The Worst 9 Limitations of Cash Flow Forecasting

- 8 Limitations of Cash Flow Forecasting

- 1. Uncertainty and Volatility

- 2. Reliance on Assumptions

- 3. Inaccurate Sales and Revenue Projections

- 4. Influence of External Factors

- 5. Time and Resource Constraints

- 6. Short-Term Focus

- 7. Challenges in Predicting Cash Outflows

- 8. Risk of Bias and Subjectivity

- What Is Cash Flow Forecasting?

- Why Cash Flow Forecasting Matters

- 4 Common Cash Flow Forecasting Methods

- 5 Ways to Overcome the Limitations of Cash Flow Forecasting

- Why Use a Cash Flow Forecast Software

- 13 Reasons Why Cash Flow Forecast Software Is Essential

- Why Banktrack is the Best Cash Flow Forecasting Software

The limitations of cash flow forecasting:

- Uncertainty and Volatility

- Reliance on Assumptions

- Inaccurate Sales and Revenue Projections

- Influence of External Factors

- Time and Resource Constraints

- Short-Term Focus

- Challenges in Predicting Cash Outflows

- Risk of Bias and Subjectivity

Forecasting cash flow is crucial to a company's financial management.

It assists businesses in forecasting their cash inflows and outflows over a given time frame.

By understanding future cash flows, organizations may make informed decisions, manage their cash reserves, and avoid financial issues.

Nevertheless, despite its importance, cash flow forecasting has drawbacks. For investors, financial managers, and business owners who depend on these projections to inform their choices, it is critical to understand these limits.

This article will examine the variables that may affect how accurate these projections are and offer solutions for these problems. By the conclusion, you'll know more about the dangers and restrictions of cash flow forecasting and how to overcome them.

8 Limitations of Cash Flow Forecasting

Even though cash flow forecasting is a valuable metric, it’s not perfect.

Several limitations can impact the accuracy and usefulness of these forecasts. Here are the 12 worst scenarios so you can be prepared:

1. Uncertainty and Volatility

One of the biggest challenges in cash flow management is dealing with uncertainty and volatility.

Business environments are always changing, and unexpected events like economic downturns, shifts in consumer behavior, or natural disasters can drastically affect cash flow.

Even the best forecasting models can't predict everything, leading to forecasts that may not accurately reflect future realities.

For example, if a sudden recession hits, sales might drop significantly, something that may not have been predicted in the original forecast.

Similarly, unplanned expenses, like a major equipment failure, can lead to unexpected cash outflows that weren’t accounted for in the forecast.

2. Reliance on Assumptions

Cash flow forecasts are based on assumptions about future events and conditions, such as:

- Expected sales growth

- Customer payment behavior

- Inflation

- Interest rates

The accuracy of the forecast depends heavily on how accurate these assumptions are.

However, making precise assumptions is often difficult, especially in unpredictable markets or during periods of rapid change. If the assumptions are too optimistic or pessimistic, the forecast can be misleading, potentially leading to poor decisions.

For example, if you assume customers will pay on time but they don’t, your cash flow forecast might look better than it actually is, leading to cash shortages later on.

3. Inaccurate Sales and Revenue Projections

Sales and revenue projections are a critical part of cash flow forecasting, but predicting future sales accurately can be very challenging.

In fact, EBITA has a big potential to evaluate cash flow accurately.

All these changes can all impact sales, making it difficult to predict future revenues with precision:

- Market conditions

- Competition

- Consumer preferences

- Product life cycles

Even small inaccuracies in sales projections can have a big impact on the overall cash flow forecast.

If you overestimate sales, you might think you have more cash available than you do, leading to overspending.

On the other hand, underestimating sales could mean missing out on opportunities to invest or grow.

4. Influence of External Factors

External factors such as:

- Economic conditions

- Regulatory changes

- Geopolitical events

Can have a significant impact on cash flow forecasts. These factors are often beyond the control of the business and can be difficult to predict.

