Top 6 best budget apps for couples

- Why are Budget Apps Useful?

- 3 Benefits of Using Budget Apps

- 1. Banktrack: The Best Budget App for Couples

- 2. Scoro as a Budgeting App for Couples

- 3. Float

- 4. Pulse

- 5. QuickBooks

- 6. Vena Solutions

- Choosing the Right App

- Key Features to Look For

- Frequently Asked Questions - FAQs

- How do budget tracking apps benefit couples?

- Are budget tracking apps secure?

- Can budget tracking apps help couples save money?

- Do budget tracking apps sync in real-time?

- Are budget tracking apps customizable?

- Can budget tracking apps help reduce financial conflicts in relationships?

Looking for the best budget app for couples?

- Banktrack

- Scoro

- Float

- Pulse

- Quickbooks

- Vena Solutions

Managing finances can be challenging enough on your own, let alone as a couple.

However, with the right budgeting app for couples, it can transform into a seamless and even enjoyable task.

This article dives deep into the world of budget apps tailored specifically for couples, providing insights, recommendations, and expert tips to help couples navigate their financial journey together.

Why are Budget Apps Useful?

Maintaining financial harmony is vital in any relationship, and a budget app can serve as a very good tool in achieving this goal.

Let's just say it keeps you away from having to be mentally involved in budgeting, which can avoid many problems in a relationship.

With shared expenses, savings goals, and different spending habits, couples often find it challenging to manage their finances effectively.

This is why a budget app tailored for couples provides a centralized platform to monitor expenses, set joint financial goals, and communicate openly about money matters.

3 Benefits of Using Budget Apps

- Improved Communication: These apps facilitate transparent communication about finances, fostering trust and understanding between partners.

- Shared Accountability: Couples can hold each other accountable for spending habits and progress towards financial goals.

- Financial Transparency: All financial information is readily accessible, promoting transparency and reducing conflicts related to money management.

