Best 8 Cashflow Monitoring Apps in 2025

- Best 8 Cashflow Monitoring Apps

- 1. Banktrack

- 2. Float

- 3. Pulse

- 4. QuickBooks Cash Flow Planner

- 5. CashAnalytics

- 6. Agicap

- 7. PlanGuru

- 8. Cube

- What Are Cashflow Monitoring Apps?

- Why Cashflow Monitoring Matters

- Why Banktrack Is the Best Cashflow Monitoring App

- 7 Key Features That Make Banktrack One of the Best Cashflow Monitoring Apps

- 1. Real-Time Financial Visibility

- 2. Smart Forecasting and Planning

- 3. Personalized Dashboards and Reports

- 4. Multi-Bank and Multi-Entity Management

- 5. Automatic Categorization

- 6. Alerts and Notifications

- 7. Bank-Level Security

- How to Choose the Best Cashflow Monitoring App

- Final Thoughts

- Frequently Asked Questions (FAQs)

- What is a cashflow monitoring app?

- Which is the best app for cashflow forecasting?

- Are these apps secure?

- Can small businesses use cashflow apps?

- Do these apps integrate with accounting software?

- Is manual data entry required?

These are the best cashflow monitoring apps:

- Banktrack

- Float

- Pulse

- QuickBooks Cash Flow Planner

- CashAnalytics

- Agicap

- PlanGuru

- Cube

Cashflow is the lifeblood of every business. When managed well, it fuels growth and stability. When overlooked, even profitable companies can face liquidity issues. Thankfully, a new generation of cashflow monitoring apps makes it easier than ever to stay on top of your finances.

These tools give finance teams and entrepreneurs real-time visibility into their cash positions, automate tedious reporting, and help forecast future liquidity. Among all available options, Banktrack stands out as the most comprehensive and intuitive solution in 2025, a true command center for your company’s finances.

Below, we explore the 8 best cashflow monitoring apps to help you take control of your treasury, plan ahead, and make smarter financial decisions.

Best 8 Cashflow Monitoring Apps

1. Banktrack

Best for: Real-time financial visibility and treasury forecasting

Banktrack is a next-generation cashflow monitoring app designed for businesses that want total financial control without complexity.

It consolidates data from multiple bank accounts, invoices, and entities, giving you a live view of your liquidity in one dashboard. Its forecasting engine anticipates cash surpluses or shortages and allows you to simulate “what-if” scenarios to prepare for any situation.

Banktrack’s intuitive interface, automation capabilities, and data security make it a favorite among finance teams, CFOs, and entrepreneurs.

Key Features:

- Real-time synchronization with multiple bank accounts

- Smart cashflow forecasting and scenario planning

- Automated transaction categorization

- Customizable dashboards and alerts

- Bank-level encryption and PSD2 compliance

Why it stands out: Banktrack doesn’t just track cash, it predicts it. Its automation and forecasting capabilities help businesses act strategically instead of reactively.

2. Float

Best for: Visual and simple budgeting for SMEs

Float simplifies cashflow management with colorful dashboards and easy-to-read reports. The app integrates with accounting systems like Xero, QuickBooks, and FreeAgent, providing live financial data that automatically updates as transactions occur.

It’s particularly popular with small businesses that want a clear visual overview of their cash inflows and outflows without deep financial training.

Key Features:

- Real-time cash tracking

- Integrations with major accounting software

- Scenario planning and forecasting tools

- Collaborative user access

- Clear visual design for non-finance users

Why it stands out: Float’s clean interface makes financial planning accessible to everyone, turning complex reports into intuitive visuals.

3. Pulse

Best for: Creative agencies and freelancers

Pulse is a user-friendly cashflow app built for entrepreneurs who need clarity without complexity. It helps track cash movements across projects, visualize trends, and manage client payments efficiently.

Freelancers, consultants, and agencies particularly appreciate its simple setup and the ability to create tailored forecasts for different income streams.

Key Features:

- Custom forecasting by project or client

- Intuitive graphs and dashboards

- Export to Excel and CSV

- Email reminders for upcoming expenses

- Multi-user access

Why it stands out: Pulse focuses on simplicity. It’s ideal for small teams that need actionable cash insights without the overhead of an enterprise tool.

4. QuickBooks Cash Flow Planner

Best for: Businesses already using QuickBooks

QuickBooks, long known for its accounting platform, includes a Cash Flow Planner module that helps businesses predict and monitor their liquidity in real time.

The system automatically analyzes past transactions to forecast upcoming balances, making it a convenient choice for companies already managing their books through QuickBooks.

