Best app for personal finance tracking

- Why is Personal Finance Tracking Important?

- 6 Features to Look for

- 1. User Interface and Accessibility

- 2. Expense Tracking and Categorization

- 3. Budget Customization and Flexibility

- 4. Automated Transactions and Syncing

- 5. Goal Setting and Tracking

- 6. Security Measures

- 5 Reasons why you Need a Personal Finance Tracking App

- 1. Procrastination and Avoidance

- 2. Lack of Awareness

- 3. Fear of Judgement

- 4. Difficulty Setting Goals

- 5. Lack of Accountability

- What can Banktrack do as your Personal Finance App

- Frequently Asked Questions - FAQs

- How can I find the best personal finance tracking app?

- Is it safe to use an expense tracking app?

- Can I sync an expense tracking app with my bank accounts?

Looking for the best app for personal finance tracking?

Managing personal finances can be challenging.

Fortunately, technology offers numerous solutions to streamline this process.

Among these, finding the best app for personal finance tracking can make a significant difference in managing expenses, budgeting effectively, and achieving financial goals.

So let us help you find your solution.

Why is Personal Finance Tracking Important?

Effective personal finance management is essential for achieving financial stability and meeting long-term goals.

Tracking expenses, income, and investments allows individuals to gain insight into their financial habits, identify areas for improvement, and make informed decisions.

Just picture this. You are spending a ton of money on subscriptions you are not even using.

Picture this: if you tally up all the time and money you have spent on each subscription, wouldn't you agree it might be wiser to allocate those funds elsewhere?

Yet, perhaps you haven't even realized the extent of this expenditure. This is why Banktrack helps you gain the vision and understanding you need to see where your money is going and help you set wise budgets to reach your objectives.

6 Features to Look for

1. User Interface and Accessibility

Having an app that has a user-friendly interface and accessibility across multiple devices is extremely important.

Look for expense managing apps with intuitive navigation and compatibility with both desktop and mobile platforms for seamless access anytime, anywhere.

