Best 7 Cash Flow Forecasting Softwares for Startup Businesses

- Best 7 Cash Flow Forecasting Softwares in Startups

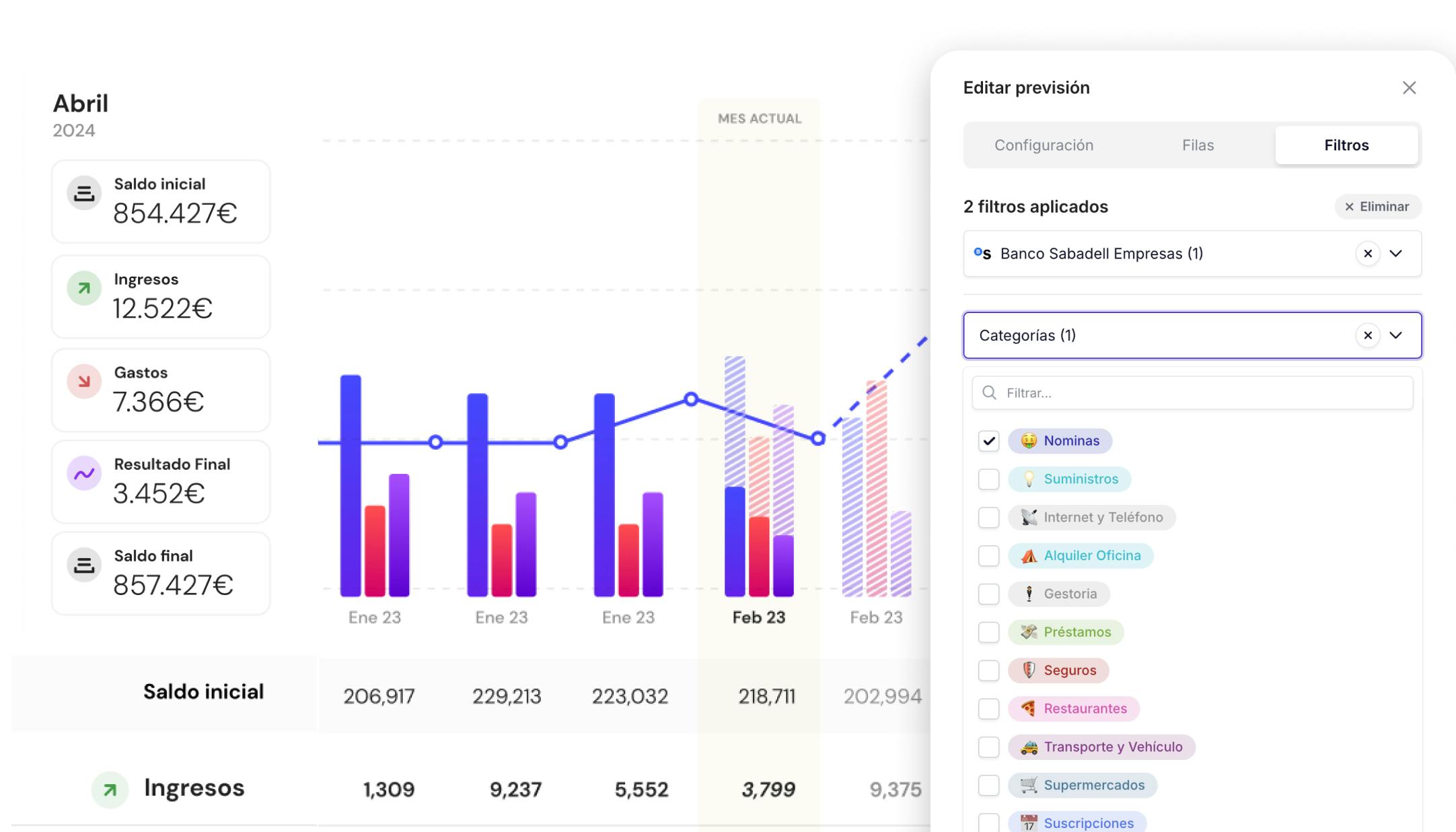

- 1. Banktrack

- 2. Float

- 3. Pulse

- 4. Futrli

- 5. Agicap

- 6. Anaplan

- 7. Excel & Google Sheets

- What Is Cash Flow Forecasting?

