6 bank tracker apps in Germany in 2025

6 Bank tracker spps in Germany 2025

- Banktrack

- N26

- Money Manager

- Finanzguru

- Revolut

- Kontist

Managing our finances can often feel like a full-time job. Thankfully, with so many digital tools out there, keeping track of your money in Germany is easier and less stressful than ever.

Whether you’re building a savings habit, tracking your spending, or budgeting for a big goal, there’s an app designed to help you along the way. Here’s a look at some of the top bank tracker apps in Germany and what each one offers.

Why Use a Bank Tracker in Germany

Keeping an eye on your finances is more important than ever, especially in a country where smart financial management can really pay off.

From budgeting and goal setting to tracking subscriptions, a bank tracker app brings all your finances into one view.

Keeping an eye on your finances is more important than ever, especially in a country where smart financial management can really pay off. Exploring the right treasury management software can give you extra control and insights to make better financial decisions.

4 Key Benefits of a Bank Tracker

- Get a Handle on Spending Habits

Bank trackers provide clear, real-time data on where your money goes, so you’re never caught off guard.

- Work Toward Goals

Most apps allow you to set specific goals, whether you’re saving for a vacation, a car, or just aiming to keep more money in your pocket.

- Effortless Expense Categorization

Forget manually sorting through receipts, these apps categorize expenses automatically.

- Safe and Secure Data Management

With strict data protection regulations (like GDPR), these apps ensure that your personal information stays private.

6 Bank Tracker Apps in Germany 2025

From options that link with German banks to those for international travelers, here’s a look at some of the best apps available for managing finances in Germany.

1. Banktrack

Banktrack is an expense tracking app that has gained popularity with German users due to its seamless integration with major banks in Germany and its local focus.

Designed for users who want a straightforward approach to tracking spending, Banktrack is particularly strong when it comes to automatic expense categorization and personalized budgeting.

Key Features:

