Best 6 Household Expense Manager Apps for 2025

These are the best household expense manager apps

- Banktrack

- Mint

- YNAB

- Goodbudget

- Honeydue

- PocketGuard

Managing household expenses can be a challenging task, especially when you have multiple categories of spending to keep track of, from groceries and utility bills to entertainment and personal care.

A good household expense manager app can simplify this process by helping you budget, track spending, and make informed financial decisions.

In this article, we’ll explore the best household expense manager apps for 2025, highlighting their key features, benefits, and how they can help you stay on top of your finances.

Top Household Expense Manager Apps for 2025

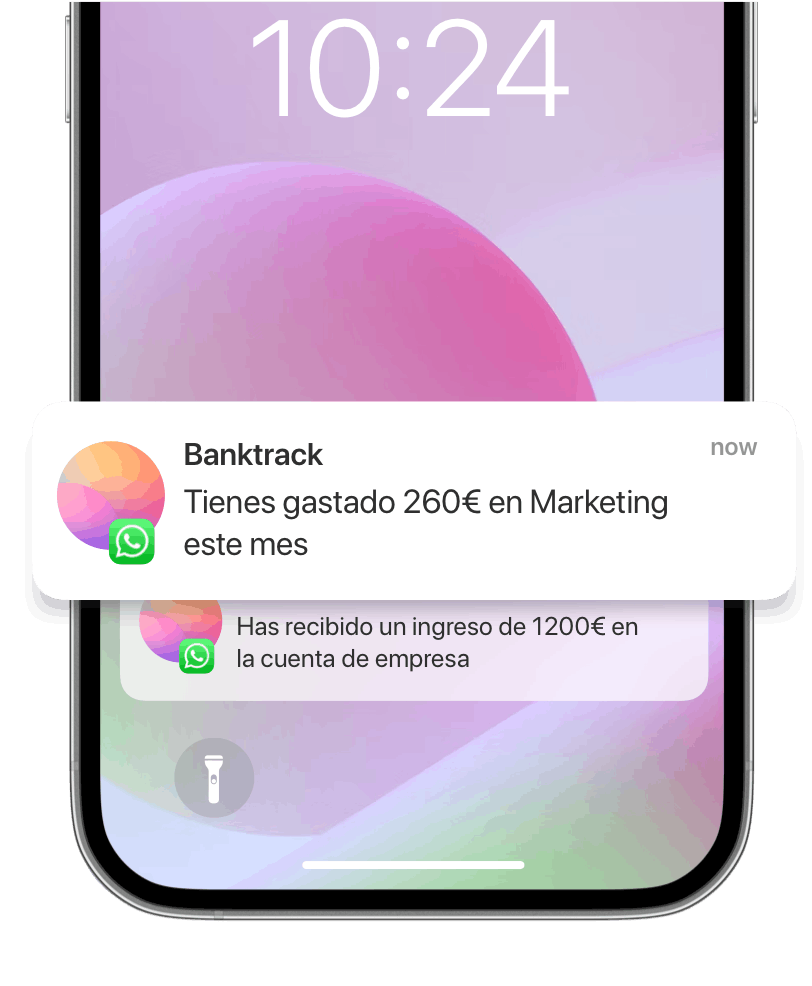

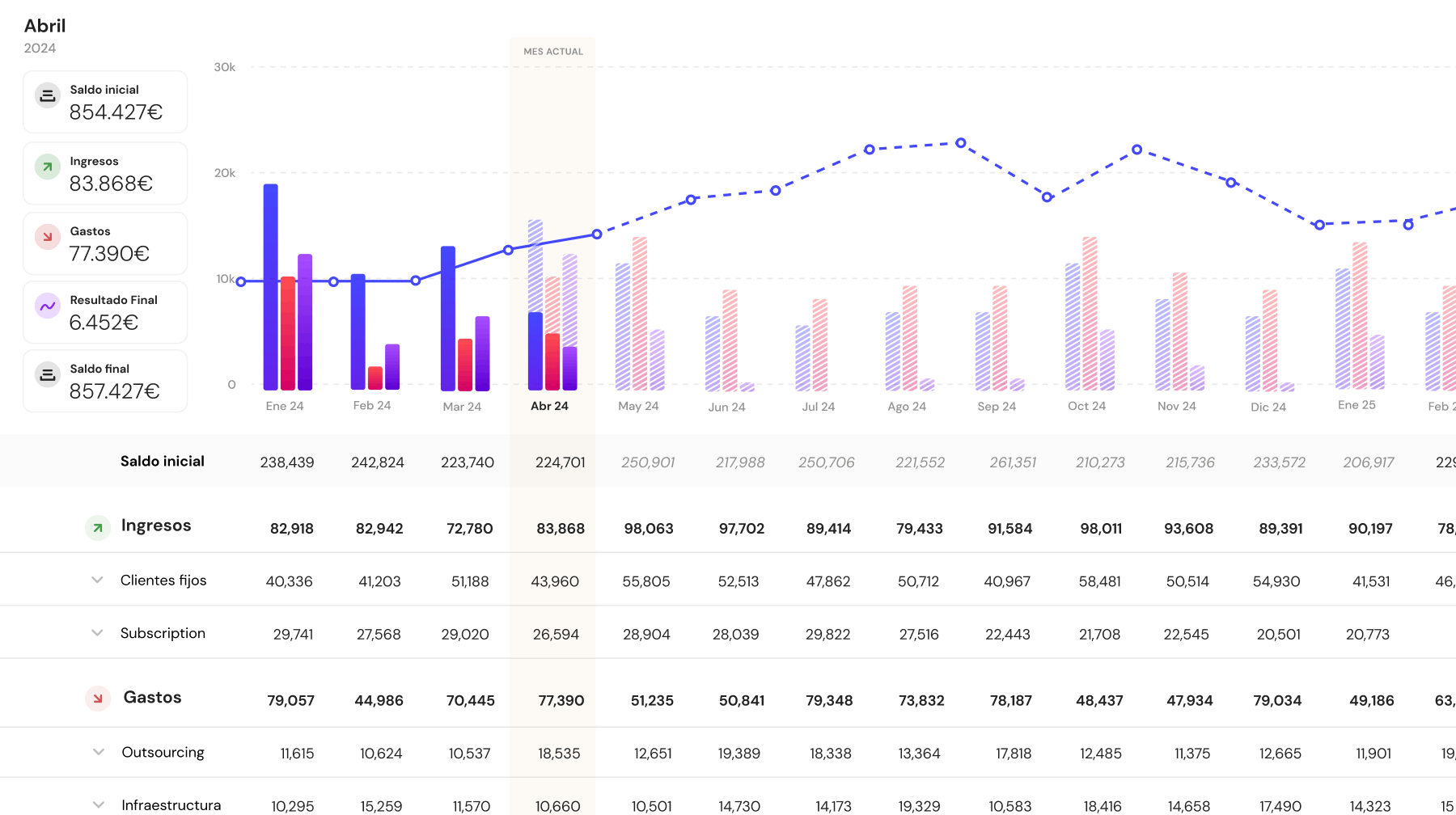

1. Banktrack

Banktrack is a complete cash management software that allows households to manage all their finances in one place.

With real-time transaction tracking, customizable dashboards, and seamless integration with multiple banks, Banktrack makes it easy to keep track of all your household expenses, ensuring you stay within your budget and achieve your financial goals.

Key Features

Personalized Reports and Alerts:

- Expense Alerts: Receive notifications via WhatsApp, SMS, email, Slack, or Telegram whenever you approach or exceed your budget limits. This feature ensures you are always aware of your spending and can adjust as needed to avoid overspending.

- Custom Reports: Generate detailed reports that provide insights into your household spending patterns, helping you identify areas where you can save money.

Real-Time Transaction Tracking:

- Customizable Dashboards: Banktrack offers customizable dashboards that provide a real-time overview of all your household expenses. Whether you need a breakdown of your grocery spending, utility bills, or entertainment costs, Banktrack’s dashboards make it easy to manage your money.

- Flexible Categorization: Allows you to create and customize categories for different types of household expenses, ensuring you always know exactly where your money is going.

Seamless Bank Integration:

- Extensive Bank Coverage: Syncs with over 120 banks, allowing you to consolidate all your financial accounts into one platform. This app to link all bank accounts makes it easy to track all household expenses directly from your bank accounts.

Dual Connection Methods:

- Open Banking (PSD2): Provides a secure, standardized way to access your banking data.

- Direct Access: Offers connections for banks not covered under PSD2, ensuring complete integration of your financial data.

Cash Flow Forecasting:

- Predictive Analytics: Uses historical data to predict future spending trends, helping you plan your household budget more effectively.

- Dynamic Forecasting: Adjusts forecasts in real-time based on your current financial data, allowing you to stay on top of your household budget.

