Top 8 alternatives to 1Money in 2025

Top 8 alternatives to 1Money:

- Banktrack

- Mint

- YNAB

- Goodbudget

- PocketGuard

- Spendee

- Moneydance

- Quicken

If you are looking for different functionalities, more control or just want to explore other options, there are some alternatives that can boost your expense management.

In this guide, we will look at a few of the top 8 alternatives to 1Money to help you manage your finances to be efficient.

8 Alternatives to 1Money in 2025

1. Banktrack is your Cash Management App

Banktrack is the best cash management application for the year 2025.

Why is it thought to be the best option? Let us explain:

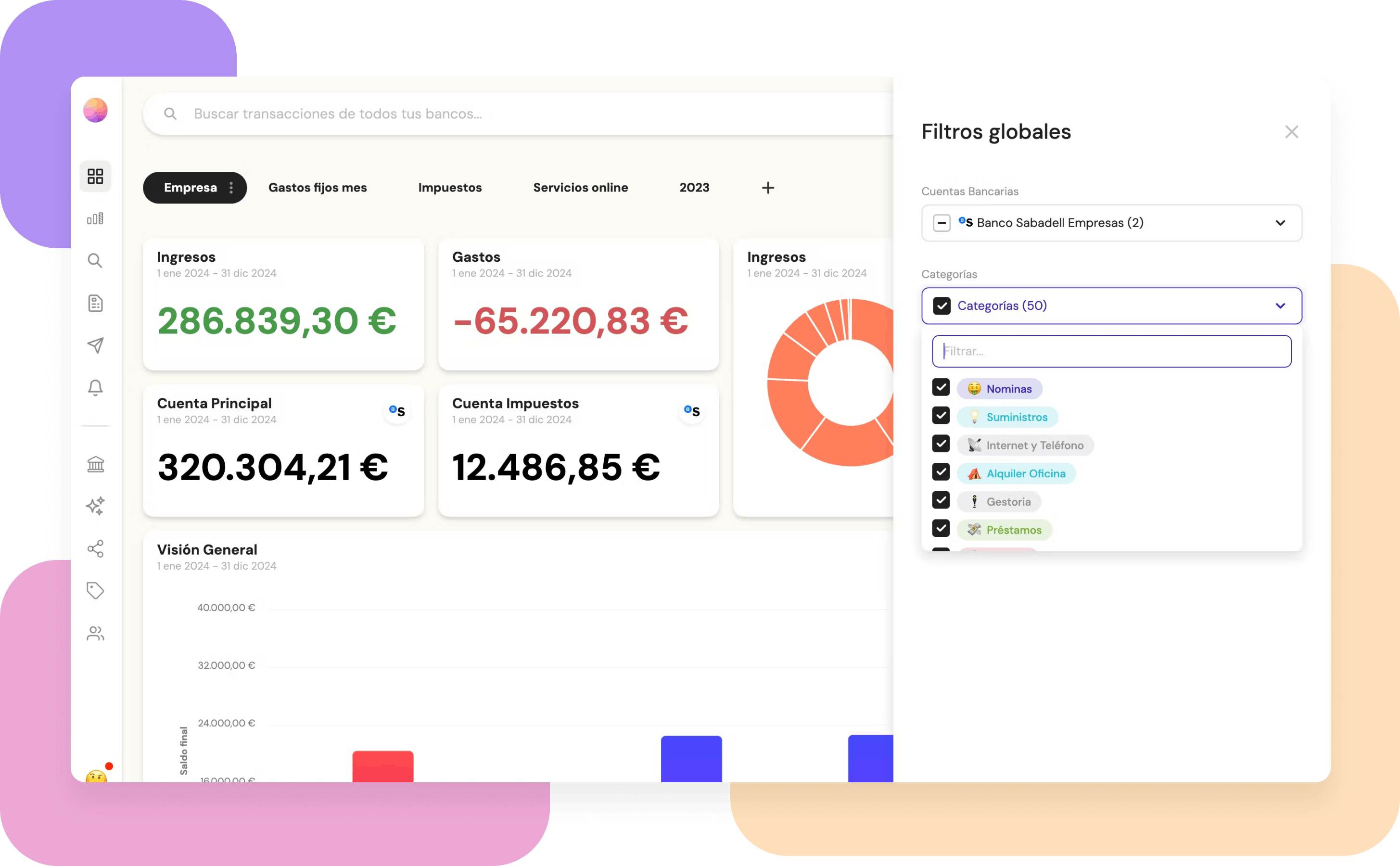

Custom Dashboards

First of all, this cash management tool stands out by its capacity to build personalized dashboards combining perspectives from various financial products, companies, and bank accounts.

