Best App to Link All Bank Accounts

- Top 5 Budgeting Apps to Consider

- 1. Banktrack

- 2. YNAB (You Need a Budget)

- 3. Goodbudget

- 4. Simplifi by Quicken

- 5. PocketGuard

- Understanding Your Budgeting Needs

- 5 Key Features to Look For in a App to Link All Bank Accounts

- 1. User Interface and Accessibility

- 2. Expense Tracking and Categorization

- 3. Budget Customization and Flexibility

- 4. Automated Transactions and Syncing

- 5. Goal Setting and Tracking

- Conclusion

These is the top 5 best app to link all bank accounts:

- Banktrack - Your app to link all bank accounts

- YNAB

- Goodbudget

- Simplifi by Quicken

- PocketGuard

We understand that budgeting can be complicated, and even the mere mention of the "B" word can be triggering for many individuals.

Moreover, with numerous expenses to track and income sources to manage, we know that finding the right budgeting app can make a world of difference. That is why we are here to help you.

At Banktrack, we have developed a comprehensive guide to help you in understanding and identifying the best budgeting app that fits best with your needs.

Top 5 Budgeting Apps to Consider

After extensive research and analysis, we have identified the following budgeting apps to link bank accounts as the top options in the market:

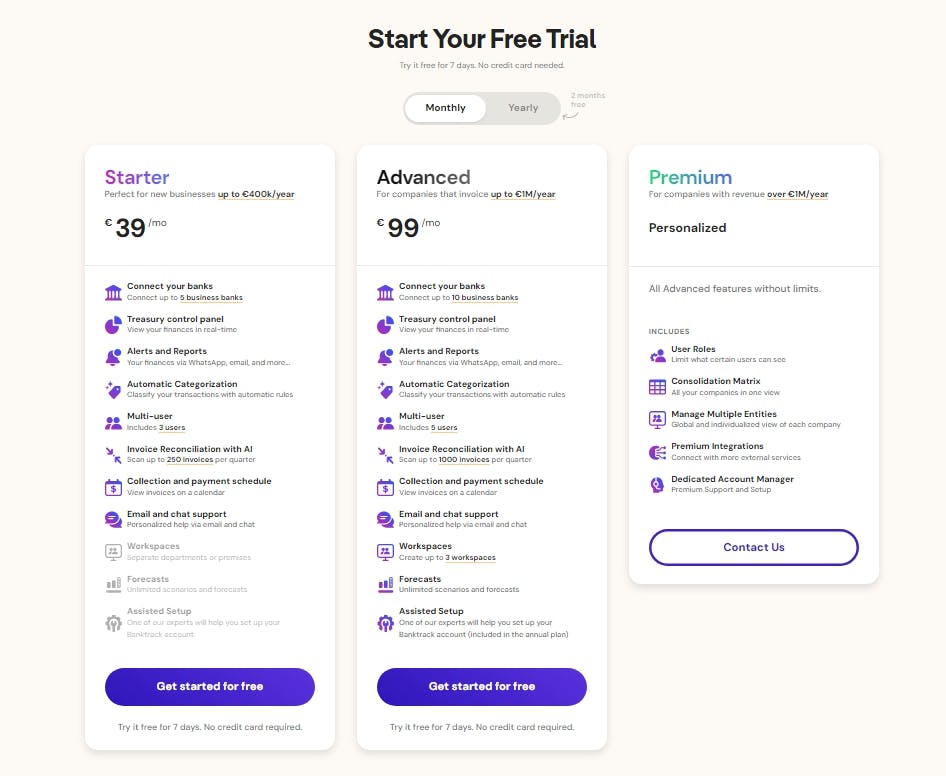

1. Banktrack

Banktrack provides users with a powerful tool to manage their finances effectively, offering convenience, security, and peace of mind.

Do you know why Banktrack is the absolute best app to see all bank accounts?

Let us explain it to you:

Banktrack has a unique bank aggregator feature which is crucial as it allows users to sync more than 120 banks, including both traditional and neobanks, in a highly intuitive manner.

Depending on the bank you wish to sync, Banktrack offers two types of connections:

- Open Banking (PSD2)

- Direct access

These methods ensure efficient and secure integration of your financial data.

Regarding the security of your personal and banking data, Banktrack takes all necessary measures to ensure protection. Here's how:

- Only authorized and audited data providers approved by the Bank of Spain are used.

- Banktrack never has access to perform transactions on your bank accounts; only read access to your data is obtained.

- Your bank passwords are not stored, as the connection process is carried out using a unique access token.

- All transaction data is encrypted in Banktrack's systems, ensuring the confidentiality and security of your financial information.

Cost: And the best part is that you can use Banktrack for as little as €16.5 per month!