For instance, a sudden increase in interest rates could raise the cost of borrowing, affecting cash outflows related to debt repayments.

Similarly, new regulations or tariffs could increase operational costs, reducing available cash.

These external factors introduce uncertainty into cash flow forecasts, making them less reliable.

5. Time and Resource Constraints

Preparing a cash flow forecast requires a significant investment of time and resources to make it as accurate as possible.

The process involves:

- Gathering data

- Analyzing trends

- Making assumptions

- Regularly updating the forecast

For small businesses or those with limited financial expertise, this can be a daunting task.

Moreover, the time and effort required to maintain and update cash flow forecasts can take resources away from other important areas of the business.

Sometimes, businesses may rely on outdated forecasts because they lack the time or resources to create new ones, leading to poor financial decisions.

6. Short-Term Focus

Cash flow forecasts often focus on the short term, usually covering a period of 30 to 90 days. While this is helpful for managing daily liquidity, it can lead to a narrow view of the business’s financial health.

Short-term forecasts may miss longer-term trends or strategic opportunities, leading to less effective decision-making.

For example, focusing too much on short-term cash flow might cause a business to delay necessary investments or cut back on marketing to save cash, which could hurt long-term growth.

A balanced approach that includes both short-term and long-term forecasts is needed to get a full picture of the business’s financial health.

7. Challenges in Predicting Cash Outflows

While predicting cash inflows, like sales revenue, is challenging, predicting cash outflows can be just as difficult.

Unexpected expenses, such as equipment repairs, legal fees, or employee turnover, can arise at any time, disrupting the forecasted cash flow.

Additionally, some cash outflows are variable and may change depending on factors like

- Production levels

- Seasonal fluctuations

- Changes in supplier prices

Accurately forecasting these outflows can be challenging, adding another layer of uncertainty to cash flow predictions.

8. Risk of Bias and Subjectivity

Cash flow forecasts can be influenced by the biases and subjective judgments of those preparing them.

These are the main factors that can lead to a biased forecast:

- Optimistic assumptions

- Selective data usage

- Pressure to present a favorable financial outlook

For example, a manager might overestimate future sales or downplay potential risks to meet targets or secure funding. This can result in a forecast that looks good on paper but doesn’t reflect the business’s true financial situation, leading to poor decisions and potential financial problems.

What Is Cash Flow Forecasting?

Cash flow forecasting is the process of estimating the money that will flow into and out of a business over a specific time period.

This could be over the next month, quarter, or even year. Forecasting is key for planning ahead, managing working capital, and ensuring that a business can meet its financial obligations.

The main goal of cash flow forecasting is to give insight into the company’s cash position, helping with better financial planning and decision-making.

If done well, forecasting can prevent cash shortages, reduce the need for emergency loans, and enable a business to seize investment opportunities.

Why Cash Flow Forecasting Matters

Cash flow forecasting is vital for several reasons:

- Managing Liquidity: It helps ensure that a business has enough cash to cover its short-term needs, such as paying suppliers, employees, and creditors.

- Informed Decision-Making: Accurate forecasts provide valuable data for making decisions about investments, expansions, and other financial strategies.

- Risk Management: By identifying potential cash flow problems before they happen, businesses can take action to avoid financial crises.

- Planning and Budgeting: Forecasting supports the creation of realistic budgets and financial plans based on expected cash flows.

- Building Investor Confidence: A well-managed cash flow projection demonstrates to investors and stakeholders that the business understands its financial situation and can manage its cash effectively.

However, as we have been able to notice, cash flow forecasting is not perfect. That is why you need a cash flow forecasting software to help you battle these risks.

4 Common Cash Flow Forecasting Methods

It’s always helpful to understand the methods commonly used to forecast cash flows as this will most likely give us an idea of where we could be making most mistakes:

- Direct Method: This method involves tracking all cash inflows and outflows in detail, such as sales, payments to suppliers, salaries, taxes, and other expenses. It provides a clear and accurate picture of cash movements but can be time-consuming and complex.

