5 best bank reconciliation software in 2025

- What is a bank reconciliation?

- Why is account reconciliation important?

- Benefits of having a bank reconciliation software for your business

- 1. Time savings

- 2. Accuracy and reduced human error

- 3. Improved financial visibility

- 4. Better fraud detection

- 5. Increased efficiency

- 6. Better cash flow management

- 7. Compliance and audit readiness

- 8. Cost-effectiveness

- Best bank reconciliation software 2025

- Banktrack

- 2. QuickBooks

- 3. Xero

- 4. FreshBooks

- 5. Expensify

- Questions to ask yourself when choosing the best bank reconciliation software

- 1. Is the software compatible with my bank and accounting system?

- 2. Does the software offer automatic and real-time reconciliation?

- 3. What security measures does it implement to protect financial data?

- 4. Is it easy for my team to use?

- 5. Does it allow generating customized reports?

- 6. Does it offer automatic alerts for due dates or discrepancies?

- 7. What costs are associated with using the software?

What is a bank reconciliation?

A bank reconciliation is the process of comparing and matching the financial records of a company's cash account (in its books) with the bank statement.

The goal is to identify discrepancies between the two records and adjust for any differences, ensuring that both are aligned.

Here’s a general breakdown of the process:

- Comparing transactions: the business compares the transactions recorded in its accounting system with those listed on the bank statement.

- Identifying differences: common differences include outstanding checks, deposits not yet processed by the bank, bank fees, interest income, or errors in either the company’s or bank’s records.

- Adjusting entries: once discrepancies are identified, adjustments or corrections are made to the company’s books or the bank’s records to bring them in line.

- Finalizing the reconciliation: after adjustments are made, the balance in the company’s books should match the balance shown on the bank statement.

Why is account reconciliation important?

Account reconciliation is important for a company for several key reasons:

- Ensures financial accuracy: it helps verify that the financial records are accurate by comparing and matching transactions in the company's accounts with external sources (like bank statements or vendor records). This ensures that there are no discrepancies or errors in financial reporting.

- Prevents fraud and errors: regular reconciliations can identify unauthorized transactions, errors, or fraudulent activities. By comparing internal records with external ones, discrepancies can be spotted early and investigated.

- Improves financial planning: reconciliation ensures that the company’s financial statements, such as the balance sheet and income statement, reflect true and correct information. This is essential for reporting to stakeholders, auditors, and regulatory bodies.

- Cash flow management: by reconciling accounts, businesses can better track their available funds, identify unrecorded transactions, and ensure cash flow is managed effectively. This helps prevent issues like overdrafts or missed payments.

- Compliance and audit preparedness: regular reconciliation is a best practice that supports compliance with accounting standards and regulations. It ensures that the company is prepared for audits, reducing the risk of penalties or legal issues.

- Improves decision making: accurate financial data is essential for strategic decision-making. Reconciliation ensures the company has reliable information to assess its financial health and make informed business decisions.

- Prevents tax issues: by reconciling accounts, a company ensures that its financial data is accurate, which is essential for tax filings. Accurate data helps avoid tax discrepancies and potential penalties.

Benefits of having a bank reconciliation software for your business

1. Time savings

- Automated processes: bank reconciliation software automates the process of matching transactions between the company’s financial records and its bank statements. This saves time compared to manual reconciliation and allows staff to focus on more strategic tasks.

- Faster reconciliation: the software quickly identifies discrepancies and matches transactions, speeding up the reconciliation process.

2. Accuracy and reduced human error

- Error-free matching: the software uses algorithms to automatically match transactions, reducing the likelihood of human error that can occur in manual reconciliation.

- Minimizes data entry mistakes: automated data entry reduces the chance of mistakes from inputting incorrect figures or omitting transactions.

3. Improved financial visibility

- Real-time updates: bank reconciliation software provides real-time updates of the company’s financial status, making it easier to monitor cash flow, account balances, and outstanding payments.

- Comprehensive reports: the software generates detailed reports that give insights into financial discrepancies, pending transactions, and overall financial health.

4. Better fraud detection

- Quick identification of discrepancies: any discrepancies between bank transactions and internal records are quickly flagged, allowing businesses to detect fraudulent activities early.

- Audit trail: the software often keeps a complete audit trail of all reconciliations, making it easier to trace discrepancies and investigate suspicious activity.

