The 8 best alternatives to Spendee in 2025

Best alternatives to Spendee:

- Banktrack

- Planful

- Mint

- Spendesk

- Workiva

- Quicken

- Moneydance

- Solver

It's 2025, and keeping track of your money is really important. There are bills to pay, things you want to save for, and maybe even invest in. Spendee is one app that helps people do this, but it’s not the only one.

There are other apps that might be even better for you. Some are super easy to use, others let you change things how you like, and some work well with other apps. Trying different ones can help you find the best fit!

Best 8 Alternatives to Spendee

In this article, we’ll dive into the 8 best alternatives to Spendee for 2025.

Each of these tools is designed to help you manage your spending, savings, and overall financial health, giving you the control and clarity you need to make better financial decisions.

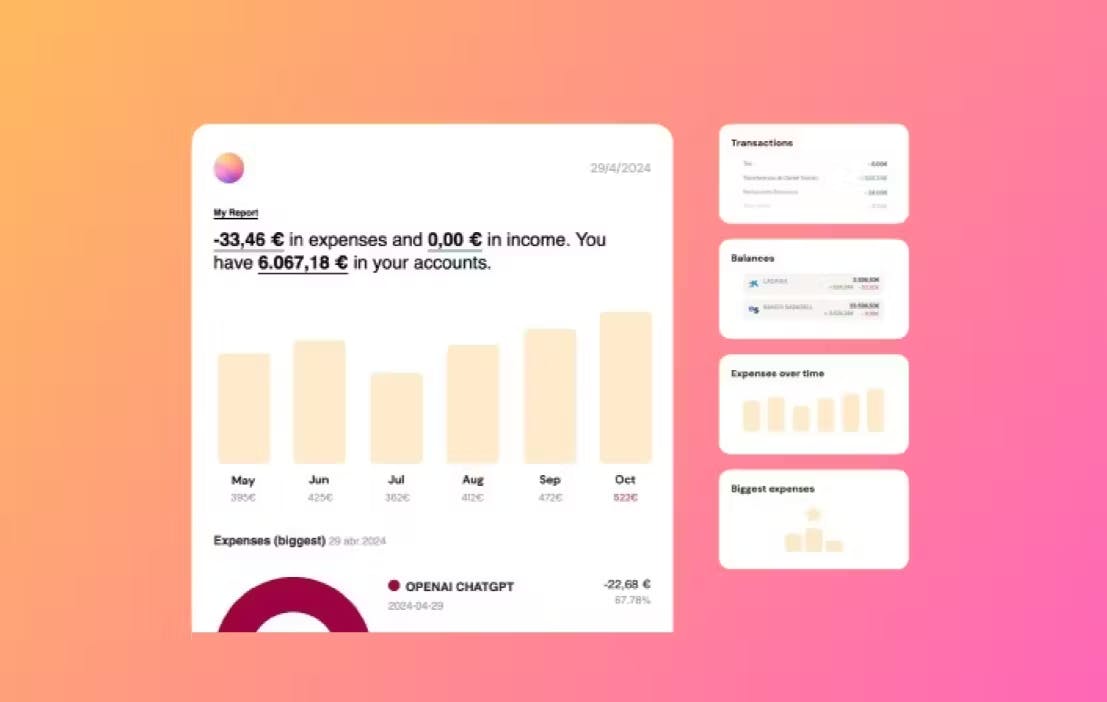

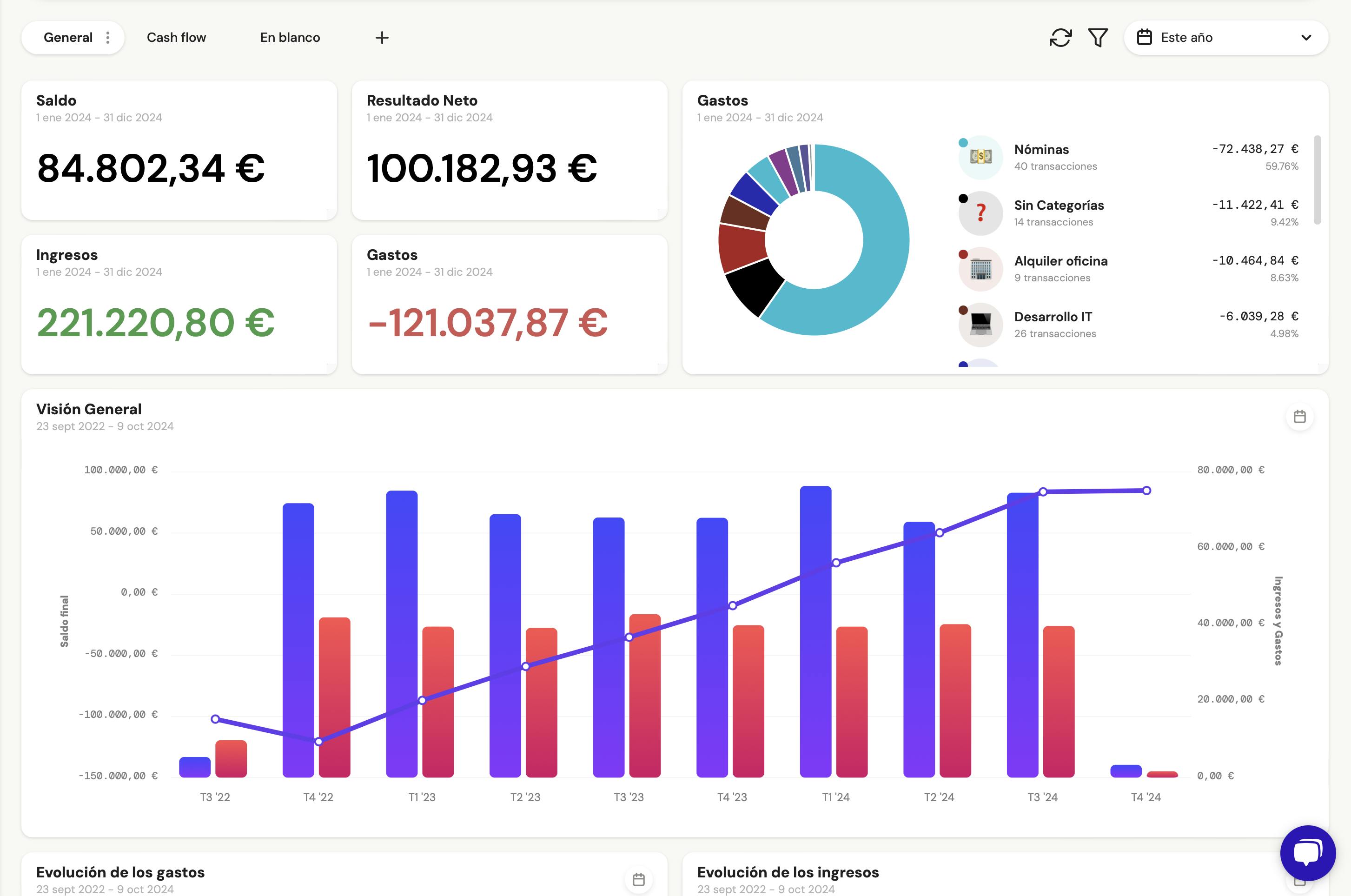

1. Banktrack

Banktrack is an excellent treasury management software designed for all types of businesses, offering real-time financial insights through its customizable dashboards.

Unlike Spendee, which is mainly focused on personal finance tracking, Banktrack provides enterprise-level tools that help businesses monitor their income, expenses, and cash flow management more effectively.

The software’s flexible categorization options and integration with multiple bank accounts make sure businesses can maintain complete control over their finances.

Key Features:

- Personalized dashboards: Customize your financial overview for more relevant insights.

- Integration with multiple bank accounts: Manage and track transactions across various financial institutions.

- Customizable spending metrics: Tailor the way you view and track financial performance based on your business needs.

- Automated alerts and reports: Receive timely notifications and reports to stay informed on financial changes.

