Top 8 cash flow forecast generators

- The Best Cash Flow Forecast Generators

- 1. Banktrack

- 2. Float

- 3. PlanGuru

- 4. QuickBooks Cash Flow Planner

- 5. Dryrun

- 6. Pulse

- 7. CashAnalytics

- 8. LivePlan

- What Is a Cash Flow Forecast Generator

- Here’s why they’re so useful:

- What Makes a Great Cash Flow Forecast Generator

- 1. Ease of Use

- 2. Integrations

- 3. Customizable Dashboards

- 4. Scenario Planning

- 5. Budget-Friendly Pricing

- 4 Tips for Making the Most of Your Cash Flow Tool

- Why Choose Banktrack as Your Cash Flow Forecast Generator

These are the top 8 cash flow forecast generators

- Banktrack

- Float

- PlanGuru

- QuickBooks

- Dryrun

- Pulse

- CashAnalytics

- LivePlan

Managing your cash flow is fundamental to keeping control of your money. Whether you run a business, knowing exactly where your money is coming from and going to can make all the difference.

And the best part? Cash forecasting tools make it easy for you. They help you plan ahead, prevent financial surprises and make more intelligent decisions by giving you a clear view of your financial picture.

In this guide, we'll show you the top cash forecasting generators, how they differ and how to choose the one that's right for you.

The Best Cash Flow Forecast Generators

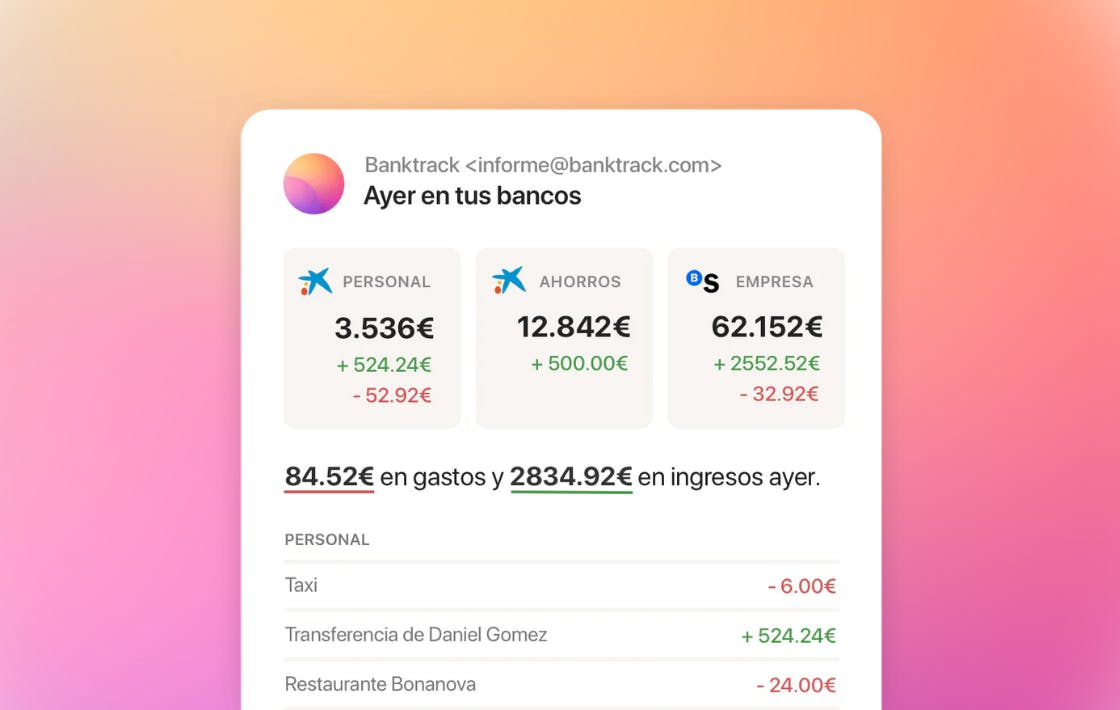

1. Banktrack

Banktrack is perfect for small to medium-sized businesses. It’s user-friendly, packed with features, and affordable.

