The 7 Best Fintonic Alternatives in Spain for 2025

These are the best Fintonic alternatives:

- Banktrack

- Revolut Business

- N26 Business

- Wise Business

- Contasimple

- Xero

- Expensify

Managing money has become increasingly digital. In Spain, Fintonic earned its reputation as one of the first apps to help individuals and small businesses connect their bank accounts, track spending, and receive financial recommendations. But while Fintonic remains well-known, it’s no longer the only option.

In 2025, new financial platforms have emerged that go beyond basic personal finance tracking.

Today’s alternatives provide real-time visibility, cash flow forecasting, e-invoicing compliance, and integrations with business tools, features that many freelancers, SMEs, and even individuals now expect.

This article explores the 7 best alternatives to Fintonic available in Spain, analyzing their strengths, ideal users, and the trends that are shaping financial management software this year.

The 7 Best Alternatives to Fintonic

1. Banktrack

The best Fintonic alternative for businesses and freelancers

Banktrack goes far beyond expense tracking. It is designed for SMEs, freelancers, and professionals who need real-time financial control, predictive cash flow tools, and compliance with Spanish and European regulations.

Key features:

- Connects with more than 120 banks in Spain and across Europe.

- Real-time updates and multi-account consolidation.

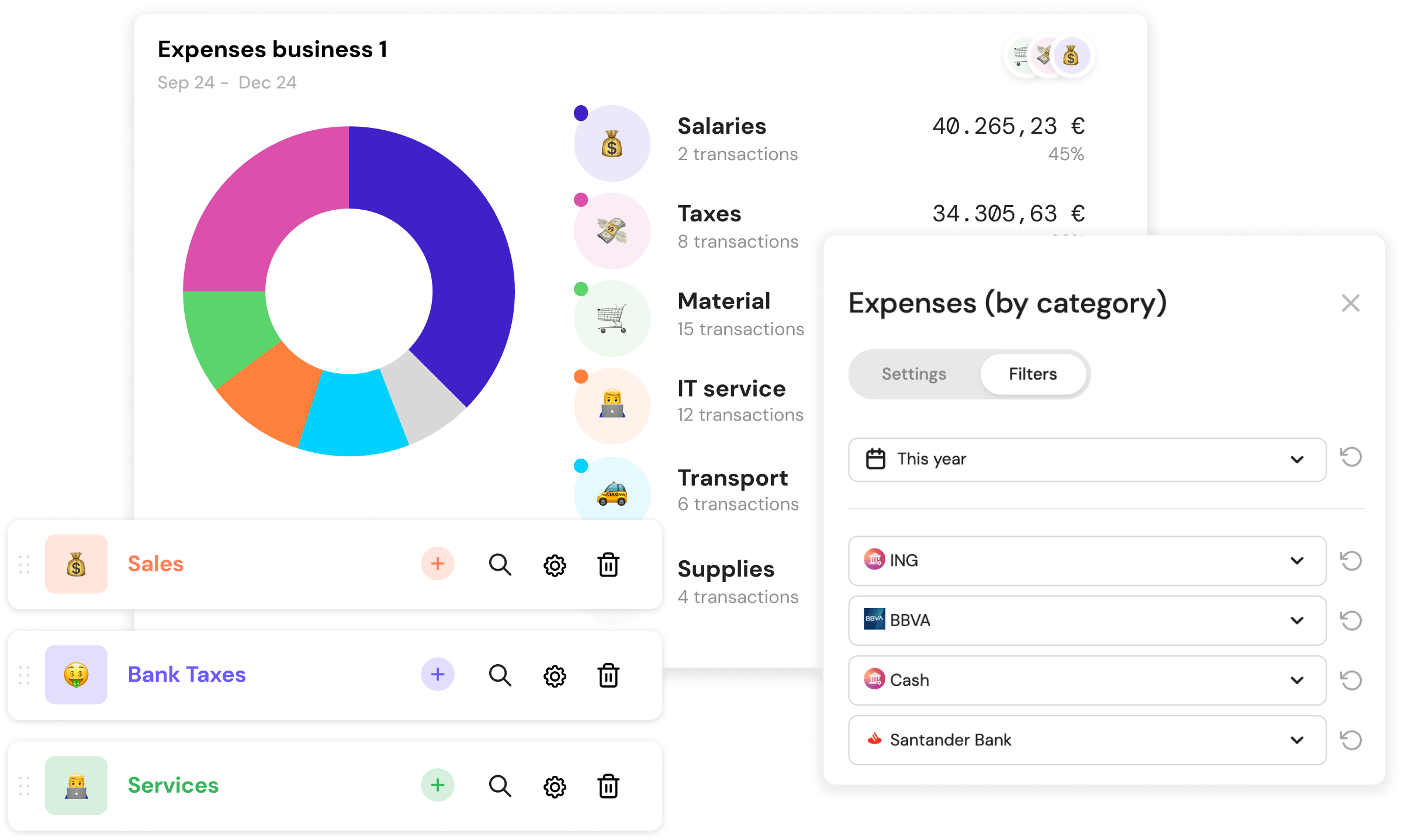

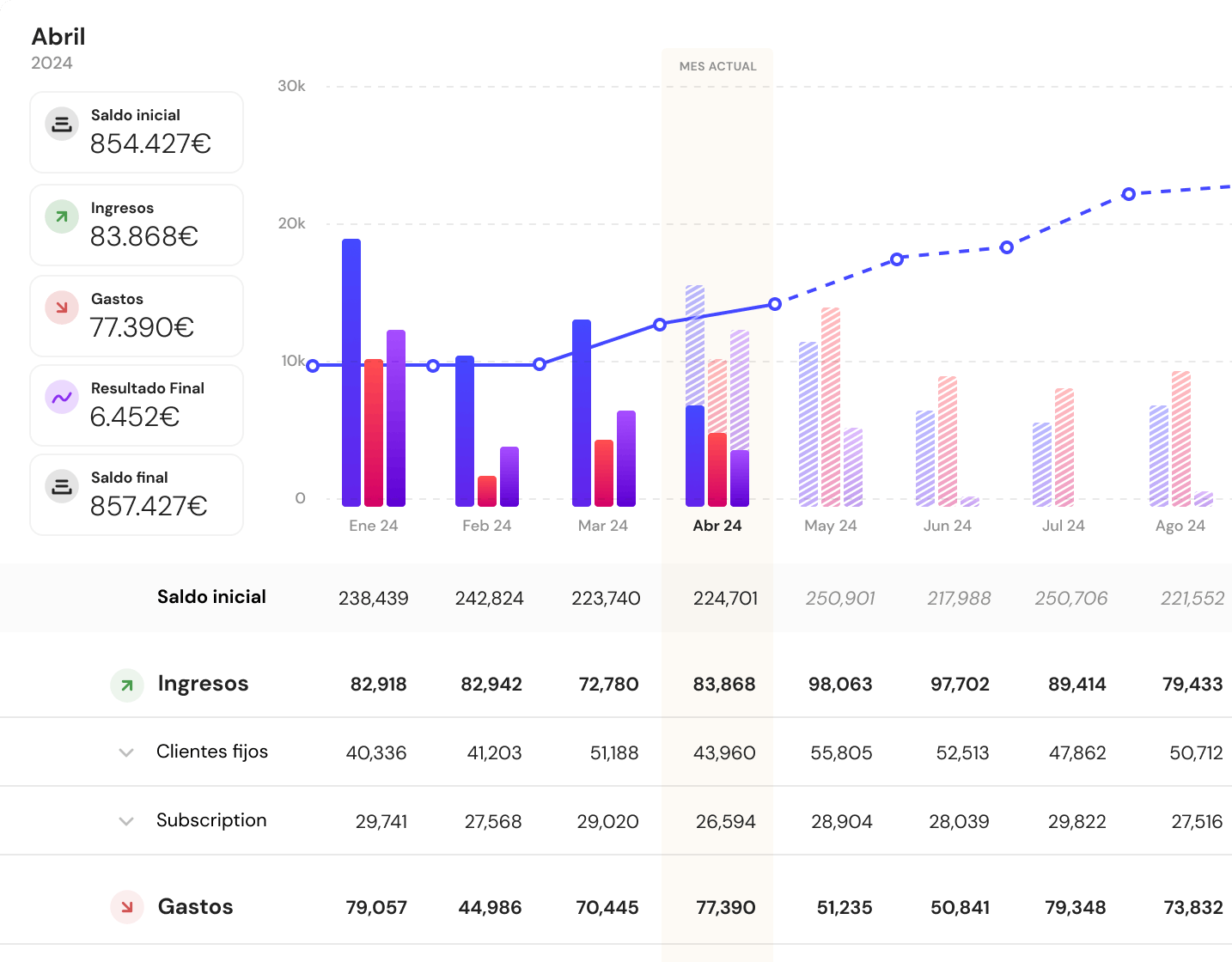

- Automatic categorization of income and expenses (by project, department, or client).

- Scenario-based cash flow forecasting to prepare for risks or investments.