- Why Cash Flow Forecasting Is Crucial for Startups

- Challenges Startups Face with Cash Flow Forecasting

- 3 Methods of Cash Flow Forecasting

- 1. Direct Method

- 2. Indirect Method

- 3. Scenario-Based Forecasting

- 5 Best Practices for Startup Cash Flow Forecasting

- 5 Trends in Startup Cash Flow Forecasting in 2025

- Benefits of Good Cash Flow Forecasting for Startups

- 7 Steps to Build Your First Forecast

- Conclusion

These are the best cash flow forecasting softwares for startups:

- Banktrack

- Float

- Pulse

- Futrli

- Agicap

- Anaplan

- Excel & Google Sheets

When you launch a startup, your main focus is usually on building the product, signing the first customers, and convincing investors. But one of the biggest reasons startups fail is not lack of demand, but running out of cash. Managing your runway, predicting when money will come in or flow out, and being able to act before problems hit is critical.

That’s where cash flow forecasting comes in.

In this guide, we’ll break down what cash flow forecasting is, why it matters for startups, the challenges founders face, the most effective methods, and the best tools you can use, with a strong focus on how Banktrack helps startups combine compliance, forecasting, and real-time financial control.

Best 7 Cash Flow Forecasting Softwares in Startups

While Excel and Google Sheets are still common, startups increasingly turn to dedicated tools that automate forecasting and integrate with bank accounts.

Here are some of the top options in 2025:

