Amplify Gains with Financial Leverage

- What Is Financial Leverage?

- How Does Financial Leverage Work?

- 3 Advantages of Financial Leverage

- 3 Risks of Financial Leverage

- 4 Strategies to Use Financial Leverage Like a Pro:

- 1. Know Your Risk Tolerance

- 2. Don’t Overdo It

- 3. Keep an Eye on Your Investments

- 4. Consult Experts

- Real-Life Examples of Financial Leverage

- Real Estate Leverage

- Stock Market Leverage

- 3 Tips for Managing Financial Leverage

- Choose Banktrack to Help with your Financial Management

- 1. Transaction Tracking

- 2. Seamless Bank Integration

- 3. Good Security Measures

- 4. Cash Flow Forecasting

- 5. Bank Reconciliation

Amplify gains with financial leverage.

It is like using borrowed money t o achieve bigger gains. Let us show you how you can do this!

When it comes to investing, many people dream of making big bucks without having to dig deep into their pockets.

Discover financial leverage, the magical tool that lets you borrow money to make even more money.

But hold on! Before you get too excited about the prospect of doubling your returns, it's crucial to understand exactly what financial leverage is, how it works, and how to use it wisely. Let’s dive in and explain this powerful investment strategy.

What Is Financial Leverage?

Imagine you’re at a carnival and you spot a game where you can win a giant stuffed bear. It costs $5 to play, but you only have $1 in your wallet.

No worries, if you can borrow $4 from a friend, you can now play the game and, if you win, walk away with the bear.

That’s financial leverage in a nutshell: using borrowed money to amplify your investment potential.

How Does Financial Leverage Work?

In the world of finance, leverage works similarly. You use borrowed funds to increase the size of your investment.

For example, if you’re interested in buying a rental property, but don’t have enough cash on hand, you can take out a mortgage.

This allows you to buy a property worth $300,000 with just a fraction of that amount from your own savings.

If the property value goes up or generates rental income, you can potentially make a hefty profit. But remember, if things go south, the losses could be equally magnified.

3 Advantages of Financial Leverage

Let’s face it, who doesn’t like the idea of making more money with less effort?

Here are some of the key benefits of financial leverage that might just make you want to dive in:

- Bigger Investment Opportunities: Leverage allows you to invest in assets that might be out of reach if you were only using your own money. This means you can get in on larger deals or more lucrative investments that have the potential for higher returns.

- More Diversification: By borrowing funds, you can spread your investments across various assets. Think of it as not putting all your eggs in one basket. This diversification can help stabilize your portfolio and reduce the impact of a poor-performing investment.

- Boosted Returns on Equity: When you use leverage, you can enhance your return on equity (ROE). In simple terms, ROE measures how much profit you make with the money you’ve invested. By using borrowed funds, you might achieve a higher ROE, making your investments look even more impressive.

3 Risks of Financial Leverage

Just as leverage can magnify your gains, it can also amplify your losses. It’s a bit like playing with fire, exciting but potentially dangerous.

Here’s what you need to watch out for:

- Bigger Losses: If your investment doesn’t perform as expected, leverage can turn your moderate loss into a significant one. Imagine buying that rental property, but the market crashes and property values plummet. You might find yourself in a situation where you owe more than the property is worth.

- Interest Costs: Borrowing money usually comes with interest, and that can eat into your profits. If the interest rates are high, it can make your leveraged investment less profitable. Make sure to calculate these costs before diving in.

- Margin Calls: If you’re using a margin account (basically borrowing money from a broker to invest), you might face a margin call if your investment loses value. This means you’ll need to either deposit more money or sell off some of your investments to cover the loss.

4 Strategies to Use Financial Leverage Like a Pro:

1. Know Your Risk Tolerance

Risk tolerance is essentially your comfort level with potential financial losses. It’s about how much risk you’re willing to take on in pursuit of higher returns. Understanding your risk tolerance helps you determine if leveraging investments aligns with your financial situation and psychological comfort.

Before diving into financial leverage, ask yourself: How would you feel if your investment loses value?

Are you okay with potentially losing more than you invested? If these thoughts cause anxiety or sleepless nights, leveraging might not be suitable for you.

