7 Best Cashflow Management Tools in Sweden for 2025

- Top 7 Cash Flow Management Tools for Swedish Businesses in 2025

- 1. Banktrack

- 2. Fortnox

- 3. Visma eEkonomi

- 4. Float

- 5. Företagskollen

- 6. Anaplan

- 7. QuickBooks Online

- Why Cash Flow Management Matters in Sweden

- 5 Common challenges for Swedish businesses include:

- 7 Key Features to Look for in a Cash Flow Management Tool in Sweden

- 5 Best Practices for Using a Cash Flow Management Tool in Sweden

- Conclusion

These are the best cashflow management tools in Sweden:

- Banktrack

- Fortnox

- Visma eKonomi

- Float

- Företagskollen

- Anaplan

- QuickBooks Online

Cash flow management has become one of the most critical aspects of running a successful business in Sweden.

Whether you are a startup in Stockholm, an SME in Malmö, or a multinational with operations across the Nordic region, maintaining healthy cash flow is essential for stability, growth, and long-term profitability.

In 2025, Swedish companies are increasingly turning to digital tools that provide real-time visibility, automation, and predictive analytics to ensure that liquidity is never an afterthought.

This guide explores what to look for in a cash flow management tool, the key players in the Swedish market, and how these solutions integrate with local banking and tax regulations.