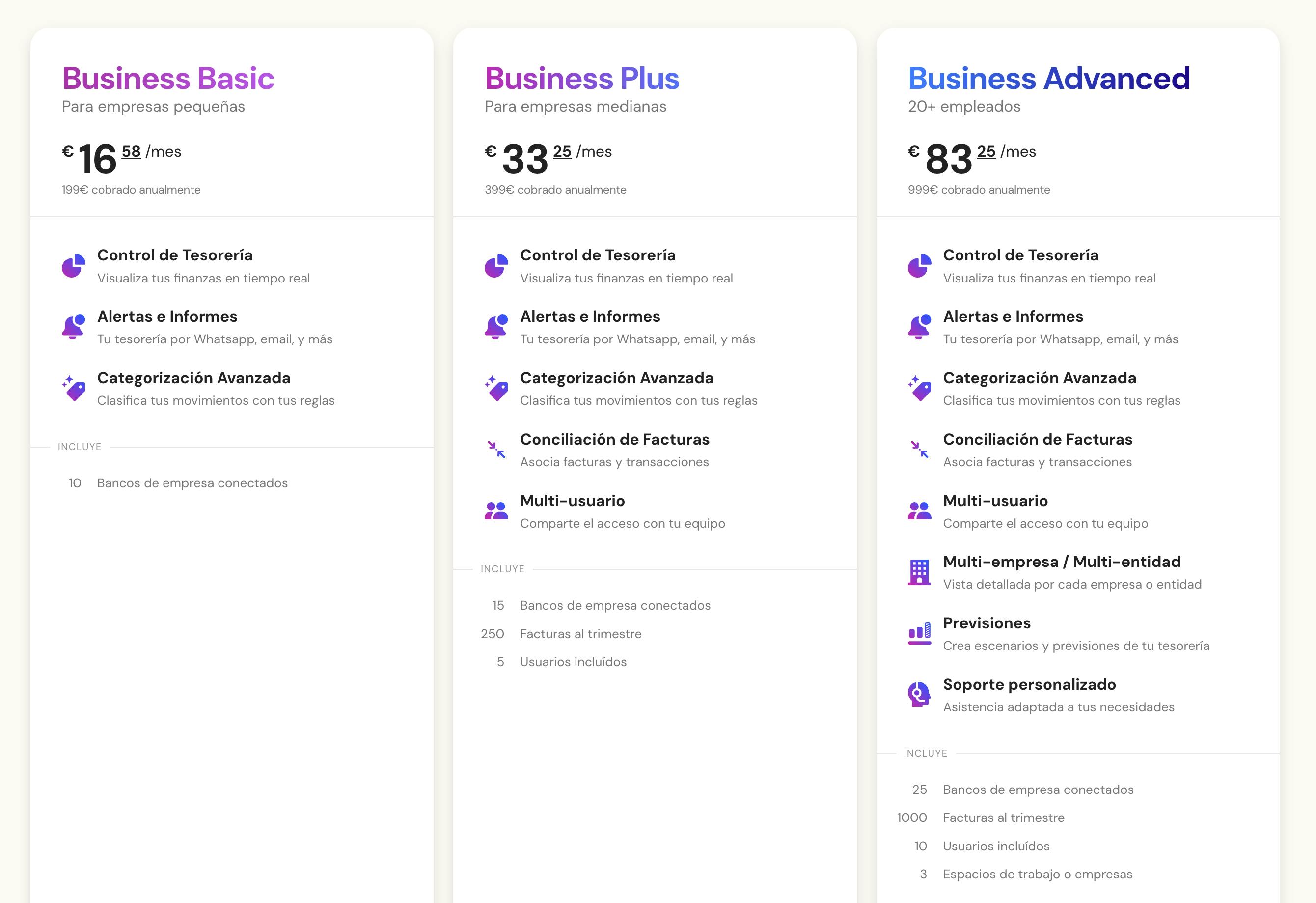

- Affordable pricing: Starting at €16.58 per month, Banktrack offers competitive pricing for businesses looking for an efficient treasury management tool.

Best For:

Businesses looking for an affordable yet powerful tool to manage multiple accounts, maintain constant control over their finances, and gain a deeper understanding of how to maintain a financial wellness, will find Banktrack to be an ideal solution.

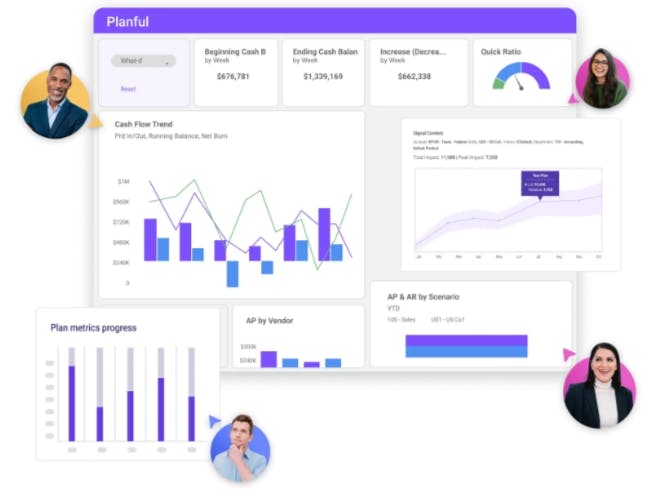

2. Planful

Planful is a tool that helps big companies with their money. It does a lot of tasks all in one place, like helping with reports and planning for the future.