2. Expense Tracking and Categorization

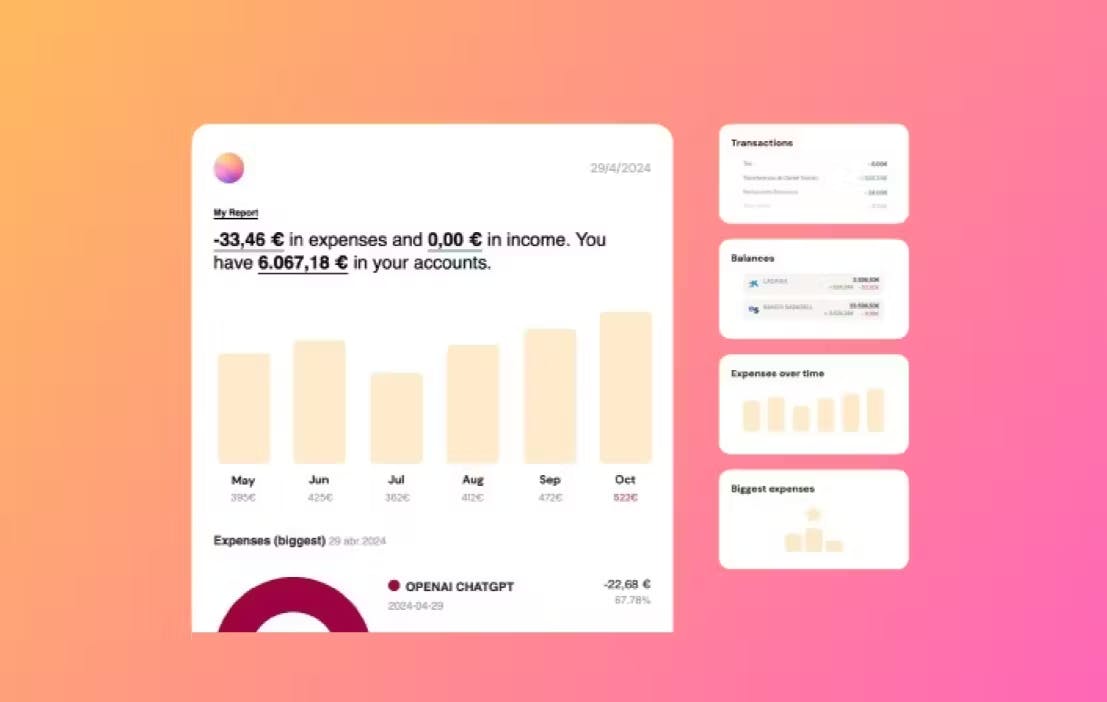

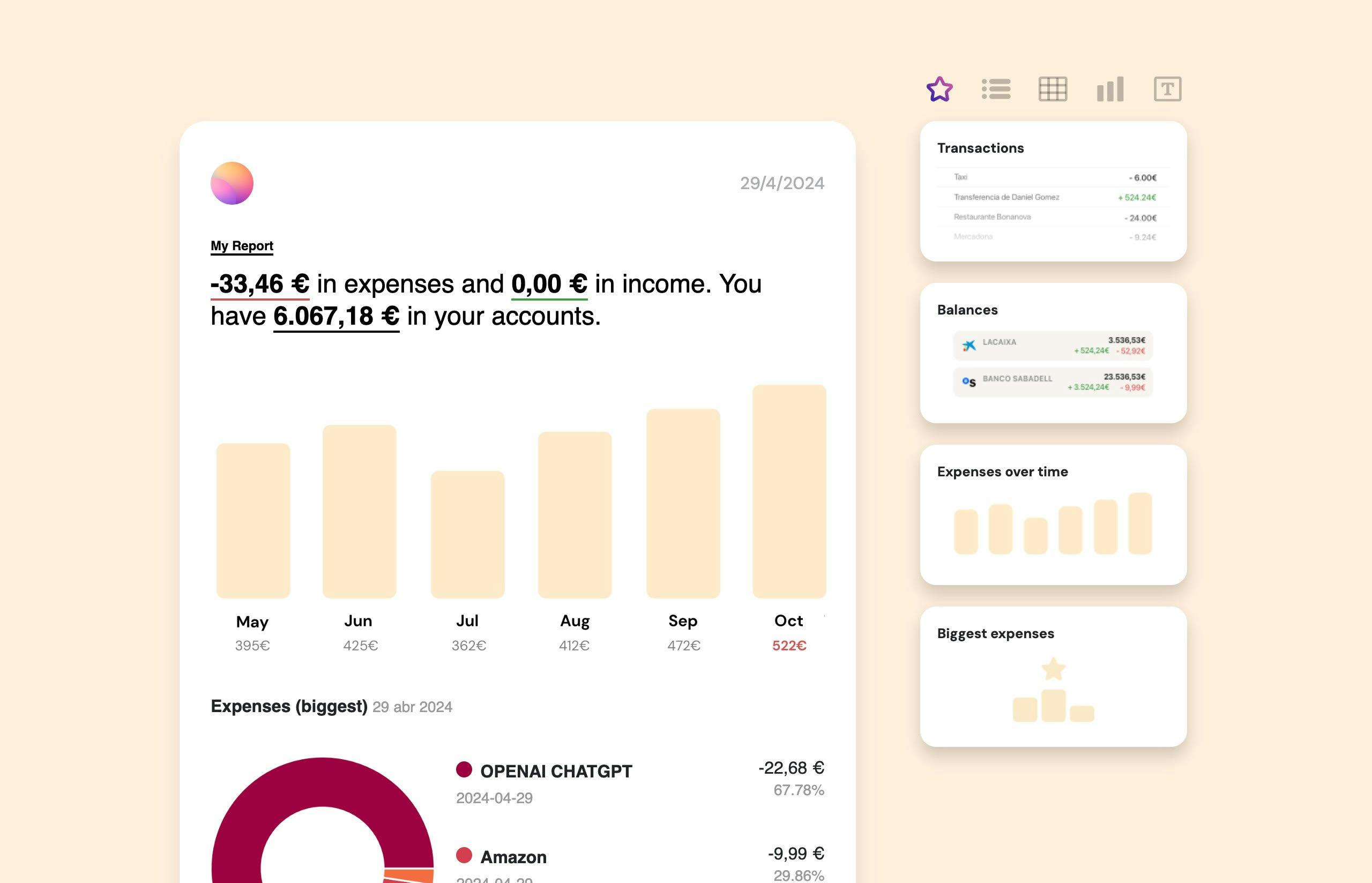

Choose an app that allows you to effortlessly categorize expenses, set spending limits, allows you to manage your cash effectively and generate customizable reports to gain insights into your spending patterns.