Top 7 Cash Flow Management Tools for Swedish Businesses in 2025

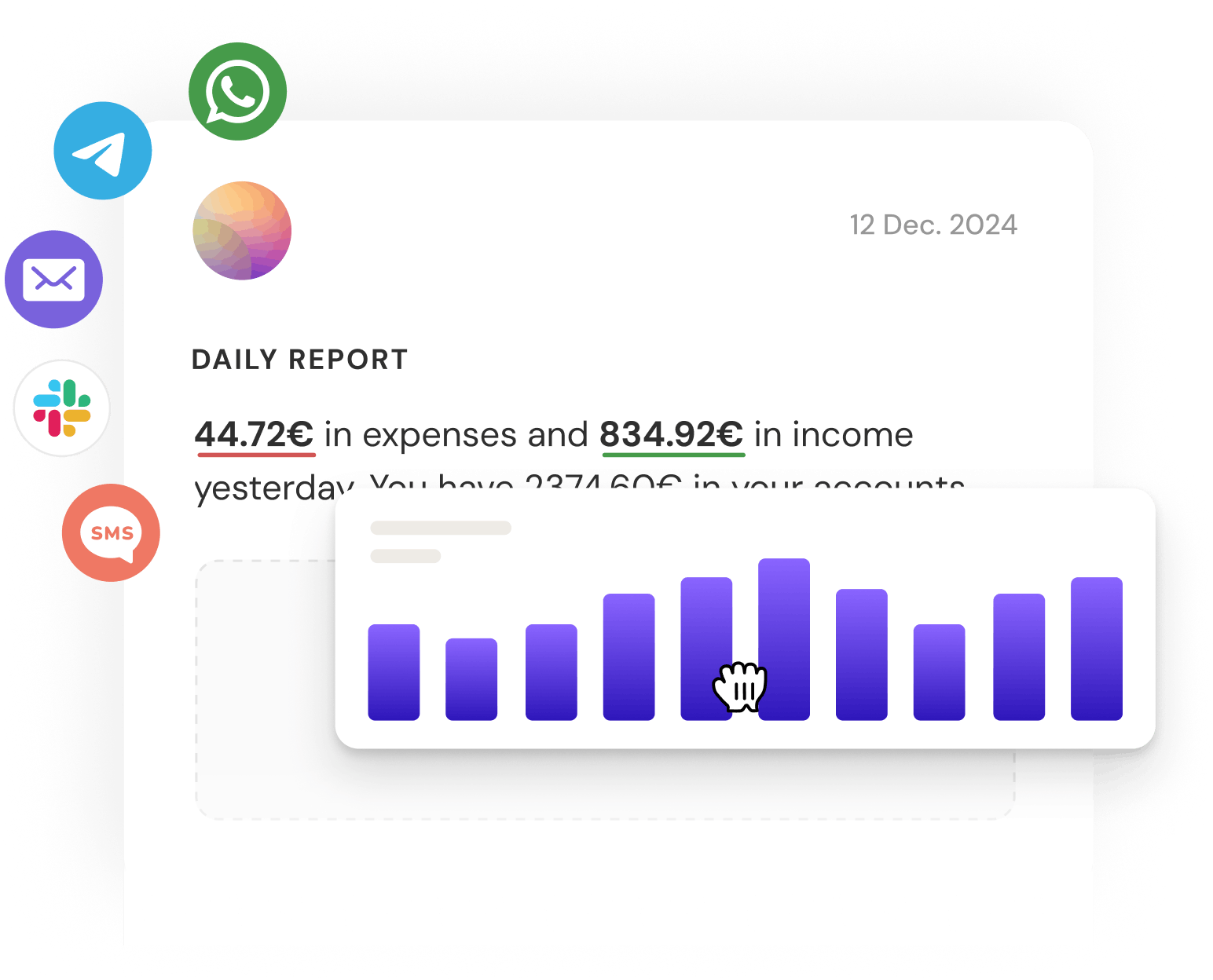

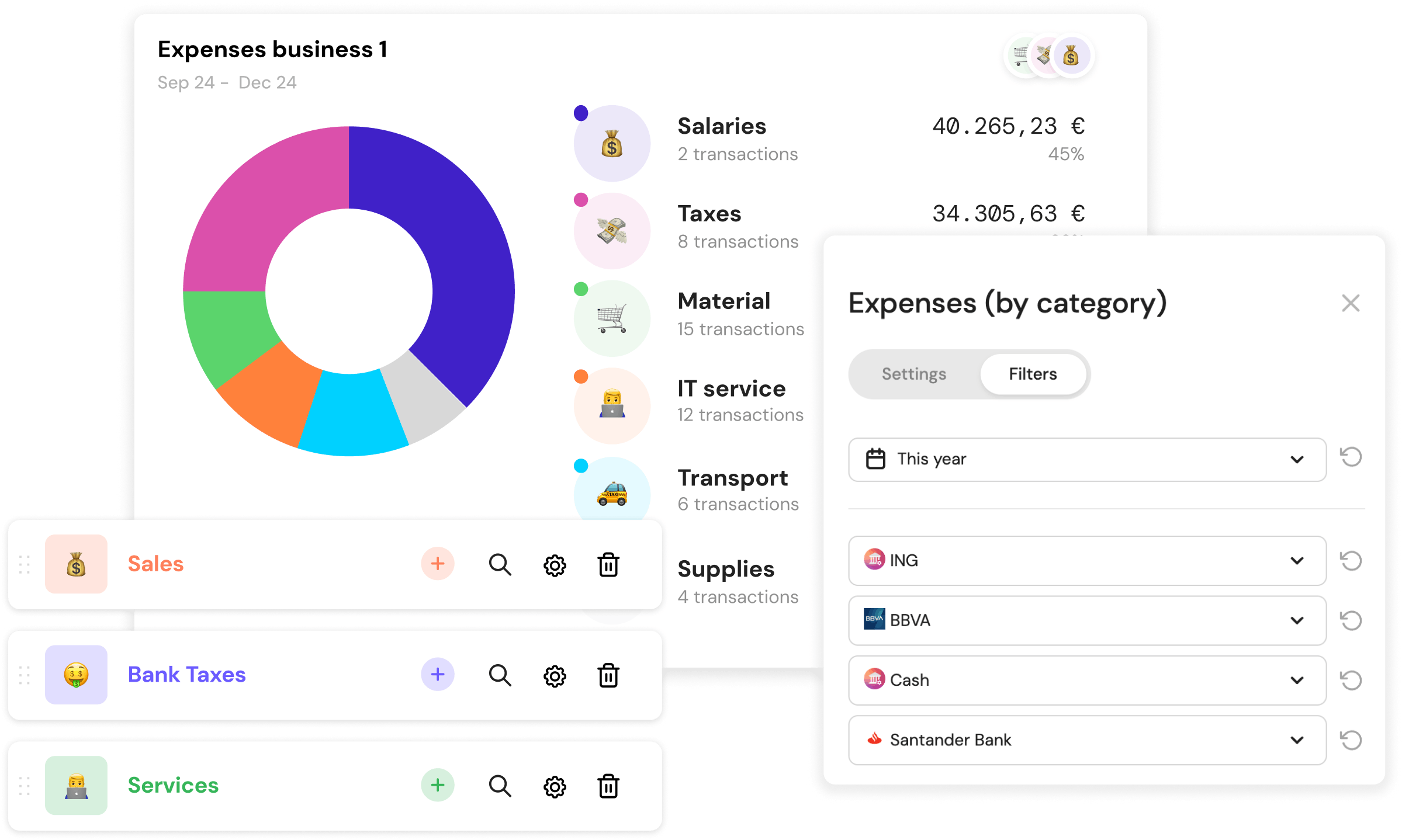

1. Banktrack

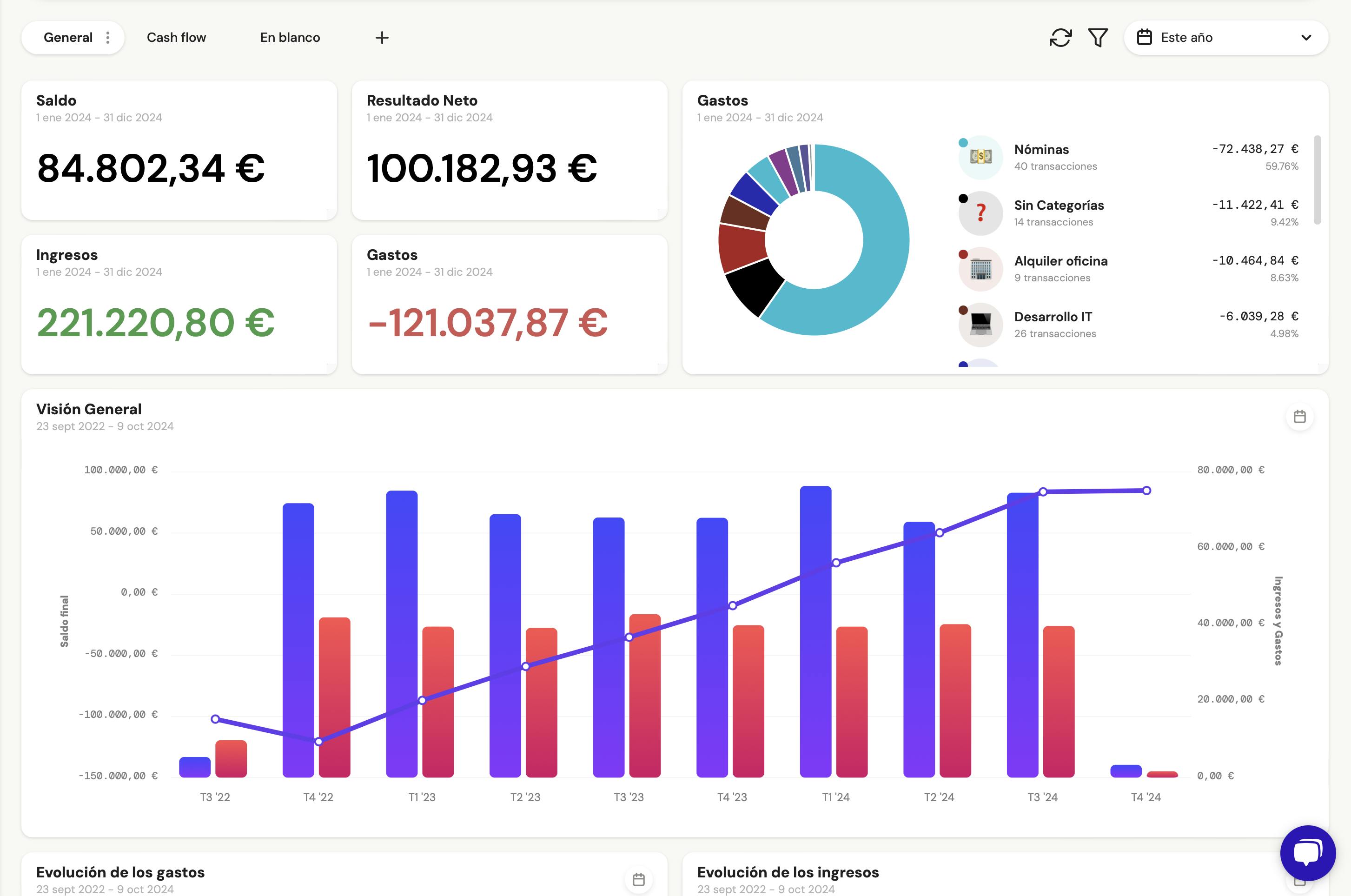

Banktrack is a powerful, all-in-one treasury and cash flow management software ideal for SMEs and mid-sized companies operating in Sweden.

It connects to over 120 banks worldwide, including all major Swedish institutions, providing a consolidated view of your finances.

Some of its Best Features:

- Integration with over 120 banks: Connect seamlessly to both Swedish and international banks, including Swedbank, SEB, Handelsbanken, Nordea, and digital banks. Banktrack uses Open Banking (PSD2) where available or direct connections for banks without PSD2 access. This ensures up-to-date, secure, and reliable transaction data at all times.