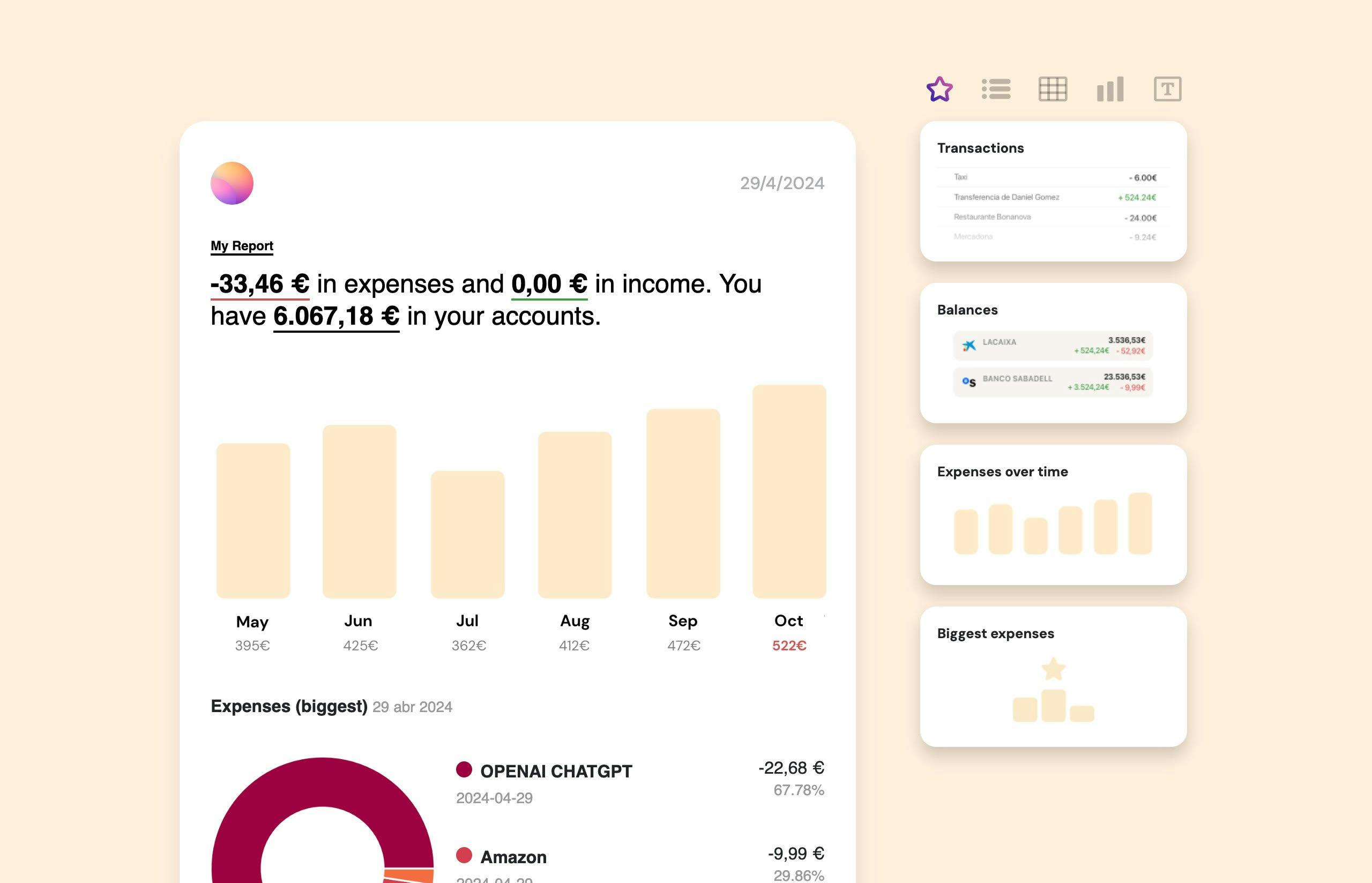

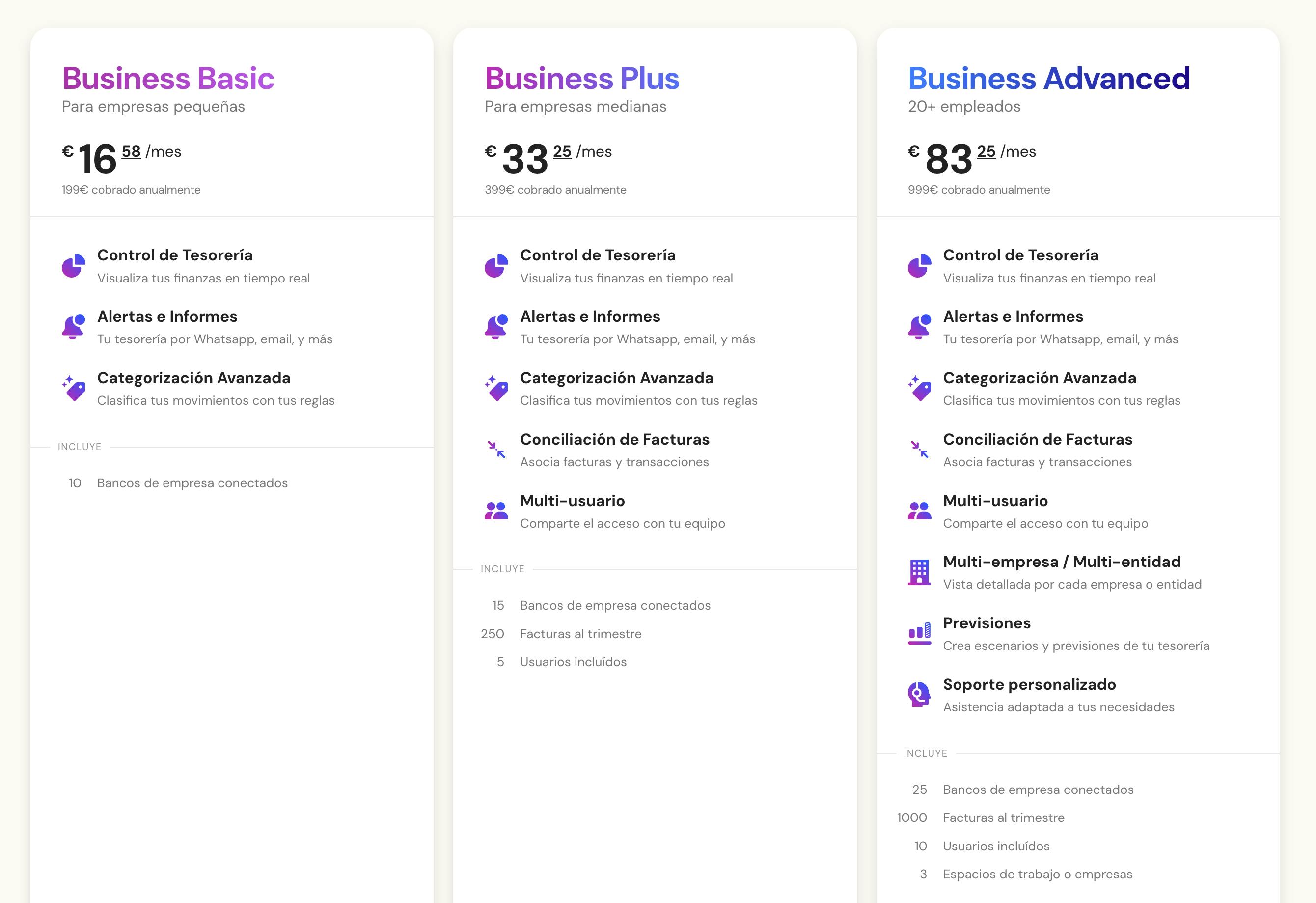

1. Banktrack: The Best Budget App for Couples

Banktrack is the best budget tracking app for couples this 2024.

Let us walk you through the reasons:

- A budget tracking app offers customizable dashboards that integrate views from different bank accounts, companies, and financial products, providing users with quick access to essential financial information.

- With a budget tracking app, users can create and customize categories for revenues expenses, allowing for detailed tracking and understanding of their financial activities.

- The app also provides personalized reports and alerts, enabling users to stay informed about their expenses via various channels such as WhatsApp, SMS, email, Slack, or Telegram.

- In addition, Banktrack is the best app to link all bank accounts, because it bank aggregator allows users to sync with over 120 banks, offering both Open Banking (PSD2) and Direct Access connections for efficient and secure integration of financial data.

- Pricing: this app offers various plans with competitive pricing, catering to the needs and budgets of individuals, small businesses, and enterprises.