5. Increased efficiency

- Multi-bank support: bank reconciliation software can link multiple bank accounts simultaneously, streamlining the process for businesses with complex banking relationships.

- Customizable matching rules: the software can be customized to match transactions according to specific criteria, allowing businesses to optimize the reconciliation process for their unique needs.

6. Better cash flow management

- Accurate cash position: by automating the reconciliation process, the software provides accurate real-time insights into the company’s cash position, helping businesses manage cash flow more effectively.

- Reduced risk of overdrafts: timely reconciliation ensures that the business has an accurate record of available funds, reducing the likelihood of overdrafts or missed payments.

7. Compliance and audit readiness

- Ensures compliance: bank reconciliation software helps businesses stay compliant with accounting standards, regulations, and tax laws by maintaining accurate and up-to-date financial records.

- Audit-friendly: the software’s detailed reporting and tracking features make it easier to prepare for audits and provide the necessary documentation.

8. Cost-effectiveness

- Reduces labor costs: by automating reconciliation, the software reduces the need for manual effort, saving the company money on labor costs.

- Avoids fees: accurate reconciliations help businesses avoid unnecessary bank fees, such as overdraft or late payment penalties, by ensuring transactions are properly recorded and monitored.

Best bank reconciliation software 2025

Banktrack

1. Invoice centralization

One of the main features of Banktrack is that it centralizes all a company's invoices in one place.

This is achieved through a series of easy-to-use methods that allow you to receive, store, and organize invoices, whether they are electronic or paper-based.

- Email Redirection: You can redirect all emails with invoices to your Banktrack account, so you don’t have to worry about losing documents or searching through your emails. Banktrack will automatically store and organize them.

- Paper Invoices: If you receive paper invoices, you can take a photo of the invoice with your phone and send it directly to your Banktrack account via WhatsApp. The platform will recognize the image and convert it into a digital document that will be stored and managed.