What Makes Banktrack Stand Out

Customizable Dashboards

Banktrack lets you build dashboards adapted to your goals. Whether you want to track your income, manage expenses, or save for something big, it’s all there. With real-time insights, you can see your financial health at a glance.

Integrates with Over 120 Banks

Banktrack syncs seamlessly with both traditional banks and neobanks. From checking and savings accounts to credit cards and investments, it pulls everything into one place.

Open Banking technology keeps things secure and straightforward. Get to know the best apps to link all banks accounts.

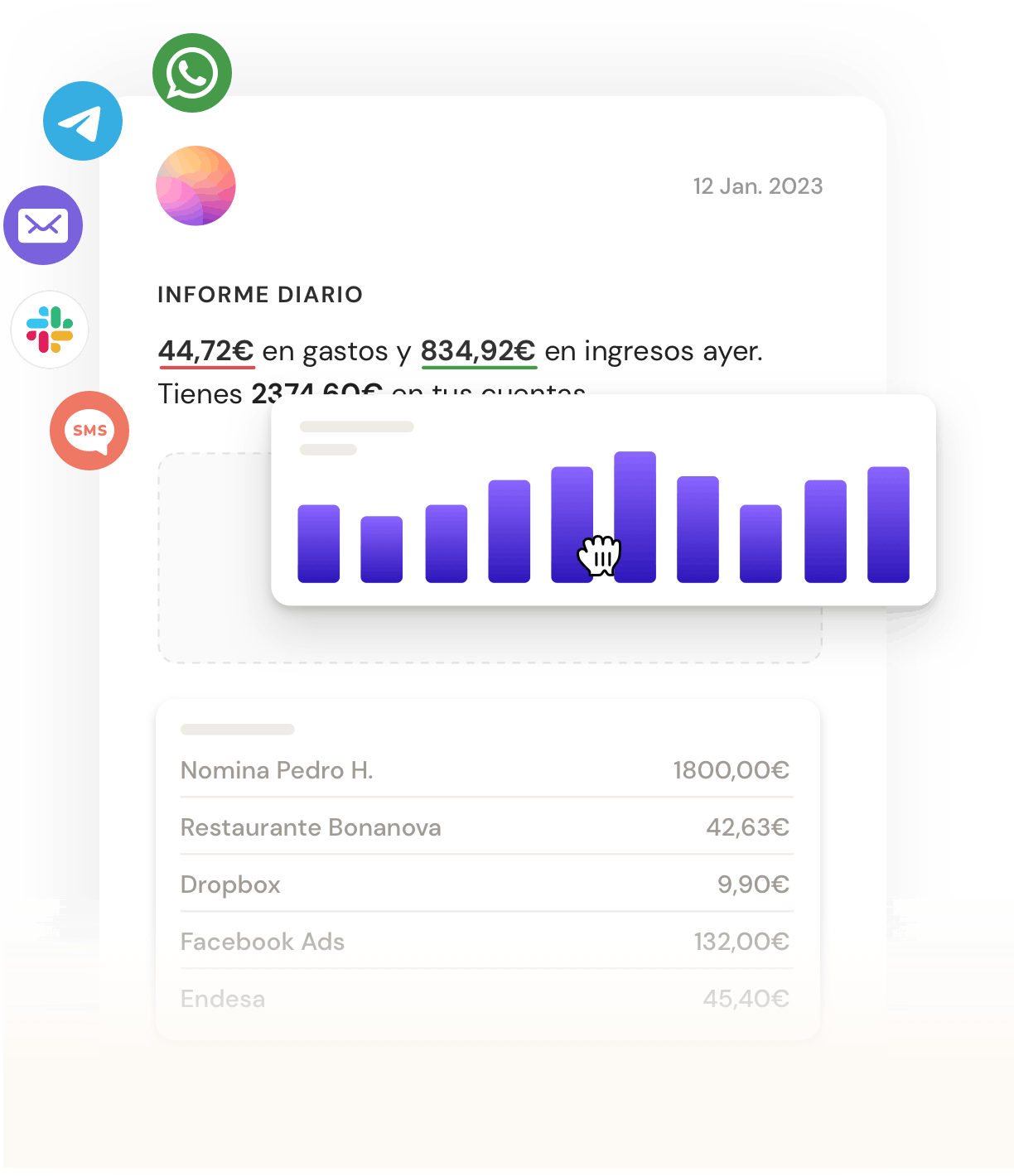

Spending Alerts to Keep You on Track

Set spending limits for categories like dining out, shopping, or entertainment. Banktrack will send you real-time alerts when you’re nearing your limits or when bills are due.

