7 cash flow forecasting trends of 2025

- Top 7 Trends in Cash Flow Forecasting for 2025

- 1. Real-Time Forecasting Powered by Automation

- 2. AI and Predictive Analytics

- 3. Scenario-Based Forecasting

- 4. Integration with Broader Financial Systems

- 5. Increased Focus on Sustainability and ESG

- 6. Mobile and Cloud-Based Solutions

- 7. Smarter Alerts and Notifications

- The Evolving Role of Cash Flow Forecasting

- Why Banktrack is Leading the Way in 2025

- Adapting to Cash Flow Trends with Banktrack

These are the best cash flow forecasting trends of the year:

- Real-Time Forecasting Powered by Automation

- AI and Predictive Analytics

- Scenario-Based Forecasting

- Integration with Broader Financial Systems

- Increased Focus on Sustainability and ESG

- Mobile and Cloud-Based Solutions

- Smarter Alerts and Notifications

As we move into 2025, cash flow forecasting remains one of the most critical financial tools for businesses aiming to navigate uncertainty, seize opportunities, and maintain financial health.

Evolving technologies, economic shifts, and the growing demand for real-time insights are shaping how businesses approach forecasting.

In this post, we’ll explore the top trends in cash flow forecasting for 2025 and how tools like Banktrack are revolutionizing the way businesses manage and project their cash flows.

