Explore the ideal bill management app designed to simplify your financial management effortlessly.

- What is a bill management app?

- Essential features

- 1. User-friendly interface and accessibility

- 2. Expense tracking and categorization

- 3. Customizable budgeting and flexibility

- 4. Automated transactions and integration

- 5. Goal setting and progress tracking

- 6. Enhanced security measures

- Tips for effective bill management

- Why use a bill management app?

- How can Banktrack help manage and optimize my bills?

- Conclusion

- Frequently asked questions - (FAQs)

- 1. Is it safe to use a bill management app?

- 2. Can I sync an expense tracking app with my bank accounts?

- 3. Can bill management apps help me save money?

- 4. How do I choose the right bill management app for my needs?

Looking for the best bill management app to streamline your finances effortlessly?

Managing bills can be a daunting task, we have all been there.

You also need it to make wiser financial decisions.

Either you have a business or it's for your family money management, you need to get a big picture of your finances and let's be honest, excel isn't the way to go in 2025.

However, with the advent of technology, there's a solution at your fingertips, the best bill management app.

These apps offer a comprehensive platform to organize, track, and pay your bills seamlessly, saving you time and effort.

Discover how these apps can help you organize, track, and pay your bills conveniently.

What is a bill management app?

A bill management app is a digital tool designed to help individuals and businesses manage their bills effectively.

These apps offer features such as bill tracking, payment reminders, budgeting tools, and expense categorization.

By centralizing all your bills in one place, these apps provide convenience and organization, allowing you to stay on top of your financial obligations effortlessly.

Essential features

The best bill management apps offer a range of essential features to streamline your financial tasks. These include:

1. User-friendly interface and accessibility

Having an app with a user-friendly interface that perfectly adapts to different devices is crucial. Just know that if you struggle to navigate through the app every time you use it, you're likely to abandon it altogether. So keep this in mind!

Look for expense management apps that offer intuitive navigation and are compatible with both desktop and mobile platforms, ensuring you can access your finances whenever and wherever you need to.

2. Expense tracking and categorization

Opt for an app that simplifies expense categorization, allows you to set spending limits, and generates customizable reports to help you understand your spending habits.

For instance, with Banktrack, you can consolidate views of different bank accounts, companies, and financial products.

This customizable setup ensures that users can access the specific information they require, precisely when they need it.

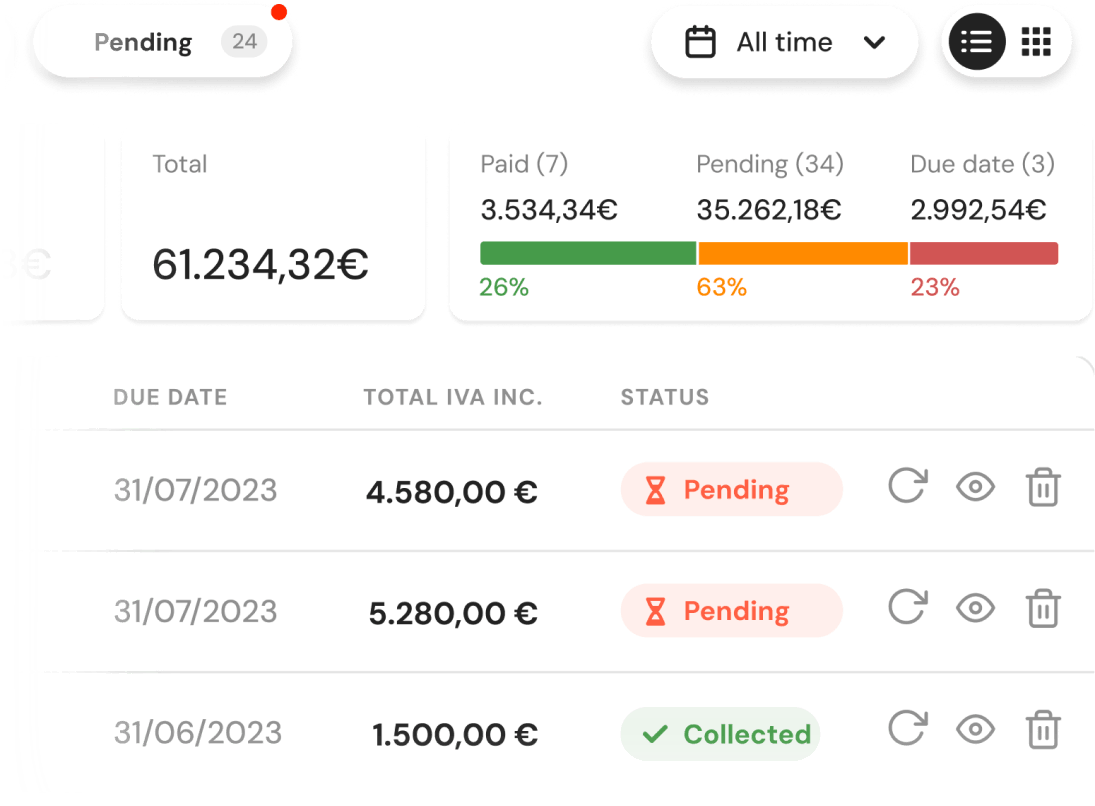

Here's an example of how you can personalize expense filtering and visualization:

3. Customizable budgeting and flexibility

Each person has its own unique financial goals and preferences.