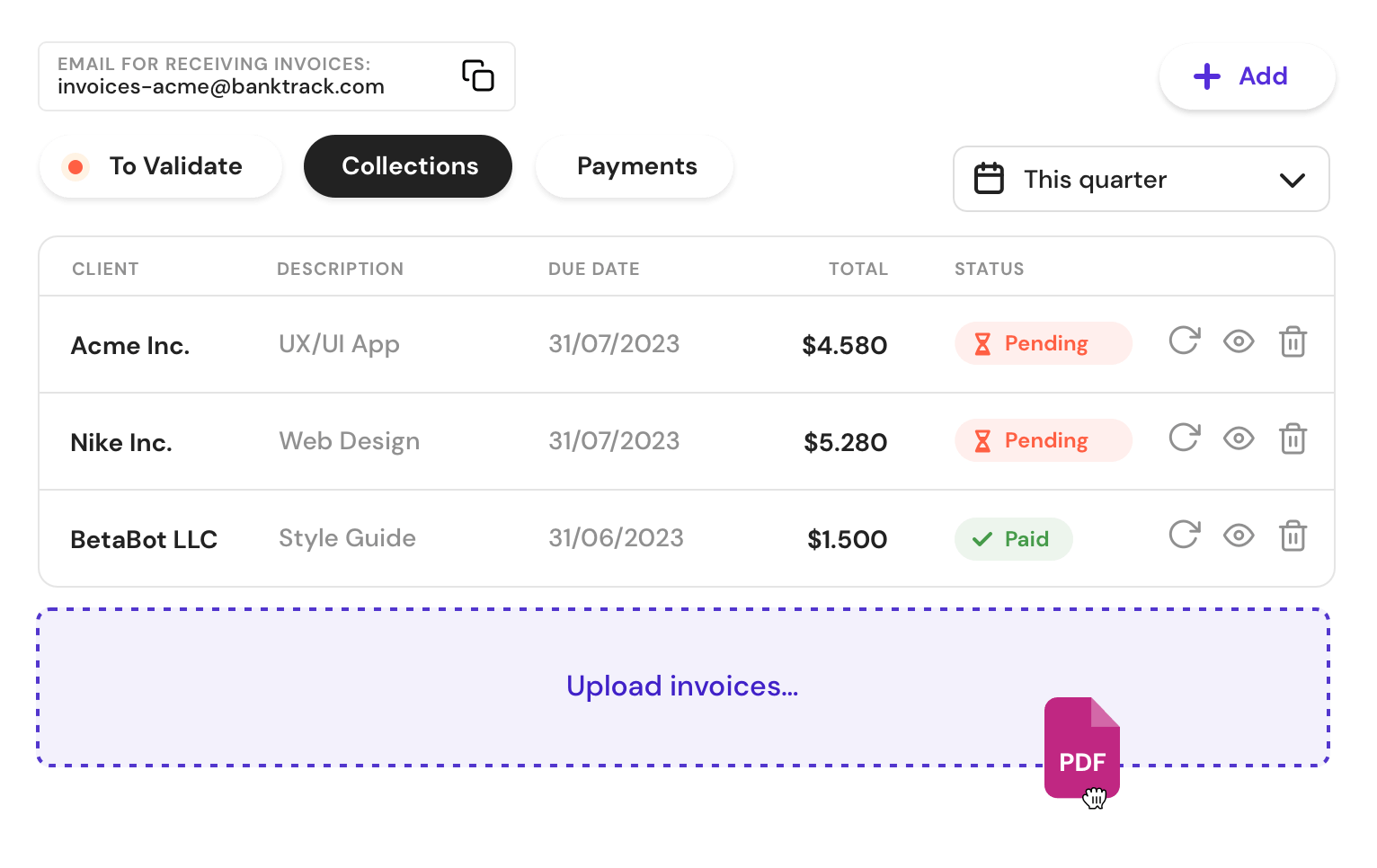

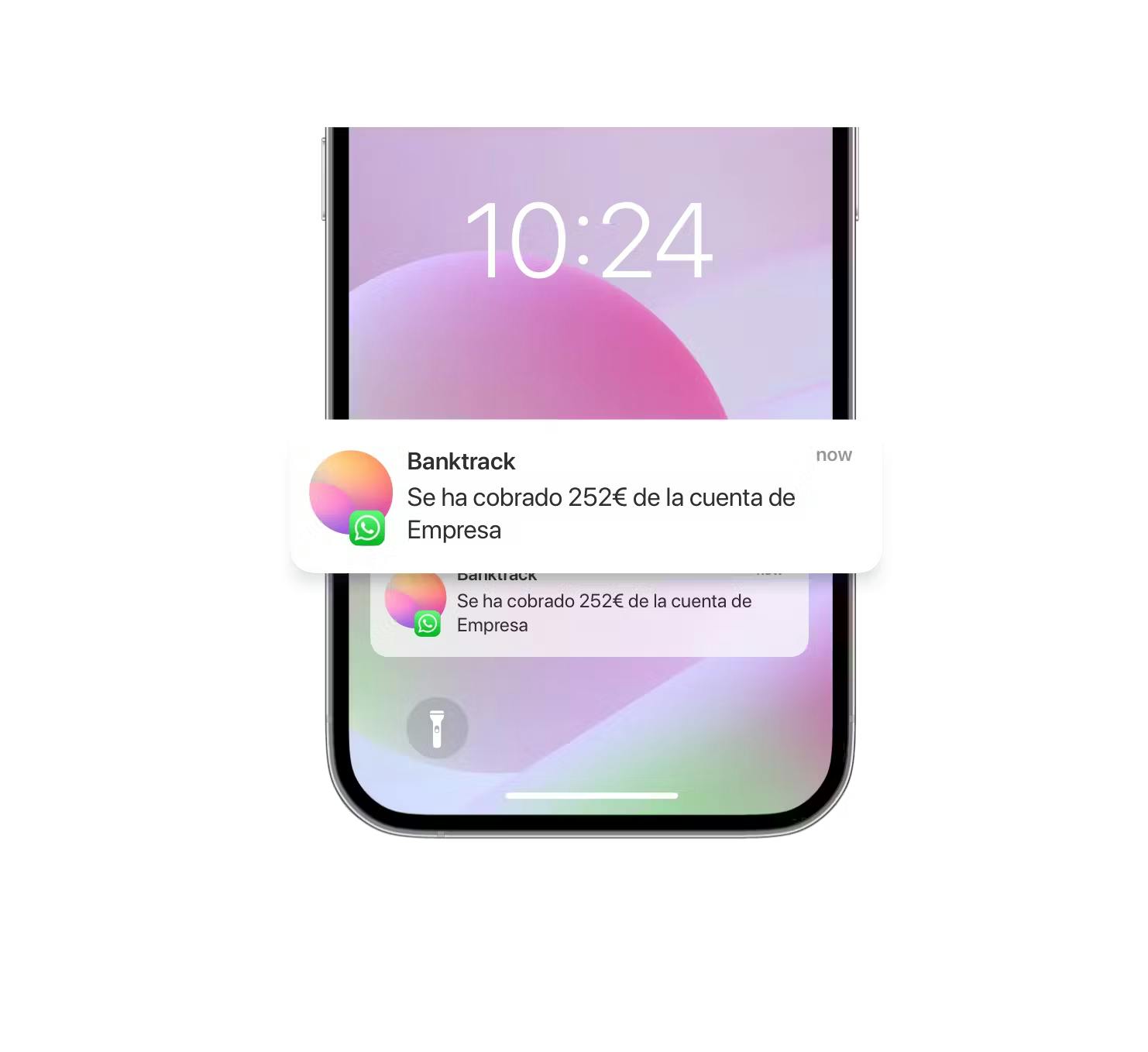

- Invoice reconciliation through email, WhatsApp, or drag-and-drop.

- Alerts for duplicate charges, low balances, or unusual transactions.

- E-invoicing compliance with Spanish regulations.

- Exportable dashboards for accountants, managers, or investors.

Best for: Freelancers, SMEs, and agencies that want to move beyond personal finance tracking and adopt a tool that gives professional-level control and forecasting.

2. Revolut Business

Best for international freelancers and startups

Revolut began as a consumer-focused app but has expanded into business banking. It offers multi-currency accounts, debit cards, and financial dashboards that compete with Fintonic in terms of usability while adding global reach.

Key features:

- Multi-currency accounts with real exchange rates.

- Expense tracking per card or user.

- Team management and spending limits.

