9 steps to master money management

- Step 1: Create a Realistic Budget

- How to Create a Budget

- Using the 50/30/20 Rule

- Step 2: Track Your Spending with Money Management Tools

- Banktrack

- Step 3: Build an Emergency Fund

- How Much Should You Save?

- Tips for Building an Emergency Fund

- Step 4: Manage and Reduce Debt

- Snowball Method

- Avalanche Method

- Tips for Staying Debt-Free

- Step 5: Set Clear Financial Goals

- Step 6: Build Good Credit for Financial Flexibility

- Tips for Improving Your Credit Score

- Step 7: Start Investing for the Future

- How to Get Started with Investing

- Use an Investment Tracking Tool

- Step 8: Regularly Review and Adjust Your Budget

- Tips for Reviewing Your Finances

- Why Money Management Matters

- Take Control of Your Financial Future with Banktrack

- Why Choose Banktrack?

Money management is the cornerstone of financial success.

Effective money management isn’t about having a high income or sacrificing all the things you love, it’s about making smart choices with the resources you have.

This guide will take you through the essential steps to manage your money better, from budgeting and saving to investing and planning for long-term goals.

By following these steps, you can take control of your financial future and achieve greater peace of mind.

Step 1: Create a Realistic Budget

Budgeting is the foundation of effective money management.

A budget helps you understand where your money goes and allows you to make informed choices about spending and saving.

How to Create a Budget

- List Your Income: Start with your monthly take-home pay (after taxes).

- Identify Fixed Expenses: Write down bills and other fixed costs, such as rent, utilities, and car payments.

- Categorize Variable Expenses: Track costs that vary monthly, like groceries, dining out, entertainment, and shopping.

- Set Savings Goals: Include an amount for savings, even if it’s small, to build good financial habits.

Using the 50/30/20 Rule

A popular budgeting method is the 50/30/20 budget rule, which divides your income into three categories:

- 50% for Essentials: Rent, utilities, groceries, transportation.

- 30% for Wants: Dining out, hobbies, entertainment.

- 20% for Savings and Debt Repayment: Focus on building an emergency fund, retirement savings, and paying off debt.

Step 2: Track Your Spending with Money Management Tools

Tracking spending helps you stay within budget and highlights where you might overspend.

There are several tools designed to simplify this process, including:

Banktrack

For those serious about mastering money management, Banktrack is a powerful cash management software that combines powerful financial tracking features with real-time updates, detailed reports, and multi-account integration.

It’s designed for business who want to stay on top of their financial metrics, optimize cash flow and expenses. Here’s a closer look at how Banktrack can help you take control of your finances.

Key Features and Benefits of Banktrack

- Customizable Dashboards: One of the best features of Banktrack is its customizable dashboards. This flexibility allows you to create a financial overview tailored to your needs. You can choose to focus on specific areas, such as income streams, spending categories, cash flow, or savings goals. The dashboard serves as your personal financial snapshot, making it easy to check your financial health at a glance.

- Seamless Integration with Multiple Accounts: Banktrack syncs with over 120 banks, including both traditional financial institutions and digital neobanks, using secure connections through Open Banking or Direct Access. This means you can connect all of your accounts, checking, savings, credit cards, and investment accounts,and manage them from a single platform. Instead of logging into multiple apps or websites, Banktrack gives you a unified view, making it easier to understand your entire financial picture.

- Customizable Spending Limits: With Banktrack, you can set personalized spending limits across different categories. If you’re trying to reduce your dining-out expenses or keep a close eye on entertainment spending, Banktrack will alert you when you’re nearing your set limit. This feature helps you stay on track with your budget and avoid overspending, especially in areas where you tend to spend impulsively.

