ robust security protocols to safeguard sensitive financial data. Features such as data encryption, multi-factor authentication, and regular security audits mitigate the risk of unauthorized access or breaches.

- Customer support: evaluate the level of customer support offered by the software provider, including availability, responsiveness, and expertise. Access to knowledgeable support representatives can expedite issue resolution and maximize the value of your investment.

By considering these factors you can confidently choose the best cash flow management software to optimize your financial processes.

Frequently Asked Questions - FAQs

How does cash flow management software differ from accounting software?

Cash flow management software primarily focuses on monitoring and optimizing cash inflows and outflows in real-time, whereas accounting software encompasses broader financial functions such as bookkeeping, payroll, and tax compliance.

Is cash flow management software suitable for small businesses?

Yes, many cash flow management software solutions cater to the unique needs of small businesses, offering scalable features and affordable pricing plans tailored to their requirements.

Can cash flow management software integrate with existing accounting systems?

Absolutely! Most modern cash flow management software platforms are designed to seamlessly integrate with popular accounting systems, allowing for smooth data synchronization and workflow automation. Rest assured that Banktrack has this covered!

What security measures are in place to protect sensitive financial data?

Leading cash flow management software providers employ robust security protocols, including data encryption, multi-factor authentication, and regular security audits, to safeguard sensitive financial information from unauthorized access or breaches. Banktrack prioritizes user security by employing authorized and audited banking data providers approved by the Bank of Spain. Additionally, all transaction data is encrypted to ensure the confidentiality and security of users' financial information.

Can cash flow management software help in identifying opportunities for cost savings?

Absolutely! By analyzing historical spending patterns and identifying areas of inefficiency, cash flow management software can pinpoint opportunities for cost savings and process optimization, ultimately enhancing profitability.

Share this post

Related Posts

Top 7 bank trackers in Austria to manage your finances

Explore the top 7 bank tracker apps in Austria for 2024. Easily manage budgets, track expenses, and gain control over your finances with these essential tools.Best 7 Anaplan alternatives in 2024

Regardless of the size of your company, selecting the best cash management software is essential. Find the top 7 alternatives for Anaplan here.Amplify Gains with Financial Leverage

Financial leverage is the magical tool that lets you borrow money to make even more money. Let us show you how.

Try it now with your data

- Your free account in 2 minutes

- No credit card needed