Advanced cash flow forecasting: techniques and tools

- Why cash flow forecasting is important

- Avoiding unpleasant surprises

- Maximizing the use of working capital

- Effective debt and financing management

- Practical example for your business

- Advanced cash forecasting techniques

- 1. Direct method

- 2. Indirect method

- 3. Rolling forecast

- 4. Scenario-based forecasting

- 5. Adjusting for seasonality

- Advanced cash flow forecasting tools

- 1. Direct method

- 2. Indirect method

- 3. Rolling forecast

- 4. Scenario-based forecasting

- 5. Adjusting for seasonality

- Advanced tools for cash flow forecasting

- Specialized treasury software

- Advanced spreadsheets

- Predictive analytics with Business Intelligence (BI) tools

- ERP (Enterprise Resource Planning) software

- Financial modeling-specific tools

- AI-Powered analytics platforms

- Conclusion

Advanced cash flow forecasting is the process of projecting or estimating a company's future cash flows.

This involves forecasting both cash inflows and outflows over a specific period, with the goal of properly managing the company's liquidity and making informed decisions about its financial health.

Why cash flow forecasting is important

Cash flow forecasting is essential for any business that aims to stay financially healthy, and its importance goes beyond a simple projection of numbers.

Avoiding unpleasant surprises

Liquidity is the lifeblood of a business. If you don't know when and how much cash is coming in or going out, you might find yourself in a situation where, even though your company is generating revenue, you don't have enough cash available to cover critical payments like salaries, suppliers, or taxes.

Cash flow forecasting allows you to see your company's financial future and detect potential liquidity gaps in advance.

This enables you to make decisions to avoid those surprises that could jeopardize daily operations.

Maximizing the use of working capital

If you know when you'll have more cash available, you can take advantage of those moments to make strategic investments, reduce debt, or make early payments to suppliers to benefit from early payment discounts.

In this way, not only do you keep your cash flow under control, but you can also improve your profitability.

Effective debt and financing management

If your business needs external financing, cash flow forecasting is the best way to present your company to lenders or investors.

It’s not enough to say your business is solvent; you need to demonstrate with clear data that you are capable of handling debt payments.

Beyond forecasting cash needs, many global entrepreneurs also think ahead about where to base themselves and their families. Exploring options like citizenship by investment can complement financial planning by adding geographic and tax flexibility.

Practical example for your business

Let’s say you own a manufacturing company and you’re planning an expansion into a new market.

You have high sales expectations, but you also know you’ll need to make investments in equipment and hire more staff.

Without a cash flow forecast, you could end up with more expenses than income during a critical period, putting your expansion at risk.

Now imagine that, by creating your cash flow forecast, you identify that over the next three months your income will increase due to a large contract with an important client, but your expenses will also rise due to the purchase of equipment and hiring new staff.

Thanks to this forecast, you can plan how to distribute those payments over the coming months, ensuring that you have the necessary cash flow to cover everything without any issues.

Advanced cash forecasting techniques

There are several methods for cash flow forecasting that businesses can use depending on their size, complexity, and specific financial needs.

Each method offers different levels of detail, accuracy, and effort required. Here are the most common methods:

1. Direct method

The direct method of cash flow forecasting involves estimating all the cash inflows and outflows that a business expects to receive or pay over a specific period.

This method is straightforward and focuses on the actual cash transactions, giving an accurate representation of the business's liquidity.

Key features:

- Cash inflows: includes cash sales, customer payments, loan receipts, and any other sources of cash.

- Cash outflows: includes operating expenses, salaries, supplier payments, interest, taxes, and loan repayments.

- Timeframe: it typically forecasts on a weekly, monthly, or quarterly basis.

Advantages:

- High accuracy because it relies on actual transactions.

- Provides a clear view of cash availability for paying expenses.

Disadvantages:

- Requires a detailed and up-to-date record of all expected cash receipts and payments, which can be labor-intensive.

- Can be difficult to use for businesses with complex revenue streams or irregular cash flows.

2. Indirect method

The indirect method is commonly used for forecasting cash flow because it is based on adjusting the net income from the income statement by adding back non-cash items and changes in working capital.

This method is often used in more formal financial reporting, including financial statements.

Key features:

- Starts with net income from the income statement.

- Adjusts for non-cash items (like depreciation) and changes in working capital (such as changes in accounts receivable, accounts payable, or inventory levels).

- Often used for long-term forecasting and budgeting.

Advantages:

- Less detailed than the direct method, making it easier for businesses with complex revenue and expense structures.

- Widely used in financial reporting, making it easier for businesses to adapt the method for other purposes like tax reporting or investor relations.

Disadvantages:

- Can be less accurate for short-term planning, since it is based on past figures (net income) and estimates of future changes in working capital.