Top 7 Trends in Cash Flow Forecasting for 2025

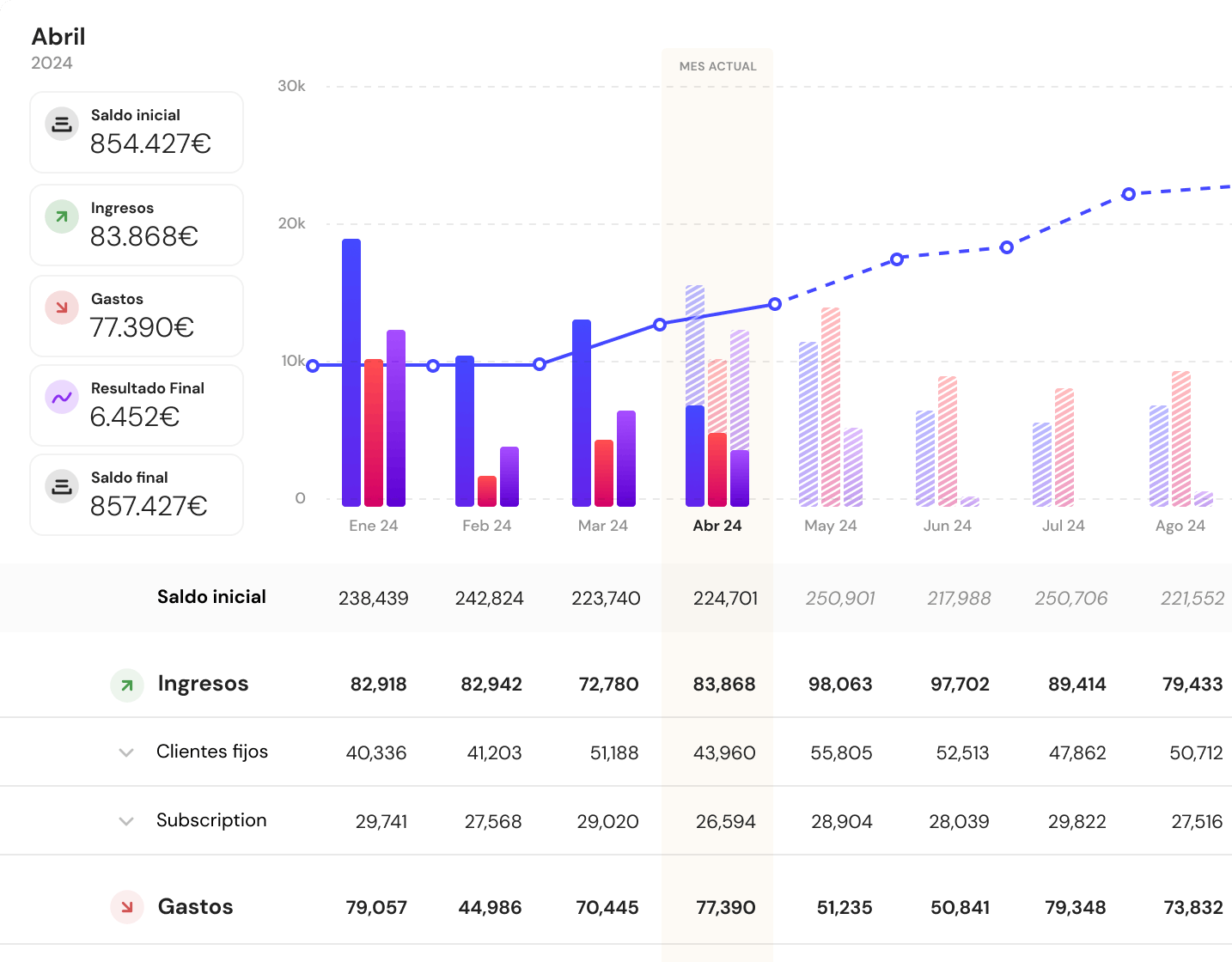

1. Real-Time Forecasting Powered by Automation

In 2025, businesses are moving beyond static, spreadsheet-based forecasts. Real-time forecasting, powered by automated tools like Banktrack, is becoming the norm.

By integrating directly with financial systems and bank accounts, tools like Banktrack provide up-to-date cash flow insights, eliminating the delays and errors associated with manual processes.

Benefits:

- Always have the latest financial data for better decision-making.

- Identify cash flow issues early and take proactive steps.

- Free up time for strategic tasks instead of manual data entry.

2. AI and Predictive Analytics

Artificial Intelligence (AI) is reshaping cash flow forecasting.

Predictive analytics allows businesses to forecast more accurately by analyzing historical trends, seasonal fluctuations, and market data.

Advanced tools like Banktrack are leveraging AI to provide smarter, more accurate projections that account for a variety of scenarios.

Example: Banktrack uses predictive analytics to identify patterns in cash flow, helping businesses prepare for slow sales periods or spikes in expenses with greater precision.

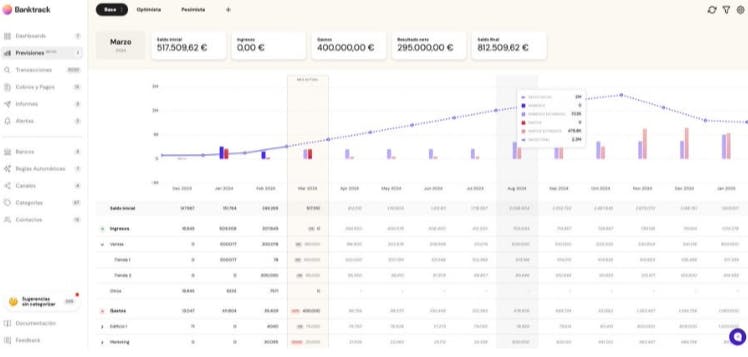

3. Scenario-Based Forecasting

As economic conditions remain volatile, scenario planning has become an essential part of cash flow forecasting.

Businesses need to model multiple "what-if" scenarios, such as revenue shortfalls, unexpected costs, or changes in interest rates, to prepare for a range of outcomes.

Banktrack simplifies this process by allowing users to easily create and compare multiple scenarios within its platform.

For instance, you can simulate the impact of delayed receivables or increased supplier costs and adjust your strategies accordingly.

4. Integration with Broader Financial Systems

In 2025, businesses are looking for tools that integrate seamlessly with their existing accounting and ERP systems.

Banktrack stands out by offering smooth integration with various financial platforms, enabling unified data management and better forecasting accuracy.

Why This Matters:

- Reduces the need for manual data entry.

- Provides a holistic view of your financial health.

- Ensures your forecasts align with your overall financial strategy.

5. Increased Focus on Sustainability and ESG

Environmental, Social, and Governance (ESG) considerations are increasingly influencing financial decisions.

Businesses are incorporating sustainability into their cash flow forecasting by accounting for ESG-related investments and risks.

Banktrack supports this trend by offering detailed categorization and reporting, making it easier to track sustainability-focused expenses or revenue streams and include them in your forecasts.

6. Mobile and Cloud-Based Solutions

With remote work and distributed teams becoming more common, cloud-based cash flow forecasting tools are a must-have in 2025.

Banktrack provides mobile and cloud-based access, ensuring that businesses can monitor, manage and improve cash flow from anywhere, at any time.

Advantages:

- Greater flexibility for business owners and finance teams.

- Access to real-time data on the go.

- Enhanced collaboration across teams.