Key Features:

- Built-in cashflow forecasts

- Invoice and payment tracking

- Automatic categorization of income and expenses

- Integration with QuickBooks Online and Payroll

- Alerts for cash shortages

Why it stands out: For QuickBooks users, this feature eliminates the need for third-party tools. It’s practical and seamlessly integrated into existing workflows.

5. CashAnalytics

Best for: Mid-sized and large corporations

CashAnalytics is an advanced treasury management solution that specializes in automating cashflow forecasting and reporting for complex organizations.

It provides detailed visibility over multi-currency accounts, subsidiaries, and entities, making it ideal for CFOs managing large-scale financial operations.

Key Features:

- Automated consolidation of multiple entities

- Multi-currency forecasting and analytics

- Bank and ERP integrations

- Scenario planning and risk analysis

- Advanced visualization dashboards

Why it stands out: CashAnalytics focuses on enterprise-level treasury visibility, helping larger teams identify liquidity risks and optimize working capital.

6. Agicap

Best for: SMBs needing dynamic forecasting

Agicap has become one of Europe’s most popular cashflow management apps, thanks to its balance between simplicity and power.

The app connects to your bank accounts and accounting software, updates forecasts automatically, and allows you to model multiple scenarios easily.

Key Features:

- Bank synchronization with daily updates

- Customizable forecasts and reports

- Expense and project tracking

- Collaboration across departments

- Multi-subsidiary visibility

Why it stands out: Agicap’s sleek interface and automation make it an accessible option for growing companies that need clear, accurate forecasts.

7. PlanGuru

Best for: Budgeting and long-term financial planning

PlanGuru goes beyond simple cashflow monitoring by offering advanced budgeting and forecasting tools.

It integrates with QuickBooks and Excel, helping finance teams build multi-year projections and evaluate long-term profitability through data-driven planning.

Key Features:

- Budgeting, forecasting, and reporting in one tool

- Integration with Excel and accounting software

- 30-day money-back guarantee and 14-day free trial

- Scenario analysis and KPI tracking

- Educational resources for finance teams

Why it stands out: PlanGuru is ideal for organizations that want to connect daily cashflow data with long-term financial strategies.

8. Cube

Best for: Finance teams that rely on spreadsheets

Cube bridges the gap between spreadsheets and real-time financial data.

It lets teams continue working in Excel or Google Sheets while automating data imports, consolidations, and forecasts. This makes it ideal for financial professionals who prefer spreadsheet flexibility with modern automation.

Key Features:

- Integration with Excel and Google Sheets

- Real-time synchronization with financial data

- Custom dashboards and reports

- Approval workflows and audit trails

- Scenario modeling and KPI tracking

Why it stands out: Cube offers the power of automation without forcing teams to abandon familiar spreadsheet workflows, a great hybrid approach for modern finance departments.

What Are Cashflow Monitoring Apps?

A cashflow monitoring app is a digital tool that helps businesses and individuals track their income, expenses, and overall liquidity. It connects directly to your bank accounts and financial systems, providing real-time visibility into how money moves in and out of your business.

Unlike basic accounting software, which focuses on recordkeeping, cashflow monitoring apps are forward-looking, they analyze trends, forecast future balances, and alert users to potential liquidity gaps before they become problems.

Banktrack takes this concept further by combining treasury management, forecasting, and expense tracking into one unified platform.