2. Integration with your ERP

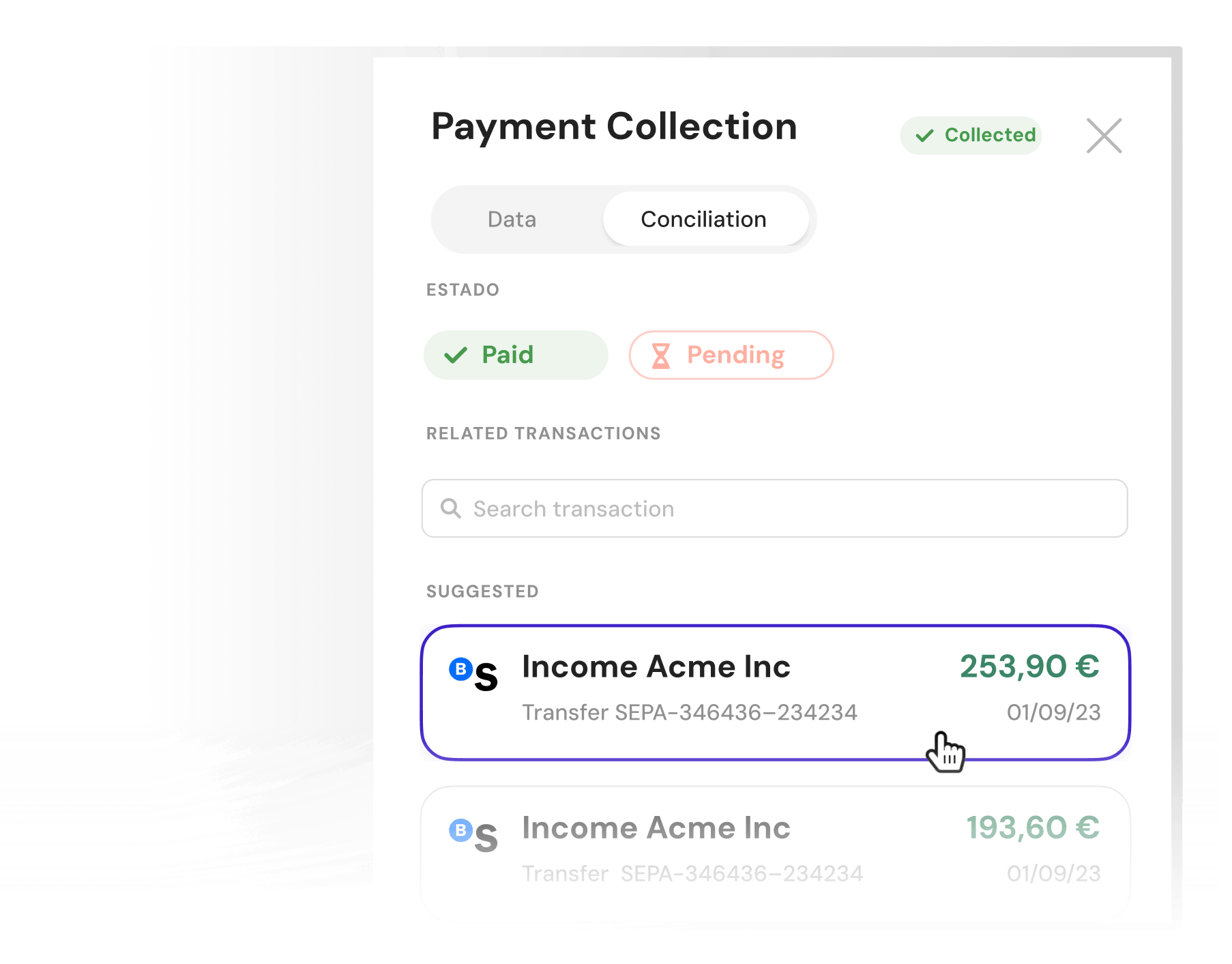

Banktrack integrates with your ERP (Enterprise Resource Planning) system. This integration facilitates the automatic and real-time reconciliation of invoices. Through this integration, you can:

- Automatic invoice reconciliation: once you upload an invoice to Banktrack, the system automatically scans the information using its OCR (Optical Character Recognition) technology.

This allows it to read key invoice data and match it with payments and collections already registered in your ERP. This eliminates the need to manually review each invoice.

- Detailed view of payments and collections: Banktrack provides a detailed view of all transactions associated with invoices, allowing you to quickly see details such as the supplier name, applied taxes, and due dates.

3. Quick detection of outstanding invoices

One of the biggest challenges in invoice management is keeping track of those that are still pending payment or collection. This process becomes much simpler with bank reconciliation software:

- Quick identification of outstanding invoices: the system instantly alerts you to any invoice that is still pending payment or collection.

This helps you avoid delays and potential penalties for missing due dates.

Additionally, integration with your ERP ensures that all payments and collections are reflected immediately, providing you with a clear and up-to-date view at all times.

4. Smart reconciliation with OCR

Each time you upload an invoice to Banktrack, the system will use advanced OCR technology to scan the information contained in the document.

This includes identifying data such as the issue date, amount due, taxes applied, and other important details.

If any invoice doesn’t match or is missing data, Banktrack will alert you so you can correct it quickly.

5. Invoice due date management: payment and collection calendar

One of the greatest benefits of Banktrack is its ability to manage the due dates of all your invoices.

By analyzing all the invoices in the system, Banktrack provides you with an estimate of your future payments and collections.

This is shown in an easy-to-read calendar format, allowing you to effectively plan your company’s cash flow.

With this calendar view, you can anticipate the due dates of all your invoices and ensure timely payments, avoiding delays that could affect relationships with suppliers or customers.

6. Organized download of all transactions

In addition to helping you manage your invoices centrally, Banktrack also allows you to download all transactions associated with your invoices in an organized manner.

This includes information about payments made, invoices issued, and those still pending. Everything is organized by date, supplier, and transaction type, making it easy to search and organize data for audits or financial reports.

2. QuickBooks

QuickBooks is one of the most widely used accounting software, especially for small and medium-sized businesses.

It offers a complete range of features for financial management, including bank reconciliation, invoicing, payment management, and report generation.

Main features:

- Automatic bank reconciliation: QuickBooks allows you to automatically import bank transactions from your bank account and credit card. This makes it easy to reconcile accounts accurately and quickly.

- Financial report generation: the software provides reporting tools that allow you to generate balance sheets, income statements, cash flow reports, among others, to give you a clear view of your company's finances.

- Payment and invoicing management: it allows you to create and send invoices, record customer payments, and track accounts receivable.