1. Banktrack

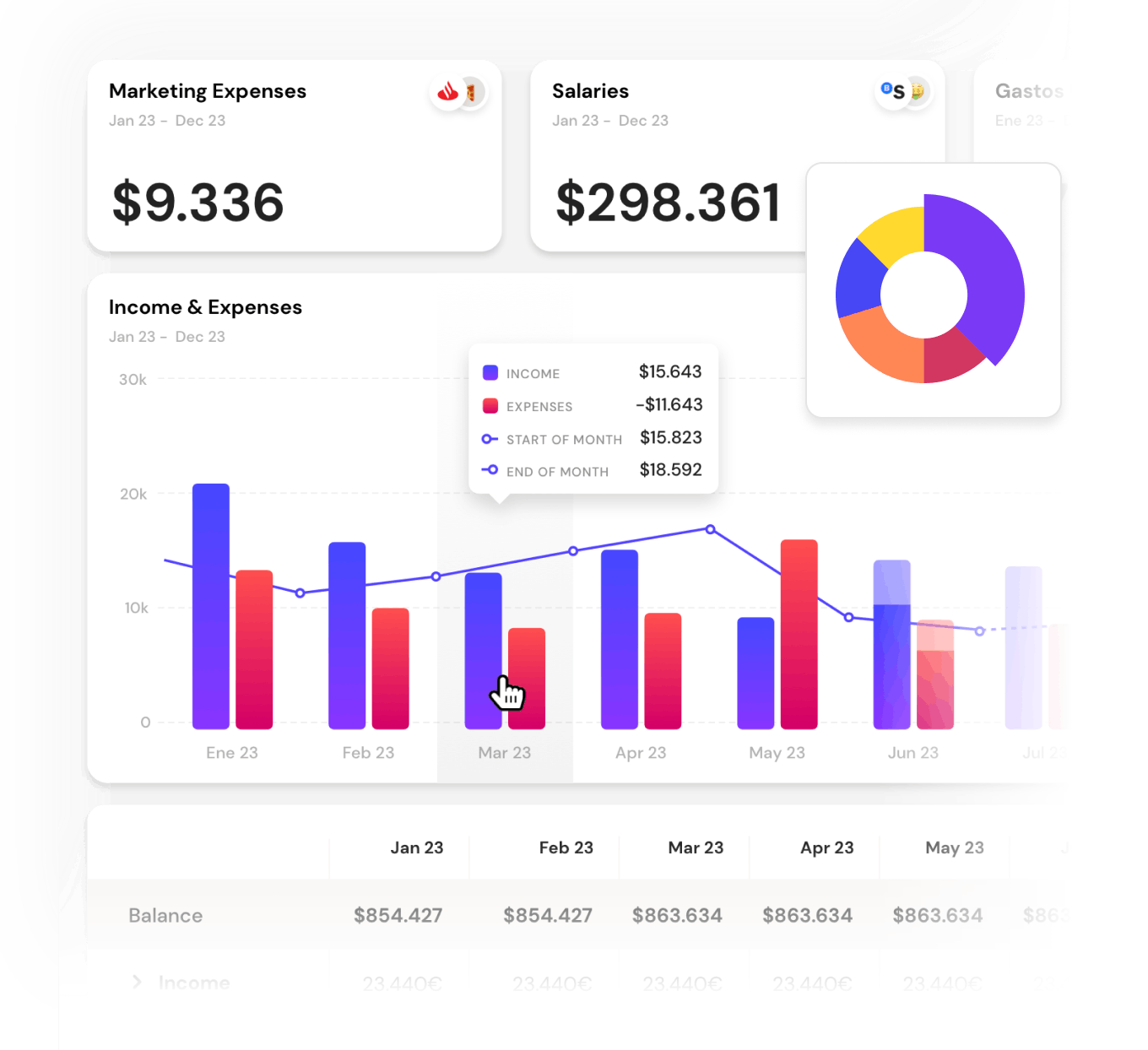

Banktrack is much more than a forecasting app. It’s a complete treasury management software designed for startups, SMEs, and growing businesses that need both compliance and forward visibility.

Where Banktrack shines is in its ability to combine regulatory compliance (such as Verifactu in Spain) with powerful financial forecasting and automation. Startups don’t need to stitch together different tools for invoicing, cash flow, and compliance — it’s all under one roof.

What it offers:

- Real-time synchronization with over 120 banks through Open Banking and direct integrations.

- Cash flow dashboards that update instantly, showing liquidity, burn rate, and runway.

