Verifactu for Startups in Spain: Complete Guide 2025

- What Is Verifactu?

- Why Verifactu Matters for Startups

- 6 Key Changes When Verifactu Applies to Startups

- 1. Integration at the core

- 2. Immutability and permission control

- 3. Logging and audit trails

- 4. Storage and backup

- 5. Transmission to tax authority (if required)

- 6. Customer experience

- 6 Challenges for Startups Adopting Verifactu

- Benefits of Verifactu for Startups

- Timeline and Deadlines

- Banktrack: A Solution Built for Verifactu + Startup Growth

- Key Capabilities of Banktrack for Startups

- Why Banktrack is a strong choice vs custom build

- 7 Steps for Startups to Implement Verifactu

- Conclusion

Startups often operate at the intersection of speed, innovation, scaling, and compliance. They push new business models, adopt new technologies, and move quickly, but they also need to keep financial and legal foundations solid.

Introducing Verifactu, the new invoice verification system mandated in Spain, adds a regulatory dimension startups must understand and incorporate as they grow.

This guide examines what Verifactu is, how it specifically impacts startups, the challenges and benefits, the timeline, steps for implementation, and why Banktrack emerges as a strong tool for startups wanting to comply and remain agile.

What Is Verifactu?

Verifactu is a system designed by the Spanish Tax Agency (AEAT) to make invoicing more transparent, traceable, and tamper-proof. It arises from legislative efforts (notably the anti-fraud laws) to reduce tax evasion, ensure that invoices are immutable, and to provide mechanisms for verification by authorities and third parties.

Key properties of Verifactu invoices:

- Inalterability: Once issued, a document cannot be modified.

- Unique identification: Each invoice or ticket must generate a digital hash (a fingerprint) so that any change breaks verification.

- Verifiability: A QR code or equivalent element must allow someone (client, authority) to check authenticity.

- Sequential numbering: Correlatively numbered invoices without gaps.

- Logging and trace records: Emission timestamps, user identity, and audit logs.

- Optional real-time or delayed transmission to AEAT: Invoices may be sent live to the tax body, or stored in secure, traceable archives to be submitted when requested.

For startups, often operating in lean, fast-paced environments, Verifactu introduces a new legal and technical requirement to factor into product, billing, and infrastructure decisions.

Why Verifactu Matters for Startups

Startups have unique features that make Verifactu’s implications particularly relevant:

- Rapid growth and scaling: As startups scale, their invoicing volume, number of clients, and complexity of billing increase. Embedding compliance early helps avoid rework.

- Recurring subscription and SaaS models: Many startups run subscription models, usage billing, or hybrid models. Ensuring each bill meets verification standards is essential.

- Global and cross-border operations: Startups often work with clients in multiple countries. Their billing systems must handle domestic compliance while supporting multi-currency, cross-border, and integration needs.

- Investor visibility and audit readiness: Investors and audits expect clean, verifiable financial records. Non-compliant invoicing can raise red flags.

- Lean teams and automation-first mindset: Startups must automate as much as possible. Manual interventions in billing expose risk and inefficiency.

6 Key Changes When Verifactu Applies to Startups

1. Integration at the core

Billing systems, subscription engines, CRMs, all must generate invoices compliant with Verifactu. It is not sufficient to bolt compliance later; it must be integrated into the product or finance stack.

2. Immutability and permission control

Once an invoice is generated, it cannot be edited. Corrections or reversals must follow prescribed “corrective invoice” flows, with audit trail metadata.

3. Logging and audit trails

Every action (issue, cancel, correct) must leave a trace: who did it, when, and how. Startups must ensure their infrastructure supports strong logging.

4. Storage and backup

Invoices must be stored in a secure, non-modifiable repository, preserving the hash and QR metadata so that future verifications remain valid.

5. Transmission to tax authority (if required)

Where applicable, startups might need to transmit invoices live or in batches to AEAT, requiring reliable connectivity, retry logic, and error handling.

6. Customer experience

Startups must balance compliance with a smooth experience: invoices arriving with QR codes should still look nice, integrate into dashboards, and link to customer portals without friction.

6 Challenges for Startups Adopting Verifactu

- Tech overhead: building or modifying billing systems to support hash, QR, digital signatures, and audit logs.

- Cost and time: investing in compliance can delay product features or deployment.