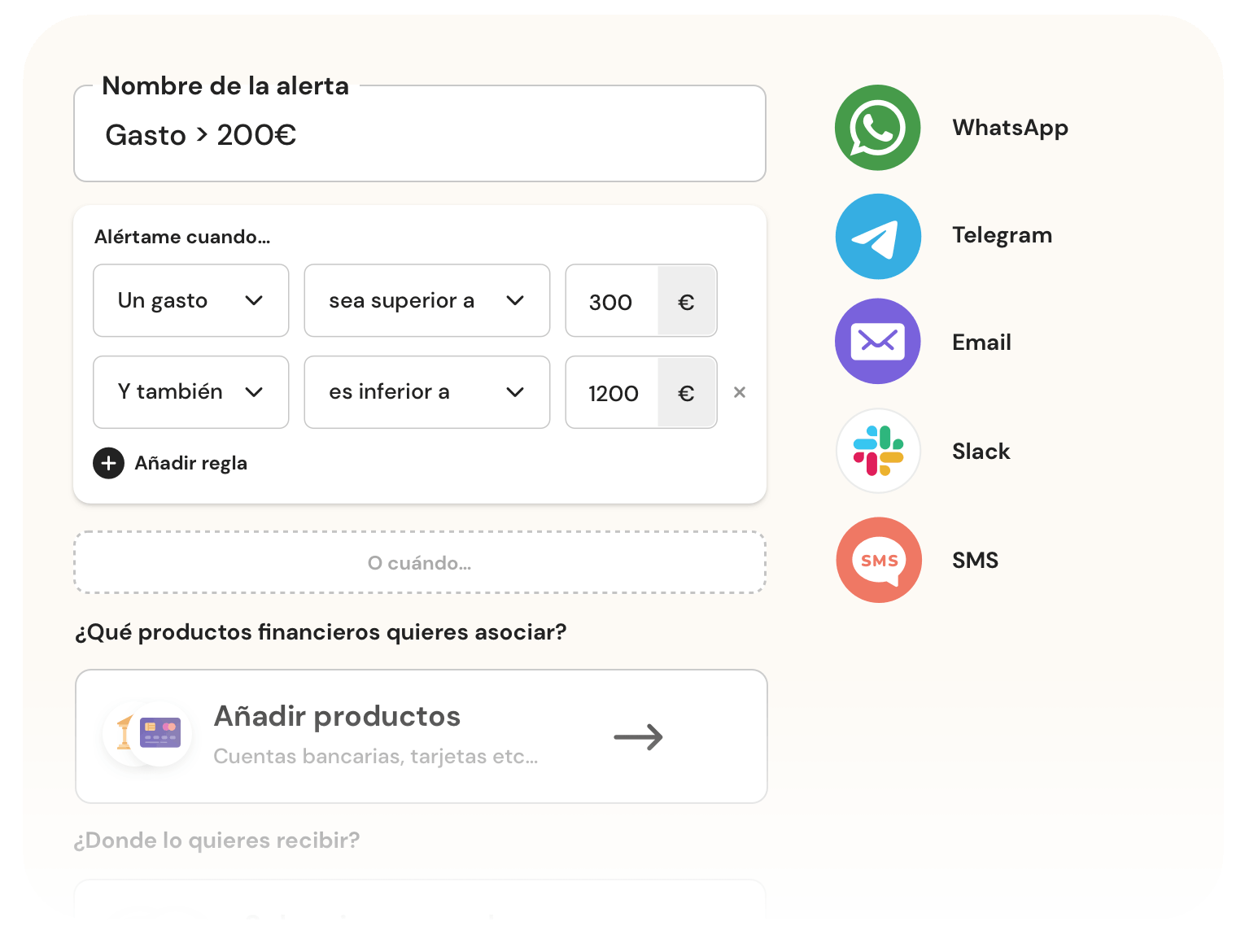

- Automated Alerts and Real-Time Notifications: Banktrack’s automated alert system helps you avoid missed payments, low balances, and duplicate charges. You can customize these alerts to your preferred communication channel, WhatsApp, SMS, email, Slack, or Telegram, so you’re always informed. Real-time notifications ensure you’re aware of every important financial update, helping you avoid costly mistakes like late fees or overdraft charges.

