Top 6 best budgeting tools

- 1. Banktrack

- Key Features of Banktrack:

- Why Banktrack is the Top Choice

- 2. Mint

- Key Features of Mint:

- 3. You Need A Budget (YNAB)

- Key Features of YNAB:

- 4. PocketGuard

- Key Features of PocketGuard:

- 5. EveryDollar

- Key Features of EveryDollar:

- 6. Empower

- Key Features of Empower:

- Why Use a Budgeting Tool?

- How to Choose the Right Budgeting Tool for You

- Maximizing Your Budgeting Tool’s Potential

- Take Control of Your Finances with Banktrack

These are the top 6 best budgeting tools:

- Banktrack

- Mint

- You Need A Budget

- PocketGuard

- EveryDollar

- Empower

Creating a budget is one of the most effective ways to take control of your finances, reduce debt, and work toward financial stability.

Budgeting tools make it easier by organizing expenses, tracking spending, and setting reminders, so you never miss a payment.

This guide covers the top budgeting tools available today, with a focus on their unique features and how they can help you reach your financial goals.

1. Banktrack

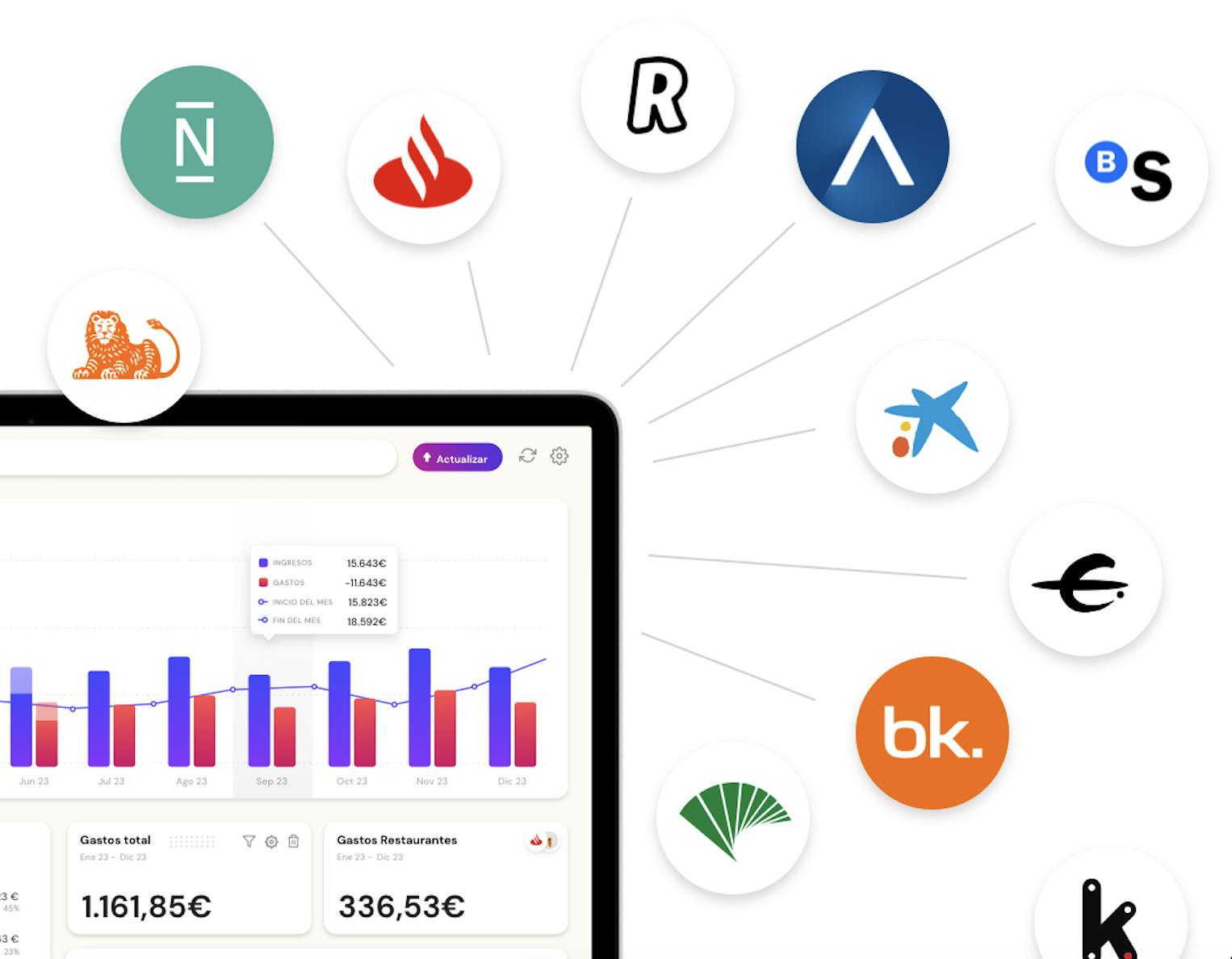

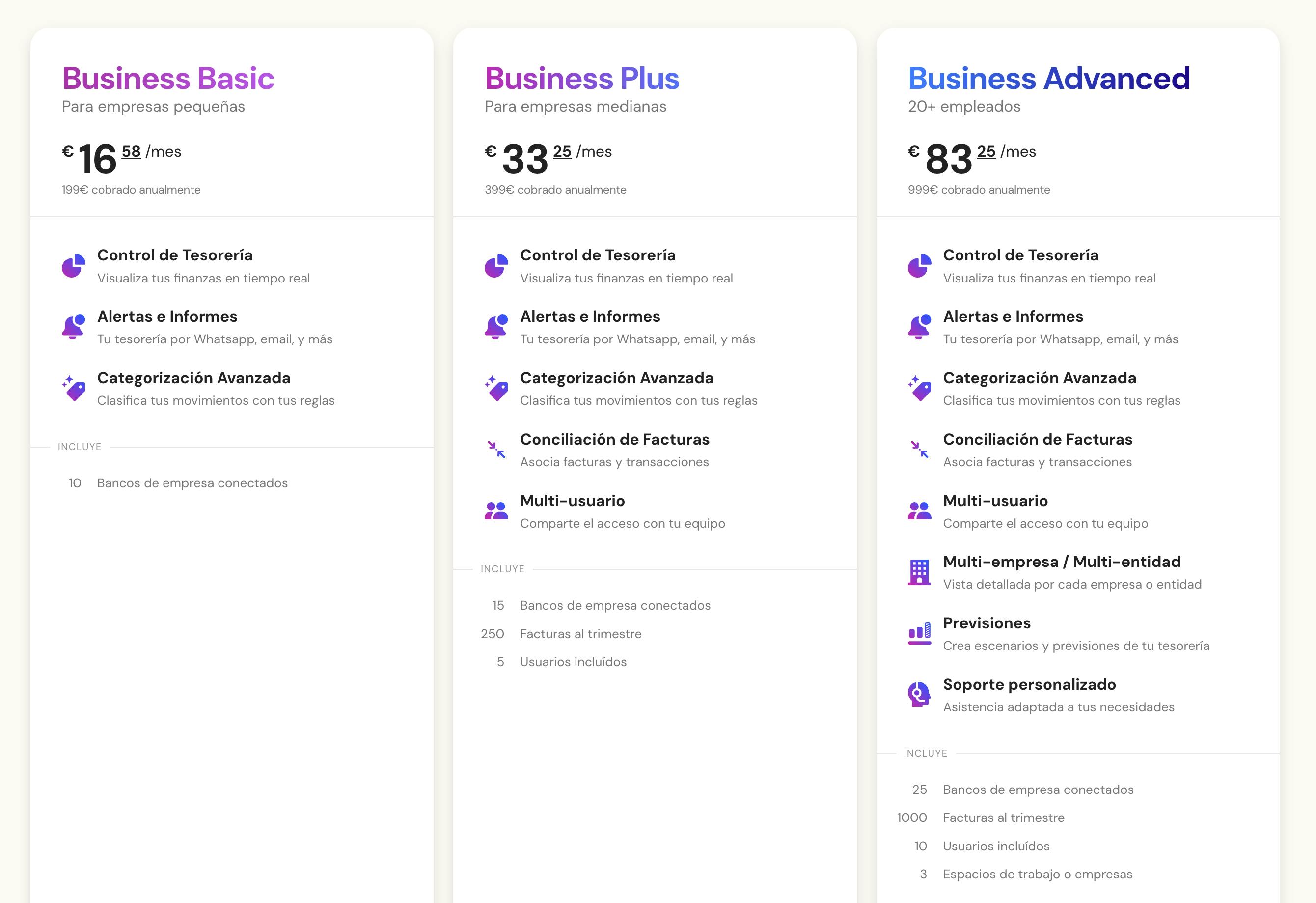

Banktrack is a comprehensive budgeting tool that stands out for its integration with over 120 banks, strong expense tracking, and real-time financial insights.