Notifications come via WhatsApp, Slack, email, Telegram, or SMS, so you’ll never miss a beat.

Effortless Reporting

Banktrack’s drag-and-drop reporting makes it easy to analyze your financial trends. Create detailed reports, track savings progress, or share insights with your partner, family, or accountant.

Top-Notch Security

Are you worried about the security of your data? Your data is safe with Banktrack. They use advanced encryption standard (AES) and follow strict security protocols to protect your information.

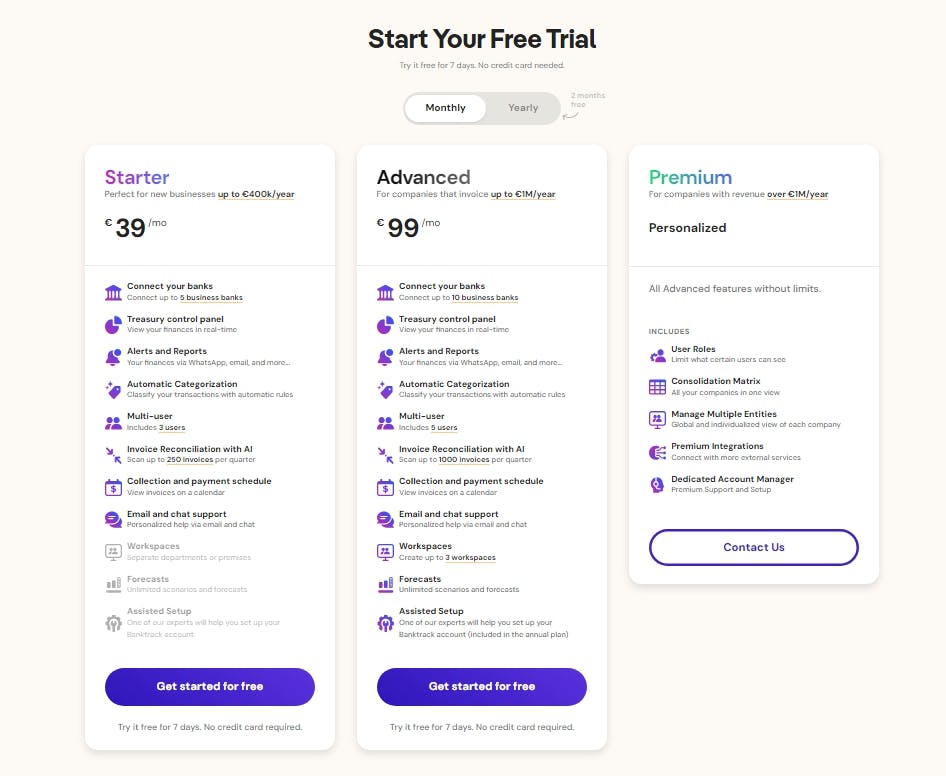

Affordable Pricing

At just €39/month, Banktrack offers great features at a fraction of the cost of some competitors. It’s a great choice for budget-conscious users who need powerful financial tools.

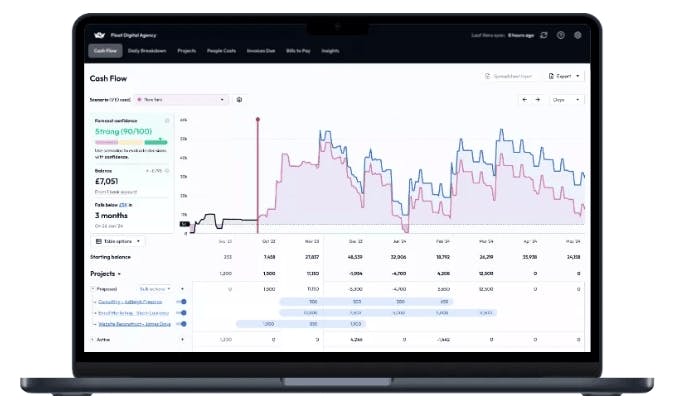

2. Float

If you’re running a small business, Float is one of the easiest tools to use for cash flow forecasting.

