Top 5 Bank Trackers in Ireland

- 5 Best Bank Trackers in Ireland

- 1. Banktrack

- 2. Revolut

- 3. N26

- 4. Emma

- 5. Yolt

- What is a Bank Tracker?

- Why Use a Bank Tracker in Ireland?

- 1. Avoid Overdraft Fees and Penalties

- 2. Detect Fraud Early

- 3. Better Budget Management

- 4. Track Multiple Accounts in One Place

- 5. Set and Achieve Financial Goals

- Key Features to Look for in a Bank Tracker

- 1. Real-Time Alerts

- 2. Customizable Budgets

- 3. Security Features

- 4. Cross-Platform Access

- 5. Multiple Account Integration

- 6. Goal-Setting Tools

- How to Choose the Right Bank Tracker for You

- 1. Your Financial Needs

- 2. Number of Accounts

- 3. Budget

- 4. Ease of Use

- 5. Security

- Get the Best Bank Tracker in Ireland

These are the top 5 bank trackers in Ireland:

- Banktrack

- Revolut

- N26

- Emma

- Yolt

Managing your finances is an important part of ensuring long-term financial health.

Whether you want to track your day-to-day expenses, stay within your budget, or keep an eye on multiple accounts, a bank tracker can be a game-changer.

In Ireland, bank trackers are increasingly becoming popular as tools to simplify the process of managing money.

In this guide, we’ll explore how bank trackers work, the best options available in Ireland, and how you can use these tools to stay in control of your finances.

We’ll also explain why Banktrack is the top choice for both personal and business financial management.

5 Best Bank Trackers in Ireland

Now that you know why bank trackers are useful, let’s look at some of the best options available in Ireland, starting with the top choice, Banktrack.