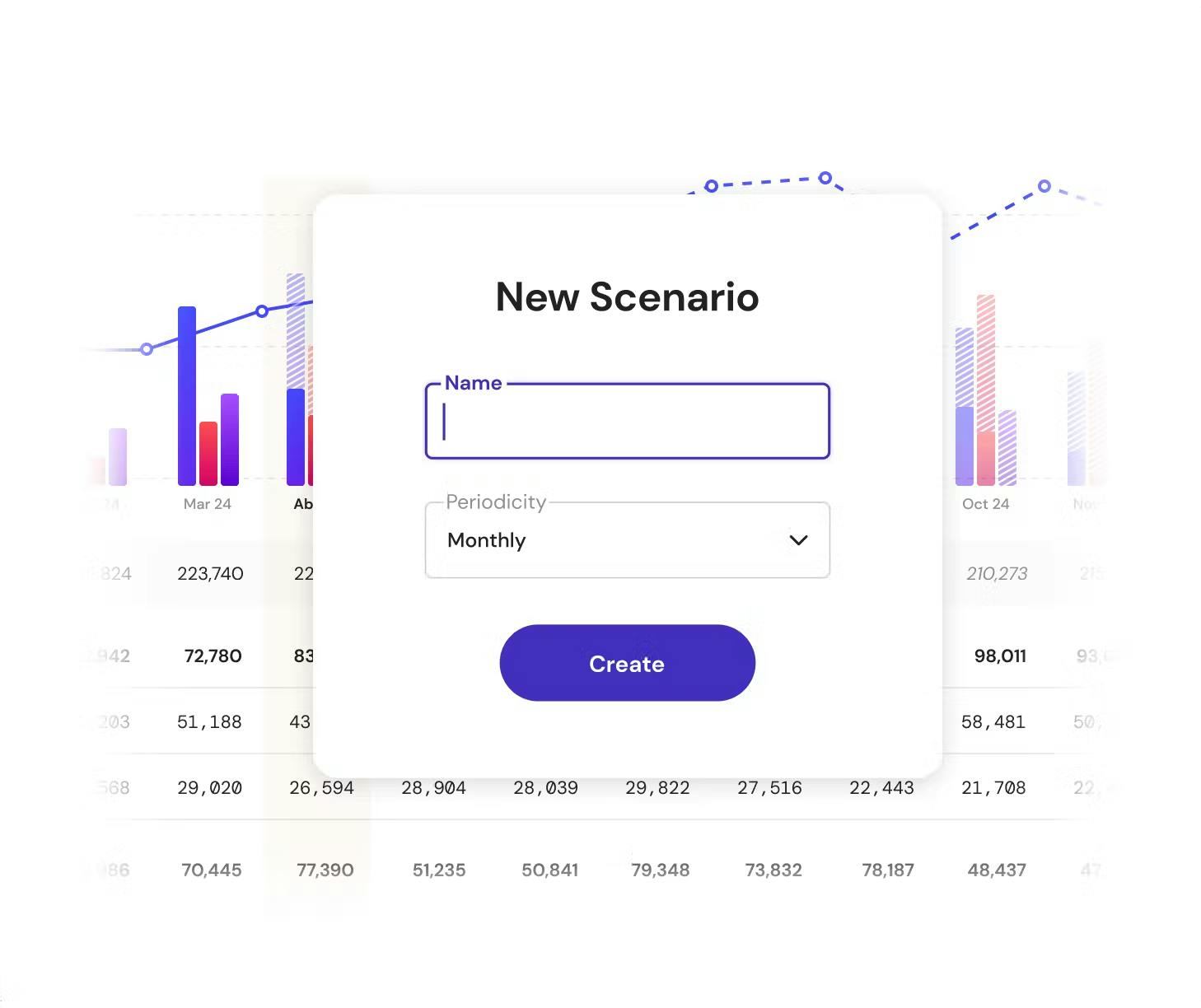

- Forecasting by scenarios: simulate delays in fundraising, client churn, or expansion to new markets.

- Conciliation automation: invoices, tickets, and payments are reconciled automatically.