Why Choose Float?

- Automatically syncs with QuickBooks, Xero, and FreeAgent.

- Real-time updates so you always know where your finances statements.

- Scenario planning to test different financial decisions.

- Visual, easy-to-understand graphs and charts.

Who It’s Best For:

Small business owners who want simple, actionable insights without a steep learning curve.

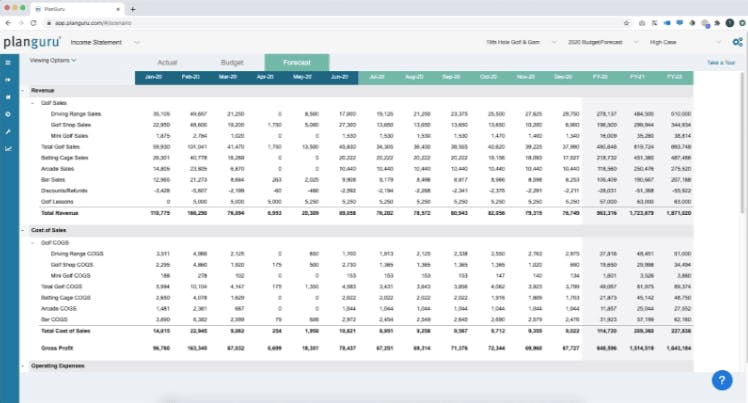

3. PlanGuru

PlanGuru is all about advanced financial planning. If you’re looking for a tool that goes deep, this is it.

Features:

- Forecast up to 10 years into the future.

- Integrates with Excel and QuickBooks.

- Offers professional-grade reports for investors or stakeholders.

- Built-in tools for creating budgets and strategic plans.

Learn about the best budgeting tools.

Who It’s Best For:

Medium to large businesses that need detailed forecasts and planning tools.

4. QuickBooks Cash Flow Planner

If you already use QuickBooks for accounting, its built-in Cash Flow Planner is a no-brainer.

Why It’s Great:

- Automatically pulls in data from your QuickBooks account.

- Offers clear visuals of cash flow trends.

- Identifies potential shortages and surpluses.

- Perfect for small businesses looking to streamline their finances.

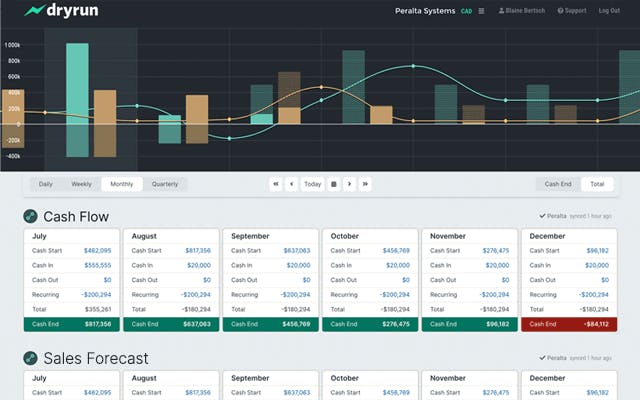

5. Dryrun

Dryrun is synonymous with flexibility. It is designed for companies that need to manage multiple settings.

Key Features:

- Scenario planning lets you test different financial outcomes.

- Real-time collaboration for teams.

- Integrates with accounting tools like QuickBooks and Xero.

- Easy-to-customize reports for stakeholders.

Find out about the best expense reports softwares in 2024.

Who It’s Best For:

Entrepreneurs and teams who need to manage cash flow dynamically.

6. Pulse

Pulse keeps things simple and effective, making it for smaller teams or solo entrepreneurs.

What It Offers:

- Clear, customizable cash flow reports.

- Collaboration features for teams and advisors.

- Manual or automated data entry.

- Affordable and easy to use.

Who It’s Best For:

Business owners who want a direct view of the treasury without unnecessary complexities.