- Does not provide as granular a view of actual cash inflows and outflows.

3. Rolling forecast

A rolling forecast is a dynamic forecasting method that is updated regularly (often monthly or quarterly) and typically projects cash flows for a set period ahead, such as 12 months.

As each month or quarter ends, the forecast is updated to include a new month or quarter of data.

Key features:

- Continuously updated: as the period progresses, the forecast is adjusted to reflect the most current data.

- Suitable for businesses with fluctuating or uncertain cash flows.

- It is often used in strategic planning and long-term budgeting.

Advantages:

- Provides a flexible, up-to-date view of cash flow and allows businesses to respond quickly to changes in market conditions or business performance.

- Encourages more frequent adjustments to reflect reality and better predict cash shortages or surpluses.

Disadvantages:

- Requires continuous monitoring and frequent updates, which can be resource-intensive.

- Can be less accurate for businesses with very volatile revenues or seasonal variations.

4. Scenario-based forecasting

This method involves creating multiple cash flow projections based on different assumptions or scenarios, such as best-case, worst-case, and most-likely scenarios.

It helps businesses plan for uncertainty by showing how cash flow could change under various conditions.

Key features:

- Involves creating several cash flow scenarios based on different assumptions.

- Allows businesses to understand the range of possible outcomes based on key variables, like sales volume, payment delays, or expense increases.

Advantages:

- Helps businesses prepare for uncertainty by understanding potential worst-case and best-case scenarios.

- Provides insight into how different factors (like changes in sales or costs) can impact cash flow.

Disadvantages:

- Can be time-consuming to prepare multiple scenarios, especially if the assumptions are complex or numerous.

- The forecasts might be less precise since they involve assumptions about future events, which can be difficult to predict.

Example:

A company might create three cash flow forecasts:

- Best-case scenario: high sales and prompt customer payments result in a cash surplus.

- Worst-case scenario: delayed customer payments and higher-than-expected costs result in a cash shortfall.

- Most-likely scenario: a moderate increase in sales and timely payments leads to a manageable cash flow.

5. Adjusting for seasonality

For businesses with seasonal variations in cash flow (e.g., retail, agriculture, tourism), it is crucial to adjust forecasts for predictable peaks and troughs in sales and cash flow.

This method incorporates historical data and seasonal trends to forecast cash flow fluctuations.

Key features:

- Takes into account seasonal fluctuations and adjusts the forecast accordingly.

- Ideal for businesses with seasonal revenue patterns, such as holiday sales, harvest periods, or weather-dependent services.

Advantages:

- Provides a realistic view of cash flow during periods of high or low sales.

- Allows businesses to plan for periods of low cash flow and build reserves during higher sales periods.

Disadvantages:

- Requires historical data and deep understanding of the seasonal patterns specific to the business.

- Can be challenging to predict for businesses in industries that experience unpredictable demand or external shocks.

Advanced cash flow forecasting tools

There are several methods for cash flow forecasting that businesses can use depending on their size, complexity, and specific financial needs. Each method offers different levels of detail, accuracy, and effort required. Here are the most common methods:

1. Direct method

The direct method of cash flow forecasting involves estimating all the cash inflows and outflows that a business expects to receive or pay over a specific period. This method is straightforward and focuses on the actual cash transactions, giving an accurate representation of the business's liquidity.

Key features:

- Cash inflows: includes cash sales, customer payments, loan receipts, and any other sources of cash.

- Cash outflows: includes operating expenses, salaries, supplier payments, interest, taxes, and loan repayments.

- Timeframe: it typically forecasts on a weekly, monthly, or quarterly basis.

Advantages:

- High accuracy because it relies on actual transactions.

- Provides a clear view of cash availability for paying expenses.

Disadvantages:

- Requires a detailed and up-to-date record of all expected cash receipts and payments, which can be labor-intensive.

- Can be difficult to use for businesses with complex revenue streams or irregular cash flows.

2. Indirect method

The indirect method is commonly used for forecasting cash flow because it is based on adjusting the net income from the income statement by adding back non-cash items and changes in working capital. This method is often used in more formal financial reporting, including financial statements.

Key features:

- Starts with net income from the income statement.

- Adjusts for non-cash items (like depreciation) and changes in working capital (such as changes in accounts receivable, accounts payable, or inventory levels).

- Often used for long-term forecasting and budgeting.

Advantages:

- Less detailed than the direct method, making it easier for businesses with complex revenue and expense structures.

- Widely used in financial reporting, making it easier for businesses to adapt the method for other purposes like tax reporting or investor relations.

Disadvantages:

- Can be less accurate for short-term planning, since it is based on past figures (net income) and estimates of future changes in working capital.

- Does not provide as granular a view of actual cash inflows and outflows.

