A guide to intercompany transactions in 2025

- What Are Intercompany Transactions?

- 3 Types of intercompany transactions

- 1. Downstream transactions:

- 2. Upstream transactions:

- 3. Lateral transactions:

- Accounting for intercompany transactions

- 6 Benefits of recording intercompany transactions

- 1. Transparency:

- 2. Accurate financial reporting:

- 3. Regulatory compliance:

- 4. Efficient resource allocation:

- 5. Improved internal controls:

- 6. Streamlined financial processes:

- Handling complex intercompany transactions

- Best practices for managing intercompany transactions

- 4 Challenges in managing intercompany transactions

- Regulatory Considerations

- 3 Steps to implement technology in intercompany transactions

- How can Banktrack help you

Intercompany transactions are financial dealings that occur between related entities within a corporate group.

These transactions, which include the movement of funds and resources, play a crucial role in the financial management and operational efficiency of conglomerates.

Let’s dive into what intercompany transactions are, their types, benefits, and how they are handled in accounting.

What Are Intercompany Transactions?

Intercompany transactions refer to financial activities between different entities within the same corporate group.

These can be between a parent company and its subsidiaries, or between subsidiaries themselves.

These transactions must be meticulously recorded and reported to maintain transparency and accuracy in financial statements.

3 Types of intercompany transactions

1. Downstream transactions:

These transactions involve the parent company providing funds or resources to its subsidiaries.

Some examples are the following situations:

- Intercompany Loans: The parent company lends money to a subsidiary, often at favorable interest rates. This can help the subsidiary manage its cash flow needs or finance new projects.

- Asset Transfers: The parent company transfers assets, such as equipment or technology, to the subsidiary to support its operations or expansion.

- Cost Sharing: The parent company allocates costs for shared services (like IT or HR) to the subsidiary, distributing the expense burden proportionally.

2. Upstream transactions:

In these transactions, funds or resources move from a subsidiary to the parent company.

Some examples are:

- Dividends: Subsidiaries pay dividends to the parent company as a return on investment, providing the parent with income and potentially funding for other investments.

- Management Fees: Subsidiaries pay fees to the parent company for administrative, managerial, or strategic services provided, ensuring that the parent is compensated for its support.

- Royalty Payments: Subsidiaries make payments to the parent company for the use of intellectual property, such as patents, trademarks, or proprietary technology.

3. Lateral transactions:

These transactions occur between two subsidiaries within the same corporate group.

Some examples are the following:

- Goods and Services: One subsidiary sells products or services to another, which can streamline supply chains and improve efficiency. For instance, a manufacturing subsidiary might supply products to a sales subsidiary.

- Shared Services: Subsidiaries share services like logistics, IT, or research and development, optimizing resource utilization and reducing redundancy.

- Cross-Border Transactions: Subsidiaries in different countries engage in trade, helping to leverage global market opportunities and diversify risks.

Accounting for intercompany transactions

To ensure accurate financial reporting, intercompany transactions must be recorded separately from external transactions.

This prevents double counting and provides a clear view of the group’s financial position.

Here’s how these transactions are typically handled:

- Recording: each entity records its part of the transaction.

- Consolidation: the parent company consolidates these records to create a comprehensive financial statement.

- Elimination: to avoid overstating assets and liabilities, intercompany transactions are eliminated during the consolidation process.