Strong Security Measures:

- Data Encryption and Privacy: Protects your financial information with encryption, read-only access, and authorized data providers, ensuring your household expense data remains secure.

Pros and Cons

- Pros: It's a good expense tracking app that includes real-time alerts, customizable features, seamless bank integration, and strong security measures.

- Cons: Some advanced features may require a premium subscription.

2. Mint

Mint is a popular household expense manager app that offers a wide range of features to help you manage your finances.

It connects directly to your bank and credit card accounts, automatically categorizing transactions and providing real-time insights into your spending.

Key Features

- Automatic Expense Categorization: Automatically sorts transactions into categories such as groceries, utilities, and entertainment, giving you an instant overview of your household spending.

- Budgeting Tools: Allows you to create a household budget and set spending limits for different categories.

- Bill Reminders: Sends alerts for upcoming bills, helping you avoid late fees.

- Financial Overview: Provides a comprehensive overview of your entire financial picture, including assets, debts, and net worth.

Pros and Cons

- Pros: Free to use, integrates with multiple financial institutions, user-friendly interface.

- Cons: Ads can be intrusive, some users report synchronization issues.

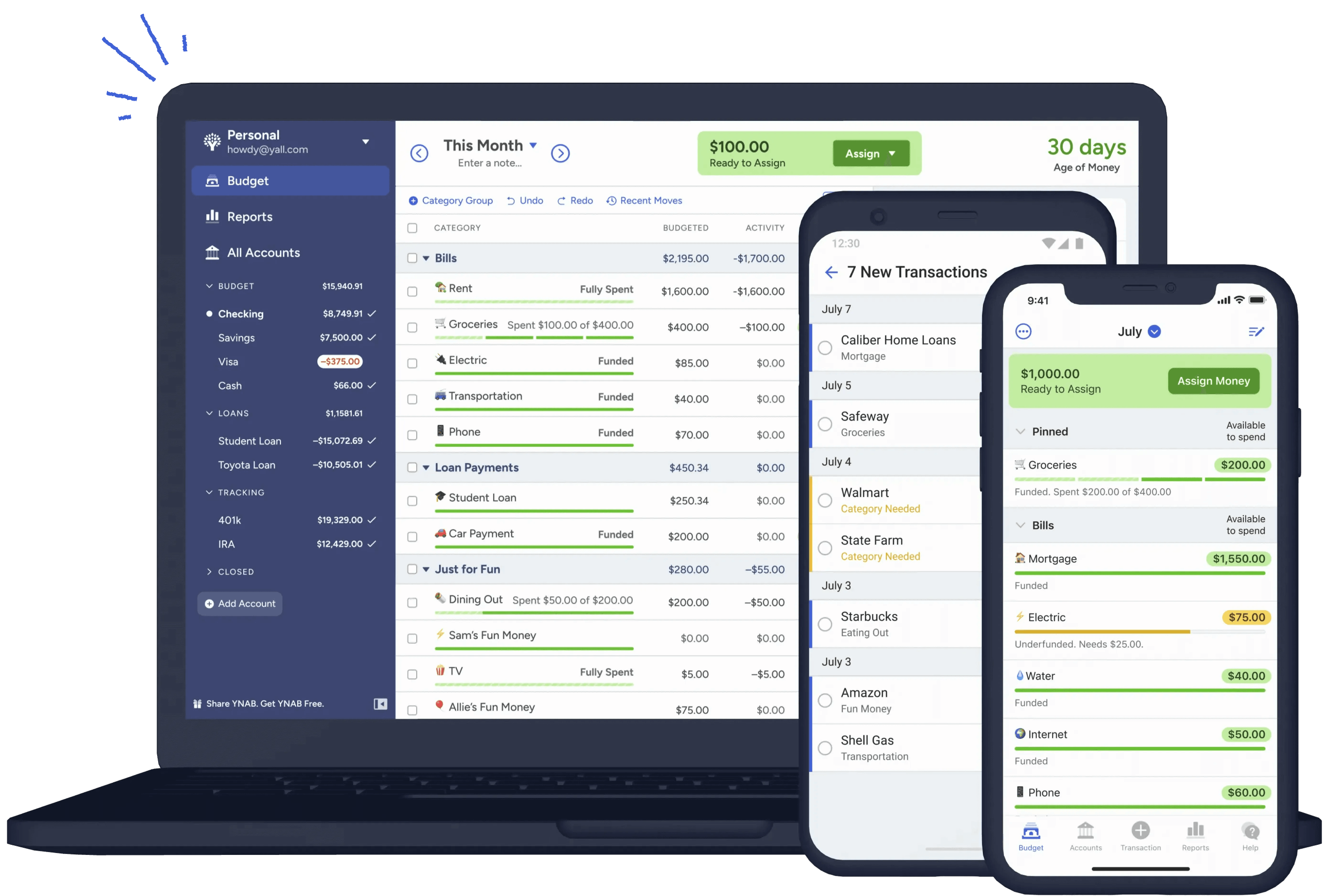

3. YNAB (You Need A Budget)

YNAB is a powerful budgeting app designed to help you gain control over your finances by giving every dollar a job.