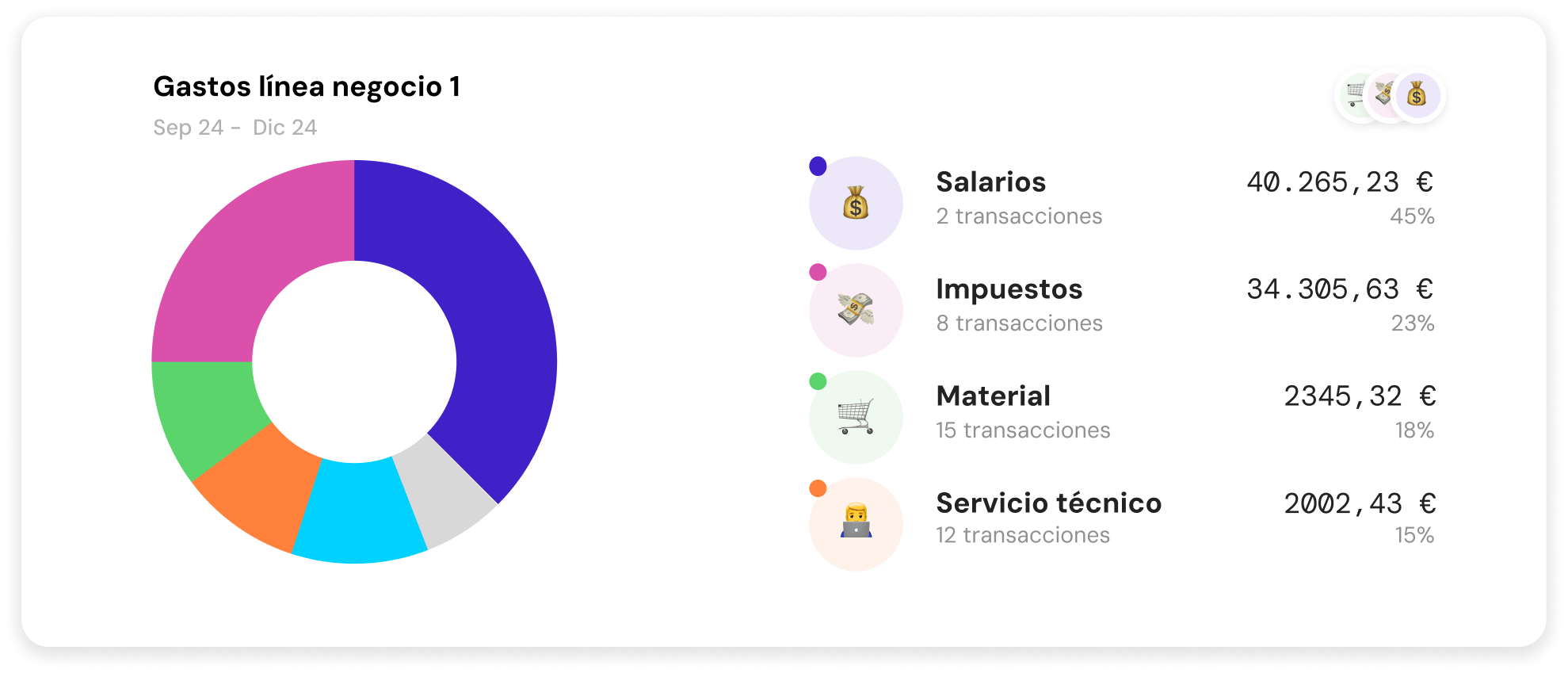

- Customisable dashboards: Create tailored views for different departments or service areas. For example, a company with multiple revenue streams, such as retail, consulting, and e-commerce, can track each segment’s cash flow independently while keeping an aggregated view for the whole business.

- Automatic categorisation of income and expenses: Classify transactions by service type, supplier, or even the responsible team member. This automation speeds up bookkeeping and ensures consistency, reducing the risk of human error.

