Best 8 Cash Flow Management Tools in Norway for 2025

- Best 8 Cash Flow Management Tools in Norway

- 1. Banktrack

- 2. Tripletex

- 3. Visma eAccounting

- 4. PowerOffice Go

- 5. Xledger

- 6. Fiken

- 7. Float

- 8. QuickBooks Online

- How to Choose the Right Cash Flow Tool in Norway

- 7 Best Practices for Cash Flow Management in Norway

- 1. Connect All Financial Accounts

- 2. Use Scenario Forecasting Regularly

- 3. Monitor VAT Obligations in Real Time

- 4. Set Alerts for Critical Events

- 5. Integrate With Your Accountant’s Workflow

- 6. Keep Reports Visual and Action-Oriented

- 7. Review and Adjust Monthly

- Conclusion

These are the best cash flow management tools in Norway:

- Banktrack

- Tripletex

- Visma eAccounting

- PowerOffice Go

- Xledger

- Fike

- Float

- QuickBooks Online

Managing cash flow effectively is essential for every business in Norway, from startups in Oslo to large enterprises with operations across the Nordics.

With strict compliance requirements from Skatteetaten (Norwegian Tax Administration), fluctuating seasonal demand, and the need to plan for VAT and corporate tax payments, having the right cash flow management tool can make the difference between financial stability and liquidity challenges.

In this guide, we review the eight best cash flow management tools for Norwegian businesses in 2025, focusing on features, banking integration, forecasting capabilities, and compliance support.