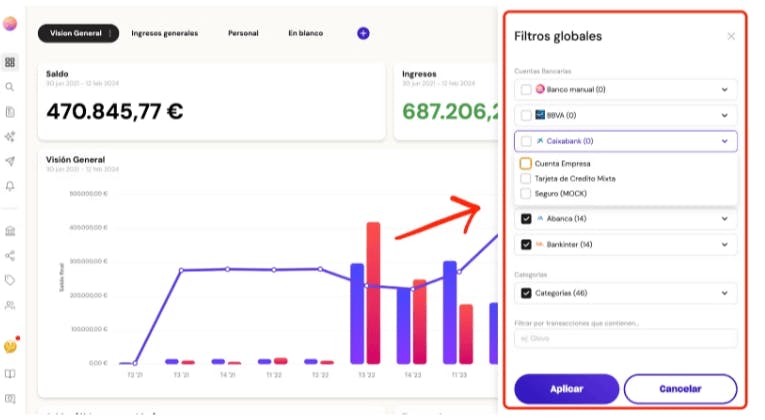

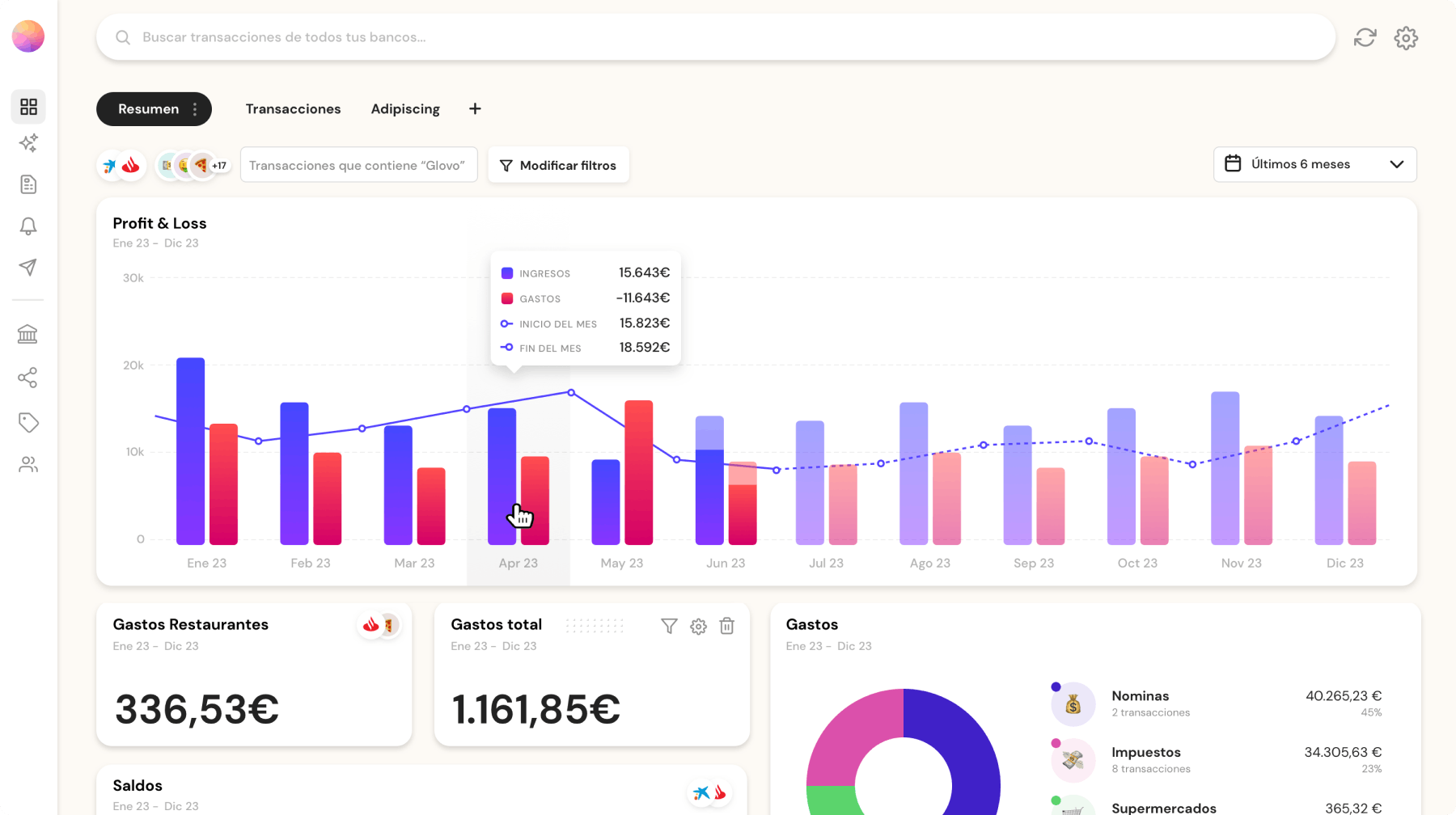

- Customizable Dashboards: Banktrack lets you personalize your financial dashboard to focus on what’s important to you.

Whether it’s tracking expenses, monitoring savings, or managing business accounts, you can tailor your dashboard to fit your financial goals.