- Integrations with accounting software.

Best for: Startups and freelancers who work internationally.

3. N26 Business

Best mobile-first bank alternative

N26 provides mobile banking with integrated expense management, making it a strong alternative to Fintonic for freelancers who want both a bank account and financial tracking in one place.

Key features:

- Free or premium business accounts.

- Automatic expense categorization.

- Real-time notifications for transactions.

- Easy card management.

Best for: Freelancers and small businesses that value simplicity and mobile-first banking.

4. Wise Business

Best for cross-border payments

Formerly TransferWise, Wise Business is ideal for companies and freelancers that operate internationally. It combines multi-currency wallets with expense tracking and transparent fees.

Key features:

- Multi-currency accounts with local bank details in multiple countries.

- Low-cost international transfers.

- Expense tracking and reports.

- API for integrations.

Best for: Businesses with international clients and suppliers.

5. Contasimple

Best compliance-focused alternative

Contasimple is designed for Spanish freelancers and SMEs who need help not only with expense tracking but also with taxes and compliance.

Key features:

- Automatic categorization of expenses.

- Preparation of Spanish tax forms (IVA, IRPF).

- Bookkeeping aligned with Spanish regulations.

- Invoicing and reporting tools.

Best for: Professionals and small businesses that prioritize legal compliance.

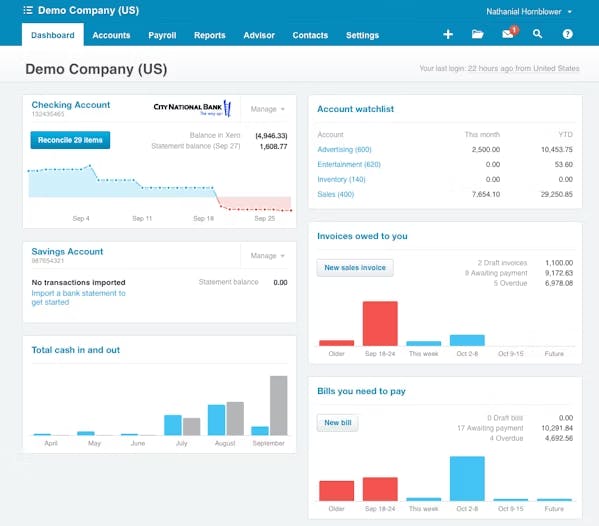

6. Xero

Best for SMEs with growth ambitions

Xero is a global accounting platform that combines real-time dashboards, expense tracking, invoicing, and multi-currency support. It is more advanced than Fintonic and suitable for scaling businesses.

Key features:

- Invoicing and billing.