With Banktrack, you can manage everything from personal finance tracking to complex business finances, making it an ideal choice for both individuals and businesses.

Key Features of Banktrack:

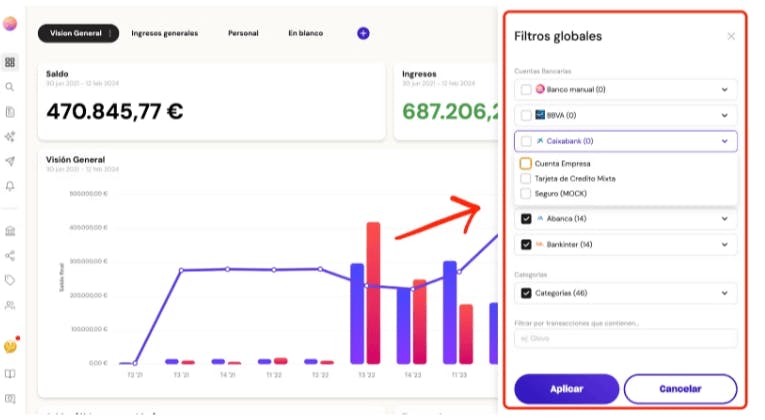

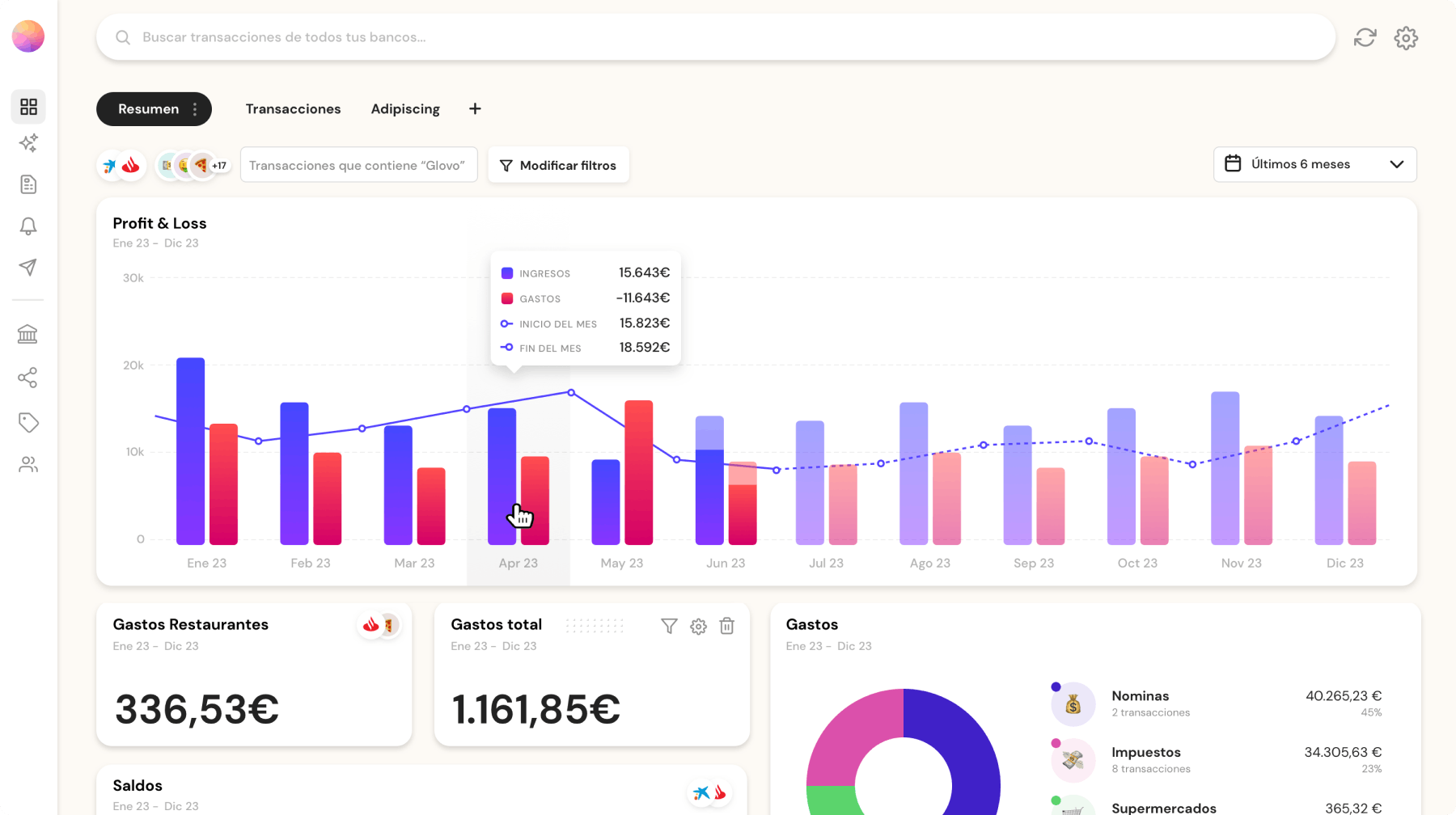

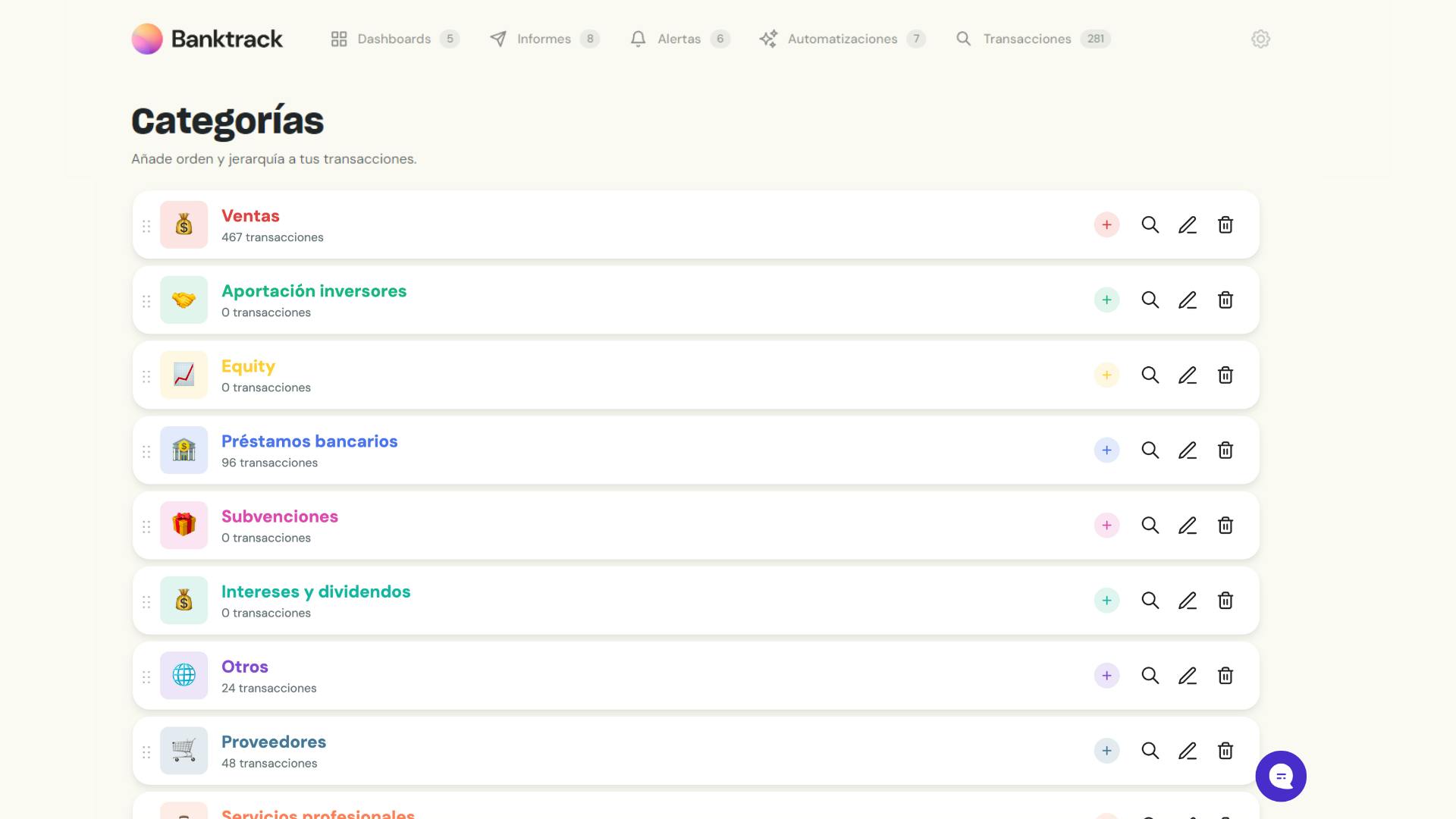

- Personalized Dashboards: Banktrack lets you customize your financial dashboard, allowing you to focus on what matters most. Track income, spending, cash flow, and more at a glance.

- Seamless Multi-Account Integration: Banktrack connects to both traditional banks and digital neobanks using Open Banking or Direct Access, giving you a single view of all your accounts in one place.

- Customizable Spending Limits: Set limits for different spending categories, and Banktrack will alert you if you’re nearing a cap, spotting a duplicate charge, or have a low balance. This keeps you on top of your finances without the guesswork.

- Automated Alerts and Reports: Banktrack sends real-time alerts via WhatsApp, SMS, email, Slack, or Telegram, keeping you informed about upcoming bills, spending, and account changes.

- User-Friendly Interface: With a drag-and-drop system for report creation, Banktrack makes it easy to generate and share financial insights with just a few clicks.