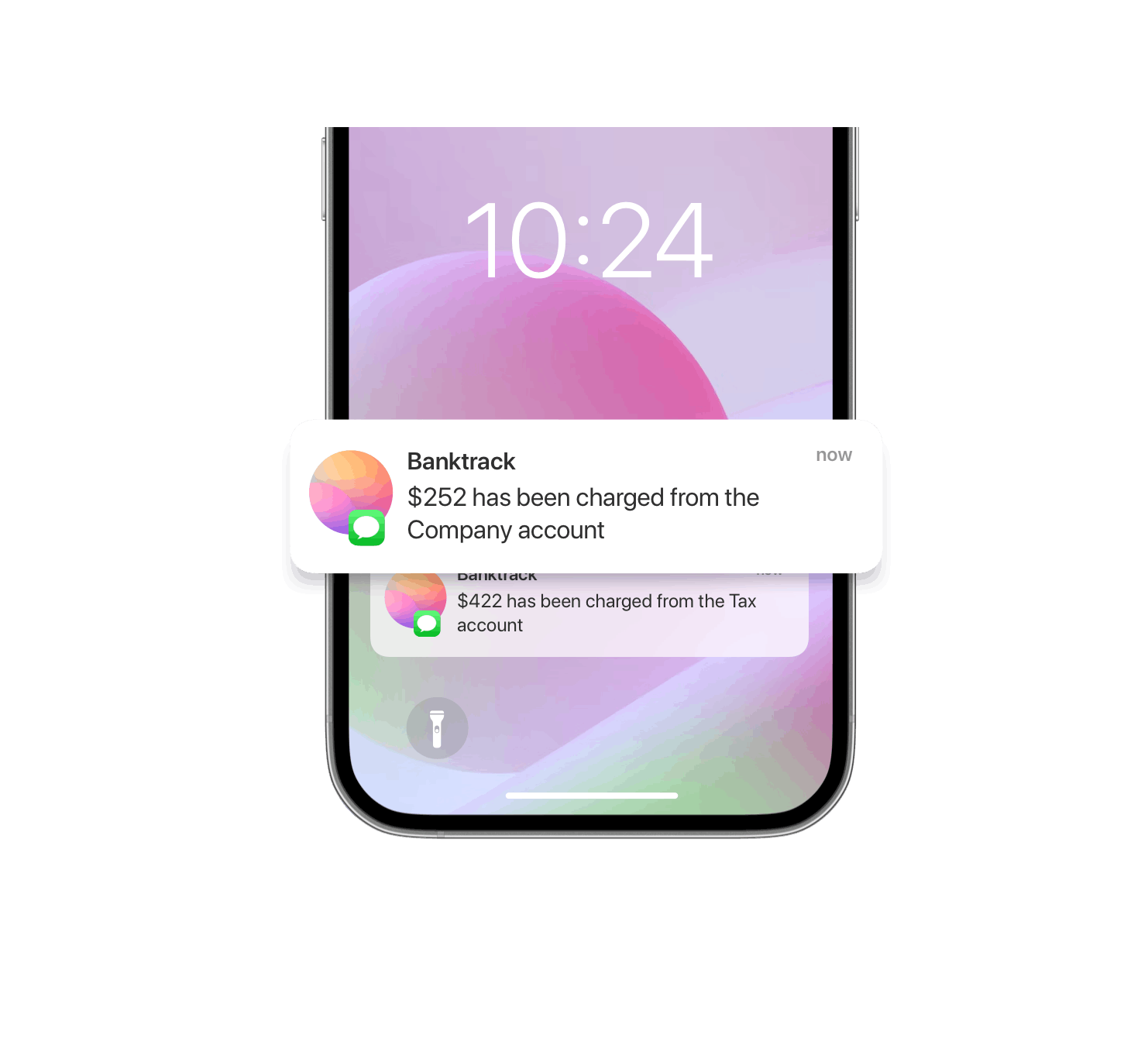

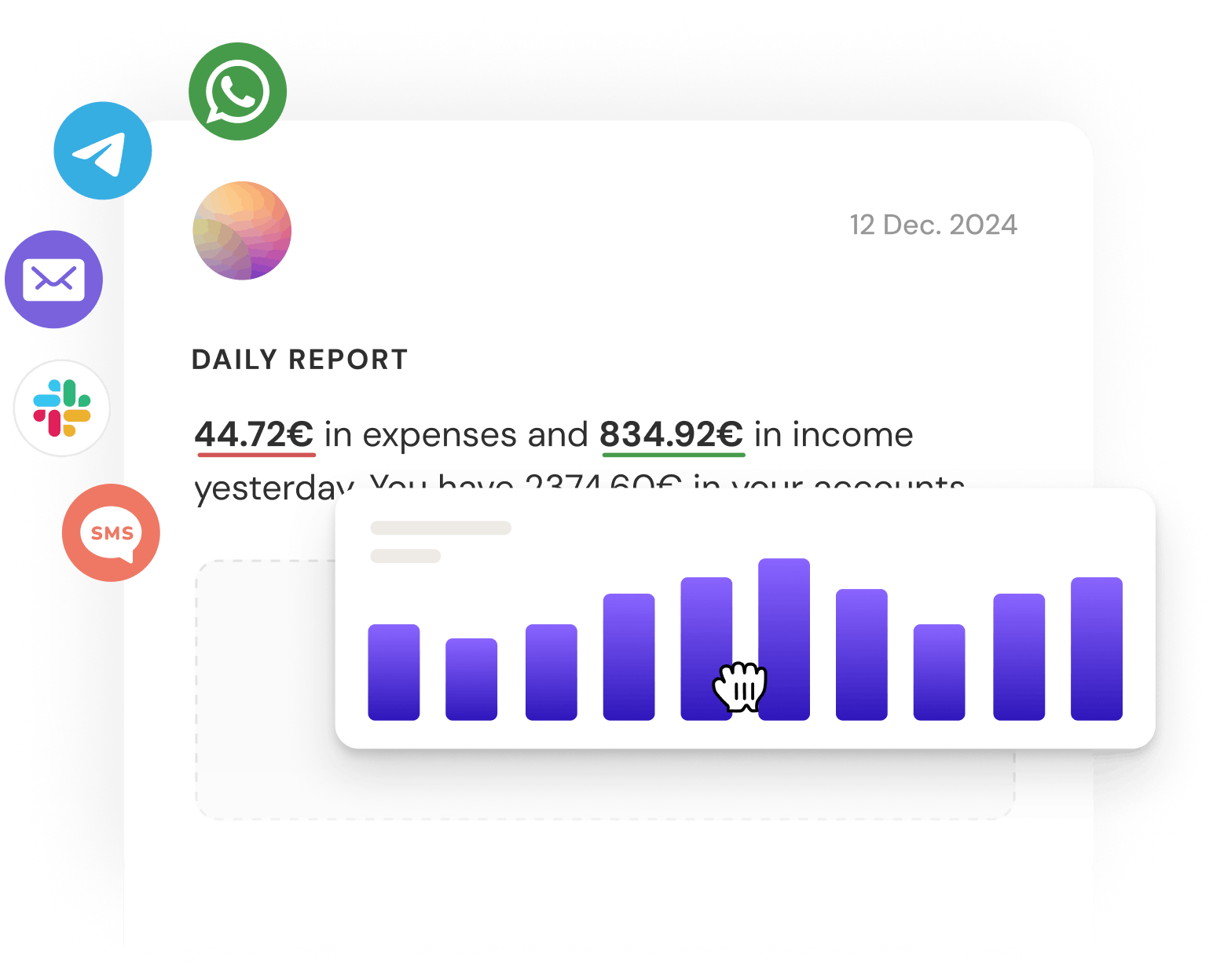

- Alerts across multiple channels (Slack, WhatsApp, SMS, email) for low balances, anomalies, or due payments.

- Multi-entity and multi-currency support, ideal for startups with subsidiaries or international clients.

- Exportable reports tailored for investors, CFOs, or boards.

Why it works for startups: Banktrack helps founders answer the most pressing question: “Do we have enough money to survive and grow?” It eliminates spreadsheet chaos, reduces manual admin, and provides data-driven insights. More importantly, it adapts as the startup scales, from pre-seed to Series A and beyond.

2. Float

Float is a cash flow add-on that integrates seamlessly with popular accounting softwares. This makes it especially attractive for startups that already use one of these platforms and don’t want to reinvent their finance stack.

What it offers:

- Two-way sync with accounting systems, pulling in invoices, bills, and bank balances automatically.

- Scenario planning for different revenue and expense projections.

- Cash flow calendars that show weekly, monthly, or quarterly liquidity.

- Variance reporting: compare forecasts against actual results to spot trends or mistakes.

Why it works for startups: Float is perfect for finance teams or founders who already rely on accounting software but need a clearer forward-looking view. It’s not as advanced as Banktrack in multi-bank integrations, but for startups with solid accounting habits, it provides reliable forecasting without much setup.

3. Pulse

Pulse is built with simplicity in mind. Unlike enterprise tools, it doesn’t overwhelm startups with features they won’t use in the early stages. Instead, it focuses on helping founders see their cash position clearly without needing an accounting degree.

What it offers:

- Easy manual input of expected income and expenses.

- Color-coded dashboards for clarity on positive and negative cash months.

- Scenario views to compare optimistic vs conservative forecasts.

- Collaborator access so advisors or investors can view cash forecasts.

Why it works for startups: For founders who are not finance experts, Pulse acts like a “training wheels” tool. It’s intuitive, visual, and easy to update. The trade-off is less automation, you’ll need to input more data manually compared to Banktrack or Float, but it’s a good starter option.