It’s particularly effective for households looking to manage their expenses proactively and build better budgeting habits.

Key Features

- Zero-Based Budgeting: Encourages you to allocate every dollar of your income to specific expenses, including all household costs, ensuring you know where your money is going.

- Real-Time Syncing: Syncs with your bank accounts to automatically update and categorize expenses.

- Goal Setting: Helps you set and track financial goals, such as building an emergency fund or saving for a vacation.

- Education and Support: Offers a wealth of educational resources, including workshops and a supportive online community.

Pros and Cons

- Pros: Comprehensive budgeting features, strong community support, effective for building better financial habits.

- Cons: Subscription-based, may have a learning curve for new users.

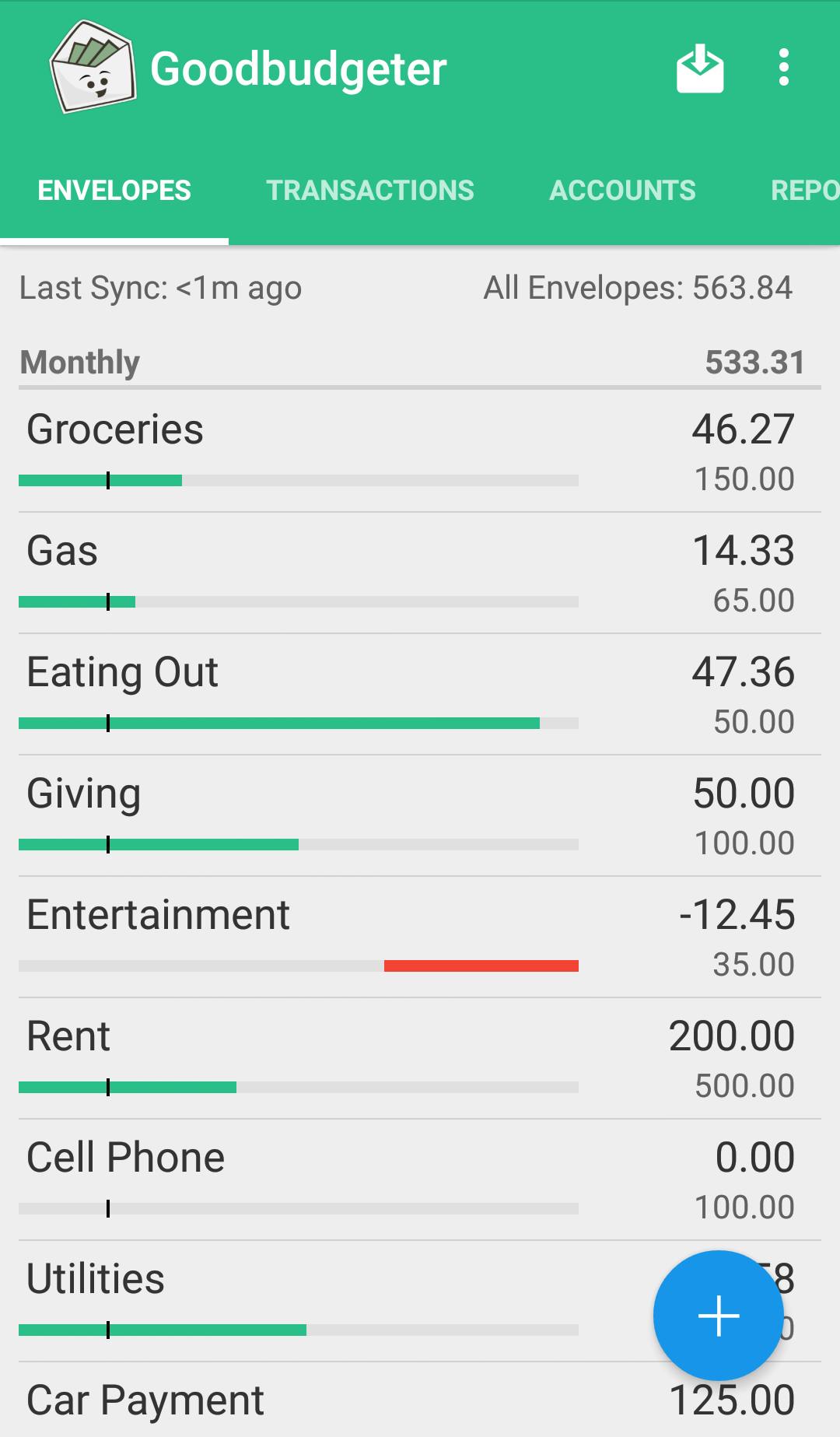

4. Goodbudget

Goodbudget is a simple, envelope-based budgeting app that helps households allocate their income into different spending categories, like groceries, utilities, and entertainment.

It’s great for those who prefer a straightforward budgeting approach.

Key Features

- Envelope Budgeting: Uses a digital version of the envelope method to help you allocate money for different household expenses.

- Expense Tracking: Allows you to manually enter expenses and track spending across multiple categories.

- Multi-Device Sync: Syncs across multiple devices, making it ideal for managing a household budget with family members.

- Reports and Insights: Provides detailed spending reports to help you analyze your household expenses.

Pros and Cons

- Pros: Easy to use, great for shared household budgeting, encourages disciplined spending.

- Cons: Limited features in the free version, manual entry can be time-consuming.

5. Honeydue

Honeydue is an expense manager app designed for couples and households, making it easy to manage shared expenses and financial goals.

It provides transparency and encourages communication about money, helping avoid financial misunderstandings.

Key Features

- Expense Sharing: Allows you to track and split shared expenses with your partner or family members.

- Bill Reminders: Sends notifications for upcoming bills, ensuring they are paid on time.

- Custom Categories: Create custom categories for household expenses, from groceries to rent.

- Financial Insights: Provides insights into your spending patterns and helps you set shared financial goals.

Are you looking for a more dedicated budget app for couples? Try Banktrack!

Pros and Cons

- Pros: Ideal for couples or households, easy to use, promotes transparency and communication about personal finance tracking.

- Cons: Limited advanced features, may not be suitable for larger households.

6. PocketGuard