- Affordable Pricing: Starting at just €16.58 per month, Banktrack provides an affordable, high-value solution for anyone serious about optimizing their finances.

Why Banktrack is the Top Choice

With its range of features and integrations, Banktrack goes beyond basic budgeting, allowing users to manage their entire financial world.

The customizable dashboards and automated alerts give you control over spending, while multi-account support makes it easier to manage diverse income and expenses.

Banktrack is the ultimate choice for those looking to simplify, organize, and optimize their financial lives.

Best For: Individuals and businesses seeking a powerful, all-in-one budgeting and cash management software.

2. Mint

Mint is a popular, free budgeting tool that offers an easy-to-use platform with bank integrations and bill-tracking features.

With Mint, you can link all your accounts and get an overview of your financial health, making it a convenient choice for anyone starting with budgeting.

Key Features of Mint:

- Automatic Categorization: Mint categorizes your spending automatically, providing insights into where your money goes.

- Credit Score Monitoring: Mint includes a free credit score tracker to keep you informed of your financial health.

- Bill Tracking and Alerts: Get reminders for due dates and avoid late fees.

Best For: Individuals looking for a free, all-in-one tool to track spending, monitor credit, and manage budgets.

3. You Need A Budget (YNAB)

YNAB is known for its zero-based budgeting approach, where every dollar is assigned a purpose.

This tool encourages proactive budgeting, making it ideal for those who want to control every dollar of their budget and prioritize debt reduction or saving.

Key Features of YNAB:

- Goal Setting: Set and track savings and debt payoff goals.

- Detailed Reports: YNAB provides detailed spending and income reports, helping you understand where you can improve.

- Debt Payoff Tools: YNAB focuses on paying down debt and building financial security.

Best For: People who want a structured approach to budgeting with a focus on debt reduction.

4. PocketGuard

PocketGuard is designed to keep you from overspending by showing you exactly how much you can safely spend after covering essentials.

It’s straightforward and perfect for users who want a quick view of their finances without too many additional features.

Key Features of PocketGuard:

- “In My Pocket” Feature: Shows you available spending money after bills and goals.

- Bill Negotiation: PocketGuard can help you find better deals on recurring bills, potentially saving you money.