- Easy integration: it integrates with a wide range of banks and other payment platforms, simplifying the reconciliation and financial management process.

3. Xero

Xero is a cloud-based accounting software aimed at small and medium-sized businesses. It stands out for its intuitive interface and powerful bank reconciliation and financial management tools. Xero focuses on automating financial processes and integration with banks.

Main features:

- Real-time bank reconciliation: Xero allows direct connection to your bank account to automatically import transactions and perform real-time reconciliation. This gives you an accurate, up-to-the-minute view of your finances.

- Integration with banks and payment platforms: it integrates with banks worldwide as well as payment platforms like PayPal and Stripe, making it easier to import and reconcile transactions.

- Customizable financial reports: Xero provides advanced tools for creating customizable financial reports such as balance sheets and income statements tailored to your business needs.

- Collaboration Tools: Xero facilitates collaboration between your team members or with your accountant, making it easier to work together on financial management.

4. FreshBooks

FreshBooks is an online accounting software designed for freelancers and small businesses. It focuses on simplicity and ease of use, with key features for bank reconciliation, invoicing, and expense management.

Main features:

- Simple and fast bank reconciliation: FreshBooks connects with your bank accounts and credit cards to import transactions and quickly reconcile them. This saves time and improves accounting accuracy.

- Invoicing and payment management: it allows you to create and send personalized invoices, accept online payments, and track accounts receivable all within the same platform.

- Expense tracking: FreshBooks also enables you to record and categorize your expenses, making it easier to reconcile income and expenses and optimize tax filing.

- Financial reports: it offers financial reports such as income statements, cash flow, and profit reports, which allow you to track your business's financial performance in detail.

5. Expensify

Expensify is an expense management and bank reconciliation tool focused on simplifying the tracking and control of business expenses. It is designed for both small businesses and large corporations that need to automate the bank reconciliation process and receipt management.

Main features:

- Automatic bank transaction reconciliation: Expensify allows you to link your bank accounts and credit cards to import transactions and automatically reconcile payments and expenses. The software also uses OCR (Optical Character Recognition) technology to scan receipts and match them with the corresponding transactions.

- Expense and receipt management: you can quickly scan and upload expense receipts from your mobile phone, making it easier to capture and categorize expenses for review and approval.

- Real-Time expense approval: expenses can be approved and rejected in real time, improving the efficiency of the internal audit process.

- Detailed expense reports: Expensify provides detailed expense and transaction reports, making it easier to manage budgets and overall financial management.

- ERP and accounting software integration: Expensify integrates with accounting platforms like QuickBooks, Xero, and NetSuite, allowing you to sync expenses with other financial management systems in your business.

Questions to ask yourself when choosing the best bank reconciliation software

1. Is the software compatible with my bank and accounting system?

It's important to confirm whether the software can integrate with your bank and current accounting system to ensure efficient synchronization and avoid compatibility issues.

2. Does the software offer automatic and real-time reconciliation?

Automation and real-time processing are essential features to save time and reduce manual errors.

3. What security measures does it implement to protect financial data?

Make sure the software includes encryption, two-factor authentication, and regular audits to protect your company's financial information.

4. Is it easy for my team to use?

The software should be intuitive and have a low learning curve, as well as offer technical support to resolve any questions or issues.

5. Does it allow generating customized reports?

The ability to customize reports is key for analyzing specific financial data, such as balances, taxes, suppliers, or expense categories.

6. Does it offer automatic alerts for due dates or discrepancies?

A good software should send automatic alerts for upcoming payments, overdue invoices, or detected discrepancies, to help manage things in a timely manner.

7. What costs are associated with using the software?

Check the initial costs, monthly fees, updates, and possible additional integrations to understand the impact on your budget.

Share this post

Related Posts

Best App to Link All Bank Accounts

Find out the best app to link all bank accounts. Here are our top 5 options.Automated invoice management for businesses: tools and benefits

Automated invoice management streamlines processing, reduces errors, and saves time. With AI and OCR, businesses can digitize invoices, track payments, and improve financial control efficiently.7 cash flow forecasting trends of 2025

Discover the key trends shaping cash flow forecasting, including AI integration, real-time data, and predictive analytics for smarter financial decision-making.

Try it now with your data

- Your free account in 2 minutes

- No credit card needed