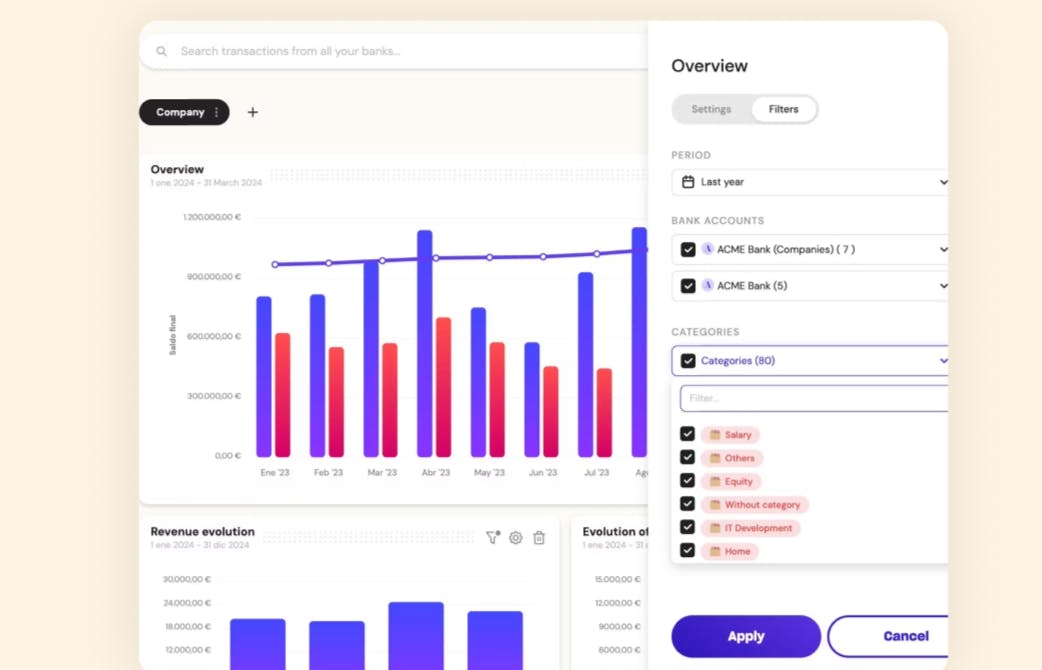

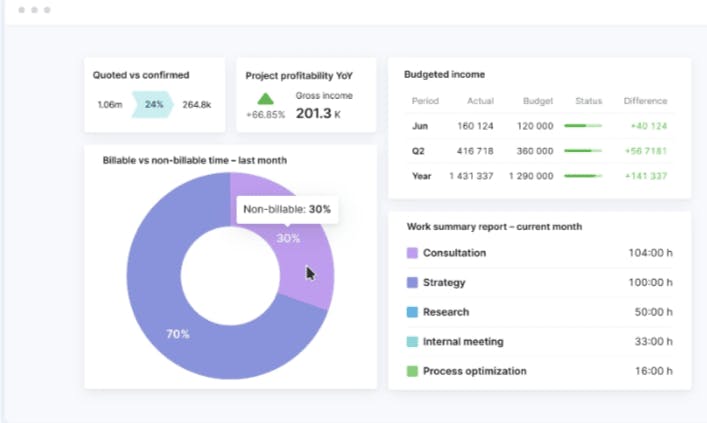

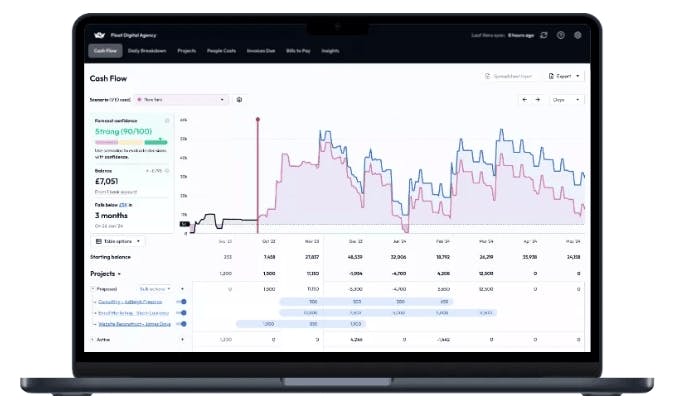

2. Scoro as a Budgeting App for Couples

Scoro offers quite a complete solution for couples, combining cash flow management with project management, sales tracking, and even invoice reconciliation.

While the basic version may lack advanced financial functionalities, upgrading to higher-tier plans provides access to a wealth of tools designed to streamline operations and drive growth.

Key Features:

- Comprehensive business management tools

- Project management and sales pipeline tracking

- Supplier management and invoicing

- Customizable reporting options

3. Float

Float’s intuitive interface and tools for budgeting make budgeting easier for couples.

To maximize their financial planning, users can create budgets, run different scenarios, and get professional reviews.

For many couples, Float is a worthwhile investment due to its functionality and ease of use, even though its pricing may be deemed relatively high.

Key Features:

- Simplified budgeting and forecasting

- Clean and intuitive interface

- Multi-user functionality

- Expert review options for premium plans

4. Pulse

Pulse offers couples effective tracking features, including the ability to categorize cash flow by event, project or other categories they choose to create.

