Creating a budget when you have debt

- Why Budgeting is Crucial When You’re in Debt

- Step 1: Understand Your Financial Situation

- Gather Financial Information

- Step 2: Set Achievable Financial Goals

- Step 3: Choose Your Debt Repayment Strategy

- The Snowball Method

- The Avalanche Method

- Debt Consolidation

- Step 4: Design Your Monthly Budget

- Step 5: Track Your Spending with Banktrack

- Why Choose Banktrack for Expense Tracking?

- How Banktrack Helps You Stick to Your Budget

- Step 6: Boost Your Income

- Step 7: Celebrate Your Progress

- Step 8: Avoid New Debt

- Achieving Financial Freedom on Your Terms

This is how you can create a budget when you have debt.

Debt can feel like a heavy weight, holding you back from financial freedom.

But creating a budget that prioritizes debt repayment doesn’t have to mean sacrificing everything you enjoy.

Instead, it’s about managing your money so you can gradually regain control, reduce debt, and build a stable foundation for the future.

This guide will walk you through essential budgeting steps with practical tips and tools to help you pay off debt while balancing your financial life.

Why Budgeting is Crucial When You’re in Debt

A budget isn’t just about tracking what you spend; it’s a powerful tool to achieve your financial goals. For those managing debt, a solid budget can help:

- Prioritize payments: Identify which debts need attention first.

- Avoid new debt: By keeping track of spending, you’re less likely to borrow more.

- Reduce financial stress: Knowing you’re making progress can be a huge relief.

Creating a budget might sound intimidating, but it can be simple, manageable, and even empowering when done correctly. Let’s start with some foundational steps.

Step 1: Understand Your Financial Situation

Before creating a budget, you need a clear view of where your money is coming from and where it’s going.

Gather Financial Information

- Total Monthly Income: Calculate your monthly income from all sources—your primary job, freelance work, side hustles, or any other sources. Make sure you’re using your net income (what you actually take home after taxes).

- List of Debts: Make a detailed list of every debt you owe. This should include:

- Outstanding balance

- Interest rate

- Minimum monthly payment

- By knowing the specific amounts, you’ll be able to prioritize which debts to pay off first.

- Monthly Expenses: Write down every expense, separating essential costs from non-essentials:

- Essential expenses: Rent, groceries, utilities, transportation, and insurance.

- Non-essential expenses: Dining out, subscriptions, hobbies, etc.

Having everything laid out helps you understand your cash flow and pinpoint areas where you can cut back to focus on debt repayment.

Step 2: Set Achievable Financial Goals

Setting goals makes budgeting with debt less daunting. These goals will keep you motivated, especially when things get tough. Here are some examples:

- Prioritize High-Interest Debt: Focus on paying off debts with high-interest rates first, like credit cards or personal loans, to reduce the amount you pay in interest.

- Build an Emergency Fund: Even a small fund of $500 to $1000 can be a lifesaver. This will prevent you from adding new debt in case of unexpected expenses.

- Reward Yourself for Progress: Paying off debt takes time, so it’s important to include small rewards. Maybe you treat yourself to a night out or buy something you’ve wanted (within budget, of course) when you reach a milestone.

Step 3: Choose Your Debt Repayment Strategy

There’s no “one-size-fits-all” approach to paying off debt. Pick a strategy that suits your situation and motivates you to stay consistent.

The Snowball Method

The snowball method is great for quick wins. Focus on paying off your smallest debt first while making minimum payments on others. Once it’s gone, roll that payment into the next smallest debt. The quick victories keep you motivated!

The Avalanche Method

The avalanche method targets high-interest debt first, saving you the most money in the long run.

Start with the debt with the highest interest rate, regardless of balance, and then move to the next highest once that’s paid off. It might take longer to see progress, but it’s the most efficient.

Debt Consolidation

If you have multiple high-interest debts, consider consolidating them into one loan with a lower interest rate. This can simplify payments and reduce your overall interest, making debt more manageable.

Each of these methods works differently, so choose one based on what keeps you motivated and financially stable.

Step 4: Design Your Monthly Budget

Once you’ve chosen your repayment strategy, set up a budget to ensure you’re allocating enough toward debt payments while covering your essentials.

