The 11 Best Cloud Cash Management Software

- Top 11 Cloud Management Softwares:

- 1. Banktrack

- 2. QuickBooks sash management

- 3. Xero Cashbook

- 4. Wave Financial

- 5. Sage Intacct

- 6. NetSuite

- 7. FreshBooks

- 8. Zoho Books

- 9. Kashoo

- 10. Pleo

- 11. Expensify

- 6 Signs indicating the need for cloud cash management software

- 1. Inefficient cash flow management

- 2. Manual data entry errors

- 3. Lack of real-time visibility

- 4. Limited scalability

- 5. High compliance risks

- 6. Difficulty in financial analysis

- Conclusion

- Frequently asked questions - FAQs

- 1. What is cloud cash management software?

- 2. How does cloud cash management software differ from traditional methods?

- 3. Can cloud cash management software integrate with other business tools?

- 4. Is cloud cash management software suitable for small businesses?

- 5. How can I choose the right cloud cash management software for my business?

The best cloud management softwares:

- Banktrack

- Quickbooks Cash Management

- Xero Cashbook

- Wave Financial

- Sage Intacct

- NetSuite Cash Management

- Freshbooks

- Zoho Books

- Kashoo

- Pleo

- Expensify

A cloud cash management software revolutionizes how businesses handle their finances by providing real-time insights, automation, and accessibility from anywhere with an internet connection.

But not every tool can do the work.

We have gathered the best tools this 2025 has to offer and its comprehensive features designed to optimize cash flow, minimize risks, and enhance financial decision-making processes for you to find your perfect fit.

Top 11 Cloud Management Softwares:

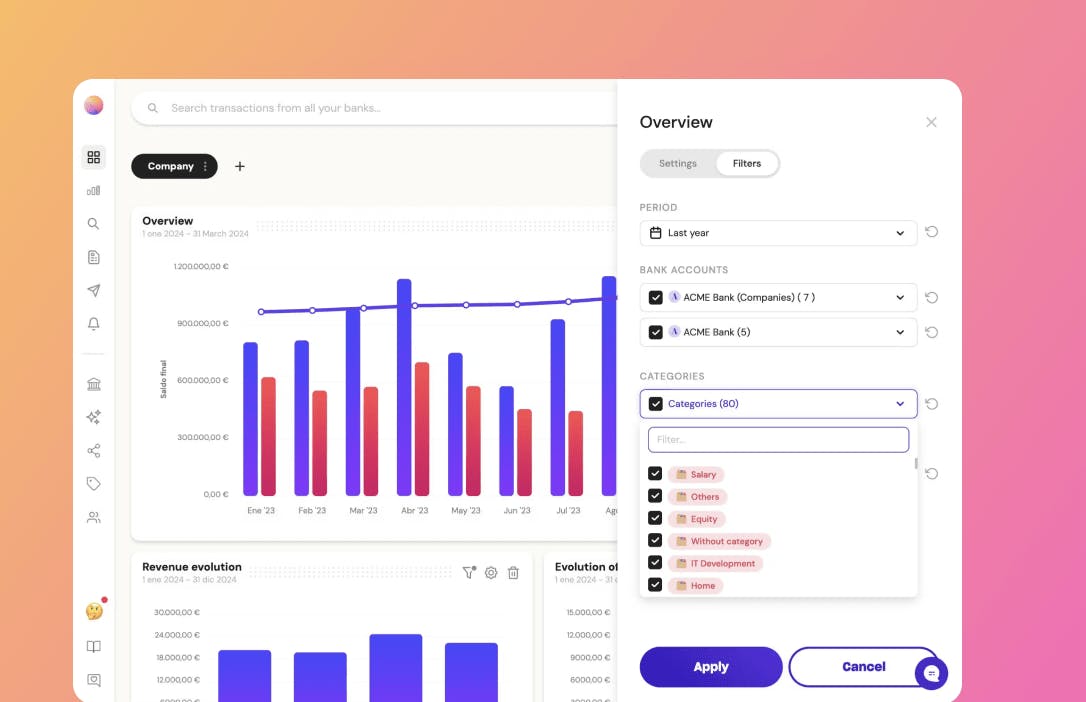

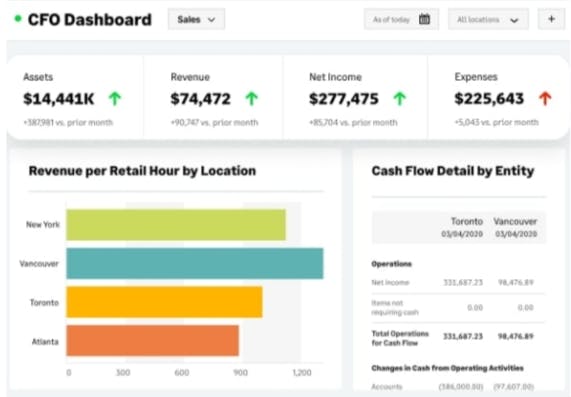

1. Banktrack

Banktrack is the best cloud cash management software available in 2025.