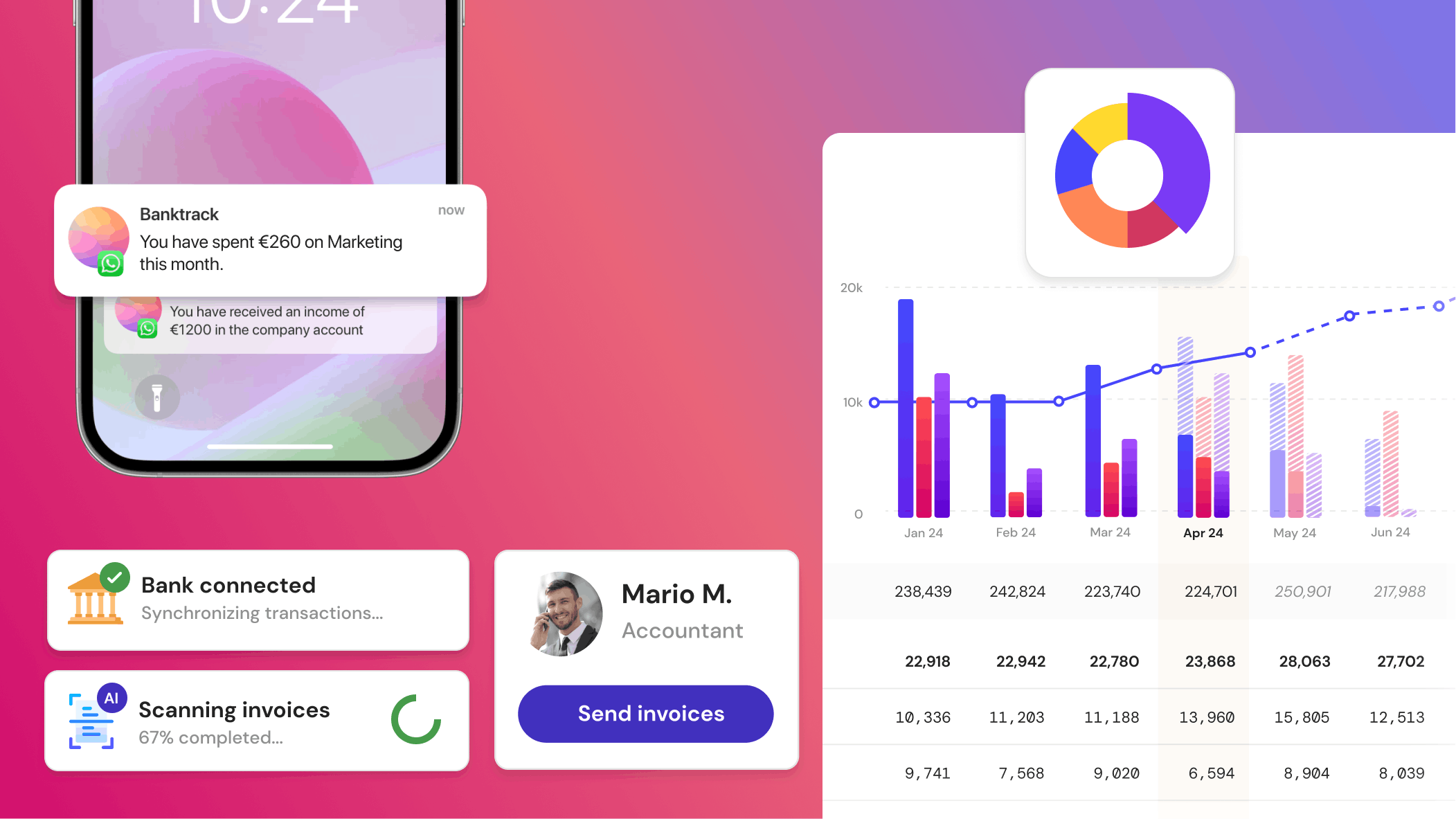

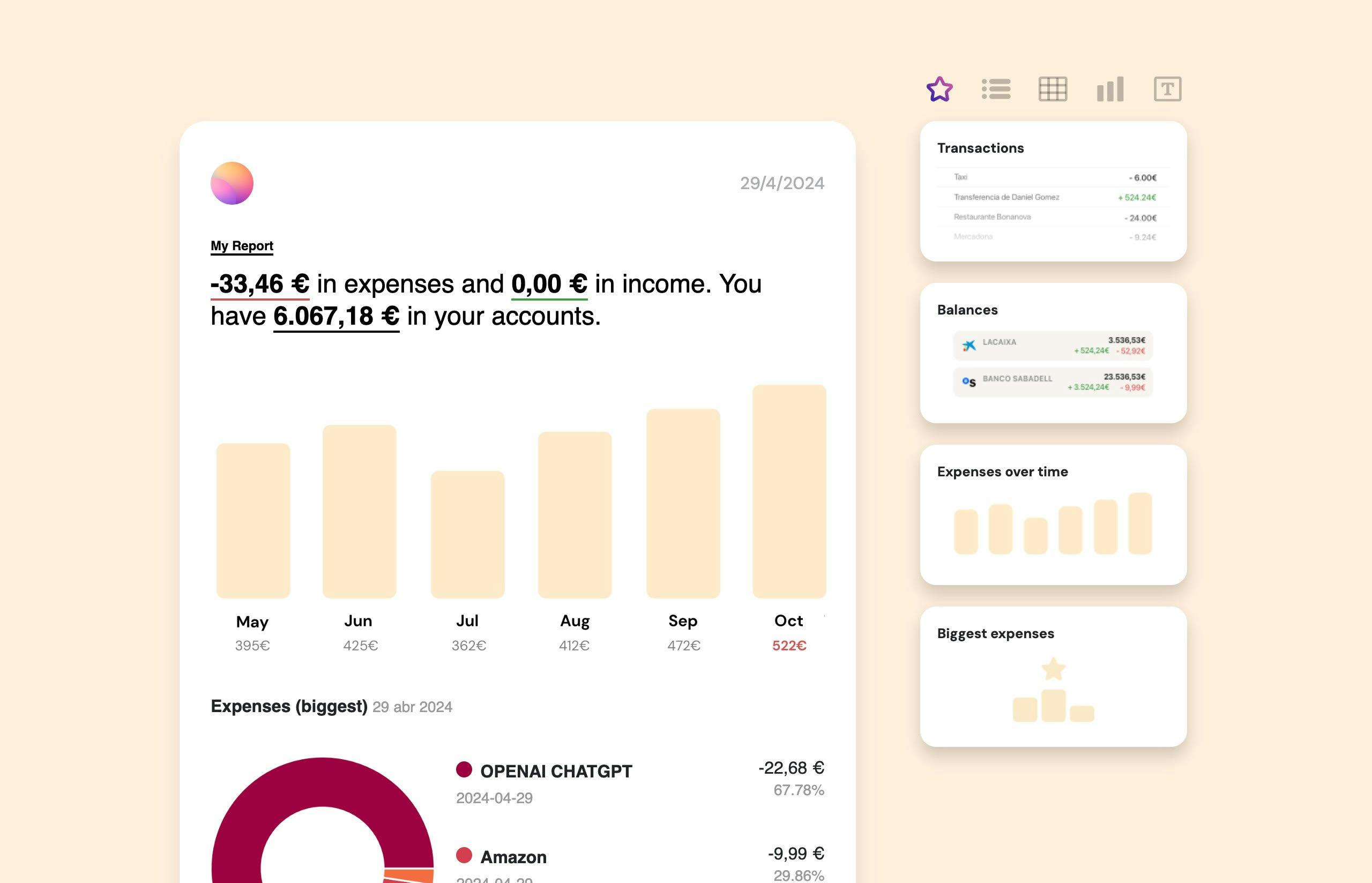

Do you want to forget about the accounting nightmares and have all your financial information in one place? Try out a dedicated cloud cash management software.

These are the key features:

- Personalized dashboards

- Integration with multiple bank accounts and products

- Customizable spending metrics

- Automated alerts and reports

- Affordable pricing starting at €16.58 per month

6 Benefits of recording intercompany transactions

1. Transparency:

Clear financial picture: properly recording intercompany transactions provides a transparent view of financial flows within the corporate group. This helps stakeholders understand how resources are allocated and used among different entities.

Enhanced trust: transparency in intercompany dealings builds trust among investors, regulators, and other stakeholders, as it demonstrates that the company is managing its internal finances responsibly and ethically.

2. Accurate financial reporting:

True economic activity: recording intercompany transactions accurately ensures that the consolidated financial statements of the corporate group reflect its true economic activities. This means that revenues, expenses, assets, and liabilities are reported without double counting or omission.

Informed decision-making: accurate financial reporting provides management with reliable data to make informed decisions regarding resource allocation, budgeting, and strategic planning.

3. Regulatory compliance:

Meeting legal requirements: different jurisdictions have specific laws and regulations regarding intercompany transactions, especially concerning transfer pricing and tax reporting. Proper recording helps ensure compliance with these legal requirements, reducing the risk of legal penalties and fines.

Tax efficiency: by accurately recording and reporting intercompany transactions, companies can optimize their tax strategies, taking advantage of legal tax benefits and avoiding unnecessary tax liabilities.

4. Efficient resource allocation:

Cost management: by tracking intercompany transactions, companies can better manage costs and allocate resources efficiently across the corporate group. This helps in identifying cost-saving opportunities and reducing unnecessary expenses.

Performance monitoring: recording intercompany transactions enables the parent company to monitor the performance of its subsidiaries more effectively. It can identify which subsidiaries are performing well and which need additional support or restructuring.