Here are all the plans with their respective features:

Our goal is to make your finances no longer a problem for you.

That's why, in our most accessible plan, "Business Basic," we offer the possibility to connect up to 10 bank accounts, something you won't find so easily in other services.

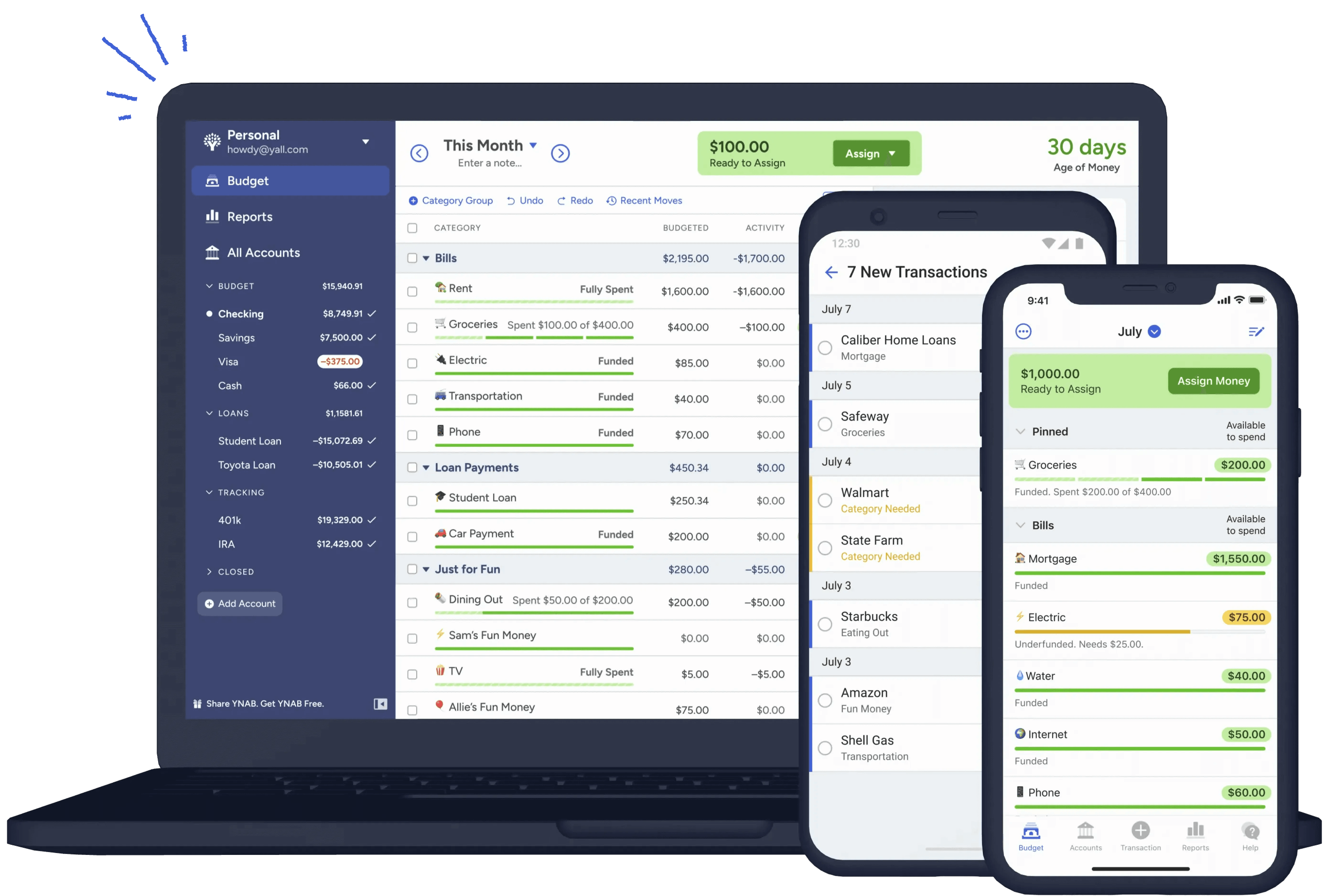

2. YNAB (You Need a Budget)

YNAB is a budgeting app designed to empower users with a proactive approach to managing their finances. It operates on the principle of zero-based budgeting, where every dollar earned is allocated to specific expenses or savings goals.

YNAB encourages users to plan ahead for their financial decisions rather than simply tracking past transactions.

YNAB stands out for its comprehensive budgeting system, syncing capabilities with bank and credit cards, goal setting features, and extensive educational resources.

Cost: YNAB offers a 34-day free trial, after which it costs $99 per year or $14.99 per month. College students who provide proof of enrollment can get 12 months free.