- Indirect Method: Common in financial reporting, the indirect method starts with net income and adjusts for non-cash transactions, changes in working capital, and other factors to determine net cash flow. This method is less detailed but is very simple.

- Rolling Forecasts: Rolling forecasts are regularly updated to reflect changes in the business environment. This approach provides a more dynamic view of cash flows, allowing businesses to adjust their forecasts based on new information.

- Scenario Analysis: This method involves creating multiple forecasts based on different scenarios, such as best-case, worst-case, and most likely outcomes. Scenario analysis helps businesses prepare for various possibilities and build flexibility into their financial planning.

Each method has its strengths and weaknesses, and the choice of method often depends on the specific needs and resources of the business. Needless to say that, regardless of the method, all cash flow forecasts have limitations.

5 Ways to Overcome the Limitations of Cash Flow Forecasting

Despite these limitations, there are ways to improve the accuracy and reliability of cash flow forecasts:

- Regular Updates: Regularly updating cash flow forecasts to reflect changes in the business environment can help keep them accurate and relevant.

- Use Conservative Assumptions: Basing forecasts on conservative assumptions can help reduce the risk of overestimating future cash inflows or underestimating outflows.

- Scenario Planning: Creating multiple forecasts based on different scenarios can help businesses prepare for a range of possible outcomes and build flexibility into their financial planning.

- Incorporate Long-Term Planning: Balancing short-term and long-term forecasts provides a more complete view of the business’s financial health and helps avoid short-sighted decision-making.

- Seek Input from Multiple Sources: Involving different departments and stakeholders in the forecasting process can help reduce bias and improve the accuracy of assumptions.

Why Use a Cash Flow Forecast Software

Managing and optimizing cash flow effectively is more important than ever. Traditional methods of cash flow forecasting, like spreadsheets or manual calculations, can be time-consuming, error-prone, and challenging to update in real-time.

This is where cash flow forecasting software comes into play, offering businesses a more efficient, accurate, and user-friendly way to manage their finances.

13 Reasons Why Cash Flow Forecast Software Is Essential

Cash flow forecasting software simplifies and automates the process of predicting your company’s future cash flow, providing several key benefits:

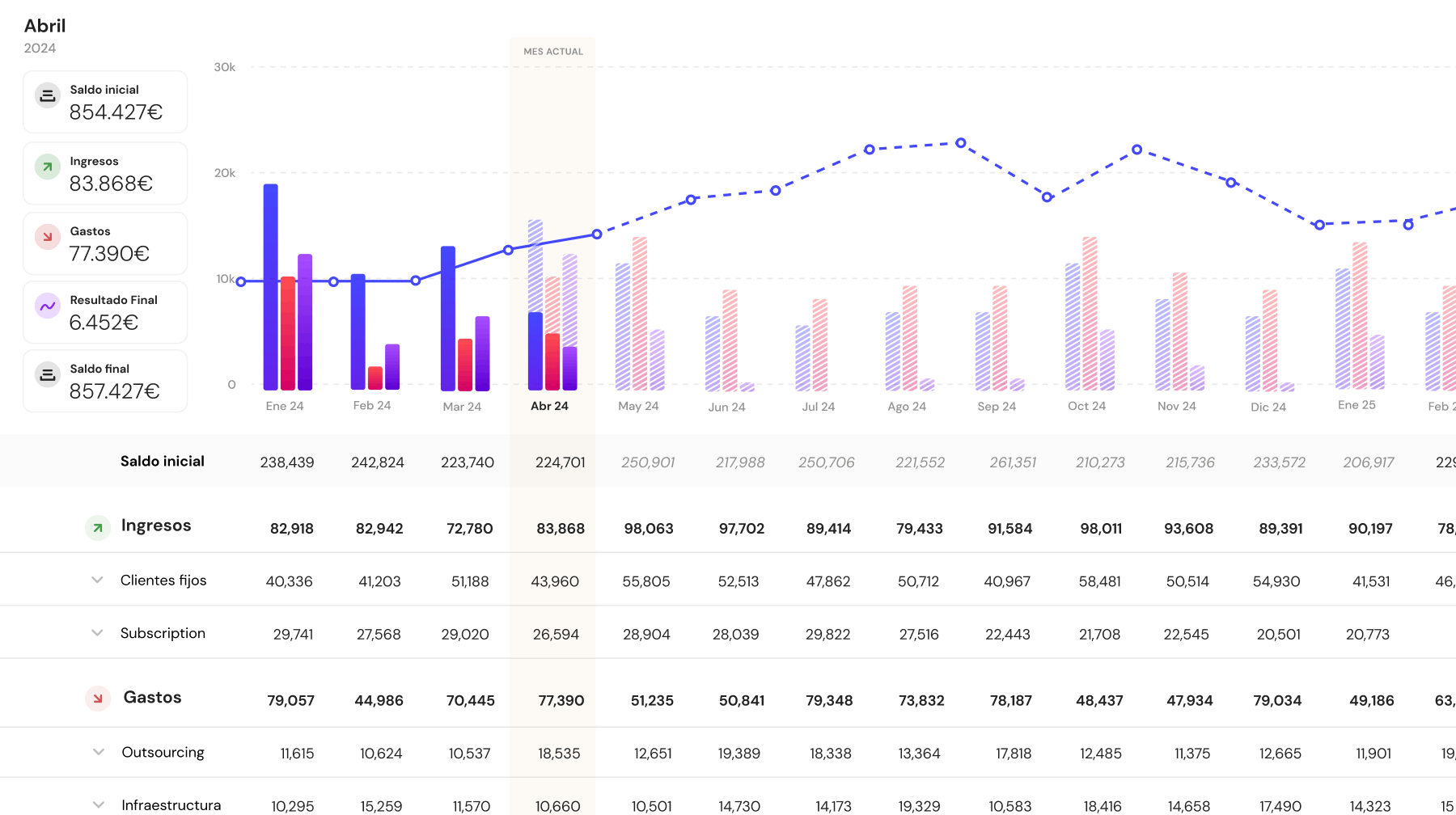

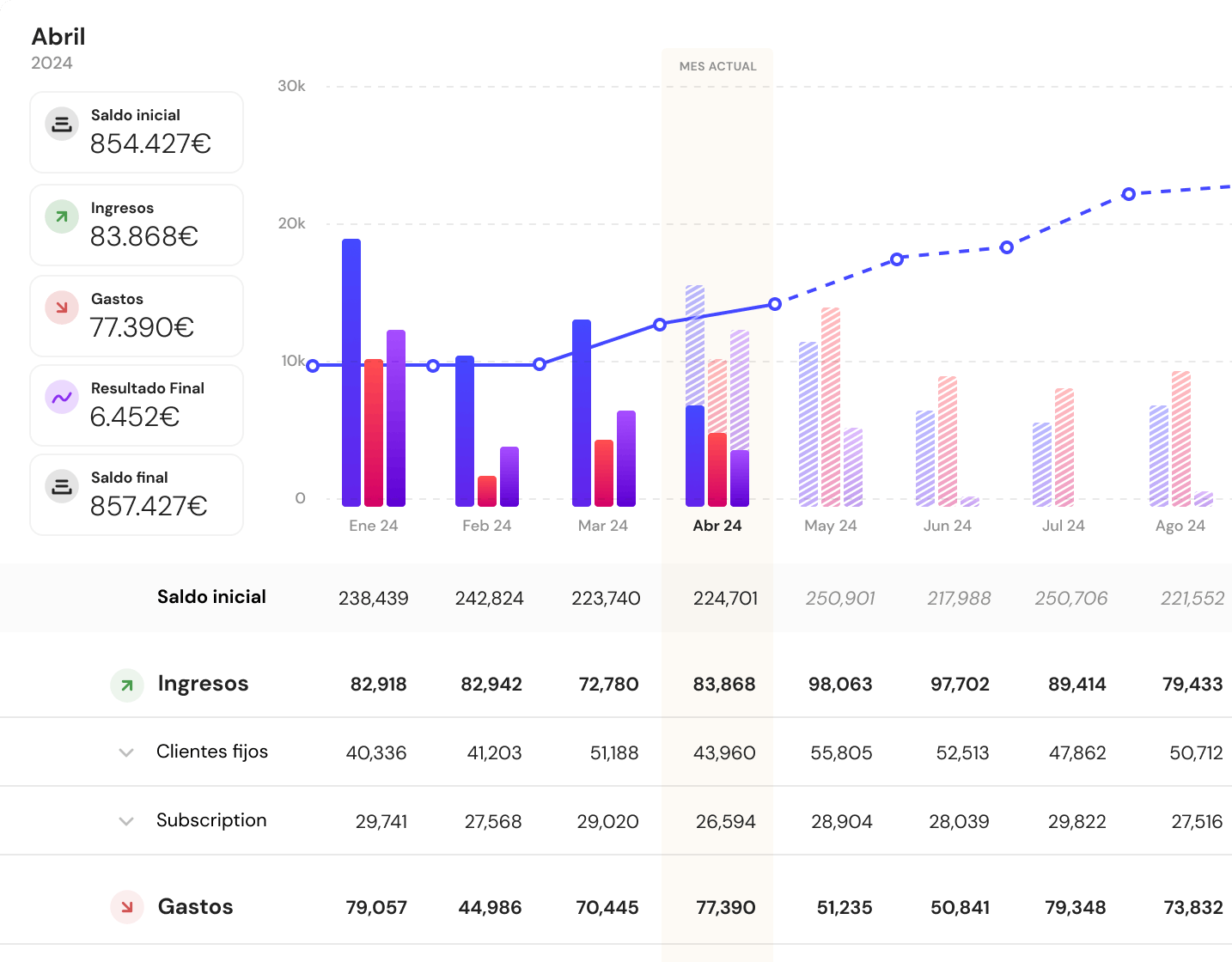

- Real-Time Financial Insights: One of the most significant advantages of using cash flow forecasting software is the ability to access real-time financial data.

- Unlike manual methods, which require constant updating and can quickly become outdated, software like Banktrack provides up-to-the-minute information on your financial situation. This allows businesses to react quickly to changes in cash flow, making it easier to manage liquidity and avoid financial shortfalls.

- Improved Accuracy and Reduced Errors: Manual cash flow forecasting is susceptible to human error, especially when dealing with large volumes of data. Mistakes in data entry or formula calculations can lead to inaccurate forecasts, which can have serious consequences for the business.

- A cash flow forecasting software automates many of these processes, significantly reducing the risk of errors and ensuring more accurate forecasts.

