Best 7 Cash Flow Management Tools in Finland for 2025

- Best 7 Cash Flow Management Tools in Finland

- 1. Banktrack

- 2. Procountor

- 3. Netvisor

- 4. Visma eAccounting

- 5. Fennoa

- 6. Float

- 7. QuickBooks Online

- How to Choose the Right Cash Flow Management Tool in Finland

- Best 5 Practices for Finnish Businesses

- 6 Future Trends in Cash Flow Management in Finland

- 1. Deeper Open Banking Integration

- 2. AI-Powered Forecasting

- 3. ESG and Sustainability-Linked Reporting

- 4. Automated VAT and Tax Filing

- 5. Embedded Financing

- 6. Multi-Entity and Global Consolidation

- Conclusion

These are the best cash flow management tools in Finland:

- Banktrack

- Procountor

- Netvisor

- Visma eAccounting

- Fennoa

- Float

- QuickBooks Online

In Finland’s competitive business environment, from Helsinki’s tech startups to manufacturing companies in Tampere, cash flow management is a crucial part of financial success.

With the Finnish Tax Administration (Verohallinto) requiring accurate VAT reporting and financial transparency, businesses need tools that not only track cash flow but also help forecast, optimise, and comply with local regulations.

This guide reviews the seven best cash flow management tools for Finnish businesses in 2025, comparing features, integrations with Finnish banks, forecasting capabilities, and suitability for different company sizes.

