Best 7 Anaplan alternatives in 2024

- Top 7 Anaplan Alternatives

- 1. Banktrack

- 2. PlanGuru

- 3. Pulse

- 4. Vena Solutions

- 5. QuickBooks

- 6. Cube

- 7. Float

- 5 Factors to Consider When Choosing an Alternative

- 1. Cost and ROI

- 2. Scalability and Integration

- 3. Usability and User Experience

- 4. Support and Maintenance

- 5. Security and Compliance

- What Makes a Great Anaplan Alternative?

- Understanding Business Requirements

- Flexibility and Customization

- How Can Banktrack Help You?

- Frequently Asked Questions - (FAQs)

- Are these alternatives suitable for all industries?

- Can I customize these alternatives to fit my unique business processes?

- Do these alternatives offer cloud-based solutions?

- How can I migrate from Anaplan to one of these alternatives?

The best Anaplan alternatives in 2024:

- Banktrack

- PlanGuru

- Pulse

- Vena Solutions

- QuickBooks

- Cube

- Float

Hello, planners! Looking to upgrade your toolkit?

We're diving into seven alternatives to Anaplan, each with its own set of perks and quirks.

Whether you're a small business owner or part of a large enterprise, finding the right fit is key.

So, let's roll up our sleeves and explore these options to see which one could help you the most in your strategic planning process!

Top 7 Anaplan Alternatives

1. Banktrack

Banktrack is the best cash management software for the year 2024.

Banktrack offers robust financial planning and analysis solutions for small or large businesses or individuals.

It provides tools for:

- Budgeting

- Forecasting

- Risk management

- Regulatory compliance

With its specialized features for the banking sector, Banktrack enables institutions to optimize resource allocation, mitigate risks, and enhance decision-making processes.

But let’s examine these features more in detail:

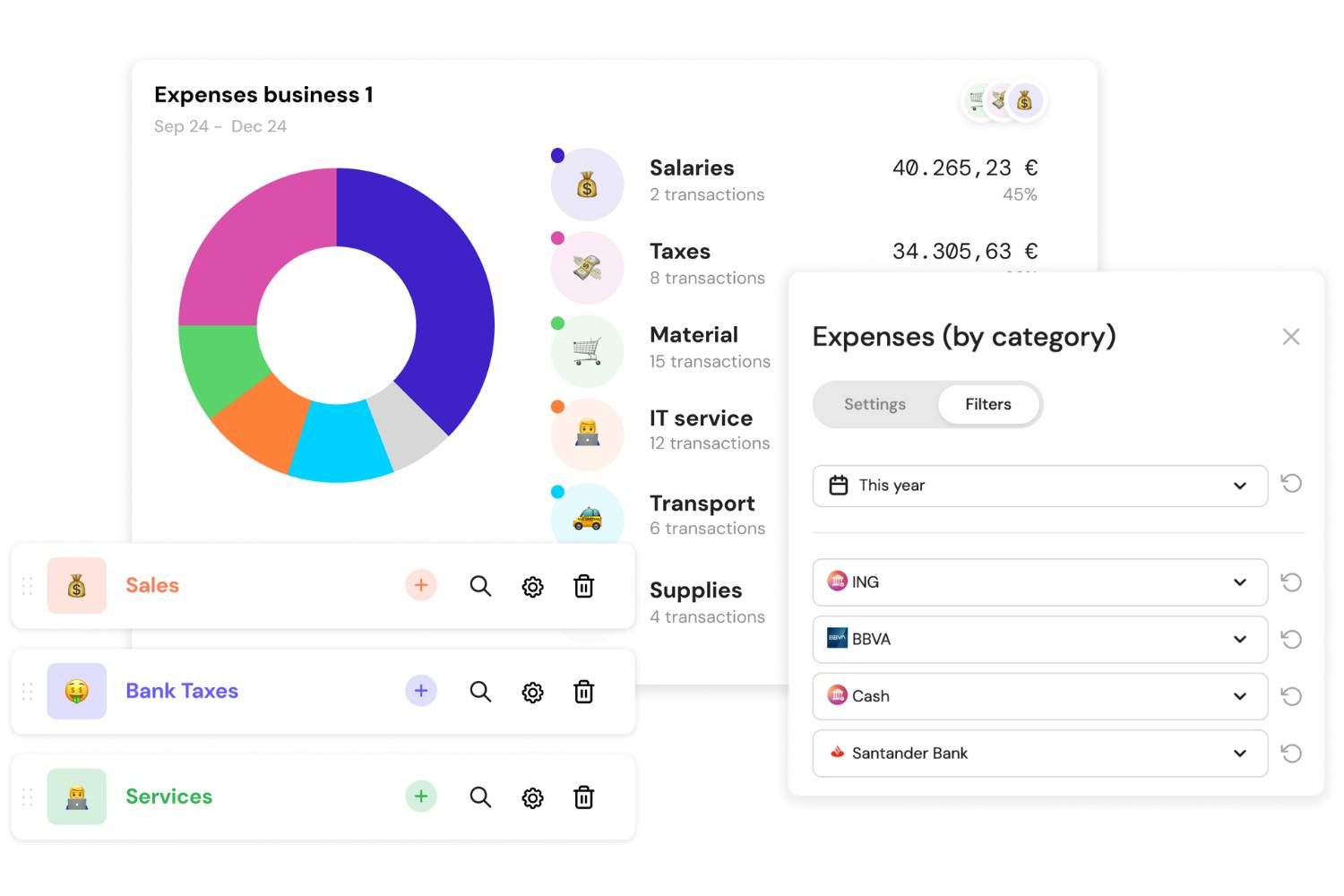

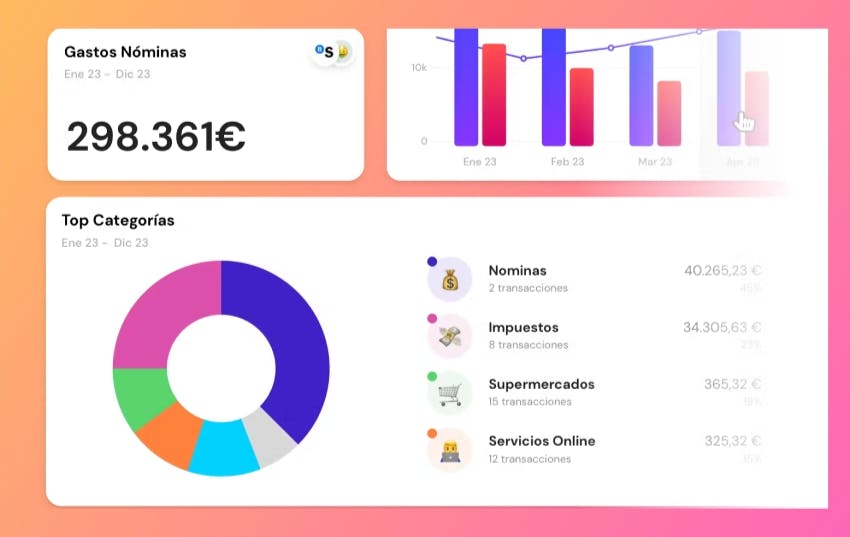

Custom Dashboards

First of all, this cash management solution stands out by its capacity to build personalized dashboards combining perspectives from various financial products, companies, and bank accounts.

With Banktrack, you can easily obtain the information you need to manage your spending.

Adapted Categories

A cash management tool allows you to adjust the categories to suit your needs because they are specifically designed to fit your expenses.

You can create and modify an infinite number of categories using sophisticated rules to arrange your revenue and expenses however you see fit.

You can monitor your finances and determine where your money is going thanks to this flexibility.

Custom Reports and Alerts

Moreover, Banktrack offers personalized reports and financial alerts.

You can create customized reports and receive alerts through SMS, WhatsApp, Slack, Telegram, and email about the money you spend.

These alerts can also be set up to notify you of duplicate charges, low balances, and other noteworthy occurrences.

This will enable you to manage your money well and make informed decisions at all times.