3. Rolling forecast

A rolling forecast is a dynamic forecasting method that is updated regularly (often monthly or quarterly) and typically projects cash flows for a set period ahead, such as 12 months. As each month or quarter ends, the forecast is updated to include a new month or quarter of data.

Key features:

- Continuously updated: As the period progresses, the forecast is adjusted to reflect the most current data.

- Suitable for businesses with fluctuating or uncertain cash flows.

- It is often used in strategic planning and long-term budgeting.

Advantages:

- Provides a flexible, up-to-date view of cash flow and allows businesses to respond quickly to changes in market conditions or business performance.

- Encourages more frequent adjustments to reflect reality and better predict cash shortages or surpluses.

Disadvantages:

- Requires continuous monitoring and frequent updates, which can be resource-intensive.

- Can be less accurate for businesses with very volatile revenues or seasonal variations.

Example:

A company may initially forecast cash flow for 12 months, but after six months, the forecast will be adjusted to cover the next 12 months, rolling forward with the updated actual results and projections.

4. Scenario-based forecasting

This method involves creating multiple cash flow projections based on different assumptions or scenarios, such as best-case, worst-case, and most-likely scenarios. It helps businesses plan for uncertainty by showing how cash flow could change under various conditions.

Key features:

- Involves creating several cash flow scenarios based on different assumptions.

- Allows businesses to understand the range of possible outcomes based on key variables, like sales volume, payment delays, or expense increases.

Advantages:

- Helps businesses prepare for uncertainty by understanding potential worst-case and best-case scenarios.

- Provides insight into how different factors (like changes in sales or costs) can impact cash flow.

Disadvantages:

- Can be time-consuming to prepare multiple scenarios, especially if the assumptions are complex or numerous.

- The forecasts might be less precise since they involve assumptions about future events, which can be difficult to predict.

Example:

A company might create three cash flow forecasts:

- Best-case scenario: high sales and prompt customer payments result in a cash surplus.

- Worst-case scenario: delayed customer payments and higher-than-expected costs result in a cash shortfall.

- Most-likely scenario: a moderate increase in sales and timely payments leads to a manageable cash flow.

5. Adjusting for seasonality

For businesses with seasonal variations in cash flow (e.g., retail, agriculture, tourism), it is crucial to adjust forecasts for predictable peaks and troughs in sales and cash flow. This method incorporates historical data and seasonal trends to forecast cash flow fluctuations.

Key Features:

- Takes into account seasonal fluctuations and adjusts the forecast accordingly.

- Ideal for businesses with seasonal revenue patterns, such as holiday sales, harvest periods, or weather-dependent services.

Advantages:

- Provides a realistic view of cash flow during periods of high or low sales.

- Allows businesses to plan for periods of low cash flow and build reserves during higher sales periods.

Disadvantages:

- Requires historical data and deep understanding of the seasonal patterns specific to the business.

- Can be challenging to predict for businesses in industries that experience unpredictable demand or external shocks.

Example:

A clothing retailer might predict that cash flow will be high in the months leading up to the holiday season, but they anticipate cash flow shortages in the early months of the year when sales are lower.

Adjusting the cash flow forecast to account for these seasonal patterns allows them to plan accordingly.