Best 7 Cash Flow Management Tools in Finland

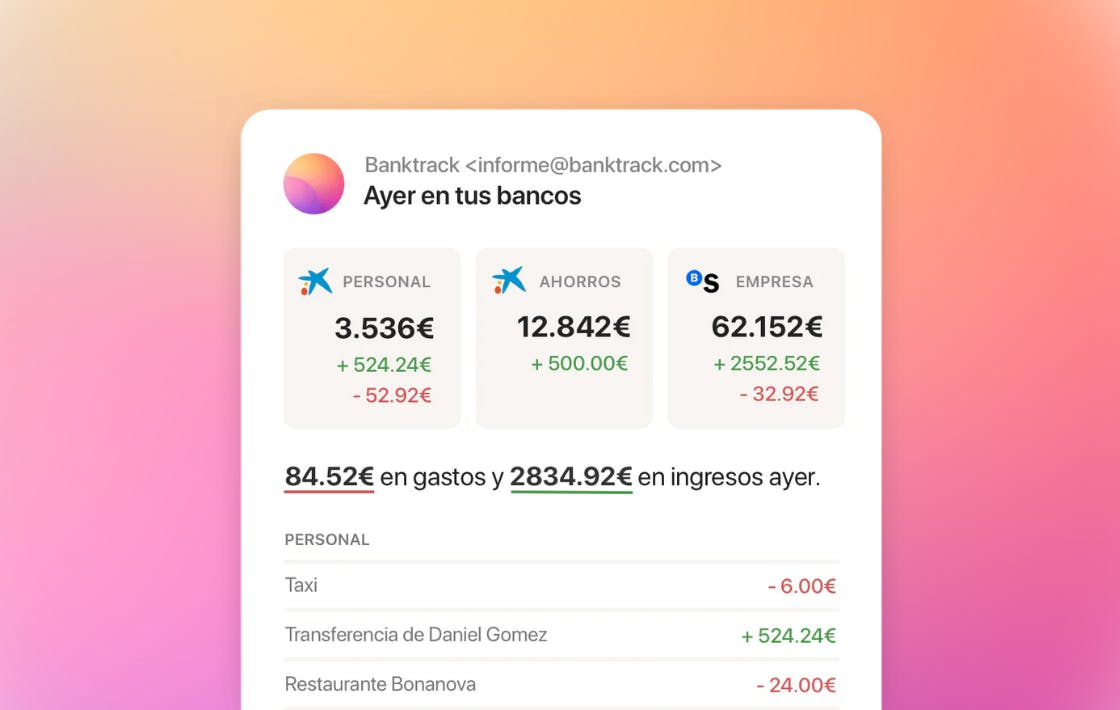

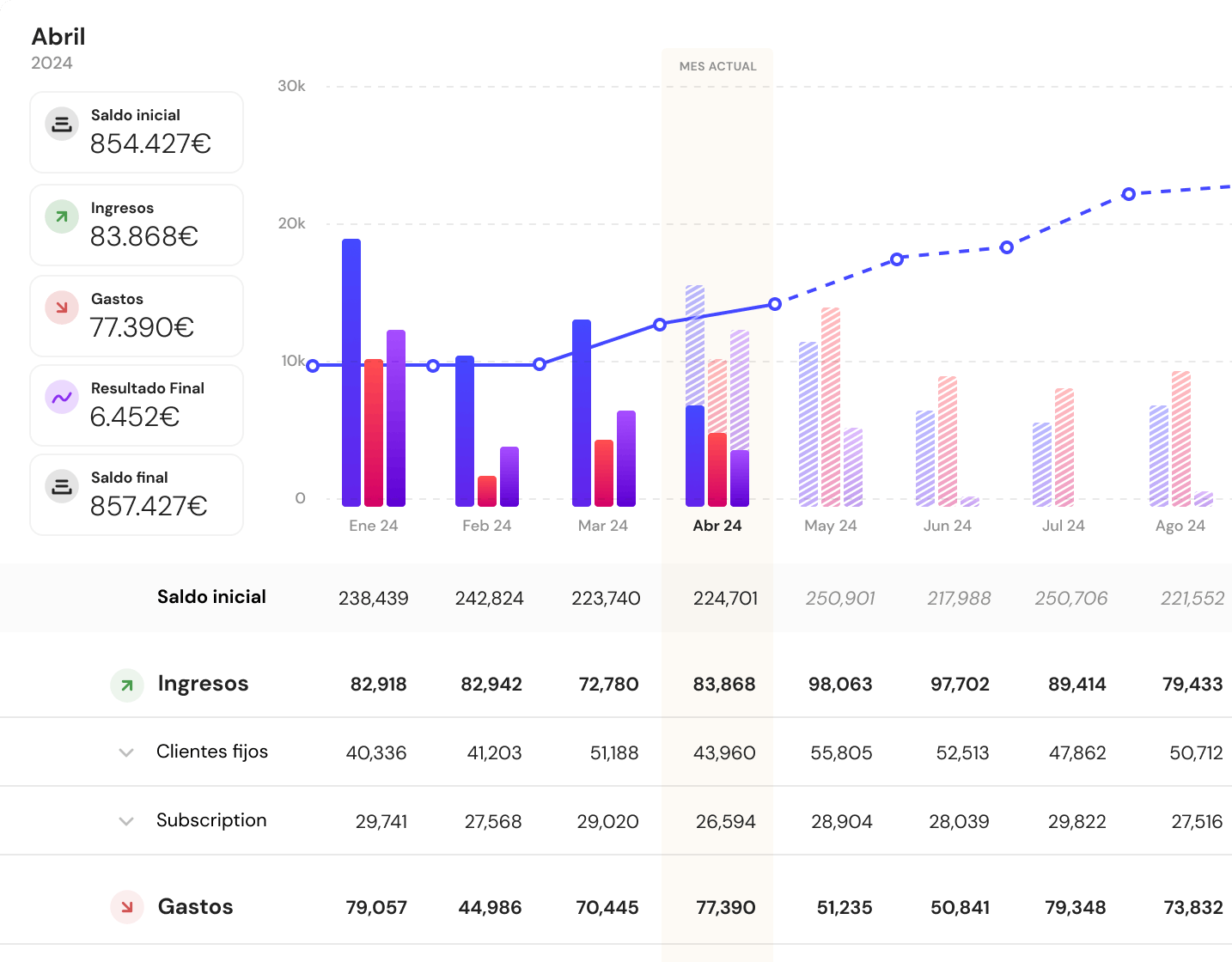

1. Banktrack

Best all-in-one treasury and cash flow management software for SMEs and multi-entity companies in Finland