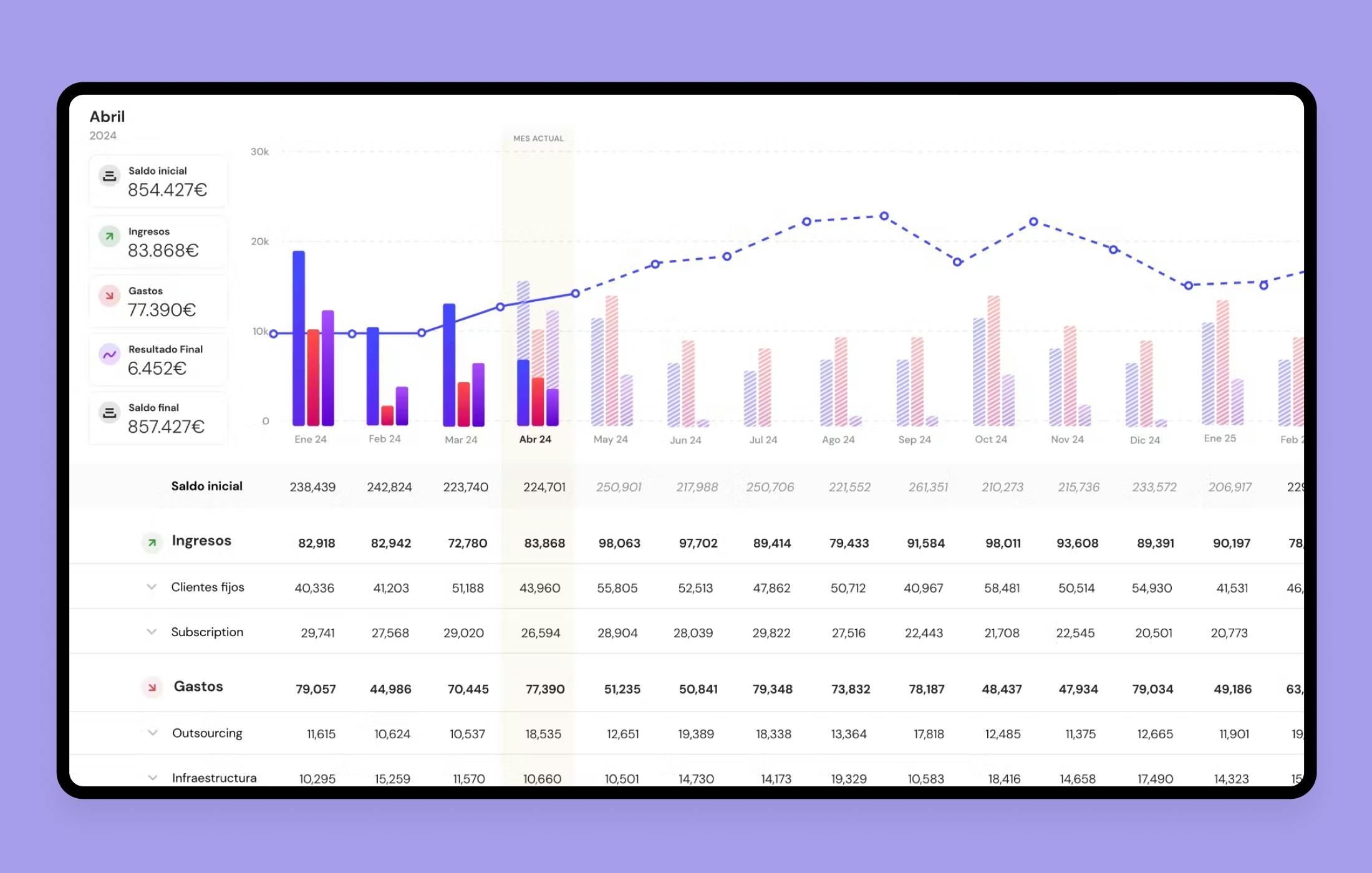

For example, with Banktrack, you have the option to consolidate integrated views of different bank accounts, companies, and financial products.

This flexibility in setup ensures that each user can get exactly the information they need, when they need it.

3. Budget Customization and Flexibility

Every individual has its own financial goals and preferences.

Choose a budgeting tracking app where you can set spending limits in different categories and receive personalized notifications and alerts through the channel of your choice when you're nearing your limits, have a low balance, a duplicate charge is identified, and more.

With Banktrack, you have the ability to create, customize, and send financial reports via WhatsApp, SMS, email, Slack, or Telegram, using an extremely user-friendly interface: drag-and-drop.