Leverage magnifies both gains and losses, so it's crucial to be realistic about how much risk you can handle.

How to assess your risk tolerance:

- Evaluate Your Financial Situation: Look at your overall financial health, including your savings, income stability, and existing debt. A strong financial foundation allows you to absorb potential losses better.

- Consider Your Investment Goals: What are you aiming to achieve with your investments? Short-term gains often come with higher risks, whereas long-term investments might be less volatile. Aligning your leverage strategy with your goals helps manage risk.

- Understand Your Emotional Reaction: Think about how you’ve reacted to past financial setbacks. If you tend to panic or make hasty decisions, leveraging might be too risky for you.

- Use Risk Tolerance Tools: Many financial institutions offer tools and questionnaires to help assess your risk tolerance. These can provide valuable insights into whether leveraging is appropriate for you.

2. Don’t Overdo It

While leveraging can amplify returns, borrowing too much can lead to serious financial trouble. Over-leveraging occurs when you take on more debt than you can comfortably handle, increasing the risk of substantial losses.

A conservative approach to leveraging helps mitigate the risks associated with debt.

Over-leveraging can strain your finances, especially if your investments don’t perform as expected. It’s better to use leverage judiciously rather than going all-in and facing severe consequences if things go wrong.

Tips to avoid over-leveraging:

- Set Limits on Borrowing: Determine a maximum amount of leverage you’re willing to use. Stick to this limit to avoid excessive debt and potential financial strain.

- Calculate Debt-to-Equity Ratio: This ratio measures the proportion of debt used relative to your own equity. Keeping this ratio at a manageable level ensures that you’re not overly reliant on borrowed funds.

- Monitor Your Debt Levels: Regularly review your debt levels to ensure they remain within your comfort zone. If you notice that your debt is increasing, reassess your leverage strategy.

- Have an Exit Plan: Develop a strategy for how you’ll handle situations where your investments aren’t performing as expected. This might include setting stop-loss limits or planning to reduce debt if necessary.

3. Keep an Eye on Your Investments

Even if you start with a solid leverage strategy, market conditions can change, and investments can underperform.

Regular monitoring helps you stay informed about your investments’ performance and makes it easier to make adjustments as needed.

- Track Performance Regularly: Use financial tools and platforms to track the performance of your leveraged investments. Regular updates help you understand how your investments are doing.

- Stay Informed About Market Trends: Keep an eye on market conditions that could affect your investments. Economic changes, interest rate fluctuations, and other factors can impact your leveraged positions.

- Review Financial Statements: Regularly review financial statements and reports related to your investments. These documents provide insights into performance and financial health.

- Adjust Your Strategy as Needed: If you notice that your investments are underperforming or market conditions change, be prepared to adjust your strategy. This might include reducing leverage or reallocating investments to more promising areas.

4. Consult Experts

If you’re new to financial leverage, understanding its risks can be quite daunting.

Financial experts, such as financial advisors or investment consultants, can provide good guidance to help you make informed decisions.

- Understand Complexities: Financial experts can help you understand the nuances of leveraging, including how different types of leverage work and how they might impact your investments.

- Develop a Customized Strategy: Professionals can help create a leverage strategy tailored to your financial goals, risk tolerance, and investment preferences. This personalized approach ensures that leverage aligns with your overall financial plan.

- Provide Market Insights: Experts have access to in-depth market research and insights that can help you make better decisions about when and how to use leverage.

- Monitor and Adjust: Financial advisors can help monitor your leveraged investments and make adjustments as needed based on changes in market conditions or your personal financial situation.

Real-Life Examples of Financial Leverage

To better understand how leverage works, let’s look at a few real-life examples:

Real Estate Leverage

Imagine you’re buying a rental property. You find a property worth $500,000, but you only have $100,000 of your own money. You take out a mortgage for the remaining $400,000.

If the property increases in value by 10%, you could see a significant return on your initial $100,000 investment. However, if the property value drops, your losses could be equally amplified.

Stock Market Leverage

Let’s say you’re using margin trading in the stock market. You invest $10,000 of your own money and borrow an additional $10,000 from your broker to buy more shares.

If the stock price rises, your returns are doubled compared to if you had only used your own money. But if the stock price falls, you could end up owing more than your initial investment.