A popular way to organize your budget is through the 50/30/20 budget rule:

- 50% for Essentials: Use 50% of your income for necessary expenses like rent, utilities, and groceries.

- 30% for Discretionary Spending: Allocate 30% for wants, like entertainment or dining out.

- 20% for Debt Repayment and Savings: This portion goes toward paying off debt and building savings. If you have significant debt, you may want to increase this percentage by reducing discretionary spending.

Step 5: Track Your Spending with Banktrack

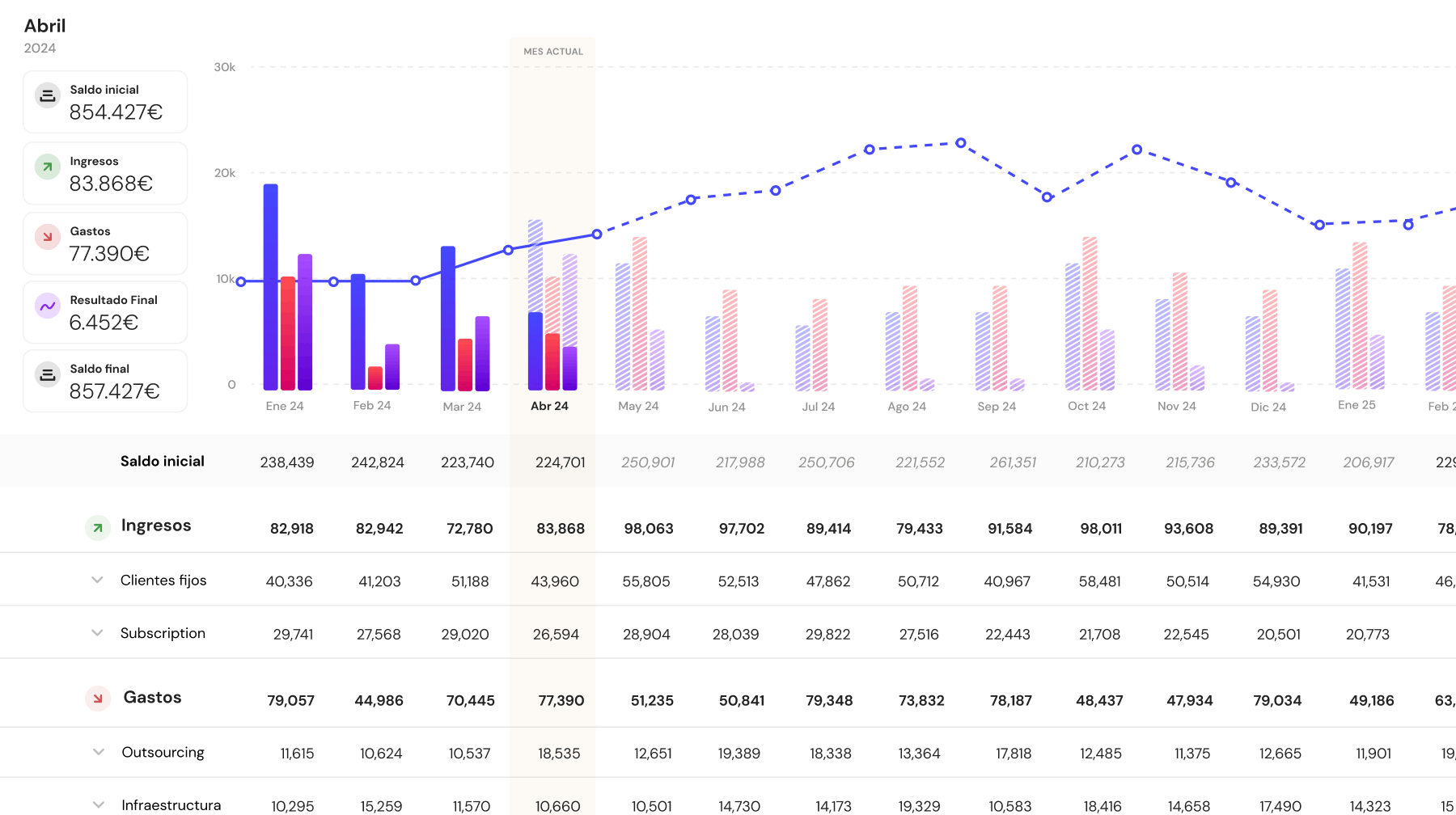

Tracking spending is crucial for staying within budget and ensuring that every dollar works toward your financial goals. Banktrack is an ideal tool to help manage your cash flow and monitor expenses.