Why Cashflow Monitoring Matters

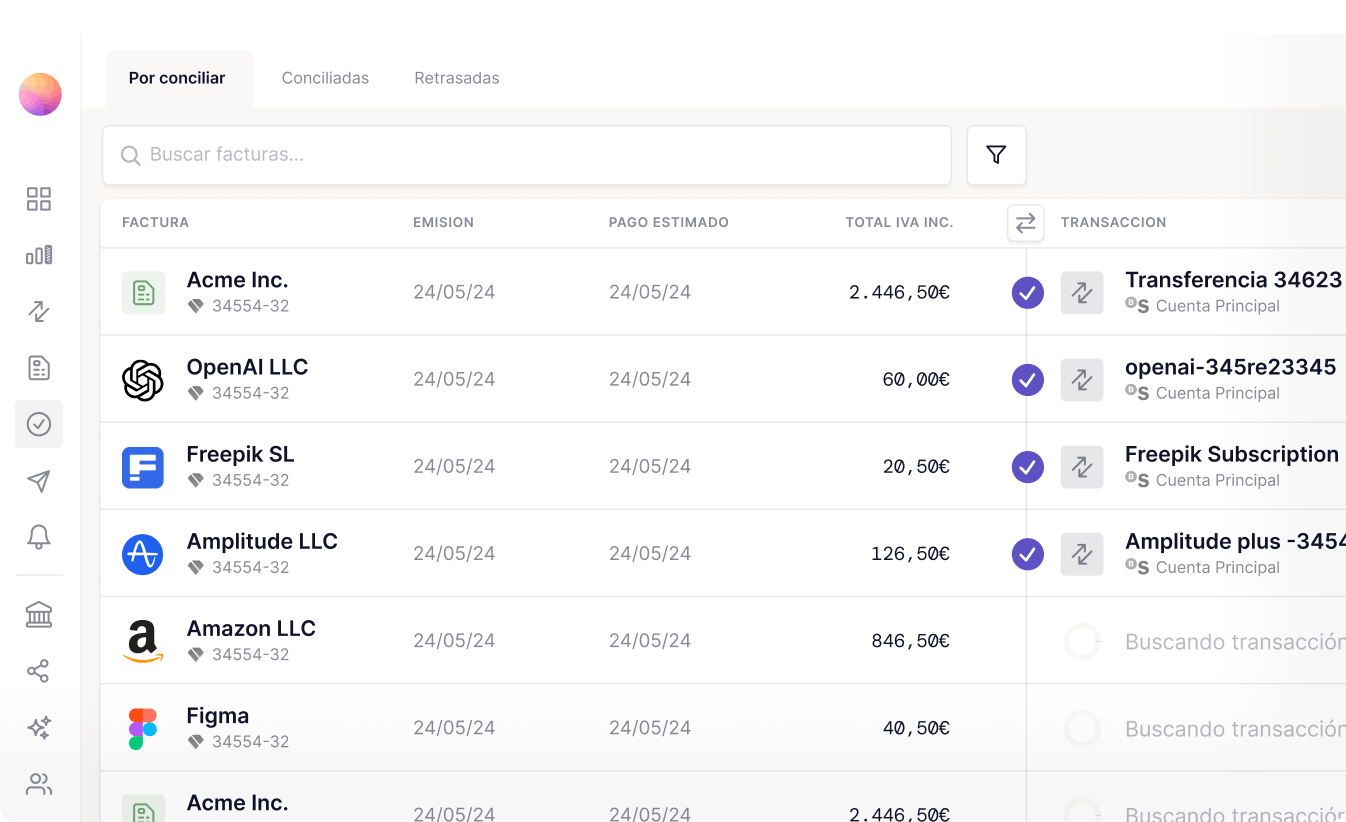

For growing companies, cashflow isn’t just about numbers, it’s about financial agility. Without accurate data, it’s easy to make decisions that compromise liquidity. Cashflow monitoring apps like Banktrack allow you to:

- Anticipate future cash shortages or surpluses

- Adjust payment schedules strategically

- Control spending in real time

- Automate reconciliations and reduce human error

- Make decisions backed by reliable, current financial data

In short, effective monitoring gives businesses the confidence to grow sustainably, and that’s exactly what Banktrack was built for.

Why Banktrack Is the Best Cashflow Monitoring App

While there are many cashflow tools on the market, Banktrack distinguishes itself with a blend of automation, precision, and user experience.

Where others focus on single features, Banktrack integrates forecasting, tracking, and reporting into a single intuitive ecosystem.

Its security-first approach, flexible pricing, and powerful integrations make it the go-to solution for any business that values control and clarity over its finances.

In short, Banktrack doesn’t just monitor your cashflow, it helps you understand, predict, and optimize it.