With Banktrack, you can easily obtain the information you need to manage your spending.

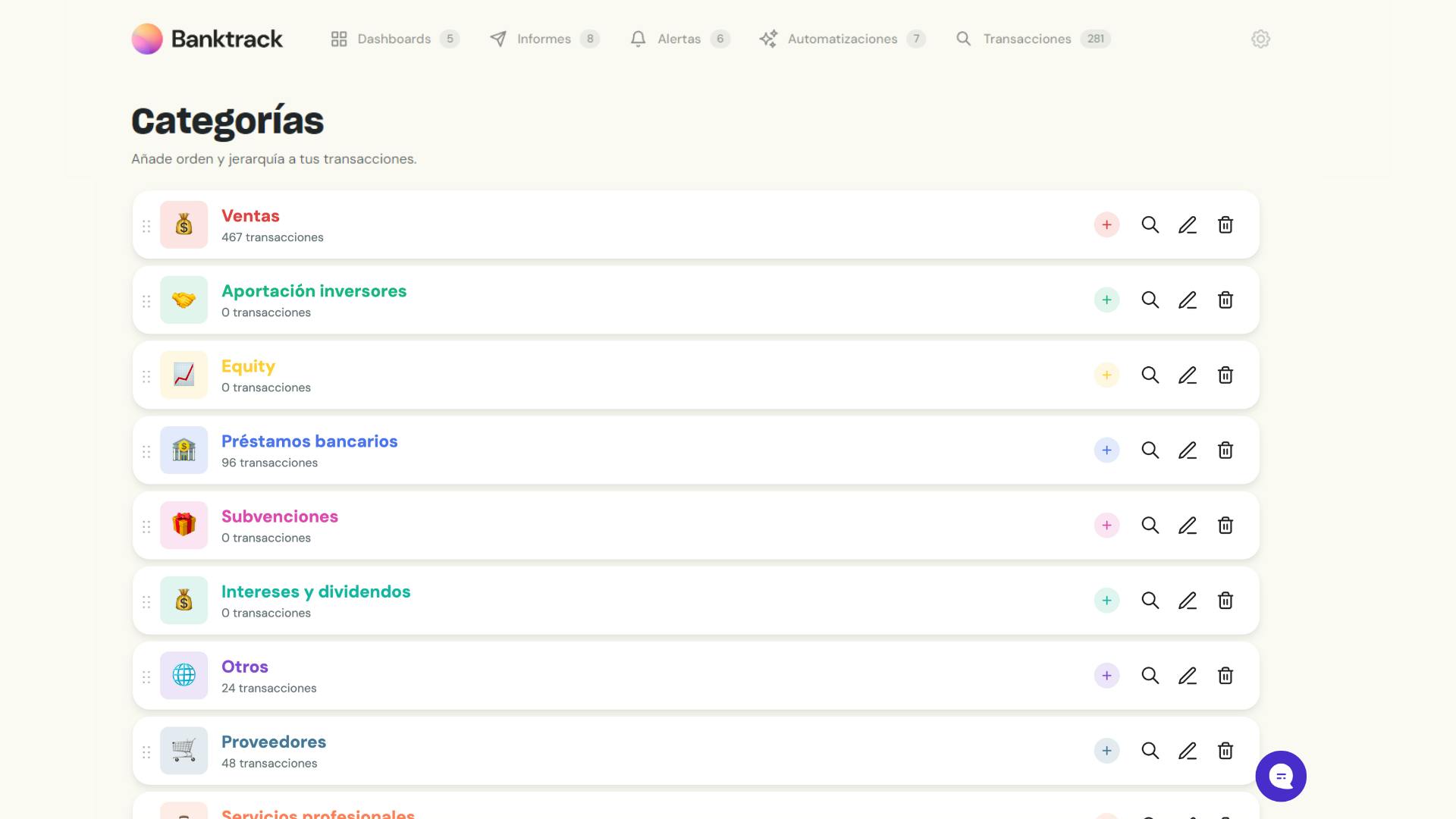

Adapted Categories

A good cash management software allows you to adjust the categories to suit your needs because they are specifically designed to fit your expenses.