Best 8 Cash Flow Management Tools in Norway

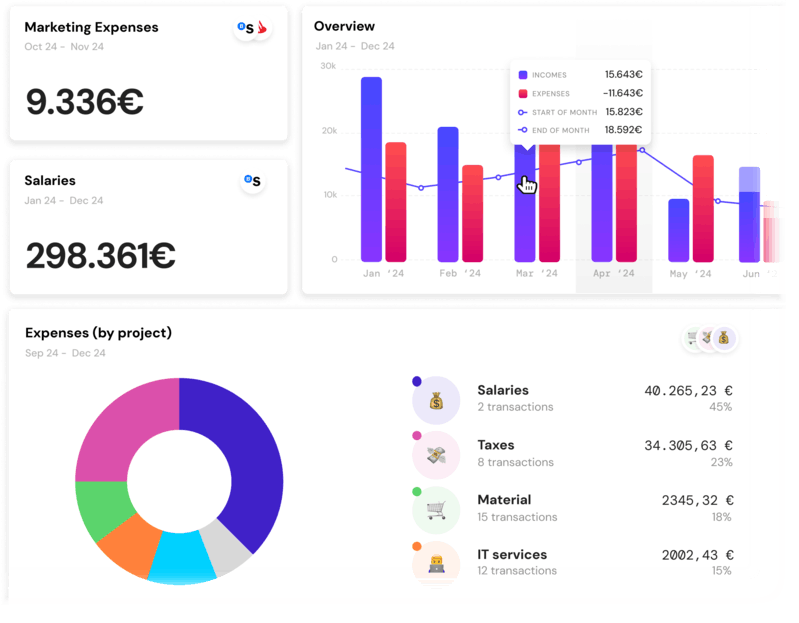

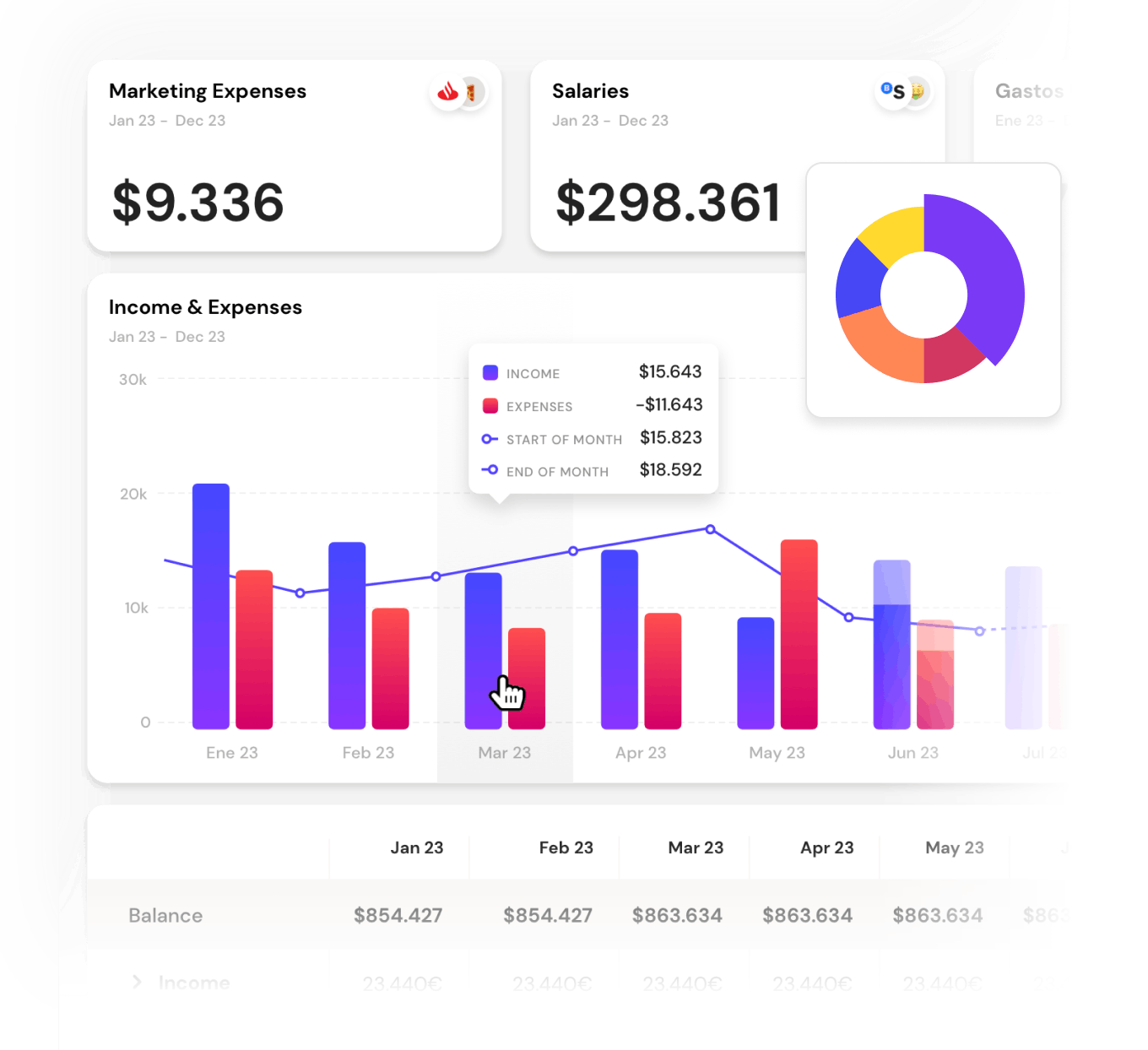

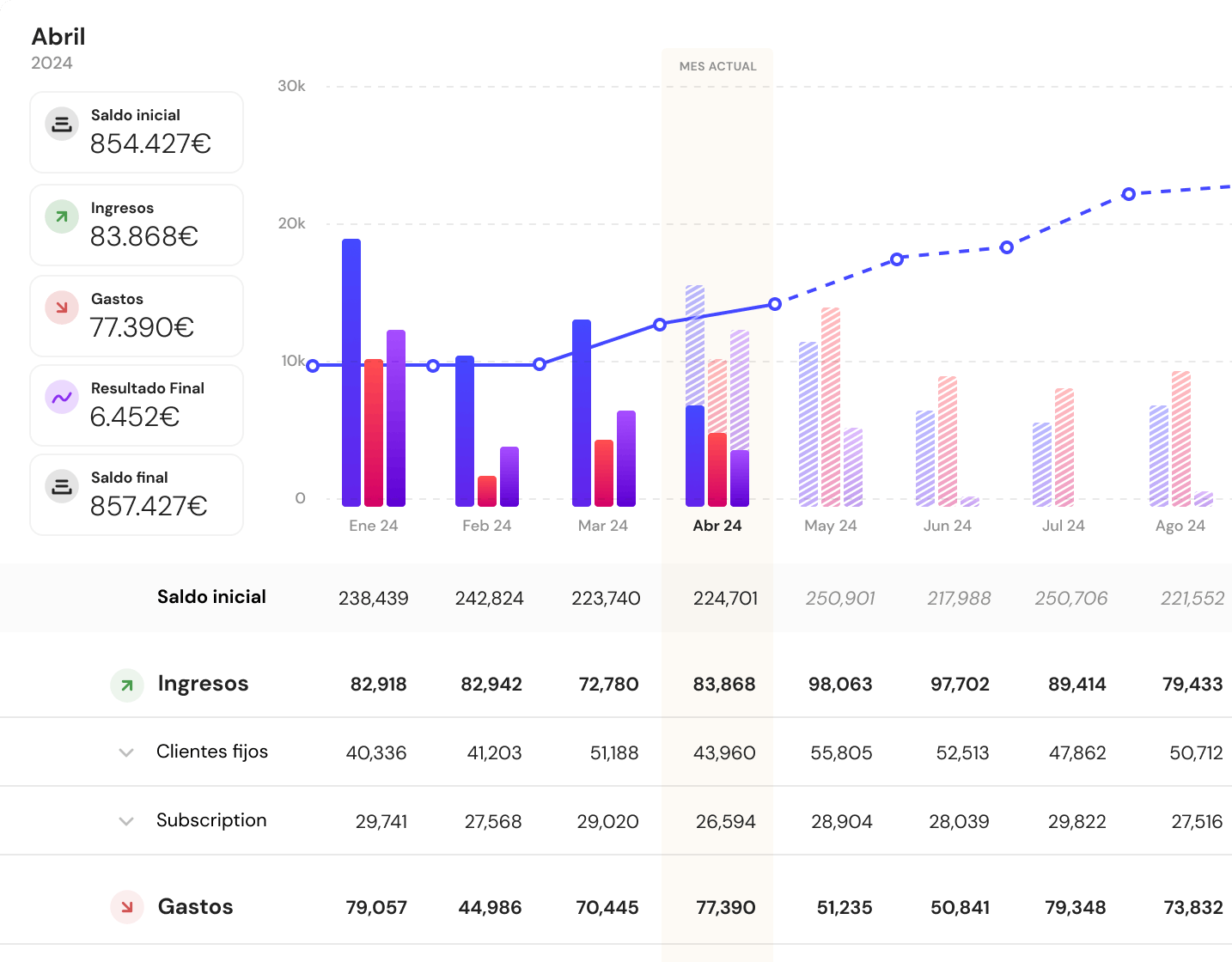

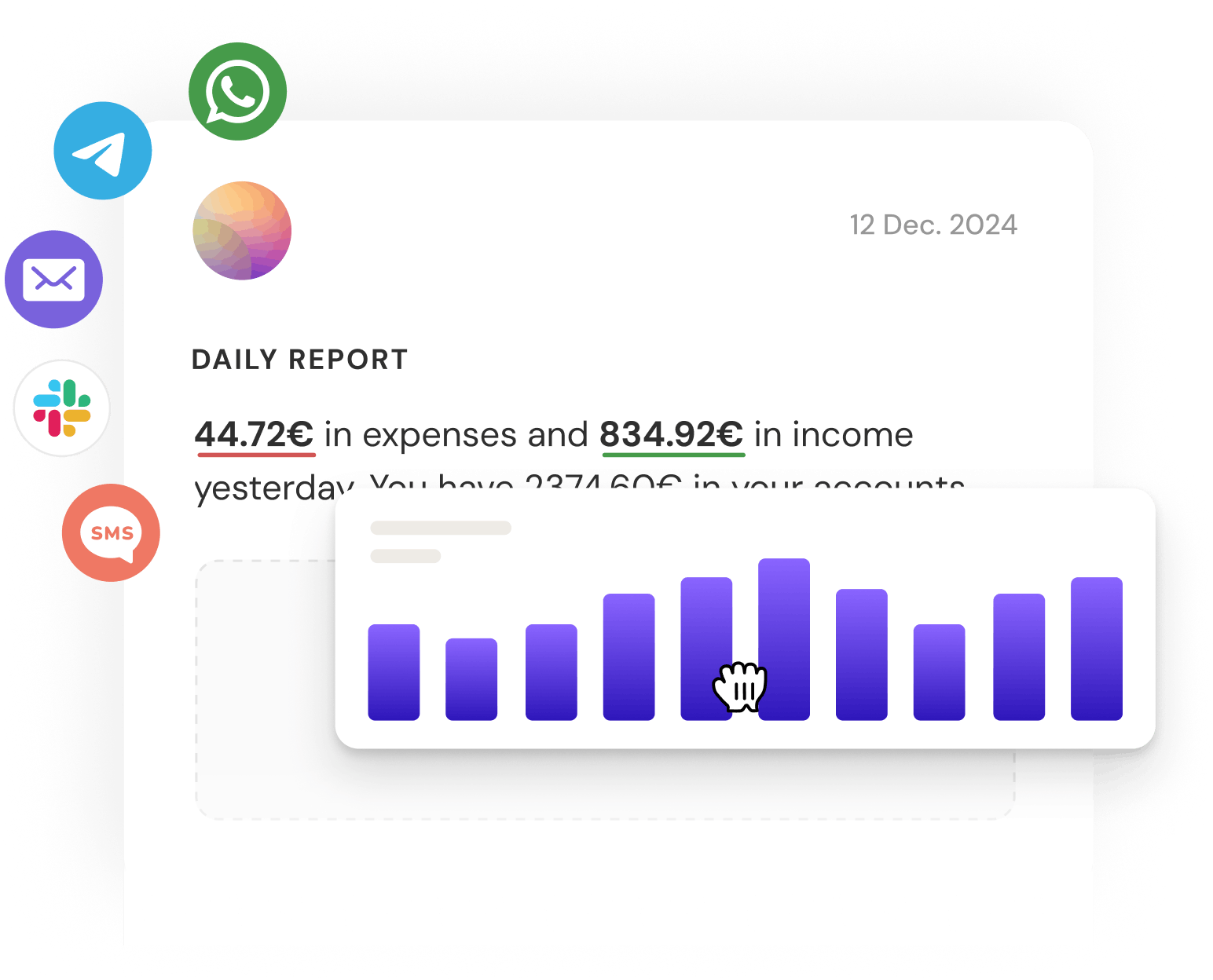

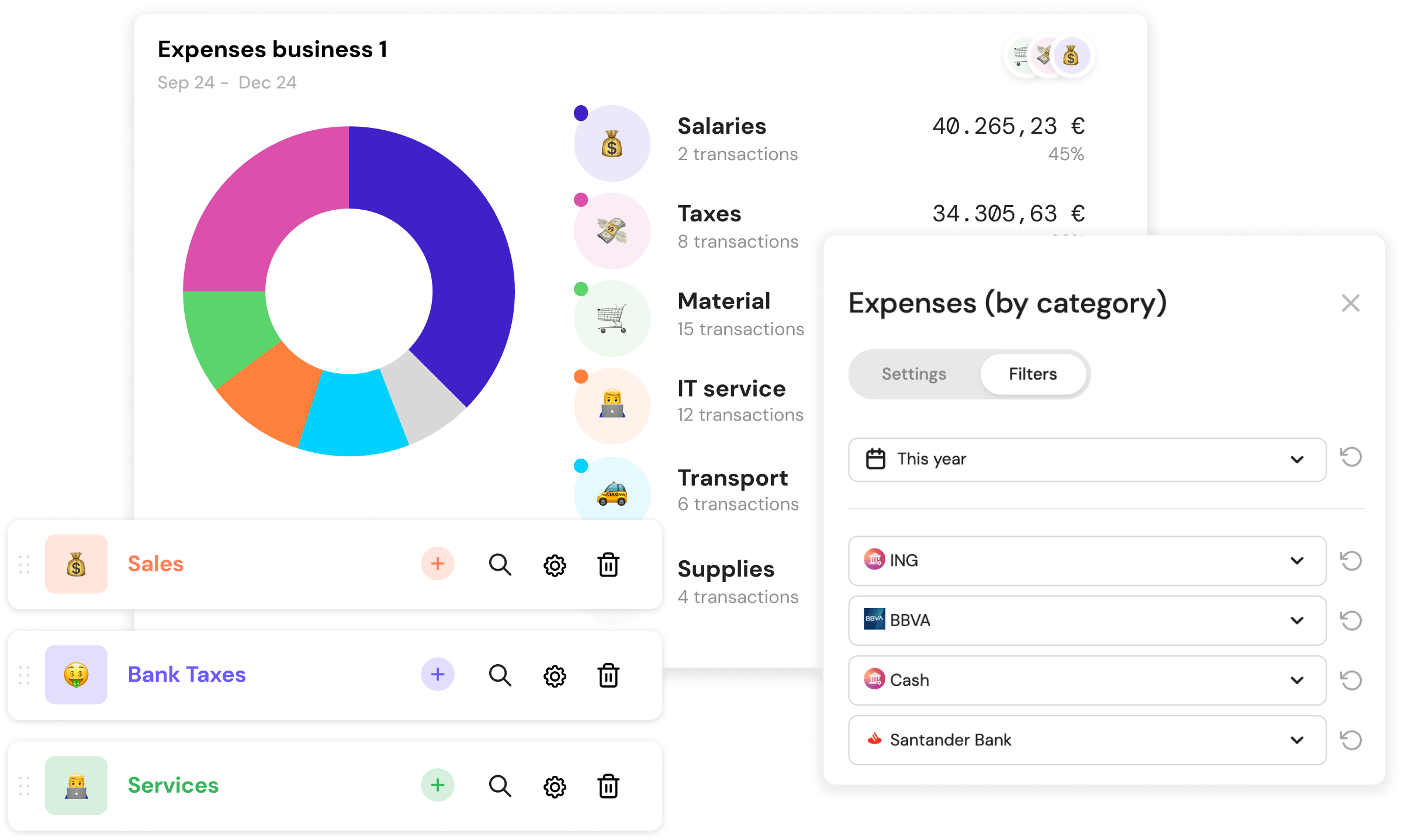

1. Banktrack

Best all-in-one treasury and cash flow management software for SMEs and mid-sized companies in Norway

Banktrack is more than an invoicing or expense tracker, it’s a complete cash flow and treasury management software built to give Norwegian businesses full control over their finances.

It offers deep integration with local and international banks, powerful forecasting tools, and compliance-ready reporting.

Best Features

- Integration with over 120 banks – Connect to DNB, Nordea Norge, SpareBank 1, Handelsbanken, and more via Open Banking (PSD2) or secure direct connections.

- Customisable dashboards – Track different departments, revenue streams, or projects separately while keeping a group-wide view.

- Automatic categorisation – Classify transactions by service, supplier, or project manager automatically.

