The Best Bank Tracker in the UK

- 5 Best Bank Trackers in the UK

- 1. Banktrack

- 2. Monzo

- 3. Starling Bank

- 4. Emma

- 5. Yolt

- What is a Bank Tracker?

- Why Use a Bank Tracker in the UK?

- 1. Avoid Overdrafts and Penalties

- 2. Identify Fraud Quickly

- 3. Better Budgeting

- 4. Track Multiple Accounts in One Place

- 5. Financial Goal Setting

- 6 Key Features to Look for in a Bank Tracker

- 1. Real-Time Notifications

- 2. Customizable Budgets

- 3. Security Features

- 4. Cross-Platform Access

- 5. Multiple Account Integration

- 6. Goal-Setting Tools

- How to Choose the Right Bank Tracker for You

- 1. Your Financial Needs

- 2. Number of Accounts

- 3. Budget

- 4. Ease of Use

- 5. Security

The best bank tracker in the UK is amongst this list:

- Banktrack

- Monzo

- Starling Bank

- Emma

- Yolt

Keeping track of your financial health is super important, we know that.

Whether you're managing personal accounts or business finances, having a clear and organized view of your money is essential.

A bank tracker can be a powerful tool to help you manage your accounts, track expenses, monitor income, and even set financial goals. If you're based in the UK, there are several great options available that can help you stay on top of your finances.

This guide will explore everything you need to know about bank trackers in the UK and how they work to the best options available. We'll also cover key features to look for, how to use a bank tracker, and the benefits of integrating one into your financial routine.

5 Best Bank Trackers in the UK

Let’s explore some of the best bank trackers available in the UK

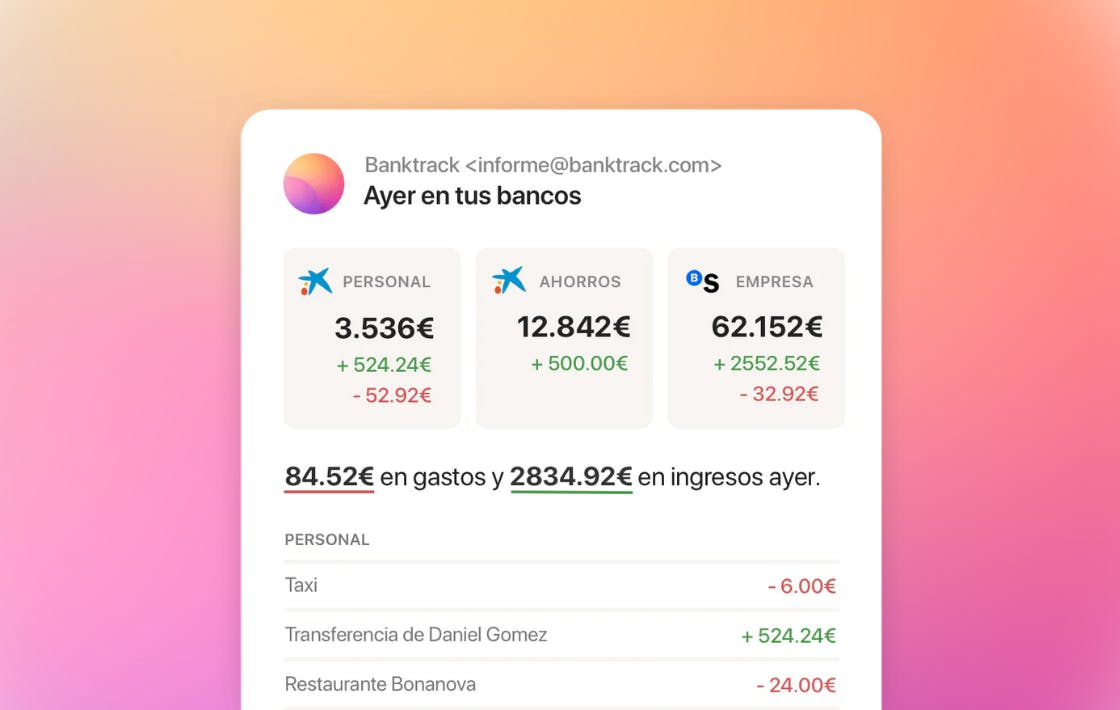

1. Banktrack

Banktrack is the top expense tracker app in the UK.

Its customizable dashboards, real-time notifications, and seamless integration with over 120 banks make it the best tool for both personal and business use.

When managing your finances, you need a tool that does more than just track expenses, it should seamlessly integrate with your bank accounts, offer strong security, and include advanced features to enhance your financial management.

Banktrack is that solution, being the best expense tracker software with bank sync features in the UK.