3 Tips for Managing Financial Leverage

- Set Clear Goals: Define what you want to achieve with leverage. Are you aiming for long-term growth, or are you looking for short-term gains? Having clear goals can help you make better decisions and manage your leverage effectively.

- Maintain a Buffer: Keep some extra funds in reserve to cover any unexpected expenses or market fluctuations. This buffer can help you avoid being forced to sell investments at a loss if things don’t go as planned.

- Review Your Leverage Regularly: As markets and personal circumstances change, so should your approach to leverage. Regularly assess how leverage is affecting your investment performance and make adjustments as needed.

Choose Banktrack to Help with your Financial Management

When it comes to managing your finances, having the right tool can make all the difference.

You need a solution that not only tracks your expenses but also integrates with your bank accounts, provides good security, and offers advanced features to optimize your financial performance.

And that’s exactly where the expense tracking app of Banktrack comes in. Here’s why it stands out as the ultimate cash management tool.

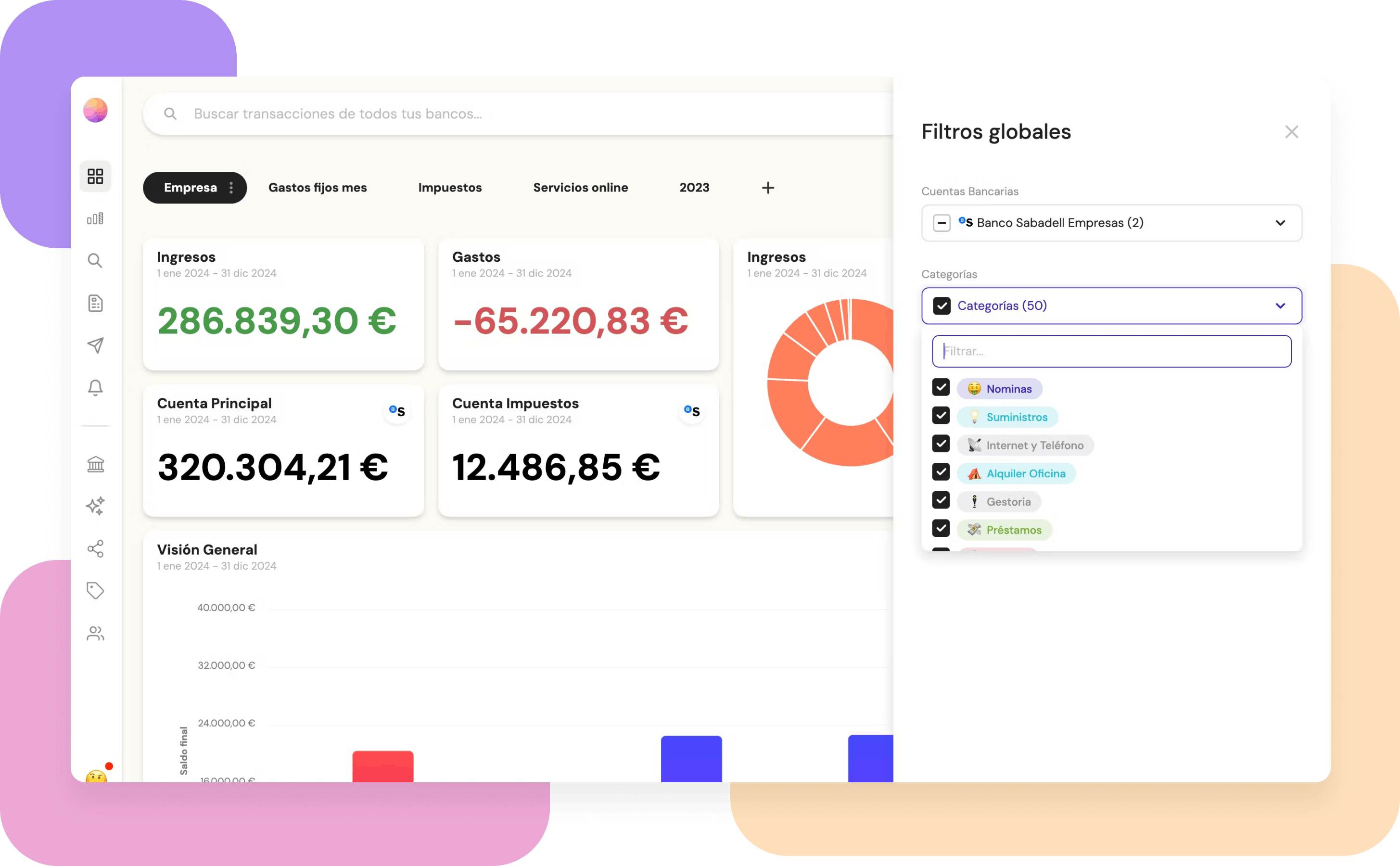

1. Transaction Tracking

Managing and tracking transactions is crucial for maintaining a clear understanding of your financial health.

Banktrack excels in this area, offering comprehensive features that make transaction tracking efficient and user-friendly.