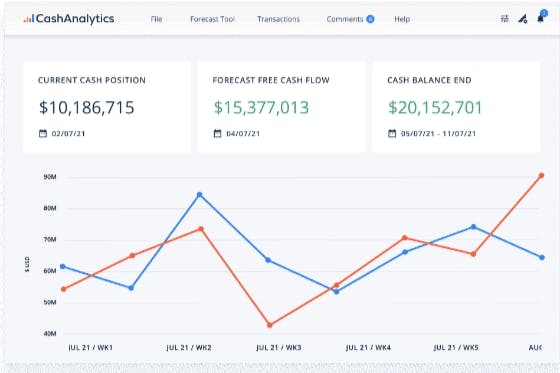

7. CashAnalytics

CashAnalytics is a specialized tool for businesses with a focus on cash flow automation and reporting.

Why It’s Great:

- Automates cash flow data collection and reporting.

- Tracks historical and projected cash flow trends.

- Ideal for businesses with multiple accounts and subsidiaries.

Who It’s Best For:

Large organizations or businesses with complex cash flow needs.

8. LivePlan

LivePlan is a versatile tool that combines cash flow forecasting with business planning.

What It Offers:

- Easy-to-use templates for cash flow forecasts.

- Integration with QuickBooks and Xero.

- Business planning tools to setting financial goals.

Who It’s Best For:

Startups and small businesses looking to combine cash flow insights with strategic planning.

What Is a Cash Flow Forecast Generator

A cash flow forecaster analyzes your income and expenses and predicts how much money you will have in the future. These forecasts are based on your current financial data, historical trends and even future plans.

Here’s why they’re so useful:

- Avoid Cash Crunches: Spot potential shortages before they happen.

- Plan for Growth: See when you’ll have extra funds to invest or save.

- Be Ready for Emergencies: Build a cushion for unexpected expenses.

- Make Confident Decisions: Understand the financial impact of big moves, like hiring someone new or buying equipment.

Whether you’re managing a household or running a business, these tools give you the insight you need to make smarter financial choices.

What Makes a Great Cash Flow Forecast Generator

With so many options out there, how do you know which one to choose? Here are some key features to look for:

1. Ease of Use

No one wants to struggle with a complicated application. The best tools are intuitive, easy to navigate and easy to configure.

2. Integrations

Your cash forecast generator should be synchronized with your bank accounts, credit cards or accounting software. This way, you will spend less time entering data manually.

3. Customizable Dashboards

Your financial situation is specific, so your dashboard should be too. A good tool allows you to keep track of the numbers that matter most to you.

4. Scenario Planning

Want to see how a new expense or investment might affect your finances? Scenario planning functions allow you to model different outcomes.

5. Budget-Friendly Pricing

While some tools are free, others offer premium features at a cost. Look for something that fits your budget without compromising on value.

4 Tips for Making the Most of Your Cash Flow Tool

- Update Regularly: Keep your accounts synced so your forecasts are always accurate.

- Use Alerts: Let the tool remind you about bills, low balances, or spending limits.

- Review Monthly: Set aside time to analyze your cash flow trends and make adjustments.

- Experiment with Scenarios: Test different decisions (like increasing savings or taking on a loan) to see how they’ll impact your finances.

Why Choose Banktrack as Your Cash Flow Forecast Generator

When it comes to forecasting your finances, the right tool can transform the way you manage your treasury and plan for the future.

Banktrack makes it a top choice thanks to its features, banking integration and advanced security measures. With customizable dashboards, expense alerts and intuitive reporting, Banktrack gives you all you need to stay in control of your money, whether you're running a business.

Take control of your finances with confidence.

Share this post

Related Posts

Best 8 Cashflow Monitoring Apps in 2025

Discover the best 8 cashflow monitoring apps in 2025 that help businesses track income, expenses, and liquidity in real timeThe 6 Best SaaS Financial Projections for Founders in 2025

Discover six top SaaS financial-projection platforms tailored for founders, enabling accurate subscription modelling, scenario planning, and metric tracking to drive scalable growth in 2025.7 Best Financial Projection Apps in 2025

Discover the top financial-projection apps that simplify scenario modelling, integrate with your accounting data, and help your business forecast revenue, expenses and growth with confidence.

Try it now with your data

- Your free account in 2 minutes

- No credit card needed