Key Features:

- Customizable Dashboards: With Banktrack, you can create personalized dashboards that show exactly the financial information you need. Whether you want to focus on income, spending, or savings goals, Banktrack allows you to tailor your view for better control.

- Integration with Multiple Banks: Banktrack connects with over 120 banks, including both traditional banks and neobanks in the UK. Its seamless integration makes it the best app to link all bank accounts as it ensures that all your accounts, personal or business, are accessible in one place.

- Real-Time Alerts: Banktrack sends real-time notifications to your preferred platform, whether that’s WhatsApp, SMS, Slack, or email. You’ll get instant alerts when your balance is low, you’re nearing a spending limit, or there’s unusual account activity.

- Spending Controls: You can set spending limits in different categories, such as groceries, dining, and utilities. If you’re nearing your limit in any category, Banktrack will notify you to help you stay on budget.

- Automated Reports: Banktrack makes it easy to generate and customize financial reports, which can be sent via WhatsApp, email, or other platforms. This is especially useful for businesses or freelancers needing to keep track of their expenses.

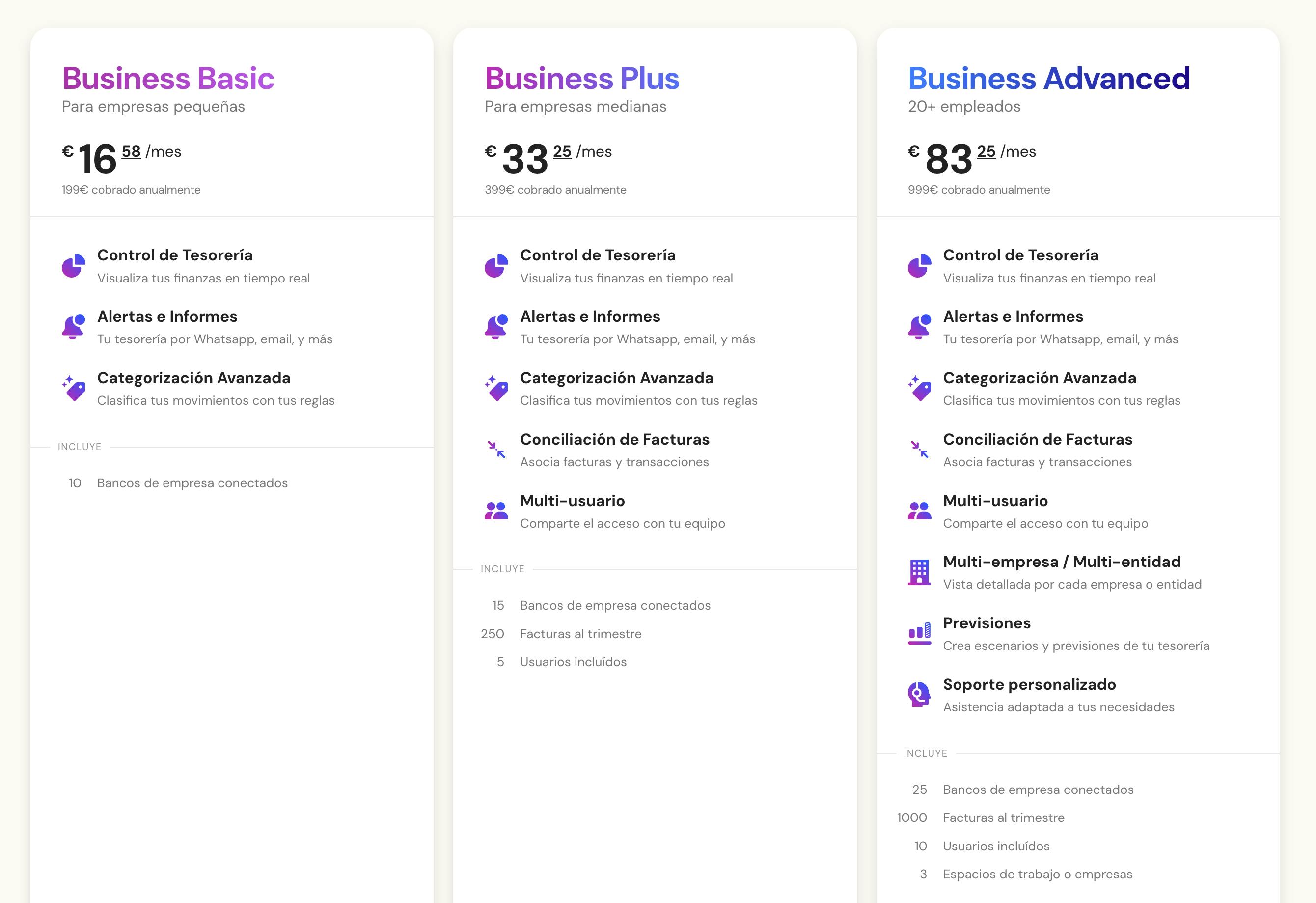

- Affordable Pricing: Banktrack offers a cost-effective solution with plans starting at €16.58 per month. Its affordable pricing makes it accessible for individuals and businesses alike.