You can create and modify an infinite number of categories using sophisticated rules to arrange your revenue and expenses however you see fit.

You can monitor your finances and determine where your money is going thanks to this flexibility.

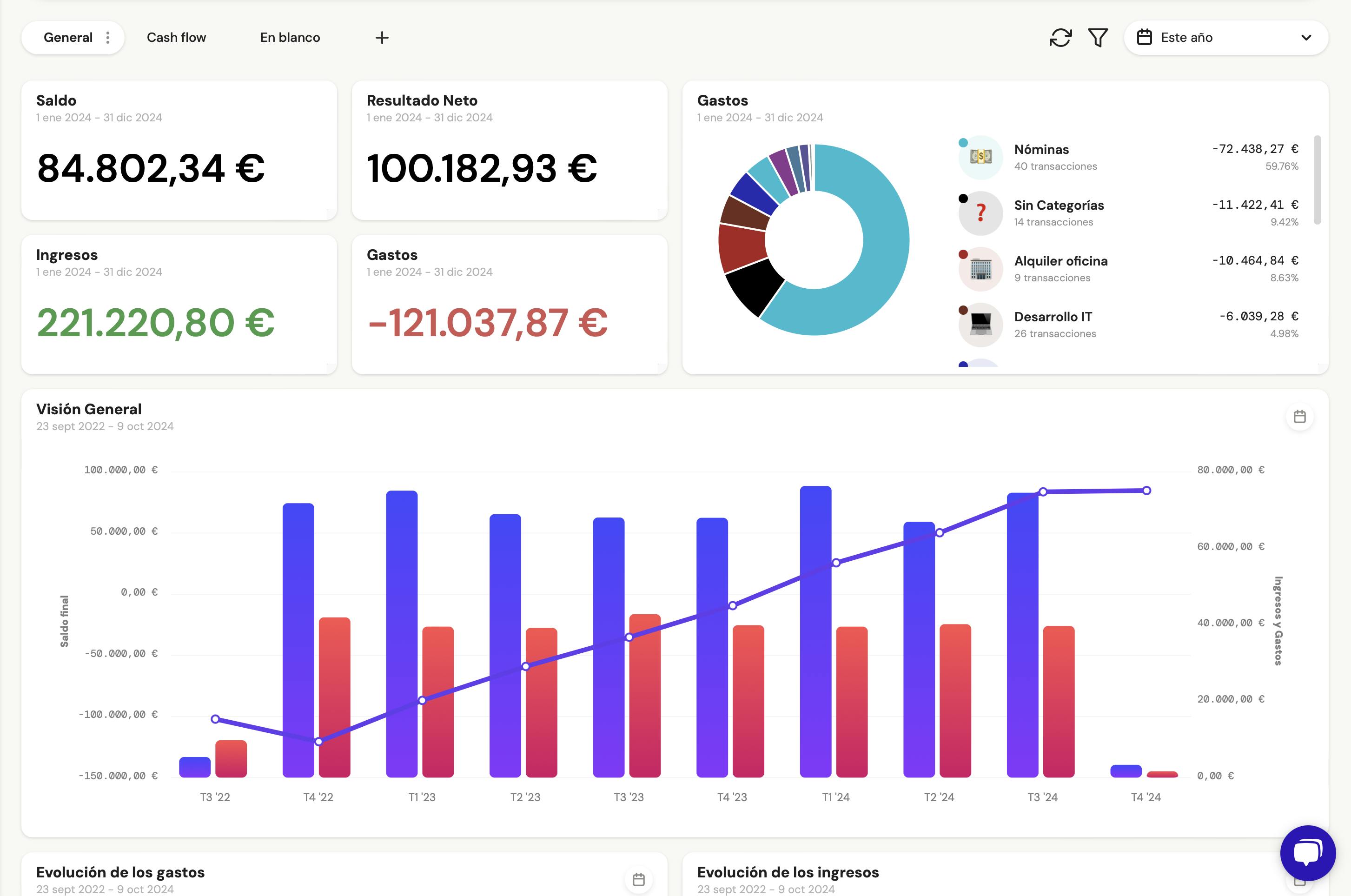

Custom Reports and Alerts

Moreover, Banktrack offers personalized reports and alerts. Customized reports can be generated, and you can get alerts regarding your spending via email, Slack, Telegram, WhatsApp, and SMS.

You can even configure these alerts to tell you when there are duplicate charges, low balances, or other significant events. This will help you stay on top of your finances and make wise decisions at all times.

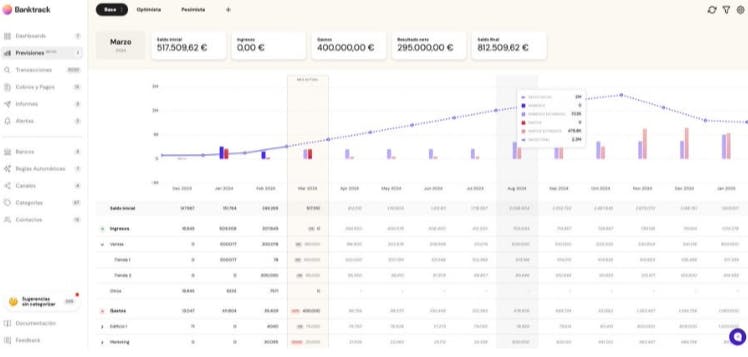

Forecasts

You can create estimates of cash flow and make sure they are met.

Formulas also allow you to add a lot more dynamic functionality to your calculations.

Banktrack is the best treasury cash flow forecasting software.

Thanks to its adaptable dashboards and flexible categorization options, users can efficiently access real-time financial information and maintain precise records of their income and expenses.

Here are 12 tips to improve cash flow for better financial health.