Main Features:

- Zero-based budgeting system

- Syncing with bank and credit cards

- Goal setting

- Customizable spending categories

- Educational resources such as budgeting advice and live workshops

Who's It For: YNAB is ideal for determined budgeters who want hands-on control over their finances. It's suited for individuals looking to get out of debt and build healthy spending habits.

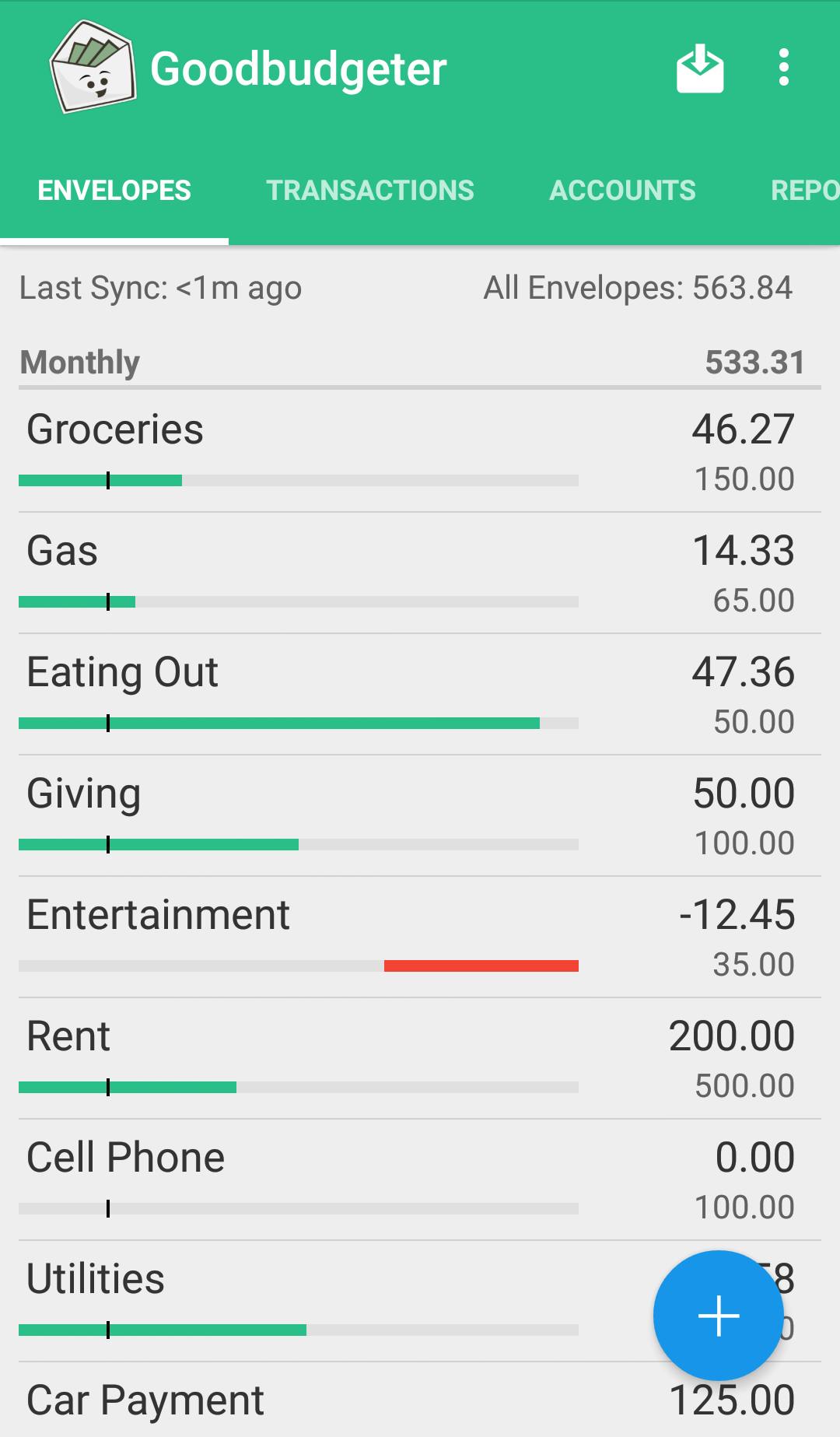

3. Goodbudget

Goodbudget is an app that facilitates digital envelope budgeting, a method where users allocate funds to different spending categories known as "envelopes." This approach helps users prioritize their spending and track their expenses effectively.

Goodbudget is particularly useful for couples who want to manage their finances together, as it allows them to collaborate on budgeting and debt tracking. Goodbudget also provides money management courses and resources to support users in improving their financial literacy.

Cost: Goodbudget offers a free version for 20 envelopes and charges $10 per month (or $80 per year) for unlimited envelopes.