- Expense and income tracking.

- Multi-currency support.

- Integration with 800+ apps.

Best for: SMEs and startups looking for a global, growth-oriented platform.

7. Expensify

Best for team expense tracking

Expensify specializes in tracking expenses at the employee level. For businesses that need to monitor spending across a team, something Fintonic doesn’t offer, Expensify is a strong fit.

Key features:

- Receipt scanning and automatic categorization.

- Expense approvals and reimbursements.

- Corporate card management.

- Integration with accounting systems.

Best for: SMEs with multiple employees or departments managing their own budgets.

Why Look for Fintonic Alternatives?

Although Fintonic remains simple and user-friendly, there are reasons why many people and businesses seek alternatives:

- Limited forecasting capabilities – It tracks what has happened, but it doesn’t anticipate what will happen.

- Focus on personal finance – While good for individuals, its features may not fully cover freelancers or SMEs.

- Basic reporting – Advanced dashboards, exportable reports, or team collaboration are missing.

- Regulatory needs – New Spanish e-invoicing and compliance laws require certified systems that go beyond Fintonic’s scope.

- Scalability – As users grow, they often need more powerful financial tools that handle multiple accounts, clients, or projects.

Business Challenges Without the Right Software

Freelancers and SMEs in Spain who still rely on spreadsheets or outdated tools face challenges that apps like Fintonic or its alternatives solve:

- No real-time visibility: It’s impossible to make confident decisions without knowing your exact financial position.

- High error risk: Manual data entry increases mistakes in expenses or invoices.

- Time wasted on admin: Hours spent reconciling accounts could be used for growth.

- Poor scalability: As businesses grow, managing multiple clients and projects becomes chaotic.

Modern financial tools eliminate these bottlenecks, making financial management proactive instead of reactive.

6 Trends in Financial Management Software

- Smart automation – Apps now detect duplicate transactions, highlight anomalies, and prepare compliance-ready reports automatically.

- Real-time banking integration – With PSD2 and Open Banking, financial apps sync instantly with bank accounts.

- E-invoicing compliance – New Spanish regulations require digital invoices that are secure, traceable, and audit-ready.

- Scenario forecasting – Users expect tools to simulate future cash flow, not just track past expenses.

- Modular SaaS – Businesses want scalable subscriptions that start small and expand with growth.

- Data security – End-to-end encryption and GDPR compliance are now baseline requirements.

7 Benefits of Moving Beyond Fintonic

Adopting a modern alternative to Fintonic provides:

- Time savings – Automating expense categorization, invoicing, and reporting.

- Better financial control financial control – Real-time dashboards showing where money is going.

- Regulatory compliance – Built-in Spanish tax form generation and e-invoicing.

- Improved decision-making – Scenario forecasts replacing guesswork with strategy.

- Scalability – Tools that grow alongside freelancers, startups, and SMEs.

- Stronger collaboration – Multi-user access allows teams to work together without silos.

- Competitive advantage – Faster decisions, greater transparency, and professionalized financial management.

Conclusion

Fintonic helped many people in Spain take their first step into digital finance. But in 2025, the needs of freelancers, startups, and SMEs go beyond simple expense tracking. Businesses now require real-time data, cash flow forecasting, compliance features, and scalability.

The alternatives available today offer exactly that. Whether it’s a professional-grade treasury tool, an international platform with multi-currency accounts, or a compliance-focused system built for Spain’s tax regulations, the options are diverse and powerful.

The real priority is not choosing the most popular name, but adopting the system that best matches your goals, whether that’s simplicity, growth, compliance, or forecasting. With the right platform in place, financial management becomes less of a burden and more of a strategic advantage.

Share this post

Related Posts

Top 7 bank trackers in Austria to manage your finances

Explore the top 7 bank tracker apps in Austria for 2024. Easily manage budgets, track expenses, and gain control over your finances with these essential tools.Top 9 bank trackers in France in 2024

Explore the top bank trackers in France to simplify your finances. These apps help you monitor spending and set budgets.

Try it now with your data

- Your free account in 2 minutes

- No credit card needed