Because of its simplicity and ease of use, Pulse is a good option for couples, even though some advanced features might require more expensive subscriptions.

Key Features:

- Cash flow organization by customer and project

- Simple and intuitive interface

- Integration with accounting software

- Affordable pricing starting at $29 per month

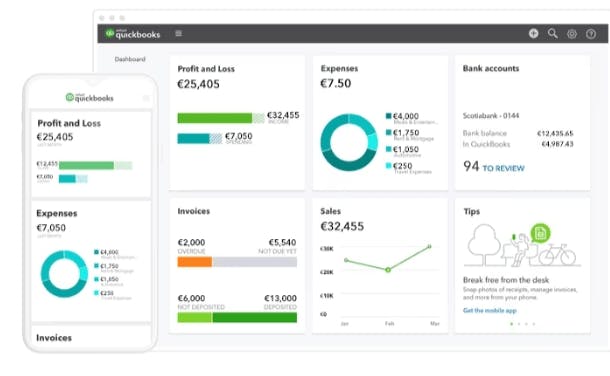

5. QuickBooks

QuickBooks is another popular app for budget tracking, which is well-known for its user-friendliness and basic cash flow management features.

Although QuickBooks might not have all the sophisticated features of specialized cash management software, it is still a good option for couples.

Key Features:

- Basic cash flow management tools

- Invoicing and bill payment capabilities

- Financial reporting and analysis

- Seamless integration with accounting software

6. Vena Solutions

Vena Solutions utilizes Excel to provide cash management, financial planning, and expense tracking solutions.

Vena's extensive feature set and adaptable reporting options make it an invaluable resource for couples, even though certain users may find the learning curve for some tools to be quite steep.

Key Features:

- Cloud-based financial planning and cash management

- Excel-based interface for familiar user experience

- Knowledgeable support staff and online training materials

- Flexible reporting options and mobile support

Choosing the Right App

Selecting the best budget tracking app for couples requires careful consideration of various factors to ensure it aligns with their specific needs and preferences.

Key Features to Look For

Are you wondering which factors should you consider?

- Shared Access: The app should allow both partners to access and update financial information collaboratively.

- Customizable Categories: Flexible budget categories cater to diverse spending habits and preferences.

- Real-Time Syncing: Ensures that both partners have up-to-date financial information at their fingertips.

- Goal Tracking: Enables couples to set and track joint financial goals, such as saving for a vacation or a down payment.

If you have not found any suitable option, we recommend you check out this article on the best Anaplan alternatives which has a thorough analysis of recommendations.

Frequently Asked Questions - FAQs

How do budget tracking apps benefit couples?

Budget tracking apps promote financial transparency, shared accountability, and improved communication between partners.

Are budget tracking apps secure?

Yes, reputable budget tracking apps employ advanced security measures to safeguard users' financial data.

Can budget tracking apps help couples save money?

Absolutely! By providing insights into spending habits and facilitating goal tracking, these apps empower couples to save more effectively.

Do budget tracking apps sync in real-time?

Many budget tracking apps offer real-time syncing, ensuring that both partners have access to the latest financial information.

Are budget tracking apps customizable?

Yes, most budget tracking apps allow users to customize budget categories and set personalized financial goals.

Can budget tracking apps help reduce financial conflicts in relationships?

By promoting transparency and facilitating open communication about finances, budget tracking apps can mitigate financial conflicts in relationships.

Share this post

Related Posts

Best 8 Cashflow Monitoring Apps in 2025

Discover the best 8 cashflow monitoring apps in 2025 that help businesses track income, expenses, and liquidity in real timeThe 6 Best SaaS Financial Projections for Founders in 2025

Discover six top SaaS financial-projection platforms tailored for founders, enabling accurate subscription modelling, scenario planning, and metric tracking to drive scalable growth in 2025.7 Best Financial Projection Apps in 2025

Discover the top financial-projection apps that simplify scenario modelling, integrate with your accounting data, and help your business forecast revenue, expenses and growth with confidence.

Try it now with your data

- Your free account in 2 minutes

- No credit card needed