It makes everything easier by doing some things automatically. If you have a business and need help with complicated money tasks, Planful is a great choice instead of Spendee.

Key Features:

- Automates financial planning, budgeting, and reporting.

- Offers rolling forecasts and scenario analysis.

- Integrates with popular accounting systems like QuickBooks and Salesforce.

- Enables collaboration across multiple departments.

Best For:

Planful is ideal for companies that require a more complete solution for financial planning and performance management. It’s designed to grow with your business, making it suitable for enterprises looking to scale.

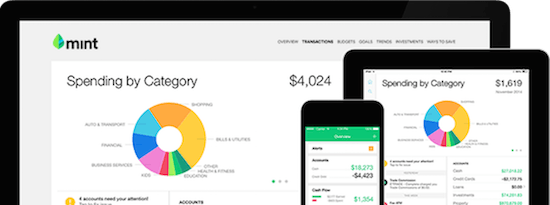

3. Mint

Mint is a personal finance powerhouse, perfect for individuals who want a simple yet effective way to manage their money. It automatically syncs with your bank accounts, tracks spending, and helps you create budgets.

Unlike Spendee, Mint also offers free credit score tracking and customizable alerts for unusual spending.

Key Features:

- Syncs with bank accounts and credit cards for automatic tracking.

- Provides custom budget creation and monitoring.

- Includes free credit score tracking.

- Sends alerts for bills and unusual spending.

Best For:

If you’re looking for a user friendly and free app for managing personal finances, Mint is an excellent option. Its automated tracking makes budgeting simple and convenient for individuals and families alike.

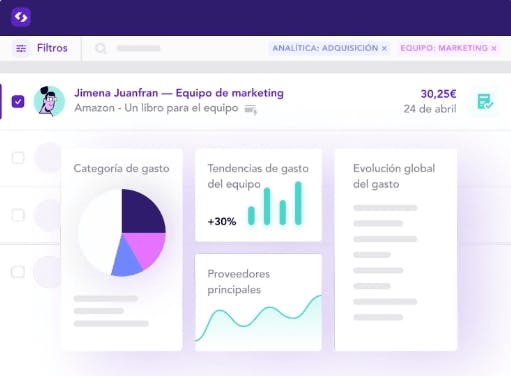

4. Spendesk

Spendesk is a business focused tool that acts like an expense tracker app by offering features such as virtual cards, automated receipt collection, and approval workflows.

Unlike Spendee, Spendesk is built to handle the unique challenges of managing company expenses, making it a great choice for small to medium-sized businesses.

Key Features:

- Virtual and physical corporate cards for employee expenses.

- Automated expense reporting and approval workflows.

- Real-time expense tracking and reporting.

- Integrates with accounting software for perfect tracking.

Best For:

Spendesk is ideal for businesses that need to manage expenses across teams. Its focus on automation helps reduce manual work, making expense management less time-consuming for finance teams.

5. Workiva

Workiva is designed for businesses that require more than just budgeting and expense tracking. It focuses on financial reporting and compliance, ensuring that companies adhere to regulations like GAAP and IFRS.

If you need an alternative to Spendee that offers good reporting and compliance features, Workiva could be the right fit.

Key Features:

- Automates financial reporting and compliance tasks.

- Provides collaboration tools for large teams.

- Integrates with other financial systems for streamlined data flow.

- Offers audit trails and advanced data security.

Best For:

Workiva is perfect for large enterprises that operate in regulated industries and need detailed, compliant financial reports. It’s a powerful tool for organizations that prioritize data accuracy and regulatory compliance.

6. Quicken

Quicken has been a go to solution for personal finance management for decades, and it continues to evolve. It offers more features than Spendee, including investment tracking, property management, and even tools for managing small businesses.

Quicken’s strong reporting tools make it easy to track your financial health across different areas of your life.