Choose a budgeting app that enables you to set spending limits in various categories and receive tailored notifications and alerts through your preferred communication channel when you reach your limits, have a low balance, or identify duplicate charges.

With Banktrack, you can create, customize, and send financial reports via WhatsApp, SMS, email, Slack, or Telegram using a user-friendly drag-and-drop interface.

These features offer a level of control and visibility over your finances that you will not find elsewhere!

4. Automated transactions and integration

Banktrack offers a bank aggregator feature, allowing users to sync with over 120 banks, including traditional and neobanks.

Depending on the bank, Banktrack provides two types of connections:

- Open Banking (PSD2)

- Direct Access

This ensures efficient and secure integration of your financial data.

5. Goal setting and progress tracking

Setting achievable financial goals is essential for staying motivated and on budget.

Look for apps specialized in setting savings goals, debt repayment targets, and milestones, with progress tracking features to monitor your financial journey.

6. Enhanced security measures

When it comes to safeguarding your personal and banking data, Banktrack takes all necessary precautions.

- We exclusively use authorized and audited banking data providers approved by the Bank of Spain.

- Banktrack never has access to conduct transactions in your bank accounts; it only obtains read access to your data.

- Your banking passwords are not stored, as the connection process is facilitated through a unique access token.

- All transaction data within Banktrack systems is encrypted, ensuring the confidentiality and security of your financial information.

Tips for effective bill management

Here are some additional tips to enhance your bill management experience. Put them into practice when using your new app!

- Set up automatic payments: automate recurring bill payments to avoid late fees and streamline your financial tasks.

- Review your bills regularly: take time to review your bills and statements for any discrepancies or errors, ensuring accuracy and accountability.

- Create a budget: establish a realistic budget and stick to it to maintain financial stability and achieve your financial goals.

Why use a bill management app?

Using a bill management app offers several advantages.

Firstly, it eliminates the hassle of manual bill payments and reduces the risk of missing due dates, thereby avoiding late fees and penalties.

Additionally, these apps provide insights into your spending habits, allowing you to make informed financial decisions.

Moreover, they offer secure payment options and encryption to protect your sensitive financial information from cyber threats.

How can Banktrack help manage and optimize my bills?

Banktrack can help you manage and optimize your invoices in several ways:

- Invoice scanning: uses OCR (Optical Character Recognition) technology to scan invoices and automatically associate them with bank transactions, facilitating their recording and reconciliation.

- Payment automation: allows you to set up payment reminders and manage due dates, ensuring nothing is overlooked.

- Bank reconciliation: bank transactions are automatically reconciled with the scanned invoices, simplifying the process and reducing manual errors.

- Ticket management: employees can send payment tickets or requests via WhatsApp or email, which are recorded and reconciled without needing to access the app.

- Receivables and payables calendar: helps you visualize upcoming collections and payments, enabling you to plan cash flow more efficiently.

- Multiple account access: Banktrack allows the integration of multiple bank accounts, giving you a comprehensive view of all invoices and payments from one place.

Conclusion

In conclusion, the best bill management app is a valuable tool for individuals and businesses seeking to streamline their financial tasks effectively.

By offering features such as bill tracking, payment reminders, budgeting tools, and expense categorization, these apps empower users to take control of their finances and achieve financial stability.

With a wide range of options available in the market, it's essential to evaluate your needs, preferences, and budget to choose the right app for you.

Start simplifying your bill management process today with the best bill management app!

Frequently asked questions - (FAQs)

1. Is it safe to use a bill management app?

Most bill management apps employ good security measures to protect users' financial information.

For example, Banktrack only uses authorized and audited banking data providers approved by the Bank of Spain, never has access to conduct transactions in your accounts, and all your data is always encrypted.

2. Can I sync an expense tracking app with my bank accounts?

Yes, many bill management apps offer the option to sync your bank accounts so that your transactions are automatically imported into the app.

Banktrack's bank aggregator allows users to sync with over 120 banks, both traditional and neobanks.

3. Can bill management apps help me save money?

Yes, by providing insights into your spending habits, offering budgeting tools, and sending payment reminders, bill management apps can help you save money and achieve better financial management.

4. How do I choose the right bill management app for my needs?

When choosing a bill management app, consider factors such as compatibility, user interface, security, customer support, and available features to find the app that best suits your needs and preferences.

Share this post

Related Posts

Best 8 Cashflow Monitoring Apps in 2025

Discover the best 8 cashflow monitoring apps in 2025 that help businesses track income, expenses, and liquidity in real timeThe 6 Best SaaS Financial Projections for Founders in 2025

Discover six top SaaS financial-projection platforms tailored for founders, enabling accurate subscription modelling, scenario planning, and metric tracking to drive scalable growth in 2025.7 Best Financial Projection Apps in 2025

Discover the top financial-projection apps that simplify scenario modelling, integrate with your accounting data, and help your business forecast revenue, expenses and growth with confidence.

Try it now with your data

- Your free account in 2 minutes

- No credit card needed