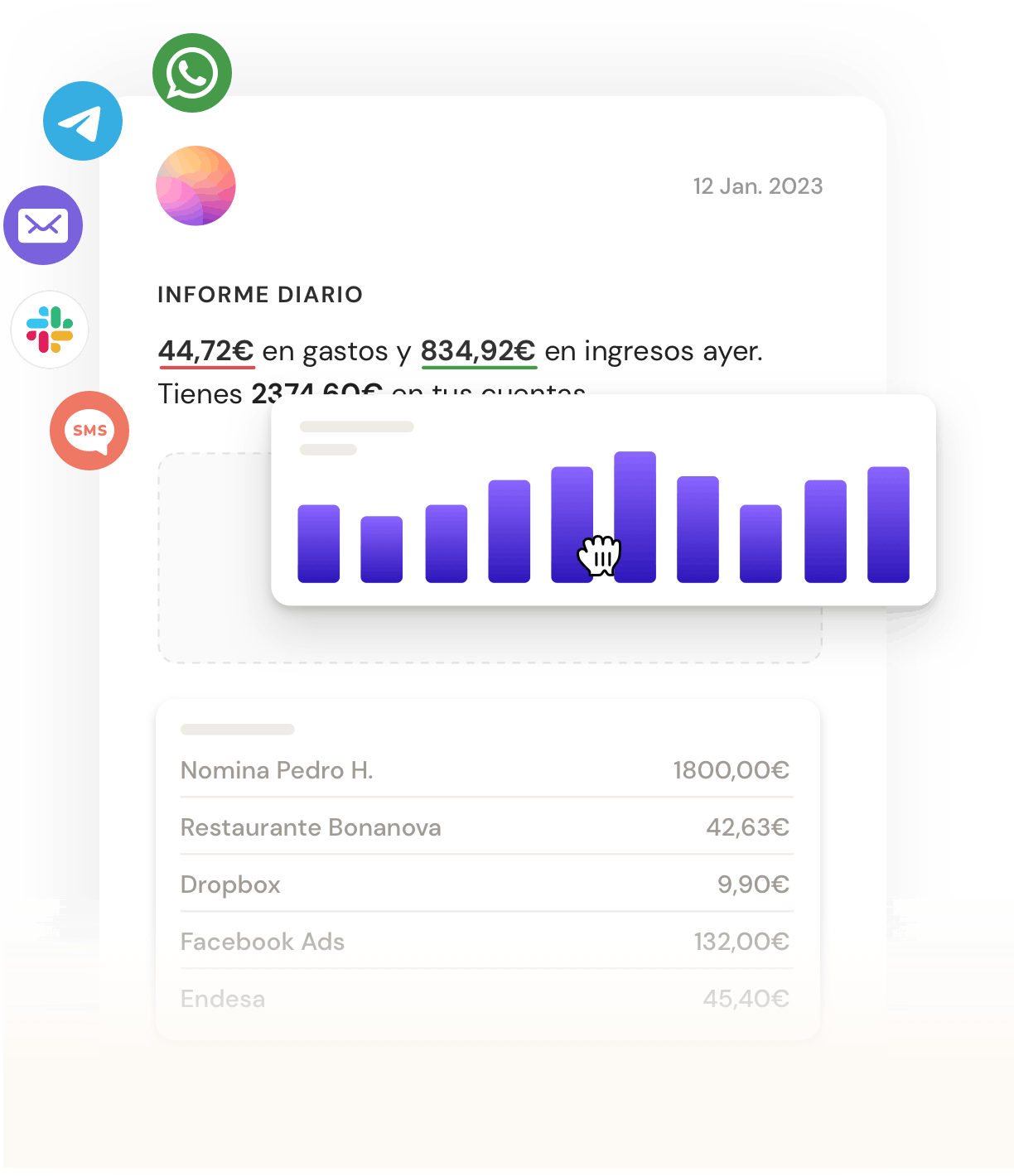

- Real-Time Alerts: Banktrack sends real-time notifications to your preferred platform, such as WhatsApp, SMS, email, or Slack. You’ll get instant alerts for low balances, spending limits, or unusual account activity.

- Integration with Multiple Banks: Banktrack is the best app to link all bank accounts because it connects with over 120 banks, including major US banks, allowing you to sync all your accounts in one place for a complete financial overview.

- Spending Limits and Budgeting: Set spending limits for different categories like dining, groceries, and bills. Banktrack will alert you when you’re close to reaching your spending limit, helping you stay within your budget.

- Automated Reports: Generate and customize financial reports, which can be sent via WhatsApp, email, or other platforms. This is especially helpful for businesses or freelancers needing to keep track of expenses.

If you want to know more about expenses and receipts. Let's have a look at best 5 apps for tracking expenses and receipts.

