How to Determine if you Need a Business Budgeting Software

- What is a Business Budgeting Software?

- 5 Reasons Why a Business Budgeting Software is a Game-Changer

- 1. Say Goodbye to Human Error

- 2. Save Time, Make Money

- 3. Teamwork Makes the Dream Work

- 4. Real-Time Financial Updates

- 5. Grow Without the Growing Pains

- 6 Key Features to Look For in Business Budgeting Software

- 1. Customizable Templates

- 2. Integrations

- 3. Forecasting and Scenario Planning

- 4. User-Friendly Interface

- 5. Security Features

- 6. Comprehensive Reporting Tools

- Choose the Right Business Budgeting Software for Your Business in 5 Steps

- 1. Understand Your Needs

- 2. Do Your Homework: Research

- 3. Think About the Future

- 4. Support and Training

- 5. Budget for Your Budgeting Software

- Top 5 Business Budgeting Softwares

- 1. Banktrack

- 2. QuickBooks Online

- 3. FreshBooks

- 4. PlanGuru

- 5. Xero

- Why Banktrack is the Best Budgeting Software for You

We show you how to determine if you need a business budgeting software.

Managing your business's finances can feel like juggling flaming swords while blindfolded.

But what if I told you there’s a tool that can turn this daunting task into something manageable, even enjoyable?

In this guide, we’ll explore everything you need to know about business budgeting, from what it is and why you need a software dedicated to it, to how it can transform the way you manage your business.

We’ll also dive into the must-have features and help you figure out which software might be your perfect match.

What is a Business Budgeting Software?

Let’s start with the basics. A business budgeting software is a type of program designed to help you create, manage, and monitor your company’s budget.

Imagine having a digital financial helper by your side, crunching numbers, forecasting the future, and making sure every dollar is accounted for, all while you focus on growing your business.

But why should you care about budgeting software? Well, unless you enjoy the thrill of manually updating spreadsheets and risking your financial future on human error, budgeting software is your best friend.

It takes the guesswork out of financial planning, so you can make smarter decisions faster.

5 Reasons Why a Business Budgeting Software is a Game-Changer

Let’s face it, most of us didn’t start a business because we love managing finances.

Yet, keeping your budget in line is one of the most crucial aspects of running a successful business.

That’s where budgeting software comes in, acting like a personal trainer for your finances.

Here are some ways and advantages a budgeting software has for you:

1. Say Goodbye to Human Error

Ever tried balancing a budget after a long day? One tiny slip of the finger, and suddenly, your spreadsheet is telling you that you’ve made a profit when you’re actually in the red.

A budgeting software reduces the chance of errors by automating calculations, ensuring your numbers are always spot on.

2. Save Time, Make Money

Let’s be honest, there are a million things you’d rather do than spend hours on budget planning.

A budgeting software speeds up the process by automating repetitive tasks automating repetitive tasks, so you can focus on what really matters: growing your business.

Think of it as outsourcing the boring stuff to a very efficient robot.

3. Teamwork Makes the Dream Work

If your business is more than just you, budgeting often involves multiple departments.

A budgeting software lets your whole team collaborate in real-time, ensuring everyone’s on the same page.

No more frantic emails trying to figure out who changed what; the software keeps track of everything.

4. Real-Time Financial Updates

One of the best things about a budgeting software is that it gives you real-time updates on your finances. Imagine knowing exactly where your money is at all times, without having to dive into endless reports.

With just a few clicks, you can see how your business is doing and make adjustments on the fly.

5. Grow Without the Growing Pains

As your business expands, your financial management needs will evolve.

A budgeting software is built to scale, meaning it can handle your business’s growth without missing a beat.

Whether you’re a startup or a multinational, the right software will grow with you.

6 Key Features to Look For in Business Budgeting Software

Now that you’re sold on the idea of getting a budgeting software, let’s talk about what features to look for.

Not all softwares are created equal, so it’s important to find one that fits your business like a glove. Here are some key features to keep an eye on:

1. Customizable Templates

Every business is unique, and your budgeting software should reflect that.

Look for a software that offers customizable templates so you can create budgets tailored to your specific needs.

Whether you’re in retail, tech, or a dog-walking empire, you want a tool that speaks your language.

2. Integrations

Chances are, you’re already using other financial tools like an accounting software, payroll systems, and maybe even some nifty apps for tracking expenses.

The best budgeting software will integrate seamlessly with these tools, creating a unified financial ecosystem that saves you time and headaches.

