Top 7 Best Wealth Tracking Apps in 2024

- Top 7 Best Wealth Tracking Apps

- 1. Banktrack

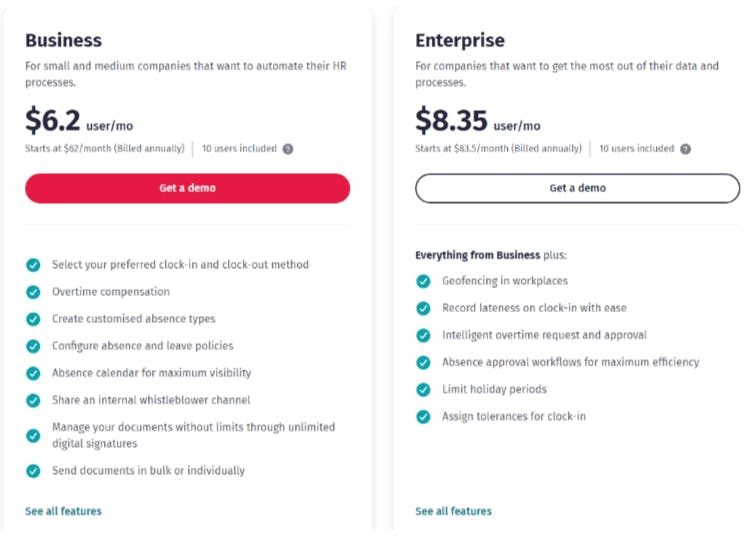

- 2. Quipu

- 3. Factorial Expenses

- 4. Payhawk

- 5. Fuell

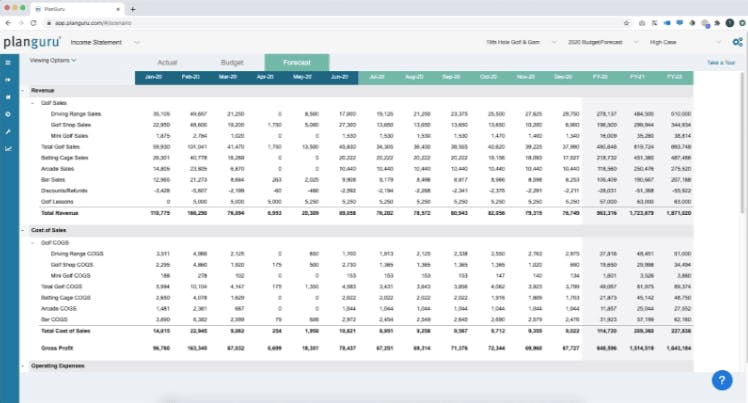

- 6. PlanGuru

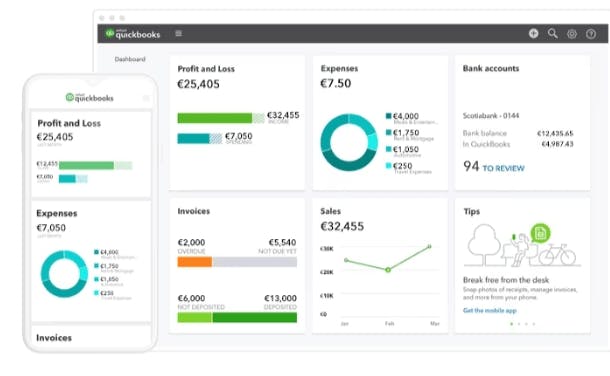

- 7. QuickBooks

- What is a Wealth Tracking App?

- 7 Effective Strategies for Using Wealth Tracking Apps

- Conclusion

- Frequently Asked Questions (FAQs)

- What is a Wealth Tracking App?

- What are the Key Features to Look for in a Wealth Tracking App?

- Why Choose Banktrack as the Best Wealth Tracking App for 2024?

- How Can Wealth Tracking Apps Benefit Businesses and Individuals?

Are you familiar with the best wealth tracking apps in 2024 yet?

- Banktrack - Your wealth tracking app

- Quipu

- Factorial Expenses

- Payhawk

- Fuell

- PlanGuru

- QuickBooks

With the goal of achieving greater financial control this year, we understand that finding the right wealth tracking app is essential.