Banktrack is a complete cash flow and treasury management solution that integrates seamlessly with over 120 banks worldwide, including OP Financial Group, Nordea Suomi, Danske Bank Finland, and Säästöpankki. It offers real-time visibility, advanced forecasting, and compliance-ready reporting.

9 Standout Features

- Integration with over 120 banks – Connect via Open Banking (PSD2) or secure direct links for accurate, real-time transaction data.

- Customisable dashboards – Tailor views for departments, product lines, or projects, giving each area its own cash flow snapshot.

- Automatic categorisation of transactions – Classify by service type, supplier, or responsible team member to streamline bookkeeping.

- Scenario-based forecasting – Model the impact of seasonal slowdowns, major equipment purchases, or pricing changes.

- Automated invoice reconciliation – Match payments with invoices uploaded via WhatsApp, email, or drag-and-drop.

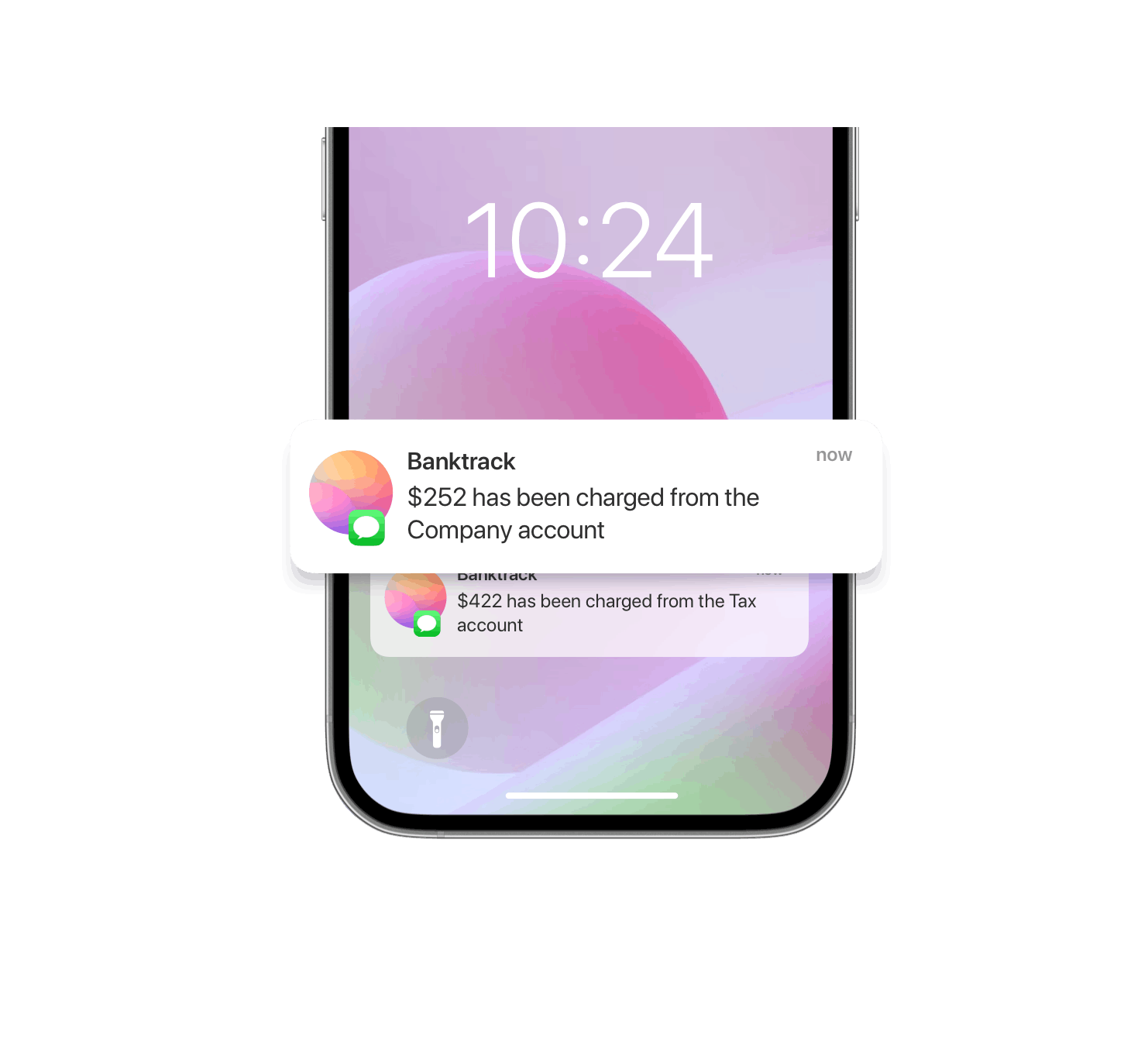

- Custom alerts – Get notified for low balances, duplicate transactions, or overdue payments via Slack, WhatsApp, SMS, or email.

- Exportable financial reports – Generate ready-to-use reports for Verohallinto and your accountant.

- Smart categories – Automatically tag income and expenses for easier analysis.

- Multi-entity and multi-location management – Oversee several companies or branches from one account.

Best for: Finnish SMEs, holding companies, and fast-growing businesses seeking both forecasting power and compliance.

2. Procountor

Best local accounting and cash flow software for Finnish SMEs

Procountor is a Finnish cloud-based financial management platform with strong cash flow features integrated into its accounting and invoicing functions.

Key features:

- Direct connection to Finnish banks via PSD2

- Automated invoicing and payment matching

- VAT calculation and filing for Verohallinto

- Budgeting and cash flow projections

Best for: SMEs wanting a Finnish-built solution with native compliance.

3. Netvisor