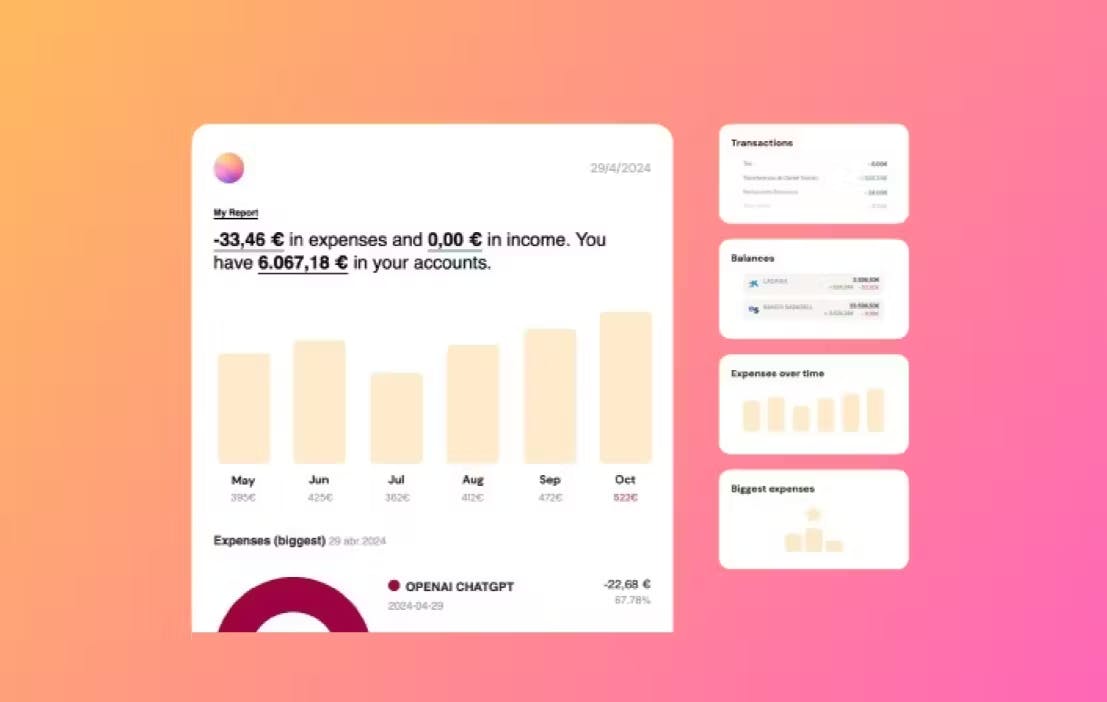

- Drag-and-Drop Reporting Interface: Banktrack makes creating reports simple and intuitive with its drag-and-drop interface. You can generate comprehensive financial reports, customize them to include specific data points, and easily share them with others, such as family members or financial advisors. Whether you’re tracking monthly expenses, reviewing income trends, or monitoring savings progress, Banktrack’s reporting tools provide clear, actionable insights.

- Advanced Security Features: Money management requires security, and Banktrack places a strong emphasis on protecting user data. With advanced encryption and secure login protocols, you can trust that your financial information is safe and only accessible to you. Banktrack is designed to meet strict security standards, making it a reliable choice for those who prioritize privacy in their treasury management softwares.