We will explore some top options to help simplify the process and ensure your wealth management becomes a breeze.

Let’s dive right in!

Top 7 Best Wealth Tracking Apps

Here are some of the best wealth tracking apps to consider this 2024:

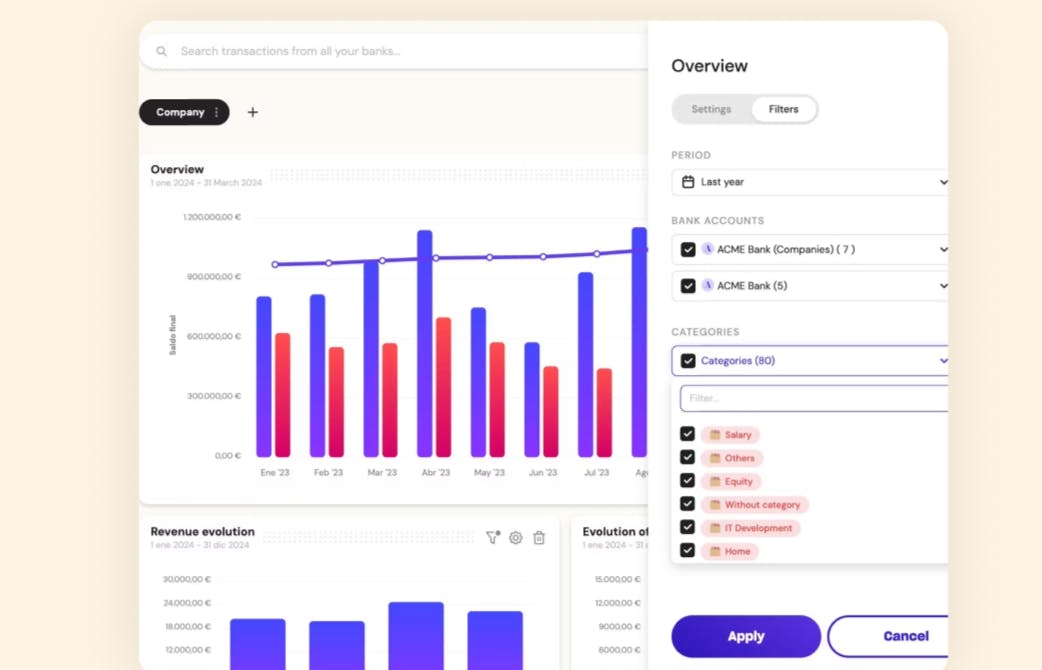

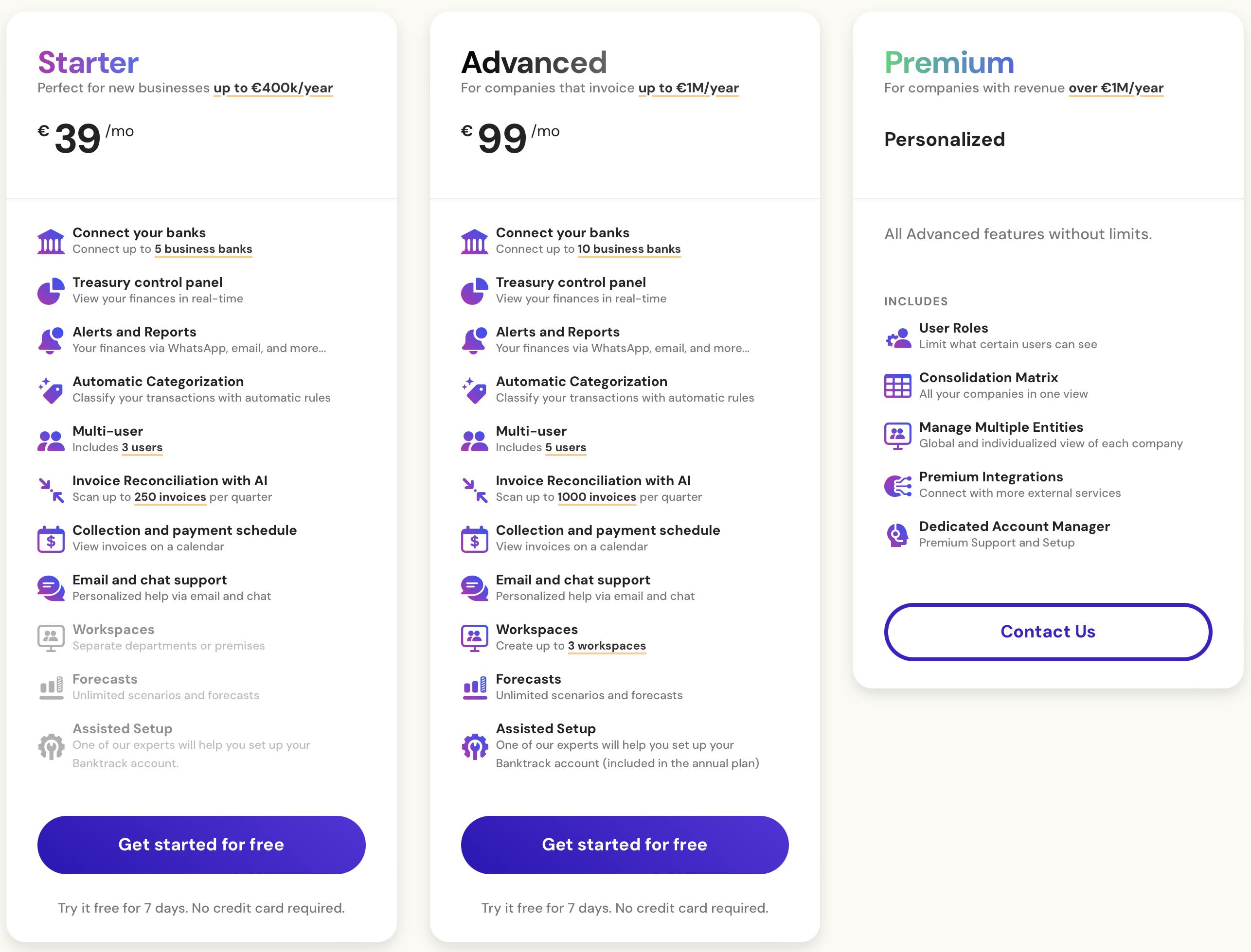

1. Banktrack

Banktrack stands out as the best wealth tracking apps for 2024. Here's why:

- This wealth tracking app offers customizable dashboards that integrate views from different bank accounts, companies, and financial products, providing users with quick access to essential financial information.