7 Key Features That Make Banktrack One of the Best Cashflow Monitoring Apps

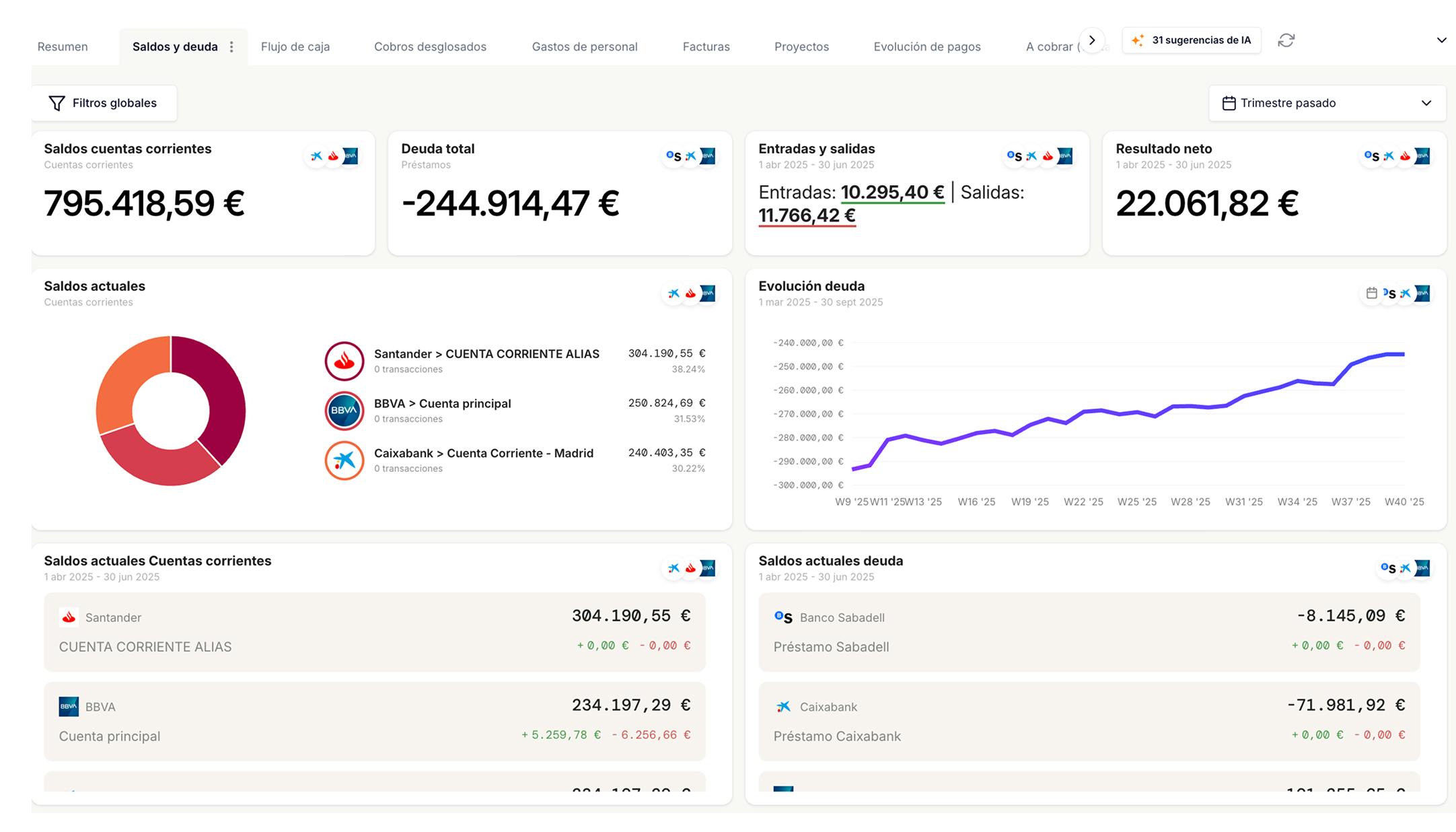

1. Real-Time Financial Visibility

Banktrack connects securely to multiple banks and payment providers, aggregating all your accounts in one view.

This gives users instant access to real-time balances and transaction data, no more logging into separate accounts or manually downloading statements.