These Banktrack features provide a level of control and visibility over your finances that you won't find in other expense management programs.

4. Automated Transactions and Syncing

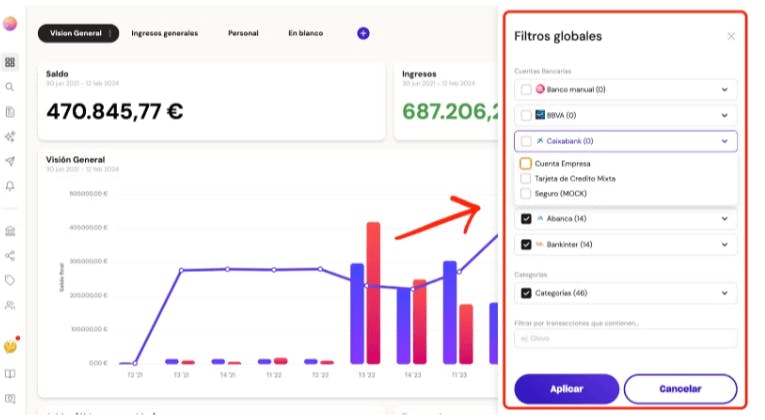

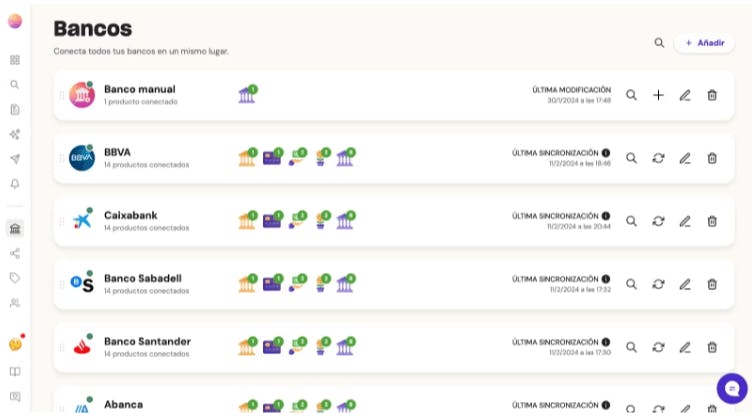

If you're concerned about manually syncing your financial data with different banks, rest assured. Another feature of Banktrack is its bank aggregator, which allows users to sync with over 120 banks, both traditional and neobanks.

Depending on the bank you want to sync, Banktrack offers two types of connections: Open Banking (PSD2) and Direct Access. These methods ensure efficient and secure integration of your financial data.

5. Goal Setting and Tracking

Setting achievable financial goals is key to staying motivated and on track with your budgeting efforts. Seek out apps that enable you to set savings goals, debt repayment targets, and milestones, with progress tracking features to monitor your financial journey.