1. Banktrack

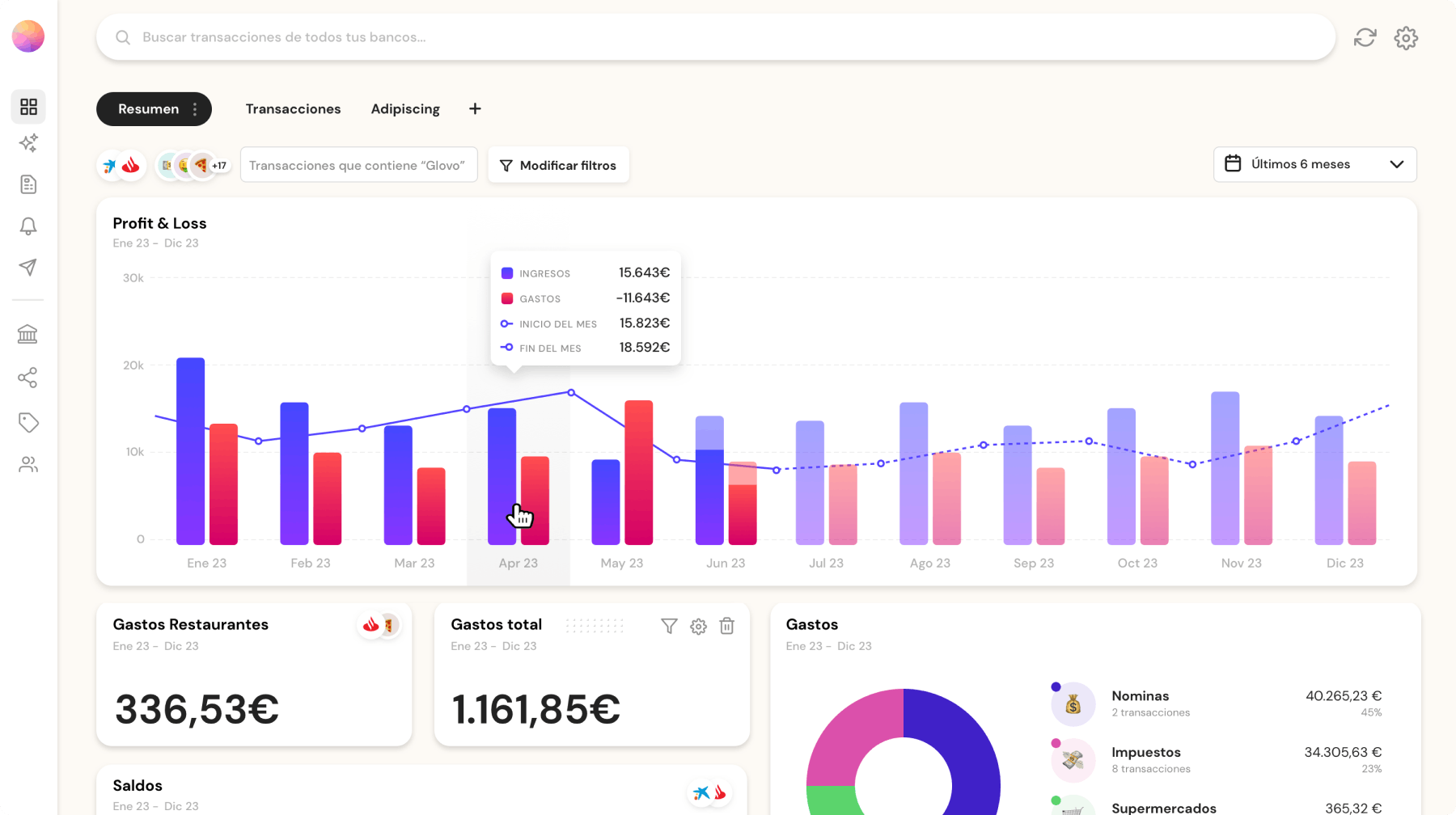

Banktrack is a highly rated expense tracking app in Ireland, offering a range of powerful features that make managing your finances easy and efficient.

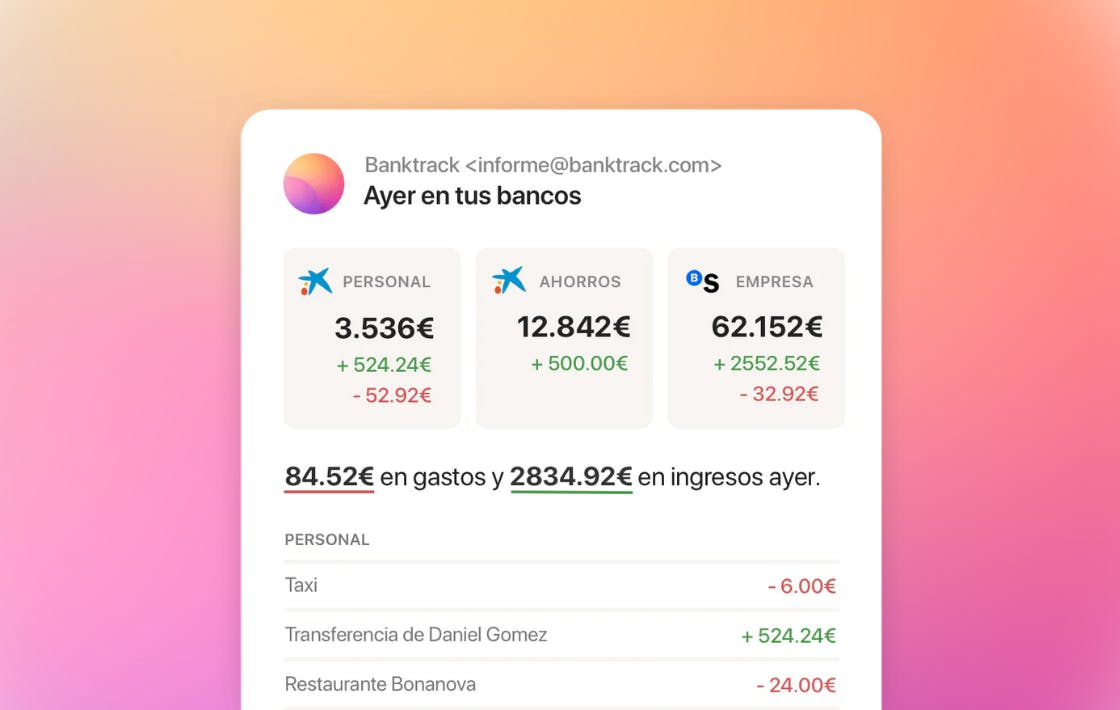

Its real-time tracking, customizable dashboards, and seamless integration with multiple banks make it a top choice for both individuals and businesses.

Key Features:

- Customizable Dashboards: Banktrack lets you personalize your financial dashboard to focus on what matters most to you, whether it’s tracking expenses, monitoring savings, or setting financial goals. You can tailor your view to see the most relevant information at a glance.