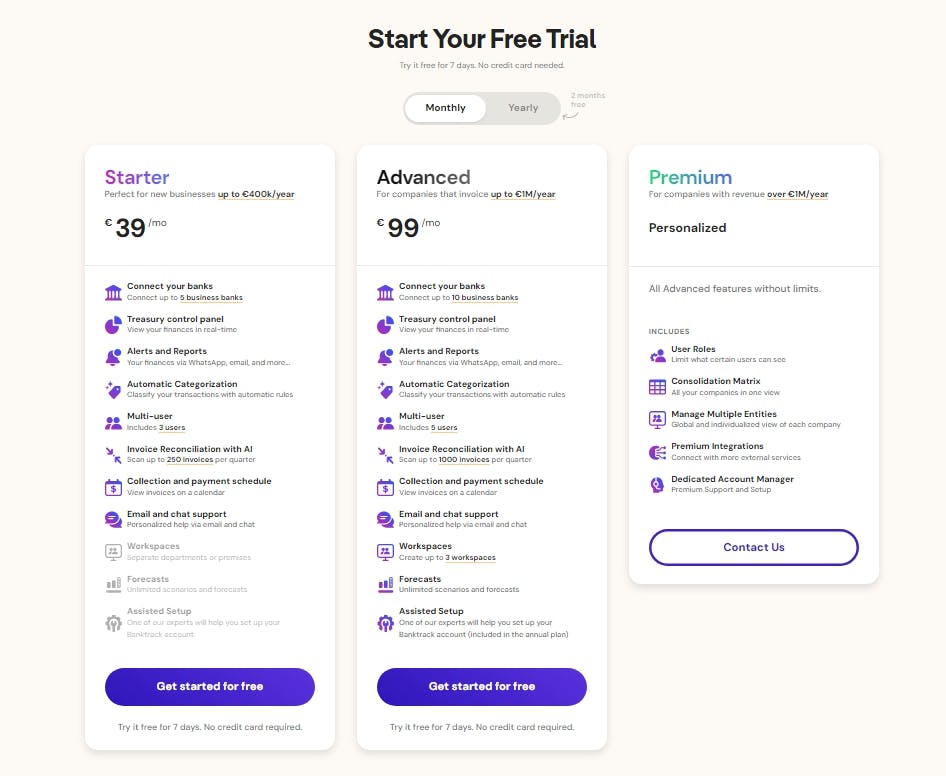

- Affordable Pricing for Individuals and Businesses: Banktrack offers an affordable solution for anyone looking to streamline their finances. For businesses, the price provides excellent value, as Banktrack’s features allow for more efficient expense tracking and cash flow management.

How Banktrack transforms your money management

Using Banktrack means having a complete, real-time view of your finances with every tool you need to stay organized and make informed decisions.

Here’s how Banktrack can enhance different areas of money management:

- Income and Expense Tracking: Banktrack automatically categorizes transactions and gives you insights into your spending patterns. By understanding where your money goes each month, you can make smarter financial decisions and allocate more toward savings or debt reduction.

- Goal Setting and Progress Monitoring: Whether you’re saving for a big purchase, paying off debt, or building an emergency fund, Banktrack’s goal-setting tools make it easy to track progress. You can set specific goals, monitor milestones, and adjust your budget as you move closer to achieving them.

- Budget Control and Overspending Alerts: Banktrack’s customizable spending limits and alerts are invaluable for anyone trying to control their budget. By receiving alerts before you overspend in certain categories, you stay accountable and are less likely to exceed your monthly budget.

- Seamless Financial Management for Multiple Accounts: Banktrack’s integration with various financial accounts allows you to view all your accounts, transactions, and balances in one place. This is particularly useful for users with multiple income sources or varied expense accounts, as it eliminates the hassle of tracking each account separately.

- Enhanced Cash Flow and Financial Planning: Banktrack’s reports and forecasting tools are especially helpful for small business owners or individuals with variable income. By analyzing past trends and setting up cash flow projections, Banktrack gives you a clear understanding of your financial trajectory, allowing for better planning and budgeting.

If you’re ready to transform the way you manage your money, Banktrack is the ultimate tool for achieving financial control and setting yourself up for a secure future.

Step 3: Build an Emergency Fund

An emergency fund is a financial safety net for unexpected expenses like medical bills, car repairs, or job loss.

It’s an essential part of money management, as it helps you avoid debt when life throws you a curveball.

How Much Should You Save?

A good starting point is three to six months’ worth of living expenses. This means if you spend $3,000 a month on essentials, aim for an emergency fund of $9,000 to $18,000.

Tips for Building an Emergency Fund

- Set Automatic Transfers: Direct a small amount from your paycheck into a savings account each month.

- Reduce Non-Essential Spending: Channel the savings toward your emergency fund.

- Use a High-Yield Savings Account: This allows your money to grow a bit while it sits in reserve.

Step 4: Manage and Reduce Debt

Debt can be a huge obstacle to financial freedom, but with a strategic plan, you can take control of it. Here are two popular strategies for paying down debt:

Snowball Method

With the snowball method, focus on paying off the smallest debt first while making minimum payments on others.

Once the smallest debt is paid off, apply that amount to the next debt. This approach builds momentum and motivation.

Avalanche Method

The avalanche method involves focusing on debts with the highest interest rates first.

This saves you more money over time, as high-interest debt adds up quickly.

Tips for Staying Debt-Free

- Avoid High-Interest Loans: Stick to low-interest credit cards and avoid payday loans.

- Pay More Than the Minimum: Even a small extra payment each month can reduce your debt faster.

- Use Debt Consolidation: Consolidating debts into one loan with a lower interest rate can simplify payments and reduce costs.