- Balancing flexibility and rigidity: startups often pivot; hardening systems too early may reduce flexibility.

- Reliability and connectivity: cloud services must guarantee uptime and connectivity to send invoices or archives when needed.

- Testing complexity: ensuring all edge cases (refunds, partial billing, corrections) comply with Verifactu logic.

- Managing historical data: for older invoices, handling migration or validity when compliance becomes mandatory.

Benefits of Verifactu for Startups

Despite the overhead, there are strong upsides for startups:

- Regulatory peace of mind: Systems comply by design, reducing audit risk, fines, or retroactive issues.

- Investor and client trust: Verifiable invoices and clean audit trails give credibility in funding rounds or enterprise deals.

- Operational efficiency: Automating verification and compliance reduces manual reconciliation and error correction.

- Better financial insight: Because invoices are structured and traceable, startups can more reliably analyze revenue, churn, refunds, and billing anomalies.

- Scalable compliance: Implementing Verifactu early means less friction as the startup grows in users, geographies, or products.

Timeline and Deadlines

Startups should be aware of implementation timelines:

- Mid-2025: New billing software listed in the market should be compatible with Verifactu.

- Early 2026: Many startups incorporated as companies will need to comply.

- Mid to late 2026: Smaller startups and solo entrepreneurs may face enforcement deadlines.

It’s advisable not to wait until deadlines; early adoption allows time for testing and smoothing out issues.

Banktrack: A Solution Built for Verifactu + Startup Growth

For startups, one of the big challenges is finding a treasury management software that complies but also supports growth, cash flow forecasting, and financial operations. Banktrack stands out in this area.

Key Capabilities of Banktrack for Startups

- Verifactu-compliant billing: Banktrack can generate invoices and billing documents fully equipped with hash, QR, and audit metadata.

- Automatic reconciliation: Moves emitted invoices into matching with bank transactions across dozens of banks, detecting gaps or anomalies.