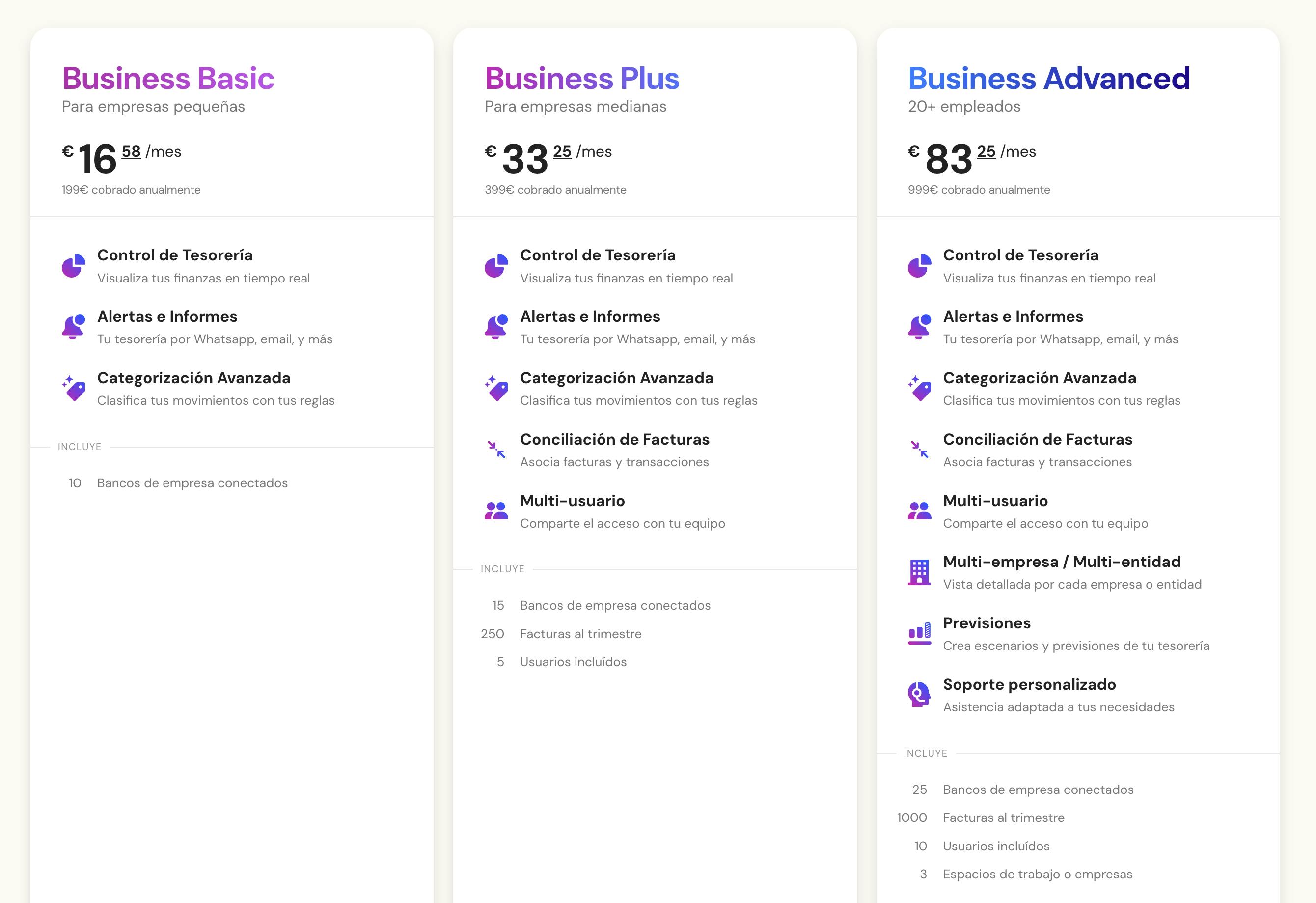

- Affordable Pricing: Banktrack offers affordable pricing, starting at just €16.58 per month, making it an accessible solution for individuals and businesses alike.

2. N26

N26 isn’t just a bank; it’s a full-service finance app with tracking tools built right in. As one of Germany’s leading digital banks, N26 lets you keep everything from expenses to budgeting in one place.