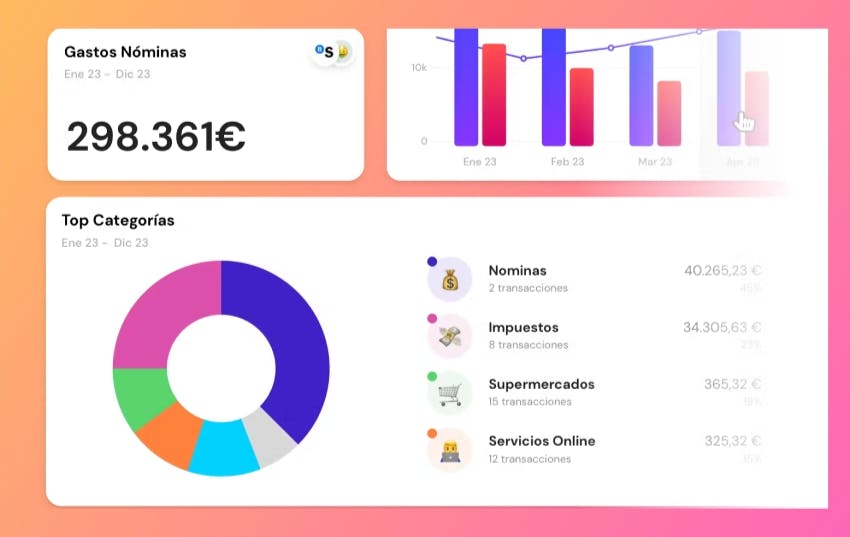

- Customization and Flexibility: A cash flow forecasting software, particularly platforms like Banktrack, offer high levels of customization.

- Businesses can tailor the software to meet their specific needs, whether it’s adjusting spending metrics, setting up personalized dashboards, or categorizing transactions.

- This flexibility allows businesses to create forecasts that are more aligned with their unique financial situations.

- Time Efficiency: Using software to manage cash flow forecasting saves time. Instead of manually gathering data from different sources and inputting it into a spreadsheet, businesses can connect their bank accounts directly to the software.

- Banktrack, for instance, integrates with multiple bank accounts and financial products, automatically pulling in transaction data. This streamlines the entire forecasting process, freeing up time for businesses to focus on other important tasks.

- Enhanced Decision-Making: With features like automated reports and alerts, cash flow forecasting software keeps businesses constantly informed about their financial position.

- Banktrack’s personalized reports and alerts enable businesses to stay in control and make well-informed decisions. By receiving timely notifications about potential cash flow issues, businesses can take proactive measures to address them before they escalate.

- Scalability and Growth: As businesses grow, their financial management needs become more complex. Cash flow forecasting software is designed to scale with your business, handling larger volumes of data and more sophisticated forecasting requirements. This makes it easier for growing businesses to maintain accurate forecasts and stay on top of their financial health.

- Data Integration and Centralization: Another critical benefit of using cash flow forecasting software is the ability to integrate and centralize financial data.

Banktrack, for example, allows users to connect multiple bank accounts and financial products into one unified platform. This centralization makes it easier to manage and analyze all financial data in one place, leading to better insights and more comprehensive forecasts.

- User-Friendly Interface: Cash flow forecasting software typically comes with user-friendly interfaces that make it easy for anyone, regardless of their financial expertise, to use.

Banktrack’s adaptable dashboards allow users to visualize their financial data in a way that’s easy to understand, making it accessible for small business owners and startups to improve their cash management.

Why Banktrack is the Best Cash Flow Forecasting Software

Banktrack offers all the benefits mentioned above, making it one of the best choices for businesses looking to optimize their cash flow forecasting.

Its key features include:

- Personalized Dashboards: Banktrack’s adaptable dashboards allow users to tailor their views to what matters most to their business, ensuring they can focus on the most critical financial metrics.

- Integration with Multiple Bank Accounts and Products: Banktrack easily connects with various bank accounts and financial products, pulling in real-time data for more accurate and comprehensive forecasts.

- Customizable Spending Metrics: Businesses can customize how they categorize and track spending, making the software more relevant to their specific needs and financial goals.

- Automated Alerts and Reports: Banktrack keeps businesses informed with personalized reports and financial alerts, helping them stay on top of their finances and make timely, informed decisions.

Share this post

Related Posts

The 6 Best SaaS Financial Projections for Founders in 2025

Discover six top SaaS financial-projection platforms tailored for founders, enabling accurate subscription modelling, scenario planning, and metric tracking to drive scalable growth in 2025.Verifactu for Startups in Spain: Complete Guide 2025

Verifactu introduces a new era of electronic invoicing in Spain, requiring startups to send invoices directly to the Tax Agency.How to improve forecasting: key strategies and techniques

Discover essential strategies and advanced methods to enhance your forecasting accuracy and make more informed decisions for your business.

Try it now with your data

- Your free account in 2 minutes

- No credit card needed