Why Choose Banktrack for Expense Tracking?

Banktrack is a treasury management software designed to simplify and optimize financial tracking for businesses.

Here’s how it can benefit you in managing debt:

- Real-Time Financial Tracking: Connect Banktrack to multiple bank accounts for a comprehensive view of your income, expenses, and cash flow. This feature lets you monitor every transaction in real-time, making it easier to stick to your budget.

- Automated Invoice Management: Banktrack automates the invoicing process, saving time and reducing errors. It reconciles invoices automatically, helping you avoid missed payments and potential fees.

- Accurate Forecasting: The treasury cash flow forecasting software in Banktrack use historical data to provide reliable cash flow predictions. This is especially useful for those in debt, as it helps you anticipate upcoming expenses and manage your payments.

- Customizable Reports: With Banktrack, you can tailor reports to suit your needs. Whether you’re tracking expenses and receipts, cash flow, monthly expenses, or debt progress, custom reports make it easy to analyze your business' financial health.

How Banktrack Helps You Stick to Your Budget

Banktrack’s dashboard offers a snapshot of key financial metrics, giving you a quick view of your financial standing. Integration with other financial tools and banks streamlines your process, helping you keep track of every dollar without the hassle of manual entries.

For any business looking to control debt, Banktrack can make tracking easy and even enjoyable, letting you focus on meeting your financial goals with clear insights into cash flow and spending habits.

Step 6: Boost Your Income

Finding ways to increase your income can be a game-changer when you’re in debt. Every extra dollar you earn can go straight toward debt repayment.

Here are some simple ways to bring in extra income:

- Freelancing or Gig Work: Many freelancing platforms allow you to take on small jobs, from writing to graphic design, or even tutoring. These are the best cash management softwares for freelancers that will help you make the most of your money.

- Sell Unused Items: Declutter your space and make money by selling things you don’t need on platforms like eBay, Craigslist, or Facebook Marketplace.

- Negotiate Bills: Contact your providers to see if there are discounts on your phone, internet, or insurance. Even small savings add up over time.

The goal is to create a little extra income that can accelerate your debt repayment, helping you get ahead.

Step 7: Celebrate Your Progress

Paying off debt is a long journey, so celebrating milestones can keep you motivated.

It could be as simple as treating yourself to a small reward whenever you pay off a specific amount or reach a significant goal.

Tracking your progress, whether through Banktrack or a simple checklist, can make a big difference in staying positive. Remember, even small steps forward are wins!

Step 8: Avoid New Debt

One of the toughest parts of budgeting with debt is not adding to it. Staying disciplined can be challenging, especially when unexpected expenses come up. Here are a few tips:

- Use a Debit Card: Stick to debit for purchases rather than credit.

- Set Up a Small Emergency Fund: This can help you handle surprises without borrowing more.

- Unsubscribe from Retailer Emails: Avoid temptations by keeping your inbox free from sales and promotional emails.

The more you can avoid adding new debt, the faster you’ll reach your financial goals.

Achieving Financial Freedom on Your Terms

Budgeting when you’re in debt doesn’t mean giving up everything you enjoy. It’s about managing your finances in a way that keeps you on track toward your goals while allowing room for balance.

With tools like Banktrack, setting up a budget becomes manageable and even empowering. A well-structured budget can help you prioritize debt, track spending, and set yourself up for a debt-free future.

Stick to your plan, celebrate the small wins, and remember, each step brings you closer to financial freedom.

Share this post

Related Posts

9 steps to master money management

Mastering money management doesn’t have to be overwhelming. Our 9-step guide offers simple, actionable strategies to help you budget effectively and build a secure financial future.Never miss a payment with bill management

Take control of your payments with bill management solutions. Stay organized, set reminders, and ensure you never miss a due date again.How to manage your money when your income is seasonal

Managing money on a seasonal income can be challenging, but with the right strategies, you can thrive.

Try it now with your data

- Your free account in 2 minutes

- No credit card needed