Customizable Dashboards

Banktrack's dashboards are not one-size-fits-all. They can be customized to fit your specific needs, providing you with a clear and real-time view of your financial situation.

Whether you want a broad overview of your spending, a detailed breakdown of your expenses, or a comparative analysis of income versus expenses over time, Banktrack’s dashboards have got you covered.

- Personalized Views: Tailor your dashboard to display the information that matters most to you, such as spending by category, income sources, or budget adherence.

- Visual Clarity: Graphs and charts make it easy to visualize your financial data, helping you spot trends and make informed decisions at a glance.

Flexible Categorization

With Banktrack, categorizing your expenses and income is a breeze. You can set up custom categories that align with your unique financial needs, allowing for detailed expense tracking and analysis.

- Custom Categories: Create categories that reflect your personal or business expenditures, from groceries and dining out to office supplies and travel.

- Detailed Reporting: Generate reports based on your customized categories to get insights into where your money is going and how it aligns with your budget.

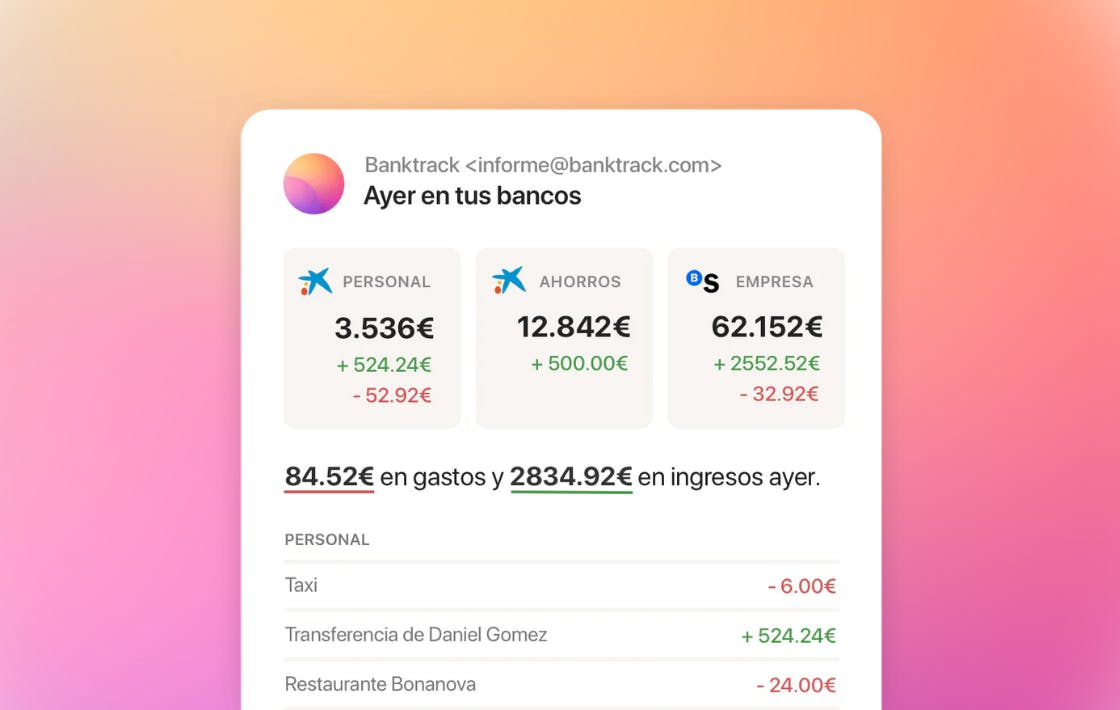

2. Seamless Bank Integration

One of Banktrack’s best features is its ability to integrate perfectly with a wide range of banks as an expense tracker software with a bank sync feature.