Best for real-time cash flow visibility and automation

Netvisor is another Finnish-developed platform that combines accounting, payroll, and financial reporting with powerful cash flow management.

Key features:

- Real-time bank integration

- Automated expense categorisation

- Forecasting tools for short and long-term planning

- Collaboration tools for finance teams and accountants

Best for: Businesses seeking automation and strong local support.

4. Visma eAccounting

Best Nordic platform for growing SMEs

Part of Visma’s Nordic product suite, eAccounting offers user-friendly cash flow tracking alongside invoicing, payroll, and expense management.

Key features:

- Bank feed integration with major Finnish banks

- Real-time cash flow dashboard

- VAT tracking and filing tools

- Budgeting and expense control features

Best for: SMEs that want scalability across Nordic markets.

5. Fennoa

Best for collaboration between businesses and accounting firms

Fennoa is a Finnish financial management software that allows real-time collaboration between a company and its accountant.

Key features:

- Cash flow overviews linked to accounting data

- Automated invoice handling and bank reconciliation

- Document sharing and approval workflows

- VAT and tax reporting aligned with Finnish legislation

Best for: Businesses that outsource accounting but want live visibility.

6. Float

Best for advanced scenario-based forecasting

Float integrates with accounting platforms like Xero, QuickBooks, and FreeAgent to provide detailed, visual cash flow forecasting.

Key features:

- Scenario modelling for strategic decision-making

- Real-time updates from accounting data

- Multi-currency support

- Income and expense trend analysis

Best for: Finnish companies with international operations or complex forecasting needs.

7. QuickBooks Online

Best global platform with Finnish bank integration

QuickBooks offers strong cash flow management features, including AI-powered predictions, while allowing integration with Finnish banks via PSD2 connectors.