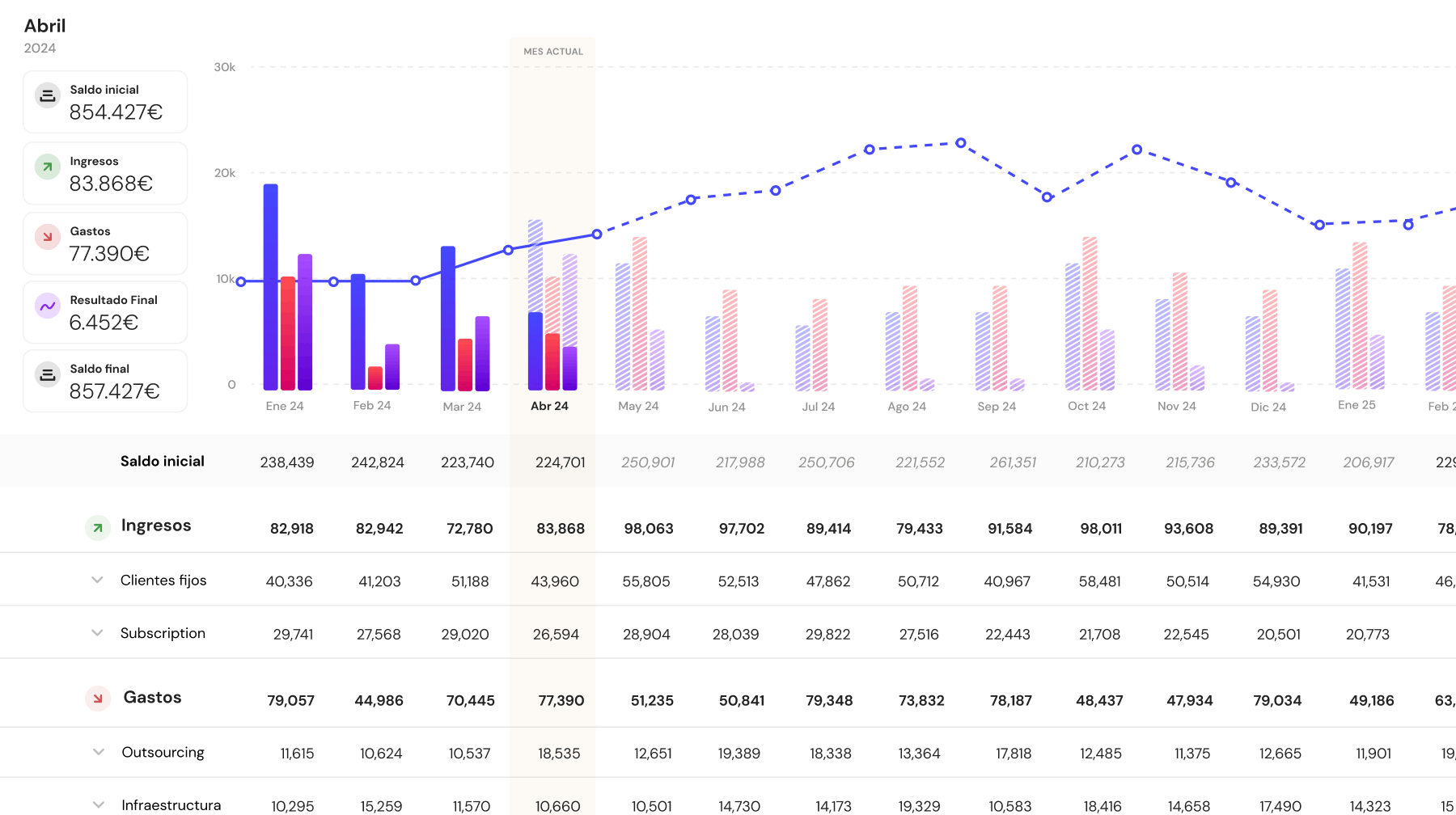

- Scenario-based cash flow forecasting: Simulate different financial situations, such as seasonal demand peaks, large capital investments, or pricing changes. This helps Swedish businesses anticipate liquidity needs and make informed strategic decisions.

- Automated invoice reconciliation: Match invoices with incoming and outgoing payments automatically. Upload invoices directly via WhatsApp, email, or drag-and-drop from your computer, no manual matching required.