3. Forecasting and Scenario Planning

We all wish we had a crystal ball, but the next best thing is forecasting tools in your budgeting software.

These features let you predict future financial outcomes based on past data and even play out different scenarios to see what could happen if you make certain decisions.

It’s like running a business with a sneak peek into the future, pretty cool, right?

Take a look into the best treasury cash flow forecasting software out there.

4. User-Friendly Interface

If your software requires a Ph.D. to operate, it’s probably not the best fit.

Look for a user-friendly interface that you and your team can pick up quickly.

The easier it is to use, the more likely you are to stick with it, and the less time you’ll spend cursing at your computer screen.

5. Security Features

Your financial data is like the crown jewels of your business, and you need to keep it safe.

Make sure the software you choose has strong security features, including data encryption, user authentication, and regular backups.

You wouldn’t leave your front door unlocked, so don’t leave your financial data vulnerable.

6. Comprehensive Reporting Tools

Having all your financial data in one place is great, but it’s only useful if you can make sense of it.

Look for software with strong reporting tools that turn raw data into easy-to-understand reports.

Whether you need a quick overview or a deep dive into the details, good reporting tools and even dashboards are essential.

Choose the Right Business Budgeting Software for Your Business in 5 Steps

Now that you know what to look for, it’s time to choose the right software. But with so many options out there, how do you pick the one that’s right for you?

Don’t worry, we’ve got you covered with these simple steps.

1. Understand Your Needs

Start by taking a good, hard look at your business’s specific needs.

What are your biggest financial challenges? Do you need help with forecasting, or are you drowning in spreadsheets?

By understanding your pain points, you can narrow down the features that are most important to you.

2. Do Your Homework: Research

Next, it’s time to dive into the research phase.

Look for reviews, compare features, and maybe even reach out to other business owners to see what they’re using.

Don’t be afraid to ask for demos or free trials, getting hands-on experience with the software is the best way to see if it’s a good fit.

3. Think About the Future

As your business grows, your needs will change, and your software should be able to grow with you.

Make sure the solution you choose is scalable, so you don’t have to start from scratch every time you hit a new milestone.

4. Support and Training

Even the best software can be tricky to learn at first, so make sure the provider offers solid support and training resources.

Whether it’s online tutorials, customer support, or a helpful FAQ section, having resources at your fingertips can make the transition smoother.

5. Budget for Your Budgeting Software

Finally, consider your budget for a budgeting software.

While it’s tempting to go for the cheapest option, remember that you get what you pay for.

Consider the value the software will bring to your business and weigh that against the cost.

If you find the options too expensive for your needs, you may be looking for a personal finance tracking app instead.

Investing in a good tool now can save you money (and stress) in the long run.

Top 5 Business Budgeting Softwares

To help you get started on your search, let’s take a look at some of the most popular budgeting software options out there.

Each of these tools has its own strengths, so consider which one aligns best with your business needs.