- Users can create and customize categories for revenues expenses, allowing for detailed tracking and understanding of their financial activities.

- The app also provides personalized reports and alerts, enabling users to stay informed about their expenses via various channels such as WhatsApp, SMS, email, Slack, or Telegram.

- Pricing: Banktrack offers various plans with competitive pricing, catering to the needs and budgets of individuals, small businesses, and enterprises.

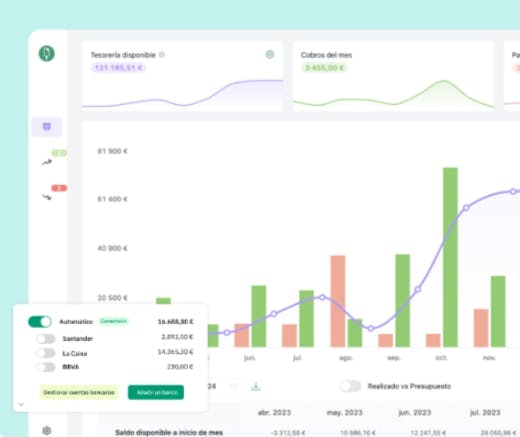

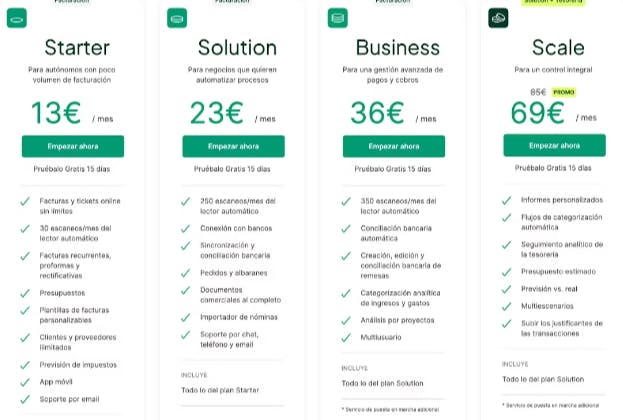

2. Quipu

Quipu is a pre-accounting tool designed specifically for freelancers and small to medium-sized enterprises (SMEs).