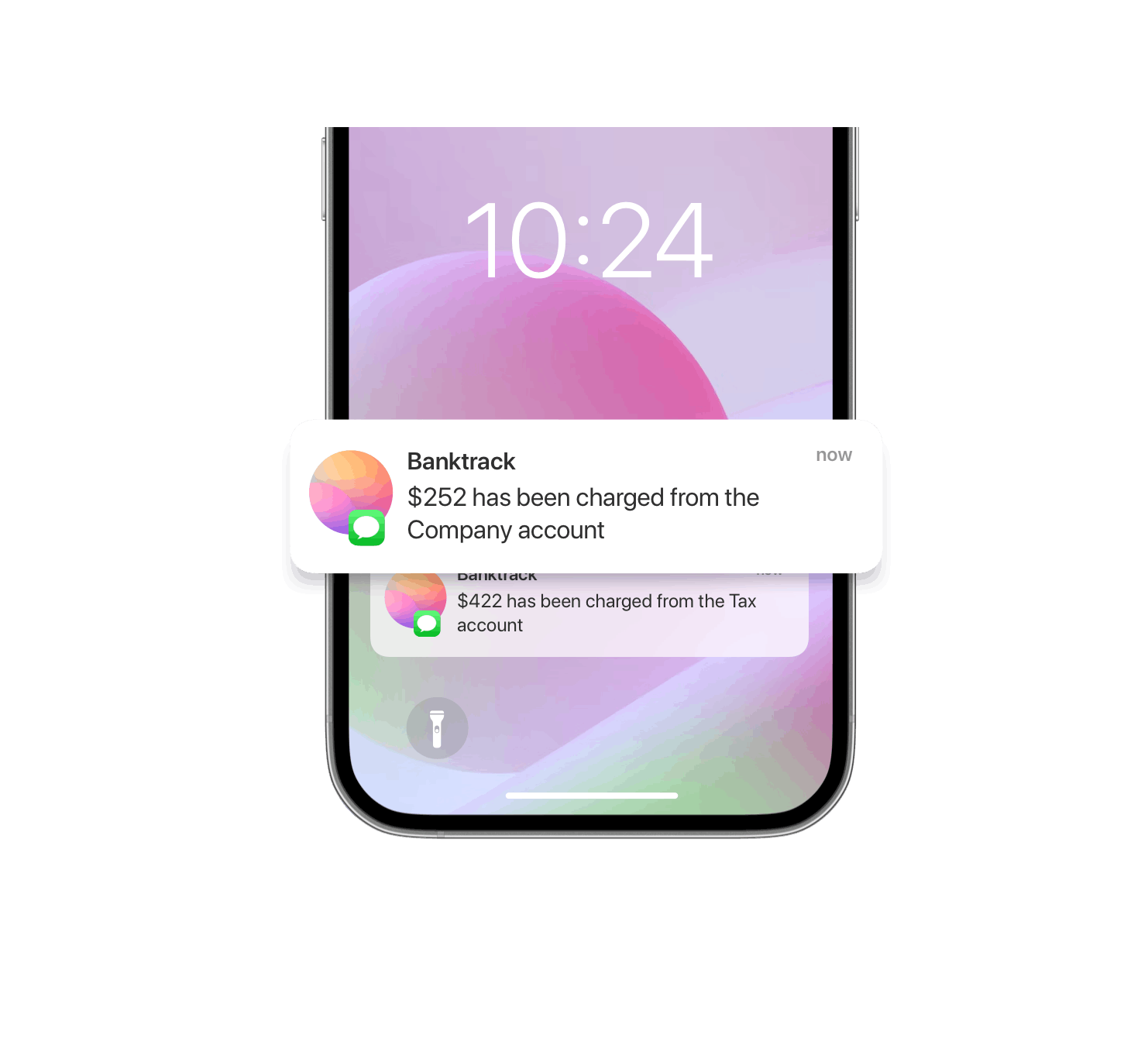

- Custom alerts: Receive instant notifications for duplicate charges, overdue payments, unusual transaction amounts, or low account balances. Alerts can be delivered via WhatsApp, Slack, Telegram, email, or SMS.

- Exportable financial reports: Generate detailed, exportable reports that make monthly closing, tax filing, and collaboration with accountants much easier. These reports are designed to meet Skatteverket requirements in Sweden.

- Smart categories: Use intelligent category rules to automatically tag income and expenses. For businesses with multiple product lines or service types, this means clearer, more actionable insights.

- Multi-entity and multi-location view: Manage several companies or business units from one platform. This is ideal for Swedish groups operating across multiple cities or with both domestic and international operations.

Best for: Businesses looking for a single tool to handle both cash flow visibility and invoice management, with scalability for international operations.

2. Fortnox

A popular choice among Swedish SMEs, Fortnox combines accounting, invoicing, and cash flow tracking in one platform.

Key features:

- Integration with Swedish tax reporting systems

- Bank feed connections to major Swedish banks

- Built-in invoicing and payment reminders

- Cash flow reports aligned with Swedish accounting standards

Best for: Small businesses and freelancers who want an affordable, locally-oriented solution.

3. Visma eEkonomi

Visma is one of the most established financial software providers in the Nordics, offering strong cash flow functionality.

Key features:

- Real-time financial dashboard

- Bank reconciliation automation

- Built-in budgeting and forecasting tools

- Compliance-ready VAT tracking

Best for: Growing SMEs with in-house finance teams.

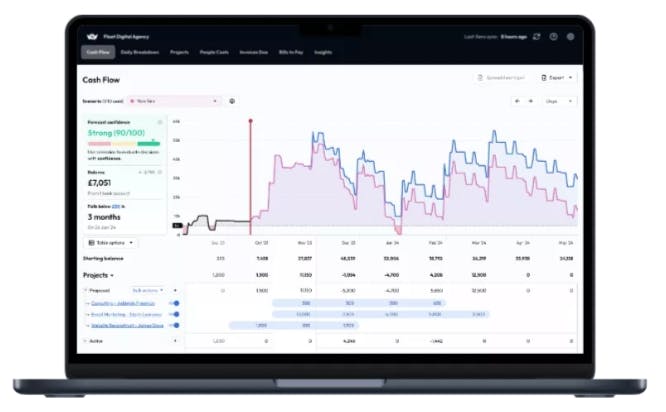

4. Float

A forecasting-focused cash flow tool that integrates with cloud accounting systems like Xero and QuickBooks.

Key features:

- Scenario modelling for future planning

- Detailed income and expense projections

- Integrations with accounting software used in Sweden

- Multi-currency support

Best for: Businesses that prioritise strategic cash flow forecasting over operational banking functions.

5. Företagskollen

A Sweden-based platform designed specifically for local business owners.

Key features:

- Real-time revenue and expense tracking

- VAT preparation tools

- Simple and intuitive interface for non-financial users

- Connection to local banks

Best for: Micro-businesses and sole traders in Sweden.