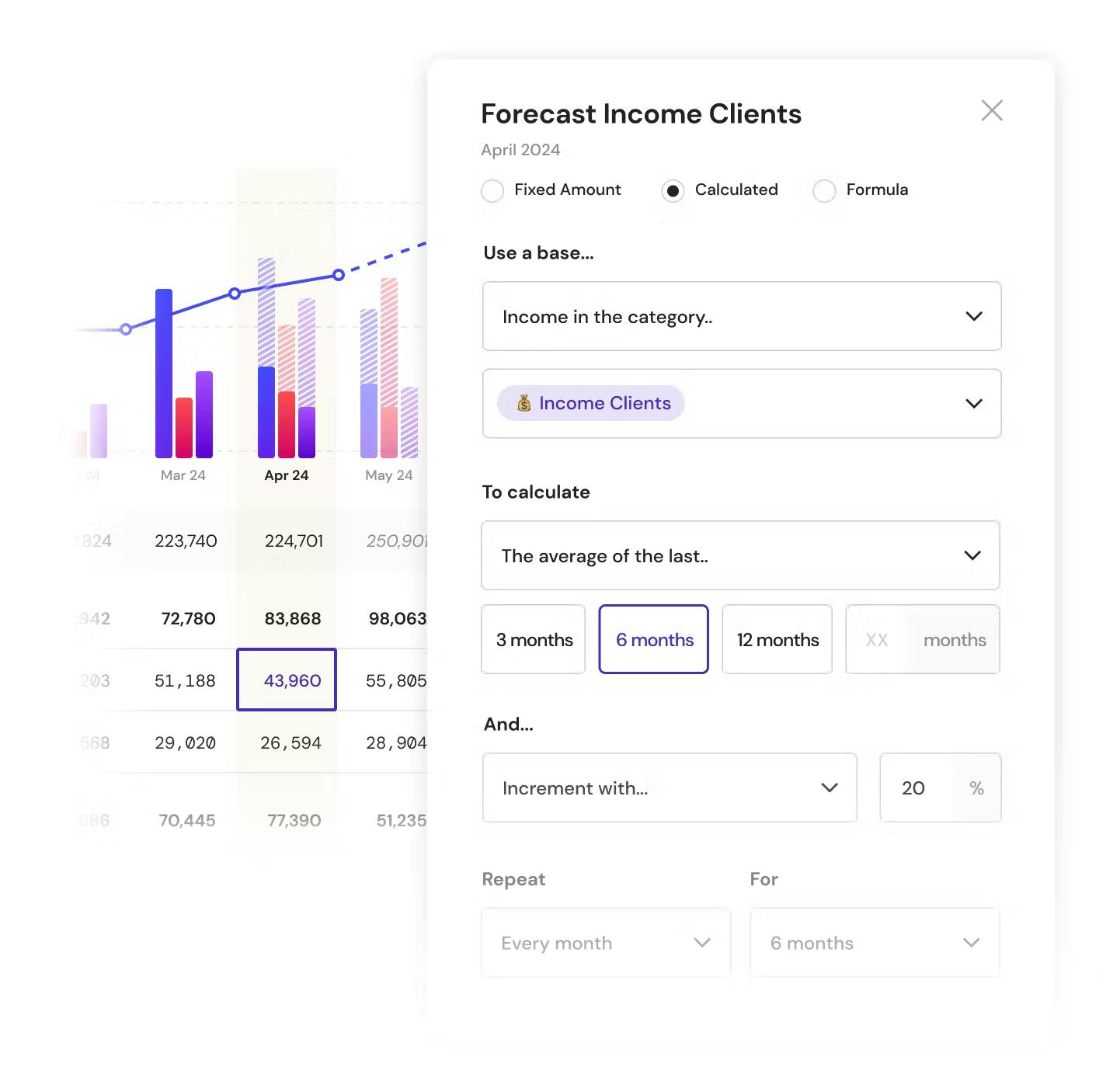

2. Smart Forecasting and Planning

Banktrack doesn’t just show you your current financial status; it helps you anticipate the future.

Its forecasting engine analyzes historical data and recurring patterns to project future cashflows. You can simulate different scenarios, such as delays in client payments or new investments, and immediately see the potential impact.

3. Personalized Dashboards and Reports

Every business has different needs. With Banktrack, users can build custom dashboards that track the metrics that matter most to them, such as account balances, overdue invoices, or upcoming payments.

Reports are also fully customizable and can be generated with one click for team meetings or board reviews.

4. Multi-Bank and Multi-Entity Management

Banktrack supports integration with multiple banks and entities, making it ideal for business groups or companies operating internationally.

You can monitor the treasury of several subsidiaries at once, transfer funds between them, and maintain total visibility over your consolidated cash position.

5. Automatic Categorization

Every incoming or outgoing transaction is automatically categorized based on its type and description. Payroll, rent, utilities, subscriptions, and client payments are all sorted automatically, making it easier to understand where your money is going.