It is truly amazing how well this solution can adjust to your needs for categorization. Want to know how?

You can arrange your income and expenses by creating and customizing an infinite number of categories using sophisticated rules.

And, because of this flexibility, you can monitor your finances closely and know exactly where your money is going.

Additionally, Banktrack provides customized reports and alerts. You can choose to generate personalized reports and get notifications regarding your spending via email, Slack, Telegram, WhatsApp, and SMS.

You have the ability to create alerts for any important aspect for you, such as low balances or duplicate charges. With the aid of this feature, you can always stay in control of your money and make wise decisions.

Personalized reports and alerts enable businesses to stay in constant financial control and make well-informed decisions.

And if you want a more visual scheme of all of Banktrack’s features… here you are.

Key features:

- Personalized dashboards: customizable views providing real-time financial insights, allowing businesses to track their expenses, income, and overall cash flow from one place.

- Integration with multiple bank accounts and products: seamlessly connect and synchronize with various bank accounts and financial products to get a holistic view of all financial activities.

- Customizable spending metrics: tailor financial metrics to track specific expenses and optimize cash flow management, making it easier to monitor where money is being spent and identify savings opportunities.

- Invoice reconciliation: automatically scan and reconcile invoices with bank transactions using OCR technology, streamlining the reconciliation process and ensuring financial accuracy.

- Cash flow forecasting: leverage financial data to predict future cash inflows and outflows, helping businesses plan ahead, anticipate cash shortages, and optimize their treasury management.

- Automated alerts and reports: stay informed with real-time notifications and custom reports about overdue invoices, upcoming payments, or any discrepancies, ensuring you never miss a financial deadline.

- Affordable pricing starting at €39 per month

2. QuickBooks sash management

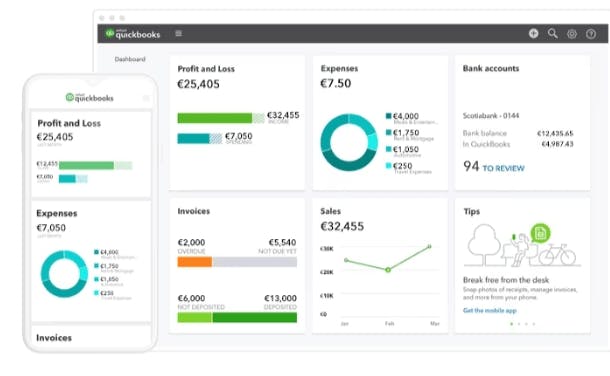

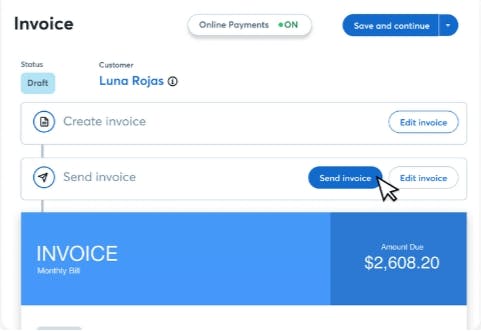

QuickBooks is a widely-used accounting software that offers a comprehensive set of tools for small businesses to manage their cash flow efficiently.

If you want to know more about cash management software alternatives for small businesses check out this article!

Anyway, Quickbooks enables users to do the following:

- Create and send invoices

- Track payments

- Reconcile bank transactions

- Monitor expenses in real-time

With features like customizable financial reports and integrations with various banking institutions, QuickBooks simplifies cash management tasks quite significantly.

3. Xero Cashbook

Xero Cashbook is another popular cloud-based accounting software known for its user-friendly interface and powerful features.

But how does it really help improve companies?

Xero Cashbook is designed to help businesses like "GreenTech Solutions" streamline their cash management processes.

It allows users to do the following things:

- Track income and expenses

- Reconcile bank accounts

- Manage invoices and bills

- Generate insightful financial reports

Xero's mobile app also enables users to manage their finances on the go, making it a convenient choice for busy entrepreneurs.

4. Wave Financial

Wave Financial is a free accounting and invoicing software that caters to small businesses and freelancers

Wave offers features such as:

- Customizable invoicing

- Receipt scanning

- Expense tracking

- Seamless integration with bank accounts

Additionally, Wave provides tools for payroll management, making it a complete solution for businesses looking to streamline their financial operations without breaking the bank.