- Scenario-based forecasting – Simulate seasonal demand changes, large purchases, or pricing adjustments to plan ahead.

- Automated invoice reconciliation – Upload invoices via WhatsApp, email, or drag-and-drop and match them automatically with transactions.

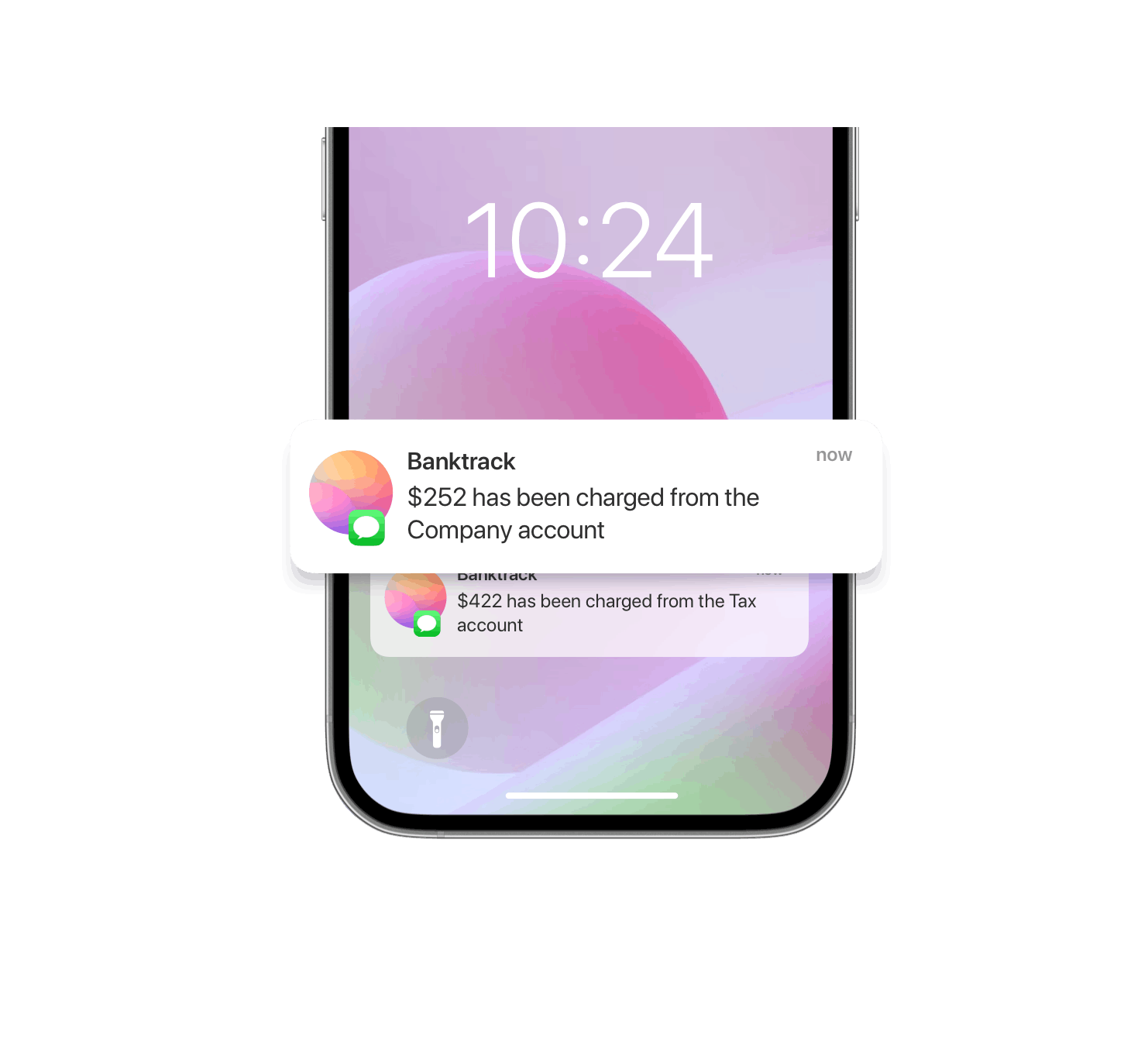

- Custom alerts – Get instant notifications for low balances, duplicate charges, or unusual transactions.