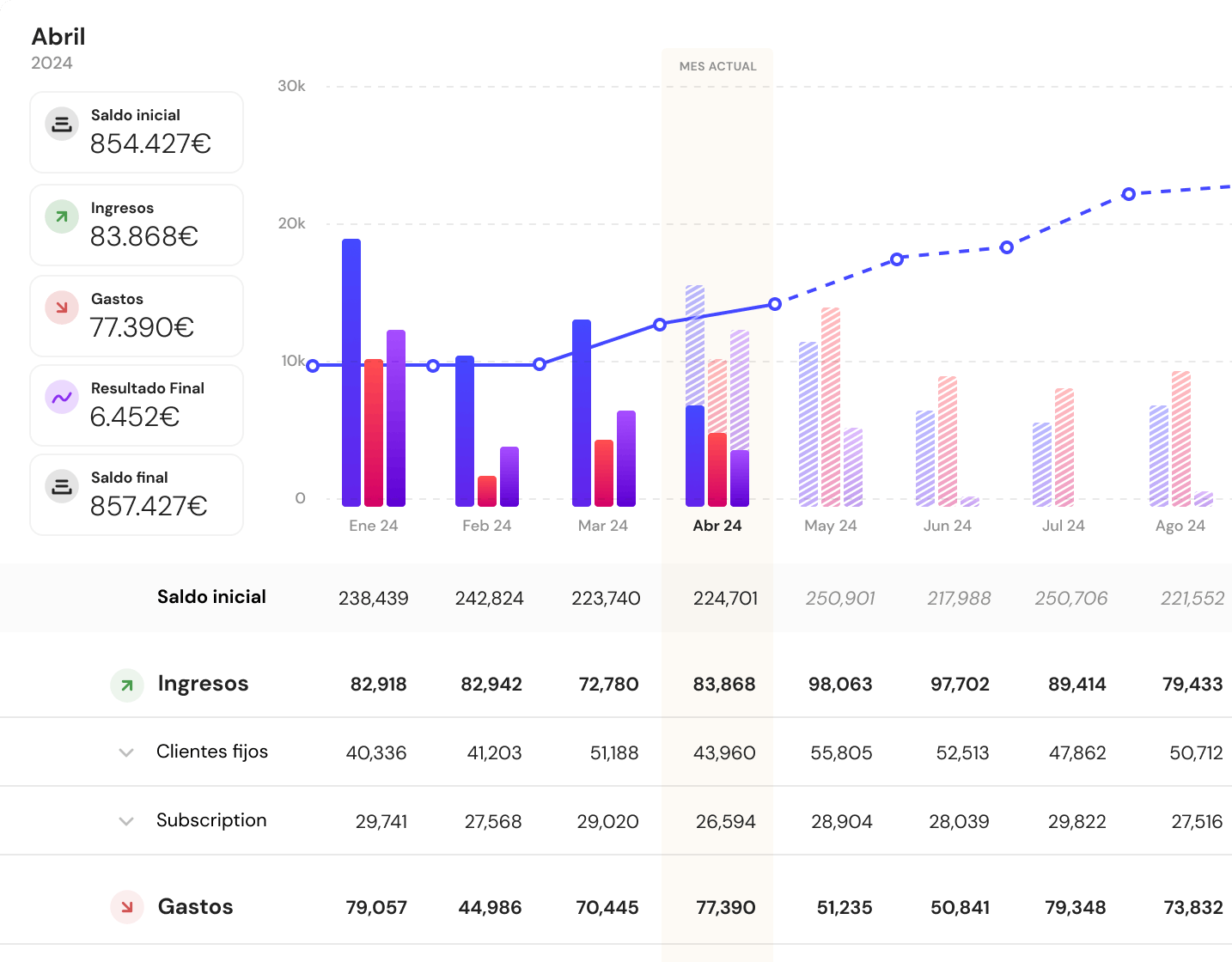

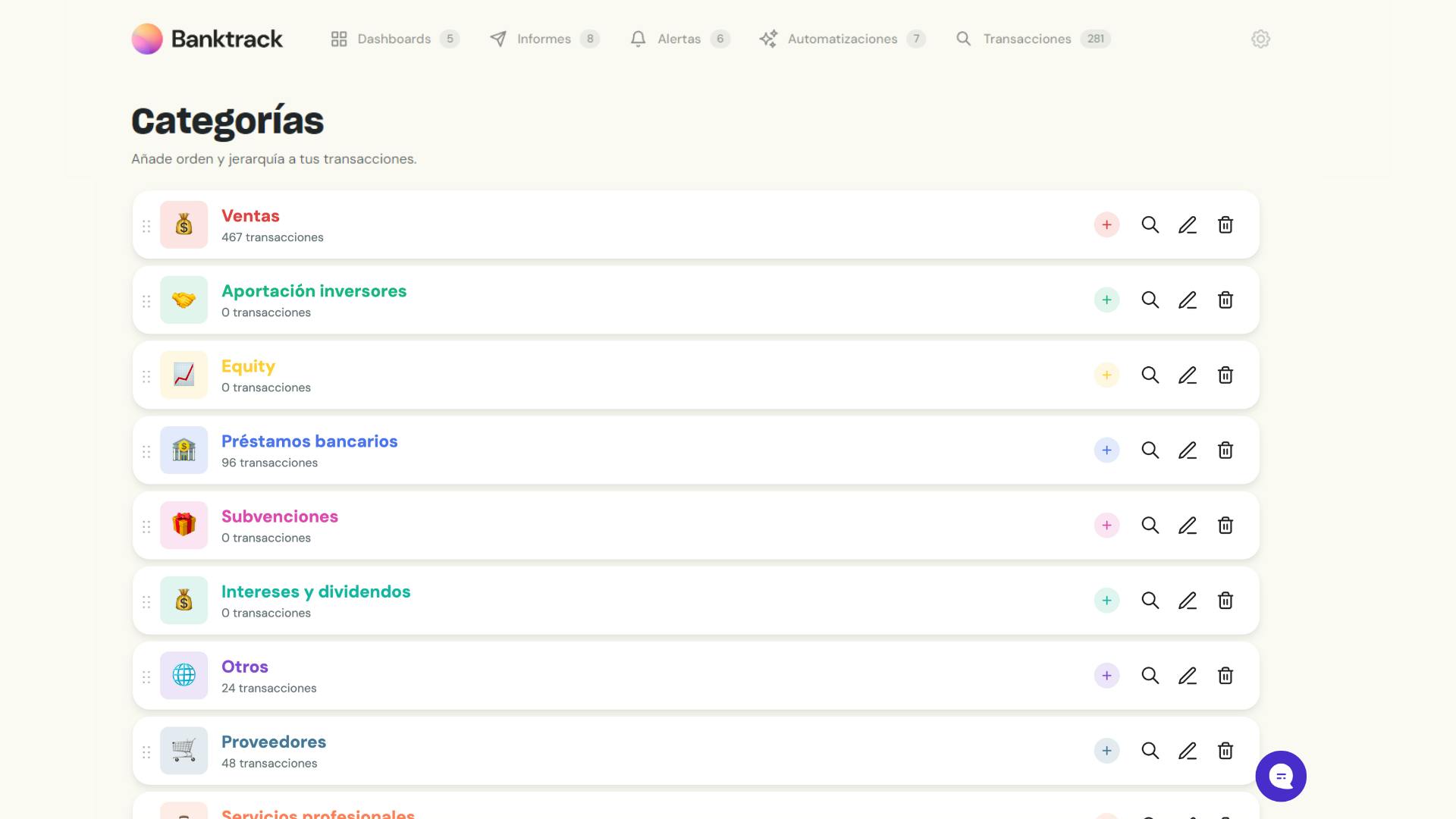

1. Banktrack

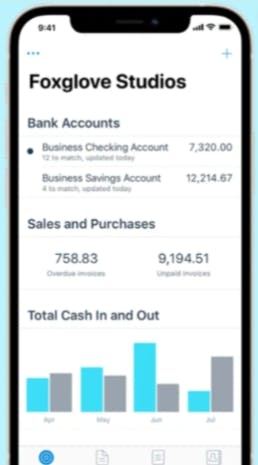

If you’re looking for a business budgeting software that gives you real-time financial insights, Banktrack is the way to go.

Unlike traditional methods, which can quickly become outdated, Banktrack provides up-to-the-minute information on your financial situation. This means that you can use it as a cash visibility tool, so you can react quickly to changes in cash, making it easier to manage liquidity and avoid financial shortfalls.

Banktrack isn’t just about keeping your data fresh; it also improves accuracy by reducing the risk of human error. Manual forecasting can be a minefield of mistakes, but with Banktrack’s automated processes, you can trust that your forecasts are spot on.

Plus, Banktrack offers a high level of customization. Whether you need to adjust spending metrics, set up personalized dashboards, or categorize transactions, Banktrack lets you tailor the software to fit your business perfectly.

Why Banktrack is a top choice:

- Real-Time Financial Insights: Access up-to-the-minute financial data, helping you manage cash and set budgets more effectively.

- Improved Accuracy: Automated processes reduce errors, ensuring more accurate forecasts.

- Customization and Flexibility: Tailor the software to your specific needs, from spending metrics to personalized dashboards.

- Time Efficiency: Integrates with multiple bank accounts, pulling in real-time data and saving you hours of manual input.

- Enhanced Decision-Making: Automated reports and alerts keep you informed, helping you make proactive decisions.

- Scalability: Designed to grow with your business, handling more data and complex forecasting needs as you expand.

- Data Integration: Centralizes financial data by connecting multiple bank accounts into one unified platform.

- User-Friendly Interface: Visualize financial data easily with adaptable dashboards, making cash management accessible even for small business owners.

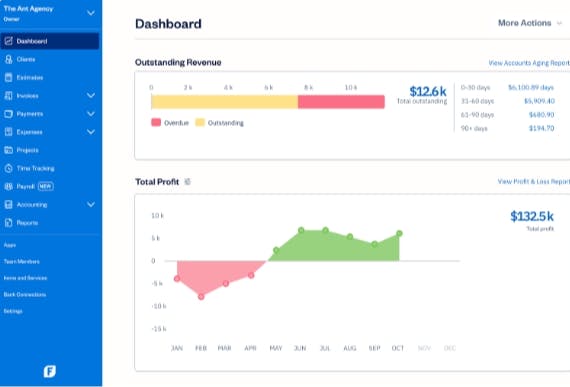

2. QuickBooks Online

QuickBooks is a household name for small businesses, and its budgeting features are a big part of the reason why.