6. Anaplan

Best for large enterprises with complex financial models

While not Sweden-specific, Anaplan is widely used by larger Nordic corporations for advanced financial planning and cash flow forecasting.

Key features:

- Enterprise-level financial modelling

- Multi-department collaboration

- Scenario analysis and forecasting

- Integrations with ERP and BI systems

Best for: Corporations with complex, multi-entity financial structures.

Not sure about this option? Here are some of the best alternatives to Anaplan.

7. QuickBooks Online

Best global accounting platform with cash flow features

QuickBooks offers Swedish-friendly cash flow tools when paired with local bank integrations. It’s ideal for companies that need international accounting capabilities alongside daily cash flow tracking.

Key features:

- Cash flow planner with AI-driven predictions

- Bank feed integration

- Automated invoicing and payment tracking

- Mobile app for on-the-go access

Best for: Swedish businesses with cross-border operations.

Why Cash Flow Management Matters in Sweden

Sweden’s competitive business landscape and high cost of labour make cash flow planning more than just an accounting task.

With strong compliance requirements from the Swedish Tax Agency (Skatteverket) and growing demands for financial transparency, a reliable cash flow tool is no longer optional, it’s a necessity.

5 Common challenges for Swedish businesses include:

- Seasonal fluctuations in sales (especially for tourism, retail, and construction sectors)

- High VAT rates and strict reporting deadlines

- Currency fluctuations for import/export businesses

- Long payment terms from corporate clients

- The need to integrate with multiple local and international banks

7 Key Features to Look for in a Cash Flow Management Tool in Sweden

When evaluating software, make sure it includes the following:

- Multi-bank connectivity with Swedish and Nordic banks: Integration with banks like Swedbank, SEB, Handelsbanken, and Nordea is essential for real-time transaction data.

- Automatic categorisation of income and expenses: Saves time and improves accuracy, especially for companies with multiple revenue streams.

- Scenario-based forecasting: Lets you simulate changes in revenue, costs, or financing to anticipate liquidity issues before they arise.

- VAT and tax compliance support: Automatic tracking of VAT obligations aligned with Skatteverket’s requirements.

- Multi-currency support: Crucial for Swedish companies engaged in cross-border trade.

- Collaboration tools: Role-based access for finance teams, external accountants, and management.

- Mobile access: A responsive interface or dedicated mobile app for on-the-go decision-making.

5 Best Practices for Using a Cash Flow Management Tool in Sweden

- Connect all accounts from day one. Ensure every corporate bank account, credit line, and payment platform is linked to get a complete financial picture.

- Review VAT obligations regularly. Many tools allow you to track VAT liabilities in real-time, a must for avoiding penalties from Skatteverket.

- Set up alerts. Receive notifications for overdue invoices, cash shortfalls, or significant spending changes.

- Run scenario tests monthly. Adjust for seasonality, new contracts, or market changes before they impact your liquidity.

- Integrate with your accountant’s systems. This improves efficiency and ensures your reporting is always aligned with Swedish accounting rules.

Conclusion

Choosing the right cash flow management solutions in Sweden depends on the size of your business, the complexity of your finances, and how much automation you want.

For small companies seeking local simplicity, tools like Fortnox or Företagskollen are excellent.

For more advanced needs, especially for companies operating internationally or with complex treasury requirements, Banktrack stands out for its combination of forecasting, multi-bank integration, and compliance capabilities.

In 2025, managing your cash flow isn’t just about keeping track of your bank balance. It’s about having the insight, control, and foresight to make better business decisions every single day.

Share this post

Related Posts

Best 8 Cash Flow Management Tools in Norway for 2025

Explore top cash flow management tools in Norway for 2025, featuring automation and real-time analytics to optimize business finances.Best 7 Cash Flow Management Tools in Finland for 2025

These are the best cash flow management tools in Finland: Banktrack Procountor Netvisor Visma eAccounting Fennoa Float QuickBooks Online In Finland’s competitive business environment, from Helsinki’s

Try it now with your data

- Your free account in 2 minutes

- No credit card needed