Never miss a payment with bill management

- Why Effective Bill Management Matters

- Step 1: List All Your Bills

- Step 2: Choose a Bill Management System

- Manual Method: Calendar or Spreadsheet

- Bill Management Apps

- Step 3: Set Up Automatic Payments and Alerts

- How to Set Up Automatic Payments

- Set Up Alerts for Variable Bills

- Step 4: Prioritize Bills Based on Due Dates and Amounts

- Step 5: Track and Review Your Bills Monthly

- Step 6: Set Up a Bill Payment Fund

- How to Build a Bill Payment Fund

- Step 7: Avoid 3 Common Bill Management Pitfalls

- 1. Ignoring Small Bills

- 2. Forgetting to Update Information

- 3. Relying Only on Paper Statements

- Step 8: Use Bill Management for Budgeting Goals

- Take Control of Your Finances with Banktrack’s Bill Management

Never miss a payment with bill management and always stay organized.

Managing bills might seem like a simple task, but when they start piling up, credit cards, utilities, rent, subscriptions, insurance, and more, keeping track can get overwhelming.

Poor bill management can lead to late fees, credit score damage, and unnecessary stress.

This guide will walk you through practical steps to simplify bill management, stay organized, and save money.

Why Effective Bill Management Matters

Effective bill management goes beyond just paying bills on time; it’s about keeping your financial life organized. Here’s why it’s crucial:

- Avoid Late Fees: Late fees add up quickly, but managing bills helps you avoid these extra costs.

- Protect Your Credit Score: Missing payments can hurt your credit score, affecting everything from loan approvals to interest rates.

- Reduce Financial Stress: Knowing when and how much you owe makes budgeting easier and relieves the stress of scrambling to make payments.

Managing bills well gives you control over your finances, helping you focus on long-term goals without worrying about missed payments or penalties.

Step 1: List All Your Bills

The first step in managing bills effectively is knowing exactly what you owe and when each bill is due.

Create a complete list of all your monthly bills, including:

- Fixed bills (same amount every month): Rent, car payments, insurance.

- Variable bills (change each month): Utilities, credit card bills, groceries.

- Annual or semi-annual payments: Insurance premiums, property taxes, subscription renewals.

This list will serve as your bill-tracking foundation. You can keep it on a spreadsheet, in a notebook, or with a dedicated app.

Step 2: Choose a Bill Management System

Once you have a list of bills, it’s time to pick a system that makes tracking and paying them as easy as possible.

Here are some options:

Manual Method: Calendar or Spreadsheet

If you prefer a hands-on approach, use a calendar or a cash flow spreadsheet to mark due dates. Color-code payments as paid or pending, and add reminders for upcoming bills.

This method works best if you have a limited number of bills and like managing details manually.

Bill Management Apps

For a more automated experience, consider using a bill management app. Many apps link directly to your bank accounts, alerting you when a bill is due and even allowing you to pay bills directly from the app.

Popular options include Banktrack, Prism, Mint, and Quicken.

Using Banktrack for Bill Management

Banktrack isn’t just for managing cash effectively; it also offers strong bill management tools.

You can set up bill reminders, automate payments, and track expenses in real time. This all-in-one approach makes it easy to stay organized and keep your bills up to date.

Here’s a closer look at what makes Banktrack a top choice for effective bill and expense management:

Key Features that make Banktrack the best choice

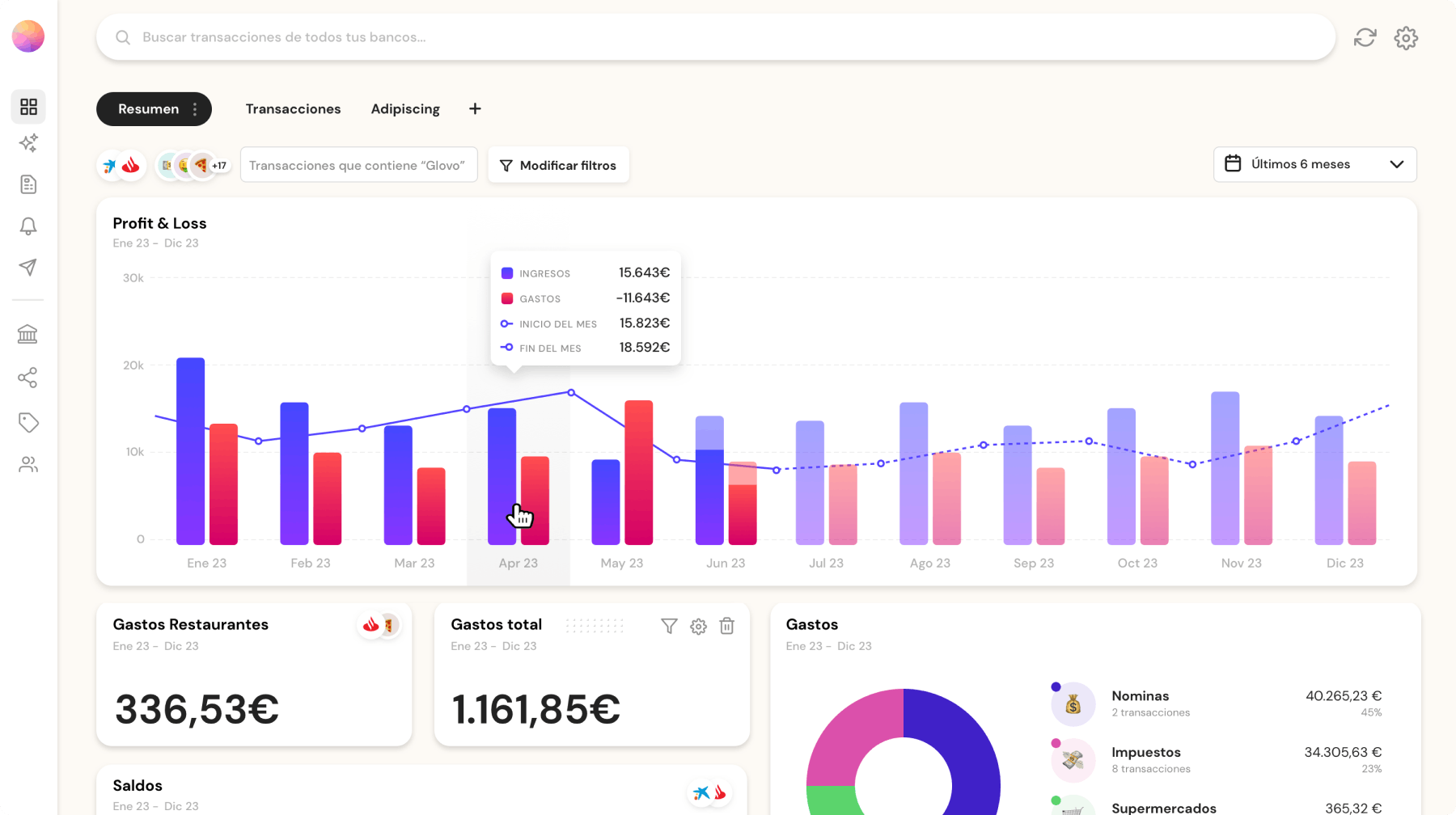

- Personalized Dashboards: Banktrack allows you to tailor your financial overview with fully customizable dashboards. Whether you want to focus on income streams, spending habits, or track specific categories, Banktrack’s dashboards let you visualize what’s most important. This personalized approach makes it easy to manage bills by keeping the key data front and center, so you always know where you stand financially.

- Integration with Multiple Accounts: Banktrack seamlessly syncs with over 120 banks, including both traditional banks and digital neobanks. Using Open Banking or Direct Access, it connects securely to your accounts, allowing you to manage all your finances in one place. Instead of logging in to multiple bank accounts to check balances and bill payments, Banktrack consolidates everything, offering a real-time view of cash flow across accounts.

- Customizable Spending Limits: One of the biggest challenges in managing bills is staying within budget. Banktrack’s customizable spending limits let you set caps for different spending categories, groceries, utilities, entertainment, and more. You’ll receive real-time notifications when you’re approaching your limit, have a low balance, or detect a duplicate charge, helping you avoid overspending and stay on track.

- Automated Alerts and Reports: Forget about manually checking every due date, Banktrack automates alerts and reports, sending real-time updates through your preferred channels, including WhatsApp, SMS, email, Slack, or Telegram. These alerts keep you informed of upcoming bills, spending trends, and account changes, giving you peace of mind and reducing the risk of missed payments.

- Drag-and-Drop Interface: Banktrack’s drag-and-drop interface is intuitive, making it easy to create, customize, and share financial reports with just a few clicks. Whether you’re tracking personal expenses or managing business finances, this interface simplifies reporting and helps you organize data effortlessly.