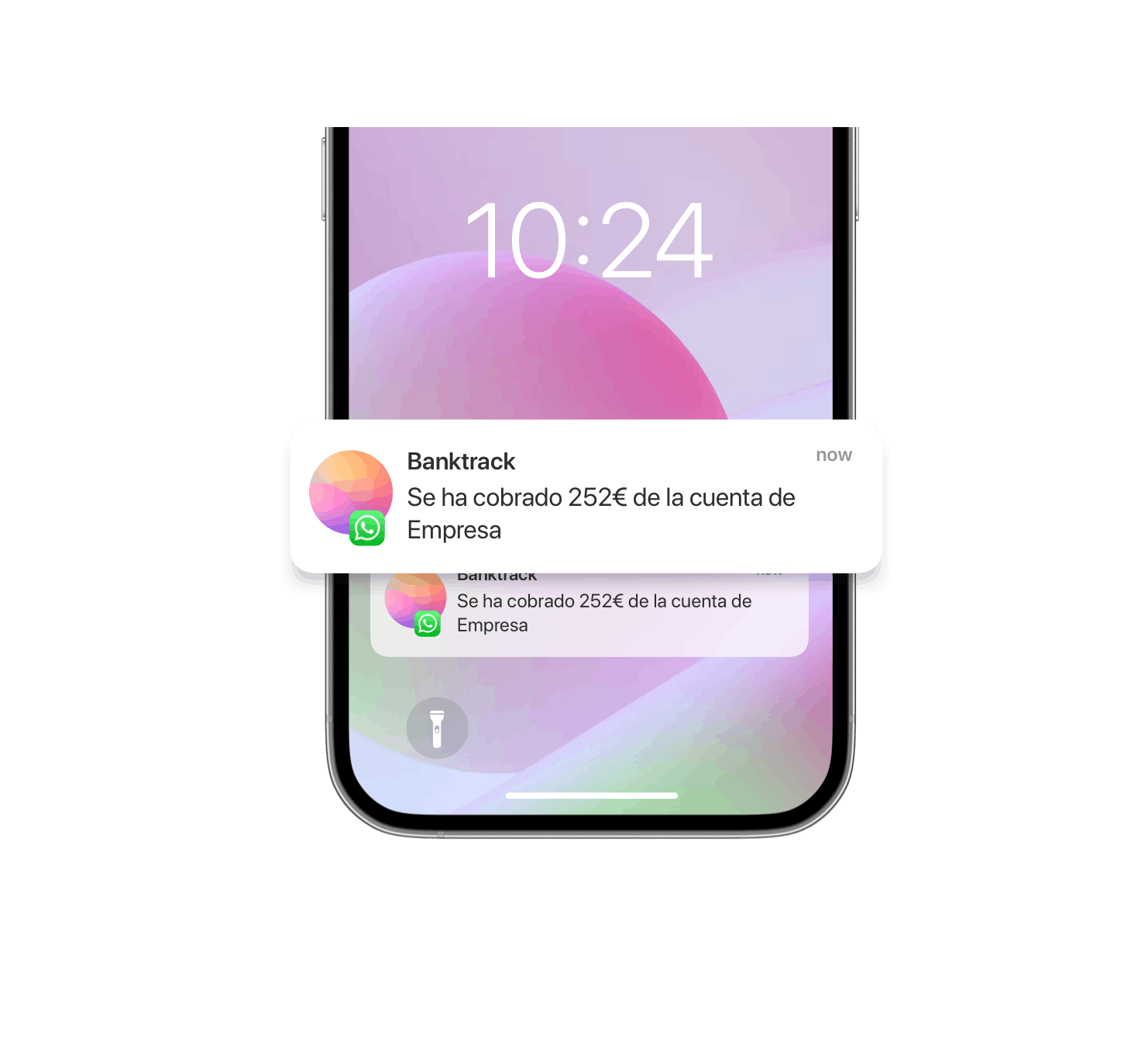

- Real-Time Alerts: You’ll receive notifications through your preferred platform (WhatsApp, SMS, email, or Slack) about important account activity, such as low balances, upcoming payments, or unusual transactions.

- Integration with Multiple Banks: Banktrack connects with over 120 banks, including major Irish banks, so you can easily sync your accounts and get a comprehensive view of your finances.

- Spending Limits and Budgeting: Set spending limits for different categories, like groceries, entertainment, and bills. Banktrack will alert you if you’re getting close to your limit, helping you stay within your budget.