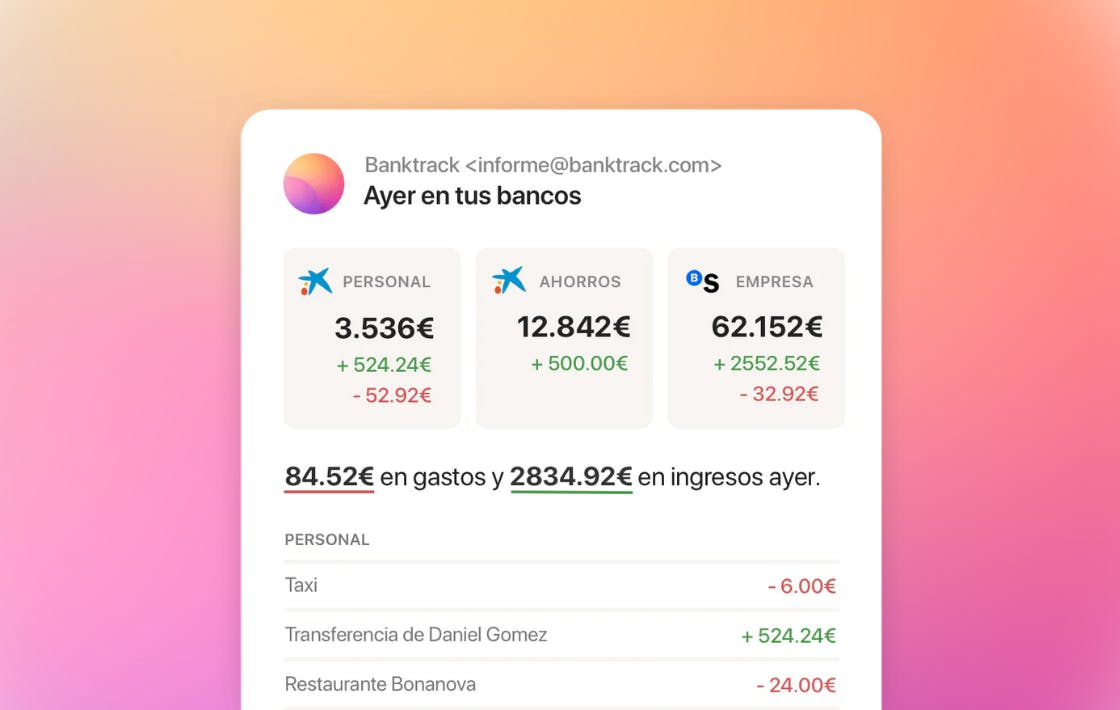

7. Smarter Alerts and Notifications

Proactive cash flow management relies on staying ahead of potential problems. Banktrack’s automated alerts notify users of critical changes, such as low balances, delayed receivables, or upcoming payments.

These smarter alerts ensure businesses can take timely action to avoid cash shortages or missed opportunities.

The Evolving Role of Cash Flow Forecasting

Cash flow forecasting is no longer just a tool for financial planning, it’s now a strategic advantage.

In today’s fast-paced business environment, organizations are using advanced forecasting techniques to not only avoid cash shortages but also to identify growth opportunities, mitigate risks, and improve decision-making.

Why is this critical in 2025?

- Economic uncertainty and inflation require agile and precise financial management.

- Increasing digitization demands real-time financial insights.

- Stakeholders expect accurate forecasts for confident decision-making.

Why Banktrack is Leading the Way in 2025

With these trends shaping cash flow forecasting, Banktrack stands out as the best cash flow management software for businesses looking to stay ahead. Its advanced features align perfectly with the demands of 2025:

- Real-Time Insights: Banktrack integrates with your bank accounts to provide up-to-date cash flow data.

- Predictive Analytics: Use AI-driven insights to forecast with precision.

- Scenario Planning: Compare multiple scenarios to prepare for uncertainties.

- Seamless Integration: Connect Banktrack to your accounting software for a unified view.

- Cloud Access: Manage your forecasts from anywhere.

- Affordable Pricing: Banktrack is accessible to businesses of all sizes.

By combining automation, AI, and user-friendly features, Banktrack simplifies forecasting and empowers businesses to make data-driven decisions.

Adapting to Cash Flow Trends with Banktrack

The future of cash flow forecasting is here, and staying ahead means embracing innovation. Tools like Banktrack aren’t just helpful, they’re essential for navigating the complexities of 2025.

Whether you’re looking to improve accuracy, save time, or gain deeper insights into your finances, Banktrack has you covered.

Stay on top of cash flow forecasting trends with Banktrack. Try it today and ensure your business is prepared for whatever 2025 brings!

Share this post

Related Posts

Best 7 Cash Flow Management Tools in Finland for 2025

These are the best cash flow management tools in Finland: Banktrack Procountor Netvisor Visma eAccounting Fennoa Float QuickBooks Online In Finland’s competitive business environment, from Helsinki’s

Try it now with your data

- Your free account in 2 minutes

- No credit card needed