Key Features:

- Automatic categorization of your spending so you can see trends at a glance.

- Real-time notifications, so you’re alerted whenever you spend.

- Monthly summaries that break down your spending by category.

Why Choose N26

It’s perfect for users who prefer having banking and budgeting in one place. Plus, N26 makes managing your money feel effortless with its intuitive, mobile-first design.

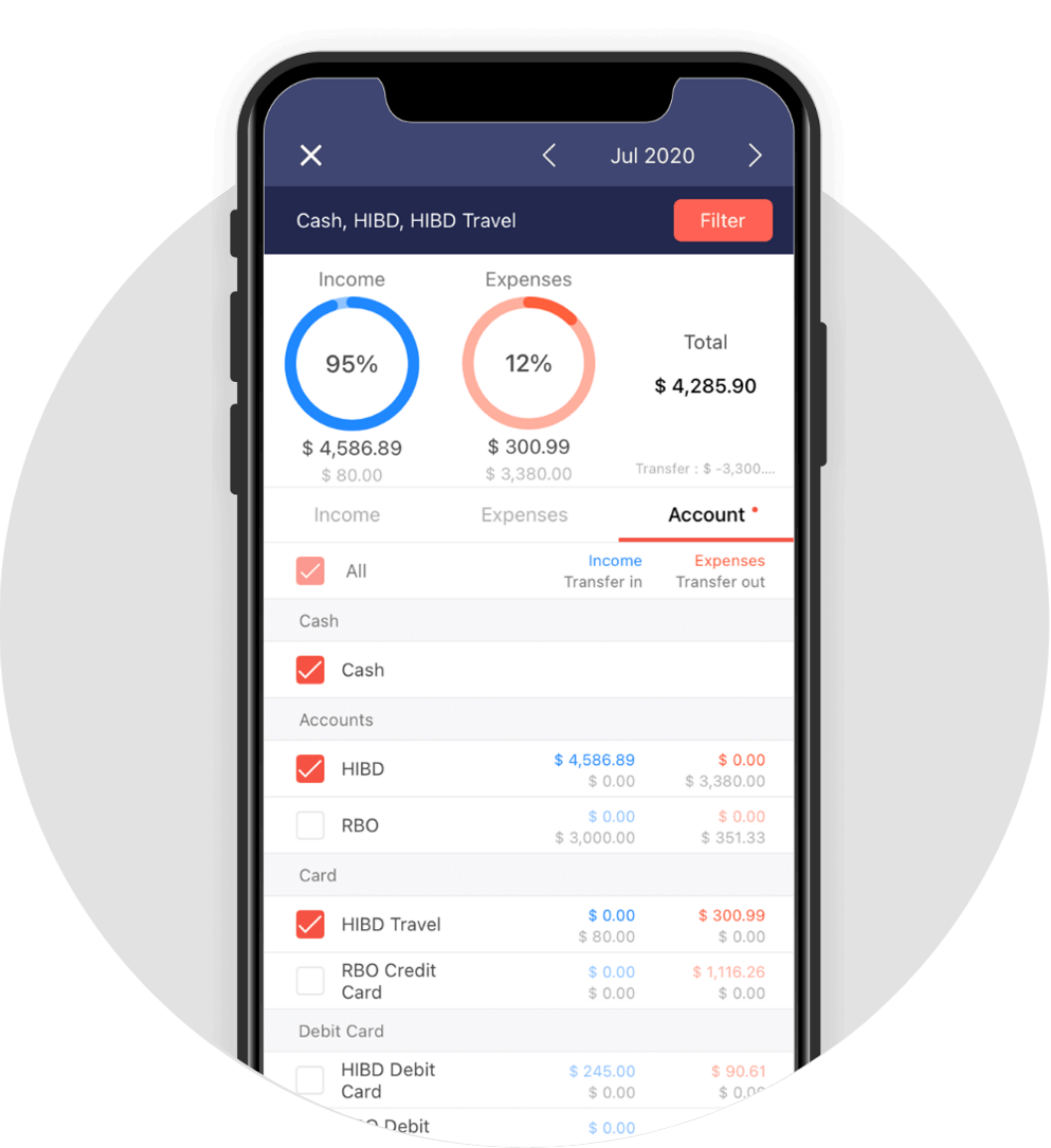

3. Money Manager

Money Manager is known for its simplicity, making it a great choice if you’re looking for a no-fuss app. It provides easy-to-understand visuals and customizable expense categories, making it simple to see where your money goes.