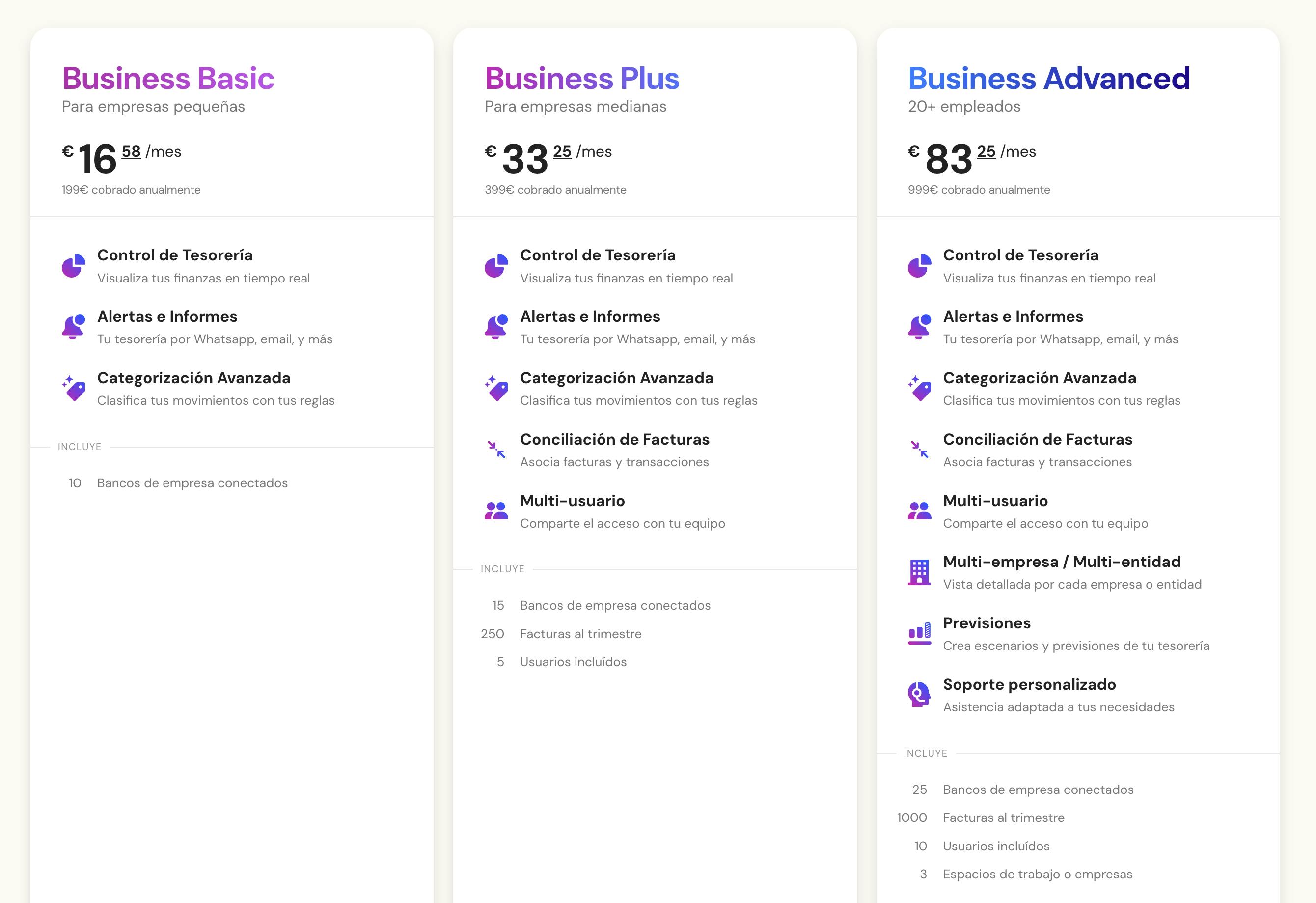

Affordable Prices

Banktrack offers a variety of plans with different functionalities at affordable prices.

For example, the "Business Basic" plan allows the connection of up to 10 bank accounts for just €16.58 per month.

2. Mint

Mint is an app offering budgeting, expense tracking, and financial planning features. Its suite of tools makes it.

- Automatic Categorization: Mint automatically categorizes expenses, allowing users to see where their money goes.

- Credit Score Tracking: Users can check their credit score for free, keeping track of their financial health.

- Goal Setting: You can set savings goals, debt repayment plans, and track your progress.

Who Should Use Mint?

Mint is for beginners and those looking for an easy-to-use budgeting tool with additional features such as credit monitoring and goal setting.

3. YNAB (You Need a Budget)

YNAB (You Need a Budget) offers a proactive approach to budgeting by encouraging users to assign a purpose to every dollar.

Key Features:

- Zero-Based Budgeting: YNAB’s budgeting philosophy focuses on “giving every dollar a job,” reducing impulsive spending.

- Real-Time Syncing: All financial data syncs across devices in real time, so couples or families can stay aligned.

- Educational Resources: YNAB provides articles, guides, and webinars to help users improve their budgeting skills.

Who Should Use YNAB?

YNAB is for those who want a hands-on budgeting experience, especially if they’re focused on reducing debt, saving, or gaining more control over their spending.

4. Goodbudget

Goodbudget uses the classic “envelope” budgeting system to help users allocate funds for each spending category.

Key Features:

- Digital Envelopes: Users set up digital envelopes for each category, making it easy to track allocated spending.

- Debt Tracking: Goodbudget helps users manage debt repayment alongside other expenses.

- Shared Budgeting: The app can be shared across devices, so families can budget together.

Who Should Use Goodbudget?

Goodbudget is perfect for those who prefer the envelope methodenvelope method and want a simple way to control their spending.

5. PocketGuard

PocketGuard offers a unique approach to budgeting by focusing on the amount users have “in their pocket” after essential expenses are accounted for.

Key Features:

- In-My-Pocket Feature: This tool shows users how much they can spend after bills and savings goals.