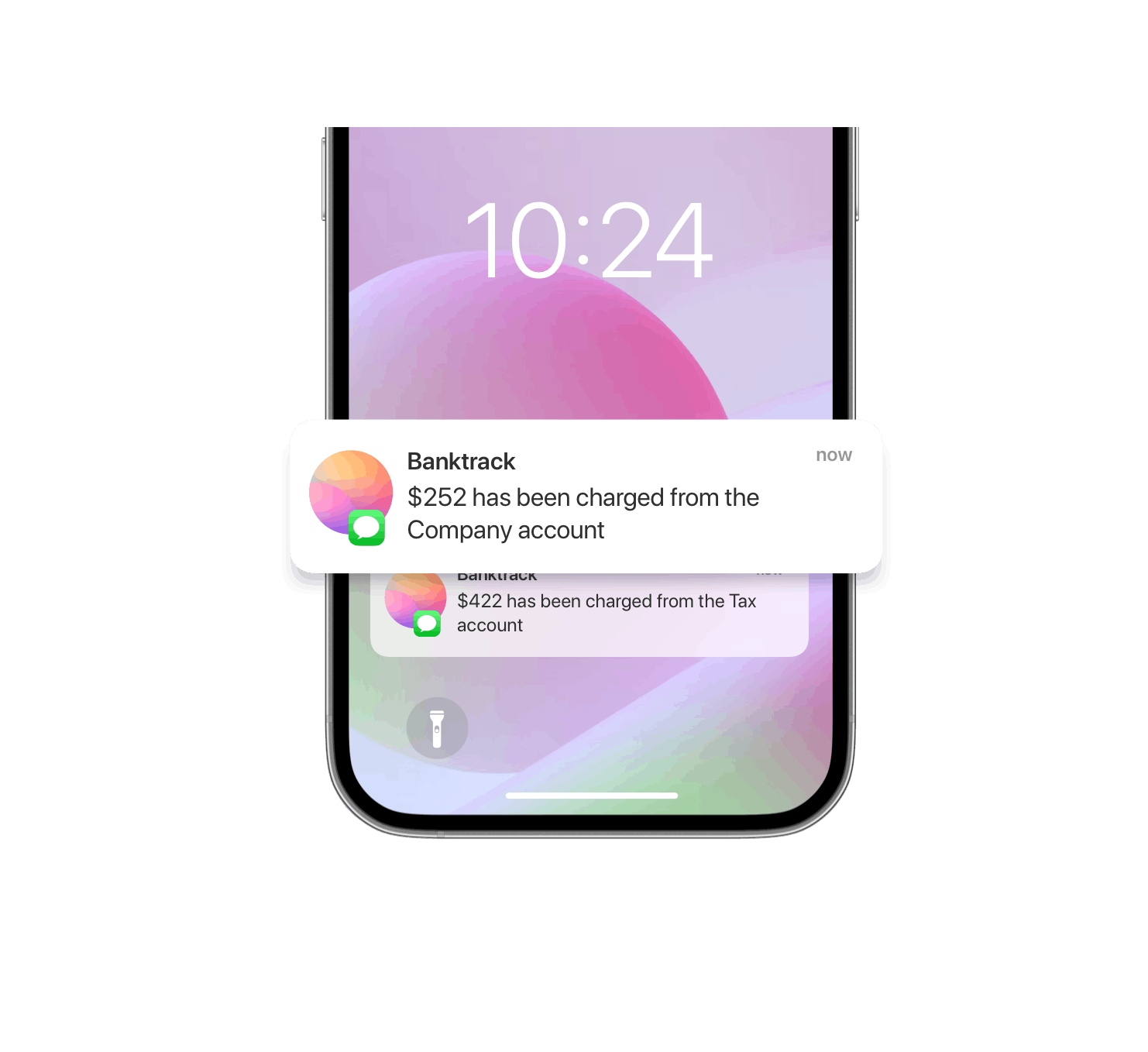

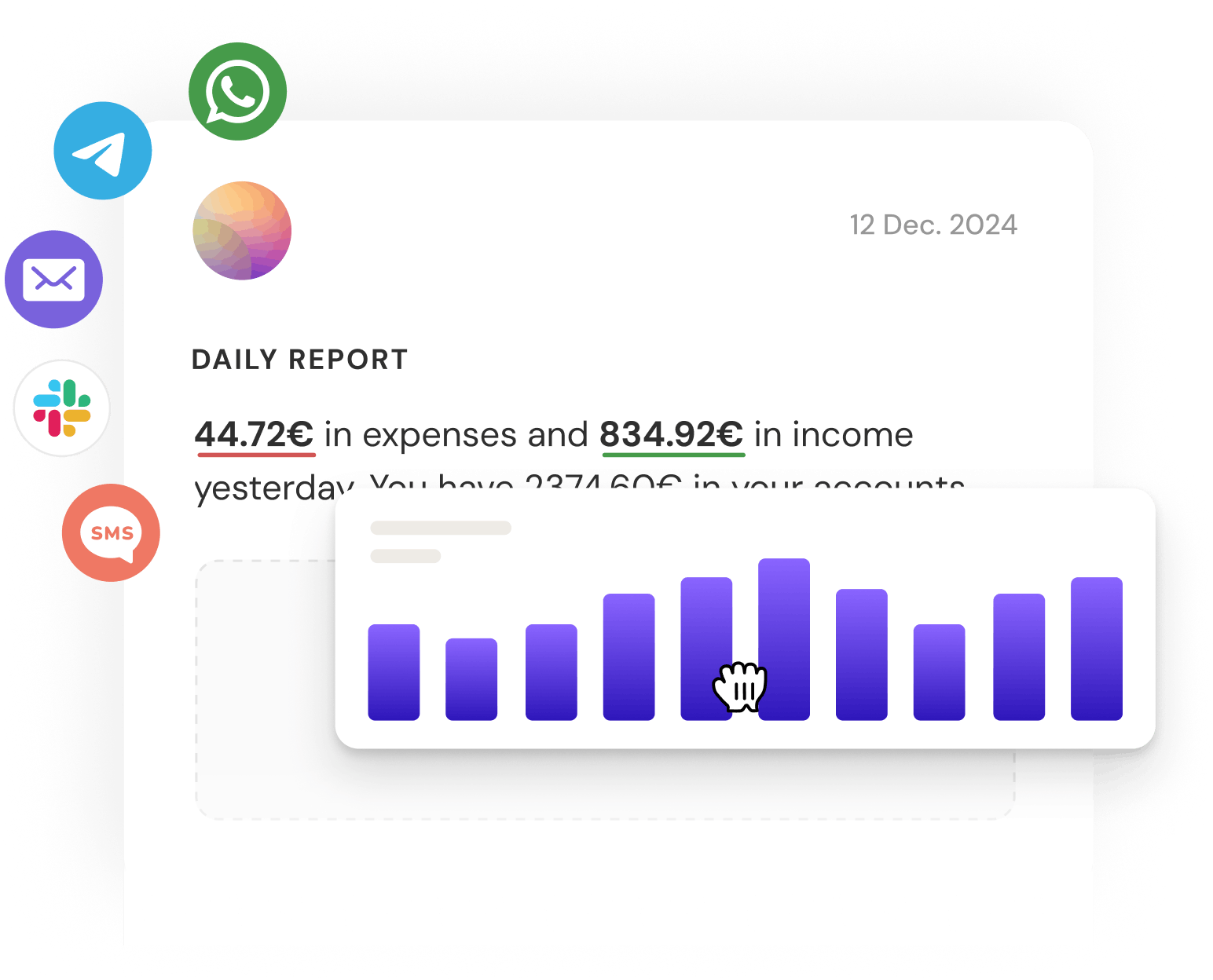

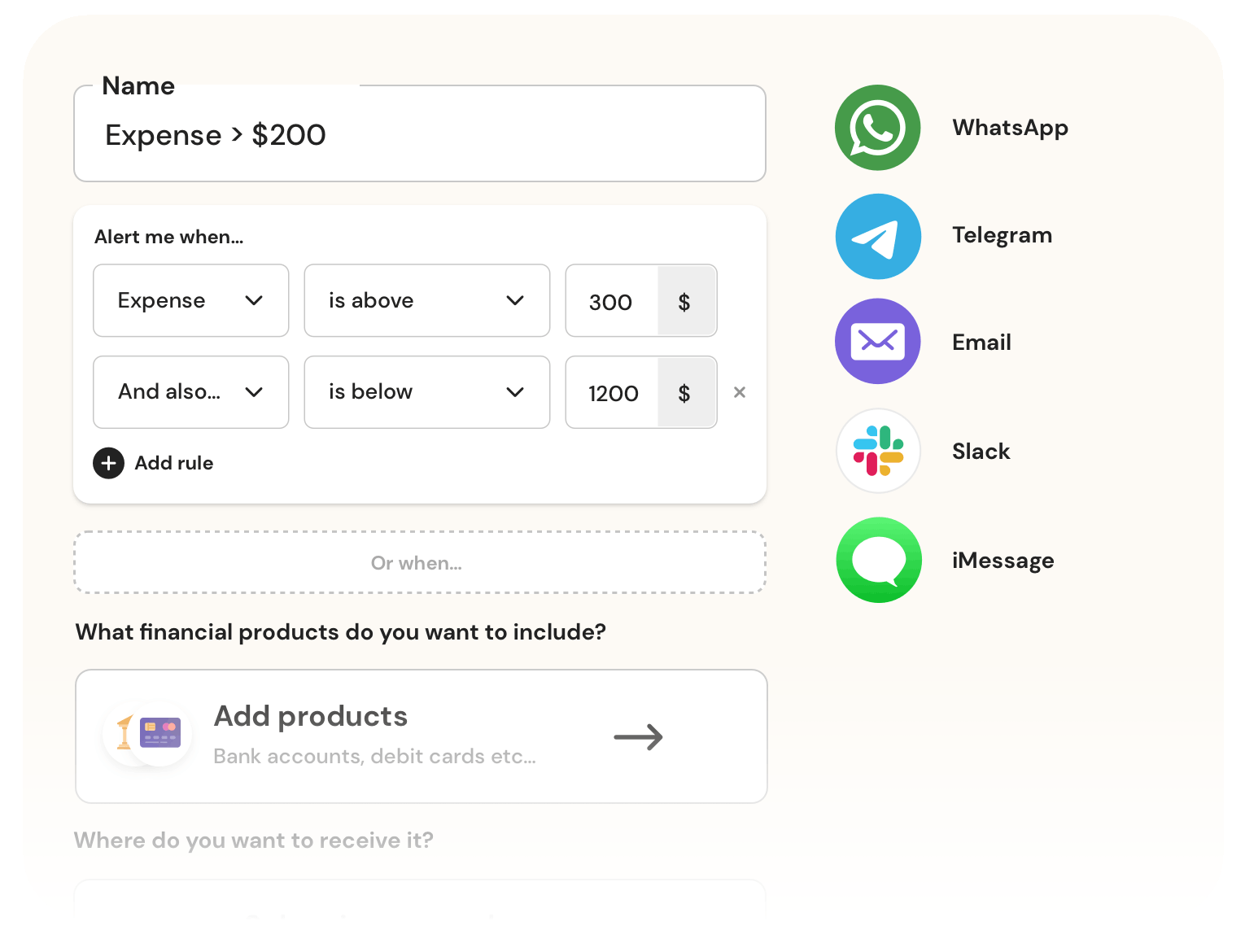

6. Alerts and Notifications

Banktrack keeps you informed through automated alerts.

Receive notifications about upcoming payments, low balances, or deviations from your forecast, via email, WhatsApp, or within the app itself.

This ensures you never lose sight of critical financial events.

7. Bank-Level Security

Security is at the core of Banktrack’s design.

The app uses bank-grade encryption, complies with European PSD2 regulations, and only works with authorized banking data providers approved by the Bank of Spain and EU regulators.

All transactions are encrypted end-to-end, ensuring that your financial information is always safe.

How to Choose the Best Cashflow Monitoring App

Before selecting a tool, consider the following key aspects:

- Ease of use: Your team should be able to navigate the interface without extensive training.

- Integrations: Check if it connects with your banks, accounting software, or ERP.

- Automation: Look for automatic categorization, alerts, and real-time updates.

- Forecasting capabilities: Choose apps that let you plan scenarios and test assumptions.