Key features:

- Automated bank feeds and reconciliation

- Cash flow planner with predictive analytics

- Invoice and payment tracking

- Mobile access for managing finances on the go

Best for: Finnish businesses that operate across borders and need international accounting capabilities.

How to Choose the Right Cash Flow Management Tool in Finland

When selecting a platform, consider:

- Banking integration – Ensure compatibility with your primary Finnish bank.

- VAT compliance – The tool should handle Finnish VAT rates and filing requirements.

- Forecasting capabilities – Look for scenario planning to anticipate seasonal or market changes.

- Collaboration – Tools that allow accountant access can streamline tax preparation.

- Scalability – Choose software that grows with your business.

Best 5 Practices for Finnish Businesses

- Monitor VAT in real time – With Finland’s standard VAT rate at 24%, tracking liabilities helps avoid last-minute payment issues.

- Review cash flow monthly – Compare actuals vs. forecasts to adjust your plans quickly.

- Set automated alerts – Notifications for low balances or overdue invoices can prevent cash flow crunches.

- Integrate with your accountant – A shared platform ensures accurate, up-to-date records for tax filings.

- Plan for seasonality – Especially important in industries like tourism, retail, and construction.

6 Future Trends in Cash Flow Management in Finland

As Finland’s business environment becomes more digital and interconnected, cash flow management tools are evolving to meet new challenges and opportunities. Here are some trends that Finnish companies should watch for in 2025 and beyond:

1. Deeper Open Banking Integration

While PSD2 has already made it possible for cash flow tools to connect directly to Finnish banks, the next wave will go beyond just transaction feeds. Expect real-time payment initiation from within cash flow software, reducing the need to log in to separate banking portals.

2. AI-Powered Forecasting

Machine learning will increasingly be used to predict cash flow patterns, spot anomalies, and make automated recommendations. Finnish companies will be able to:

- Predict seasonal cash dips months ahead

- Detect early warning signs of customer payment delays

- Receive suggestions for optimising payment schedules

3. ESG and Sustainability-Linked Reporting

With Finland’s commitment to sustainability and EU reporting requirements, some cash flow tools will integrate environmental and social impact tracking alongside financial data. This could help businesses link their cash flow projections with ESG performance.

4. Automated VAT and Tax Filing

While many tools already calculate VAT, the next stage is direct submission to Verohallinto from within the cash flow platform. This will streamline compliance even further, especially for SMEs without in-house tax teams.

5. Embedded Financing

Some platforms are beginning to offer embedded short-term financing options, allowing businesses to access liquidity directly from their cash flow dashboard when projections indicate a gap.

6. Multi-Entity and Global Consolidation

For Finnish companies operating in multiple markets, demand will grow for platforms that can consolidate cash flow across subsidiaries, currencies, and tax jurisdictions, all in real time.

Conclusion

In 2025, Finnish businesses have access to a mix of local leaders like Procountor, Netvisor, and Fennoa, and global players like Banktrack, Float, and QuickBooks.

For companies prioritising real-time visibility, multi-bank integration, and advanced forecasting, Banktrack stands out as the most comprehensive choice.

With the right tool and a proactive approach, you can ensure that your business not only meets its obligations but also grows with confidence.

Share this post

Related Posts

Verifactu for Startups in Spain: Complete Guide 2025

Verifactu introduces a new era of electronic invoicing in Spain, requiring startups to send invoices directly to the Tax Agency.The 8 Best Odoo Alternatives for Businesses in 2025

The 8 best Odoo alternatives for businesses in 2025 to streamline operations, CRM, and accounting with efficient software.Best 8 Cash Flow Management Tools in Norway for 2025

Explore top cash flow management tools in Norway for 2025, featuring automation and real-time analytics to optimize business finances.

Try it now with your data

- Your free account in 2 minutes

- No credit card needed