Main Features:

- Digital envelope system

- Couples tracking spending and debt tracking

- Money management courses and resources for users

Who's It For: Goodbudget is tailored for beginner budgeters who are exploring the envelope budgeting method. It's particularly useful for couples looking to manage their finances jointly and prioritize their financial goals together.

If you’re interested in going beyond personal budgeting apps and exploring advanced tools for managing multiple accounts and forecasting cash flow, check out our guide to the best treasury management software.

It covers powerful solutions that help both individuals and businesses optimize liquidity, centralize accounts, and improve financial decision-making.

4. Simplifi by Quicken

Simplifi by Quicken is a budgeting app that offers fully customizable reports based on users' spending, income, and savings.

It provides personalized spending plans that adjust in real time, helping users stay on track with their financial goals. Simplifi syncs with various financial accounts, including bank, credit cards, investments, and loans, allowing for a comprehensive view of finances.

The app also offers educational resources such as blogs, investment research tools, and financial calculators.

Cost: Simplifi by Quicken currently has a 50% off promotion, so it costs $2 per month.

Main Features: Simplifi offers fully customizable reports based on:

- Spending

- Income

- Savings

It syncs with bank, credit cards, investments, and loans, and automatically categorizes spending.

Who's It For: Simplifi by Quicken caters to planners who seek detailed financial insights and real-time adjustments to their spending plans. It's suitable for individuals who want comprehensive financial reports to help in decision-making and goal tracking.

5. PocketGuard

PocketGuard is a budgeting app that simplifies financial management by offering a snapshot of users' spending and available funds. It calculates available spending based on estimated income, upcoming expenses, and savings goals.

PocketGuard alerts users when they are nearing spending limits and tracks net worth over time.

Cost: PocketGuard offers a basic free version and a premium version priced at $12.99 per month or $74.99 per year.

Main Features:

- In “My Pocket" feature calculates available spending based on several factors

- Alerts for nearing spending limits and tracks net worth.

- Security features like major bank-level encryption, PIN codes, and biometrics like Touch ID and Face ID.

Who's It For: PocketGuard is designed for individuals who need accountability and want to prevent overspending. It's suitable for those seeking a simplified budgeting snapshot and alerts for maintaining financial discipline.

Understanding Your Budgeting Needs

Are you looking to track daily expenses, save for a large purchase, or pay off debt?

It is important to assess your financial situation and identify your specific needs and goals before choosing an app.

Understanding your objectives will help narrow down the options and find an app tailored to your requirements.

5 Key Features to Look For in a App to Link All Bank Accounts

When comparing budgeting apps, several key features should be on your radar:

1. User Interface and Accessibility

A user-friendly interface and accessibility across multiple devices is significantly important.

Look for expense managing apps with intuitive navigation and compatibility with both desktop and mobile platforms for seamless access anytime, anywhere.

2. Expense Tracking and Categorization

Efficient expense tracking is the cornerstone of any budgeting app. Opt for apps that allow you to effortlessly categorize expenses, set spending limits, and generate customizable reports to gain insights into your spending patterns.

3. Budget Customization and Flexibility

Every individual has unique financial goals and preferences. Choose a budgeting app that offers flexible budget customization options, allowing you to tailor your budget categories, savings goals, and spending limits according to your specific needs.

4. Automated Transactions and Syncing

Automation can streamline the budgeting process and save you valuable time. Look for a software that can have all banks in one app apps and that support automated transaction imports and syncing with your bank accounts and credit cards to ensure real-time updates and accurate financial data.

5. Goal Setting and Tracking

Setting achievable financial goals is key to staying motivated and on track with your budgeting efforts. Seek out apps that enable you to set savings goals, debt repayment targets, and milestones, with progress tracking features to monitor your financial journey.

And without further due, let's dive into all the options available!

Conclusion

In conclusion, Banktrack is the top choice for linking all bank accounts efficiently.

With its intuitive bank aggregator feature, secure connections, and affordable pricing starting at $16.5 per month, Banktrack offers amazing convenience, security, and affordability.

Compared to other apps, Banktrack stands out for its comprehensive yet user-friendly approach, making it the best option for effortless financial management.

Share this post

Related Posts

Best 8 Cashflow Monitoring Apps in 2025

Discover the best 8 cashflow monitoring apps in 2025 that help businesses track income, expenses, and liquidity in real timeThe 6 Best SaaS Financial Projections for Founders in 2025

Discover six top SaaS financial-projection platforms tailored for founders, enabling accurate subscription modelling, scenario planning, and metric tracking to drive scalable growth in 2025.7 Best Financial Projection Apps in 2025

Discover the top financial-projection apps that simplify scenario modelling, integrate with your accounting data, and help your business forecast revenue, expenses and growth with confidence.

Try it now with your data

- Your free account in 2 minutes

- No credit card needed