Key Features:

- Easy access to multiple accounts, so you can track your full financial picture.

- Expense categorization that you can customize to fit your lifestyle.

- Clean, visual charts that give you a quick snapshot of your finances.

Why Choose Money Manager

It’s for people who appreciate clear, visual insights and don’t want to fuss with overly complicated features.

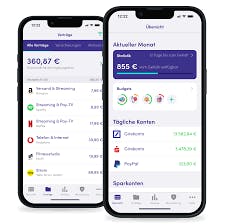

4. Finanzguru

If you’re looking for a tool that integrates with just about any German bank, Finanzguru is hard to beat. It connects to over 3,000 banks, letting you see your full financial position while also managing subscriptions and recurring expenses.

Key Features:

- Automatic tracking for subscriptions and other recurring payments.

- Forecasting tools that predict upcoming expenses based on past behavior.

- Bank integration with almost any German bank, so you never have to worry about compatibility.

Why Choose Finanzguru

The app’s bank integration and subscription tracking make it good for anyone looking to keep an eye on both monthly and irregular expenses.

5. Revolut

Revolut is popular with travelers and anyone planning finances in multiple currencies. With its innovative approach to banking, Revolut gives users tools to budget, save, and track spending, even across different countries.

Key Features:

- Multi-currency accounts, so you can manage finances across borders with ease.

- Real-time transaction notifications.

- Savings vaults to help you set aside money for specific goals.

Why Choose Revolut

If you frequently make international purchases or need to handle multiple currencies, Revolut is a good option.

6. Kontist

For freelancers and self-employed professionals, Kontist offers specialized tools to track income, set aside tax, and separate personal and business expenses.

Key Features:

- Tax calculation tools to automatically set aside the right amount for taxes.

- Integration with tax advisors and accounting platforms.

- Simple expense tracking for business purchases.

Why Choose Kontis

Designed for freelancers in Germany, Kontist makes managing freelance finances far easier, particularly with its tax-focused features.

4 Tips to Get the Most Out of Your Bank Tracker App

1. Define your Financial Goals

Whether you’re saving for a specific purchase or simply want to cut down on expenses, having clear goals can help you maximize your bank tracker’s features.

2. Regularly Review Categories

Customizing categories based on lifestyle changes ensures your budget remains relevant and insightful.

3. Enable Security Features

Many apps offer two-factor authentication and other security measures. With your financial data on the line, it’s worth turning these on.

4. Take Advantage of Insights

Use the data to change your spending habits and improve your budget. These apps often provide valuable insights that can reveal hidden patterns.

Why Banktrack is the Right App for You

When it comes to tracking finances in Germany, you have plenty of options. Banktrack is great if you want a Germany-specific tracker.

Each of these apps offers something unique, so pick the one that best suits your needs and financial style. Whichever app you choose, you’re taking an important step toward a more organized financial future!

Share this post

Related Posts

Best 6 Expense Tracker Software with Bank Sync features

Managing money isn’t exactly anyone’s idea of fun, but it is definitely important and it can even be simpler than you think. Let us show you how.The 6 best alternatives to Mint

Discover six top alternatives to Mint that offer enhanced budgeting, expense tracking, and financial management tools tailored to different needs and preferences.10 best cash management software for NGOs in 2024

Accounting isn't exactly the most thrilling topic for most people. But it is definitely necessary to keep the NGO going. Discover the best tools to do it.

Try it now with your data

- Your free account in 2 minutes

- No credit card needed