- Automated Reports: Generate detailed financial reports that can be customized and sent via WhatsApp, email, or other platforms. This is especially useful for businesses or anyone who needs to keep track of expenses.

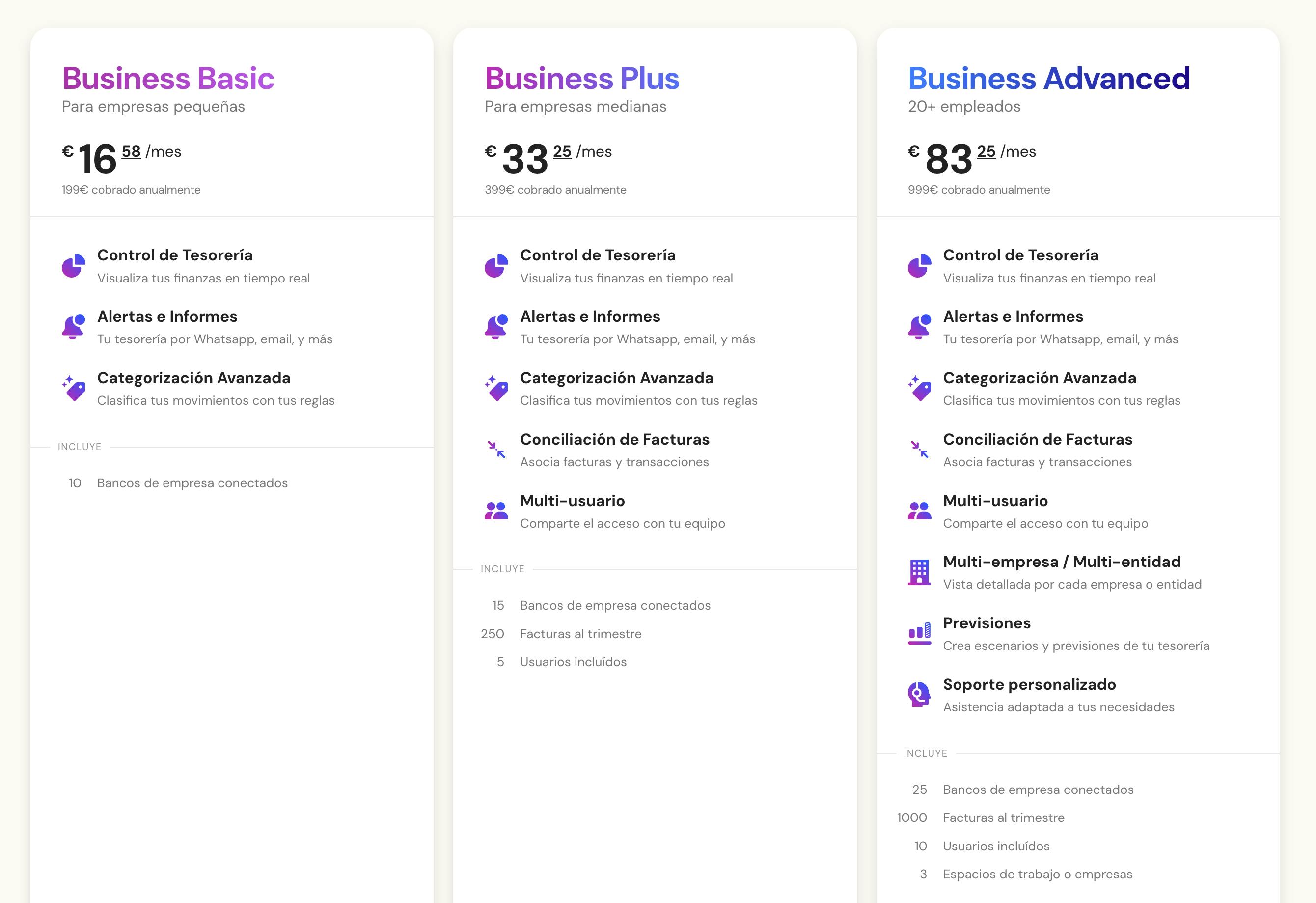

- Affordable Pricing: With pricing starting at €16.58 per month, Banktrack offers great value for individuals and businesses looking for a comprehensive financial management solution.

Why Banktrack is the Best Bank Tracker in Ireland

Banktrack excels because of its advanced features, ease of use, and seamless bank integration.