- Exportable reports – Generate compliance-ready reports for Skatteetaten and your accountant.

- Smart categories – Automatically tag transactions with intelligent, rule-based categorisation.

- Multi-entity and multi-location view – Manage several companies or branches from a single account.

Best for: SMEs, multi-branch organisations, and fast-growing Norwegian businesses needing visibility, forecasting, and compliance in one platform.

2. Tripletex

Best for integrated accounting and cash flow tracking

Tripletex is a leading Norwegian accounting software with built-in cash flow management tools. It’s designed to handle everything from invoicing to payroll, making it ideal for companies wanting one platform for all finance operations.

Key features:

- Bank integration with major Norwegian banks

- Automated invoicing and payment reminders

- VAT reporting aligned with Skatteetaten

- Cash flow projections and budgeting tools

Best for: Businesses wanting a local, all-in-one accounting and cash flow solution.

3. Visma eAccounting

Best for SMEs looking for simplicity and automation

Part of Visma’s Nordic suite, eAccounting offers easy-to-use cash flow tools alongside invoicing, expense tracking, and bank reconciliation.

Key features:

- Real-time cash flow dashboard

- Automated bank feeds

- VAT calculation and reporting

- Integration with POS systems and e-commerce platforms

Best for: SMEs wanting a straightforward solution with local compliance built-in.

4. PowerOffice Go

Best for SMEs with accounting partners

PowerOffice Go is a Norwegian cloud-based accounting and cash flow tool often used in collaboration with accounting firms.

Key features:

- Real-time collaboration with accountants

- Bank integration and reconciliation

- Automated expense tracking

- Budget and forecast capabilities

Best for: Companies that work closely with external accountants but still want internal cash flow visibility.

5. Xledger

Best for large enterprises with complex financial needs

Xledger is an ERP and financial management platform offering advanced cash flow tools for larger organisations.

Key features:

- Multi-entity and multi-currency support

- Real-time cash position overview

- Advanced forecasting models

- Integration with BI tools for deeper analysis

Best for: Corporations and multi-entity organisations needing enterprise-level control.

6. Fiken

Best for small businesses and freelancers

Fiken is designed for simplicity, making it a great option for sole traders and micro-businesses in Norway.

Key features:

- Easy invoicing with payment tracking

- Bank import for transaction reconciliation

- VAT and tax return preparation

- Simple cash flow reports

Best for: Freelancers and very small businesses that want ease over complexity.

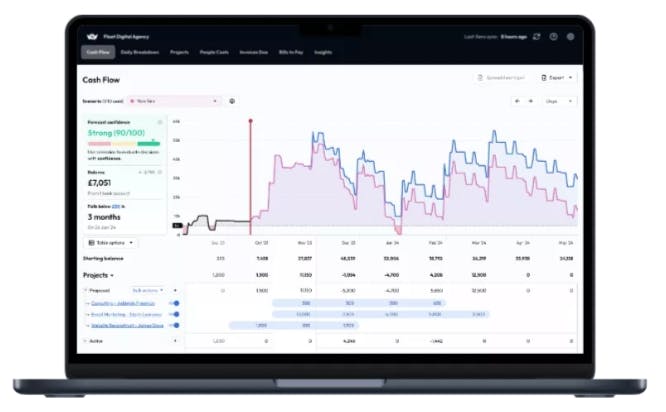

7. Float

Best for visual, scenario-based forecasting

Float integrates with accounting software like Xero, QuickBooks, and FreeAgent to offer highly visual cash flow forecasting.