5. Improved internal controls:

Risk management: Proper recording of intercompany transactions enhances internal controls, helping to identify and mitigate risks related to financial misstatements, fraud, and inefficiencies.

Audit readiness: Detailed records of intercompany transactions make it easier to prepare for internal and external audits. This ensures that the company can provide auditors with the necessary documentation and explanations, facilitating a smoother audit process.

6. Streamlined financial processes:

Consolidation efficiency: Accurate recording simplifies the consolidation process of financial statements. It ensures that intercompany eliminations are handled correctly, saving time and reducing the risk of errors during consolidation.

Automation potential: With proper recording systems in place, companies can automate many aspects of intercompany transactions, such as invoicing, reconciliation, and reporting. This increases efficiency and reduces the administrative burden on accounting teams.

Handling complex intercompany transactions

Managing intercompany transactions becomes more complex when dealing with multiple subsidiaries across different countries.

Each country may have unique tax laws and regulations, requiring careful compliance to avoid legal issues and ensure accurate tax reporting.

Best practices for managing intercompany transactions

- Centralized management: implement a centralized system for managing and recording all intercompany transactions.

- Regular audits: conduct regular audits to ensure accuracy and compliance with all regulations.

- Clear policies: establish clear policies and procedures for recording and reporting intercompany transactions.

- Training: ensure that accounting staff are well-trained and understand the complexities of intercompany transactions.

4 Challenges in managing intercompany transactions

Despite their benefits, managing intercompany transactions comes with challenges:

- Currency fluctuations: dealing with transactions in different currencies can lead to exchange rate gains or losses. Companies must implement strategies to mitigate currency risk.

- Tax implications: different tax jurisdictions have varying regulations. Ensuring compliance with these regulations can be complex and time-consuming.

- Transfer pricing: setting fair prices for transactions between subsidiaries is crucial to avoid regulatory scrutiny and potential fines. Companies need to document and justify their transfer pricing policies.

- Data consistency: maintaining consistent data across different entities can be challenging, especially with decentralized systems. Implementing robust data management practices is essential for accuracy.

Regulatory Considerations

Intercompany transactions must comply with various regulations:

- GAAP/IFRS compliance: financial reporting standards like GAAP (Generally Accepted Accounting Principles) and IFRS (International Financial Reporting Standards) require transparent and accurate reporting of intercompany transactions.

- Tax regulations: adhering to tax laws in different jurisdictions is crucial. This includes transfer pricing rules, withholding taxes, and VAT regulations.

- Internal controls: establishing strong internal controls ensures that intercompany transactions are authorized, recorded, and reported accurately.

3 Steps to implement technology in intercompany transactions

Leveraging technology can streamline the management of intercompany transactions:

- ERP systems: Enterprise Resource Planning (ERP) systems integrate and automate financial processes, providing a centralized platform for managing intercompany transactions.

- Intercompany hubs: specialized software solutions can act as hubs for intercompany transactions, ensuring consistency and compliance.

- Blockchain: emerging technologies like blockchain can provide transparent and immutable records of intercompany transactions, enhancing trust and reducing reconciliation efforts.

How can Banktrack help you

- Visualize your finances in real time: get a clear picture of your financial status at any moment. Make informed decisions based on up-to-date data.

- Keep all your financial information in one place: centralize your financial data for easy access and management. Avoid the hassle of juggling multiple tools and documents.

- Automate calculations and save time: let Banktrack handle complex calculations automatically. Focus on strategic tasks while saving time on routine financial management.

- Make projections to better manage your business: use financial projections to plan for the future. Anticipate needs and allocate resources more effectively.

- Stay on top of expenses, incomes and more: monitor your cash flow and financial activities closely. Ensure you are always aware of your financial situation.

Share this post

Related Posts

Best 7 Cash Flow Management Tools in Finland for 2025

These are the best cash flow management tools in Finland: Banktrack Procountor Netvisor Visma eAccounting Fennoa Float QuickBooks Online In Finland’s competitive business environment, from Helsinki’sThe 8 best alternatives to Spendee in 2025

Looking for a fresh way to manage your budget? Check out these top Spendee alternatives to help you track spending, set goals, control your finances.Top 7 Best Treasury Management Software

What is the best treasury management software? Managing corporate finances involves many tasks, including cash flow management, risk assessment, and financial planning.

Try it now with your data

- Your free account in 2 minutes

- No credit card needed