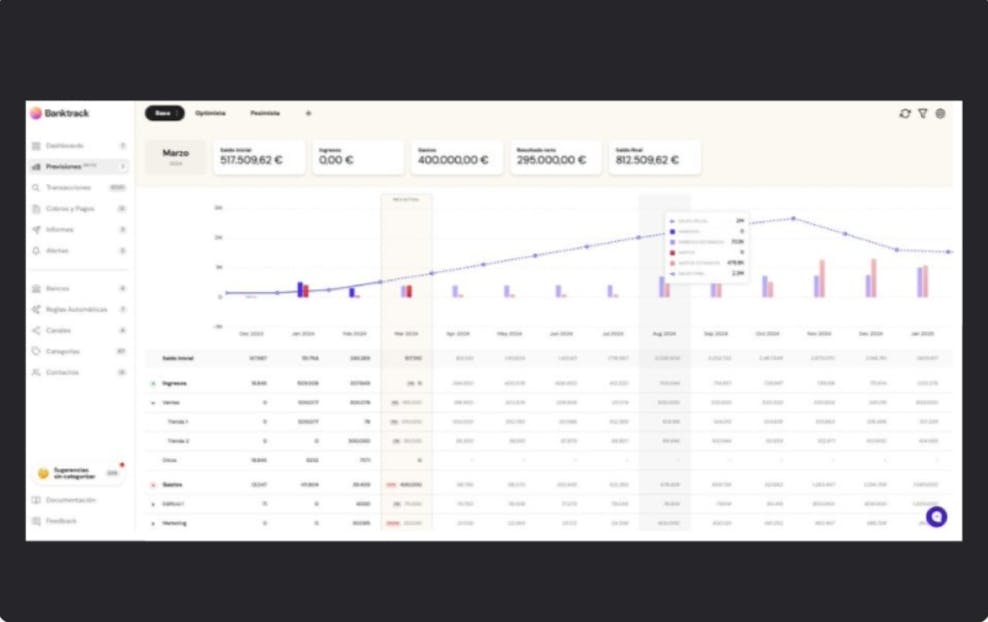

Forecasts

Cash flow estimates can be made, and you can even ensure that they are fulfilled.

You can also add a lot more dynamic functionalities to your calculations by using formulas.

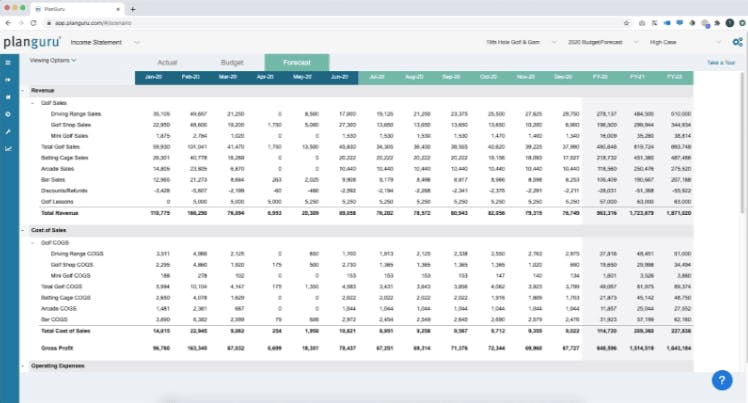

2. PlanGuru

PlanGuru is a financial planning and analysis software designed for small to mid-sized businesses.

It offers:

- Budgeting

- Forecasting

- Performance analysis tools

This allows organizations to create detailed financial plans and projections.

PlanGuru's intuitive interface and customizable templates make it easy for users to generate accurate forecasts and make informed strategic decisions.

However, it also comes with some limitations:

- Steep learning curve: PlanGuru's extensive features may require significant training and time investment for users to fully utilize, particularly for those new to financial planning software.

- Limited integrations: PlanGuru may have limited integrations with other business tools and software, potentially requiring manual data entry and reconciliation.

3. Pulse

Pulse is a modern financial planning and analysis platform that provides real-time insights and forecasting capabilities.

It offers:

- Interactive dashboards

- Scenario analysis

- Predictive modeling tools

These functionalities empower organizations to make data-driven decisions quickly.

Pulse's cloud-based structure and intuitive design make it suitable for businesses of all sizes looking to enhance agility and competitiveness.

If you want to have more information on the availability of cash management solutions for corporates, you can read this article.

Companies or individuals should, however, also consider its limitations:

- Cost considerations: Pulse's advanced features and real-time insights may come at a higher price point, potentially making it less accessible for smaller businesses with limited budgets.

- Integration challenges: Integrating Pulse with existing systems and data sources may require additional configuration and support, leading to potential implementation hurdles.

4. Vena Solutions

Vena Solutions is an enterprise performance management software that combines budgeting, planning, and reporting capabilities in a single platform.

It offers advanced features for:

- Financial consolidation

- Workflow automation

- Collaboration

This enables organizations to streamline financial processes and improve decision-making efficiency.

Vena Solutions' flexible structure and integration with existing systems make it an ideal choice for large enterprises seeking comprehensive financial management solutions.

However, this software has some limitations:

- Cost of ownership: The total cost of ownership for Vena Solutions, including licensing fees and ongoing maintenance, may be higher compared to other alternatives, particularly for smaller organizations.