Key features:

- Scenario modelling and what-if analysis

- Real-time updates from accounting data

- Expense and income projections

- Multi-currency support

Best for: Businesses that prioritise long-term planning and forecasting detail.

8. QuickBooks Online

Best for international companies operating in Norway

QuickBooks is a global accounting platform with strong cash flow features and integrations for Norwegian banking.

Key features:

- AI-powered cash flow predictions

- Automated invoicing and reminders

- Bank feed integration for Norwegian banks

- Mobile app for on-the-go cash flow management

Best for: Norwegian companies with cross-border operations needing international accounting features.

How to Choose the Right Cash Flow Tool in Norway

When evaluating options, focus on:

- Bank integration – Ensure it connects to your primary Norwegian bank(s).

- Forecasting power – Look for tools that allow scenario modelling and seasonal adjustments.

- Compliance – VAT and tax reporting should align with Skatteetaten’s requirements.

- Scalability – The tool should adapt to your growth, whether you’re expanding locally or internationally.

- Ease of use – Finance teams and external accountants should be able to work in it seamlessly.

7 Best Practices for Cash Flow Management in Norway

Choosing the right software is only part of the equation, the way you use it can have just as much impact on your financial stability. Below are key strategies Norwegian businesses can apply to get the most out of their cash flow management tools.

1. Connect All Financial Accounts

Link every relevant bank account, credit facility, and payment platform to your tool from day one. This ensures that your cash flow data is complete and accurate, giving you a true picture of liquidity.

2. Use Scenario Forecasting Regularly

Norwegian businesses often face seasonal fluctuations, especially in tourism, retail, and construction. Use your tool’s scenario modelling features to simulate slower months, potential VAT increases, or large upcoming expenses.

3. Monitor VAT Obligations in Real Time

With a standard VAT rate of 25% in Norway, keeping track of your VAT liabilities is crucial. A good cash flow tool can calculate VAT as transactions occur, helping you prepare for Skatteetaten reporting deadlines without last-minute stress.

4. Set Alerts for Critical Events

Custom alerts can act as an early warning system. Examples include:

- Low balance notifications before payroll deadlines

- Alerts for overdue customer payments

- Warnings for duplicate or unusually high expenses

5. Integrate With Your Accountant’s Workflow

Choose a platform that allows shared access with your external accountant or in-house finance team. This eliminates data silos and ensures that reports, reconciliations, and tax submissions are always based on the latest numbers.

6. Keep Reports Visual and Action-Oriented

Many tools allow you to create dashboards that are easy for both finance and non-finance stakeholders to interpret. Use visual reports to highlight trends, bottlenecks, and opportunities for cost savings.

7. Review and Adjust Monthly

A cash flow management tool isn’t a set-and-forget system. Review your data at least once a month, compare actual performance to forecasts, and update your assumptions as your business evolves.

Conclusion

Norwegian businesses in 2025 have a wide choice of cash flow management tools, from local champions like Tripletex, Visma, and Fiken to international leaders like Banktrack and Float.

If your priority is full visibility, multi-bank integration, and advanced forecasting, Banktrack leads the list. For smaller companies prioritising simplicity and local compliance, solutions like Fiken or Fortnox-style platforms are ideal.

Whichever you choose, the right tool will not only track your cash flow but also help you predict, plan, and grow with confidence.

Share this post

Related Posts

7 Best Cashflow Management Tools in Sweden for 2025

Explore the 7 best cash flow management tools in Sweden for 2025, offering advanced forecasting and automation to streamline your business finances.Best 7 Cash Flow Management Tools in Finland for 2025

These are the best cash flow management tools in Finland: Banktrack Procountor Netvisor Visma eAccounting Fennoa Float QuickBooks Online In Finland’s competitive business environment, from Helsinki’sHow to do financial planning for business owners

Effective financial planning for business owners is key to managing cash flow, setting goals, and securing long-term growth. It helps make informed decisions and mitigate financial risks.

Try it now with your data

- Your free account in 2 minutes

- No credit card needed