Why Banktrack is the Best Bank Tracker in the UK

Banktrack excels in both functionality and usability. It offers features like customizable spending limits, personalized financial reports, and real-time alerts across multiple platforms.

Its user-friendly interface, coupled with strong security features, ensures that your data is protected while giving you complete control over your finances.

Whether you're an individual looking to improve your personal budgeting or a business owner managing multiple accounts, Banktrack offers the flexibility and tools you need.

2. Monzo

Monzo is a popular digital bank in the UK that also offers great bank tracking features.

With Monzo, you can track your spending in real-time, set budgets, and get instant notifications for every transaction.

It also allows you to set saving goals and offers easy-to-read breakdowns of your spending habits.

- Pros: Real-time notifications, user-friendly app, integrates with other financial services.

- Cons: Only available to Monzo account holders, limited investment tracking options.

3. Starling Bank

Starling Bank is another top choice for UK residents. It’s a fully digital bank with built-in spending tracking features.

Starling allows you to categorize your spending, set up savings goals, and track your financial habits in real-time.

- Pros: No monthly fees, excellent for real-time expense tracking, integrates with other financial tools.

- Cons: Limited to Starling Bank account holders, fewer customization options compared to standalone trackers.

4. Emma

Emma is a dedicated financial management app that helps you track your bank accounts, credit cards, and investments all in one place.

It’s compatible with major UK banks and offers features like budgeting tools, spending insights, and real-time balance updates.

- Pros: Great for tracking multiple accounts, strong budgeting features, integrates with UK banks.

- Cons: Some features are locked behind a premium subscription.

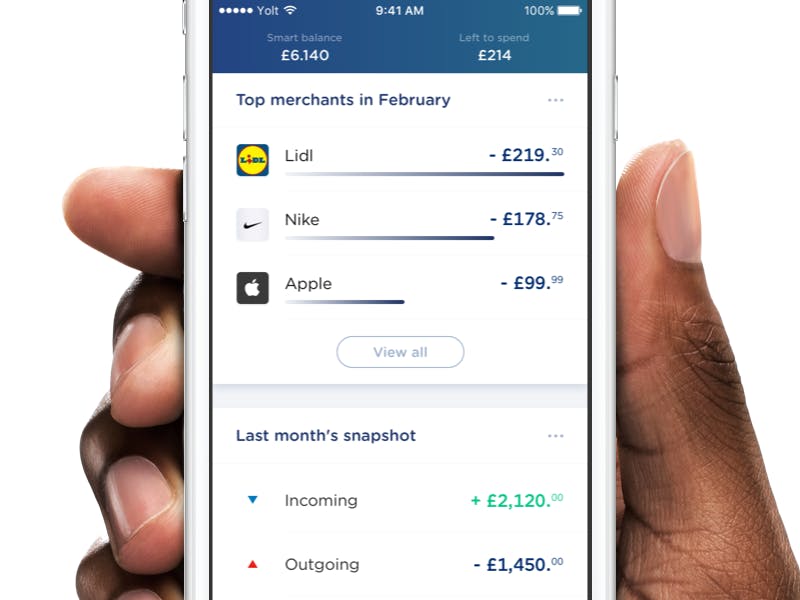

5. Yolt

Yolt is a free bank tracker that connects to your UK bank accounts and helps you manage your spending and savings.

It offers tools to set budgets, track transactions, and even compare utility bills to help you save money.

- Pros: Free to use, easy to set up, helps reduce unnecessary spending.

- Cons: Limited investment tracking, lacks advanced customization.

What is a Bank Tracker?

A bank tracker is a tool, often an app or online platform, that connects with your bank accounts to give you an overview of your financial activity. It provides real-time insights into your spending habits, income, savings, and investments, all in one place.

Bank trackers can categorize transactions, track budgets, and send alerts about important account activities, like when your balance is low or a bill is due.

Bank trackers are especially helpful for people who have multiple accounts or manage both personal and business finances.

They allow you to see all your financial information in one dashboard, making it easier to understand where your money is going and how to improve your financial health.

Why Use a Bank Tracker in the UK?