- Implementation complexity: Implementing Vena Solutions may require significant time and resources due to its comprehensive features and customization options, potentially causing delays and operational disruptions.

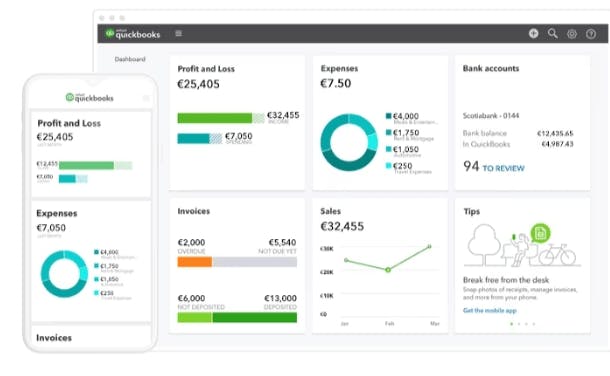

5. QuickBooks

QuickBooks is a widely used accounting software that also offers good budgeting and financial planning features.

It enables businesses to:

- It is one of the best expense tracker apps

- It creates budgets

- It generates financial reports

QuickBooks' user-friendly interface, scalability, and integration with other business tools make it a popular choice for small businesses and freelancers seeking efficient financial management solutions.

Nonetheless, this software also comes with some limitations to it:

- Basic forecasting capabilities: While QuickBooks offers budgeting and financial planning features, its forecasting capabilities may be more basic compared to specialized planning software.

- Limited scalability: QuickBooks may struggle to meet the needs of larger businesses with complex financial planning requirements, lacking advanced features found in enterprise-level solutions.

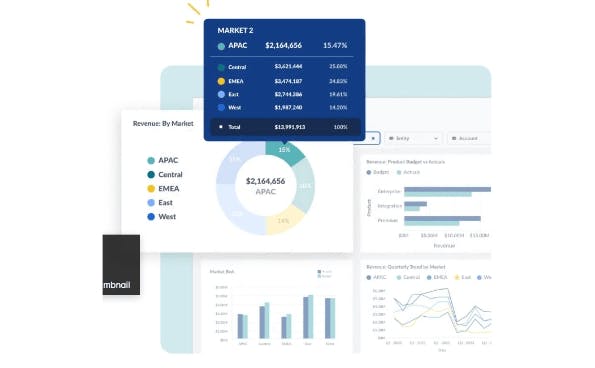

6. Cube

Cube is a cloud cash management software that focuses on financial planning and analysis designed for modern businesses.

It offers:

- Intuitive planning

- Forecasting

- Reporting tools

Cube's dynamic modeling capabilities, scenario analysis, and predictive analytics features enable proactive decision-making and strategic long-term planning.

With its user-friendly interface and scalable business model, Cube caters to the needs of businesses looking to optimize financial processes and achieve sustainable growth.

Its limitations are:

- Limited industry focus: Cube may lack specialized features tailored to specific industries, making it less suitable for businesses with unique planning requirements, such as banking or healthcare.

- Integration limitations: Cube's integration capabilities with other business tools and software may be limited, potentially requiring manual data entry or workaround solutions for seamless data flow.

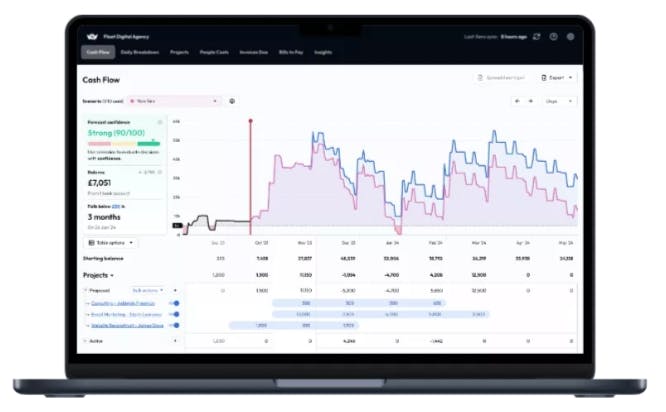

7. Float

Float is a cash liquidity forecasting software that simplifies budgeting and cash flow forecasting.

Users can create and modify budgets to simulate a range of scenarios, including increased labor costs or rising material costs.

Its main features are:

- Well-designed Interface: Float boasts a clean and intuitive interface, facilitating the quick and easy creation of forecasts for different scenarios.