Its key features include:

- High-precision OCR technology for accurate digitization of receipts and expenses.

- Three options for digitizing receipts and invoices: via web, app, or email.

- Full integration with invoicing to avoid parallel software usage.

- Cash flow management functionality for real-time cash flow visualization.

3. Factorial Expenses

Factorial Expenses is part of the human resources suite offered by Factorial.

It uses advanced OCR technology for digitalizing expense receipts through its mobile app.

Key features include:

- Advanced OCR technology for accurate receipt digitization.

- Ability to generate expense cards associated with projects or employees, both physical and virtual, instantly.

- Capacity to set spending limits on cards, employees, or teams, and activate or deactivate them as needed.

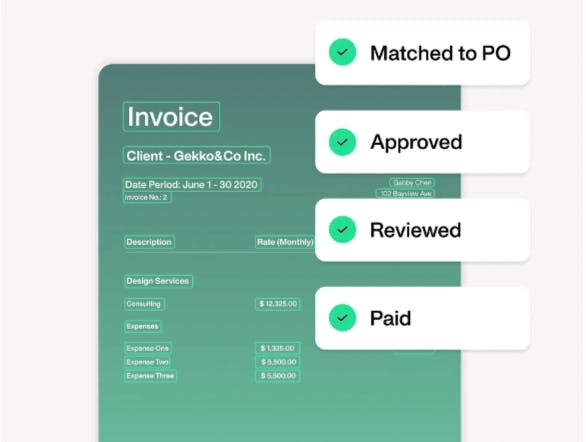

4. Payhawk

Payhawk is a global expense management application that combines corporate cards with advanced tracking software. Its key features include:

- Reimbursement of prepaid expenses.

- Commission-free currency exchanges.

- Generation of physical and virtual credit cards, with the ability to set custom spending limits.

- Multi-entity management, allowing companies to control expense flow centrally.

5. Fuell

Fuell combines corporate cards with advanced expense management software. This makes it a good wealth tracking app.

Its main features include:

- Unlimited generation of physical and virtual credit cards.

- Compatibility with various ERPs.

- OCR technology for automatic reading of receipts, certified by the Tax Agency.

- Ability to automate VAT recovery and generate custom expense reports.

6. PlanGuru

With the help of PlanGuru's tracking, forecasting and budgeting tools, companies can examine financial data and make well-informed decisions about their future.

Users can gain valuable insights into their cash flow and optimize their financial processes by integrating with QuickBooks and Excel.

Important characteristics:

- Tools for forecasting and budgeting

- Excel and QuickBooks integration

- Resources for users' education

- 30-day money-back guarantee and a 14-day complimentary trial

7. QuickBooks

Another popular wealth tracking app is QuickBooks, which has a reputation for being easy to use and providing basic cash flow management capabilities.

QuickBooks is still a good option for businesses that currently use the platform for bookkeeping, even though it might not have all the advanced features of specialized cash management software.

Important characteristics:

- Traditional cash flow management capabilities

- Capabilities for billing and invoicing

- Analysis and reporting of financial data

- Smooth compatibility with accounting software

What is a Wealth Tracking App?

Wealth tracking apps are powerful tools designed to automate, simplify, and track wealth-related activities efficiently.

From tracking assets to managing investments, these platforms offer a variety of features aimed at empowering users to make informed financial decisions and achieve their wealth-related goals.

7 Effective Strategies for Using Wealth Tracking Apps

While wealth tracking apps offer many features and benefits, effectively taking advantage of their features requires additional practical strategies and approaches.

Here are some actionable tips to help individuals and businesses make the most of these powerful tools:

- Set Clear Financial Goals: Before diving into using a wealth tracking app, take the time to establish clear and measurable financial goals.