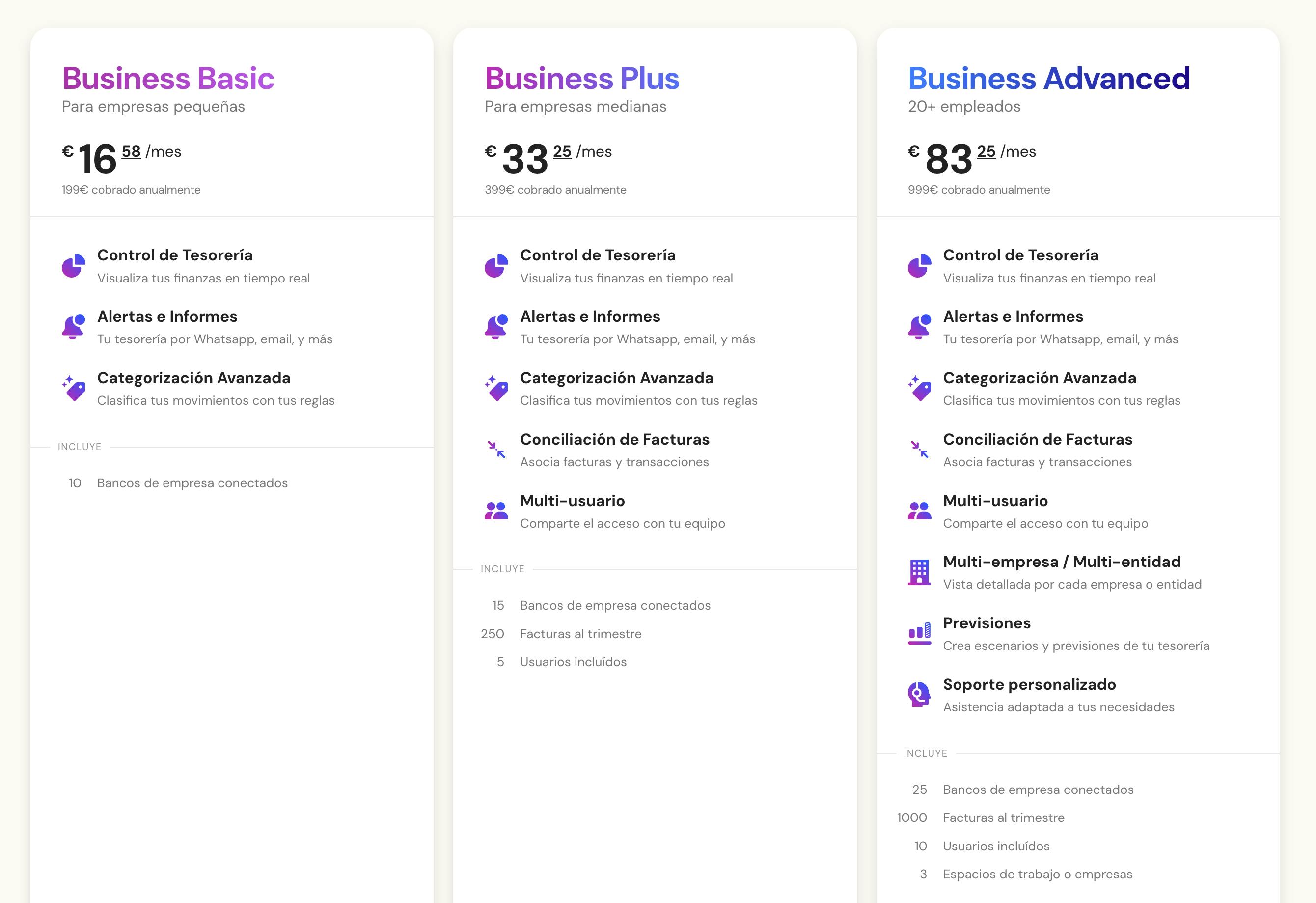

- Affordable Pricing: Banktrack offers an affordable entry point for those looking to optimize their bill management and overall financial health. Plans start at just €16.58 per month, making it accessible for individuals and businesses alike who want to efficiently manage their cash flow and stay on top of financial obligations.

Banktrack’s Benefits for Bill Management

With Banktrack, managing bills becomes a breeze. The customizable spending limits and automated alerts keep you in control, notifying you of any irregularities or upcoming bills.

By integrating multiple bank accounts, Banktrack consolidates everything in one platform, saving you time and hassle.

For businesses and individuals seeking a reliable, easy-to-use expense tracker app that goes beyond basic expense tracking, Banktrack is a complete solution.

From tracking every dollar spent to staying informed with instant alerts, Banktrack gives you the insights needed to manage your bills and expenses confidently.

Step 3: Set Up Automatic Payments and Alerts

One of the easiest ways to manage bills is by automating payments.

Most banks and service providers offer automatic payment options, which let you schedule payments on the due date directly from your bank account or credit card.