4. Futrli

Futrli positions itself as an AI-driven forecasting solution that goes beyond cash flow to include profitability and performance predictions. Startups that want more analytical depth, especially SaaS or data-heavy companies, can benefit from its predictive models.

What it offers:

- AI-based forecasts that learn from historical data.

- Multiple financial models: profit & loss, balance sheet, and cash flow in one place.

- Integrations with Xero, QuickBooks, and other accounting systems.

- Customizable KPIs so startups can track churn, ARPU, CAC, and other growth metrics.

Why it works for startups: Futrli is particularly attractive to SaaS startups with complex metrics. Instead of focusing only on cash balances, it links financial and operational KPIs, showing how changes in churn or acquisition impact runway. It’s more advanced but requires discipline in data entry.

5. Agicap

Agicap is a European favorite among SMEs and scale-ups. It specializes in connecting multiple bank accounts, offering a consolidated view of liquidity across entities. For startups that operate with several bank accounts, PSPs, or across borders, this centralization is key.

What it offers:

- Bank aggregation: connects to dozens of European banks for live balance updates.

- Budget vs actual tracking: compare forecasts with reality and adjust.

- Collaborative dashboards: allow finance teams, founders, and investors to monitor in one place.

- Scenario planning: simulate investments, hiring, or expansion.

Why it works for startups: Agicap is great for startups in Europe with multi-bank complexity. It doesn’t provide Verifactu compliance or invoicing like Banktrack, but for pure liquidity and cash tracking, it’s powerful and reliable.

6. Anaplan

Anaplan is a corporate-grade planning tool often used by larger organizations, but some well-funded startups adopt it once they reach Series B or later. It’s highly customizable and covers not just cash flow, but also sales forecasting, workforce planning, and supply chain modeling.

What it offers:

- Enterprise-level modeling: multi-scenario and multi-department planning.

- Collaboration tools for large teams.

- Extensive integrations with ERP and CRM systems.

- Predictive analytics for long-term planning.

Why it works for startups: Anaplan is not for every startup, it’s expensive and complex. But for those scaling fast into multiple markets with 50+ employees, it offers control and precision at enterprise scale. It’s overkill for early-stage founders, but a future option for scale-ups.

7. Excel & Google Sheets

Despite the rise of modern SaaS tools, Excel and Google Sheets remain the most common tools for cash flow forecasting in startups. They’re flexible, free (or nearly), and familiar.

What it offers:

- Full customization: build any model you want.

- Scenario analysis via formulas and linked sheets.

- Shareability via Google Sheets for collaboration.

- Low cost: perfect for pre-revenue startups.

Why it works for startups: Spreadsheets are fine for the very early days. But they’re prone to errors, version conflicts, and manual work. As soon as a startup handles multiple clients, bank accounts, or fundraising rounds, the limits of Excel appear quickly.

What Is Cash Flow Forecasting?

Cash flow forecasting is the process of predicting your company’s inflows (money received) and outflows (money spent) over a defined period. For startups, it’s usually done monthly or weekly, covering:

- Cash inflows: revenues, investment rounds, loans, grants.

- Cash outflows: salaries, subscriptions, marketing spend, rent, taxes, supplier invoices.

Unlike traditional accounting that looks at what has already happened, forecasting is forward-looking. It tells you if you’ll have enough cash in the bank in three, six, or twelve months, and under what conditions.

Why Cash Flow Forecasting Is Crucial for Startups

- Runway visibility: Forecasting shows how many months you can keep operating before running out of cash. This is the #1 metric investors ask for.

- Investor readiness: Being able to present clear cash projections builds trust with VCs, angel investors, or banks.

- Decision-making: Should you hire another engineer? Can you afford to double your marketing budget? Cash flow projections give you the answers.

- Surviving uncertainty: Startups live with uncertainty: client delays, faster growth than expected, or fundraising gaps. Forecasting lets you plan scenarios.

- Compliance & taxes: Forecasting helps anticipate VAT, corporate tax, or other obligations that could create cash crunches if not planned.