Advanced tools for cash flow forecasting

Specialized treasury software

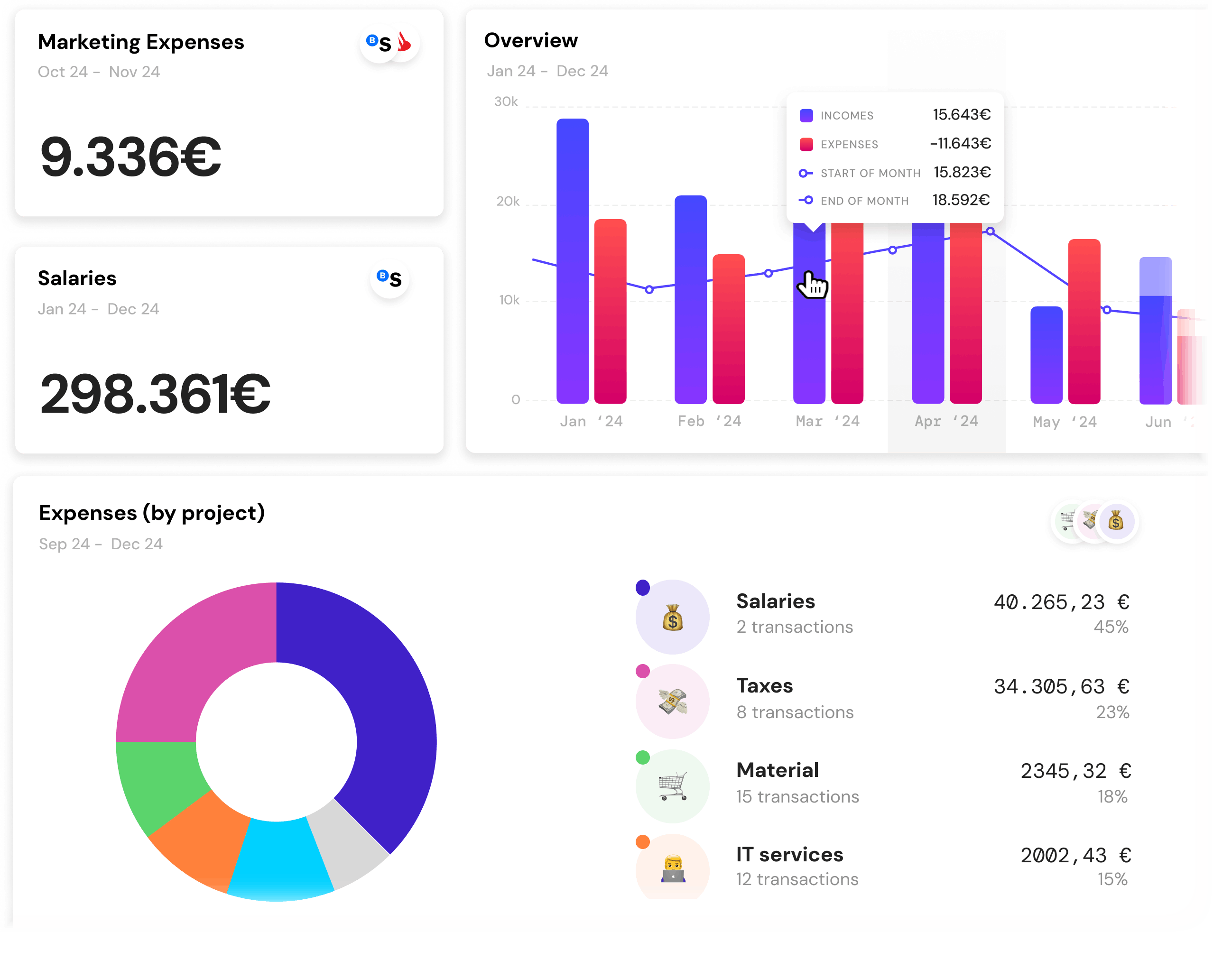

- Banktrack: centralizes and automates tracking of income and expenses, simplifying cash flow projections. Ideal for consolidating bank accounts and analyzing historical patterns.

- Kyriba: a robust solution for treasury management and liquidity planning, featuring scenario simulation tools.

- Tesorio: focused on cash flow forecasting using AI, analyzing historical data with clear visualizations.

Advanced spreadsheets

- Microsoft Excel / Google Sheets: offers advanced templates and customizable formulas for dynamic cash flow modeling. Can be enhanced with financial add-ins for deeper analysis.

- QuickBooks: provides automated forecasting tools based on accounting data, with options to create financial scenarios.

- Xero: suitable for small and medium businesses, offering real-time cash flow tracking tools.

Predictive analytics with Business Intelligence (BI) tools

- Power BI: integrates data from multiple sources to visualize cash flow trends and run simulations.

- Tableau: useful for generating interactive reports and predictive cash flow analysis.

ERP (Enterprise Resource Planning) software

- SAP S/4HANA: includes advanced modules for treasury management and financial planning.

- Oracle NetSuite: automates cash flow tracking and forecasts using historical data and trends.

Financial modeling-specific tools

- Adaptive Insights (Workday): provides detailed, customizable models for cash flow forecasting under various scenarios.

- Anaplan: a powerful platform for financial planning with real-time simulation capabilities.

AI-Powered analytics platforms

- Fathom: analyzes key metrics and generates AI-based cash flow projections.

Conclusion

Cash flow forecasting is not just a financial tool, it’s the foundation of successful and sustainable business management.

By knowing in advance when your company will have more money and when it could be tight, you can make smart decisions that help your business grow without compromising its stability.

It allows you to be proactive, not reactive, when facing financial challenges, and gives you the peace of mind of knowing you’re prepared for whatever comes next.

Share this post

Related Posts

Best 5 short-term cash forecasting methods

Discover effective short-term cash forecasting methods like receipts and disbursements, rolling forecasts, and scenario planning to optimize your business’s liquidity.Best 7 bank trackers in the Netherlands

This guide lists the top 7 tools to help you track expenses, monitor accounts, and improve your financial management. Find the perfect tracker to stay on top of your moneyBest 6 Practices for Managing Cash Effectively

Mastering cash management keeps your business on point, letting you tackle bills, increase growth chances, and handle surprises with ease!

Try it now with your data

- Your free account in 2 minutes

- No credit card needed