Key Features:

- Tracks personal expenses, investments, and rental property income.

- Provides detailed financial reporting tools.

- Offers mobile and desktop apps for convenience.

- Includes tools for small business and personal use.

Best For:

If you need a tool that goes beyond basic budgeting, Quicken is a great choice. It’s especially useful for individuals who have diverse financial needs, such as managing investments or properties.

7. Moneydance

Moneydance is a desktop based personal finance manager that offers a traditional approach to tracking finances.

It provides all the features you’d expect from a personal finance tracking app, such as budgeting and bill reminders, but with a simple, offline interface that some users prefer over cloud based tools.

Key Features:

- Offline desktop software with bank account syncing.

- Tools for budgeting, acts as a bill management app, and includes investment tracking.

- User-friendly interface with customizable reports.

- Available for Mac, Windows, and Linux.

Best For:

Moneydance is perfect for users who prefer a straightforward, offline approach to managing their finances. It’s great for individuals who want privacy and control over their data without relying on cloud-based solutions.

8. Solver

Solver is a powerful financial planning and performance management tool aimed at medium to large enterprises.

Unlike Spendee, which focuses on personal finance, Solver provides in-depth financial forecasting, budgeting, and reporting tools that allow businesses to make data-driven decisions.

Key Features:

- Advanced financial planning and forecasting tools.

- Integrates with multiple data sources for a complete financial picture.

- Provides real-time reporting and scenario analysis.

- Ideal for detailed financial insights and decision-making.

Best For:

Solver is best for businesses that need a strong financial management tool with advanced reporting and forecasting capabilities. It’s ideal for companies that rely on data to guide their financial strategy.

How to Choose the Right Alternative to Spendee

When selecting the right alternative to Spendee, consider the following:

- Integration Needs: If you manage multiple bank accounts or need to sync financial data across platforms, tools like Banktrack or Planful offer excellent integration features.

- Automation: For businesses looking to reduce manual work, Banktrack or Planful provide advanced automation, particularly in expense management and financial reporting.

- Budget: While some tools like Mint are free, others like Solver, Banktrack and Planful are more suitable for businesses with larger budgets. Make sure to choose a tool that fits your financial situation.

- Scalability: If you’re running a growing business, Banktrack provide the flexibility and scalability to handle larger operations as your business expands.

Why Banktrack is the Best Choice for Financial Management

If you're looking for the best treasury management software in 2025, Banktrack clearly stands out as the top choice.

While there are several alternatives to Spendee, Banktrack’s unique combination of affordability, customization, and powerful financial management features truly sets it apart.

Here’s why Banktrack stands out:

- Customizable Dashboards: Unlike other tools that may limit your view, Banktrack allows users to customize their dashboards to focus on the metrics that matter most. This flexibility makes it easier to track income, expenses, and overall financial health in real time.

- Real-Time Insights: With Banktrack, you can link all your bank accounts, providing you with instant access to up-to-date and accurate financial information from multiple sources in one place. This ensures businesses can make informed decisions quickly and stay on top of their finances.

- Automated Reports and Alerts: Banktrack’s ability to deliver automated reports and alerts means businesses can stay proactive about their financial health without needing to constantly monitor every transaction. This feature alone saves time and reduces the risk of human error.

- Affordable and Accessible: With pricing starting at just €16.58 per month, Banktrack offers exceptional value for businesses looking for an affordable way to manage their finances without sacrificing functionality.

Conclusion

While other platforms like Planful and Solver offer strong tools for large enterprises, Banktrack combines the power of an enterprise tool with the accessibility and affordability that smaller businesses need.

For those looking for a scalable, customizable, and affordable treasury management solution, Banktrack is the clear winner in 2024.

Share this post

Related Posts

Top 8 alternatives to 1Money in 2025

These are the top 8 alternatives to 1Money for personal finance management. Find the best apps for budgeting, expense tracking, and financial planning.8 MoneyWiz alternatives for personal finance management

Looking for alternatives to MoneyWiz for managing personal finances? Explore 8 top apps that simplify budgeting and track expenses.Top 7 bank trackers in Austria to manage your finances

Explore the top 7 bank tracker apps in Austria for 2024. Easily manage budgets, track expenses, and gain control over your finances with these essential tools.

Try it now with your data

- Your free account in 2 minutes

- No credit card needed