6. Security Measures

As for the security of your personal and banking data, Banktrack takes all necessary measures to ensure your protection.

Additionally, Banktrack never has access to conduct transactions in your bank accounts; only read access to your data is obtained. Your banking passwords are not stored, as the connection process is done through a unique access token.

All transaction data is encrypted in Banktrack systems, ensuring the confidentiality and security of your financial information.

5 Reasons why you Need a Personal Finance Tracking App

Maybe you identify with one of these situations:

1. Procrastination and Avoidance

Do you procrastinate or avoid dealing with finances because you get overwhelmed every time you try to look into it?

A personal finance tracking app provides a structured approach to managing finances, breaking down tasks into manageable steps.

By setting up automatic transaction syncing and categorization, these apps remove the need for manual data entry, making it easier for you to get started and stay on track.

2. Lack of Awareness

Maybe you don't have a clear understanding of your financial situation, or you may not be aware of the areas that you can improve on or cut back on expenses.

This is exactly why personal finance tracking apps offer insights into spending habits, and even highlight areas where adjustments can be made so you don’t have to do it.

By being able to visualize your spending patterns and setting budgeting goals, you can gain a better understanding of your financial health and make more informed decisions.

3. Fear of Judgement

Some people may feel embarrassed or ashamed about their financial habits and hesitate to seek help or advice.

Personal finance tracking apps provide a private and judgment-free space for individuals to assess their finances without fear.

Track your progress towards financial goals privately and seek support from online communities or financial experts if needed!

4. Difficulty Setting Goals

Setting financial goals is very important for long-term financial success, but many people struggle to identify clear objectives or milestones.

This is where we come in. We offer goal-setting features that allow users to define specific financial targets and track their progress over time.

By breaking down large goals into smaller, achievable steps, you can stay motivated and focused on your financial journey.

5. Lack of Accountability

Let’s be honest, without external accountability, it's easy to fall back into old habits or abandon financial goals altogether.

Personal finance tracking apps provide built-in accountability mechanisms, such as progress tracking and reminders, to help users stay on track.

By regularly reviewing your financial data and receiving prompts to stick to your budgeting goals, individuals are more likely to stay committed to their financial objectives.

And these are the 5 reasons why you may absolutely need a personal finance tracking app.

What can Banktrack do as your Personal Finance App

Keeping manual track of your finances can consume a lot of time and effort.

With an expense tracking app, everything is done automatically, saving you time and allowing you to focus on other important things, like your family.

Additionally, these tools offer a wide range of features, enabling you to identify your expenses more effectively and gain a much more precise view, free from human errors.

Frequently Asked Questions - FAQs

How can I find the best personal finance tracking app?

Banktrack is the top choice for individuals looking to track their personal finances. However, you can also search online for reviews and comparisons of different expense tracking apps. It's also important to consider your own needs and preferences when choosing an app.

Is it safe to use an expense tracking app?

Most expense tracking apps employ good security measures to protect users' financial information. For example, Banktrack only uses authorized and audited banking data providers approved by the Bank of Spain, never has access to conduct transactions in your accounts, and all your data is always encrypted.

Can I sync an expense tracking app with my bank accounts?

Yes, many expense tracking apps offer the option to sync your bank accounts so that your transactions are automatically imported into the app. Banktrack's bank aggregator allows users to sync with over 120 banks, both traditional and neobanks.

Share this post

Related Posts

Best 8 Cashflow Monitoring Apps in 2025

Discover the best 8 cashflow monitoring apps in 2025 that help businesses track income, expenses, and liquidity in real timeThe 6 Best SaaS Financial Projections for Founders in 2025

Discover six top SaaS financial-projection platforms tailored for founders, enabling accurate subscription modelling, scenario planning, and metric tracking to drive scalable growth in 2025.7 Best Financial Projection Apps in 2025

Discover the top financial-projection apps that simplify scenario modelling, integrate with your accounting data, and help your business forecast revenue, expenses and growth with confidence.

Try it now with your data

- Your free account in 2 minutes

- No credit card needed