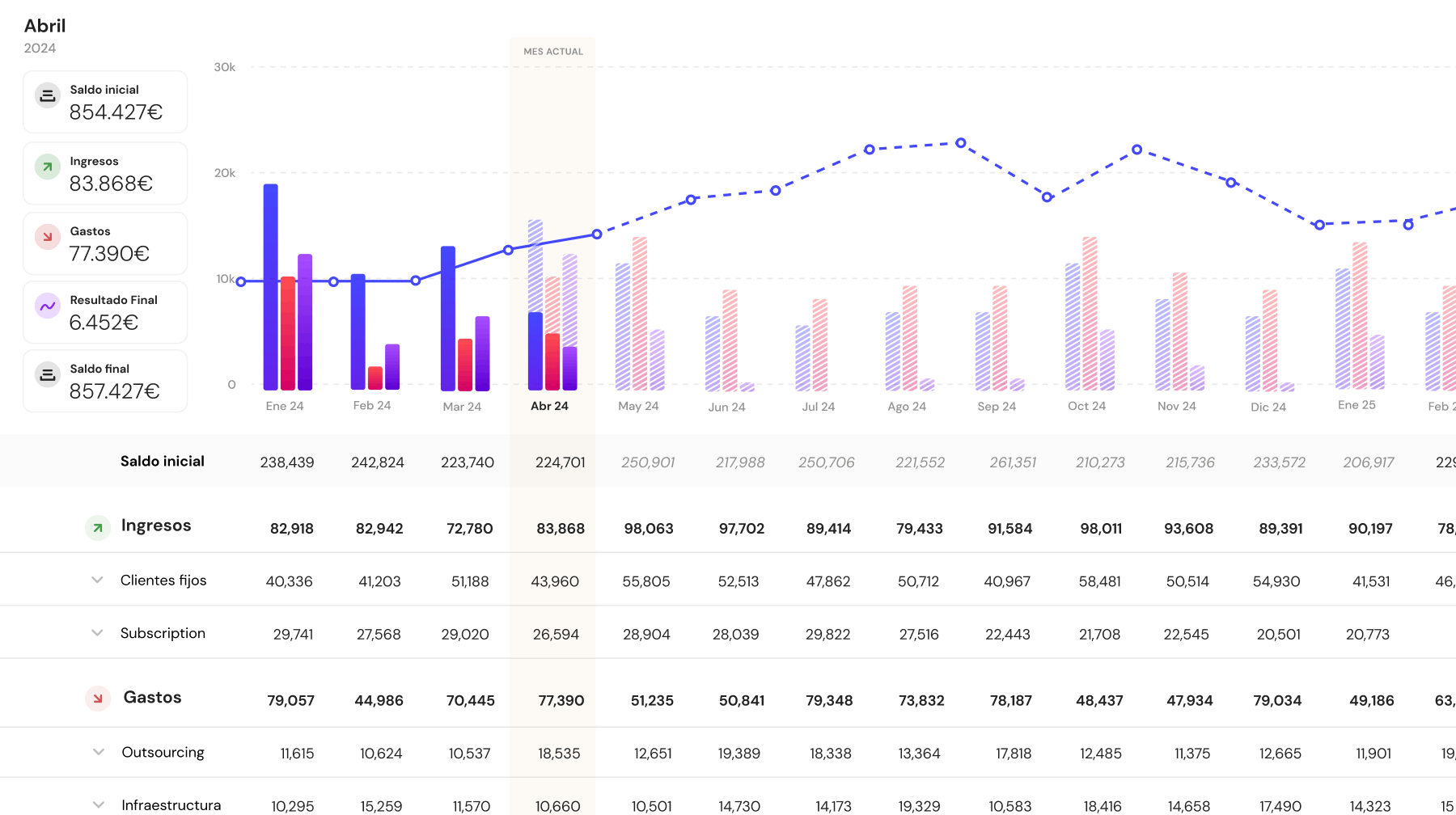

- Cash flow forecasting & scenarios: Startups can run “what if” analysis: e.g. delayed client payments, increased marketing spend, scaling hiring, or sudden churn.

- Alerts and anomaly detection: Banktrack flags duplicate invoices, out-of-pattern billing, or low cash buffer alerts.

- Multi-entity and multi-product support: Ideal for startups operating with multiple service lines or subsidiaries, all under one management panel.

- Exportable reports and dashboards: Teams, investors, or auditors can get clean, compliant data easily.

Why Banktrack is a strong choice vs custom build

- Reduces time to compliance.

- Offloads maintenance and audit burden.

- Provides growth-stage financial intelligence.

- Lets the startup focus on product rather than compliance plumbing.

7 Steps for Startups to Implement Verifactu

- Audit current billing stack: Identify if your invoice engine or subscription software can support hash, QR, and audit logs.

- Engage development/finance teams: Define how Verifactu flows fit into your invoicing pipelines, corrections, refunds.

- Select or upgrade software: Either adopt a platform already compliant (like Banktrack) or upgrade your own system.

- Train operations and finance teams: Every team touching billing must understand what can or can’t be changed post issuance.

- Test extensively in staging: Simulate edge cases: partial refunds, subscription proration, cancellations, mid-billing adjustments.

- Decide on transmission mode: Real-time or deferred, configure communication with AEAT if needed.

- Monitor post-launch closely: Track errors, rejections, mismatches, and iterate.

Conclusion

For startups, balancing speed, growth, and compliance is always a delicate act. Verifactu introduces a regulatory dimension that cannot be ignored, but it also offers a chance to build billing systems that are robust, transparent, and investor-ready from the start.

Startups that embed Verifactu compliance early, rather than retrofitting later, will benefit from cleaner financial foundations, improved trust, and scalable billing infrastructure. Tools like Banktrack make this path easier, combining strict compliance with forecasting, reconciliation, and operational insight.

Verifactu for startups is not only a legal necessity, it’s a gateway to mature financial operations, better control, and confidence as you scale.

Share this post

Related Posts

Best 8 Cashflow Monitoring Apps in 2025

Discover the best 8 cashflow monitoring apps in 2025 that help businesses track income, expenses, and liquidity in real timeThe 6 Best SaaS Financial Projections for Founders in 2025

Discover six top SaaS financial-projection platforms tailored for founders, enabling accurate subscription modelling, scenario planning, and metric tracking to drive scalable growth in 2025.Best 7 Cash Flow Forecasting Softwares for Startup Businesses

Explore the best cash-flow forecasting software for startups, with tools that simplify budgeting, projections, and financial planning to keep your business healthy and scalable.

Try it now with your data

- Your free account in 2 minutes

- No credit card needed