Its real-time alerts, spending controls, and goal-setting tools make it the best option for anyone looking to stay in control of their finances.

Whether you're managing personal accounts or business expenses, Banktrack offers the flexibility and tools you need to succeed. Its affordable pricing and strong security features also make it a top choice in Ireland.

2. Revolut

Revolut is a popular digital banking app that also offers strong tracking features.

With Revolut, you can track your spending, set budgets, and even use the app to manage your savings and investments.

It’s particularly popular for its easy-to-use interface and currency exchange features, making it ideal for those who travel frequently.

- Pros: User-friendly app, real-time notifications, easy currency exchange.

- Cons: Revolut is not a full-fledged bank, which may be a limitation for some users.

3. N26

N26 is another great option for tracking your finances in Ireland.

This digital bank offers powerful budgeting tools, real-time notifications, and easy-to-read spending summaries. It’s perfect for those looking for a simple and effective way to manage their money.

- Pros: No monthly fees, strong budgeting tools, real-time updates.

- Cons: Limited to N26 account holders, fewer investment tracking features.

4. Emma

Emma is a cash management software that helps you track your bank accounts, credit cards, and even investments.

It connects to major Irish banks and provides a complete overview of your finances, helping you budget better and save more.

- Pros: Great for tracking multiple accounts, detailed budgeting tools, real-time balance updates.

- Cons: Some advanced features are only available with the premium subscription.

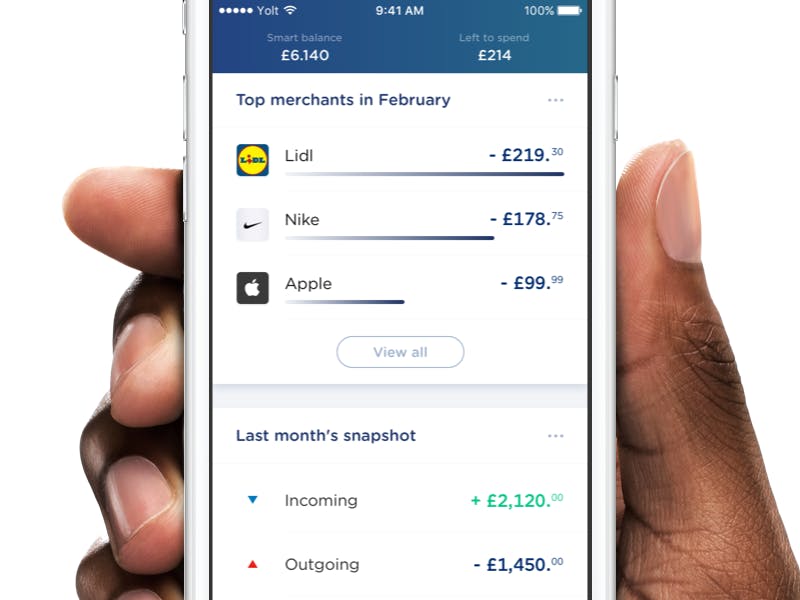

5. Yolt

Yolt is a free bank tracker that connects to your Irish bank accounts and helps you manage your spending and savings. It offers budgeting tools, spending insights, and real-time transaction tracking.

- Pros: Free to use, integrates with major Irish banks, easy to set up.

- Cons: Limited customization options, lacks advanced investment tracking.

What is a Bank Tracker?

A bank tracker is an app or software that connects to your bank accounts to give you real-time updates on your financial activity. It tracks your spending, income, savings, and even investments.

Bank trackers provide insights into how you manage your money by categorizing transactions and alerting you to significant account changes, like when your balance is low or a bill is due.

With a bank tracker, you get a complete overview of your financial health, whether you’re managing one bank account or multiple accounts across different financial institutions.

It simplifies the way you monitor your finances and helps you make informed financial decisions.

Why Use a Bank Tracker in Ireland?

There are several benefits to using a bank tracker in Ireland, whether you’re trying to stick to a budget, save for a big purchase, or simply monitor your financial habits.

Here are some key reasons why a bank tracker can be a valuable tool:

1. Avoid Overdraft Fees and Penalties

One of the most common financial problems people face is overdrawing their accounts, which often leads to costly overdraft fees.

With a bank tracker, you can set up real-time notifications that alert you when your balance is running low, helping you avoid those expensive penalties.