5. Sage Intacct

Sage Intacct is a cloud-based financial management software trusted by mid-sized businesses.

It provides real-time visibility into financial data, allowing businesses to make informed decisions.

Sage Intacct's cash management module offers features such as:

- Cash forecasting

- Bank reconciliation

- Treasury management

It also integrates with other business systems, including CRM and ERP software, to streamline processes across the organization.

6. NetSuite

NetSuite is an enterprise-level cloud ERP system that includes strong cash management capabilities to optimize their cash flow and treasury operations.

NetSuite's cash management module provides tools for:

- Cash forecasting

- Bank reconciliation

- Liquidity management

- Risk mitigation

With real-time insights and automated workflows, NetSuite helps businesses like ABC Retail Group efficiently manage their financial resources.

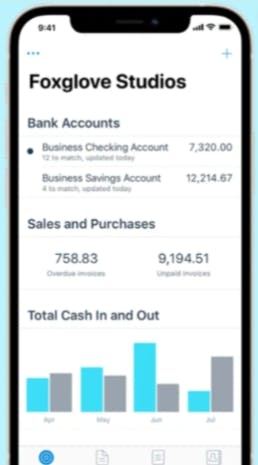

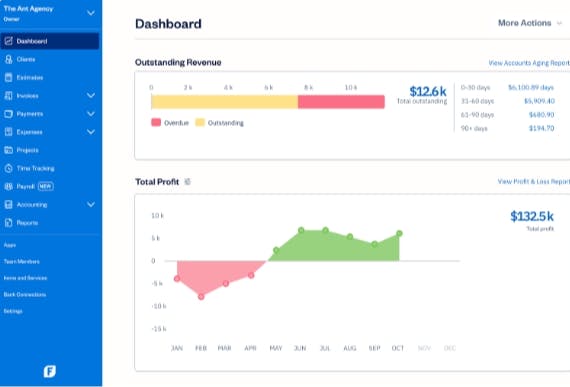

7. FreshBooks

FreshBooks is a cloud-based cash management software designed for small businesses and self-employed professionals.

You can use FreshBooks to do the following tasks:

- Track expenses

- Send invoices

- Manage cash flow effortlessly

FreshBooks offers features such as time tracking, project management, and client collaboration tools in addition to basic accounting functionalities.

Its intuitive interface and mobile app make it easy for users to stay organized and focused on growing their business.

8. Zoho Books

Zoho Books is a cloud cash management software that caters to small businesses and freelancers.

This solutions offers features such as:

- Invoicing

- Expense tracking

- Bank reconciliation

- Financial reporting

It also integrates with other Zoho applications and third-party services.

Tip: Try looking for apps for personal spending if you find yourself in need of a more individualized solution and not so much on an enterprise level.

9. Kashoo

Kashoo is a simple yet powerful cash management software designed for small businesses who want to manage their cash flow, track expenses, and generate financial reports on the go.

Kashoo offers features such as:

- Linking all bank accounts

- Invoicing

- Expense tracking

- Tax preparation tools

Its user-friendly interface and affordable pricing make it an ideal choice for small businesses looking for a straightforward accounting solution.

10. Pleo

Pleo is a corporate spending platform that helps businesses manage company expenses more efficiently by:

- Tracking company spending in real-time

- Streamlining reimbursements

Pleo provides virtual and physical cards for employees, along with a mobile app for capturing receipts and categorizing expenses.

Businesses can even enforce spending policies, gain insights into their spending patterns, and reduce administrative overhead associated with expense management.

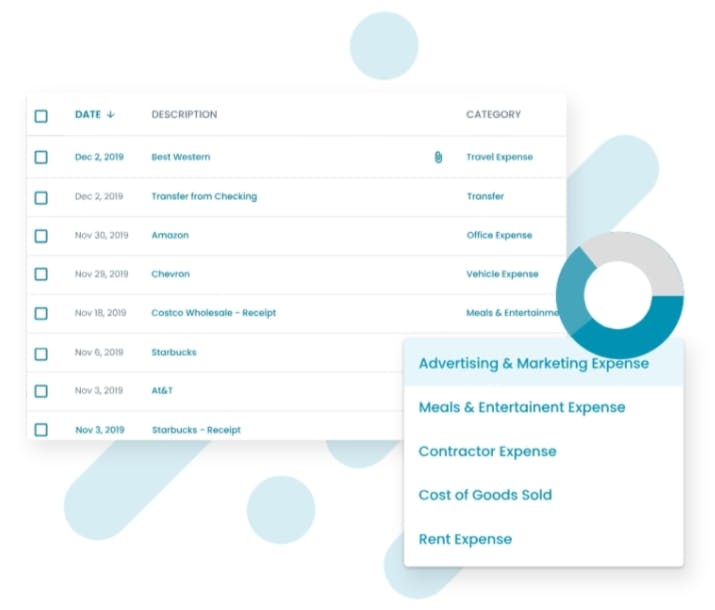

11. Expensify

Expensify is an expense management software solution used by businesses to simplify the expense reporting process.