- Whether it's saving for a home, paying off debt, or building an emergency fund, having specific objectives will guide your usage of the app and help you stay focused on your priorities.

- Regularly Track Income and Expenses: Make it a habit to diligently track your income and expenses within the app on a regular basis.

- This practice will provide you with valuable insights into your spending habits, identify areas where you can cut back or optimize, and ensure that you're staying within your budget.

- Utilize Budgeting and Forecasting Tools: Take advantage of the budgeting and forecasting tools offered by the app to create realistic budgets and predict future cash flows.

- By proactively planning your finances, you can anticipate upcoming expenses, identify potential cash flow gaps, and make informed decisions to mitigate financial risks.

- Stay Organized with Document Digitization: If the app includes document digitization features, such as OCR technology for scanning and digitizing receipts and invoices, make sure to use them to stay organized and track expenses more efficiently.

- This will eliminate the hassle of manual data entry and ensure that all financial transactions are accurately recorded.

- Review and Analyze Financial Reports: Regularly review and analyze the financial reports generated by the app to gain insights into your overall financial health and performance.

- Look for trends, anomalies, and areas for improvement, and use this information to refine your financial strategies and achieve your goals more effectively.

- Maximize Integration with Other Financial Tools: If the app offers integration with other financial tools and platforms, such as banking accounts, investment accounts, or accounting software, take full advantage of these integrations to streamline your financial management.

- This will ensure seamless data synchronization and provide you with a comprehensive view of your finances.

- Stay Educated and Informed: Keep yourself informed about the latest updates, features, and best practices related to using the wealth tracking app.

- Many app providers offer educational resources, tutorials, and webinars to help users maximize their usage of the platform. Stay engaged with these resources to continuously improve your financial literacy and proficiency.

By putting in place these practical strategies, individuals and businesses can gain the full potential of wealth tracking apps to achieve greater financial control, optimize their financial management processes, and ultimately, work towards their long-term financial goals.

Conclusion

After evaluating various options, Banktrack emerges as the best wealth tracking app for 2024.

With its customizable dashboards, adaptable categories, personalized reports, and affordable pricing, Banktrack offers users flexibility, customization, and total control over their wealth management.

Frequently Asked Questions (FAQs)

What is a Wealth Tracking App?

A wealth tracking app is a powerful tool designed to automate, simplify, and track wealth-related activities efficiently. From tracking assets to managing investments, these platforms offer a variety of features aimed at empowering users to make informed financial decisions and achieve their wealth-related goals.

What are the Key Features to Look for in a Wealth Tracking App?

Key features to consider when choosing a wealth tracking app include customizable dashboards, expense digitization capabilities, cash flow management functionality, and integration with accounting software. Additionally, consider factors such as pricing, user interface, and customer support.

Why Choose Banktrack as the Best Wealth Tracking App for 2024?

Banktrack stands out for its customizable dashboards, adaptable categories, personalized reports, and affordable pricing. With features that cater to individuals, small businesses, and enterprises, Banktrack offers users flexibility, customization, and total control over their wealth management.

How Can Wealth Tracking Apps Benefit Businesses and Individuals?

Wealth tracking apps offer several benefits, including enhanced financial visibility, process automation and efficiency, and informed decision-making for long-term success.

By providing users with real-time insights into their financial activities and empowering them to make informed decisions, these apps can help businesses and individuals achieve their wealth-related goals more effectively.

Share this post

Related Posts

Best 8 Cashflow Monitoring Apps in 2025

Discover the best 8 cashflow monitoring apps in 2025 that help businesses track income, expenses, and liquidity in real timeThe 6 Best SaaS Financial Projections for Founders in 2025

Discover six top SaaS financial-projection platforms tailored for founders, enabling accurate subscription modelling, scenario planning, and metric tracking to drive scalable growth in 2025.7 Best Financial Projection Apps in 2025

Discover the top financial-projection apps that simplify scenario modelling, integrate with your accounting data, and help your business forecast revenue, expenses and growth with confidence.

Try it now with your data

- Your free account in 2 minutes

- No credit card needed