Challenges Startups Face with Cash Flow Forecasting

- Unpredictable revenue: In early stages, contracts are not stable and churn can be high.

- Delayed payments: Clients might pay late, but payroll is always on time.

- High upfront costs: Development, marketing campaigns, or product launches create spikes.

- Lack of financial expertise: Many founders are product or tech-driven, not finance experts.

- Multiple bank accounts & tools: Cash is scattered across accounts, PSPs, or Stripe balances.

3 Methods of Cash Flow Forecasting

1. Direct Method

Track expected inflows and outflows line by line, based on invoices, salaries, and planned expenses. Very detailed, but requires data discipline.

2. Indirect Method

Start from profit and adjust for timing differences, non-cash items, and working capital. More common in larger companies, less intuitive for startups.

3. Scenario-Based Forecasting

Startups often need to model “what if” cases:

- What if sales double next quarter?

- What if funding is delayed 6 months?

- What if churn rises by 20%?

Scenario forecasting helps you stress-test your runway.

5 Best Practices for Startup Cash Flow Forecasting

- Keep it simple at first: A 3-month rolling weekly forecast is often better than a 2-year model full of assumptions.

- Update frequently: Review forecasts weekly or monthly. Startups evolve fast, a model from last quarter is outdated.

- Integrate with bank data: Connect forecasts to real-time balances, not just Excel sheets.

- Focus on key drivers: Track your biggest inflows (subscriptions, contracts, investments) and biggest outflows (payroll, rent, ads).

- Always run scenarios: Have at least 3: base case, optimistic, and worst case.

5 Trends in Startup Cash Flow Forecasting in 2025

- AI-enhanced forecasts: Tools automatically detect anomalies and suggest corrections.

- Open Banking integration: Live bank data improves accuracy.

- Scenario-first design: Modern platforms let startups simulate multiple paths with a click.

- Investor-ready outputs: Reports export in formats tailored for VC decks and board meetings.

- Multi-entity dashboards: For startups expanding internationally, tools now unify global visibility.

Benefits of Good Cash Flow Forecasting for Startups

- Time savings: Automating reduces admin work, freeing founders for growth.

- Improved survival odds: Avoids liquidity crises that kill startups.

- Stronger investor trust: Clear, credible forecasts improve fundraising chances.

- Better decisions: Hiring, marketing, and expansion are guided by real data.

- Scalability: Forecasts grow with your startup, avoiding costly system changes later.

7 Steps to Build Your First Forecast

- Collect bank balances & recent transactions.

- List fixed expenses: payroll, rent, SaaS subscriptions.

- Add variable costs: marketing, contractors, events.

- Project inflows: contracts, subscriptions, expected sales.

- Run scenarios: optimistic, base, worst case.

- Review weekly and adjust assumptions.

- Integrate a tool like Banktrack for automation.

Conclusion

For startups, cash is not just fuel, it’s oxygen. Without cash flow forecasting, you’re flying blind, risking both daily operations and long-term survival.

Implementing solid forecasting practices helps startups:

- Extend runway.

- Anticipate challenges.

- Build investor confidence.

- Scale sustainably.

While Excel can be a starting point, dedicated tools like Banktrack take forecasting to the next level. They combine real-time banking data, scenario planning, and compliance with systems like Verifactu, ensuring startups don’t just survive, but thrive.

In 2025, cash flow forecasting is no longer optional for startups. It’s the difference between burning out and breaking through.

Share this post

Related Posts

The 6 Best SaaS Financial Projections for Founders in 2025

Discover six top SaaS financial-projection platforms tailored for founders, enabling accurate subscription modelling, scenario planning, and metric tracking to drive scalable growth in 2025.7 Best Financial Projection Apps in 2025

Discover the top financial-projection apps that simplify scenario modelling, integrate with your accounting data, and help your business forecast revenue, expenses and growth with confidence.The 6 Best Quipu Alternatives in Spain for 2025

The 6 best Quipu alternatives in Spain for 2025 to simplify invoicing, accounting, and financial management for businesses.

Try it now with your data

- Your free account in 2 minutes

- No credit card needed