How to Set Up Automatic Payments

- Log in to your bank or service provider’s website.

- Find the “automatic payments” section and enter your account details.

- Choose a payment date (ideally a few days before the due date to allow for processing).

Automatic payments work well for fixed bills like rent, mortgage, and insurance.

For variable bills like credit cards or utilities, consider setting up a minimum payment automatically to avoid late fees, then pay any remaining balance manually.

Set Up Alerts for Variable Bills

For bills that fluctuate (like electricity or credit card bills), set up alerts.

Many apps and banks allow you to set notification alerts when a new bill is due or a certain spending threshold is reached. Alerts are a great way to stay on top of bills without constantly checking due dates.

Step 4: Prioritize Bills Based on Due Dates and Amounts

Organizing bills by due date and amount helps you avoid last-minute scrambles.

Arrange bills in the following order:

- Essentials First: Cover essentials like rent, utilities, and insurance.

- Debt Payments Next: Pay down high-interest debt like credit cards and personal loans.

- Non-Essentials: Finish with non-essentials like subscriptions or discretionary spending.

Prioritizing bills makes budgeting easier by helping you see which payments are critical and which ones can be adjusted if needed.

Step 5: Track and Review Your Bills Monthly

Monthly reviews of your bills and spending habits can reveal opportunities to save money.

Here’s what to look for:

- Changes in Bill Amounts: Check for any increases in bills (such as utilities or subscriptions) and adjust your budget if necessary.

- Identify Unused Services: If you’re not using a streaming service, gym membership, or subscription, consider canceling it to free up funds.

- Track Spending Trends: Over time, you’ll notice patterns in your spending that can help you budget better and cut unnecessary expenses.

Apps like Banktrack allow you to review expenses easily, giving you insights into where your money is going and how you can optimize spending.

Step 6: Set Up a Bill Payment Fund

A bill payment fund is a small buffer you keep in your checking account specifically for covering monthly bills.

This helps ensure you have enough to cover essentials even during months with irregular income or unexpected expenses.

How to Build a Bill Payment Fund

- Calculate your average monthly bill total and add a small cushion (e.g., $100).

- Transfer this amount into your bill payment fund at the start of each month.

- Use this fund strictly for bills.

Keeping a dedicated fund for bills gives you peace of mind, so you’re less likely to run short on essentials.

Step 7: Avoid 3 Common Bill Management Pitfalls

Effective money management requires staying aware of common mistakes that can lead to financial stress. Here are some pitfalls to avoid:

1. Ignoring Small Bills

It’s easy to overlook small bills like subscriptions, but these add up. Review small bills regularly to make sure they’re necessary and within your budget.

2. Forgetting to Update Information

Moving, changing banks, or updating a credit card? Remember to update your payment information with each service provider to avoid missed payments.

3. Relying Only on Paper Statements

Paper statements are easily lost or overlooked. Go digital by setting up online accounts with each provider and using bill management apps that send digital reminders.

Step 8: Use Bill Management for Budgeting Goals

By understanding how much you spend on bills each month, you can set realistic financial goals and work toward them. Here’s how to integrate bill management into your budget:

- Set a Monthly Bill Limit: Aim to keep your total monthly bill amount within a set range, adjusting as needed.

- Save on Variable Bills: Look for ways to reduce variable bills. For example, consider energy-efficient appliances to lower electricity bills.

- Put Savings Toward Financial Goals: Any money saved on bills can go directly toward other financial goals like paying down debt or building an emergency fund.

Good bill management helps you stay in control of your finances and achieve bigger goals without stretching your budget.

Take Control of Your Finances with Banktrack’s Bill Management

Managing bills might seem like a chore, but with the right system, it can be simple and stress-free.

By setting up automatic payments, using tools like Banktrack, and reviewing your spending monthly, you can keep your finances organized and avoid costly mistakes.

With smart bill management, you’ll enjoy greater financial freedom, fewer late fees, and more control over your money.

Sticking to these steps takes a bit of discipline, but once you have a system in place, managing bills becomes second nature.

Start today by making a list of your bills, setting up a bill management tool, and taking control of your financial future.

Share this post

Related Posts

Best 5 short-term cash forecasting methods

Discover effective short-term cash forecasting methods like receipts and disbursements, rolling forecasts, and scenario planning to optimize your business’s liquidity.Creating a budget when you have debt

This guide provides step-by-step advice on prioritizing debt repayment, tracking your spending, and adjusting your budget to regain control.How to manage your money when your income is seasonal

Managing money on a seasonal income can be challenging, but with the right strategies, you can thrive.

Try it now with your data

- Your free account in 2 minutes

- No credit card needed