2. Detect Fraud Early

Fraud and unauthorized transactions are, unfortunately, a reality that many people face. A bank tracker helps by giving you real-time updates on all your account activity.

If something looks suspicious, you’ll receive an alert immediately, allowing you to contact your bank and resolve the issue quickly.

3. Better Budget Management

Sticking to a budget can be challenging, but with a bank tracker, it becomes much easier.

By categorizing your transactions and tracking your spending habits, you can see where your money is going and make adjustments to stay on budget.

Many bank trackers also allow you to set spending limits for specific categories, like groceries or entertainment, and notify you when you’re close to reaching those limits.

4. Track Multiple Accounts in One Place

For those who manage multiple accounts, whether personal, joint, or business accounts, a bank tracker allows you to see everything in one place.

This can save you time and give you a complete picture of your financial situation without having to log into different accounts separately.

If you're searching for a tool that works well for both you and your partner, consider using a budget app for couples specifically.

5. Set and Achieve Financial Goals

Whether you’re saving for a holiday, a new car, or an emergency fund, bank trackers help you set financial goals and track your progress.

Some apps even let you automate savings, transferring money into your savings account based on your financial habits.

Key Features to Look for in a Bank Tracker

When choosing a bank tracker in Ireland, certain features can make a big difference in how effectively you manage your finances. Here are some of the key features to look for:

1. Real-Time Alerts

A good bank tracker will notify you in real-time whenever there is significant activity on your account, like a large transaction or a low balance.

This allows you to stay updated and take immediate action if something unexpected happens.

2. Customizable Budgets

Look for a bank tracker that allows you to customize your budget categories to fit your unique financial situation.

Whether you want to track spending on groceries, dining, or transportation, having the flexibility to create your own categories is important.

3. Security Features

Since your bank tracker will have access to sensitive financial data, it’s crucial that it includes strong security features like encryption, two-factor authentication, and data protection.

This ensures that your information remains safe and secure.

4. Cross-Platform Access

It’s important to be able to access your bank tracker from any device, whether it’s your smartphone, tablet, or computer.

This ensures that you can check your finances anytime and anywhere.

5. Multiple Account Integration

If you have multiple bank accounts, credit cards, or even investment accounts, a bank tracker should be able to integrate them all into one platform.

This gives you a complete view of your financial health.

6. Goal-Setting Tools

A bank tracker that helps you set and track savings goals is especially useful for long-term financial planning.

Some trackers even offer visual tools that show your progress, helping you stay motivated.

How to Choose the Right Bank Tracker for You

Choosing the right bank tracker depends on your financial needs and goals. Here are a few things to consider when deciding which tool is best for you:

1. Your Financial Needs

Do you need a simple tool to help you manage your daily expenses, or are you looking for something more advanced that can track investments and help with long-term financial planning?

Depending on your goals, certain bank trackers may be a better fit than others.

2. Number of Accounts

If you have multiple bank accounts, make sure the bank tracker you choose can integrate all of them.

Some apps are limited to certain types of accounts or financial institutions.

3. Budget

Some bank trackers are free, while others require a monthly or yearly subscription.

If you’re looking for more advanced features, it might be worth investing in a premium app like Banktrack. However, if you just need basic tracking, a free option like Yolt might be enough.

4. Ease of Use

Make sure the app you choose is easy to use and navigate.

Some tools offer advanced features, but they can be overwhelming if you’re looking for something simple.

5. Security

Always ensure that the bank tracker you choose has strong security features like encryption and two-factor authentication to keep your financial data safe.

Get the Best Bank Tracker in Ireland

Using a bank tracker in Ireland is a great way to take control of your finances, avoid unnecessary fees, and stay on top of your spending.

With options like Banktrack, Revolut, and Emma, you can find a tool that fits your needs, whether you’re managing personal or business accounts.

Banktrack, in particular, stands out for its customizable features, real-time notifications, and affordable pricing, making it the best choice for both individuals and businesses in Ireland. Start tracking your finances today and take the first step toward reaching your financial goals!

Share this post

Related Posts

Top 7 bank trackers in Austria to manage your finances

Explore the top 7 bank tracker apps in Austria for 2024. Easily manage budgets, track expenses, and gain control over your finances with these essential tools.The Best Bank Tracker in the UK

Find the best bank tracker in the UK to simplify managing your money, track spending, and keep your budget on course with ease.

Try it now with your data

- Your free account in 2 minutes

- No credit card needed