Step 5: Set Clear Financial Goals

Setting financial goals helps you stay motivated and focused. Goals can range from short-term (saving for a vacation) to long-term (retirement planning).

Here’s how to set effective goals:

- Define Specific Goals: Break down goals into clear steps, such as saving $5,000 for a car down payment or building a $50,000 retirement fund.

- Create a Timeline: Set a realistic timeline for achieving each goal.

- Track Progress: Regularly review your progress and adjust as needed.

Having concrete goals gives purpose to your money management efforts, making it easier to stay disciplined and motivated.

Step 6: Build Good Credit for Financial Flexibility

Your credit score is an important part of financial management, as it affects loan approval, interest rates, and even some job opportunities.

Building good credit can help you secure better financial options when needed.

Tips for Improving Your Credit Score

- Pay Bills on Time: Payment history is one of the biggest factors in your credit score.

- Keep Credit Card Balances Low: Aim to use less than 30% of your available credit limit.

- Avoid Opening Too Many Accounts: Each new credit inquiry can lower your score temporarily.

- Check Your Credit Report: Review it annually for errors and take steps to correct them.

Maintaining a good credit score gives you more options for borrowing, and it often means lower interest rates when you need a loan.

Step 7: Start Investing for the Future

Once you have a budget, an emergency fund, and a debt repayment plan in place, consider investing.

Investing allows your money to grow over time, helping you reach long-term goals like retirement or buying a home.

How to Get Started with Investing

- Determine Your Risk Tolerance: Decide how much risk you’re comfortable with, as this will guide your investment choices.

- Choose an Investment Account: Open a brokerage account or retirement account, such as an IRA or 401(k).

- Start Small: Begin with small investments in low-cost index funds, ETFs, or stocks to build confidence.

Use an Investment Tracking Tool

Tools like Banktrack allow you to monitor your investments and track portfolio performance over time.

Having a clear view of your investments can help you make smarter decisions and stay informed about your financial progress.

Step 8: Regularly Review and Adjust Your Budget

Money management isn’t a “set it and forget it” process. As your life and goals change, your budget and spending habits will need to adapt.

A regular financial check-in helps ensure you’re on the right path.

Tips for Reviewing Your Finances

- Monthly Review: Go over your budget at the end of each month to assess spending and saving habits.

- Quarterly Goal Check: Revisit financial goals and track progress.

- Annual Financial Audit: Conduct a full review of your finances, including credit score, debt, savings, and investments, to ensure you’re on track.

Regular check-ins allow you to make proactive adjustments, so you’re always prepared for changes in income, expenses, or financial goals.

Why Money Management Matters

Good money management isn’t just about avoiding debt or saving a bit every month.

It impacts every part of your life, from stress levels to the freedom to make big life decisions. Here are a few reasons why it matters:

- Financial Security: Managing money well means having savings, reducing debt, and preparing for emergencies.

- Stress Reduction: Knowing where your money is going can significantly lower stress and give you a sense of control.

- Financial Freedom: Good money management helps you reach goals, whether it’s buying a house, retiring comfortably, or traveling.

Take Control of Your Financial Future with Banktrack

Mastering money management takes time and discipline, but it’s one of the most valuable skills you can develop.

By following these steps, creating a budget, building an emergency fund, managing debt, setting goals, and investing, you’re setting yourself up for financial stability and freedom.

Remember, financial success is a journey. Start with small steps, use tools like Banktrack to keep track of your progress, and make adjustments as needed.

Why Choose Banktrack?

With its perfect combination of flexibility, customization, and real-time financial tracking, Banktrack offers features that go beyond typical budgeting apps.

In today’s fast-paced financial landscape, where transactions and bills can pile up quickly, Banktrack simplifies the entire process, saving you time, money, and stress.

With consistent effort, you’ll achieve greater financial security, peace of mind, and the freedom to manage your business on your terms.

Share this post

Related Posts

Creating a budget when you have debt

This guide provides step-by-step advice on prioritizing debt repayment, tracking your spending, and adjusting your budget to regain control.Top 6 best budgeting tools

Simplify money management and help you take control of your finances. Find the perfect app to track expenses, set goals, and save smarter.

Try it now with your data

- Your free account in 2 minutes

- No credit card needed