- Security: Ensure the platform follows strict data protection and encryption standards.

- Scalability: The app should adapt as your company grows and adds more entities or users.

The right software isn’t just about features, it’s about how it fits into your daily workflow.

Final Thoughts

The era of spreadsheets and manual reporting is fading fast. The best cashflow monitoring apps now provide automation, visibility, and predictive intelligence that finance teams could only dream of a few years ago.

If your goal is to manage liquidity efficiently and plan for the future, Banktrack stands out as the all-in-one solution. It combines powerful forecasting, real-time insights, and secure automation to keep your business financially stable and ready for growth.

With the right cashflow monitoring app, your finances finally become what they should be, predictable, transparent, and under control.

Frequently Asked Questions (FAQs)

What is a cashflow monitoring app?

A cashflow monitoring app tracks income, expenses, and liquidity in real time, helping businesses maintain visibility and make informed financial decisions.

Which is the best app for cashflow forecasting?

Banktrack is widely regarded as the best all-in-one cashflow monitoring app for forecasting, tracking, and treasury management.

Are these apps secure?

Yes. The top cashflow apps use bank-grade encryption and comply with financial regulations such as PSD2 and GDPR.

Can small businesses use cashflow apps?

Absolutely. Tools like Banktrack, Float, and Agicap are designed with SMEs in mind, offering scalable pricing and easy setup.

Do these apps integrate with accounting software?

Most of them do. Banktrack, Float, and PlanGuru integrate with platforms like QuickBooks, Xero, and Excel.

Is manual data entry required?

No. The best tools automate imports directly from bank feeds and accounting systems, saving time and minimizing errors.

Share this post

Related Posts

Best 7 Cash Flow Forecasting Softwares for Startup Businesses

Explore the best cash-flow forecasting software for startups, with tools that simplify budgeting, projections, and financial planning to keep your business healthy and scalable.Verifactu for Startups in Spain: Complete Guide 2025

Verifactu introduces a new era of electronic invoicing in Spain, requiring startups to send invoices directly to the Tax Agency.

Try it now with your data

- Your free account in 2 minutes

- No credit card needed