Expensify allows users to:

- Capture receipts

- Track mileage

- Generate expense reports

It offers features such as receipt scanning, automatic expense categorization, and multi-level approval workflows.

Expensify integrates with popular accounting and ERP systems, making it easy to sync expense data across the organization and ensure compliance with company policies and regulations.

6 Signs indicating the need for cloud cash management software

Watch out for these signs. You might need a cloud cash management software. But hey, opposed to what you may think, it might be the best move you can take.

1. Inefficient cash flow management

If you are a business experiencing:

- Delays in processing payments

- Reconciling accounts

- Forecasting cash flow

A cloud cash management software may benefit from implementing cloud cash management software.

2. Manual data entry errors

Manual entry of financial data increases the risk of errors and inconsistencies.

If you find yourself making mistakes over and over and just the thought of seeing all those numbers listed in a sheet makes you dizzy…yes, you might need a cash management software.

These solutions automate data entry processes, reducing the likelihood of mistakes.

3. Lack of real-time visibility

Without real-time access to financial data, businesses may struggle to make informed decisions regarding cash flow, expenses, and investments.

You may want to consider this one!

4. Limited scalability

Businesses experiencing growth may find their current cash management systems unable to scale effectively to meet increased demands.

This can be a very tricky position because you don't want to overspend. Right?

Well..not exactly. Cash management softwares are precisely made for businesses who want to manage their cash flows more effectively, regardless of their size!

You can also look into wealth tracking apps, which may be a better fit for your position right now.

Cloud-based solutions offer scalability to accommodate expanding operations without compromising efficiency.

5. High compliance risks

Regulatory compliance requirements continue to evolve, placing greater pressure on businesses to maintain accurate financial records and reporting.

Cloud cash management softwares often include compliance features to help businesses stay up-to-date with regulatory standards and reduce the risk of non-compliance penalties.

6. Difficulty in financial analysis

Analyzing financial data manually can be time-consuming and prone to errors.

Cloud cash management software provides strong reporting and analytics tools, enabling businesses to gain deeper insights into their financial performance and make data-driven decisions more efficiently.

Conclusion

Cloud cash management software offers a range of benefits for businesses seeking to streamline financial operations, enhance cash flow visibility, and improve decision-making processes.

By investing in the right software solution and implementing best practices, organizations can reach greater efficiency, agility, and competitiveness.

Try Banktrack to make the most of its tailored features, including customized reports and alerts, accessible through various channels like email and messaging apps.

Stay on top of your finances and access different ways of monitoring spending, receive alerts for important events like low balances or duplicate charges, and access personalized dashboards.

Frequently asked questions - FAQs

1. What is cloud cash management software?

Cloud cash management software is a digital solution that helps businesses manage their cash flow, expenses, and financial transactions securely via the cloud.

2. How does cloud cash management software differ from traditional methods?

Unlike traditional methods, cloud cash management software provides real-time insights, automated processes, and enhanced security features, allowing businesses to streamline financial operations efficiently.

3. Can cloud cash management software integrate with other business tools?

Yes, most cloud cash management software solutions offer integration capabilities with various business tools such as accounting software, CRMs, and ERP systems, ensuring seamless data flow across different platforms.

4. Is cloud cash management software suitable for small businesses?

Absolutely. Many cloud cash management software providers offer scalable solutions tailored to the needs of small businesses, providing essential features at affordable prices.

5. How can I choose the right cloud cash management software for my business?

When choosing a cloud cash management software, consider factors such as features, pricing, scalability, user-friendliness, customer support, and integration capabilities to ensure it aligns with your business requirements and objectives.

Share this post

Related Posts

How to track your business cash flow: complete guide

Failing to track cash flow properly can lead to serious financial issues. In this article, we provide efficient solutions to manage and optimize it effectively.How to take control of your money in 2024

Take charge of your finances in 2024 with practical tips on budgeting, saving, investing, and managing debt. Start the new year strong by mastering your money.Deferred Payments: An In-Depth Overview

A deferred payment is a financial arrangement where the payment for a purchase or a loan is delayed until a future date.

Try it now with your data

- Your free account in 2 minutes

- No credit card needed