There are plenty of reasons to use a bank tracker in the UK, from gaining better control over your finances to spotting fraud early. Here are some of the top benefits:

1. Avoid Overdrafts and Penalties

One of the key benefits of using a bank tracker is that it helps you avoid overdraft fees and other penalties.

With real-time balance updates and low-balance alerts, you can ensure that you don’t accidentally spend more than you have, which could lead to expensive fees from your bank.

2. Identify Fraud Quickly

Unfortunately, fraud is an issue that many people face, and it's important to catch it early.

A bank tracker helps by monitoring your account activity in real-time. If something suspicious shows up, like a transaction you didn’t authorize, you’ll get an instant alert, allowing you to act quickly.

3. Better Budgeting

If you've ever struggled to stick to a budget, a bank tracker can help.

By tracking your spending and categorizing transactions, you can see exactly where your money is going each month.

Many bank trackers also allow you to set spending limits for different categories like groceries, entertainment, and bills, helping you stay on track.

4. Track Multiple Accounts in One Place

For those managing multiple accounts, whether personal, business, or joint accounts, a bank tracker allows you to see everything in one place.

This can be especially helpful for freelancers, small business owners, or anyone managing both personal and business finances.

If you are interested in the small business version of the software, you can read all about cash management software for small businesses here.

5. Financial Goal Setting

Bank trackers aren't just for managing day-to-day expenses; they also help you set and achieve financial goals.

Whether you're saving for a holiday, paying off debt, or building an emergency fund, a bank tracker lets you set goals and monitor your progress.

Want to set financial goals with your partner? You can now do that with a budget app for couples.

Some trackers even automate savings by transferring money into your savings account based on your spending habits.

6 Key Features to Look for in a Bank Tracker

When choosing a bank tracker in the UK, there are certain features you should keep in mind to ensure you’re getting the most out of your tool. Here are some of the key features to look for:

1. Real-Time Notifications

A bank tracker that offers real-time notifications is crucial for staying updated on your finances.

Whether it’s a low balance alert, a spending limit notification, or a suspicious transaction alert, real-time updates help you stay in control of your money.

2. Customizable Budgets

The ability to create custom budget categories based on your personal spending habits is a must-have feature.

Whether it’s groceries, dining out, or bills, having personalized categories helps you track your spending more accurately.

3. Security Features

When dealing with financial information, security is non-negotiable.

Look for a bank tracker that offers encryption, two-factor authentication, and other security measures to protect your data.

4. Cross-Platform Access

Your bank tracker should be accessible across all your devices, smartphone, tablet, and desktop. This ensures that you can check your finances whenever and wherever you need to.

5. Multiple Account Integration

If you have multiple bank accounts, credit cards, or even investment accounts, a good bank tracker will allow you to sync them all into one platform. This gives you a complete view of your financial health.

6. Goal-Setting Tools

For long-term financial planning, having a bank tracker that helps you set and track savings goals is incredibly useful.

Some apps even offer progress tracking and visualizations to help keep you motivated.

How to Choose the Right Bank Tracker for You

Choosing the right bank tracker depends on your personal financial goals and how you like to manage your money. Here are a few things to consider when making your decision:

1. Your Financial Needs

Are you primarily looking for a budgeting app, or do you need something more advanced that also tracks investments?

Depending on your financial goals, certain bank trackers may be a better fit. For example, wealth tracking apps are great in giving you a broader idea of where your money is being spent and allocated.

2. Number of Accounts

If you have multiple accounts, like personal, business, and joint accounts, make sure the bank tracker you choose can integrate all of them.

Some apps are limited to certain types of accounts or banks.

3. Budget

Some bank trackers are free, while others charge a monthly or yearly subscription.

If you’re willing to pay for more advanced features, it might be worth investing in a premium app. However, if you just need basic tracking, a free option could be more than enough.

4. Ease of Use

If you prefer a simple, user-friendly interface, choose a bank tracker that’s easy to navigate.

Some apps offer advanced features but can be overwhelming to use if you’re looking for something straightforward.

5. Security

Make sure the bank tracker you choose offers strong security features, like encryption and two-factor authentication, to keep your data safe.

Share this post

Related Posts

5 best bank reconciliation software in 2025

Discover the top 5 bank reconciliation software for 2025. Streamline your financial processes, automate reconciliations, and ensure accurate financial management with the best tools available. Find out how to choose the right software for your business.Best 7 bank trackers in the Netherlands

This guide lists the top 7 tools to help you track expenses, monitor accounts, and improve your financial management. Find the perfect tracker to stay on top of your moneyTop 5 Bank Trackers in Ireland

Looking for the best bank trackers in Ireland? Here are the top 5 tools to help you monitor your spending, save money, and manage your budget.

Try it now with your data

- Your free account in 2 minutes

- No credit card needed