PocketGuard is a simple budgeting app that helps you manage your household expenses by showing how much money you have left to spend after accounting for bills, savings, and essential expenses.

Key Features

- "In My Pocket" Feature: Shows how much disposable income you have left after deducting bills, expenses, and savings goals.

- Expense Tracking: Automatically tracks and categorizes your expenses, including household costs.

- Savings Goals: Helps you set and achieve savings goals for your household.

- Financial Insights: Provides insights into your spending habits to help you make smarter financial decisions.

Pros and Cons

- Pros: Easy to use, visually appealing interface, great for budgeting beginners.

- Cons: Limited customization options, some features require a premium subscription.

Why Use a Household Expense Manager App?

Using a household expense manager app provides several benefits that can help you take control of your financial life:

- Simplifies Budgeting: Helps you create and stick to a budget by tracking all household expenses in one place.

- Improves Financial Visibility: Gives you a clear overview of where your money is going, allowing you to make better financial decisions.

- Reduces Overspending: Sends alerts and notifications when you’re nearing your budget limits, helping to prevent overspending.

- Saves Time: Automates the tracking of expenses, reducing the need for manual input and calculations.

Why Banktrack is the Best Household Expense Manager App

Selecting the right household expense manager app depends on your specific needs, budget, and desired features.

Banktrack offers a complete set of features that make it the best choice for managing household expenses in 2025.

With real-time transaction tracking, personalized reports and alerts, seamless bank integration, strong security measures, and powerful cash flow forecasting tools, Banktrack provides everything you need to stay on top of your finances.

Whether you’re looking to manage your daily expenses, create a household budget, or plan for the future, Banktrack simplifies the process and helps you achieve your financial goals.

Its intuitive interface, extensive bank coverage, and advanced features make it the best tool for anyone looking to take control of their household expenses.

Share this post

Related Posts

The 10 best alternatives to Quicken in 2024

These are the best alternatives to Quicken, featuring tools that make managing your finances, budgeting, and tracking expenses easier and more efficient.How to Determine if you Need a Business Budgeting Software

Unsure if your business needs a budgeting software? Here are the signs and advantages to streamline financial planning and improve decision-making.

Try it now with your data

- Your free account in 2 minutes

- No credit card needed