- Multi-User Functionality: The Essential plan allows up to three users, while the Enterprise plan accommodates up to 100 users, offering flexibility for businesses of different sizes.

- Premium Plans Include Expert Review: With Premium or Enterprise licenses, Float offers quarterly or monthly reviews of forecasts by in-house experts, providing valuable insights for improved cash-flow management.

However, users report it as relatively expensive. The Essential plan starts at $59 per month, while the Enterprise license costs $199 per month, which may be considered costly for some businesses.

5 Factors to Consider When Choosing an Alternative

1. Cost and ROI

Evaluate the total cost of ownership and expected return on investment to ensure the chosen alternative aligns with your budget and business objectives.

2. Scalability and Integration

Consider the scalability of the solution and its ability to integrate with existing systems and data sources to support future growth and operational efficiency.

3. Usability and User Experience

This can play a significant role in adoption and productivity.

Evaluate the interface, navigation, and ease of use of each alternative.

Are the features intuitive and accessible to users with varying levels of technical expertise?

Consider conducting user testing or requesting demos to gauge user satisfaction and identify any potential usability issues.

A user-friendly interface reduces training time, enhances user adoption, and increases overall productivity.

4. Support and Maintenance

Effective support and maintenance are essential for ensuring the smooth operation of your planning software.

Evaluate the support services offered by each alternative, including customer service availability, response times, and escalation procedures. Additionally, consider the vendor's track record for releasing updates, patches, and bug fixes.

Reliable support and proactive maintenance minimize downtime, address issues promptly, and ensure that the software remains up-to-date with evolving business needs and industry standards.

5. Security and Compliance

Data security and compliance are paramount considerations when selecting a planning alternative, especially for organizations handling sensitive financial information.

Evaluate the security measures implemented by each alternative, such as data encryption, access controls, and audit trails.

Additionally, assess the vendor's compliance with industry regulations and standards, such as GDPR, SOC 2, or HIPAA.

Choose an alternative that prioritizes data security and demonstrates a commitment to compliance, reducing the risk of data breaches, regulatory violations, and reputational damage.

What Makes a Great Anaplan Alternative?

Understanding Business Requirements

Before exploring alternatives, it's vital to assess your organization's unique needs. Consider factors like scalability, integration capabilities, user interface, and pricing.

Flexibility and Customization

An effective alternative should offer flexibility in modeling and customization to adapt to evolving business requirements seamlessly.

How Can Banktrack Help You?

Choosing the right planning software is vital for your organization's success.

By considering factors such as cost, scalability, integration, usability, support, security, and compliance, you can make an informed decision. Take the time to evaluate each alternative thoroughly and involve key stakeholders.

With the right planning tool, your organization can adapt, innovate, and thrive in today's dynamic business environment.

Choose Banktrack if you want a powerful tool to enhance your financial planning and analysis capabilities. With its industry-specific features, robust integration, and focus on compliance, you can ensure you stay competitive in today’s market.

Frequently Asked Questions - (FAQs)

Are these alternatives suitable for all industries?

While most alternatives cater to various industries, it's essential to evaluate their specific features and capabilities to ensure suitability. If you want an all-round, flexible and adaptable solution, give Banktrack a try.

Can I customize these alternatives to fit my unique business processes?

Yes, many of these alternatives offer customization options to adapt to diverse business requirements effectively. For example, Banktrack offers customizable dashboards to view your cash flows, personalized alerts and reports and much more!

Do these alternatives offer cloud-based solutions?

Yes, most alternatives provide cloud-based solutions to enhance accessibility, scalability, and collaboration.

How can I migrate from Anaplan to one of these alternatives?

Migration processes may vary depending on the chosen alternative and your existing data structures. It's recommended to consult with the vendor for guidance and support. Consider integration with other platforms and customer support in case you are in need of assistance.

Share this post

Related Posts

Verifactu for Startups in Spain: Complete Guide 2025

Verifactu introduces a new era of electronic invoicing in Spain, requiring startups to send invoices directly to the Tax Agency.Best 7 Cash Flow Management Tools in Finland for 2025

These are the best cash flow management tools in Finland: Banktrack Procountor Netvisor Visma eAccounting Fennoa Float QuickBooks Online In Finland’s competitive business environment, from Helsinki’s10 best cash management software for small businesses

Wondering what your options are as a small business to manage your cash flows wisely? We have curated a list of the top 10 best cash management softwares for you.

Try it now with your data

- Your free account in 2 minutes

- No credit card needed