- Savings Goals: Set and track goals directly in the app to stay on top of your savings.

Best For: Users who want a simple budgeting app focused on avoiding overspending.

5. EveryDollar

EveryDollar is a budgeting app based on Dave Ramsey’s zero-based budgeting philosophy.

The app is easy to use, perfect for those looking to create a strict budget without overwhelming features.

Key Features of EveryDollar:

- Zero-Based Budgeting: Assign every dollar to a specific category to create a structured budget.

- Debt Snowball Tool: Prioritize debt payments and use the debt snowball method to pay off debt faster.

- Intuitive Interface: Simple design and easy setup, making it ideal for beginners.

Best For: Fans of Dave Ramsey’s financial principles or those who want a streamlined budgeting tool.

6. Empower

Empower combines budgeting with investment tracking, making it a solid choice for those who want to manage their finances and monitor their wealth-building efforts in one place.

This tool provides insights into spending patterns and tracks investment performance.

Key Features of Empower:

- Cash Flow and Budget Tracking: Track income and spending trends over time.

- Investment Analysis: Monitor portfolio performance, asset allocation, and fees.

- Retirement Planning Tools: Project retirement savings based on current expenses and investments.

Best For: Individuals looking for an all-in-one solution that combines budgeting and investment management.

Why Use a Budgeting Tool?

A budgeting tool serves as a personal finance assistant, helping you monitor every dollar you earn and spend.

Here’s why using one can be a game-changer:

- Automated Expense Tracking: Most tools link directly with your bank accounts and automatically categorize expenses, saving you time and effort.

- Visual Insights: These tools offer charts and dashboards, making it easy to understand spending patterns.

- Goal-Oriented Features: Budgeting tools let you set goals for saving, debt reduction, or spending, and track your progress.

- Stress Reduction: Having a clear picture of your finances and knowing you’re on top of your budget eases financial anxiety.

Let’s dive into the top budgeting tools that can help you manage your finances effectively.

How to Choose the Right Budgeting Tool for You

Here’s a quick summary to help you choose the right budgeting tool based on your needs:

- For all-in-one financial tracking: Banktrack offers customizable dashboards, alerts, and multi-account integration for comprehensive budgeting.

- For a free solution: Mint provides an accessible platform for tracking spending, credit, and bills.

- For zero-based budgeting: Both YNAB and EveryDollar encourage strict budgeting, with features to support debt reduction.

- For simple, on-the-go budgeting: PocketGuard offers a clear view of your finances and helps control discretionary spending.

- For budgeting with investment tracking: Empower is ideal for users who want to monitor spending and investments.

Maximizing Your Budgeting Tool’s Potential

To make the most out of your budgeting tool, follow these tips:

- Set Clear Goals: Define what you want from your budget, such as debt reduction or saving for a big purchase.

- Regularly Review Your Budget: Check in weekly to stay on track with your spending and make adjustments as needed.

- Use Notifications and Alerts: Enable alerts to remind you of upcoming bills, low balances, or spending caps.

- Analyze Spending Reports: Most tools offer reports to help you identify where you can save.

- Stick with Your Budget: Consistency is key, create a budget that works for you and follow it regularly.

Take Control of Your Finances with Banktrack

Budgeting tools are essential for anyone serious about taking control of their finances. With a variety of options available, you can find a tool that fits your financial goals and lifestyle.

Banktrack stands out as an all-inclusive solution for those who want both personal and business budgeting with real-time tracking and bank integration.

Whichever tool you choose, remember that budgeting is a journey. With the right tool in place, you’ll gain a clear understanding of your finances, make smarter spending decisions, and work toward financial stability and success.

Share this post

Related Posts

Best 6 Subscription Manager Apps for 2025

Tired of losing track of subscriptions? Check out the top subscription manager apps that make it easy to organize, monitor, and cancel services you no longer need.Best 11 alternatives to Monarch Money

These are the best 11 alternatives to Monarch Money for budgeting and finance tracking in 2024.9 steps to master money management

Mastering money management doesn’t have to be overwhelming. Our 9-step guide offers simple, actionable strategies to help you budget effectively and build a secure financial future.

Try it now with your data

- Your free account in 2 minutes

- No credit card needed