Managing financial data manually can be cumbersome and error-prone, but Banktrack simplifies the process through its bank integration capabilities.

Extensive Bank Coverage

Banktrack supports integration with over 120 banks, covering both traditional and neobanks.

This extensive coverage ensures that regardless of where you bank, you can consolidate all your accounts into a single platform.

- All-in-One Access: View and manage all your financial data from one place, eliminating the need to log into multiple bank accounts.

- Unified View: Having all your banking information integrated allows for a more holistic view of your finances, making it easier to track and manage your money.

Dual Connection Methods

Banktrack offers two connection methods to ensure that you can integrate your financial data smoothly, regardless of your bank’s infrastructure:

- Open Banking (PSD2): This method complies with European regulations, providing a secure and standardized way to access your banking data. It ensures a high level of security and interoperability.

- Direct Access: For banks not covered under PSD2, Banktrack provides direct access connections, ensuring that you can still integrate your financial data securely.

3. Good Security Measures

When dealing with financial data, security is a top priority. Banktrack employs several robust measures to ensure that your personal and banking information is protected.

Authorized Data Providers

Banktrack collaborates with authorized and audited data providers approved by the Bank of Spain. This ensures that your data is handled securely and in compliance with regulatory standards.

- Trusted Providers: Only work with verified entities to safeguard your information and maintain high security standards.

Read-Only Access

Banktrack is designed as a view-only application, meaning it can import and display your financial data but cannot conduct transactions. This adds an extra layer of security by preventing unauthorized transactions or tampering.

- Safe Viewing: While you can view and analyze your data, there’s no risk of accidental transactions or unauthorized changes.

No Storage of Banking Passwords

Banktrack uses a unique access token system rather than storing your banking passwords.

This approach minimizes the risk of password theft and enhances overall security.

- Token-Based Access: Your passwords are never stored, reducing the likelihood of security breaches.

Data Encryption

All data within Banktrack is encrypted, ensuring that your financial information remains confidential and secure from unauthorized access.

- Encryption Standards: High-level encryption protects your data throughout its lifecycle, from transmission to storage.