QuickBooks Online offers easy-to-use budgeting tools that integrate seamlessly with your accounting data.

It’s perfect for small to medium-sized businesses looking for a straightforward, reliable solution.

Pros:

- User-friendly interface

- Excellent integration with accounting features

- Strong customer support

Cons:

- Limited advanced forecasting tools

- Can get expensive as you add more features

3. FreshBooks

FreshBooks is another popular choice for small businesses, especially those in the service industry. It offers basic budgeting tools alongside its invoicing and expense tracking app features.

It’s a great option if you’re looking for an all-in-one financial management tool or a cash management software for your restaurant.

Pros:

- Simple, intuitive design

- Great for freelancers and small service businesses

- Affordable pricing

Cons:

- Limited budgeting features compared to other tools

- Not ideal for larger businesses

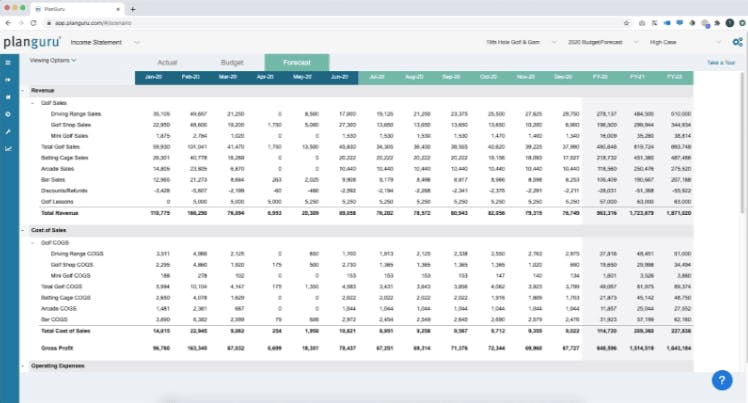

4. PlanGuru

PlanGuru is a powerhouse when it comes to budgeting and forecasting. It’s designed for businesses that need advanced tools to plan their financial future.

With strong forecasting features and detailed financial reports, PlanGuru is ideal for businesses with more complex financial needs.

Pros:

- Advanced forecasting and scenario planning

- Detailed financial reports

- Suitable for growing businesses

Cons:

- Steeper learning curve

- Higher price point

5. Xero

Xero is a cloud cash management software that also offers strong budgeting features. It’s particularly popular among small and medium-sized businesses that need a complete tool for managing finances.

Xero’s budgeting tools are integrated with its accounting features, making it easy to keep everything in one place.

Pros:

- Cloud-based, accessible from anywhere

- Strong integration with accounting features

- Easy to use

Cons:

- Budgeting features are not as advanced as some competitors

- Can be pricey for small businesses

Why Banktrack is the Best Budgeting Software for You

Let’s wrap this up. Managing your business’s finances can be a daunting task, but with the right budgeting software, it doesn’t have to be. From eliminating human errors to saving you precious time, business budgeting software can be a game-changer, allowing you to focus on what really matters, growing your business.

Of all the options available, Banktrack stands out as the best choice for businesses looking to take control of their financial future. With its real-time financial insights, you’ll never be left in the dark about your cash flow situation. Banktrack’s ability to automate processes reduces the risk of errors, ensuring your forecasts are as accurate as possible.

What truly sets Banktrack apart, though, is its flexibility and customization. Whether you’re a small startup or a growing enterprise, Banktrack’s adaptable features, like personalized dashboards and customizable spending metrics, allow you to tailor the software to fit your specific needs. Plus, its integration with multiple bank accounts and financial products means you get a comprehensive view of your finances in one centralized platform.

And let’s not forget the time you’ll save. By automating data entry and offering real-time updates, Banktrack frees up hours that you can spend on other important aspects of your business. The user-friendly interface ensures that even if you’re not a financial whiz, you can easily navigate and manage your budget.

So, don’t just think about it, take the chance with Banktrack. Your future self (and your bank account) will thank you!

Share this post

Related Posts

Best 6 Expense Tracker Software with Bank Sync features

Managing money isn’t exactly anyone’s idea of fun, but it is definitely important and it can even be simpler than you think. Let us show you how.Best 7 cash management software for startups

Managing cash flow is critical for any startup. This is why a proper cash management is very much needed. We have gathered a list of the best options for you.

Try it now with your data

- Your free account in 2 minutes

- No credit card needed