- Bill Tracking: Users can track recurring bills to avoid unexpected charges.

- Savings Goals: PocketGuard allows users to set and monitor savings goals.

Who Should Use PocketGuard?

PocketGuard is for those who want an easy budgeting app to help manage disposable income.

6. Spendee

Spendee offers a user-friendly interface and customizable features for tracking expenses and managing budgets.

Key Features:

- Shared Wallets: Spendee lets users create shared wallets, which is great for family or group budgets.

- Multiple Currency Support: Users can track finances across different currencies.

- Bill Reminders: Spendee sends reminders for recurring expenses, helping users avoid missed payments.

Who Should Use Spendee?

Spendee is for users looking for a visually appealing, flexible budgeting app with support for multiple currencies and shared budgets.

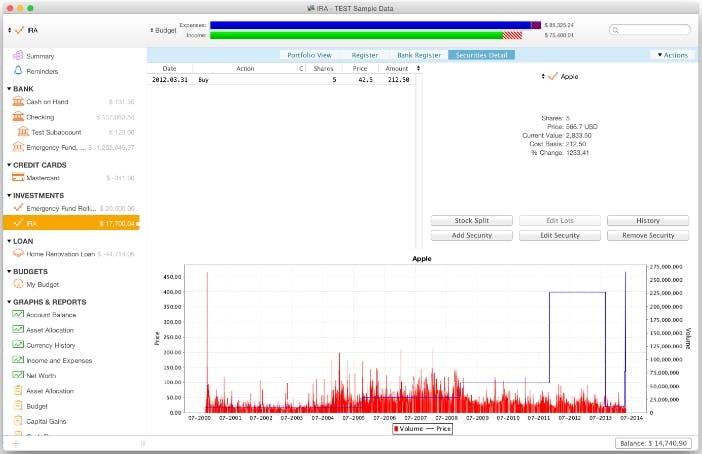

7. Moneydance

Moneydance is a finance tool for those who prefer a desktop app with in-depth features for budgeting, expense tracking, and investment monitoring.

Key Features:

- Investment Tracking: Moneydance includes tools for monitoring investments and tracking stock performance.

- Graphing and Reporting: Offers detailed reports on spending and income trends, making it easier to make data-driven financial decisions.

- Online Banking: The app connects to your bank to automatically download and categorize transactions.

Who Should Use Moneydance?

Moneydance is a choice for individuals who need comprehensive finance management tools, including those who need to track investments and detailed reports.

8. Quicken

Quicken has long been a trusted name in personal finance and continues to offer a wide array of features for budgeting, expense tracking, and financial management.

Key Features:

- Detailed Budgeting: Quicken offers extensive budgeting features that can be customized for specific financial goals.

- Real Estate Management: The app includes tools for tracking rental properties and other assets.

- Investment Portfolio Management: Users can track investment performance, making it ideal for those with financial portfolios.

Who Should Use Quicken?

Quicken is best for those looking for an all-in-one financial tool, including property management and investment tracking.

If you’re also interested in exploring advanced treasury and cash flow management tools beyond personal budgeting, take a look at our guide on the best Agicap alternatives.

These platforms are particularly useful for companies and professionals who need powerful forecasting, bank integrations, and treasury visibility at scale.

Why Choose Banktrack

One excellent substitute is Banktrack, which provides customized dashboards, flexible categories, unique reports, and alerts.

Banktrack offers an efficient and adaptable cash management solution with its user-friendly interface and reasonable price levels.

Share this post

Related Posts

The 8 best alternatives to Spendee in 2025

Looking for a fresh way to manage your budget? Check out these top Spendee alternatives to help you track spending, set goals, control your finances.8 MoneyWiz alternatives for personal finance management

Looking for alternatives to MoneyWiz for managing personal finances? Explore 8 top apps that simplify budgeting and track expenses.Top 7 bank trackers in Austria to manage your finances

Explore the top 7 bank tracker apps in Austria for 2024. Easily manage budgets, track expenses, and gain control over your finances with these essential tools.

Try it now with your data

- Your free account in 2 minutes

- No credit card needed