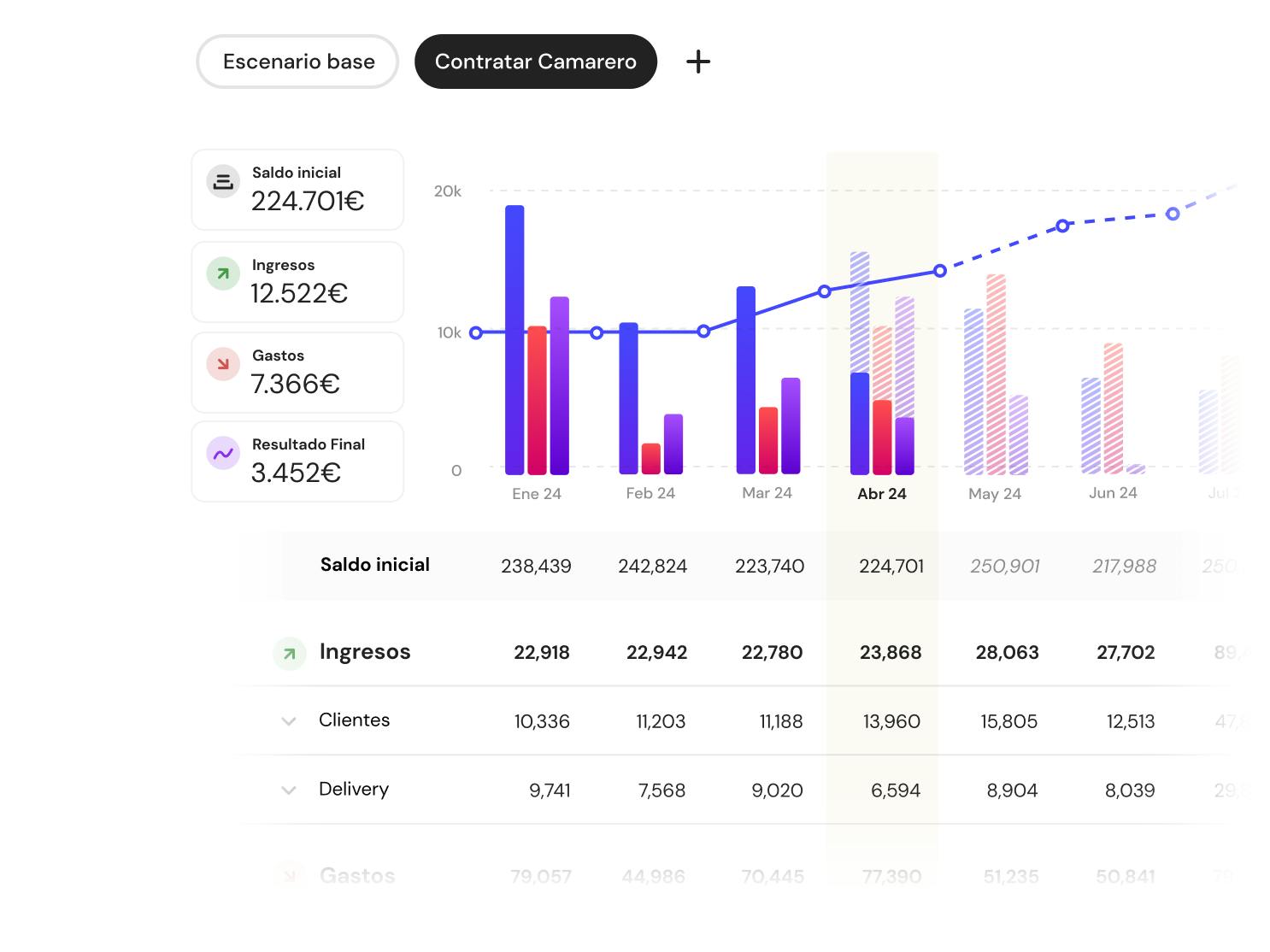

4. Cash Flow Forecasting

Understanding and predicting cash flow is essential for financial stability and growth. Banktrack’s cash flow management solution is designed to give you a strategic edge.

Historical Data Analysis

Banktrack analyzes your historical financial data to predict future cash flow trends. This analysis helps you anticipate potential shortfalls or surpluses, allowing for better financial planning.

- Trend Prediction: Use past data to forecast future cash flow, helping you prepare for potential fluctuations in your finances.

Dynamic Forecasting

A cash flow forecasting software updates financial data in real-time based on current financial data. This ensures that your projections remain accurate and relevant.

- Real-Time Adjustments: Adjust your forecasts as new data comes in, allowing you to respond flexibly to changes in your financial situation.

5. Bank Reconciliation

Reconciling bank statements with your internal records is often a time-consuming and error-prone task. Banktrack automates this process, making it efficient and reliable.

Automated Reconciliation

Banktrack automates the reconciliation process by matching your bank statements with your internal records. This reduces the risk of errors and ensures that your financial records are accurate.

- Error Reduction: Automated reconciliation minimizes human error and ensures that discrepancies are identified and addressed promptly.

Automated tools streamline the reconciliation process, saving you time and ensuring that your records are consistently up-to-date.

Share this post

Related Posts

A guide to cash flow monitoring

A guide to cash flow monitoring, highlighting strategies and tools for tracking business inflows and outflows to ensure financial stability and growth.How to do a business plan with financial projections

Discover key steps for crafting a business plan with financial projections, covering budgeting, forecasting, and financial analysis to ensure a successful business strategy.A guide to investment tracking

Keeping track of your investments is key to achieving financial success. We break down the best strategies, tools, and insights to help you stay on top of your portfolio.

Try it now with your data

- Your free account in 2 minutes

- No credit card needed